American Express (AMEX) is a leading US credit services company listed in the New York Stock Exchange (NYSE) using the ticker symbol AXP. It serves businesses and consumers across the globe, and its ability to keep growing has attracted investors to buy stocks in AMEX. In addition AMEX is a component of the Dow Jones Industrial Average, meaning you get more opportunities when investing in AXP stock.

If you want to know how to buy American Express shares, this guide is prepared for you. We will start by recommending the top three brokers to buy AXP stock and take you through the procedures of making the purchase. In addition, you will also know more about American Express company and its current share price. This is so that you can decide whether to invest in AMEX stocks.

Top 3 Brokers for Buying American Express Shares

You need the best online stockbroker to buy American Express stock. The stockbroker should have access to the NYSE and allow you to buy AXP stocks as fractions. You should also enjoy adequate resources to support your activities.

There are a plethora of stock brokers dominating the UK financial market and traders are finding it challenging to find the best broker. In this regard, we did research on UK’s stock brokers and have recommended the top three below for you to choose from.

1. eToro

eToro offers access to the NYSE exchange where you will find the American Express shares listed to purchase commission-free. With eToro, AXP stock can also be traded as CFDs and indices. In addition, American Express shares can be bought as fractions, attracting traders on a low budget to invest in American Express. eToro has a user-friendly social and copy trading platform that engages traders from diverse regions, thus maximising their chances of making profits.

Besides buying the American Express stocks, eToro offers additional securities to invest in. These include stocks of other world-renowned companies, forex, cryptocurrencies, commodities, and more. You will also be supported with outstanding learning and research materials with only a minimum deposit of $100.

On its downsides, this stock broker charges high spreads, whether you buy AXP stock or trade them as derivatives. There is also a $200 minimum amount per trade when using the copy trading platform.

Disclaimer: {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- World-leading online broker when it comes to copy and social trading of American Express and other company stocks

- Some of the best educational material to be found anywhere online

- Respected and trustworthy broker with many years of experience offering CFD trading on a range of markets

- Mainly aimed at copy traders, making it somewhat limited in case you’re not into that

