THG PLC is one of the e-commerce companies many investors are considering putting their money into in 2026. Although its share price keeps fluctuating, the company has growth potential due to the measures it has put in place to increase its revenue. If you want to buy THG shares, we have prepared this ultimate guide to take you through all the processes involved. In addition, we list the top two brokers to get you started with and share basic tips for identifying one should you not find a suitable broker from our list.

Top Brokers for Buying THG Shares

THG shares are listed on the London Stock Exchange under the symbol THG. To buy them, you must find a reliable and reputable stockbroker with access to the exchange. The best element about using brokers to buy THG stock is that you can trade the shares as derivatives or buy them in fractions. Plus, stock brokers support you with quality resources for skills and strategy development, thus maximizing your potential.

Unfortunately, not all stock brokers in the UK are legit, and you must conduct thorough research to find the best. We will take you through how to identify the best stockbroker for buying THG shares later in this guide. But first, let’s take a look below at our top recommendations based on our expert researchers’ findings.

1. eToro

eToro is a user-friendly stock broker with an intuitive design platform, making it a viable choice for newbies trying to maneuver the stock market. In addition, the broker is affordable since it doesn’t charge commissions for THG share investments. You only get to pay spreads and enjoy a low minimum deposit requirement of $100. Besides buying THG stock, eToro also lists additional assets to try via its demo account and select the best for portfolio diversification.

Note that buying THG shares with eToro gives you an opportunity to enjoy additional features. For instance, you can boost your skill level using its learning resources, from guides to webinars. There is also a social platform for networking with other global stock investors to share different ideas. On top of that, its copy trading platform allows you to follow professional investors and mirror their positions whenever you feel they have higher chances of earning profits.

Disclaimer: Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

2. CMC Markets

CMC Markets has been existing for decades, and its ability to adjust to the advancing technology makes it stand out among many. The broker offers an excellent NextGeneration trading platform for investors looking to trade THG shares as CFDs or indices. Besides allowing you to trade THG stock, CMC Markets offers thousands of additional assets, including more shares, forex, cryptocurrencies, and commodities. It also hosts the MT4 platform for traders looking to explore advanced resources and diversify their portfolios with forex trading.

Fortunately, CMC Markets doesn’t have a minimum deposit requirement after registering for a trading account. Its spreads are also low, thus attracting low-budget stock traders. Another element we like about this broker is that it hosts quality research materials for strategy development. On top of that, its platform is intuitive and user-friendly, guaranteeing the best experience for all traders.

How to Buy THG Shares With eToro

Whether you want to buy THG shares or trade them as CFDs or indices, our recommended two stock brokers above have more than enough resources to help you get started. All you have to do is compare their features and test them via demo accounts before choosing the best for your investment or trading requirements.

Below, we take you through how to buy THG shares with eToro. Note that this process applies to any FCA-regulated broker with access to the London Stock Exchange (LSE), where THG stock is listed. We only use eToro as an example.

