Futures trading may once have seemed the preserve of hedge funds or City institutions, but it’s now a realistic option for individual UK investors. Whether you’re hedging against market shifts, diversifying beyond shares, or speculating on price moves in commodities or indices like the FTSE 100, futures provide direct market exposure, with both high potential and high risk.

Because futures use leverage, even small price changes can have a big impact. That makes it essential to know exactly what you’re getting into. If you’re curious about how futures work, where they fit in your strategy, and how to begin in the UK, this guide explains it clearly and without the jargon.

What is Futures Trading?

Futures trading involves buying or selling a contract to trade an asset at a fixed price on a specific date in the future. These contracts are standardised and traded on regulated exchanges, providing transparency and consistency.

Futures were originally designed to manage risk. A typical example is a farmer agreeing to a fixed price for crops ahead of harvest to protect against falling market prices. Today, most futures activity involves speculating on price movements rather than arranging physical delivery.

Futures cover a wide range of markets, including commodities like oil, natural gas, gold and metals. It also focuses on agricultural goods and indices such as the FTSE 100 or S&P 500. They offer market exposure without requiring ownership of the underlying asset.

How Do Futures Work?

Futures contracts allow traders to speculate on the expected direction of an asset’s price over time. If you expect the price to drop, you take a short position.

Your return is based on how the market price compares to the level agreed upon in your contract.

Each contract comes with an expiry date. Most retail traders close or roll over their positions before expiry, as taking delivery of the underlying asset is rarely the goal.

Futures are traded on margin, so you only need to deposit a fraction of the contract’s full value. This boosts potential returns but also increases the risk of larger losses. In the UK, most futures are cash-settled, with gains or losses paid in cash.

How to Invest in Futures: Step-by-Step

When considering futures and options trading, it’s imperative to understand that these markets are inherently highly leveraged and speculative. To navigate them successfully and mitigate risks, it’s crucial to familiarise yourself with the intricate contract terms and the potential for margin calls that could affect your positions.

These financial instruments demand a deep understanding of derivatives trading, and therefore, it’s advisable to engage in futures and options only if you possess the requisite knowledge and expertise. Prudent and informed participation in these markets is essential to safeguard your investments and capitalise on their potential benefits.

Futures trading is now more accessible to UK investors but still demands focus and preparation. Unlike shares, futures involve expiry dates, leverage, and added risk. Here’s how to get started.

Learn how futures work by understanding key elements like margin requirements, leverage, and when contracts are due to expire. Even minor price shifts can significantly affect your position. Use demo accounts to practise in a risk-free environment.

Pick a broker authorised in the UK by the Financial Conduct Authority (FCA). Ensure it offers the futures markets you’re interested in, whether commodities, indices, or currencies. Stick to platforms with strong risk controls and reliable support.

You’ll need to meet initial margin requirements. Since futures use leverage, only a portion of the contract value is needed upfront, but you must maintain your balance to avoid forced closures.

Select a market that fits your goals. UK traders often look at Brent crude, gold, or the FTSE 100. Understand what drives price moves in your chosen asset.

Go long or short based on your view. Use limit orders, and always set stop-loss and take-profit levels to manage risk.

Monitor your trades, expiry dates, and margin levels. Markets move fast, so review your performance and adjust your strategy as needed.

Top 3 Brokers to Invest in Futures UK

Choosing the right broker is a key part of trading futures. It affects which markets you can access, the tools available, and what you’ll pay in fees. A strong broker also offers solid risk controls and reliable support, both of which are essential in fast-moving markets.

Here are three FCA-regulated brokers offering futures trading to UK investors, each with its own strengths depending on your needs and experience level.

1. IG Markets

IG Markets is a long-standing UK trading provider overseen by the Financial Conduct Authority (FCA). It offers futures access through spread betting and CFDs, allowing retail investors to trade price movements without handling contract rollovers.

The platform offers access to various markets, from stock indices and commodities to interest rate instruments. It is known for its clean interface, fast execution, and strong educational support. While overnight fees can add up on longer trades, IG Markets remains a reliable and accessible choice for futures trading.

