For UK savers looking to grow their money, investing in stocks offers a realistic path beyond low-interest savings accounts. But for beginners, the jargon and platform choices can feel like barriers.

Stocks (or shares) represent part-ownership in a company. Buying Tesco shares, for example, means holding a stake in the business and benefiting if it performs well. While prices fluctuate daily, long-term stock investing remains a proven way to build wealth.

This guide explains how to start investing in stocks in the UK. It sheds light on how to choose a broker, which shares to consider in 2026, and the key risks to keep in mind.

How to Invest in Stocks: Step-by-Step

Getting started in stock investing is often easier than it seems, though each step deserves attention. Here’s a clear breakdown for beginners in the UK.

To buy and sell shares, you’ll need to set up an account with a regulated stock broker. Most beginners choose between:

- A General Investment Account (GIA), which is subject to tax

- A Stocks and Shares ISA (tax-efficient, with a £20,000 annual allowance)

For many, the ISA is the obvious starting point. It shields gains and dividends from tax, making it simple to stay within the UK system.

Stock brokers differ in fees, available markets, user experience, and extra tools. Some platforms are built for experienced traders. Others prioritise ease of use. The next section explores key broker options in detail.

You can usually transfer money via bank deposit or card payment. If you’re buying US shares, be aware that most platforms convert pounds to dollars, often with a small fee.

Many investors start with familiar UK companies on the FTSE 100 or FTSE 250, like Lloyds, BP, and AstraZeneca. Smaller UK firms may offer faster growth, but they also carry more risk.

You can start with a small amount of money. Many stock brokers allow fractional investing, so you can buy part of a share for as little as £10. Always invest an amount you’re comfortable with, especially early on.

You may place an order at the going market rate or set a target price and wait for the market to match it. Most platforms support both options.

Check your portfolio regularly, but avoid constant monitoring. Long-term investing rewards consistency and perspective, not daily reactions.

This helps beginners stay informed and build a solid foundation without feeling overwhelmed.

Top 3 Brokers to Invest in Stocks in the UK

The right stock broker can make a real difference to your investing experience, especially when you’re just starting out. These three platforms stand out for beginners in the UK, each offering a distinct approach to investing.

1. eToro

eToro is a popular choice among new investors thanks to its clean design, simple navigation, and commission-free stock trading. It’s known for its social investing tools, which let users follow and copy the portfolios of experienced traders through the CopyTrader feature. This helps new investors build confidence before making independent decisions.

The platform also supports fractional shares, which means you can invest in high-value global stocks with a small amount of money. Its mobile-first experience, fast onboarding, and wide range of listed shares make it easy to get started, though it’s less equipped for in-depth analysis or long-term portfolio planning.

eToro works well for beginners who want a quick, low-cost way to access global markets and explore investing through a more social lens.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

- No commission on stock trading

- Supports fractional share investing

- Features CopyTrader for following top investors

- Intuitive, beginner-friendly platform

- £5 fee for withdrawals

- Trades are processed in US dollars, so FX fees apply

- Limited research tools

2. IG Markets

IG Markets combines a long-standing reputation with a powerful platform that balances functionality and education. It offers access to a broad range of UK and international shares, along with ETFs and investment trusts. For new investors who want more than just basic tools, IG’s research features, expert insights, and educational content provide strong support.

A key benefit is its demo account, allowing users to practise trading before committing real funds. IG Markets also offers a Stocks and Shares ISA for tax-efficient investing. The broker has no minimum deposit requirement, and long-term investors will find it a reliable partner.

IG suits investors who want a more in-depth experience and plan to stay active as they grow their knowledge and portfolio.

