Blackbull Markets is one of the best brokers offering quality trading resources.

- Low trading fees for all its CFD assets

- Regulated by tier-one authorities, guaranteeing users’ funds’ safety

- User-friendly platform with an intuitive design

- Excellent collection of learning resources

- MT4 and MT5 platforms supported

- Accessing prime accounts requires high minimum deposit

- Withdrawal fees apply

Blackbull Markets is one of the best brokers offering quality trading resources and advanced trading platforms for all types of traders. Founded in 2014, the broker offers forex, index, commodities, and share trading instruments, all of which you can also trade as CFDs. The broker is highly encrypted and regulated by top-tier authorities, making it safe for your investment funds.

If you are considering Blackbull Markets as a trading partner, we review the broker below so you can fully understand its features and decide whether it is worth trading with. These features include broker fees, available assets, security, payment methods, etc. We will also take you through the simple procedures involved in creating a Blackbull Markets trading account to ensure you kickstart your activities on a good note.

BlackBull Markets – Who Are They?

Founded in 2014 in Auckland, New Zealand, Blackbull Markets is one of the best CFD brokers tailored to provide global traders with the best experience. Currently, the award-winning broker serves tens of thousands of clients across over 180 countries globally. The broker also keeps updating its platform to ensure traders access the best resources to maximize their potential.

Blackbull Markets is a fully regulated ECN and CFD broker. With it, you get exposed to more than 26,000 trading securities, including forex, commodities, indices, and shares. Plus, there are various trading platforms supported that you get to choose from based on your skill level. Fortunately, Blackbull Markets hosts a demo account to test it with before deciding whether it is worth investing with.

Compare BlackBull Markets with Other Brokers

Compare brokers

Licenses and Security

As mentioned earlier, Blackbull Markets is a secure broker regulated by world-recognized authorities, including the Financial Conduct Authority (FCA), the Financial Markets Authority of New Zealand (FMA) and the Financial Services Authority of Seychelles (FSA). It also provides negative balance protection for its users, and its long track record in the financial market clearly proves that the broker is trustworthy.

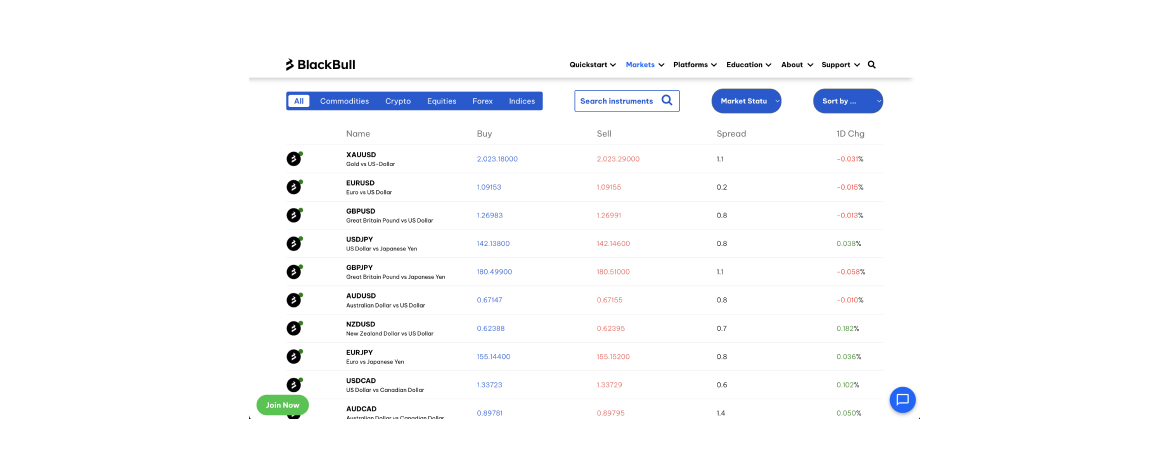

Assets Offered

Blackbull Markets hosts over 26,000 tradable instruments, including over 70 currency pairs, indices, shares, commodities, and precious metals. You can also trade these featured assets as CFDs, thus giving you an opportunity to trade under leverage and maximize your chances of earning massive profits.

However, remember that CFD trading can also leave you with huge losses and debts. Therefore, it is crucial to be confident in your strategy before applying leverage in your CFD trades. If you must trade on margin, ensure you use low leverage to avoid risking amounts you are not willing to lose.

