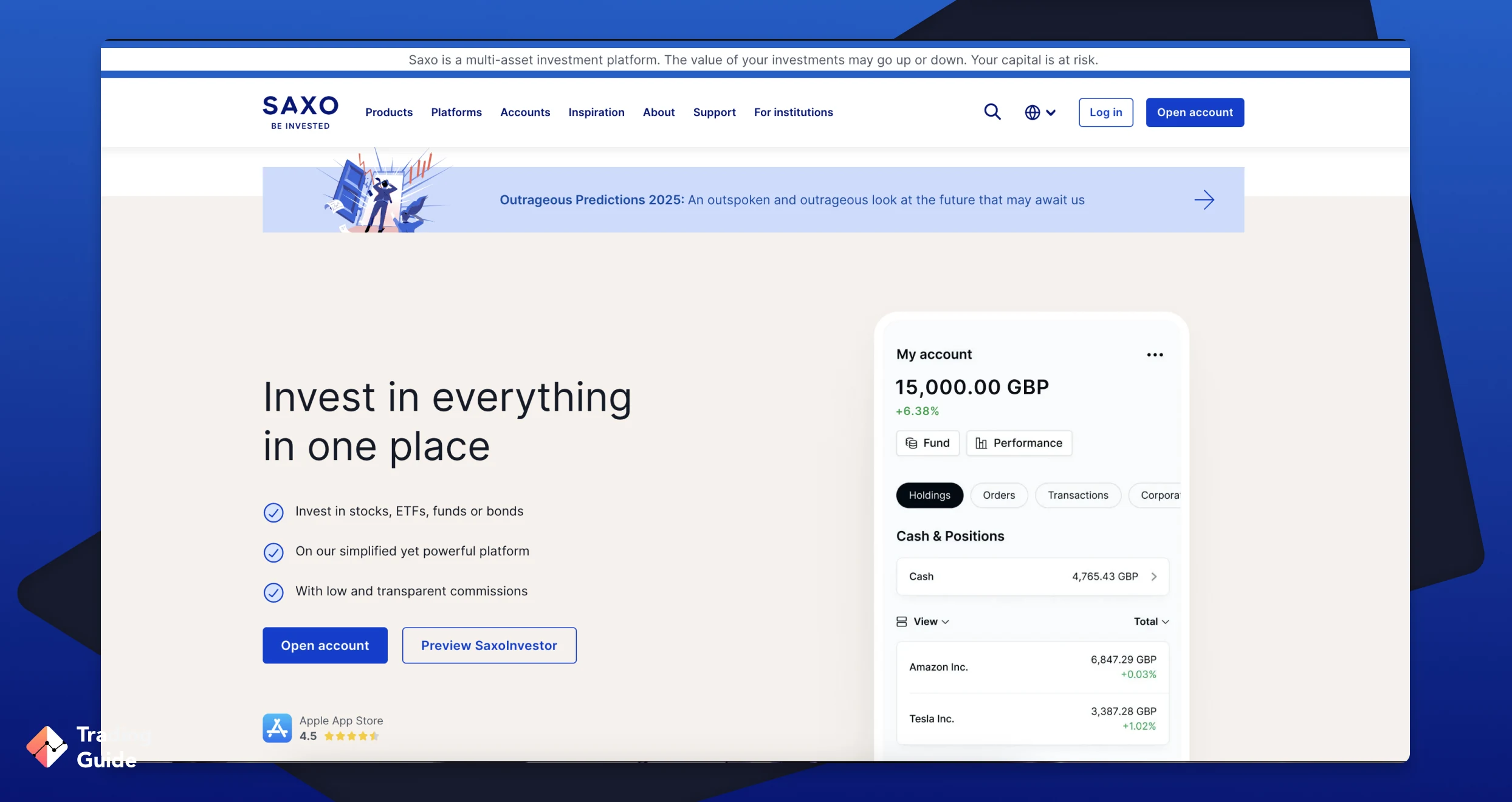

Saxo is an advanced broker that offers a wide variety of brokerage services.

