EUR/USD is one of the most widely traded currency pairs in the forex market, and it represents the exchange rate between the EURO and the US dollar. As a trader, understanding how to trade this currency pair can be crucial to your success in the forex market. This is where we come in to walk you through the basics of trading EUR/USD, including the top brokers to consider and the proper procedures for getting started.

Top Brokers to Trade EUR/USD Currencies

To trade the EUR/USD currencies, you need the best forex broker suitable for your trading needs for an exciting experience and increased potential. Unfortunately, the UK financial market hosts plenty of forex brokers for trading the EUR/USD currency pairs. This has made it challenging for many traders, especially newbies, to identify the best with features suitable for their needs.

The good news is that our professionals conducted research on hundreds of forex brokers in the UK to come up with the list below. We factored in various elements, including security, fees, support service, and more, to ensure our recommendations are unbiased.

1. Plus500

*Illustrative prices

Plus500 emerges as one of the top four brokers for trading EUR/USD currencies, offering a reliable and intuitive platform for all traders. With its user-friendly interface and rapid trade execution, Plus500 ensures a seamless trading experience. Traders can capitalize on competitive spreads, commission-free trades, and leverage options of up to 1:30 for retail traders and 1:300 for professionals, enhancing trading flexibility.

In addition to EUR/USD pairs, Plus500 provides access to over 60 CFD currency pairs for exploration. You can diversify your trading portfolio with various CFD asset classes, including additional currencies, shares, commodities, indices, ETFs, etc. With round-the-clock customer support and a commitment to transparency and security, Plus500 solidifies its position as a top broker for EUR/USD currency trading. That being said, feel free to test the platform via its demo account before making a commitment.

- Commission-free trades with low spreads from 0.0 pips

- Low minimum deposit requirement of £100

- High leverage limit for professional traders

- Virtually-funded demo account for beginners to practice forex trading and gauge their skill levels