- One of the more expensive online brokers available in the UK at the moment

2. Interactive Brokers

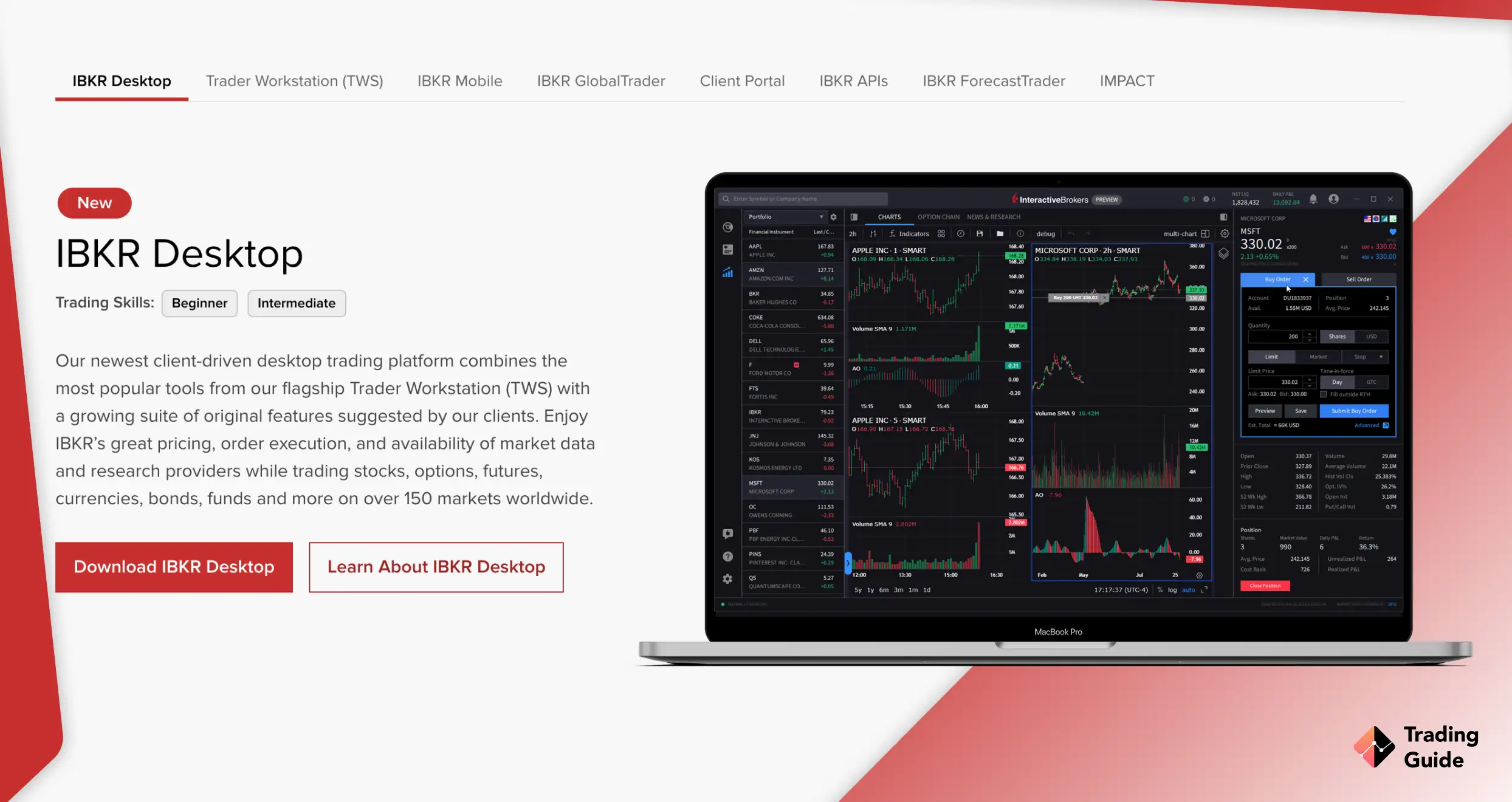

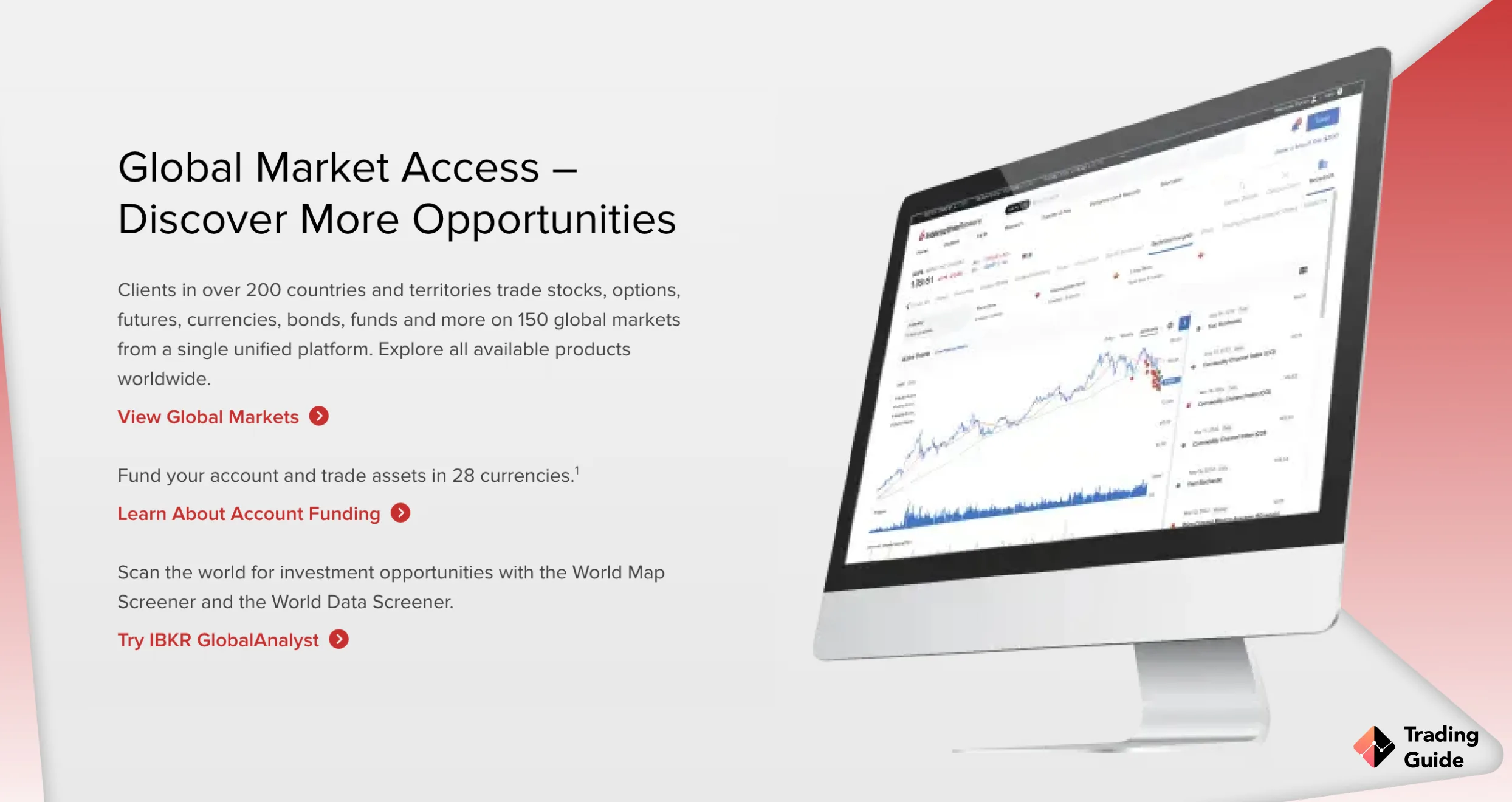

Interactive Brokers has been existing for decades, and its outstanding services makes it one of the most trusted stock brokers in the UK. IBKR hosts quality research and analysis tools on its intuitive design platform. Buying American Express shares is commission-free when using the IBKR Lite platform. In addition, you can buy the AXP shares as fractions.

To access the NYSE and buy AMEX shares using IBKR, you will deposit any amount you can afford since the broker does not have a minimum deposit requirement. There are also no fees for deposits and withdrawals, making it a suitable choice for low-budget traders. You can also diversify your portfolio with other securities offered by Interactive Brokers, including currencies, futures, options, cryptocurrencies and more.

Unfortunately, beginner traders and investors may find navigating through Interactive Brokers’ platform challenging. Its support service also operates only five days a week.

- Does not have a minimum deposit requirement allowing you to start trading for as much or as little as you want to

- Decades of experience offering trading to consumers, even before online trading really took off

- The platform makes it easy to combine stock trading with other types of trading, such as forex, cryptocurrencies, and indices

- The advanced trading platforms offered can be rather difficult to navigate if you are a beginner

- Some instruments – especially stocks – have quite high spread and is therefore expensive to trade

3. CMC Markets

CMC Markets’ NextGeneration trading platform is user-friendly with a modern design. You can trade the AXP shares as CFDs and indices while enjoying some of the quality trading tools. You will also maximise your profit potential with additional assets, including forex, cryptocurrencies, commodities, etc. For traders seeking advanced platforms, CMC hosts an MT4 platform for you.

Trading AXP stocks at CMC Markets attracts low spreads, and there is no minimum deposit requirement. Learning and analysis resources are also plenty, and you have a demo account at your disposal to test the broker and practise share trading.

Sadly, you cannot buy AMEX shares as physical assets at CMC Markets, instead the stock is offered as a CFD. The broker also has customer service that functions only five days a week.