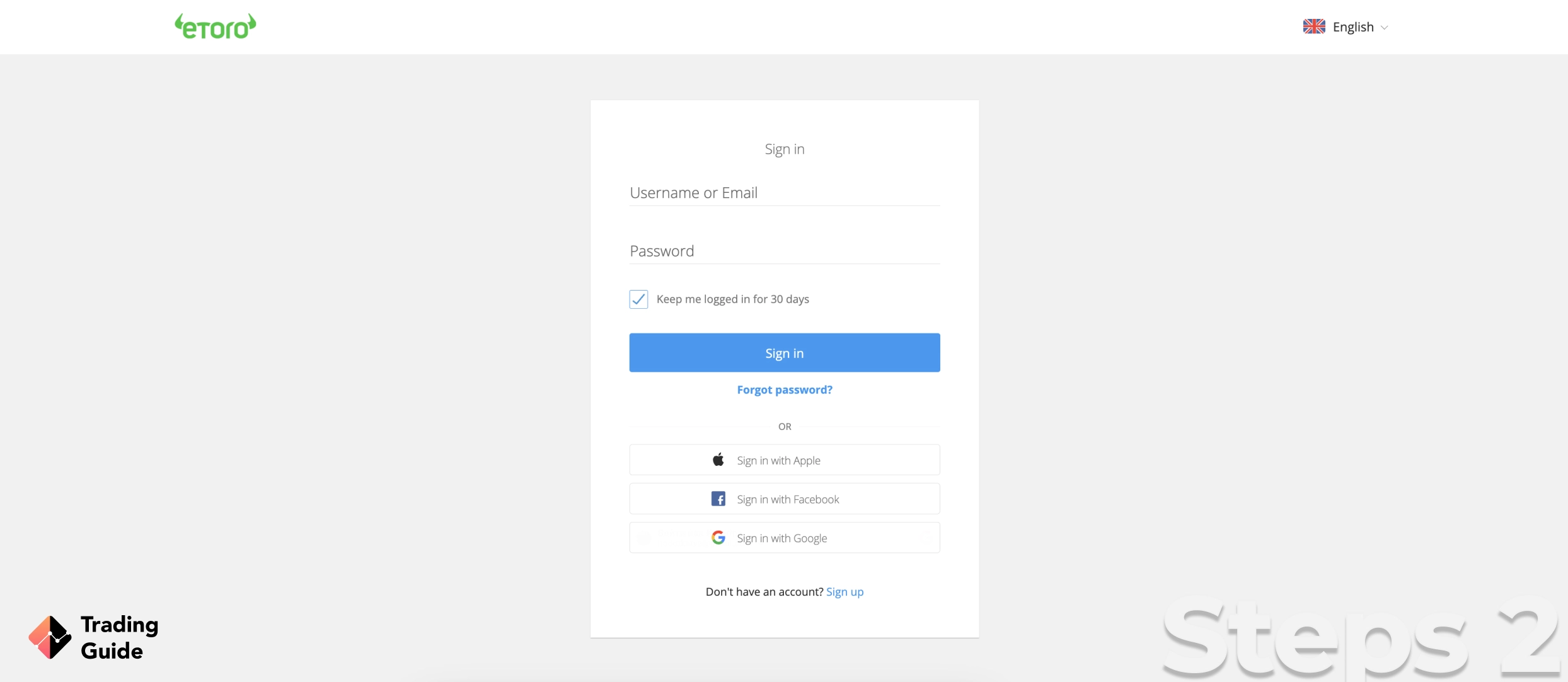

To buy THG shares with eToro, you first need to create a stock investment account with the broker. Therefore, click on the links we’ve shared on this page for quick access to begin the registration process. Once on eToro’s website, start by understanding the broker’s terms and conditions to avoid conflicts in the future. Also, consider downloading and installing its trading app from Google Play or the App Store to track your investments on the go.

Once you are confident that eToro is the right broker for you, start registering your account by clicking “join now.” You will then share your personal details, including your name, date of birth, email, source of income and tax information, etc. On top of that, eToro requires that you create a username and password to secure your investment account, whether while using a desktop or mobile device.