BlackBull Markets Fees, Commission, and Spread

Blackbull Markets is one of the most transparent brokers when it comes to fees and charges. There are no hidden costs, meaning it is easier for you to budget with the fees displayed on its platform. Plus, you get exposed to a risk-free demo account loaded with £100,000 virtual funds to gauge your skill level and test the broker with.

| Type | Fee |

|---|---|

| Deposit Fee | $0 |

| Withdrawal Fee | $5 |

| Inactivity Fee | No inactivity fees |

| Overnight Fee | No |

Blackbull Markets has no minimum deposit on its standard account, but you should expect to pay £2,000 as a minimum deposit on its prime account. All deposits, regardless of the payment method you use, are also free of charge and trading fees are also low, with spreads starting from 0.0 pips. However, there are withdrawal fees of £5 for credit/debit cards or electronic wallet transactions and £20 for international bank transfers.

BlackBull Markets Minimum Deposit by Account Type

| Account Type | Deposit (USD) |

|---|---|

| Standard | $0 |

| Prime | $2,000.00 |

| Institutional | $20,000.00 |

Deposit Methods and Supported Currencies

Depositing funds in your Blackbull Markets account is easy and straightforward. The broker understands that every trader has their own needs, so it accepts multiple deposit methods so you can transact with the most convenient one for you. Remember, making deposits with the supported payment methods is instant except for the bank transfers method, which takes 1-3 days to process.

That being said, here are the supported payment methods on Blackbull Markets.

Traders can deposit their account by:

1. Credit Cards Payment Method

- Visa

- Mastercard

2. Cryptocurrency

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Ripple

- Dogecoin

- Cardano

- Polkadot

- Chainlink

- EOS

- Stellar

3. Deposit via Payment Service Providers

- AstroPay

- Beeteller

- Boleto

- China Union Pay

- Crypto

- Deposit channel

- FasaPay

- FXPay 88

- Help2Pay

- Interac

- Neteller

- Skrill

- OpenPayd

- PaymentAsia

- PicPay

- PIX payment

- Poli

- Thai QR Payment

- Transferência Eletrônica Disponível

4. Bank Transfers

Regarding currencies for deposits, Blackbull Markets accepts USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD, and ZAR. Remember, Blackbull Markets adheres to stringent AML regulations. This means that when making withdrawals via credit/debit cards and e-wallets, you can only withdraw up to the same amount of money you deposited. Any additional amount must be sent via the bank transfer method to an account proven to be yours.

| Withdrawal Method | Withdrawal Fee |

|---|---|

| Credit Card | 5.00 Base Account Currency |

| Neteller | 5.00 Base Account Currency |

| Skrill | 5.00 Base Account Currency |

| International Bank Transfer | 5.00 Base Account Currency |

Platform and Research Tools

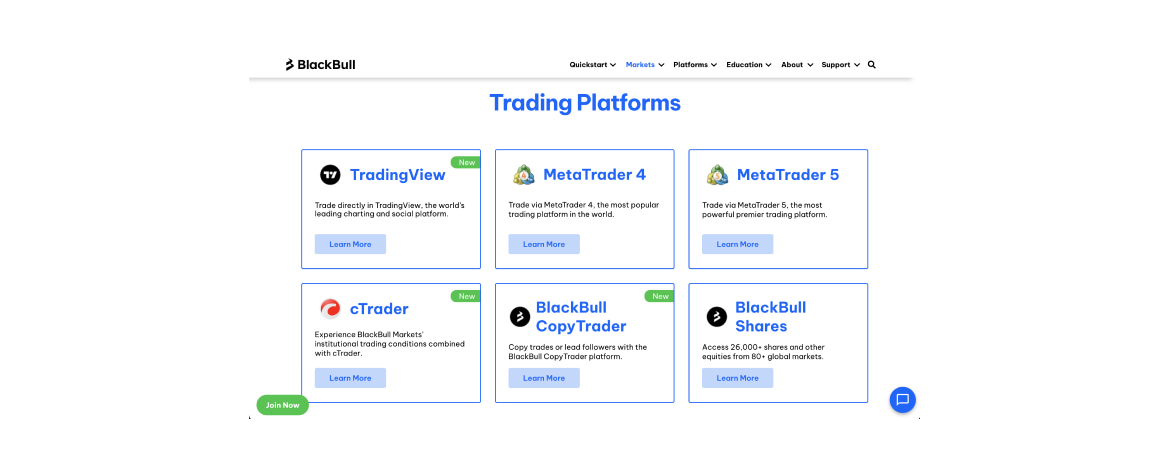

Blackbull Markets allows you to trade the way you want by offering you a wide range of trading platforms to choose from. These include the TradingView, MT4, MT5, MT4 MultiTerminal, WebTrader, and Blackbull shares. In addition, you get to ensure a social and copy trading platform, whereby you get to interact with experienced traders from global regions and follow them so you can easily mirror their positions with high-profit potential.

