Interactive Brokers is a leading online stock broker for advanced traders. They have a great 46th year of experience on the trading market.

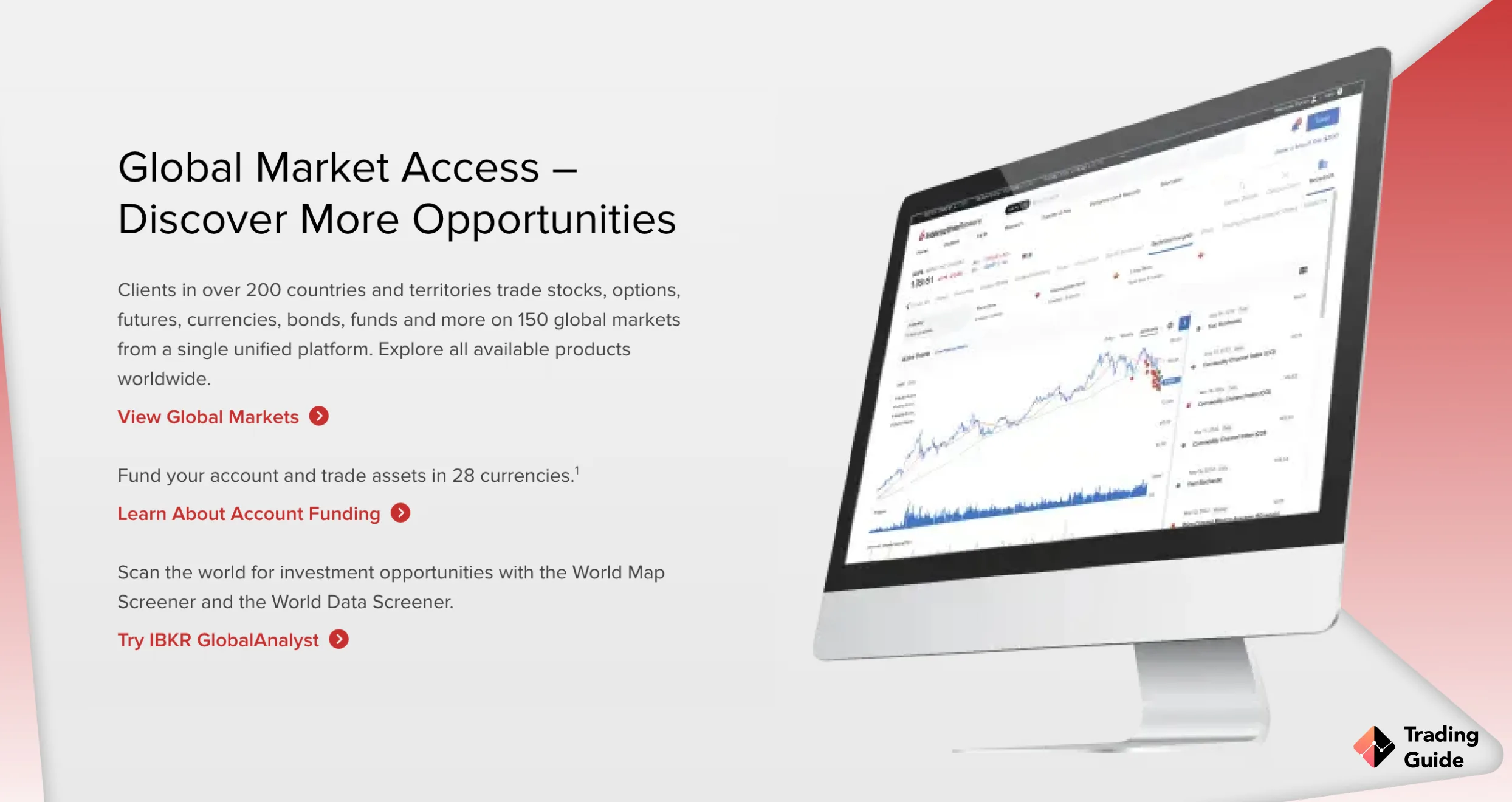

- Users get to explore over 150 markets across 33+ countries globally

- Licensed and regulated by multiple global financial authorities

- Excellent selection of trading instruments

- Withdrawal fees apply

- The IBKR Lite plan, which offers zero commission on US Stocks, is only available to US clients

Over four decades ago, Interactive Brokers (IBKR) was established as a brokerage company. Today, it serves millions of traders and investors across over 150+ market destinations globally. The broker is also safe since various global authorities regulate its services. Moreover, users get exposed to plenty of trading tools and assets to help them try their luck in the financial market.