- No support for third-party trading platforms like the MT4

- Inactivity fee of £10 monthly applies after three months of inactivity

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

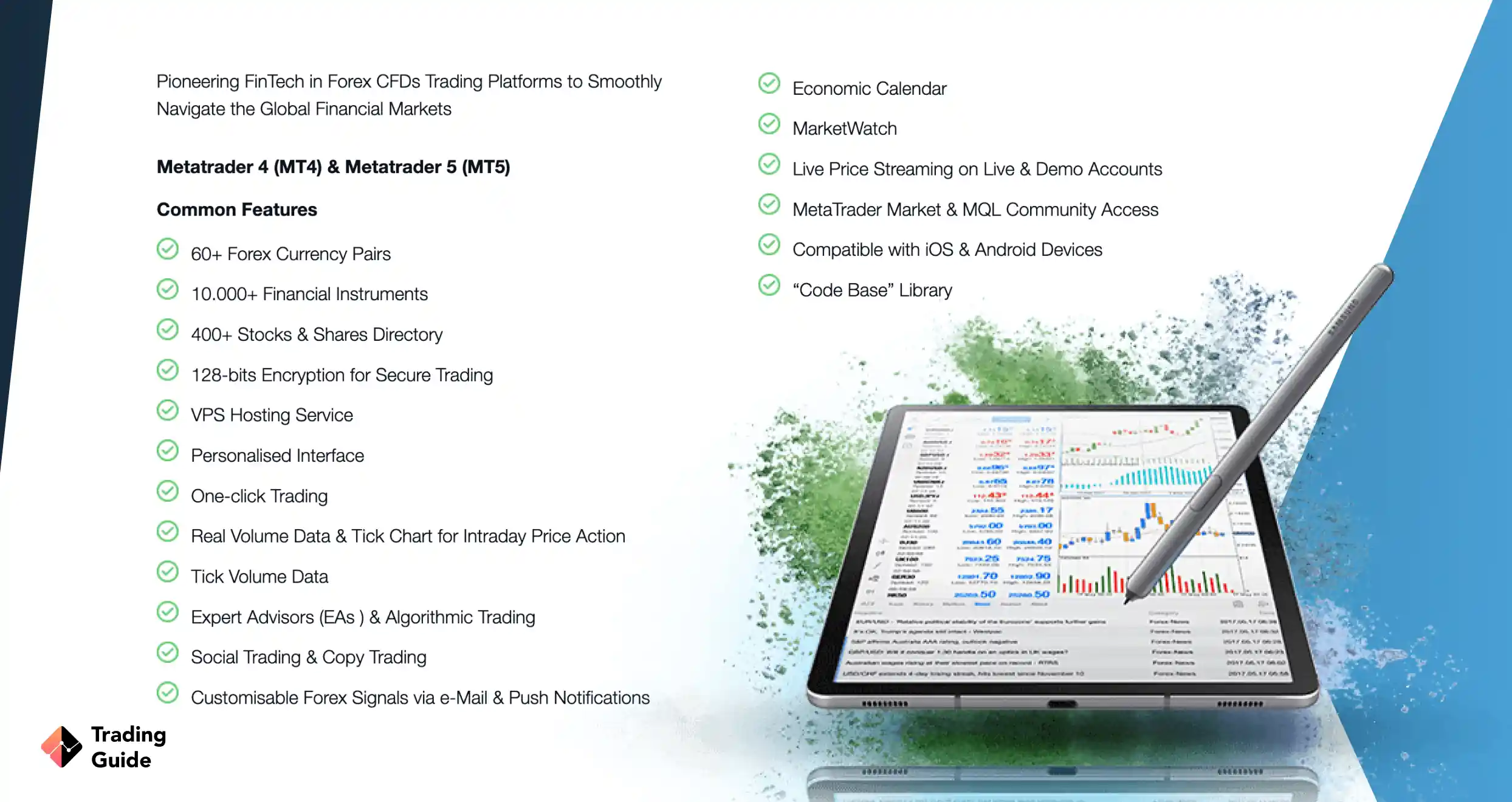

2. FP Markets

FP Markets is a globally recognised forex broker listing EUR/USD currencies for you to trade. It is also a home for additional 60+ currency pairs, which is an excellent collection for forex traders looking to diversify their portfolios. Moreover, FP Markets is a CFD broker with over 20,000 CFD assets across various classes, including shares, commodities, cryptocurrencies, indices, and more.

To trade this major currency pair, FP Markets requires you to deposit at least £100 to get started. Keep in mind that it doesn’t charge transaction fees, and you get to pay spreads starting from 0.0 pips. For professional forex traders, FP Markets hosts the powerful MT4 platform for trading EUR/USD. A range of additional products are also available on the broker’s MT4, cTrader, and Iress platforms. All you have to do is select a suitable one for you.

- Low minimum deposit requirement

- Leverage limit of up to 500:1 for professional forex traders

- A user-friendly platform with customisable interface

- Features a social trading platform for users looking to interact and learn from others

