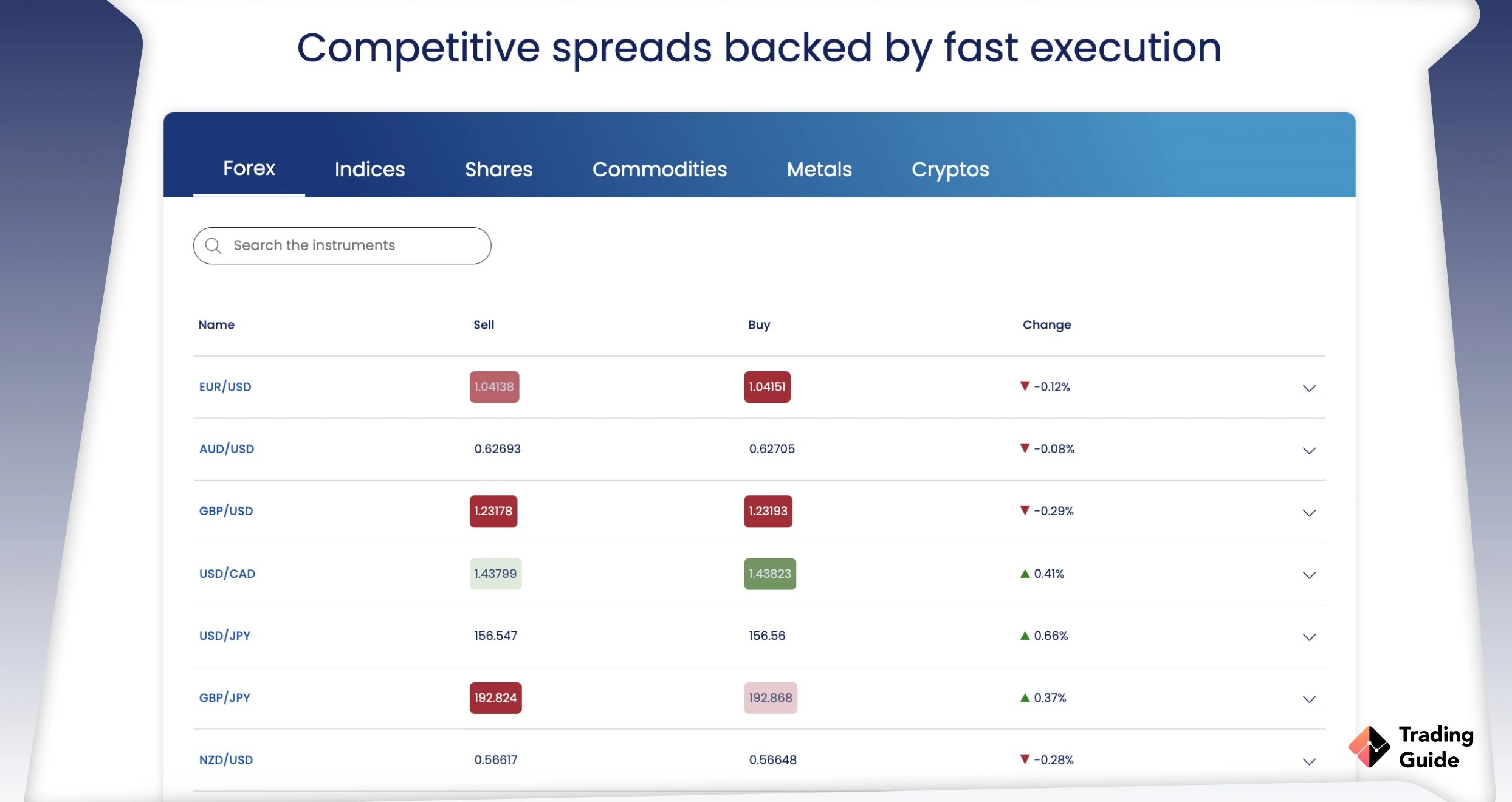

*Illustrative prices

Plus500 is dedicated to helping Brits trade CFDs on over 2,800 financial instruments, from ETFs, commodities, and shares to indices, options, and forex. You just have to pick the right assets for you and start your journey to trading and earning handsome returns.

