Trading forex can be challenging, especially if you do not know how to get started and select the best currency pairs. While there are plenty of currency pairs to trade in the UK, the GBP/USD currencies are among the most popular and liquid. This currency pair is also considered one of the safest, thanks to the stability of the UK and US economies.

If you are looking to trade GBP/USD currencies, we walk you through the basics below. We also list the top forex brokers that will give you an exciting experience and guide you on how to select a suitable one for your needs. In the end, you should have acquired the necessary knowledge and confidence to start trading the GBP/USD currency pair in the UK.

Top Brokers to Trade GBP/USD Currencies

You need the best forex broker listing the GBP/USD currency pair to effectively trade in the UK. The best broker can help you navigate the complex world of foreign exchange trading and provide the tools and resources to make informed investment decisions. However, we understand that there are numerous options in the UK market, thus making it challenging for newbies to select the best.

To help simplify your research, we did all the legwork and list below the top forex brokers we handpicked based on multiple tests and comparisons. The brokers below not only list the GBP/USD currencies but also additional pairs and assets to explore. Moreover, they are highly secure and regulated by the Financial Conduct Authority (FCA).

1. Plus500

*Illustrative prices

Plus500 stands out as one of the top four brokers for trading GBP/USD currencies, offering a reliable and user-friendly platform for forex traders. With its intuitive interface and fast trade execution speed, this broker ensures a seamless trading experience. Traders can benefit from competitive spreads, free transactions, and leverage options of up to 1:30 for retail traders and 1:300 for professionals.

Besides the GBP/USD currencies, Plus500 lists an additional 60+ CFD currency pairs to explore. You can diversify your portfolio with additional CFD asset classes, including shares, commodities, indices, ETFs, etc. With 24/7 customer support and a commitment to transparency and security, Plus500 solidifies its position as one of the top brokers for GBP/USD currency trading. You can test it out via its demo account before making a full commitment.