- FCA-regulated and trusted UK brand

- Simple, well-designed platform on mobile and desktop

- Strong educational tools and market insights

- No direct access to exchange-traded futures

- Overnight charges apply to open CFD positions

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | None |

| Advanced graphs (ProRealTime) | £30 per months |

2. Interactive Brokers

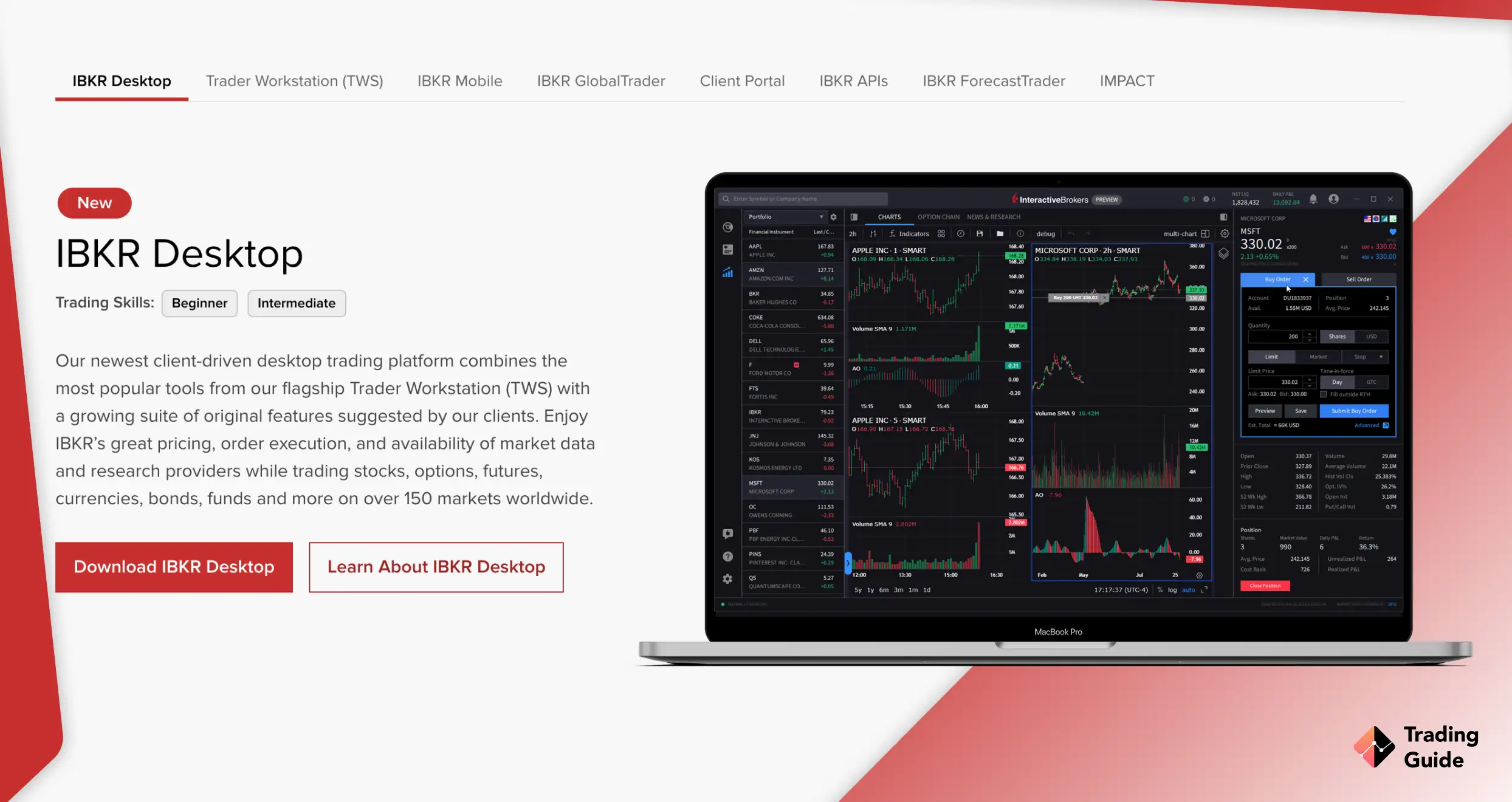

Interactive Brokers (IBKR) is a global trading platform offering UK investors direct access to futures contracts on major exchanges like CME, EUREX, and ICE. It’s best suited to experienced or high-volume traders who want global market access, tight spreads, and low commissions.