Regarding research tools, Blackbull Markets features a Blackbull Research platform that exposes you to plenty of tools to help with your strategy development. These include trading ideas, market analysis tools, a news feed, and an economic calendar. You can also access its Blackbull Shares platform via mobile device to manage your positions on the go.

How To Register a BlackBull Markets Account

Creating a Blackbull Markets account is pretty straightforward and will take only a few minutes to complete. Various trading accounts are offered, including the Standard, ECN Prime, Islamic, and Institutional accounts. Below, we take you through the procedures for creating a Standard account to ensure newbies get the procedures right and kickstart their activities on a good note. Remember, the standard account has no minimum deposit requirement and doesn’t charge commissions.

- Visit Blackbull Markets’ website via the links shared on this page to begin the account registration process.

- Before beginning the process, ensure you understand the broker’s terms and conditions and confirm whether it supports the asset you want to trade.

- Click “join now” to register for an account using your personal details, including your name, date of birth, email, phone number, jurisdiction, etc.

- A verification link will be sent to your email to confirm whether all the details you provided are accurate.

- The broker will review your application by analyzing the documents you share for verification, including your ID card or passport and a utility bill or bank statement.

- Once your account is approved, an email will be sent as a notification, after which you will deposit any amount you can afford to trade. Remember, various deposit methods are supported, all of which you get to transact with free of charge.

- You will then get access to the listed assets to choose from and trade. Remember, ensure the broker’s fees fit your budget to enjoy your experience. Also, start trading on its demo account to boost your confidence and avoid risking money without experience.

Editor’s note

Blackbull Markets is an excellent forex and CFD broker because of its comprehensive offerings. Its support service, operating 24/7, is backed up by a team of friendly professionals dedicated to offering you the assistance you need to maximize your experience. Besides offering a highly secure trading environment, you are guaranteed quality trading and learning resources.

Overall, we recommend Blackbull Markets to forex and CFD traders looking for a broker with low fees and MetaTrader platforms. Feel free to test it via its demo account and analyze user testimonials regarding their experience on Google Play, the App Store, and Trustpilot. We assure you that it is worth trading with. All you have to do is ensure it meets your trading requirements.

FAQs

According to our analysis, Blackbull Markets is a safe broker not only because of its long track record but also complies with the AML’s stringent policies. In addition, the broker is regulated by top-tier authorities across various global regions, including New Zealand, the UK, Seychelles, etc. On top of that, your money is secured in a segregated account that is only accessible to you.

Absolutely. As mentioned above, Blqackbull Market is regulated across various regions globally. Some of the authorities overseeing the broker’s activities include the Financial Conduct Authority (FCA), the Financial Markets Authority of New Zealand (FMA), and the Financial Services Authority of Seychelles (FSA).

Yes. Blackbull Markets is registered in the UK under company number 9556804. It is also regulated by the FCA, UK’s financial regulatory authority.

Yes. Blackbull Markets has an exceptional track record and ability to comply with various authorities’ policies and regulations. In addition, Blackbull Markets understands that every trader has their own interest. Therefore, it features various accounts and trading platforms to choose from, depending on your skill level. You also get exposed to additional quality resources to maximize your experience and potential.

Experience with Black Bull Markets is nice and friendly. Fast and polite customer service. Transparent commissions. But huge overnight spreads disappointing me.

Easy to use, very intuitive platform to trade. Great customer support. They have over 26,000 tradable instruments - it’s really a lot, thank you for the opportunity to choose.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

BlackBull feels like a proper trader's broker. Not trying to be flashy or attract beginners with gimmicks—just solid execution, tight pricing, and professional service.

If you're experienced and want a reliable platform without the BS, it's a strong choice. If you're new and need hand-holding or want a user-friendly app experience, probably not your best bet