- Commission-free trades with low spreads from 0.0 pips

- Low minimum deposit requirement

- High leverage limit for professional traders

- A virtually-funded demo account for beginners to get started with

- No third-party trading platforms like the MT4

- Inactivity fee of £10 monthly kicks in after only three months

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

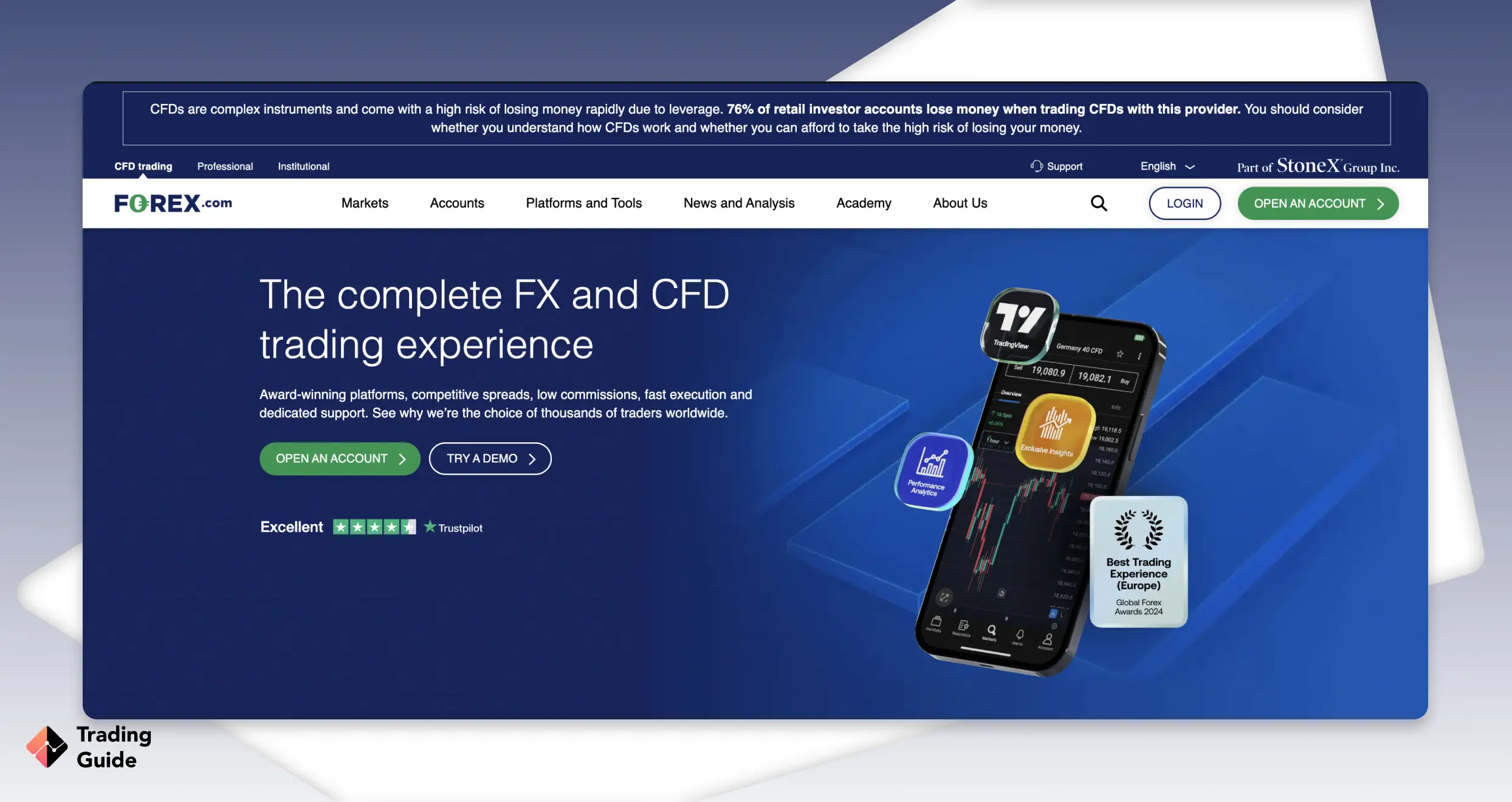

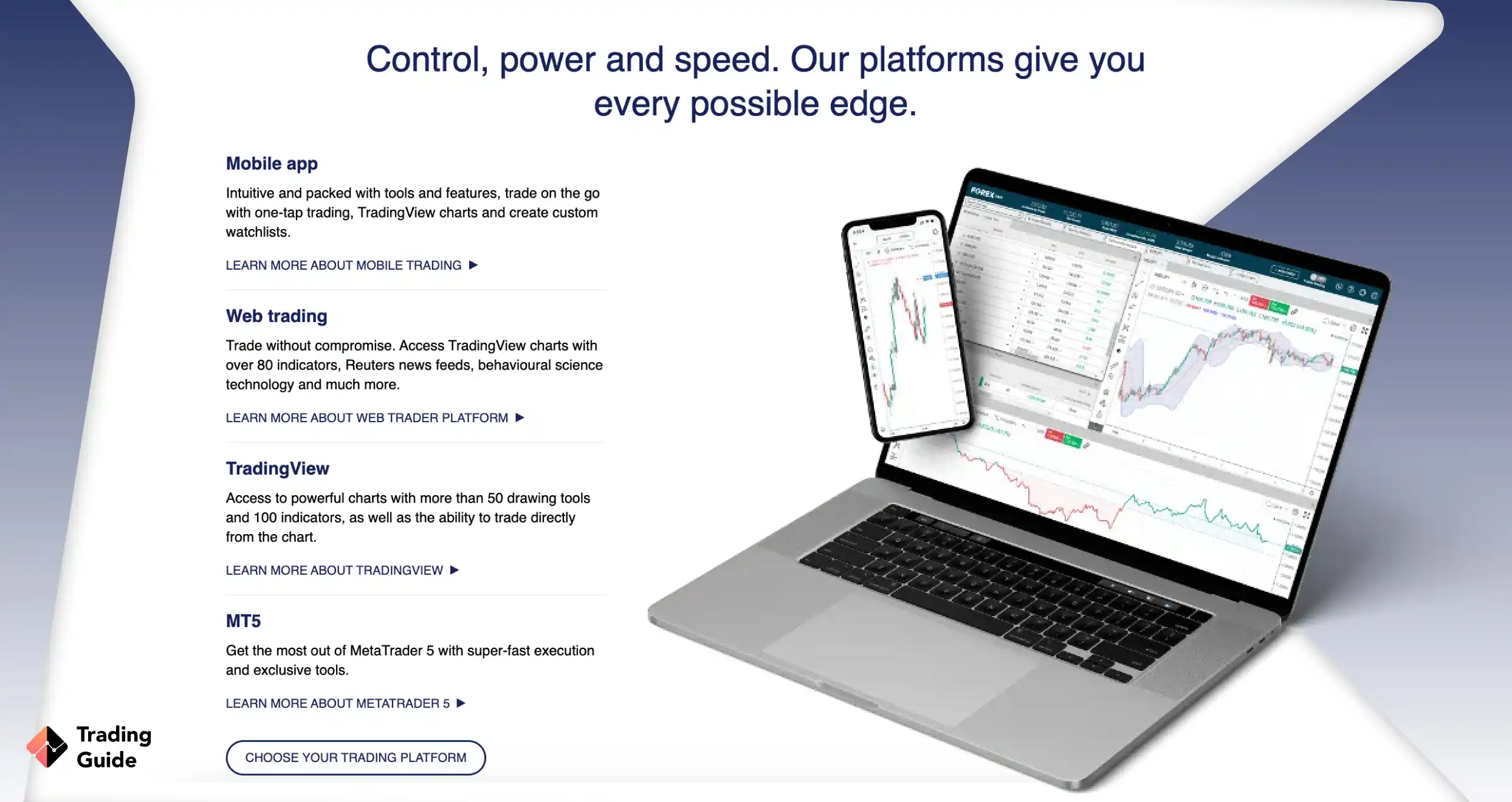

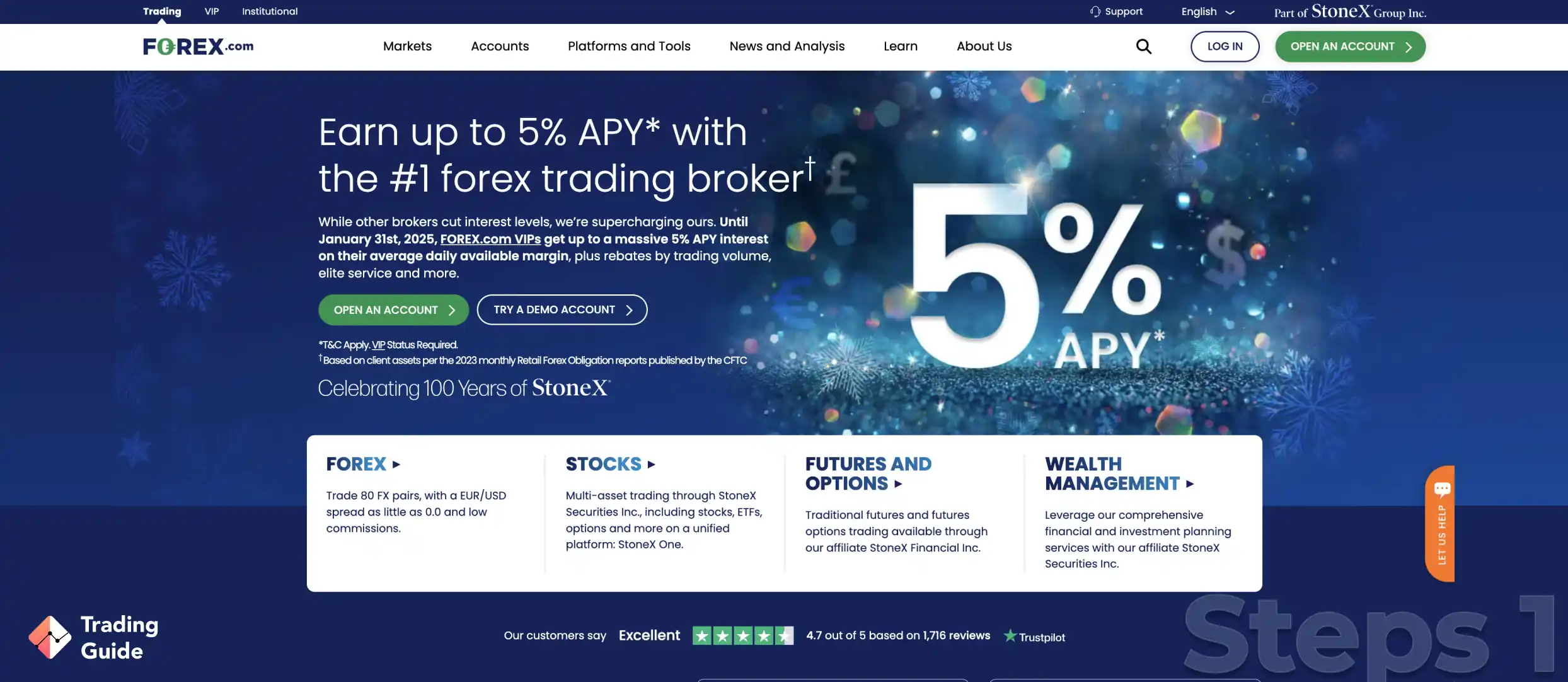

2. Forex.com