- Good for experienced

- Great research offerings

- Protection for customer accounts

- Clear user interface

- Is not available for U. S. residents

- Customer support works slowly

- Doesn't support MT4

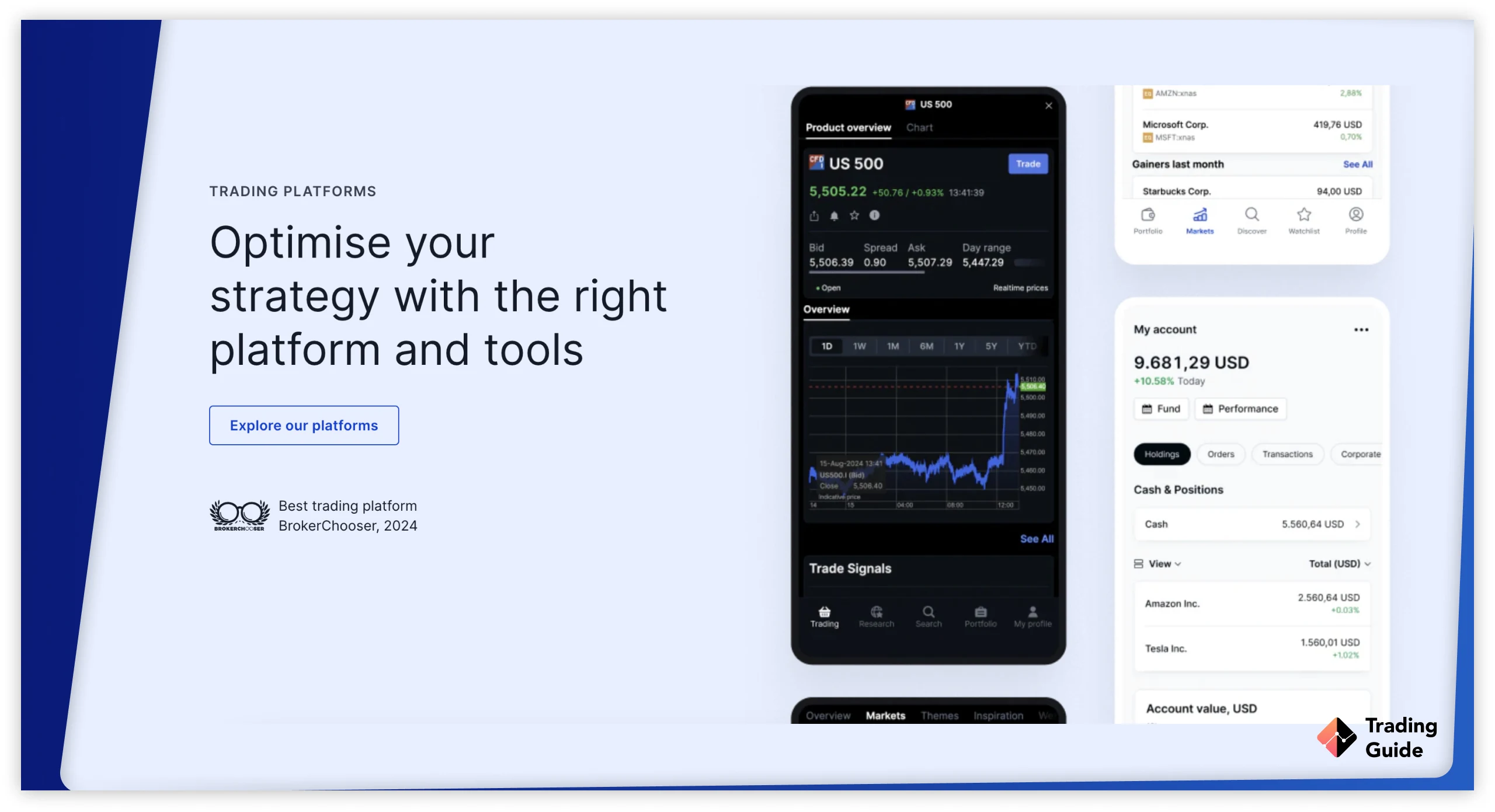