Below, we review IBKR by taking you through all its features. You will also understand where the broker excels and falls short to decide whether it is worth investing with. Keep in mind that we have a team of professional researchers who left no table unturned to ensure you are accurately informed.

Interactive Brokers is Best For

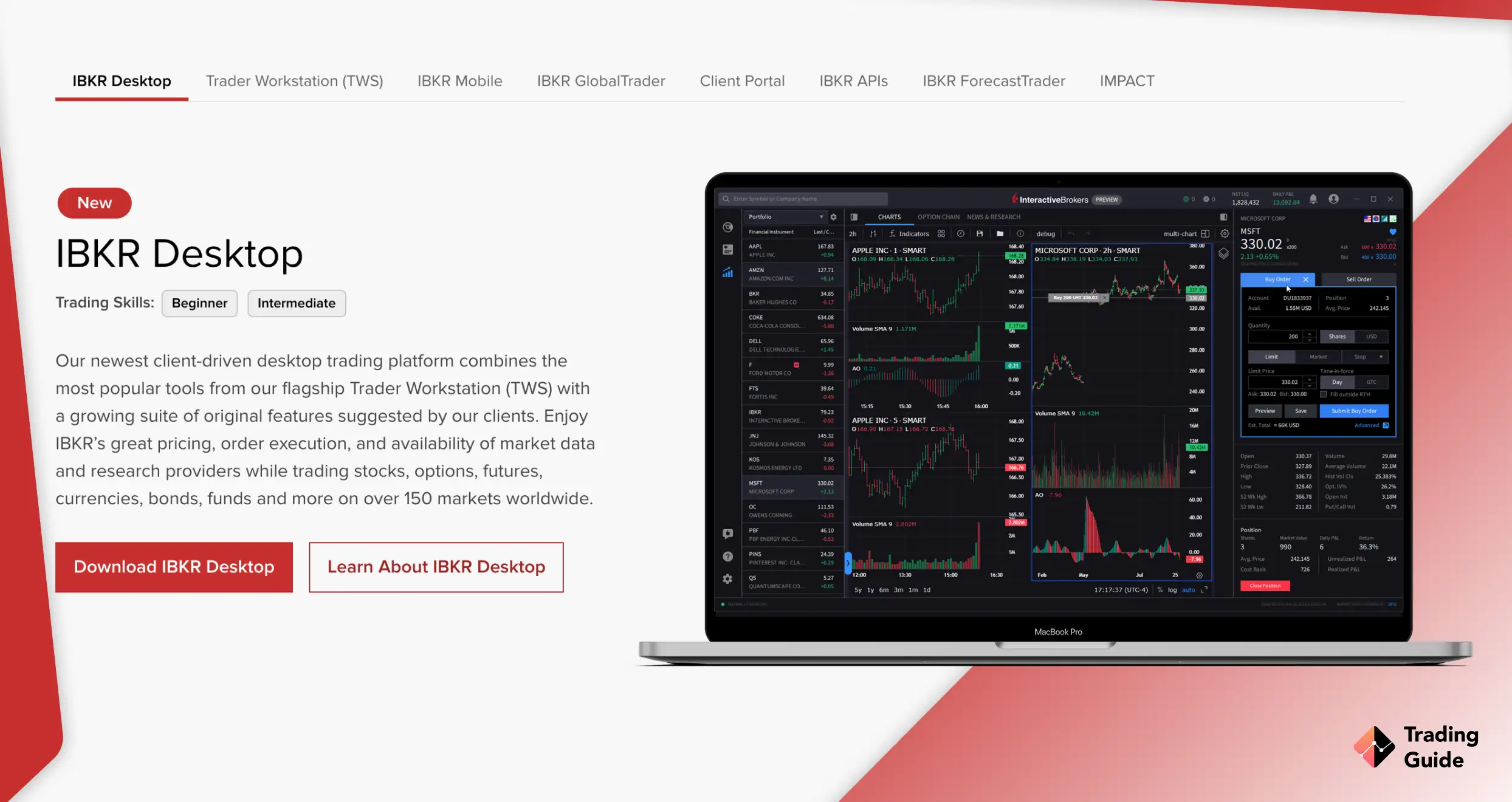

Interactive Brokers is best suited for any trader looking for a credible and reliable broker. Besides being licensed and regulated by top-tier authorities, the broker also hosts excellent tools for skills and strategy development. However, we primarily recommend the IBKR desktop platform to advanced traders since it can be challenging for newbies to navigate. This doesn’t mean that newbies should avoid using Interactive Brokers. The good news is that the broker is backed up by the GlobalTrader app, known for its streamlined design and easy for novice investors to use. Experienced stock traders can also use the app as it is powerful enough for all users. Besides, IBKR has a demo account you can test it with before making a final decision.

Interactive Brokers is also suitable for low-budget traders who are sceptical about investing a lot of money using a new broker. With it, there is no minimum deposit requirement. The first withdrawal is free; subsequent withdrawals cost GBP 7 per withdrawal in the UK. Additionally, you will incur low trading costs when trading the featured assets and zero commissions on US-listed stocks and ETF trades. On top of that, IBKR allows its users to earn extra income on lendable shares.

For share investors, note that this broker supports fractional share trading. This means that users can choose any eligible US, Canadian or European stock (or ETF, where available) and decide how much they want to invest regardless of the share price. With fractional shares, investors can divide their investments among more stocks to achieve a more diversified portfolio and put small cash balances to work quickly. And if the dollar amount doesn’t result in a whole number of shares, Interactive Brokers will buy or sell fractional shares.

Interactive Brokers – Who Are They?

