Revolut is the best solution for trading without hidden fees. There is no minimum deposit level and it is commission-free for stock investments.

- Wide range of banking and money transfer services

- Advanced mobile app

- Competitive exchange rates

- Open an account is very easy

- No ISA or pension options available

- You can only buy shares in US companies

Revolut’s trading platform is an extension of its banking app. This means you need to have a Revolut bank account open, in order to start trading with Revolut.

It takes just a few minutes to open a Revolut account and start trading. After registering a brokerage account, you get access to more than 800 US stocks, gold, silver, and some other currencies.

We’ve spent many hours studying the Revolut mobile app and trading platform in detail, to share the results of our work with you below.

Revolut – Who Are They?

Revolut is a British financial technology company headquartered in London, England, that offers banking services. It was launched in 2015 by Nikolay Storonsky and Vlad Yatsenko, with a goal to simplify banking experiences through long-term fixed-fee accounts and debit cards.

Currently, Revolut serves around 20,000 businesses, and they are signing up around 2,500 more every week. Besides its multi-currency accounts, they also ensure fast international money transfers to other businesses, corporate cards, integration with accounting software and platforms, instant settlements, and expense reports.

Today, Revolut has over 12 million customers, and they estimate that they have saved customers over £740 million in fees.

Compare Revolut Features With Other Brokers

Compare brokers

Commissions and Fees

| Type | Fee |

|---|---|

| Minimum deposit | £0 |

| Withdrawal fee | £0 |

| Deposit fee | up to $4.95 |

| Inactivity fee | £0 |

| Custody fee | 0.12% |

| US stock trading | Low |

| Gold trading | 0.25% markup during market hours 1% markup during non-market |

| Crypto trading | 1.5% markup on bid or ask price |

Payment Pricing

| Payment Method | Commission |

|---|---|

| UK consumer cards | 1% + £0.20 |

| All International and commercial cards | 2.8% + £0.20 |

| Revolut Pay | 1% + £0.20 |

| Easy Bank Transfer | 1% + £0.20 |

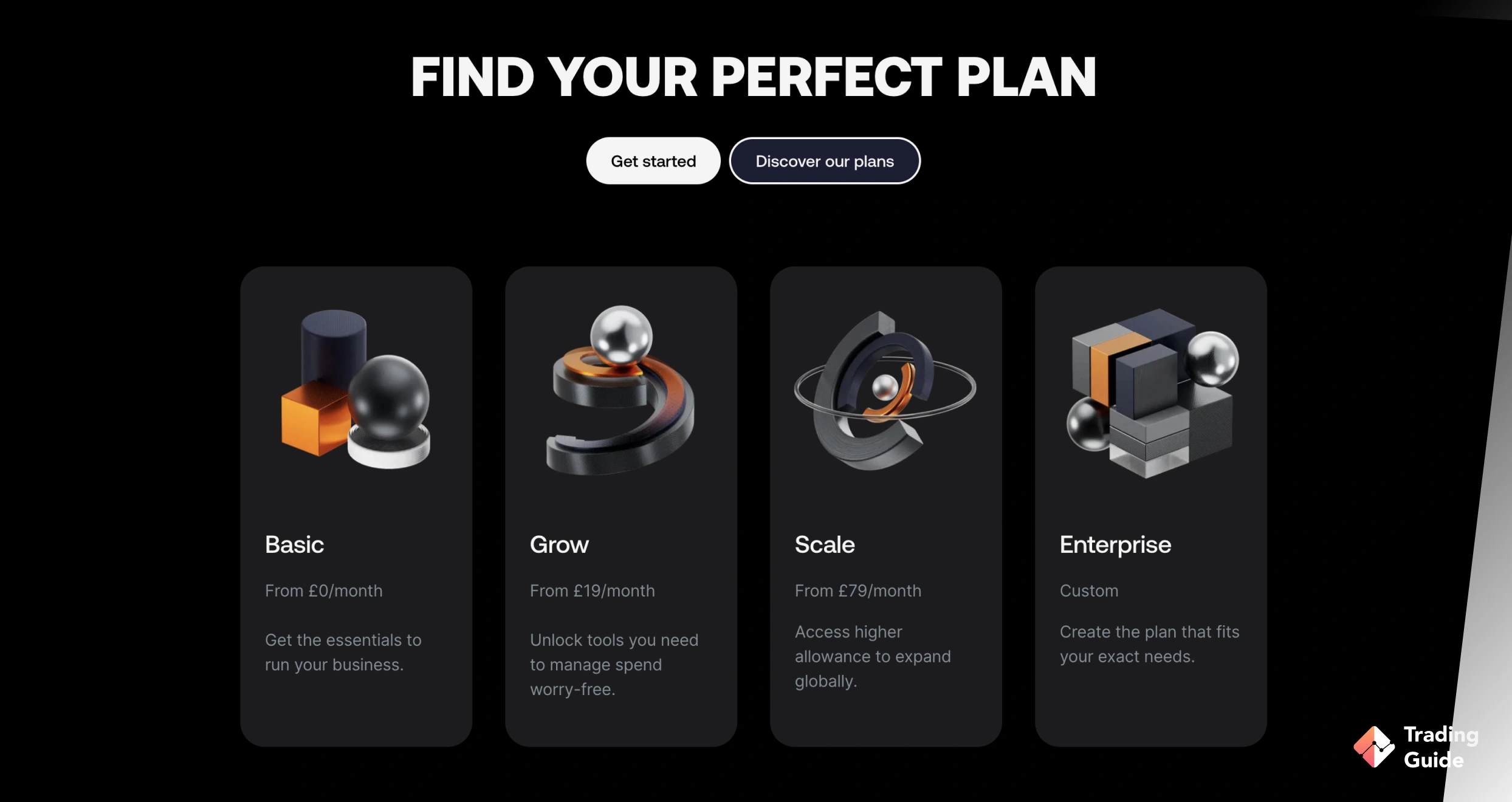

Types of Plan

| Plan | Fee |

|---|---|

| Standart | Free |

| Plus | £2.99/month |

| Premium | £6.99/month |

| Metal | £12.99/month |

Our Opinion About Revolut

During our research, our team of experts in the financial sector noted the following factors that play an important role when using Revolut.

One of the most important things is the absence of a minimum deposit level. Benefit-to-use is also justified by a free of charge basic account. But you should be aware that the free option will have limited features.