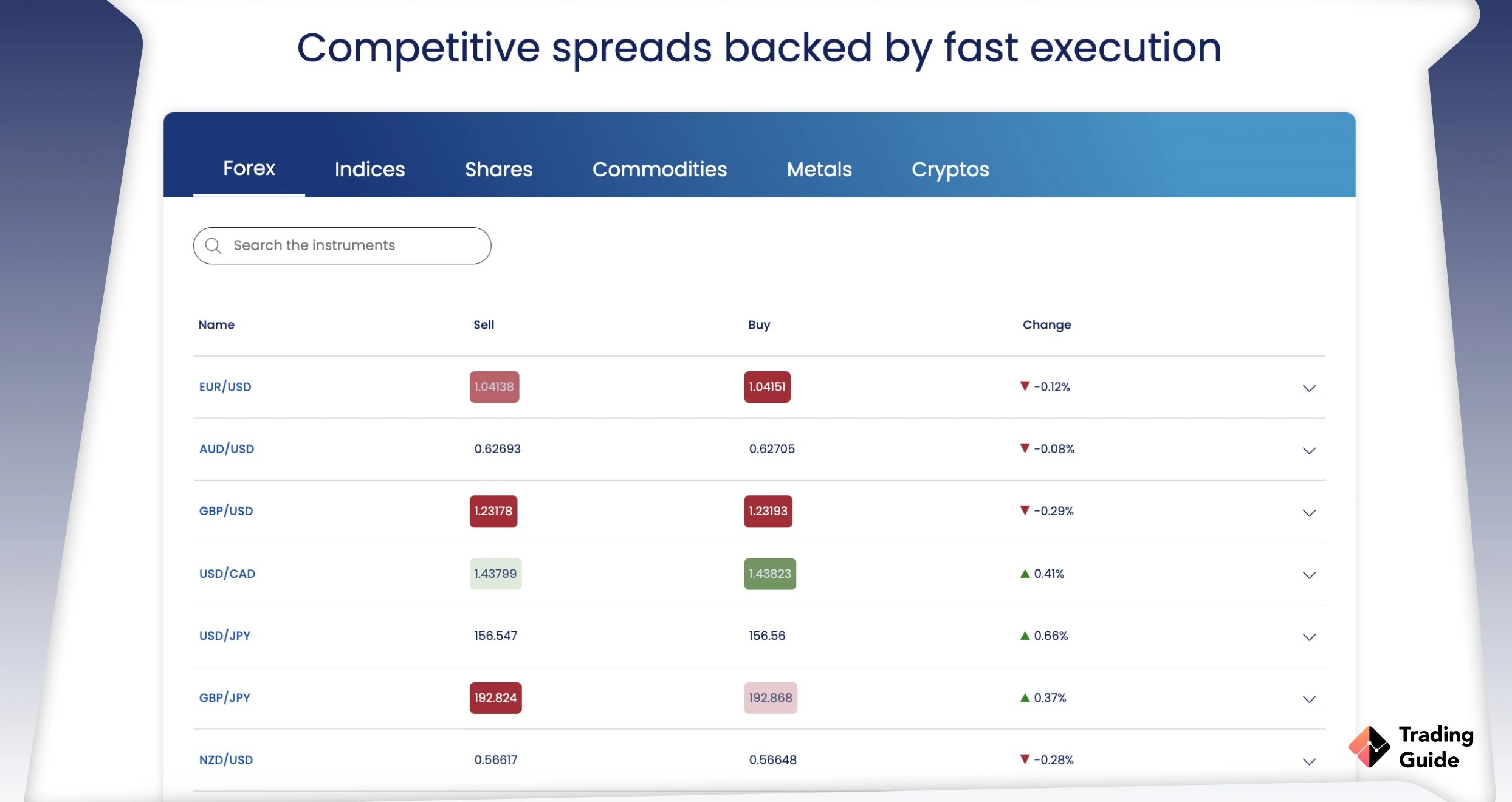

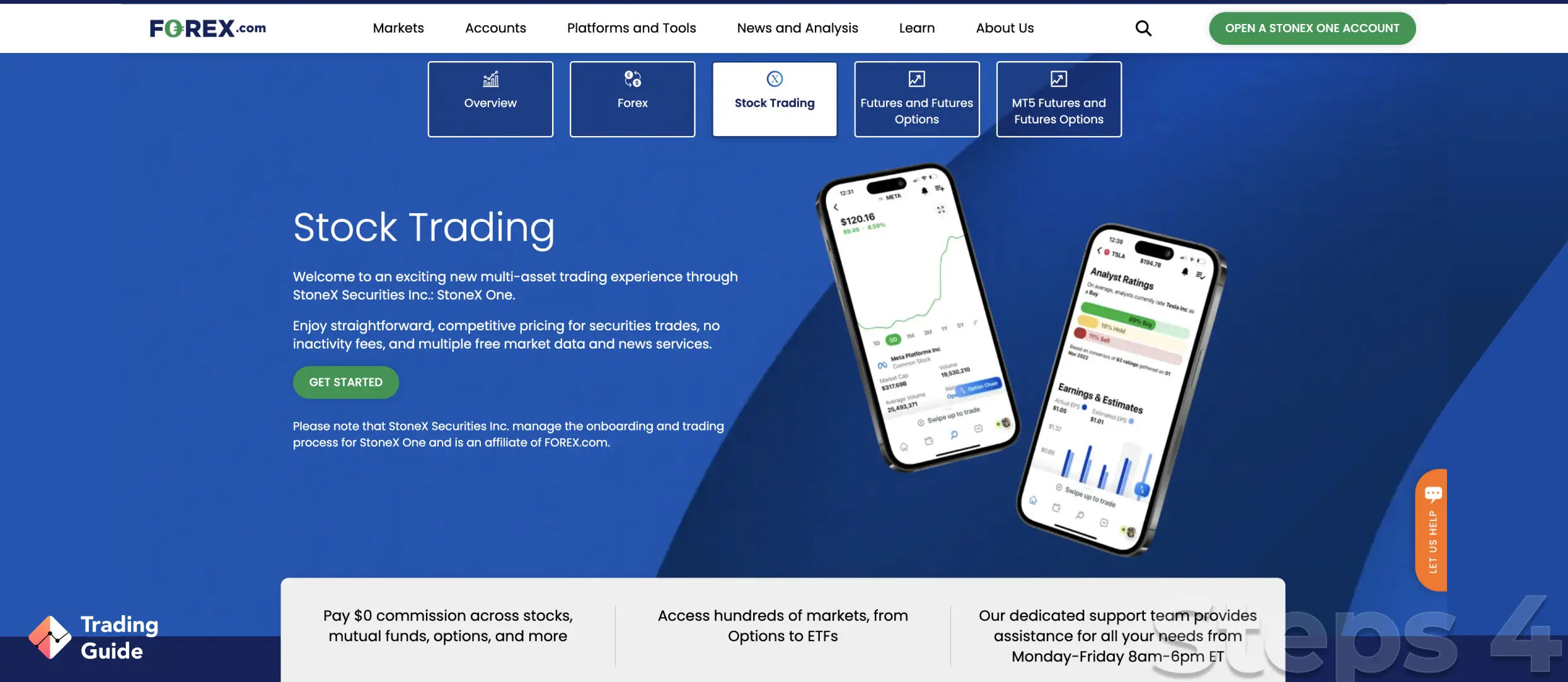

Established in 2001 as a forex and CFD broker, Forex.com is one of the most trusted and reliable forex brokers for trading GBP/USD currencies in the UK. Besides the GBP/USD, Forex.com lists additional 90+ currency pairs to explore. You will also have access to other asset classes, including shares, commodities, cryptocurrencies, and more, to trade as CFDs and diversify your portfolio with.

This forex broker has a minimum deposit requirement of £100 and allows you to transact for free using multiple payment methods, including credit/debit cards, e-wallets, and bank transfers. Trading GBP/USD currency pair attracts low spreads, making us recommend it to budget-conscious traders. When it comes to GBP/USD chart investing tools offering, you can rely on this broker’s collection for efficient strategy and skills development.

- Low USD/GBP trading fees

- Plenty of quality research and learning resources

- Additional 90+ currency pairs to explore

- Features the MT4 and MT5 platforms for advanced forex traders

- Charges a monthly inactivity fee of £15 should your account remain dormant for over 12 months

- No safe two-step login procedure

3. CMC Markets

If you are looking to trade the GBP/USD currency pair using an advanced forex broker with low fees, CMC Markets is a viable option. The broker doesn’t have a minimum deposit requirement, and charges low spreads for trading GBP/USD currencies. On top of that, CMC Markets is user-friendly and executes trades fast, making it more efficient for active traders.