Founded in 1978, Interactive Brokers is an award-winning broker that we highly recommend for individuals looking for extensive services at low fees. The broker offers its clients in over 200 countries and territories the ability to trade stocks, options, futures, currencies, bonds, funds and more from a single unified platform. You will have access to 150 markets and the ability to fund and trade accounts in up to 27 currencies.

Note that IBKR is headquartered in the US, with other offices spread globally, including Canada, the UK, Australia, Singapore, Ireland, China, etc. It is licensed and regulated by top-tier authorities, including the Australian Securities Investment Commission (ASIC), the Financial Conduct Authority (FCA), MAS, CFTC and more. This proves that your funds are safe with this broker, and all you need to do is focus on strategy development for maximum experience and potential.

Interactive Brokers: General Features

The table below summarises Interactive Brokers’ general features for better understanding. Before deciding whether to invest with it, ensure all features listed below suit your requirements for increased potential.

| Type | Fee |

|---|---|

| Account Minimum | $0 |

| Licenses and Security | FSA, FCA, ASIC, FINRA |

| Assets Offered | • Stocks.• Bonds.• Mutual funds.• ETFs.• Options.• Fractional shares.• Futures.• Forex.• Metals |

| Cryptocurrency Availability | Bitcoin, Litecoin, Ethereum, Bitcoin Cash |

| Fees and Commissions | Zero inactivity fee |

| Deposit Methods | Bank transfers |

| Account, Platforms and Research Tools | IBKR Lite* and IBKR Pro |

| Mobile Trading | Available for IOS and Android users |

| Education | Video lessons, Traders’ Academy |

| Customer Service | Phone, email, chat support |

*only available to US clients

Licences and Security

As mentioned earlier, Interactive Brokers is trustworthy since it adheres to the stringent regulations of various financial authorities globally. With it, you are guaranteed the best trading conditions that will give you a worthwhile experience. Moreover, IBKR secures traders’ funds in segregated accounts to ensure no one can access them even if the broker goes bust.

That being said, here are some of the financial authorities overseeing this broker’s activities across various regions.

- Interactive Brokers (U.K.) Limited: Licensed and regulated by the Financial Conduct Authority (FCA) under license number 208159. It offers its UK clients a compensation scheme of up to £85,000.