- No asset price plans

- No two-step login procedure

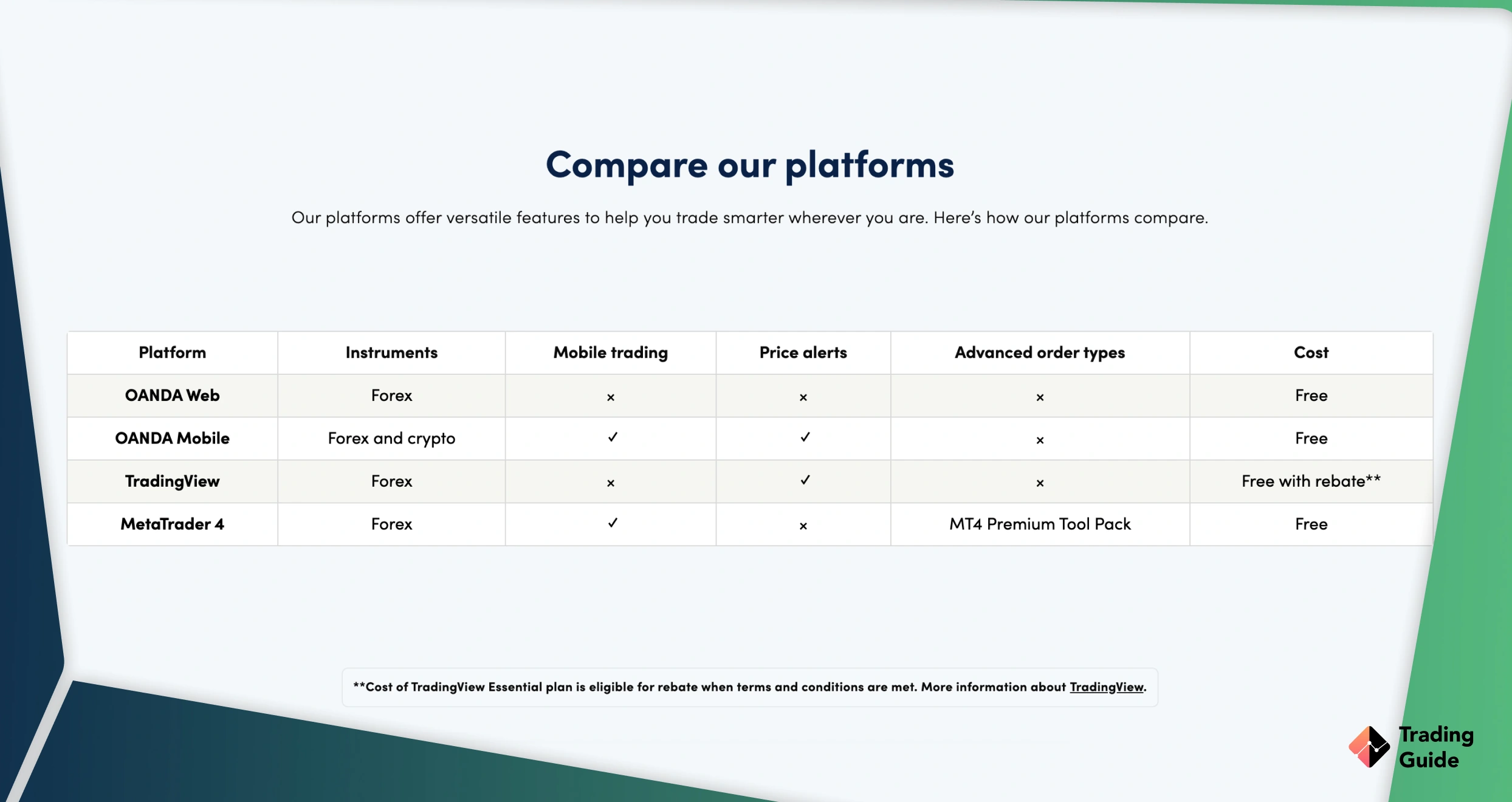

3. OANDA Europe LTD

Since its establishment in 1995, OANDA Europe LTD has made a name for itself and is considered one of the best forex brokers in the UK. Besides the EUR/USD, the broker lists additional 68 currency pairs, which you are allowed to trade with spreads starting from 1 pip. If you want to try out additional assets, OANDA Europe LTD lists plenty of options, including indices, commodities, and more.

OANDA Europe LTD is suitable for all types of forex traders in the UK since it is not only user-friendly but also lists advanced resources for market analysis. Note that OANDA doesn’t have a minimum deposit requirement, and all transactions are also free.

- No minimum deposit requirement

- Low EUR/USD trading charges

- Features advanced platforms and tools for maximum experience

- Hosts additional assets for portfolio diversification

- Charges a £13 monthly inactivity fee after 12 months

- Low leverage limit for professional traders

Note: 76.6% of retail investor accounts lose money when trading CFDs with this provider.

4. Pepperstone

If you are a new forex trader looking to explore the EUR/USD currency pair, we advise you to try Pepperstone. The broker is not only user-friendly but also hosts a social trading platform where you can mingle with other traders and learn various trading ideas. Moreover, Pepperstone hosts a wide range of learning resources for skills development. You can also take advantage of its virtually-funded demo account to test it and gauge your skill level before taking the plunge.

Although the broker has a high minimum deposit requirement of £500, trading the EUR/USD and additional major currency pairs it hosts attracts low spreads starting from 0.0 pips. The broker has a fast trade execution speed, making it easier for you to explore the forex liquid market without much risk. On top of that, Pepperstone has an Active Trader Program with amazing benefits and discounts you can never miss out on.