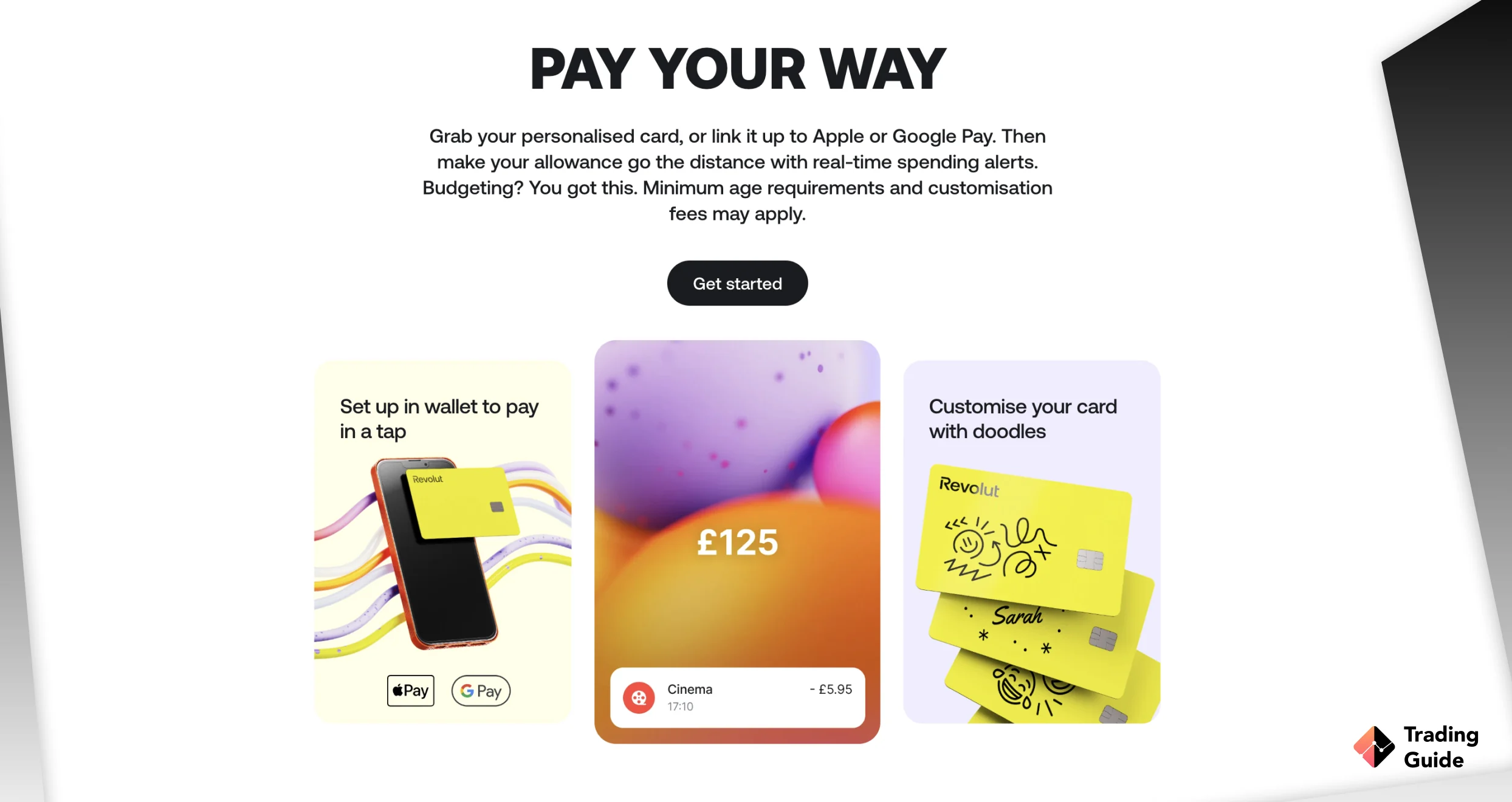

A user-friendly app will also play an important role. Revolut supports cryptocurrency and some commodity trading. Its ease of use and straightforward design make it one of the favourites.

What’s more, Revolut offers regular bank accounts and cards. This is very convenient for those who want to trade and manage all their finances through one application.

Comparing Revolut card vs Monzo (another popular digital bank), both offer innovative solutions, but Revolut’s additional features and versatility make it a preferred choice for managing finances and trading.

FAQs

Yes. Revolut UK customers can trade full and fractional shares of more than 1,500 securities listed on the New York Stock Exchange and Nasdaq.

Trading full and fractional shares on the app is commission-free and the service is also available to Revolut customers in the US and some countries in the European Economic Area (EEA). On top of that, the app also allows users to trade gold, silver, and cryptocurrencies.

Yes. Although Revolut is classified as an e-money institution in the UK, it is regulated by the Financial Conduct Authority (FCA) and licensed as a bank by the Bank of Lithuania in the EU. The fact that Revolut is regulated by the FCA means that it has to follow certain rules about safety and fund protection.

For example, it has to keep customers’ money in a segregated account at a registered bank, and that cash is ring-fenced. That way, your funds are safe even if Revolut goes bust. However, it is important to keep in mind that its Lithuanian banking licence does not cover stock trading.

Yes. Revolut trading can be a great option for those who may not have prior experience with trading and want to gain quick exposure to some of the most popular international stocks, as well as cryptocurrencies and precious metals.

Revolut offers convenience and a user-friendly platform for beginner traders. It is a low-cost broker with zero minimum deposit requirement, and you can start investing with as low as £1.

However, note that Revolut is not primarily designed for trading and lacks some of the most important tools and features traders need to succeed.