- Interactive Brokers LLC: Licensed and regulated by the Financial Industry Regulatory Authority (FINRA) and the US Securities and Exchange Commission (SEC). With these licenses, US clients get to benefit from a compensation scheme of up to $500,000.

- Interactive Brokers Ireland Limited: Licensed and regulated by the Central Bank of Ireland (CBI) with client protection of up to £20,000 for clients in northern and western Europe.

- Interactive Brokers Australia PTY LTD: Licenses and regulated by the Australian Securities and Investment Commission (ASIC) with zero protection for Australian clients.

- Interactive Brokers Singapore PTE LTD: Licensed and regulated by the Monetary Authority of Singapore (MAS) with zero client protection for clients in Singapore.

- Interactive Brokers Securities Japan Inc: Licensed and regulated by the Financial Services Agency (FSA) with no protection for Japanese clients.

- Interactive Brokers India Pvt. Ltd.

- Interactive Brokers Hong Kong Limited

Assets Offered

Thousands of instruments across various asset classes are offered by Interactive Brokers to choose from. As a new trader on this platform, understanding the availability of these assets helps you determine whether IBKR is worth trading with. Some of the product offerings on Interactive Brokers include:

- Forex

- Stocks

- Options

- Futures

- Mutual Funds

- Commodities

- ETFs

- Bonds

Interactive Brokers allows you to trade stocks across 90+ marketplaces. You can also trade the assets as CFDs and ETFs. Simply put, there are numerous asset offerings, and you will never lack options for portfolio diversification. However, note that not all assets are available in every geographical location, so confirm availability before signing up for an account.

Fees and Commissions

IBKR prides itself on charging one of the lowest fees in the industry via its IBKR Pro plan to help you limit expenditures to maximise returns. Besides its zero minimum deposit requirement, the broker has no added spreads on trades. You will also enjoy free account registration and deposits with no ticket charges or platform fees. On top of that, IBKR doesn’t charge an inactivity fee for dormant accounts, but it is important to remain active to quickly become independent and successful.

| Type | Fee |

|---|---|

| Minimum Deposit | $0 |

| Deposit Fee | Free |

| Withdrawal Fee | The first withdrawal per calendar month is free. Subsequent withdrawals cost GBP 7 per withdrawal in the UK |

| Market Interest Rate | Up to 4.83% |

| Inactivity Fee | $0 |

Besides the IBKR Pro plan, Interactive Brokers also features an IBKR Lite plan (Note that IBKR Lite is available only to US clients) that is specifically tailored for US clients. With it, you can trade US-listed stocks and ETFs commission free.

When it comes to IBKR’s market interest rate, clients can earn up to USD 4.83% on instantly available cash balances. For instance, accounts with a Net Asset Value (NAV) of USD 100,000 (or equivalent) or more are paid interest at the full rate for which they are eligible. Accounts with NAV of less than USD 100,000 (or equivalent) receive interest at rates proportional to the size of the account. Note that no interest will be paid on the first USD 10,000 of cash.

Deposit Methods and Supported Currencies

Interactive Brokers clients can fund and trade their accounts in up to 27 currencies, depending on jurisdiction. These include GBP, USD, EUR, AUD, JPY, etc., and using them allows you to transact and trade without incurring currency conversion charges. Unfortunately, IBKR only allows deposits using the bank transfer method, and you can only deposit from sources listed under your legal name.

As mentioned earlier, deposits on Interactive Brokers are free, but you might incur charges from your bank. So, ensure you are well-versed with your bank’s fees to ensure you trade under budget.

Account, Platforms and Research Tools

Interactive Brokers features web, mobile, and desktop trading platforms, all featuring amazing tools and fast trade execution speed. We primarily recommend its desktop trading platform to professionals since we noticed it can be challenging for newbies to navigate. However, its mobile app, especially the GlobalTrader, is designed with newbies in mind. Besides a modern design, its menu is easy to navigate, thus making it easier for newbies to explore the financial markets.