Your capital is at risk

- Trusted FCA-regulated broker with decades of experience

- Access to UK and global markets

- Hosts high-quality research and learning tools

- Demo account for risk-free practice

- The platform may take time for beginners to master

3. Interactive Brokers (IBKR)

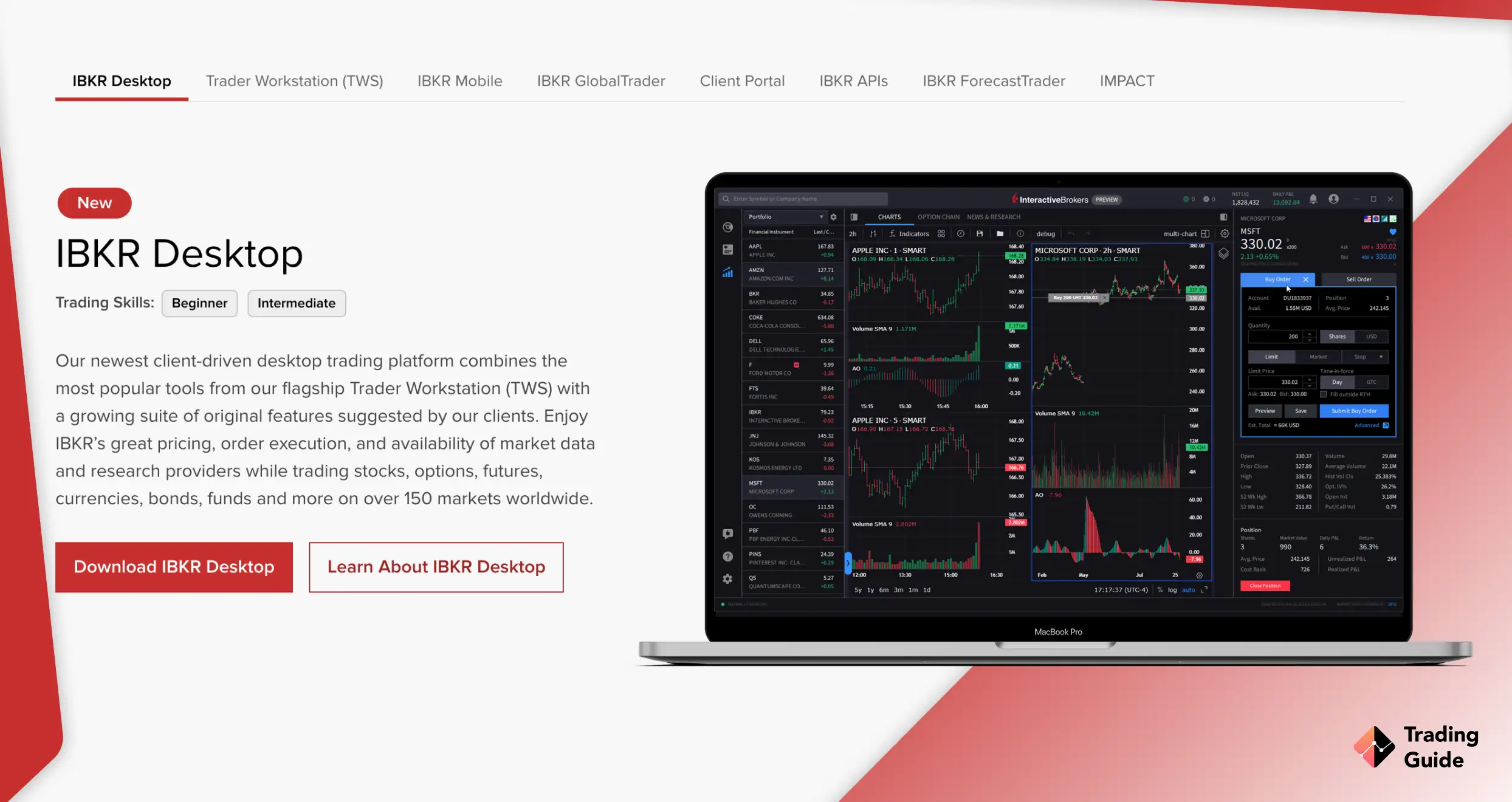

Interactive Brokers is known for its global reach, low fees, and extensive market access. Although originally built for professionals, the platform has made significant improvements to attract individual investors, including the launch of its GlobalTrader app. This streamlined version offers fractional shares, quick currency conversion, and a simplified layout that makes it easier for new users to navigate.

