Royal Mail is a British postal and courier service company existing since 1516. Although its share price keeps fluctuating, we’ve seen an increase in its value in recent years. In this regard, investors are becoming interested in being part of the company by purchasing its shares. The best element about being a shareholder in Royal Mail company is that you get to earn dividend payments on the company’s profits.

So, are you looking for an easy way to buy Royal Mail shares? This guide explains in detail to help you get started on a good note. We also recommend the best brokers for buying Royal Mail shares so you can avoid lengthy and overwhelming research procedures.

Top 3 Brokers for Buying Royal Mail Shares

To easily buy Royal Mail shares, you need the best broker that meets your trading requirements, including safety, budget, platform performance, support service reliability, etc. Additionally, the broker must have access to the London Stock Exchange (LSE), where Royal Mail stocks are listed under the ticker symbol RMG. You should also use the broker to trade RMG shares as CFDs or indices, thus maximizing your potential in the stock market.

Unfortunately, many stock brokers in the UK have access to the LSE, and it can be challenging for you to choose the best. For this reason, our expert researchers did all the legwork and considered the below three brokers as the best for buying Royal Mail shares. As an investor, we advise you to compare their elements and select the best one for your investment and trading needs.

1. eToro

eToro is one of our recommended brokers for buying Royal Mail shares because it is user-friendly, thus making it fit for all types of investors. Additionally, eToro has access to the London Stock Exchange, where the RMG shares are listed for purchase. Plus, the broker allows you to trade the RMG stock as CFDs or indices. You can test eToro via its demo account before making a final decision.

Using eToro to buy Royal Mail shares exposes you to excellent trading resources. For instance, you will have access to plenty of learning materials for skills development. You can also socialize with other stock traders on its social trading platform and copy expert investors’ positions with increased profit potential. On top of that, stock trading is commission-free, and eToro accepts fractional share purchases to attract budget-conscious investors.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

2. IG Markets

IG Markets is among the pioneer brokers in the financial market that continues to impress traders with its cutting-edge features and superior technology. It is best suited for individuals looking to trade RMG shares as indices or CFDs and do not want to take ownership of the underlying asset. Although it has a high minimum deposit requirement of £300 and charges high trading fees, it offers quality trading resources to help you effectively manage your positions.

If you are an experienced CFD or indices trader, IG Markets offers various trading platforms to choose from, including the L-2 Dealer, ProRealTime, and MT4. Like eToro, the broker also features a social trading platform where you connect with other traders to share different trading ideas. Plus, its IG Academy is loaded with learning resources, and there is a risk-free demo account to gauge your skill level before trading using real money.

Your capital is at risk

3. CMC Markets

CMC Markets also offers quality trading resources for individuals looking to trade RMG shares as CFDs, indices and spread betting. The broker is user-friendly and customizable, allowing all types of traders to try their luck trading different assets. Unlike most CFD brokers, CMC Markets doesn’t have a minimum deposit requirement and charges low commissions when trading Royal Mail shares. You can choose between the Next Generation and MT4 platforms.

CMC Markets is also an excellent choice if you want to diversify your trading portfolio. Besides trading RMG shares, you get exposed to additional 8000+ shares and other asset classes, including forex, commodities, ETFs, cryptocurrencies, and more. The broker has a demo account to test it out and ensure it is the right one for you.

How to Buy Royal Mail Shares With eToro

Now that you know the top three brokers for buying Royal Mail shares in the UK, we thought it is also best to take you through the procedures involved in making the purchase. Keep in mind that all our referenced stock brokers above are regulated by the Financial Conduct Authority (FCA), meaning they have the same processes for signing up for an account and getting started.

Let’s use eToro as an example to guide you on how to buy RMG shares.

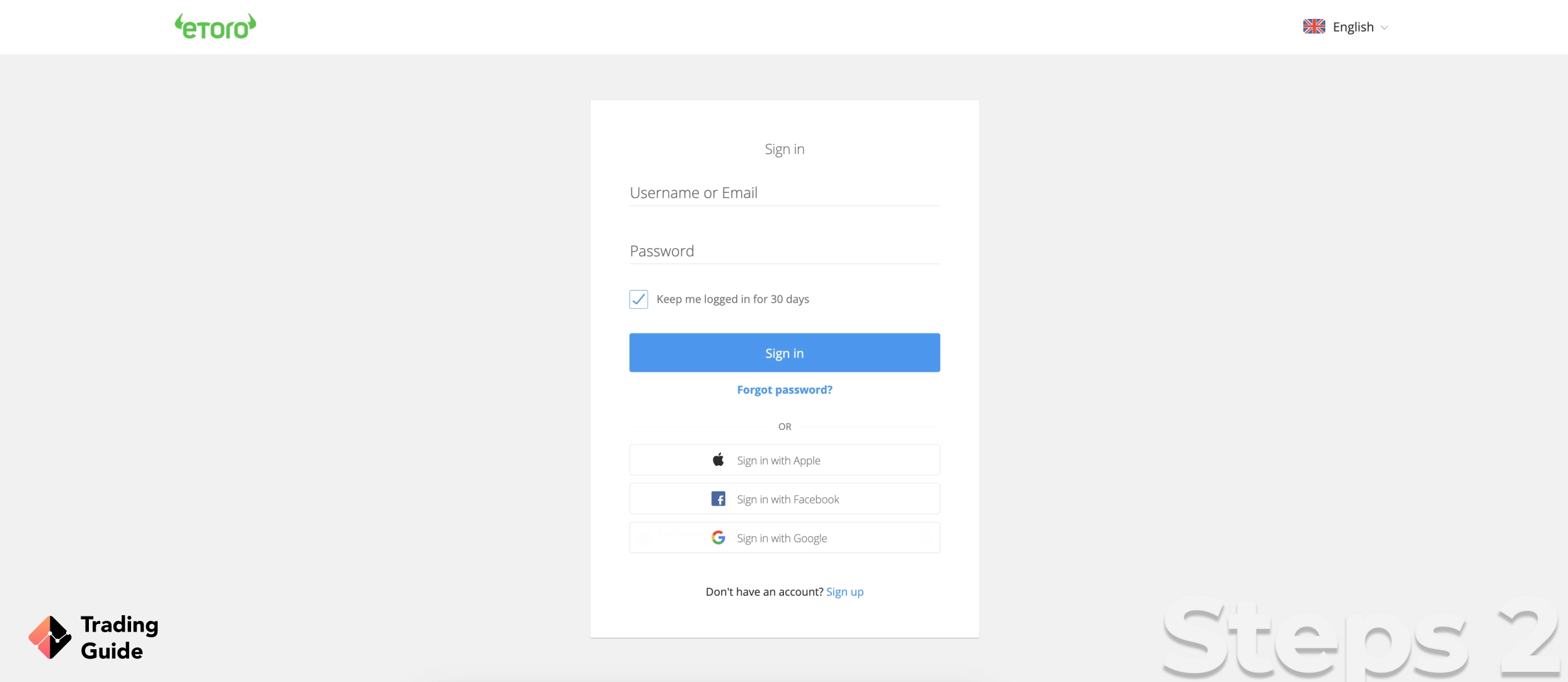

You need an investment account with eToro to buy RMG shares. Therefore, we’ve shared links on this page to quickly help you access the broker’s website to begin the registration process. If you are always on the move, eToro has a trading app you can download from Google Play or the App Store. Remember, read, understand and accept the broker’s terms and conditions to ensure you are on the same page.

Once fully prepared, complete the account registration using your name, email, phone number, date of birth, source of income, etc. You must also create a username and password to secure your account.

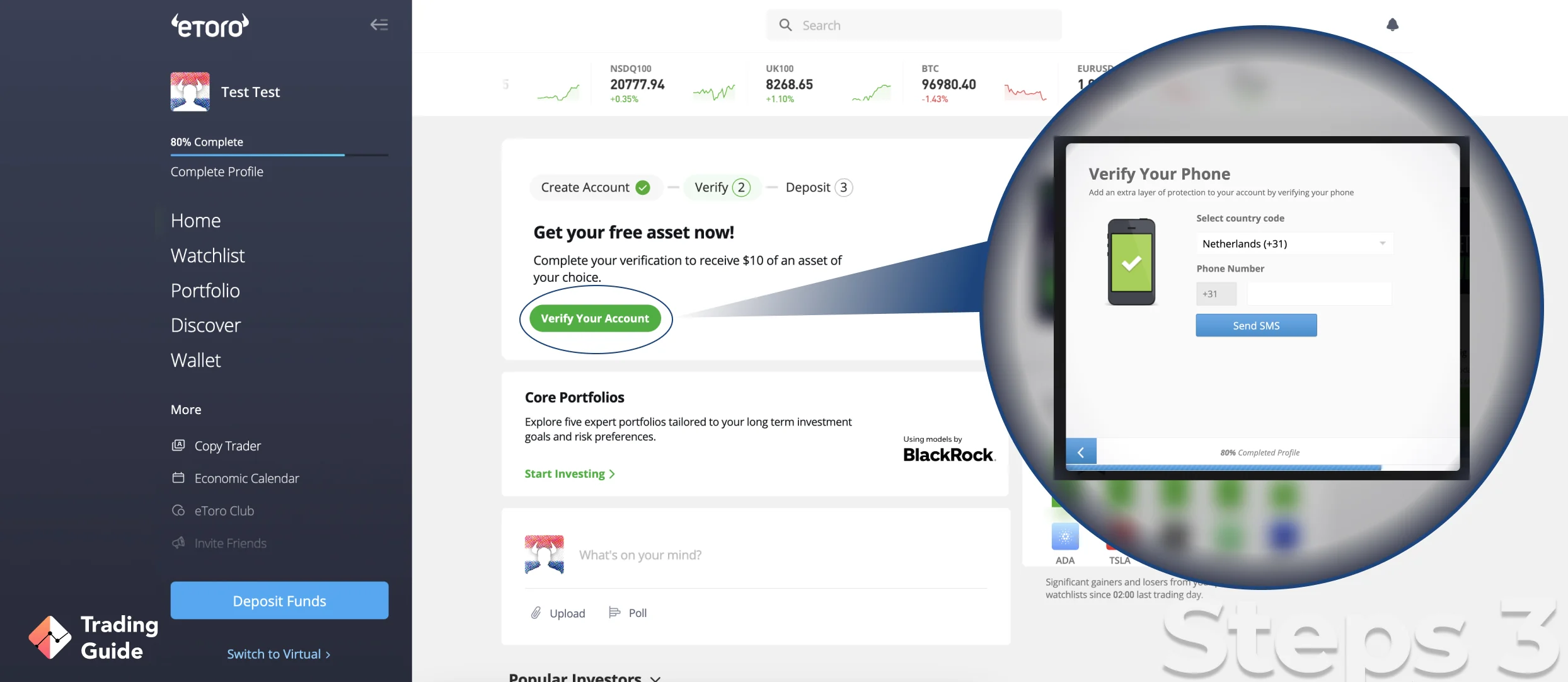

It is a standard procedure for all FCA-regulated brokers to have traders and investors verify their accounts before fully activating them. Since eToro is regulated by the FCA, you must provide copies of documents proving your identity and location. These documents include a copy of your original ID card, passport or driver’s license and a recent utility bill or bank statement.

Once your details have been reviewed and your account activated, you will make a deposit to access the Royal Mail shares and buy them. eToro’s minimum deposit requirement is $100, and you can transact using various payment methods, including debit cards, e-wallets, and bank transfers. Keep in mind that eToro is highly encrypted and regulated, thus guaranteeing your funds and data safety.

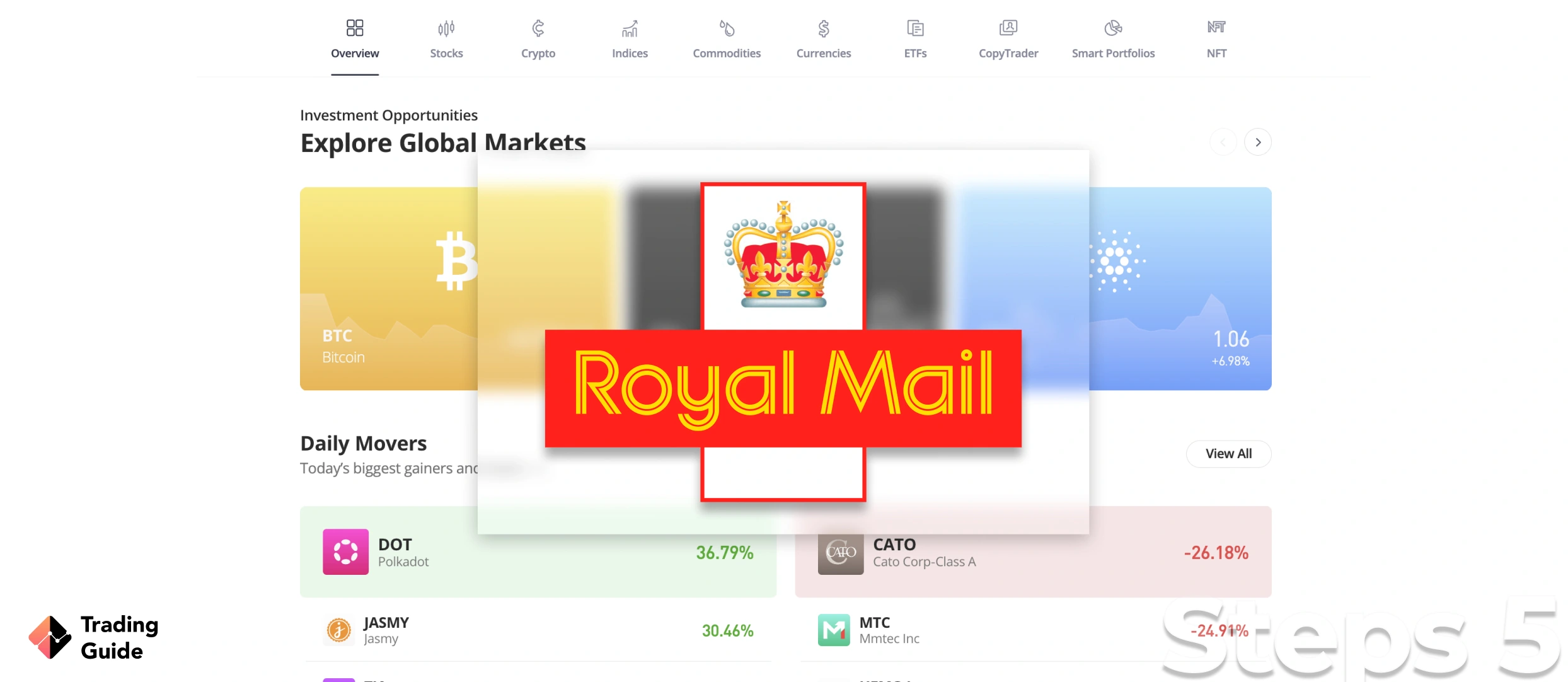

eToro will confirm your deposit and automatically give you access to the London Stock Exchange, where RMG shares are listed. You will select the number of shares you can afford to buy and complete the process. Fortunately, eToro allows its users to buy the shares in fractions, making it easier for low-budget investors to try the market.

If you prefer taking short-term positions without owning the underlying asset, eToro allows CFD trading that involves speculating on an asset’s price movement and benefiting from its price difference. You can also trade RMG shares as indices, where multiple stocks are included in a single investment.

Tips on How to Choose the Best Stock Broker to Buy Royal Mail Shares

While we recommend the above three brokers as the best for buying Royal Mail shares, you might not find them suitable for your trading needs. This means you must conduct additional research by testing and comparing other brokers to identify the best. Since the research procedure can be overwhelming, we help you efficiently manage your research process by listing below essential factors to consider.

Above everything else, the security of your funds should be paramount, considering there are numerous fraudsters in the market today claiming to be legit brokers. In this regard, choose a stock broker that the Financial Conduct Authority (FCA) regulates. Brokers regulated by world-recognized authorities guarantee your funds’ safety, and it’s easier for you to take legal action against them in case they breach your agreement.