When it comes to research materials availability, rest assured of limitless supply. For instance, there is a good interactive chart that features over 90 technical indicators. The broker also offers a news feed that helps you stay abreast with daily news, market summaries, and economic calendars for maximum experience. Other resources available on IBKR platforms include a search tool, investors’ marketplace, IBKR GlobalAnalyst, etc.

Mobile Trading

As mentioned above, IBKR features mobile trading for traders who are always on the move. This means that instead of sticking to your trading station, you can still manage your position anytime you step away. Interactive Brokers offers several apps, including IBKR GlobalTrader, IBKR Mobile and the award-winning IMPACT app (‘Top ESG Broker’ by BrokerChooser, 2022), designed to enable investors to align their investments with their values.

Education

IBKR hosts numerous learning materials that can be useful for both newbies and intermediate traders. For instance, its IBKR Campus features resources that will help you learn more about trading, financial markets, and the broker’s trading tools. There is also a Trader’s Academy with many course catalogues for informed decisions. Other learning resources offered by IBKR include webinars, Traders’ Insights, podcasts, quantitative blogs, a Student Trading Lab, videos, etc.

Customer Service

Although many users on Google Play, the App Store, and Trustpilot do not highly rate IBKR’s support service, it is available via phone, email, and live chat. Based on our experience with Interactive Brokers’ support service, its email response is relatively slow. The good news is that help is available via the IBot automated response system, a natural language-based interface that quickly provides solutions to common questions. IBKR support service agents are available in various languages, including English, Chinese, Japanese, Indian, etc.

Compare Interactive Brokers Features With Other Brokers

Compare brokers

How To Register an Interactive Brokers Account

Registering for an investment account with IBKR is a pretty straightforward process that takes minutes to complete. Below are the procedures involved to help you get started on a good note.

- You need to visit the IBKR website to create an account. We help you gain quick access to the site by sharing links on this page.

- Before you start the registration procedure, read and understand Interactive Broker’s terms and conditions. It s also essential to install the IBKR trading app on your mobile device to manage your positions on the go.

- Complete the account registration process using your personal details, including your name, email, phone number, date of birth, etc. You must also choose a unique username and create a password for maximum account security.

- IBKR is regulated across various jurisdictions, including the UK. Therefore, to ensure its trading platform is safe, the broker requires that you verify your details. This means that you must share a copy of your ID card, passport, or driver’s license for identity verification. You must also share a copy of a recent utility bill or bank statement to verify your location.

- IBKR will then review your details and send you an email notification once your account is fully activated. At this point, you are free to make your deposit and access the featured securities to explore.

Editor’s Note

Based on our tests and analysis, we consider IBKR an excellent option for traders looking for advanced platforms and features. If you are a beginner, you need to be cautious when using this broker since its platform can be challenging to navigate. The good news is that you are exposed to plenty of learning resources and a demo account to help you get familiar with the financial market.

IBKR also features an intuitive design platform that is customisable. Its mobile application is also highly rated by users as it allows you to manage your positions using your mobile device on the go. Plus, Getting started at this broker’s platform is easy and free. You can trade with any amount you can afford since IBKR doesn’t have a minimum deposit requirement.

Regarding product availability, IBKR hosts all tradable assets you may need to trade. Choosing the assets you are familiar with can make you enjoy your trading experience at Interactive Brokers’ platform and improve your profit potential. Overall, IBKR is a safe and trustworthy broker. Simply ensure it suits your trading requirements before you register for an account.

FAQs

Yes. Interactive Brokers is one of the pioneer and safe brokers globally, with high ratings from users. It is licensed and regulated by multiple world-renowned authorities as listed above. This means that using it gives you an opportunity to trade securely under the best conditions. Your money is secured in a segregated account only accessible to you.

Yes. Although we primarily recommend IBKR to professional traders, newbies who are confident in their skills are welcome to use it. As a beginner, you can benefit from the broker’s demo account and plenty of learning resources to help you improve your skills.

Interactive Brokers doesn’t have a minimum deposit requirement, and its charges are relatively low. Therefore, you can get started with IBKR with as little as £50 for as long as you understand all the trading fees applicable. Remember, trading under budget is essential to avoid getting emotionally frustrated in case a trade doesn’t work out in your favour.