- +60 currency pairs to trade besides the EUR/USD currencies

- Features advanced platforms, including MT4, MT5, cTrader, and TradingView

- A user-friendly and customisable platform

- Active Trader Program for forex traders

- High minimum deposit requirement

- Basic research materials, which can limit advanced users

How to Trade EUR/USD Currencies

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

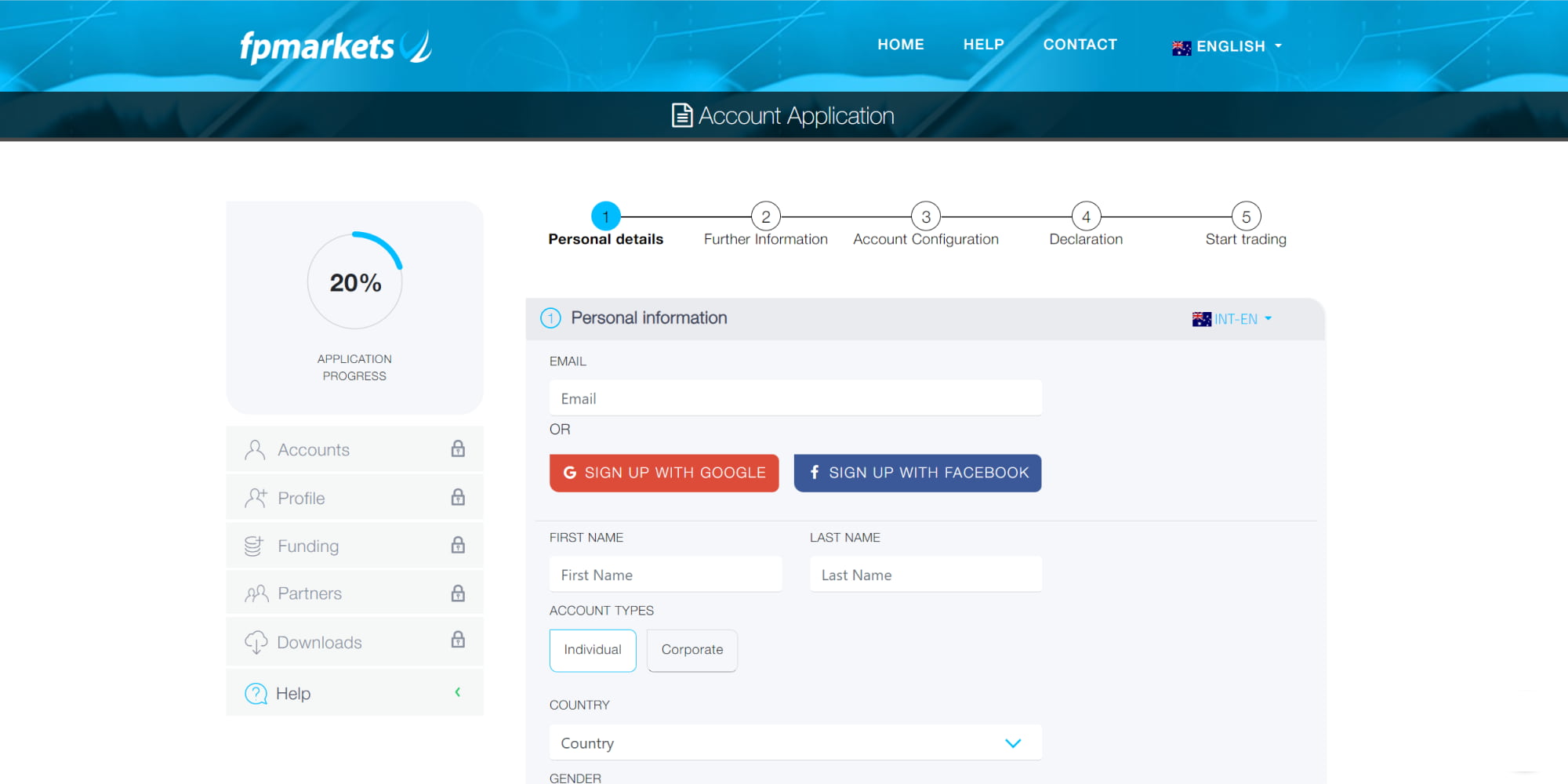

When it comes to trading EUR/USD, not only do you need the best forex broker, but you must also master the proper procedures to get started. To ensure you are fully prepared, here are the step-by-step procedures on how to trade EUR/USD currencies using FP Markets as an example.

You need a trading account with your preferred broker to trade the EUR/USD currency pair. Using FP Markets as an example, start by visiting its official website via any of the links we have shared here. Remember, always ensure you are familiar with the currencies you want to trade and understand the broker’s terms and conditions. You should also consider installing the FP Markets trading app on your mobile device for additional flexibility, especially whenever you step away from your trading station.