Yes. There are numerous dividend stocks on Revolut that you can buy and generate a passive income via dividend payments. However, always keep a close eye on a company’s stock price because it may decrease in value and significantly hurt your profit from dividend payments.

I like this broker. The platform is very easy to use

Great broker! I trade with Revolut, I have not observed problems with conclusions or conducting trading operations. Everything suits me. Thank you for your support.

I'm on the lookout for a better rebate scheme. Revolut can be the best option for you. It can precisely compute commissions, and you won't have to worry about rebates going unpaid.

It's easy to use and saves a fair amount of money on transaction fees. Often traveling in Europe, it is very convenient and profitable to convert currency. I'm glad I discovered Revolut.

Great broker, powerful tool, still customer support is hard to reach, and it takes a long time to solve issues, like my pending ID verification that took weeks.

When I was on a business trip in northern Cyprus, I used Revolut without any problems. But I am in Poland at the moment, and a couple of places have a slight problem, but I think old tech on their part but still working great here excellent exchange rate when you pay for something. Very handy and easy to use.

Excellent customer service!

The support service is fast and efficient.

We highly recommend opening a Revolut account.

I like everything very much!!! Great app, instant support, no additional fees for transfers. I have been using them for over 2 years and they have never let me down.

I've been using Revolut since the start of 2022 and I find it really useful and easy to use. My transfer experience was great. Arrived fast and correctly.

Great Company and service with an app that's easy to use and understand. I like it so much. They have amazing customer service, which always helps me when I have some problems.

Great for quick transfers, loans are easy to apply and trustworthy. I hope they always will be on the top.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

I use it as my daily spending card and travel companion, but I keep my serious money and investments elsewhere. It's a fantastic financial Swiss Army knife, just don't rely on it for everything.