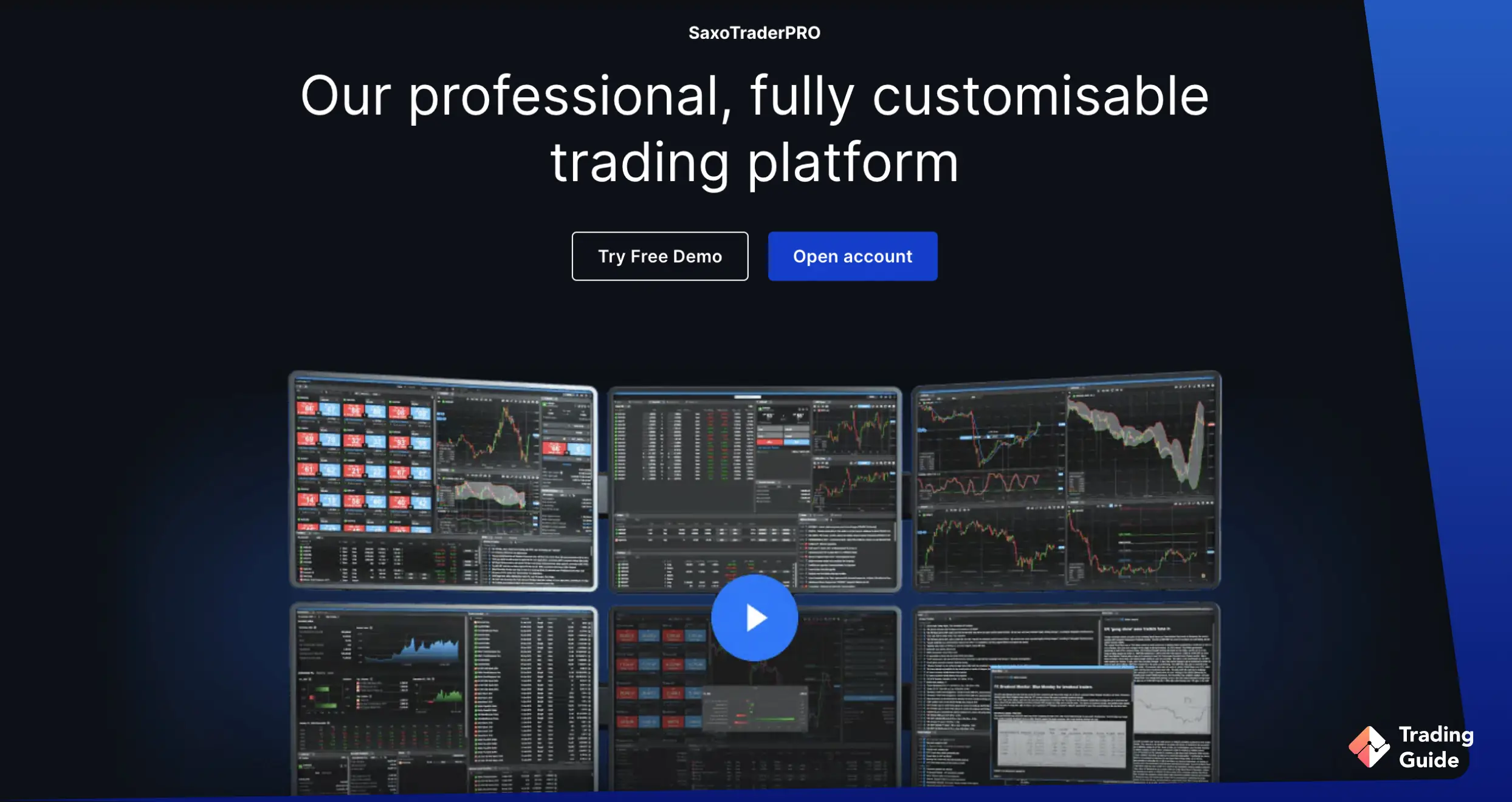

Saxo has proven to be one of the most flexible and cost-effective online trading services on the market, while also providing a comprehensive set of tools, including sophisticated charting products and many other features.