- With no minimum deposit requirement this broker is the perfect option for low-budget traders

- Great and varied selection of stocks to trade so that you never run out of options

- Several award-winning platforms to suit every trading style and need

- Customer service is closed during weekends meaning you can only get help during the weekdays

- High fees and spread for many of the stocks, making it an expensive broker

How to Buy American Express Shares With eToro

Even though you can buy AXP stocks using various stock brokers in the UK, our recommended three above will support you with adequate tools. As a result, you will easily build your skills and conduct market analysis. See below how to buy American Express shares with eToro.

On this page, we have shared links to redirect you to eToro’s website for account registration. You can either sign up for an account through your desktop or mobile device since the broker has a reliable mobile application. Most importantly, ensure you understand eToro’s terms and conditions and agree to them before signing up for a trading account.

eToro has a straightforward registration process that you can complete within minutes if you provide the required information. You will create a trading account by sharing personal details, including name, date of birth, email address, phone number, location, etc. eToro will also require more information regarding your source of income to use as the foundation of your account.

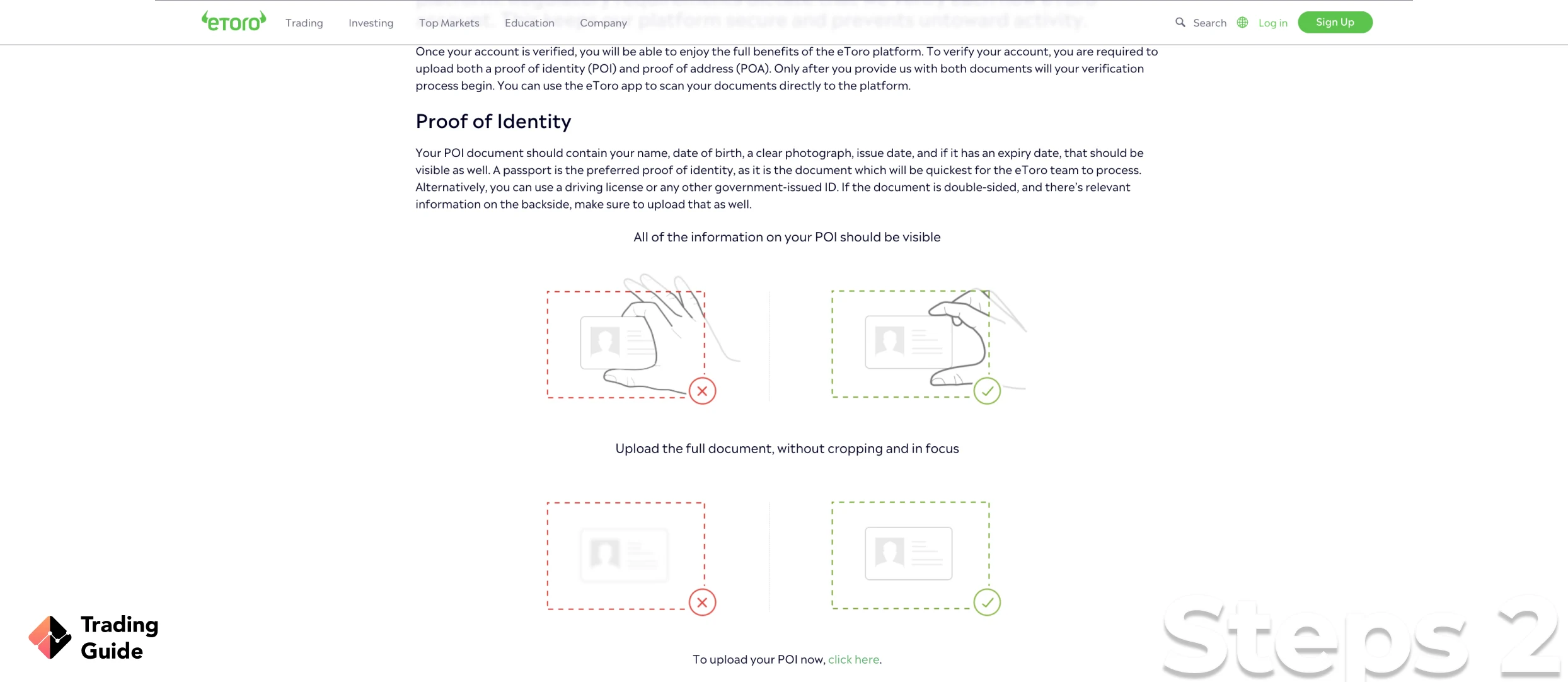

Once you provide all the information needed, identity verification will be required. This is a standard procedure by all FCA regulated brokers, including eToro. Therefore, you will share a copy of your passport or any other national identification card and a utility bill or bank statement as proof of jurisdiction.

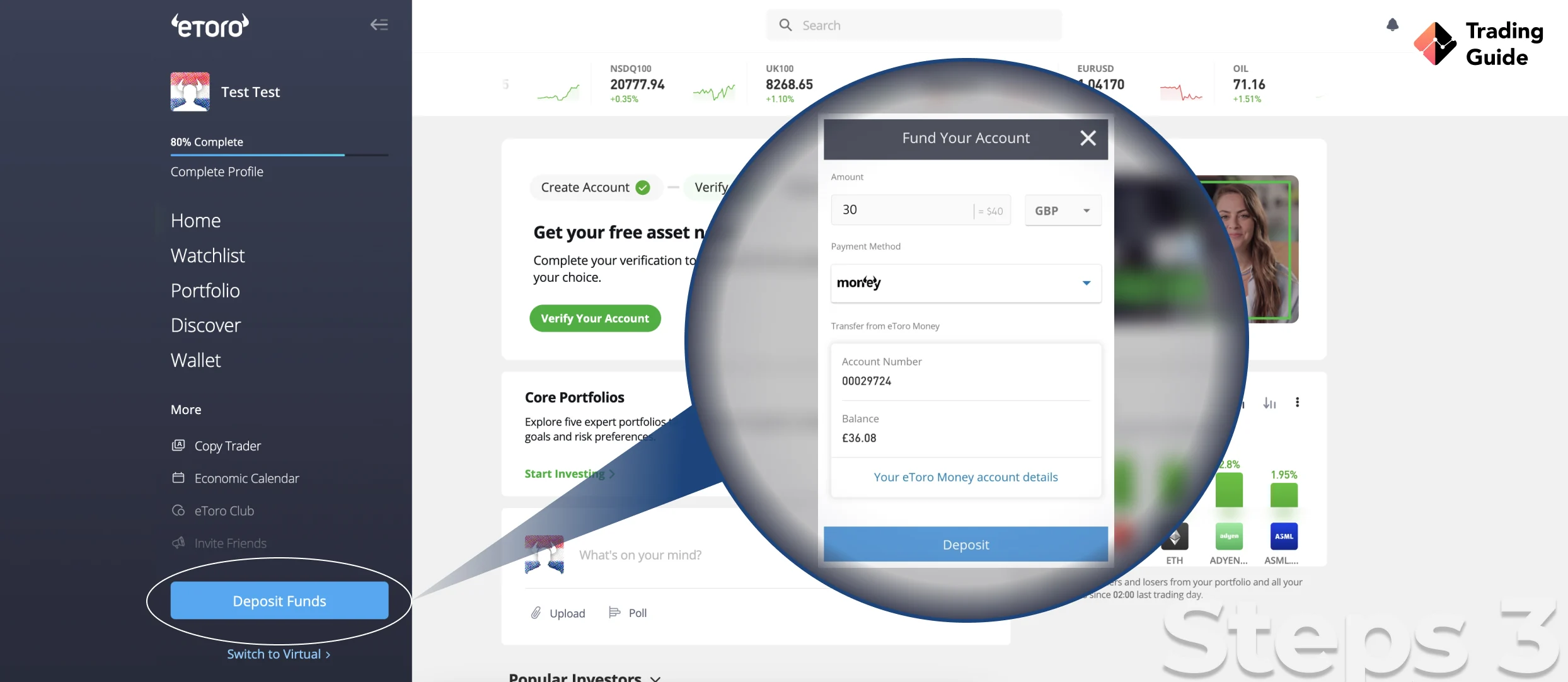

eToro will send you an email to notify you once your trading account is fully activated. At this point, the only thing left will be for you to make the required deposit of at least $100 and access the NYSE exchange to buy AXP stocks. You can make the deposit using various payment methods, including debit cards, bank transfers, and e-wallets.

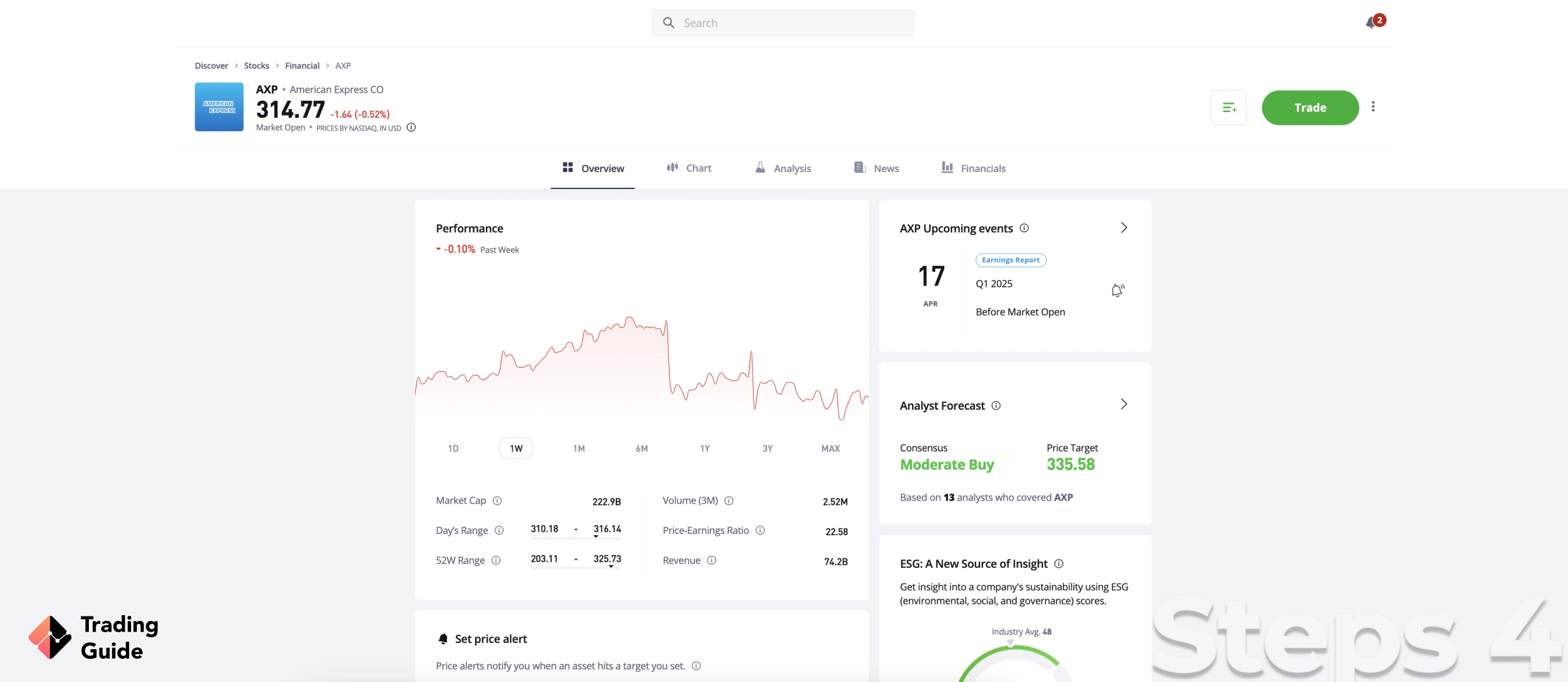

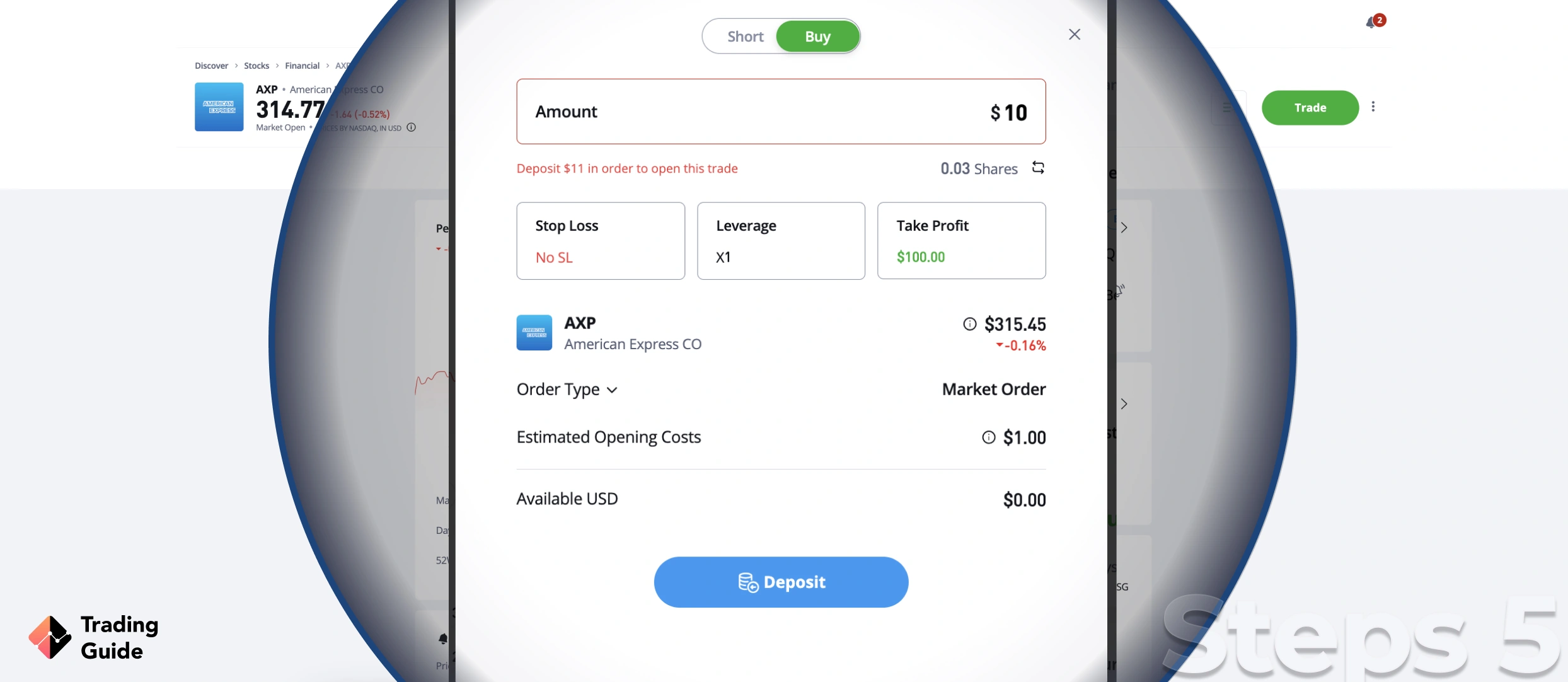

eToro will confirm your deposit before allowing you to buy AXP shares from the NYSE. AXP is one of the biggest payment card services companies globally, meaning that eToro will also allow you to trade the AMEX shares as derivatives (indices and CFDs).

Always have a budget before venturing into any investment activity so that you will be able to choose the right amount of AXP shares to buy. This also applies when you trade AMEX shares as CFDs. Simply put, invest an amount of money that you can afford to lose.

Tips on How to Choose the Best Stock Broker to Buy American Express Shares

You need to be very keen when choosing a stock broker to buy American Express shares since they will determine your chances of succeeding in the activity. Various factors need to be considered, including:

When buying AMEX shares in the UK, you should use an FCA regulated broker. Such brokers safeguard your trading funds and offer you the best platforms to maximise your potential. Note that trading with unlicensed or unregulated brokers in the UK is illegal and your safety is also not guaranteed.