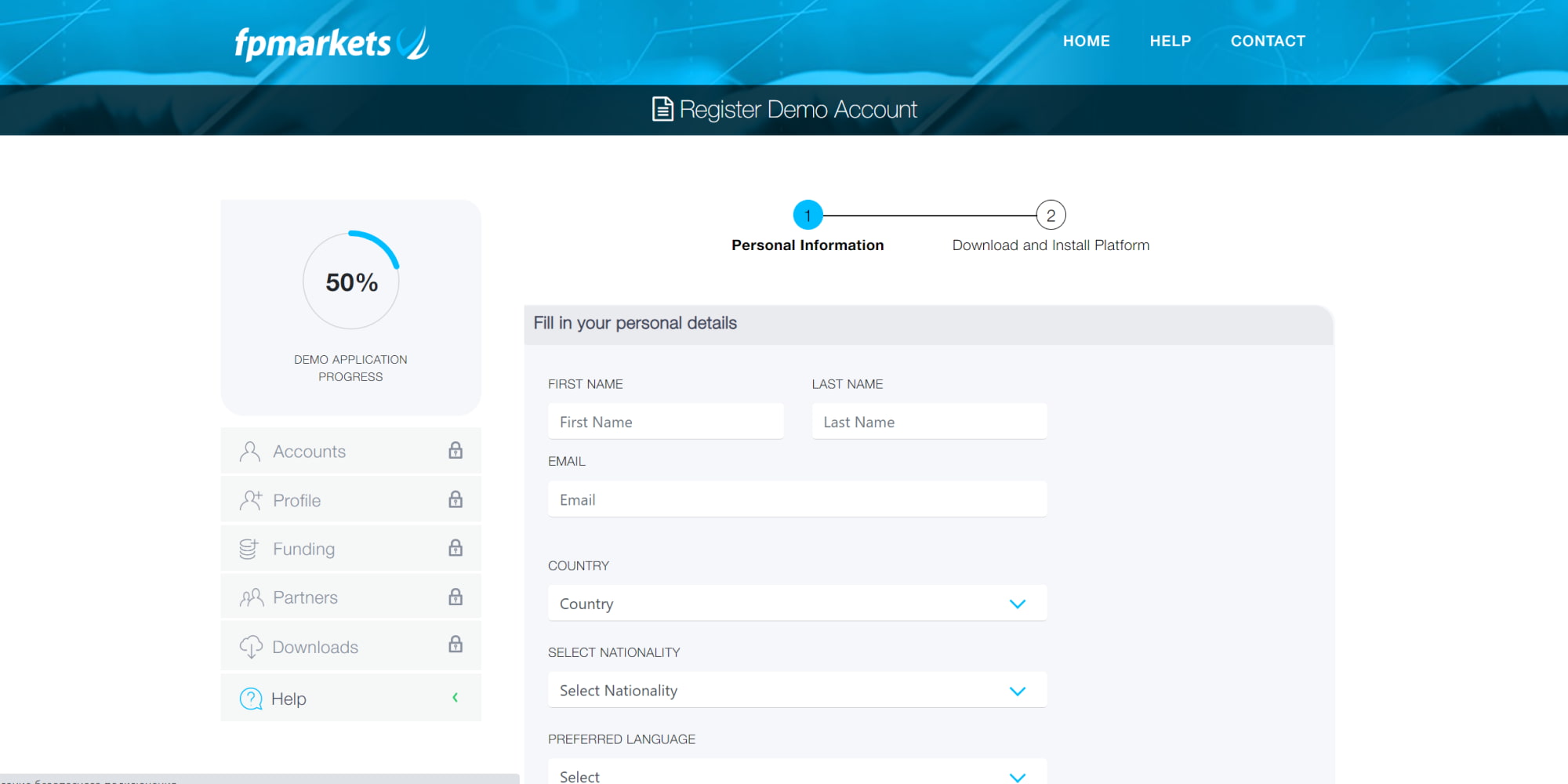

Once on the broker’s website, click the “OPEN LIVE” button to begin the registration process. You will be required to fill out the available form using your personal details, including name, email, date of birth, gender, nationality, and more. Once done, click “SAVE AND NEXT” to proceed.