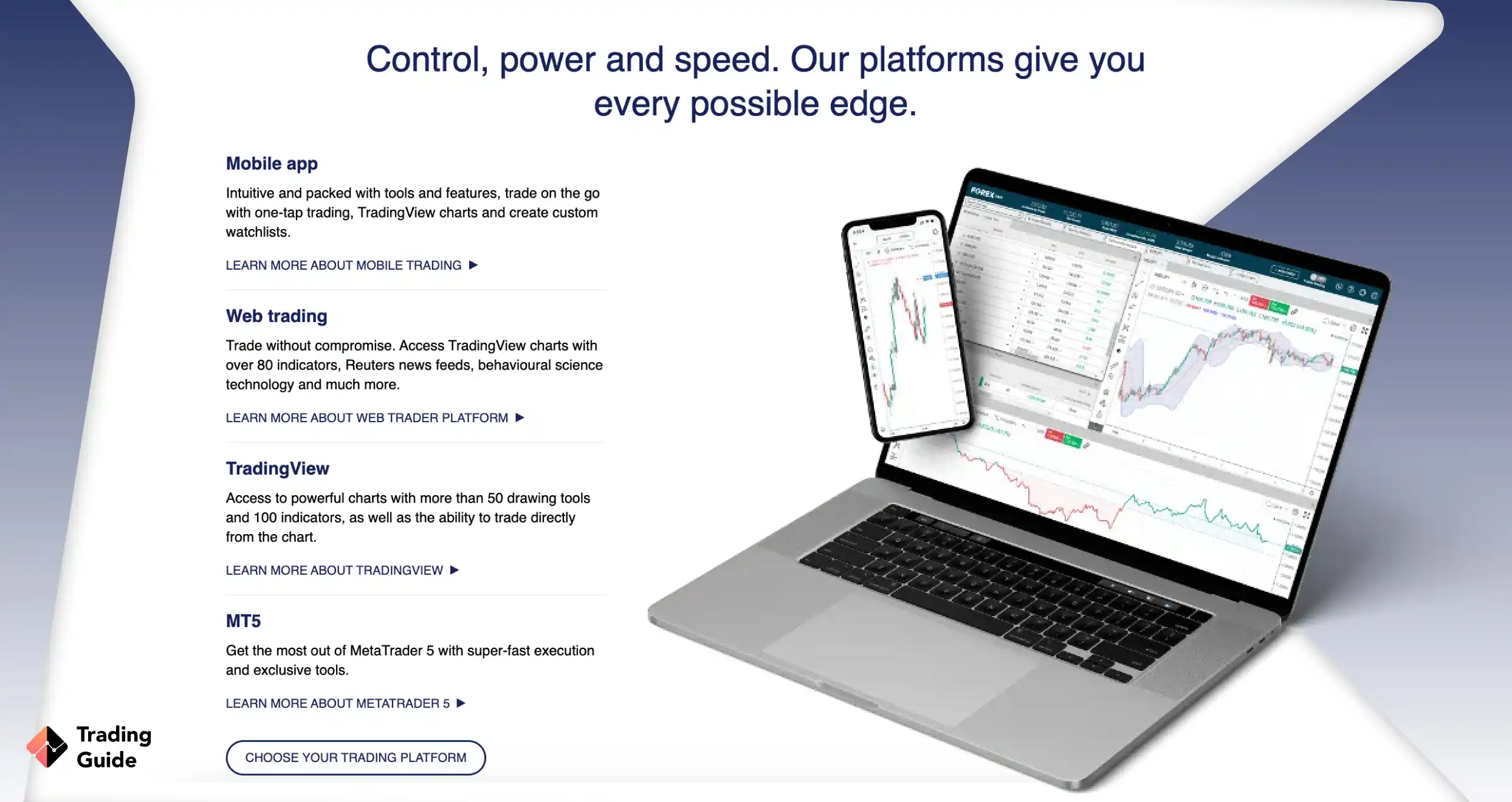

Trading with a new platform can be hectic. Plus500 knows that and does everything it can to make the process easier. This broker’s platforms have simple, user-friendly interfaces suitable for both noobs and seasoned traders. Every layout is clean and intuitive, so you won’t too much precious time familiarizing yourself with the platform.

Before signing up with Plus500, note that this broker requires a £100 minimum deposit. If you can meet it, funding your account will be a breeze since Plus500 supports a considerable variety of popular payment methods, including bank transfer, PayPal, and Skrill. Moreover, the broker covers most transaction fees, so you don’t have to worry about deposit charges.

If you’ve been in the CFD trading scene for a while, consider opening a professional Plus500 account. You’ll enjoy higher leverage options, cash rebates, and many other boons. Your funds will also be covered by the FSCS, and you’ll have access to priority support. Visit the broker’s official site to check if you’re eligible.

When evaluating Plus500 as your broker, it’s essential to consult an Plus500 review to gain a comprehensive understanding of the services it provides.

* Investment Trends 2022