The Trader Workstation platform offers advanced charting and data tools, though it can be complex for beginners. IBKR also provides tiered pricing and margin benefits for larger accounts. While its depth is a clear strength, the learning curve and extra fees, including inactivity charges, make it more appropriate for confident, active traders.

- Direct access to global futures exchanges

- Advanced tools and institutional-grade analytics

- Competitive fees for active traders

- Complex interface, not beginner-friendly

- Inactivity and market data fees may apply

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

3. Saxo

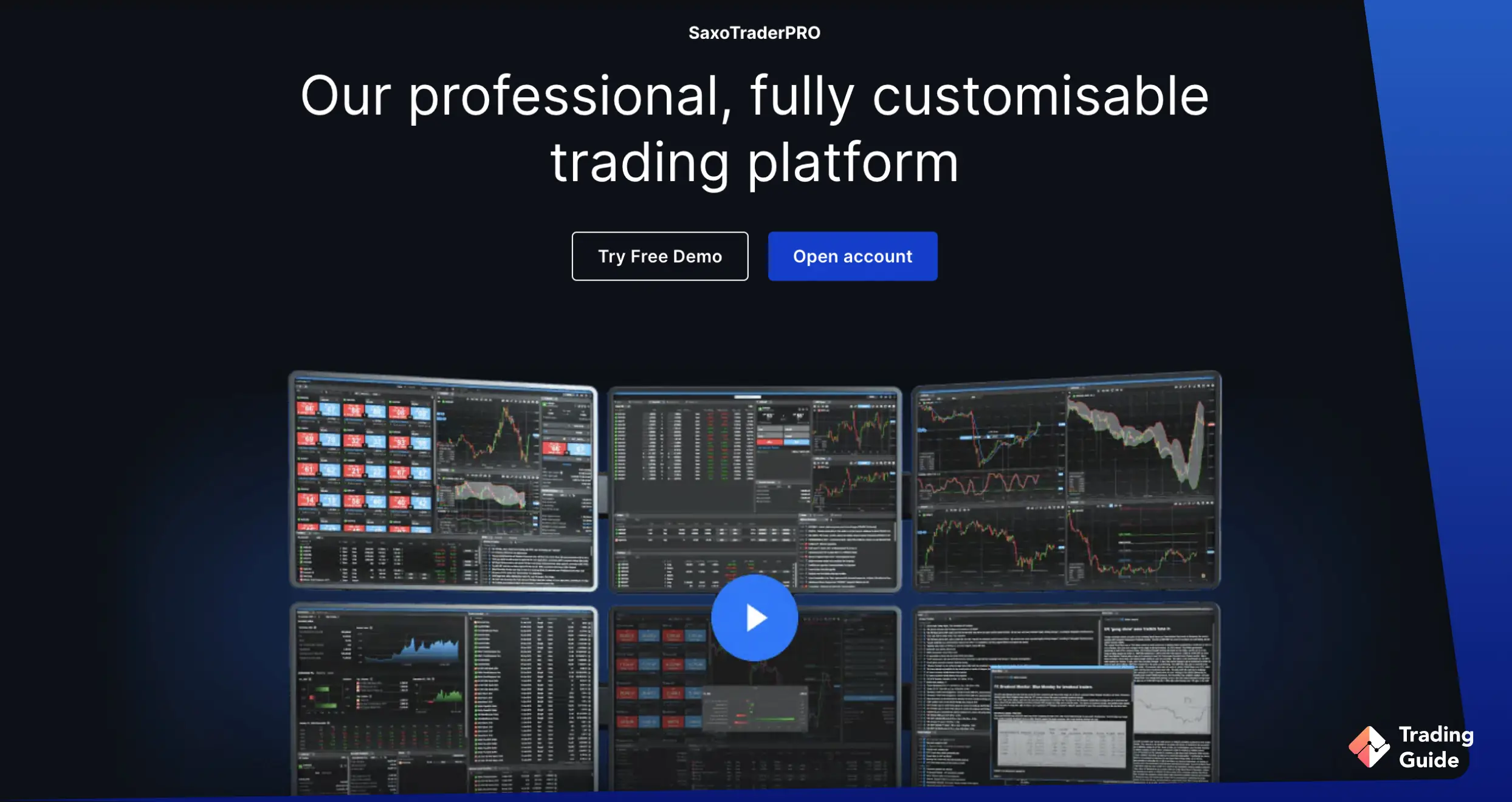

Saxo offers a high-end trading platform with broad futures coverage across commodities, indices, and interest rates. It combines a sleek, user-friendly interface with advanced tools like real-time data, fast execution, and detailed charting.

Saxo supports both retail and professional clients through tiered accounts starting at £500, with higher tiers offering better pricing and extra features. Backed by solid research and strong performance, Saxo suits traders looking for a professional-grade platform, though it may offer limited educational support for beginners.

- Excellent trading platform and mobile app

- Broad futures product range with global access

- Fast execution and reliable performance

- £500 minimum deposit may be a barrier

- Fewer learning resources for complete beginners

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

For a detailed comparison, visit the list of top futures brokers in the UK.

Selecting a Futures Trading Platform

Choosing the right trading platform is just as important as picking the right broker. It’s the tool you’ll use daily to analyse markets, place trades, and respond to fast-moving conditions. A good platform should offer more than just looks. It needs to be fast, stable, and support your strategy.

Key factors to consider:

Make sure the platform offers the futures markets you want. Some focus on indices, while others offer wider access to commodities, currencies, and global exchanges.

Check how the broker handles margin requirements and margin calls and whether negative balance protection is available. These details can directly affect your capital.

Compare trading costs, including spreads, commissions, overnight charges (for CFDs), and currency conversion fees for contracts priced in foreign currencies.

Look for features like real-time news, economic calendars, price alerts, and technical analysis tools that support your decision-making.