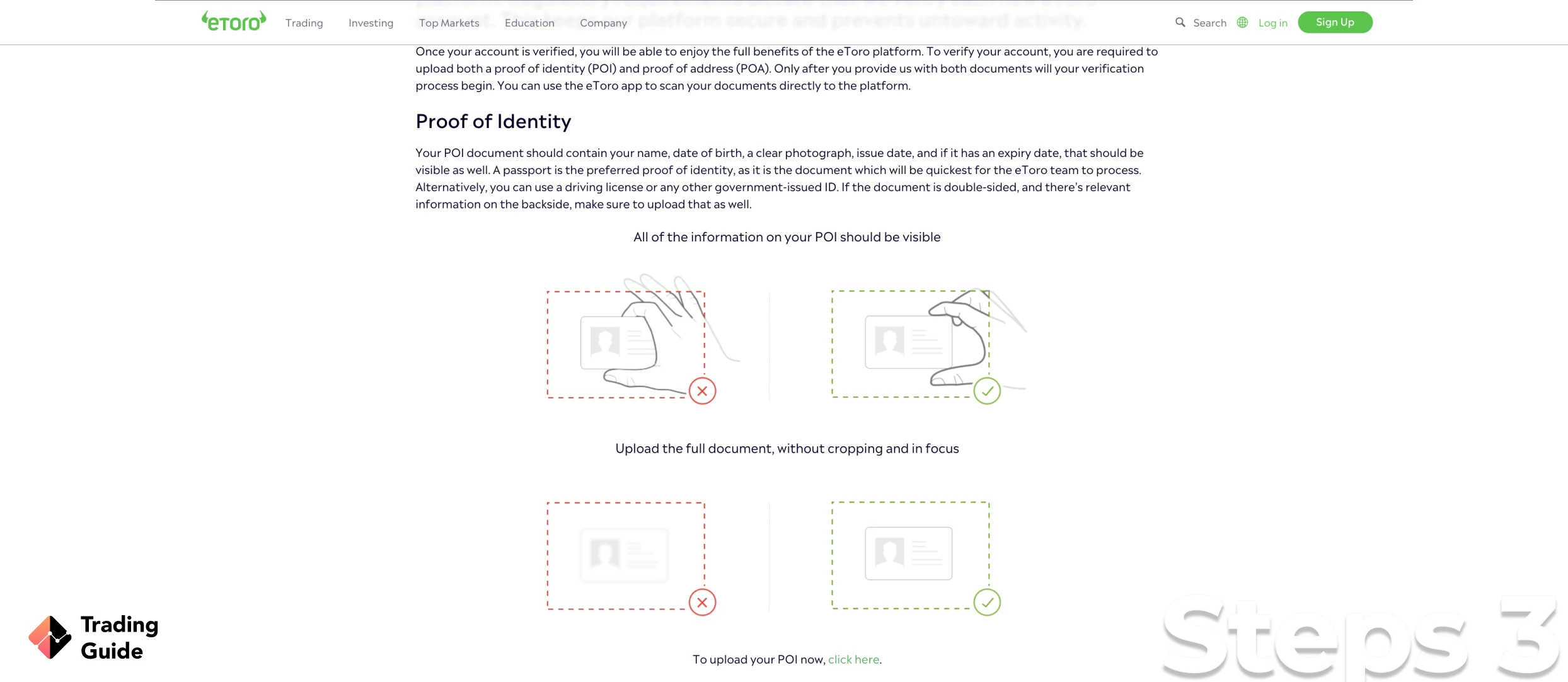

Investors using eToro or any other FCA-regulated stock brokers must verify their identities and locations before fully activating their accounts. This procedure helps secure investment platforms by keeping away imposters. In this regard, you will be required to share a copy of your ID card or passport and a bank statement or utility bill to verify your details.

Keep in mind that verification may take up to 2 days, depending on the broker you are using. You will then receive an email verification once your account is fully activated, and you are good to go.

You will make a deposit per a broker’s requirement to start trading or investing in THG shares. For eToro, the minimum deposit requirement is $100, and making the deposit is free of charge. You can transact using your preferred payment method supported by the broker, whether bank transfers, debit cards, or e-wallets.