Absolutely. Interactive Brokers is good for day traders looking to take short-term positions. Its low charges plus fast trade execution speed enables you to quickly enter and exit a trade, thus limiting the risks of losing your money.

Yes. IBKR has access to over 90 stock markets, meaning you can use it to buy various global stocks. You can also trade the featured stocks as ETFs or CFDs. Simply ensure it suits your investment requirements for maximum experience.

Yes. Interactive Brokers allows you to trade various cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. However, crypto asset offerings on this broker are limited, and you must confirm the availability of your preferred cryptocurrency before diving straight in.

No. Unfortunately, IBKR doesn’t feature MetaTrader platforms. However, advanced traders are exposed to other powerful platforms that host quality resources to help them increase their profitability.

IBKR has access to over 90 stock exchanges, including the NYSE, NASDAQ, Mexican Stock Exchange, Canadian Securities Exchange, to name a few. As a stock investor, ensure the company shares you plan to invest in are listed on an exchange IBKR has access to.

You can open multiple client accounts with Interactive Brokers. However, opening more than one account is unnecessary since you can invest in multiple assets using a single account. Simply ensure the account you select is compatible with your skill level.

Yes. Although IBKR allows transactions and trading using over 20 currencies, you may be required to convert your currency when transacting using those not accepted by the broker. For UK traders, IBKR supports trading and transactions using the GBP currency, so there is no need to worry about currency conversions.

If you trade larger blocks of low-priced shares, you might be better off at a fixed fee broker like Tradeking or Optionshouse. If you want to scale in and out of modest positions (more frequent trading) say 500, 1,000 shares, etc., Interactive Brokers charges a 50 cent commission per 100 shares (5 trades of 200 shares is the same $5 commission as one trade of 1,000 shares). Options commissions are approx 75 cts per contract (less if closing out 1 to 5 ct premiums) with free option assignment and exercise. You sometimes get rebates for providing liquidity as well.

free or premium? or both?

A glance at actual costs and whether Interactive Brokers is really free.

I have both Demo and live accounts with Interactive Brokers. Both are working well!

Interactive Brokers are the best, because they offer access to markets around the world at fair prices and support almost every trading platform on the market!!

Over the years of my trading, I've used multiple brokers. However, my favorite broker of all is still Interactive Brokers. As a UK-based investor, you are eligible to have an account with IBKR. Although they do look at your experience with investments for different products when reviewing your account application and access to each product. The best thing I like about IBKR is its low commission and wide access to various markets and products. In terms of commission, it is much cheaper than your conventional local brokers and highly competitive against offshore online brokers. As for access to products, it has virtually almost anything that a private (or even professional) investor/trader is looking for. You can trade equity, CFD (spread betting), options, futures, commodities, bonds, FX, etc. just to name a few. Besides, the online chat support is extremely helpful in my opinion when you need help asap especially during odd hours when trading other markets. The mobile app for IBKR is decent in my opinion, allows you to check your positions, enter trades, view your watch list, etc.

Guys who are just getting to know a broker, be patient. It's worth it. This broker is for those who are ready for more professional tasks that require more professional tools. This is a reliable broker, I chose it myself based on the reviews. I hope my review will help you make the right choice. The best things come from hard work!

On the whole, I am satisfied with IBKR. But it took me a while to get into it first. Now I can do all the operations I need quickly and easily. In general, the impression is that it is made with care for people and their needs. It's just that a beginner and a professional have different needs. Some need quick access, some need detailed analytics.

I am very satisfied with IBKR. Their platform is fairly easy to use.I have a friend who recommended the platform. It's a good platform and from what I have read, is also competitive.

IBKR is still working with us despite the hard situation. Thank you for it. You are out of politics! Fees good, customer service good. Platform outdated but very stable!

Great broker, with lots to offer. I've been with IB since 2019. My experience for these 3 years. The trade commissions for US markets are low, and for Europe markets-more expensive, but still. There is no inactivity fee - this is a good option, I think. I've never had any problems with withdrawals, always quick and successful.

Overall impression is good. It's not a typical retail broker. Good price for trading, customer support availability and reaction, some functions of the app are intuitive. The commissions are not high but given that I still use them as the execution and software makes it worth it.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal