Goldman Sachs is one of the most established names in global finance, with a history spanning over 150 years. For UK investors, buying its shares offers a way to gain exposure to the US banking sector and diversify beyond domestic markets.

Although investing in US stocks may seem unfamiliar, especially if you’re used to FTSE 100 companies or ISA-based portfolios, the process is simpler than it appears. With the right platform and a basic understanding of international trading, owning Goldman Sachs shares is well within reach.

This guide breaks down the steps to help UK beginners get started, from selecting a broker to placing your first trade.

How to Buy Goldman Sachs Stocks

Buying Goldman Sachs shares from the UK is a straightforward process, especially with the growing number of platforms offering access to US markets. Below is a step-by-step overview to guide you through it:

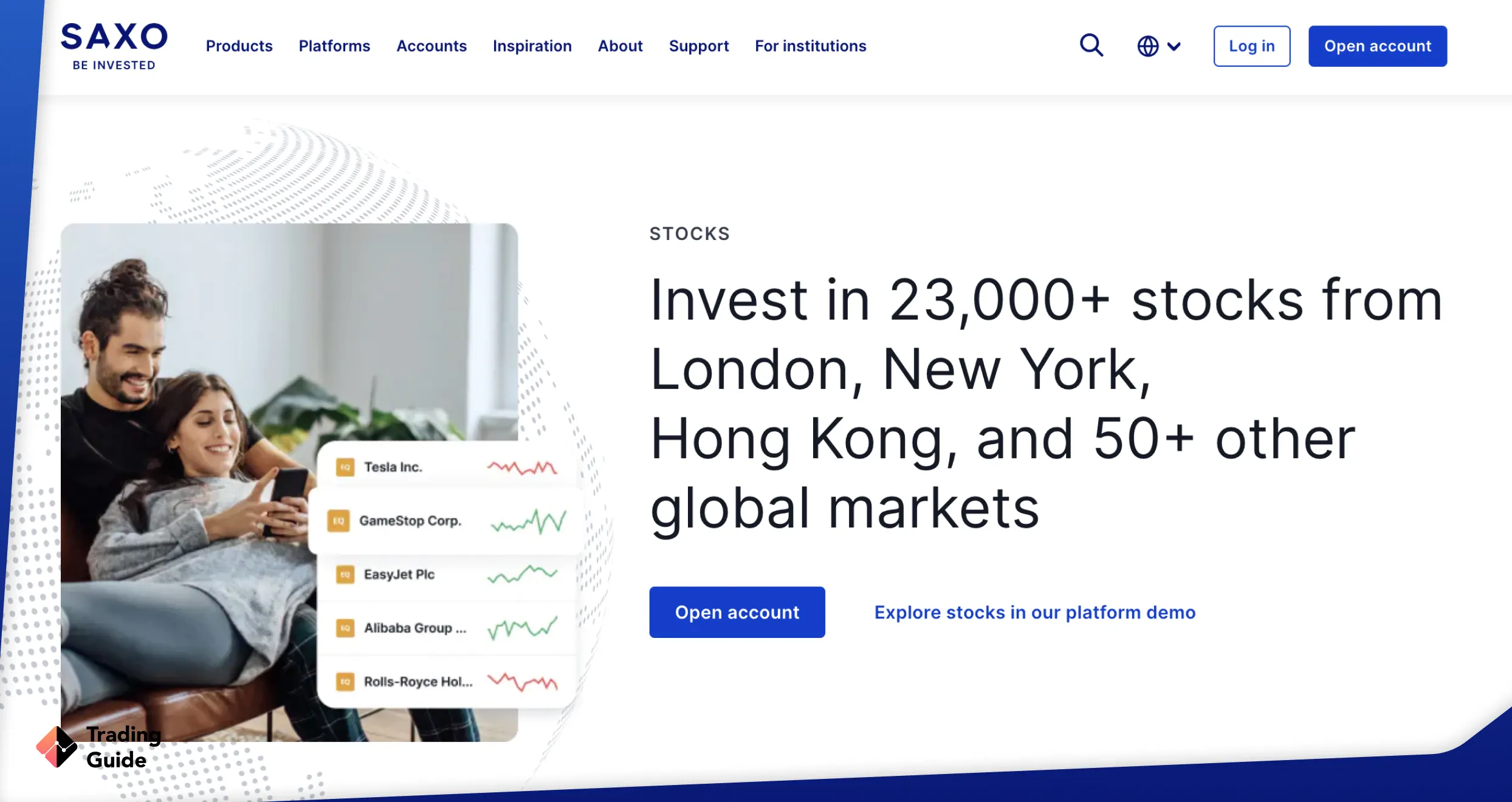

Goldman Sachs is listed on the New York Stock Exchange with the ticker code GS. To purchase its shares, you’ll need a broker that provides access to US markets.

When comparing platforms, check that they:

- Offer access to NYSE-listed shares

- Support GBP-to-USD currency conversion

- Have competitive fees on foreign exchange and commissions

- Include research tools and price alerts for the US markets

- Help you complete the necessary tax documentation (W-8BEN)

After selecting your broker, the next step is to open an account and complete identity verification. This usually involves submitting proof of ID and address. Most brokers complete these procedures within a few hours to a couple of days.

Before you can buy US shares, UK residents are required to complete a W-8BEN form. By completing this form, UK investors can lower the dividend withholding tax from 30% to 15% under the US–UK tax agreement. Most brokers include this as part of the sign-up or account settings process. It remains valid for three years.

After verification, you’ll need to fund your account. Most brokers allow funding through bank transfer or debit card payments. Keep an eye on deposit fees and minimum funding amounts, as these can vary between platforms.

Since Goldman Sachs shares are priced in US dollars, your pounds will need to be converted at the time of purchase. Some brokers use a live market rate plus a margin, while others apply a flat fee. Always review the conversion rate in advance to avoid unexpected costs when placing a trade.

Search for Goldman Sachs by name or by its ticker symbol (GS). You can then place a:

- Market order – executes at the current trading price

- Limit order – lets you set a maximum price you’re willing to pay

If you’re new to investing, a market order is typically simpler, but a limit order can help manage price fluctuations.

Double-check all order details before you confirm the trade. After the order is filled, the shares should show up in your investment account. From there, you can monitor performance, set alerts, and review company news or earnings updates within the platform.

Buying a stock is just the beginning. Think about how Goldman Sachs fits into your broader portfolio. Whether you plan to hold the position long-term for dividend income or trade actively, your investment goals should guide how you manage it.

Best Brokers to Invest in Goldman Sachs in the UK

If you’re planning to buy Goldman Sachs shares from the UK, selecting the right broker can make a meaningful difference in both cost and experience. Many platforms now offer access to US markets, but features, fees, and usability vary. Below are three well-established options suitable for different investment styles.

eToro

eToro is a popular choice for beginner investors thanks to its commission-free stock trading and clean, modern interface. It supports fractional shares, allowing you to invest in companies like Goldman Sachs without needing the full share price upfront.

- Commission-free trading on US stocks

- Fractional shares from just $10

- Beginner-friendly mobile and desktop platforms

- Social/copy trading tools to follow other investors

- Currency conversion and withdrawal fees apply

- No ISA or SIPP support for tax-efficient investing

- Research tools are less extensive than traditional brokers

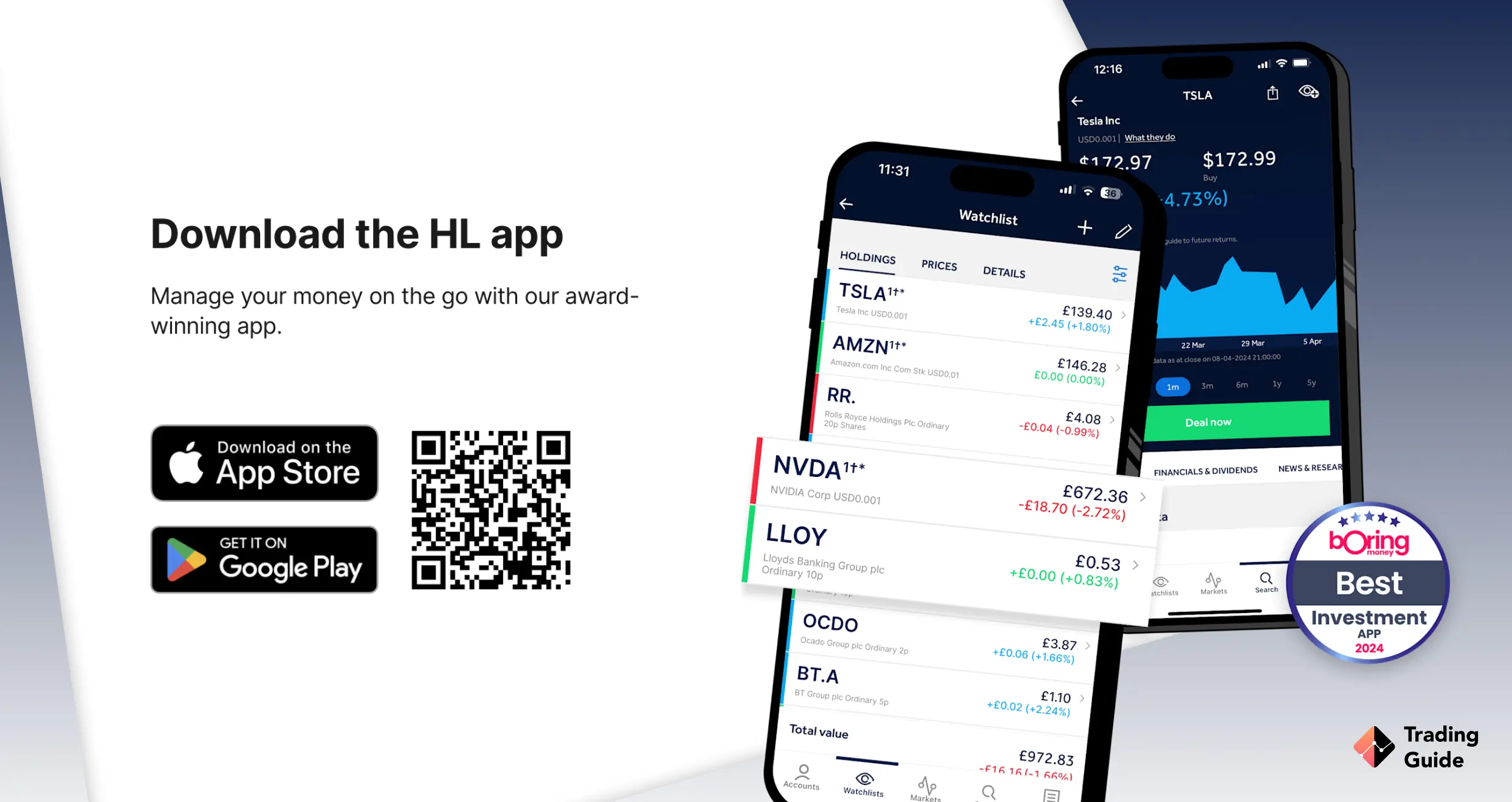

Hargreaves Lansdown

Hargreaves Lansdown is one of the UK’s largest and most trusted platforms. Though it charges per trade, it provides comprehensive tools, in-depth research, and strong customer service, making it appealing to long-term investors who value support over ultra-low fees.

- FCA-regulated, UK-based and highly trusted

- Access to US and global shares

- Extensive research, analyst reports, and portfolio tools

- Strong customer support and guidance

- Commission fees on trades can add up

- Higher FX charges compared to some newer platforms

- Better suited to larger or managed portfolios than small, casual investors

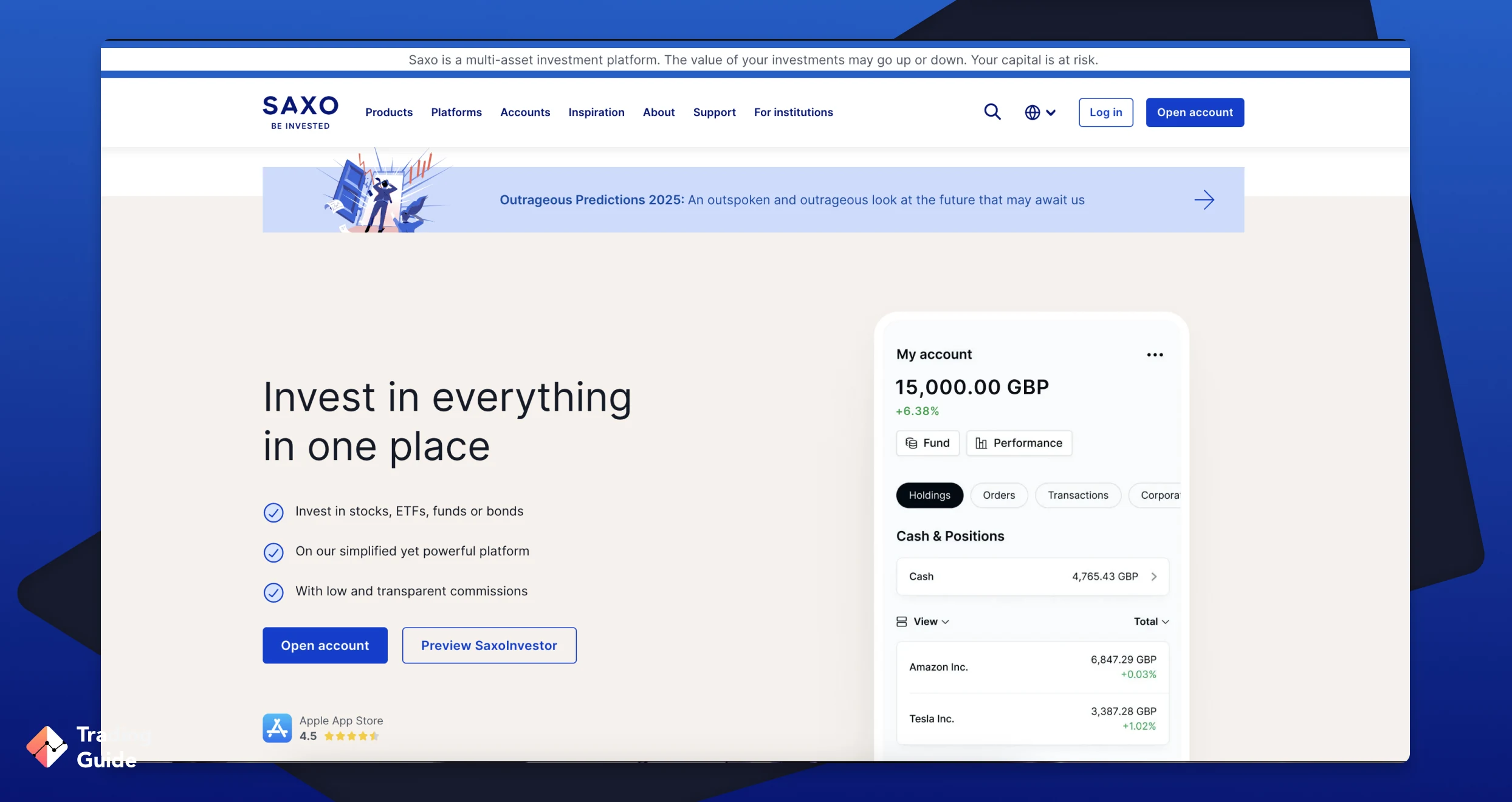

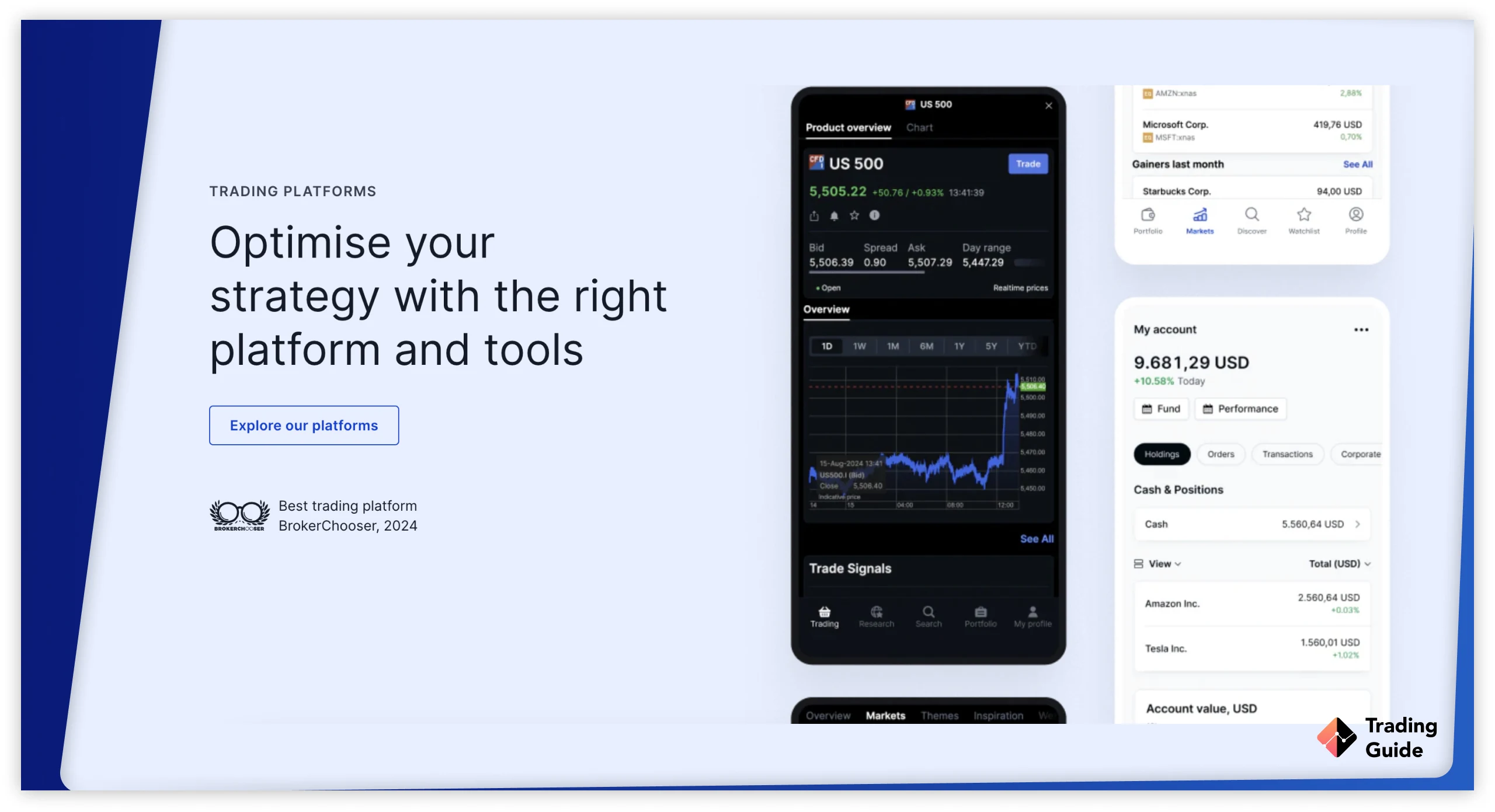

Saxo

Saxo offers access to a broad range of international stocks, including Goldman Sachs. Known for its advanced tools and competitive FX rates, it suits confident investors seeking precision and professional-level features.

- Direct access to US exchanges

- Competitive FX rates and transparent pricing

- Advanced trading platforms with detailed analytics

- Professional-level tools for active investors

- Minimum deposit required (varies by account type)

- The platform may feel complex for beginners

- Fewer beginner-friendly features compared with app-based brokers

About Goldman Sachs Group

Goldman Sachs is a leading global investment bank and financial services firm, headquartered in New York and operating since 1869. The firm collaborates with companies, public institutions, and government bodies across key financial markets, making a significant contribution to international economic activity.

The business is structured around four main divisions:

- Investment Banking – focused on supporting clients with mergers, acquisitions, and raising capital

- Global Markets – trading in equities, currencies, bonds, and derivatives

- Asset Management – managing investments for institutional and retail clients

- Consumer and Wealth Management – offering savings, lending, and advisory services

Goldman Sachs is widely known for its involvement in high-profile deals, market-making, and financial innovation. Its influence on Wall Street is significant, though not without scrutiny. For UK investors, holding shares in Goldman Sachs provides exposure to the performance of the US economy, the financial services sector, and global capital markets more broadly.

Goldman Sachs Price Today

Goldman Sachs shares trade on the New York Stock Exchange under the ticker symbol GS. The price changes throughout the trading day, influenced by earnings announcements, economic indicators, and overall market sentiment.

Since the stock is priced in US dollars, UK investors should also consider the exchange rate between the pound and the dollar, which can impact returns. For example, a weaker pound could increase the value of your US investment when converted back into sterling, even if the share price remains flat.

Below, you’ll find a live chart of Goldman Sachs stock, showing current price movements and recent trends. It’s a useful tool for reviewing how the stock has performed over time and understanding market direction before placing a trade.

Is Goldman Sachs a Good Stock to Buy?

Goldman Sachs is one of the most established names in global finance, with a solid track record and broad exposure to global markets. It’s often considered a quality pick for investors seeking stability and long-term growth.

Potential strengths:

- Strong earnings and consistent dividend payments

- Diversified business model across banking, trading, and asset management

- Global presence with a leading role in the US capital markets

Key risks:

- Sensitive to interest rate shifts and economic slowdowns

- Subject to regulatory scrutiny in the US and abroad

- Prone to market-driven share price swings

For UK investors, Goldman Sachs can offer useful diversification beyond domestic stocks. It’s a credible long-term holding, but like any single stock, it works best as part of a broader, well-balanced portfolio.

Remember that stock prices can be volatile, and it’s essential to make informed decisions, stay updated on market conditions, and stay true to your investment strategy. If you have any uncertainties or questions, don’t hesitate to consult with a financial advisor or your chosen broking’s customer support for guidance.

FAQs

No. Several UK-regulated brokers provide access to US stocks, including Goldman Sachs. You can buy shares through platforms like eToro, IG, or Freetrade without opening a US account.

Yes. Dividends from US companies are subject to a 15% withholding tax if you’ve submitted a W-8BEN form. Depending on your total income, further tax may apply under UK rules.

Yes. Many brokers now offer fractional shares, allowing you to invest smaller amounts. This can be useful, as Goldman Sachs stock typically trades at a high dollar price per share.

You can’t hold US shares in a standard Stocks and Shares ISA. However, some SIPP providers do allow access to US-listed stocks. Always check the specific terms with your platform and be aware of HMRC rules.

Conclusion

Buying shares in Goldman Sachs gives UK investors exposure to one of the most powerful forces in global finance. But the value of that investment depends on more than reputation alone.

Consider how it fits within your overall strategy, including your time frame, risk profile, and appetite for overseas exposure. US-listed stocks come with additional factors, such as currency risk, tax treatment, and market volatility. If Goldman Sachs earns a place in your portfolio, it should do so with purpose. Choose a trusted broker, understand the fees, and invest with clarity.

I’d say Goldman Sachs stock is solid for long-term investing, thanks to its strong reputation and diversified operations. Short-term, though, it can be volatile, so keeping an eye on market trends and economic news is key before making any moves.