If you are looking for a broker for buying the RMG shares, make sure the broker you select has access to the London Stock Exchange, where the assets are listed. However, if you do not want to make purchases and take complete ownership of the underlying asset, consider a broker offering derivatives trading such as CFDs or indices. Remember, choosing a broker hosting multiple assets is an excellent decision since you can easily diversify your portfolio across different asset classes.

The platform of a broker you select must be user-friendly and has an intuitive design for the best experience. In addition, it should host quality trading tools to boost your skill level. For instance, if you are a beginner, go for a stock broker with a wide selection of learning resources for skills development. The platform should also host a demo account for testing the broker and practicing stock trading before investing using real money.

It is also crucial to confirm a broker’s trading and non-trading fees and ensure they fit your budget. Remember, losses are inevitable when trading or investing in the financial market. Therefore, set aside the money you are comfortable losing and stick to your budgeted funds until you are confident in your trading or investment skills.

The responsiveness of a broker’s support service is crucial in ensuring you quickly get help if need be. Therefore, using a broker’s demo account, contact its support service and confirm their reliability. They should also be reachable via convenient communication channels via phone, email, or live chat.

Always put your trading needs first when choosing the best broker for buying Royal Mail shares. However, other users’ opinions are also crucial in making the best choice. With their views regarding their experiences with a broker, it will be easier for you to decide whether to invest with the broker. For honest user opinions and ratings, go to Google Play, the App Store, and Trustpilot.

About Royal Mail

Royal Mail is a British courier and postal service company established in 1516 by King Henry VIII. It is one of the world’s oldest organizations having operated for over 500 years and continues to improve on its services by implementing new technology and digital services. Currently, Royal Mail operates across the UK, and has started sending letters and parcels across international markets via its General Logistics Systems. Its goal is to build a more balanced qand diverse parcel-led international business.

Royal Mail Group prides itself on providing reliable and convenient services for its clients. For instance, all parcels are tracked to ensure their clients are satisfied with their services. Moreover, the company partners with various investors to ensure all its set objectives are met, thus witnessing increased revenue. Royal Mail also generates dividend returns for its shareholders annually. Overall, the company has growth potential in the coming years, and investing in it today could be the best decision for investors.

Alongside your interest in Royal Mail Group, it may be worthwhile to investigate the prospects of investing in Spotify stock and Shell A or B shares as part of a well-rounded investment approach.

FAQs

Yes. Royal Mail is a good investment because the company keeps growing with advancing technology. Not only do you have a potential of making profits from its owned shares, but you will also earn dividends and supplement your income.

You can buy Royal Mail shares from the London Stock Exchange through brokers with access to it. We recommend the top three brokers for buying Royal Mail shares above. All you have to do is compare their features and select the most suitable one for your investment needs.

Royal Mail is British postal and courier service company existing since 1516. It is based in London, England, and serves clients across the United Kingdom.

Royal Mail share price has been fluctuating in recent years, and its highest has been at around £500. With the measures the company is putting in place to boost its growth, its share price is likely to rise even higher, and bring about profits for its investors.

Currently, Royal Mail has outstanding shares of 956.19 million. You can purchase the company’s shares via brokers with access to the LSE. With brokers, you can purchase fractional shares if you are not certain about what the future holds.

The biggest Royal Mail shareholder is Czech billionaire Daniel Křetínský. Other shareholders in the company include RWC Asset Management LLP, UBS Asset Management Ltd, the Vanguard Group, Inc, etc.

Conclusion

It’s not easy predicting an asset’s future value, but our ultimate guide above will help you get started investing in Royal Mail shares. However, we advise you to conduct additional research to clear any pending doubts and decide whether it is a good investment for you. In addition, ensure you select the best broker, like the ones referenced in our mini reviews above. If you are a beginner, start your investment ventures using small amounts of money since you can lose them with poor strategic moves. Most importantly, be patient and learn from your mistakes.

how much cost royal mail shares and wich is the dividend ?