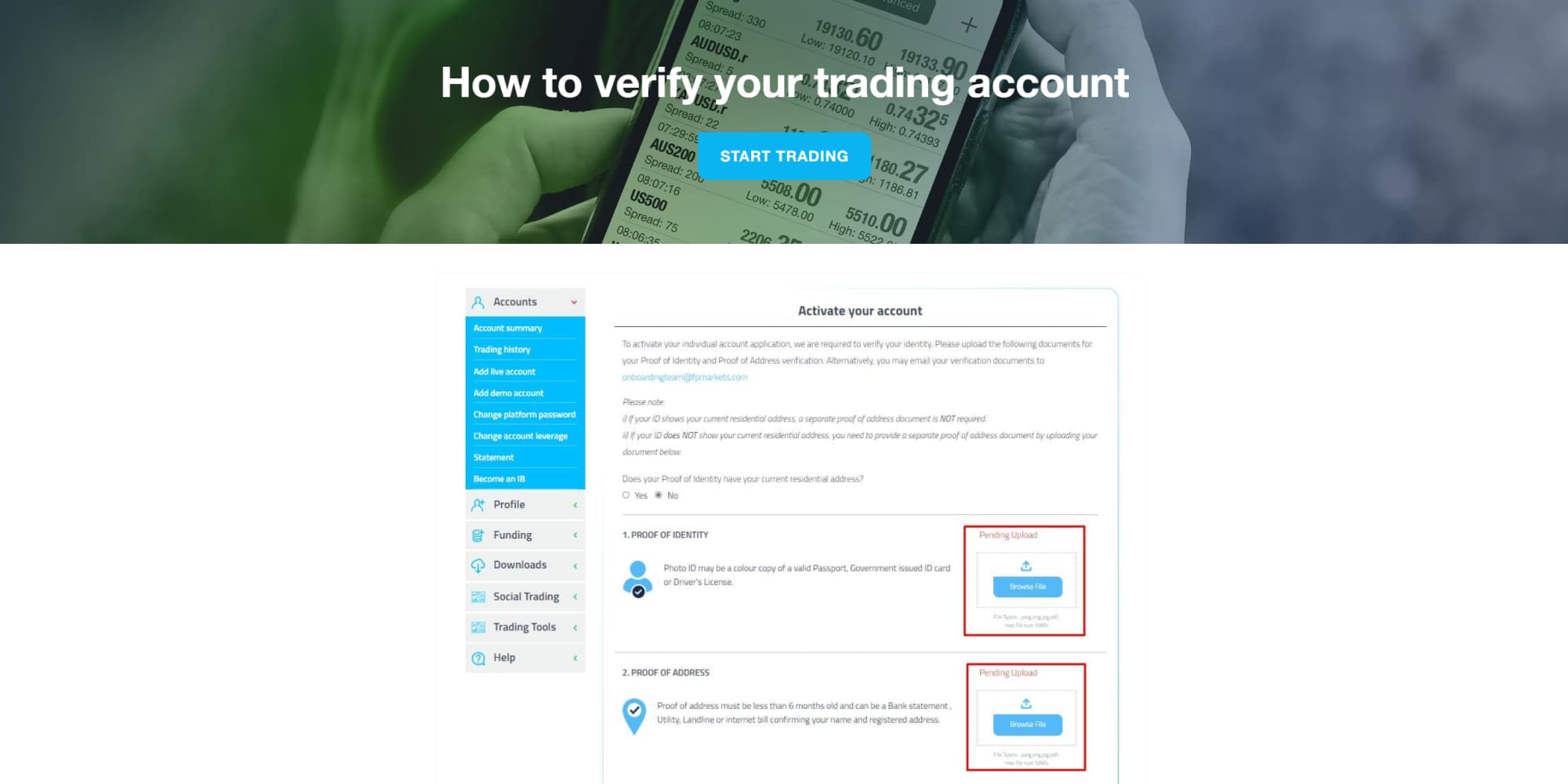

In the next step, FP Markets will give you a questionnaire to fill out and a margin trading test to participate in to gauge your skill level. The broker will then need to verify your identity and location, as this is among the FCA protocols to keep all trading platforms safe and secure. In this step, you must share a copy of your original ID Card, passport, or driver’s licence to verify your identity. It is also essential that you share proof of your location using a copy of a recent utility bill or bank statement.