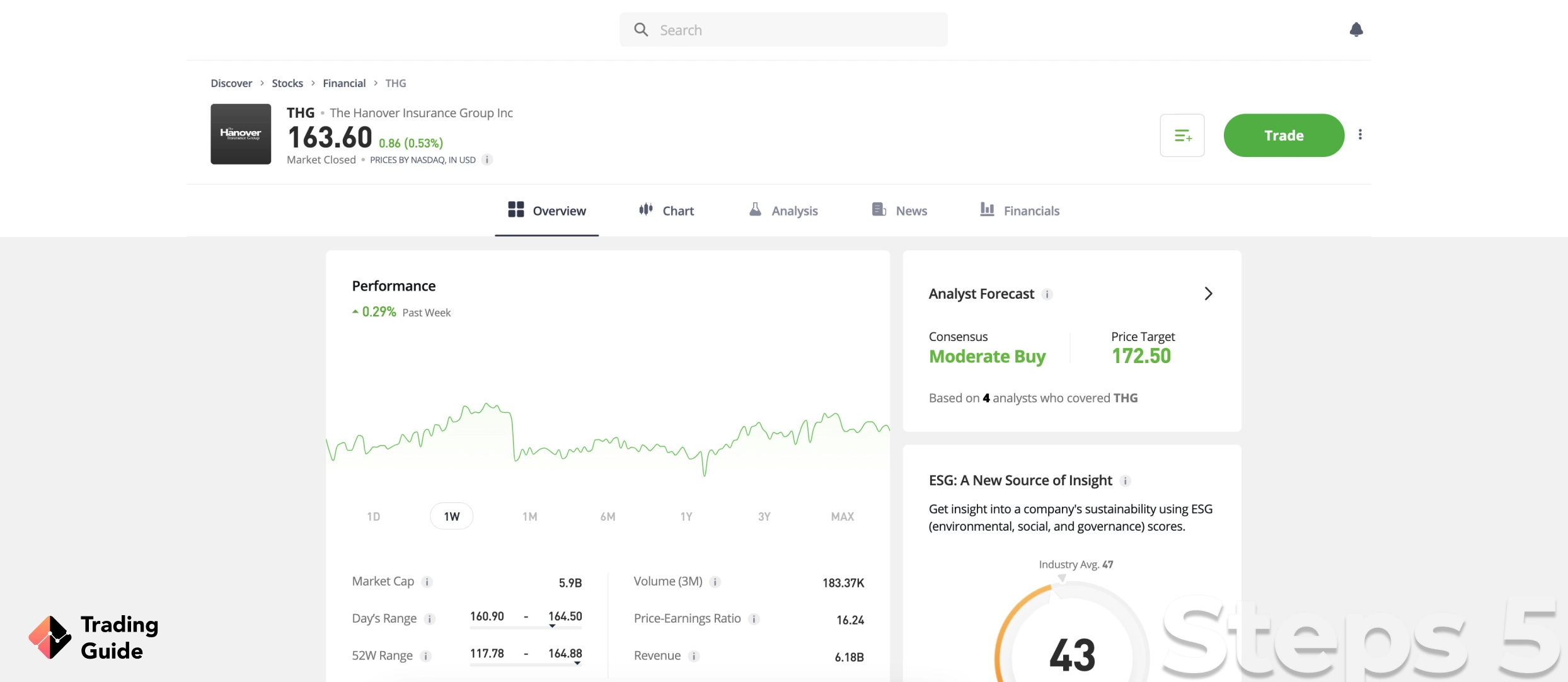

You will then access the London Stock Exchange, search for the THG stock under the ticker THG, and complete your purchase commission-free. The good news is that you can also use eToro to buy THG stock in fractions and trade the assets as CFDs or indices. All in all, choose a method you are well versed in and understand the risks.

Tips on How to Choose the Best Stock Broker to Buy THG Shares

Finding the best stock broker to buy THG shares in the UK is not easy. You need to thoroughly conduct your research by comparing as many brokers as possible to ensure you find one that meets your needs. The recommended three above have all the features you need to kickstart your investment ventures. However, should you decide to overlook our recommendations, here are the significant elements to guide you in choosing the best stock broker to invest in THG stock.

The most important element you should consider when choosing the best stock broker to buy THG shares with is its credibility. Make sure the broker is licensed and regulated by the Financial Conduct Authority (FCA) since this guarantees your funds’ safety and allows you to enjoy the best investment platforms. Settling for unregulated brokers is a risky move that can make you lose your hard-earned money to fraudsters who have dominated the online trading market.

Investing in the stock market is risky, and while you can earn profits, losses are inevitable. In this regard, find a stock broker you can afford, whereby you get to invest with amounts you are comfortable losing. This means creating a budget and using it to find a suitable broker by considering its commissions or spreads, deposits and withdrawals, minimum deposit requirement, and more.