Our team spent almost one week checking and reviewing all of Saxos’ trading platform details, and now we can safely recommend it to our readers.

Saxo – Who Are They?

Saxo Capital Markets Ltd operates as part of Saxo Bank SA, a financial institution that was founded in 1992.

Saxo is a great trading platform for experienced traders with well-funded accounts. The platform allows the use of different professional tools, charts and has more than 9000 instruments.

Advanced user interfaces and powerful research offerings make this trading platform very popular among professionals. Moreover, its tight spreads and low commissions have conquered the hearts of millions of clients around the world.

On the other hand, some beginners may find it difficult to start trading with Saxo, as the broker lacks high-quality educational materials.

Compare Saxo Features With Other Brokers

Compare brokers

Commissions and Fees

| Type | Fee |

|---|---|

| Minimum deposit | $0 (for Classic account) |

| Inactivity fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Manual order fee | €50 per order |

| Stocks | from $1 on US stocks |

| Futures | $1 per lot |

| Listed options | $0.75 per lot |

| ETFs | from $1 |

| Bonds | from 0.05% on govt. bonds |

| Mutual funds | $0 |

Our Opinion About Saxo

We spent many hours researching and testing Saxo and have concluded that this trading platform is more suitable for experienced traders who already know how the trading market works.

The educational materials of the platform leave a lot to be desired for, but keep in mind that advanced traders will still have a lot to learn by using them.

Saxo offers its experienced clients extensive research capabilities, APIs, and reduced fees. Such a set of tools can put off novice traders, but for the sophisticated, well-funded professional trader, Saxo’s extensive product catalogue, advanced user interfaces, and superior research offerings would be quite appealing.

FAQs

Saxo charges average fees to trade shares, ETFs, and forex, but it can be expensive to trade bonds on the platform. Its minimum deposit requirement varies based on account type and jurisdiction.

For example, a minimum deposit of £500 is required for UK-based investors. In other European countries, Saxo has a minimum deposit requirement of $2,000. Denmark users enjoy zero account minimums, while traders from the Middle East have to deposit at least $5,000.

