British American Tobacco plc (BAT) is one of the most well-known companies in the FTSE 100 and a major player in the global tobacco market. It sells products in over 180 countries and has recently begun to focus more on alternatives, such as vapes and heated tobacco. This shift comes at a time when rules around tobacco are getting stricter and consumer habits are changing. Still, many investors see BAT as a reliable source of dividend income and a steady option in a defensive sector.

For beginners in the UK, buying BAT shares can seem confusing at first. Choosing a broker, understanding tax-free accounts like ISAs, and monitoring the BAT share price are just a few of the challenges. This guide explains each step clearly and shows how BAT shares might fit into a balanced investment portfolio.

In this guide

How to Buy British American Tobacco Shares?

How to Buy BAT Shares

Buying shares in British American Tobacco is a straightforward process through any FCA-regulated online investment platform. These brokers provide access to the London Stock Exchange (LSE), where BAT is listed under the ticker symbol BATS, and allow UK investors to trade directly from a phone or laptop.

Here’s how it works:

Select a platform that offers access to UK-listed shares, including BAT. Look for transparent fees, ISA eligibility, and user-friendly interfaces. Well-known options include Freetrade, Hargreaves Lansdown, AJ Bell, and Interactive Investor.

You’ll typically choose between a General Investment Account (GIA) or a Stocks and Shares ISA. A GIA offers flexibility, while an ISA allows you to invest tax efficiently within your annual allowance.

To comply with KYC rules, you’ll need to provide proof of ID and address. Once approved, fund your account via bank transfer or debit card. Most platforms accept low minimum deposits, though trade sizes and charges vary.

Use the broker’s search function to find British American Tobacco or its ticker BATS. You’ll be able to view the current price, trading options, and key stock information.

Enter the amount you want to invest and select your order type. A market order buys at the current price, while a limit order lets you specify the maximum you’re willing to pay.

Check for dealing fees, stamp duty (typically 0.5% on UK shares), and any applicable charges before confirming the trade. Once executed, you become a shareholder, entitled to dividends and voting rights.

Shares are usually held in a nominee account by the broker, meaning you retain full ownership but the broker administers them on your behalf.

Best Brokers to Invest in BAT in the UK

The broker you choose can have a big impact when investing in British American Tobacco (BATS) shares. From fees to features, each platform suits different types of investors. Below are three FCA-regulated brokers that offer access to BAT and cater to a range of goals.

eToro

eToro is ideal for beginners. It has a clean, easy-to-use platform and offers commission-free trading on UK shares, including BAT. One of its standout features is copy trading, which lets users follow the strategies of more experienced investors. With a starting deposit of just $100, it’s an easy entry point for new investors. However, eToro operates in USD, so UK users may face currency conversion fees. It also charges a fixed withdrawal fee and has higher spreads compared to some of its rivals.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- Low deposit to get started

- Copy and social trading tools

- No commission on share purchases

- Currency conversion and withdrawal fees

- Fewer advanced tools for traditional investors

IG Markets

IG Markets is better suited to experienced or active traders. It provides access to BAT through both share dealing and CFDs, utilising powerful platforms such as MT4 and ProRealTime. Its research tools are some of the best in the industry. That said, it requires a £300 minimum deposit and charges inactivity fees, which may not suit casual investors.