Once FP Markets verifies your account, you can now deposit funds to trade EUR/USD. Remember, the broker’s minimum deposit requirement is £100, so ensure you stick to this requirement to kickstart your trades on a good note. You can make deposits using various payment methods, including bank transfers, credit/debit cards, and e-wallets, free of charge.

You are now free to trade the EUR/USD currency pair, so choose your strategy and apply risk management control before opening a live trade. If you are a beginner, consider getting started via the FP Markets demo account to gauge your skill level without spending real money. It is also crucial to track your open positions and keep a trading journal to identify areas that require improvement in the future.

Read about the lot sizes in forex in our other guide.

How to Choose the Best Broker to Trade EUR/USD

Finding the best forex broker to trade EUR/USD daily can be daunting since there are numerous options out there. However, with thorough market research and a keen eye for detail, you can meet a suitable broker that guarantees an exciting trading experience.

If you decide to conduct research for the best broker, here are some of the factors to consider.

The first factor to consider when choosing a forex broker for trading EUR/USD is regulatory compliance. A regulated broker is more likely to be trustworthy and reliable. In the UK, prioritise brokers regulated by the Financial Conduct Authority (FCA). Having additional regulations is also a plus since this proves that the broker operates within various ethical boundaries. You can check the broker’s website for details on the regulatory body that licences them and if they are in good standing.

A broker’s trading platform is the backbone of your trading experience. You want a broker with a user-friendly and intuitive platform that works flawlessly. The platform should also host plenty of resources for learning and market analysis. Most importantly, the platform should be compatible with desktop and mobile devices so you can easily and efficiently manage your positions anywhere, anytime.

Forex brokers generate revenue by charging spreads or commissions on your EUR/USD trading activities. These fees vary, so you should choose a broker with fees you can afford. Confirming additional charges and ensuring they fit your budget is also essential. These include minimum deposit requirements, transaction fees, inactivity costs, and more.

Not all brokers offer the same currency pairs. Therefore, if you are interested in trading the EUR/USD currencies, ensure the broker you select offers it as a tradable asset. For traders looking to diversify their trading portfolios, ensure your preferred forex broker lists additional assets to choose from. This way, you can focus on strategy and have an exciting experience.

Customer support is an essential aspect of the trading experience. A broker with an excellent customer support team can help you navigate through the trading platform and resolve any issues that may arise. Remember to also consider a broker with multiple communication channels, including phone, email, and live chat. Additionally, check the broker’s working hours and response time.

Newbies looking to trade EUR/USD currencies should choose a broker offering a demo account with all the features of the live trading account. A demo account allows you to test your trading strategy, get familiar with the platform, and evaluate the broker’s service before making a real-money deposit.

The EUR/USD Basics and History

The EUR/USD currency pair represents the exchange rate between the Euro, the official currency of 19 European Union countries, and the US Dollar, the official currency of the United States. The currency pair is quoted as EUR/USD, with the Euro being the base currency and the US Dollar being the quote currency.

The exchange rate between the Euro and the US Dollar is affected by various economic, political, and social factors. These factors include interest rates, inflation rates, government policies, economic indicators such as GDP, and geopolitical events such as elections, trade negotiations, and global pandemics.

History of EUR/USD

The EUR/USD currency pair was introduced in 1999, following the adoption of the Euro as the official currency of the European Union. The currency pair started trading at an initial exchange rate of 1.1789, and since then, it has experienced various fluctuations and trends.

One of the most significant events that affected the EUR/USD exchange rate was the global financial crisis of 2008. During this period, the Euro faced significant pressure due to the debt crisis in some European countries, leading to a sharp decline in the EUR/USD exchange rate.

Reasons to Trade EUR and USD

There are many reasons to trade EUR/USD currencies, including the following.

- High Liquidity: The EUR/USD is one of the most traded currency pairs globally, with high liquidity levels. This means that its market is vast, with numerous buyers and sellers, thus making it easier for you to quickly enter and exit positions without affecting the exchange rate. High liquidity also results in tight bid-ask spreads, reducing the trading cost.

- Economic Powerhouses: The Eurozone and the United States are two of the largest economies in the world, with significant influence on global trade and finance. Economic news and indicators from these regions can significantly impact the EUR/USD exchange rate, providing traders with opportunities to profit from market movements.