Advanced users can access Trader Workstation for powerful charting and flexible orders. While IBKR may feel more technical than some beginner platforms, it remains a top pick for cost-conscious investors who want access to a broad range of markets without paying high fees.

IBKR is a strong option for investors who want choice, low fees, and room to grow, provided they’re comfortable exploring a slightly steeper learning curve.

- Among the lowest trading costs available

- Access to over 150 global markets

- Strong research tools and data

- Suitable for both simple and advanced users

- The platform can feel complex to new investors

- Some accounts have minimum activity thresholds

Read about the Elliot Wave Principle to catch tops and bottoms in the market.

Tips for Choosing the Best Stock Investment Broker

Choosing the right stock broker isn’t just about low fees. It’s about finding a platform that fits your needs, experience, and investing style.

Only use brokers authorised by the Financial Conduct Authority (FCA) to ensure your money is protected.

A clear, intuitive platform helps reduce mistakes and makes it easier to stay on track.

Some brokers focus on UK stocks; others offer global markets. Check what’s available.

Useful if you’re starting small and want to spread your money across several shares.

Good data and analysis can support better decisions

Quick, helpful responses matter when issues come up.

Think of it like choosing a bank. Low costs are beneficial, but only if the platform is user-friendly and the service is reliable. The best brokers balance price, features, and support.

Top Stocks in 2026 for UK Traders

While no one can predict which companies will outperform this year, several sectors continue to draw attention in the UK market.

- Energy and resources: BP and Shell remain key holdings for many investors. Despite the move toward renewables, global energy demand keeps them in focus.

- Pharmaceuticals: AstraZeneca and GSK are backed by strong R&D pipelines and global reach, offering defensive qualities in uncertain markets.

- Banking: Lloyds, Barclays, and HSBC remain closely tied to the UK economy. These stocks are often chosen for their dividend potential and steady performance.

- Technology and digital infrastructure: The UK may not be home to global tech titans, but companies such as Sage and Ocado are steadily growing and gaining investor interest.

- Consumer goods: Companies such as Unilever and Tesco reflect day-to-day spending patterns, often offering a degree of stability in turbulent conditions.

For broad exposure without picking individual stocks, FTSE 100 tracker funds offer a simple, diversified entry point. Many beginners pair them with a few chosen shares to balance risk and return.

Learn how to buy Tesco shares, Carnival stock or Astrazeneca stocks in our other guides!

Risks of Investing in Stocks

All investments carry risk, and stock trading is no exception. Understanding the main risks early helps build better habits and avoid costly mistakes.

- Market swings: Share prices can shift rapidly in response to economic news, political developments, or shifting investor sentiment.

- Company issues: Even well-known firms can falter. Poor results, leadership changes, or external pressure can drag down share prices.

- Currency exposure: Investing in foreign stocks involves exchange rate risk, which can impact returns when converting them back to pounds.

- Liquidity constraints: Smaller firms may be harder to trade, making it difficult to sell at a desired price.

- Emotional reactions: Fear or hype often leads to bad decisions. Selling too soon or chasing trends can cause losses.

These risks can’t be avoided entirely, but they can be managed. Clear goals, sector diversification, and a steady strategy help remove emotion from investing.

FAQs

No. Many UK brokers now offer fractional shares, so you can begin with as little as £10. This allows you to invest without needing a large upfront amount.

No. Dividends earned within a Stocks and Shares ISA are tax-free. If you invest outside an ISA, dividend income above the £500 annual allowance is taxable.

Yes. Most UK brokers with international access let you invest in American firms, including Apple and Microsoft. Keep in mind that most platforms charge a fee when converting pounds to dollars or other currencies.

Funds offer built-in diversification by spreading your money across many companies. Individual shares carry higher risk but may offer stronger returns. Many investors choose a mix of both.

Conclusion

For UK investors starting out, access is no longer the barrier. With low-cost platforms, fractional shares, and ISA accounts, the tools are in place. The real task is using them wisely.

Success in the stock market rarely comes from chasing trends or quick wins. It comes from steady decisions, clear goals, and a willingness to stay the course. Choosing a regulated broker, managing risk, and staying focused on long-term growth are what set confident investors apart.