Your capital is at risk

- High-level trading platforms and analysis tools

- Offers trading in stocks, CFDs, and a broad range of asset classes

- High minimum deposit

- Can be complex for beginners

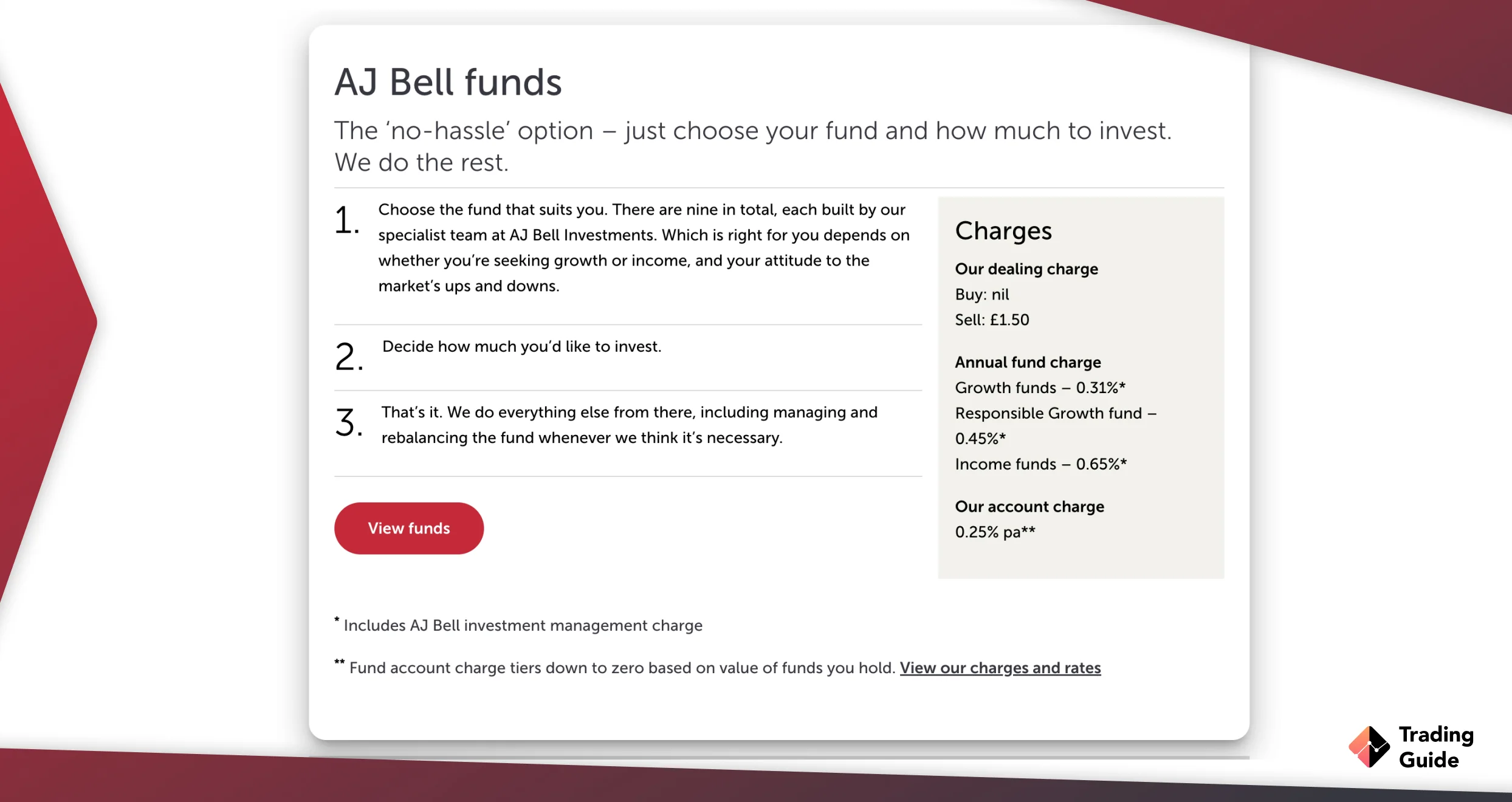

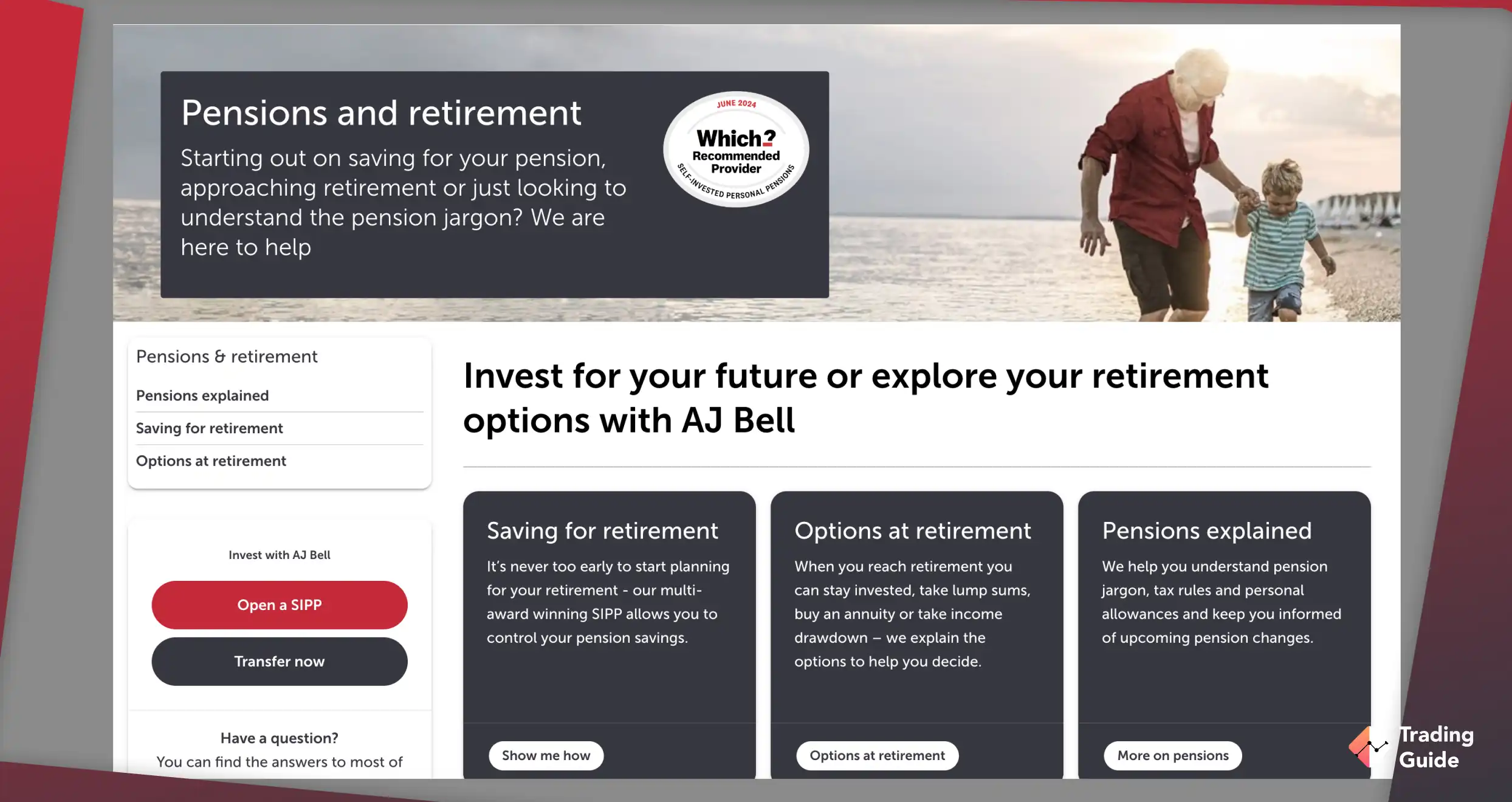

AJ Bell

AJ Bell is a strong option for long-term investors. It offers a wide range of shares, funds, and ETFs through ISAs, SIPPs, and general accounts. The platform has a clear fee structure and is trusted by many UK investors looking to build income portfolios with stocks like BAT.

- ISA and SIPP support for tax-efficient investing

- Transparent, low-cost pricing

- Well-known and reliable UK platform

- No zero-commission trading

- Not built for short-term traders

Each of these brokers takes a different approach. Pick the one that fits your goals, whether that’s simplicity, advanced tools, or building a long-term portfolio.

What to Compare Before Choosing

When looking at brokers, focus on:

- Trading fees – Flat or percentage-based charges can add up over time

- Account types – ISAs and SIPPs help protect your gains and income from tax

- Dividend reinvestment – Check if the broker offers DRIPs to automatically reinvest your dividends

- Research tools – Look for price charts, company updates, and analyst ratings

- Minimum investment – Some platforms let you start with as little as £1

It’s also worth considering how user-friendly the platform is. If you invest often, a straightforward layout can help you stay focused and manage your portfolio more effectively.

About British American Tobacco plc

British American Tobacco (BAT) ranks among the largest tobacco firms globally. The company’s cigarette brands include Dunhill, Lucky Strike, Rothmans, and Pall Mall. In recent years, BAT has expanded into alternative nicotine products such as Vuse for vaping, glo for heated tobacco, and Velo pouches, aiming to move away from traditional cigarettes over time.

The company is headquartered in London and operates in more than 180 countries. With over 50,000 employees worldwide and a presence in both advanced and developing economies, BAT benefits from a diverse and stable revenue base.

Although smoking rates have fallen in many countries, BAT still generates strong cash flow and continues to pay regular dividends. This track record makes it a popular choice for income-focused investors, particularly those building portfolios centred on FTSE 100 dividend stocks. Its size, global reach, and efforts to grow its reduced-risk product line make it a key player in a changing industry.