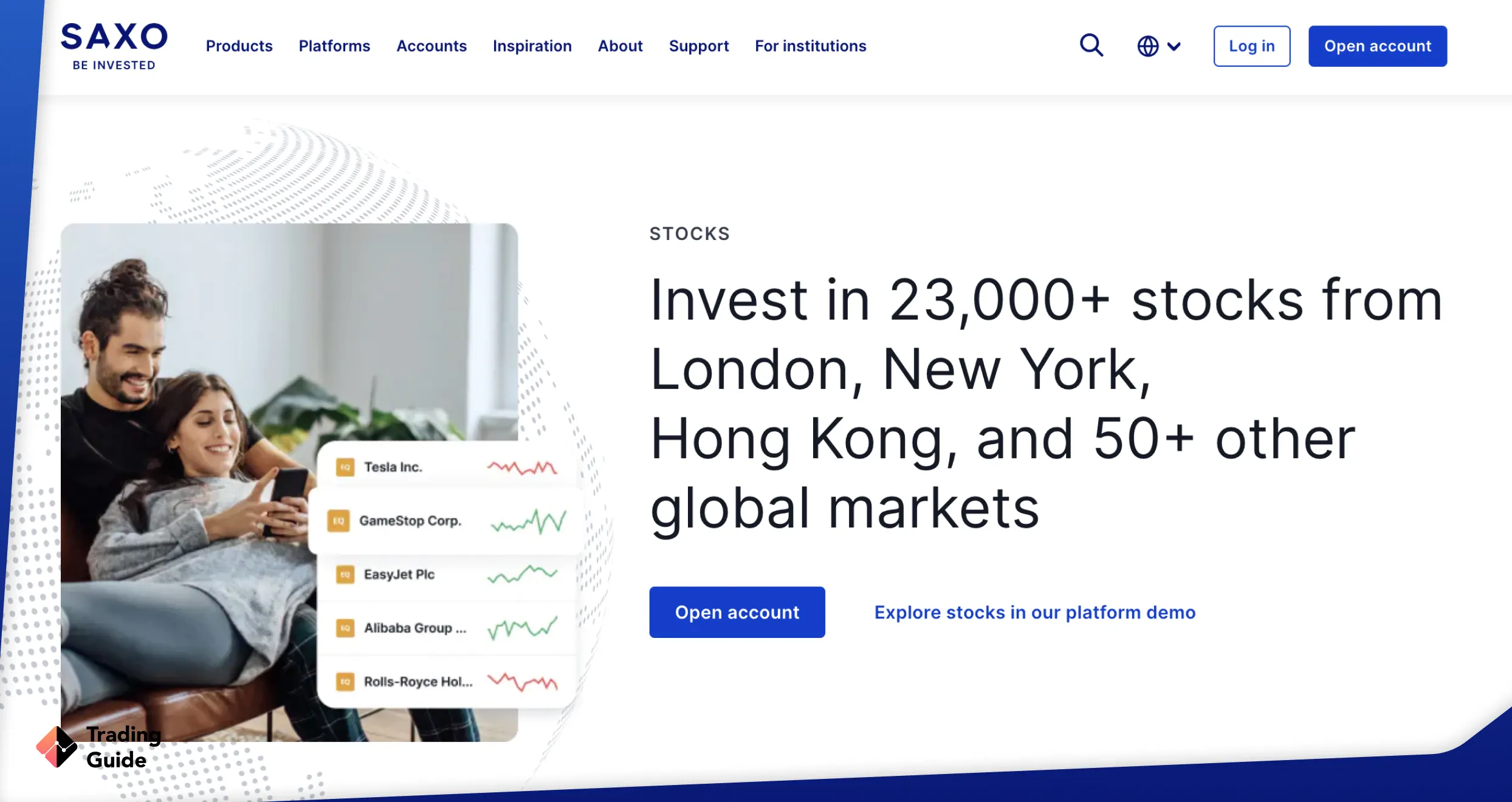

Saxo clients can trade numerous asset classes including stocks, forex, indices, futures, commodities, bonds, ETFs, and CFDs. However, ensure the broker’s charges fit your budget and you select the best trading account for your skill level.

Yes. Saxo is regulated and licensed by several top-tier financial authorities across the world, including the FCA. What’s more, your money is secured in a segregated account that is only accessible to you.

Yes. At Saxo, you can invest in crypto ETFs or crypto ETNs and track the price movement of popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin.

Saxo Capital Markets Ltd operates as part of Saxo Bank SA, a financial institution that was founded in 1992. Saxo is a great trading platform for experienced traders with well-funded accounts. The platform allows the use of different professional tools, charts and has more than 9000 instruments.

Every broker worth their salt will let you open a practice account. I would advise you to do so at Saxo Markets, I trade at Saxo Markets. Not because it is a better broker, but because I am comfortable with the trading platform I use. Whichever broker you use, become very familiar with all aspects of the trading platform before you use real money..

I like your platform; easy to understand, provides access to so many instruments all over the globe, and makes it easy to track your performance. All information is accurate and up-to-date. The perfect job is done!

Saxo Markets is a good reliable service with very friendly and helpful customer support. Great training features and videos - I like them. Also helpful are the broker consensus against some stocks.

I have been trading markets part time since 2014. The app design and content are great. Wide range of products. They charge a very reasonable fee for their services. Support is great. I recommend it.

Great customer service, great communications - very polite! User-friendly trading platform. Competitive prices. Very easy to transfer and withdraw money.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Saxo looks solid for pros, but it seems too complex and pricey for beginners. I’d rather stick with brokers like eToro or Interactive Brokers, which offer better education and lower entry costs.