The platform of a stock broker should execute trades fast and be easy to use. In addition, choose a broker with a platform hosting plenty of resources to help with your research and skills development. You should also be able to rely on its customer service regardless of their availability and access its demo account to practise share trading before putting up real money.

AMEX shares are listed on the NYSE exchange, and it is essential that you choose a stock broker with access to the exchange to buy AXP stock. Some brokers like eToro have additional features like copy and social trading, making your experience more fascinating.

If you want to buy American Express shares without spending a lot of money, we advise you to always have a budget. With this, it will be easier to identify a broker with charges and costs you can afford. So, confirm trading fees like commissions and spreads and non-trading costs like minimum deposit and transaction fees.

Stock brokers in the UK allow making deposits and withdrawals using various options, including credit/debit cards, bank transfers, and e-wallets. However, not all of them will work for you, and since it is essential that you enjoy your experience. In this case, you should choose a stock broker with payments methods that are convenient for you.

Analysing user comments and ratings is essential in choosing a stock broker in the UK since you will get to understand where the brokers excel and fall short. Although you must prioritise your needs when looking for the best stock broker, combining your test results with customer reviews guarantees accuracy. So, visit Google Play, the App Store, and Trustpilot to sample current and previous users’ comments and ratings.

AMEX Shares Price Today

American Express has had some healthy gains throughout the years, even though its share price fluctuates. Therefore, it is essential to understand American Express’ current share price to decide whether to invest in AXP stock. Below is a live chart table showing American Express current share price. Use it to monitor the performance of American Express and find additional historical data to create the best trading strategy.

About American Express

American Express (AMEX) is a multinational US-based company specialising in payment card services in the banking and finance industry. Founded in 1850 by Henry Wells, William G. Fargo, and John Warren Butterfield, AMEX continues to excel in its services across three major segments, including Global Consumer Services Group, Global Merchant and Network Services, and Global Commercial Services. It also specialises in travel-related services.

Currently, American Express is listed on the NYSE with a share price of around £126 as of 10th January 2022. It is led by Stephen Squeri, who has been AMEX CEO since early 2018. Being the largest payment card company globally, investors from diverse regions are looking to profit from the company’s stocks.

FAQs

Yes. American Express has witnessed a steady share price growth in the past year, and we hope it will keep rising now that it is taking the necessary measures to increase its revenue. To get started, find a suitable broker by following our guidelines above and conduct a thorough analysis to maximise your potential for returns.

Buying shares in American Express requires a broker with access to the NYSE, where the AMEX stocks are listed. Once you open a brokerage account, the broker will provide access to NYSE, where you will complete your purchase.

Yes. American Express pays a dividend of $0.43 per common share to all shareholders on a quarterly basis. This rate can be increased or reduced in the future depending on AMEX performance.

American Express is led by Stephen Squeri, who has been AMEX president and CEO since February 2018.

American Express was founded in 1850 by Henry Wells, William G. Fargo, and John Warren Butterfield in Buffalo, New York, United States.

American Express specialises in payment card services in over 130 countries across the globe. It serves individuals, corporate firms, and small businesses. The company also offers travel-related services, including traveller’s checks, credit cards, travel planning services, tour packages, etc.

Conclusion

American Express is taking the necessary measures to keep growing and increasing its share price. For example, it recently expanded its partnership with Nova Credit to help extend credit to more newcomers to the US. This move indicates the company’s growth potential, and if you were sceptical about investing in AMEX shares, we hope you have cleared all the doubts and see that it is worth an investment.

All in all, American Express has a bright future, considering that businesses and consumers are now resorting to online and credit card payments. Therefore, take your time to conduct the necessary due diligence and analysis before investing your money. You can also use brokers’ demo accounts to practice share investment before purchasing shares in American Express. If you’re interested in exploring credit card brokers, it’s recommended to research reputable brokers that accept credit card payment options for seamless and convenient transactions in the stock market.