- Volatility: The EUR/USD is a volatile currency pair with frequent fluctuations and trend reversals. You can take advantage of the market’s volatility to enter and exit positions at strategic points, thus maximising your profits*.

- Diversification: Trading the EUR/USD currency pair can provide traders with diversification benefits, especially when combined with other currency pairs. Diversification is essential for risk management since it reduces the impact of market volatility on a trader’s portfolio.

- Range of Trading Strategies: Trading EUR/USD currencies comes with various strategies, including trend following, range trading, and news trading. You can choose the strategy that best suits your style and risk tolerance, making it a versatile currency pair.

- Availability of Information: The Eurozone and the United States have robust financial markets, with a vast amount of data and news available to traders. Traders can easily access economic indicators, central bank announcements, and news releases, providing them with valuable information to make informed trading decisions.

*Don’t invest unless you’re prepared to lose all the money you invest.

Understand Two Economics

It is crucial to understand the two economies that underpin the EUR/USD currency pair so you can easily make the best trading decisions. Note that the US and the EU are each other’s largest trading partners, with goods and services traded between them amounting to billions of dollars annually. The European Central Bank (ECB) sets monetary policy for the Eurozone, while the Federal Reserve (Fed) sets monetary policy for the US.

While trying to understand the two economies, analyse the economic indicators of both the EU and the US, including monetary policy, fiscal policy, inflation, employment figures, and political developments. You must also stay abreast with changes in interest rates and other monetary policies that may impact the real-time EUR/USD exchange rate. On top of that, be on the lookout for macroeconomic indicators such as GDP, inflation, and trade balances, as these can also impact the currency pair’s value.

Understand Two Politics

While it is crucial to understand the economies in the Eurozone and the United States, traders should also stay abreast with political developments within the two regions. This is because political events in both regions can affect the EUR/USD exchange rate. For example, events such as the US presidential elections or changes in the EU’s political leadership can create uncertainty in the market and affect the EUR/USD pair. Therefore, always keep up with the latest EUR/USD news and developments in both regions for informed trading decisions.

Furthermore, you should understand how economic indicators and data releases from both regions can affect the currency pair. For instance, the release of the US non-farm payroll report can create volatility in the market and impact the EUR/USD exchange rate.

EUR / USD Best Time to Trade

The forex market is open 24 hours a day, five days a week. However, not every time is the best time to trade EUR/USD currency pair. You should consider trading the EUR/USD currencies during the overlap of the European and US trading sessions, which occurs between 13:00 and 17:00 GMT. The European and US markets are open during this period, leading to higher trading volume and increased volatility. As a result, you get to benefit from more trading opportunities that could bring about good returns.

Overall, the best time of day to buy Euros and USDs should depend on your trading strategy, risk tolerance, and personal schedule. Some traders may find that they are more successful trading during other sessions, such as the Asian session, which can offer lower volatility but more predictable price movements.

FAQs

Traders tend to sell euros when the euro is weakening against other currencies, such as the US dollar. This can occur during times of economic uncertainty, political instability, or when there is a shift in monetary policy. However, it is important to do your own research and analysis to determine the best time to sell euros based on your individual trading goals.

Yes. Trading the EUR and USD is legal in the UK for as long as you are using a credible broker regulated by the Financial Conduct Authority (FCA). We recommend above the top forex brokers for trading EUR/USD, so feel free to compare them and make the best choice.

The best session to trade EUR/USD is during the overlap of the European and US trading sessions, which occurs between 13:00 and 17:00 GMT. During this time, both markets are open, leading to higher trading volume and increased volatility.

Absolutely. EUR/USD is one of the major popular currency pairs traded in the forex market, and it is considered a good pair to trade due to its high liquidity and tight spreads. The pair is also heavily influenced by economic data releases and news events, which can create trading opportunities for savvy traders.

Conclusion

Trading EUR/USD currencies might seem easy, and it can if you are fully prepared. Not only do you need the best forex broker like the ones we list above, but you must also be strategic for maximum potential. Remember, the forex market is volatile, and understanding elements that affect EUR/USD prices will help you make the best trading decisions.

Overall, we have witnessed many traders earn good profits from trading this asset, and we hope that this guide will help you become independent and, hopefully, successful. Simply stick to your plan, remain dedicated, and be open to learning from mistakes.