The stock broker for buying THG stock should be available anytime you feel like trading. This is because it is usually impossible to stick to your desktop throughout the day and manage your activities. That is why we advise you to settle for a broker with a trading app that you can use to manage your THG share investments whenever you step out of your trading station.

It is crucial that you find a broker with a platform that will make you feel comfortable. For this reason, find a broker with a demo account and sign up for an account to test its platform’s performance. Moreover, the platform should host all the necessary tools for research and skills development tools. If you are an expert investor, find a stock broker with advanced features and platforms to maximize your experience.

Many investors overlook the reliability of a broker’s support service when searching for one. In the long run, they end up lacking quality assistance whenever they encounter challenges requiring professional assistance. As an investor, always consider a stock broker that guarantees relevant solutions to arising issues and operates during a convenient timeline. They should also be accessible via different channels, whether by phone, email, or live chat.

As mentioned above, choosing the best broker to buy THG stock should be based on personal preference and not what other traders recommend. However, you can still use previous and current traders’ opinions to fully understand the pros and cons of a stock broker. In addition, by sampling comments and reviews from Google Play, the App Store, and Trustpilot, you will be able to make the best choice to maximise your potential.

THG Shares Price Today

THG is one of the stocks with high growth potential in the coming years. This has attracted investors looking to take short and long-term positions. Unfortunately, THG share price keeps fluctuating, making it challenging for investors and traders to determine its current value. For this reason, we help you out by including a live chart below with THG current share value. With the chart, you can also analyze the asset’s historical value to help you create solid investment strategies.

About THG

Founded in 2004 by Matt Moulding and John Gallemore, THG PLC, formerly known as the Hut Group, is a British e-commerce company headquartered in England. Initially, the Hut Group was launched as a white-label e-commerce provider selling its own products. It has since joined partnerships and made various acquisitions to ensure consumers globally get the best beauty, wellness, sports nutrition, luxury, entertainment, and products.

In 2020, THG went public and got listed on the London stock exchange. This attracted many investors, with its share price rising tremendously. However, the company’s share price has since dropped, and the owners have taken measures to ensure it remains sustainable with investors. Besides serving UK clients, THG has operations in America, the Middle East, Asia, Australia, and Europe.

If THG shares catch your interest, exploring the investment opportunities presented by Glencore share and Unilever share could be worthwhile.

FAQs

Yes. THG has witnessed a steady share price growth in the past year, and we hope it will keep rising now that it is taking the necessary measures to increase its revenue. To get started, find a suitable broker by following our guidelines above and conducting thorough market research and analysis to ensure you are making the right decision.

The Hut Group, currently known as THG PLC, is a British e-commerce retail company that sells its own brands and third-party beauty, wellness, sports nutrition, luxury, entertainment, and luxury products to consumers globally. With the advancing technology and the rise in beauty and wellness products demand, the company has growth potential, and investing in its shares now could pay off in the long run. Simply conduct your research to ensure you are making the right investment decision.

Yes. You can invest in THG in the UK through a stock broker with access to the London Stock Exchange, where the shares are listed. With many stock brokers to choose from, ensure you conduct a thorough research by considering our tips in this guide to find the best broker that meets your investment requirements.

THG prides itself on operating across over 190 countries globally. Some of the regions where the company extends its services include America, the Middle East, Asia, Australia, and Europe.

No. Unfortunately, THG PLC does not pay dividends to its shareholders, and there are no plans for it to do so in the future. The only way to benefit from the company is through the profits you get to earn from share investments.

Conclusion

THG PLC is taking the necessary measures to keep growing and increasing its revenue and share price. It is one of the stocks to consider investing in 2026 but ensure you conduct additional research to clear any doubts regarding your investment decisions.

Overall, THG shares are listed on the London Stock Exchange, and using brokers to invest in them offers you an opportunity to explore various resources to maximize your potential. You can also purchase the shares in fractions or trade them as derivatives if you are skeptical about investing a lot of money.