For those intrigued by BAT stocks, delving into the potential of SPDR Industrials EFT and Marks and Spencer stock could offer additional investment prospects.

BAT Tobacco Share Price Today

The share price of British American Tobacco (BATS) fluctuates based on company performance, market sentiment, and broader economic factors. You can check the current BAT share price on our live chart below.

Several key factors affect the share price in the short and long term:

- Regulation: New rules on tobacco packaging, advertising, or nicotine levels can lower investor confidence and affect future earnings.

- Legal risks: Lawsuits, especially in large markets like the US, may impact how investors view the company’s outlook.

- Earnings reports: The share price often moves when quarterly or annual results are better or worse than expected.

- Dividends: Many people invest in BAT for income. Changes to its dividend payments, up or down, can lead to sharp market reactions.

- New product demand: Growth in vaping, heated tobacco, and nicotine pouches plays a bigger role in how the market sees BAT’s future potential.

BAT shares are listed on the London Stock Exchange under the ticker BATS and are priced in pounds sterling. To see the current price and performance, check our live chart below.

Is BAT a Good Stock to Buy?

British American Tobacco is often viewed as a defensive stock. This means it tends to hold its value better during times of economic uncertainty. Like utilities or everyday consumer goods, tobacco products remain in demand even when people cut back on other spending. For many investors, BAT offers a way to earn steady income while keeping risk relatively low.

Here’s why some investors consider BAT:

- Reliable dividend income: BAT has a strong record of paying dividends. This makes it appealing to people who want regular payouts rather than relying on share price growth alone.

- Global presence: BAT sells its products in many countries, which helps reduce the impact of problems in any one region.

- Investment in new products: The company is expanding into vaping, heated tobacco, and nicotine pouches. While these products make up a smaller part of its business, they show BAT is planning for the future.

- Often priced below peers: At times, BAT trades at a lower valuation than other companies in the same sector. This could give long-term investors a better entry point.

But there are also risks:

- Regulatory pressure: Governments around the world continue to introduce stricter rules on tobacco and nicotine products, which could limit future profits.

- Ethical exclusions: Many investors and funds avoid tobacco stocks for ethical or environmental reasons, which can reduce demand for BAT shares.

- Declining cigarette use: Fewer people are smoking, especially in developed countries. BAT’s newer products are growing, but they haven’t fully replaced lost sales from cigarettes.

BAT may suit investors who want stable income from a large, well-known company with global reach. It’s less likely to appeal to those focused on ethical investing or looking for high growth. opportunities. For long-term holders willing to accept the risks, BAT can still play a role in a diversified portfolio.

FAQs

Yes. British American Tobacco is publicly traded and listed on various exchanges, including London Stock Exchange. Therefore, to buy the company’s shares, you should find a broker with access to the right exchanges. Good examples of such brokers are listed in our guide above.

The easiest way to buy British American tobacco shares is through an online broker. Besides having the best broker, ensure you conduct a thorough analysis and choose the best trading method, whether buying the shares and taking ownership, trading them as CFDs or indices.

British American Tobacco was established due to a merger between Imperial Tobacco Company in the UK and American Tobacco Company in the US. BAT was founded by James Buchanan Duke, who was also the founder of the American Tobacco Company.

No. Imperial Brands and British American Tobacco are separate companies, both listed on the London Stock Exchange. They are competitors in the global tobacco market.

Yes, BAT is known for its consistent dividend payments. It typically pays shareholders quarterly, and its dividend yield is often among the highest in the FTSE 100.

If you’re living in the UK, most brokers will require a UK residential address to open an account. Expats or overseas investors can still buy BAT shares through international platforms but may face higher fees or limited tax advantages.

Conclusion

Many analysts view British American Tobacco as a reliable option for investors who want steady income. The company has a strong track record of paying regular dividends and keeping cash flow stable. Its main tobacco business still makes good profits, even though smoking is falling in many parts of the world.

The future will likely depend on how well BAT can grow its newer products, such as vapes and heated tobacco. It will also need to keep up with stricter rules around nicotine and advertising. These factors will play a big role in how the business performs over time.

BAT does face some pressure, especially in countries where fewer people smoke. But its size and international reach help support its position. For investors looking for income and lower-risk exposure to the stock market, BAT is still seen as a strong and dependable choice.