A responsive, easy-to-use interface reduces errors and supports fast execution. IG Markets and Saxo both offer smooth performance across desktop and mobile.

Always try a demo account first. A platform that feels intuitive from the start can help you avoid costly mistakes later.

Risks of Futures Investments

Futures trading offers potential rewards, but it also comes with higher risk than many other investments. Understanding these risks is essential for protecting your capital and trading responsibly.

Leverage Can Magnify Losses

Margin trading allows you to open a larger position while only putting down a fraction of its total value. While this can increase gains, it also means losses may exceed your initial stake if the market moves against you.

Markets React to News

Futures prices respond quickly to global events. A surprise interest rate change or geopolitical shock can trigger sharp moves. Staying informed is key.

Expiry Dates Require Attention

Futures contracts expire on fixed dates. If you don’t close or roll over your position in time, it may settle automatically, possibly at an unfavourable price.

Fast Markets, Emotional Decisions

Rapid price swings can lead to impulsive trades. Sticking to a clear plan helps avoid chasing losses or abandoning strategy under pressure.

Futures are best suited for traders who understand risk, follow a defined plan, and can monitor positions actively.

FAQs

Yes, but caution is essential. Start with a demo account, trade small positions, and make sure you understand margin and leverage before risking real money.

No. Futures and other derivatives aren’t permitted within Stocks and Shares ISAs or Self-Invested Personal Pensions.

It depends on the broker and contract. Standard futures may require thousands in margin, while micro contracts can start from a few hundred pounds.

The broker may liquidate your position to reduce further losses. Without negative balance protection, you could owe more than your initial deposit.

Conclusion

Futures trading isn’t about guessing short-term moves. It’s about managing risk, staying disciplined, and understanding how the market works. For UK investors who prepare properly, it can complement a broader investment strategy.

But it’s not a shortcut. If you’re unsure about how futures work or the risks involved, take the time to learn first.

With clear goals, solid research, and the right setup, futures can open the door to new opportunities on your terms.