Besides listing the GBP/USD currency pair, traders will explore other 300+ currencies using this broker. Your research and market analysis procedures are also simplified if you take advantage of CMC Markets’ quality tools. For beginners, you can take advantage of its numerous learning resources to build your skills. We advise you to test the broker using its £10,000 demo account for more understanding.

- A user-friendly and intuitive design platform for beginners

- No minimum deposit requirement

- A gazillion learning and research resources to explore

- Additional 300+ currency pairs for portfolio diversification

- Its trading app doesn’t have the safe two-step login procedure

- Support service operates only five days a week

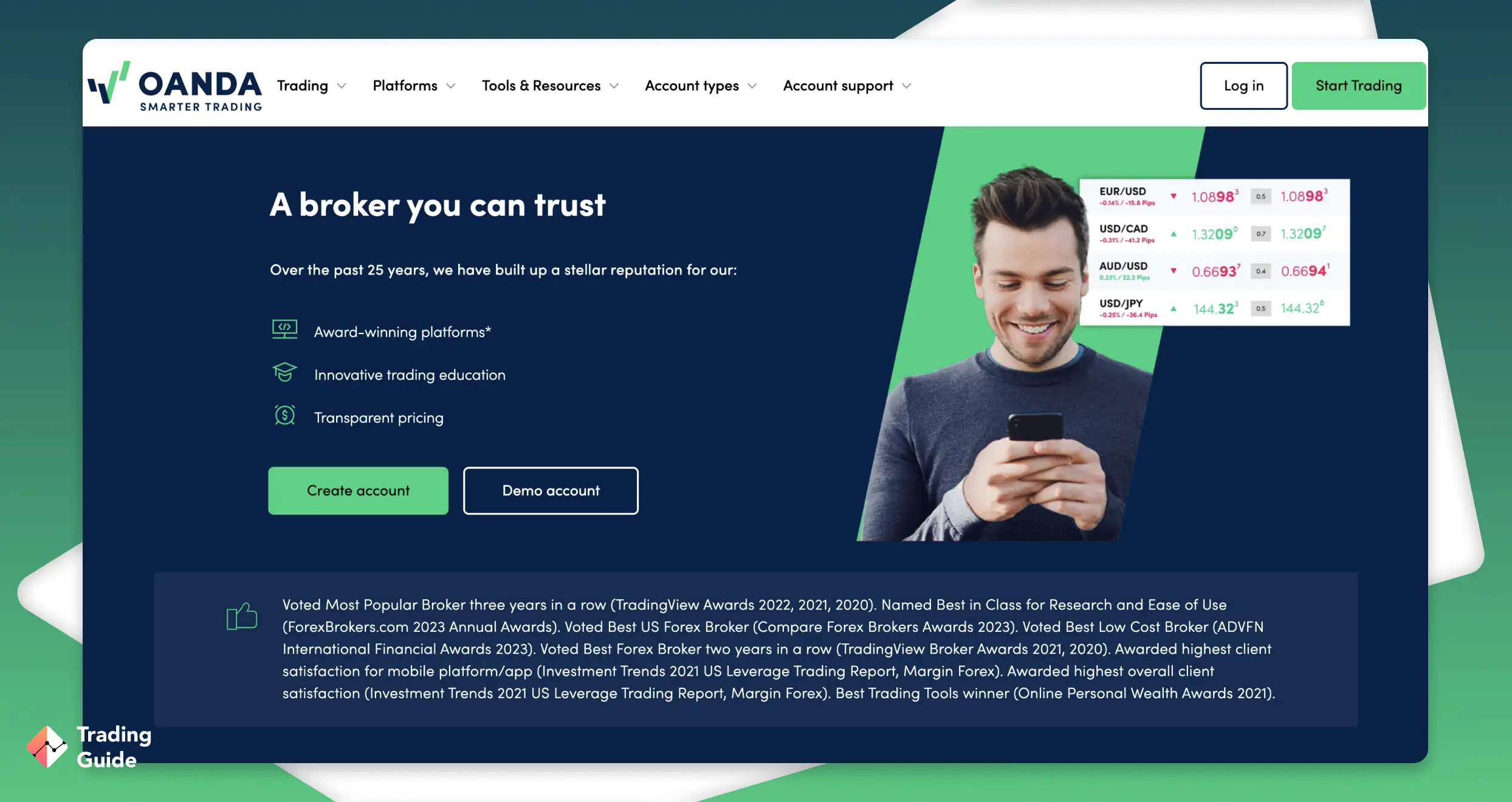

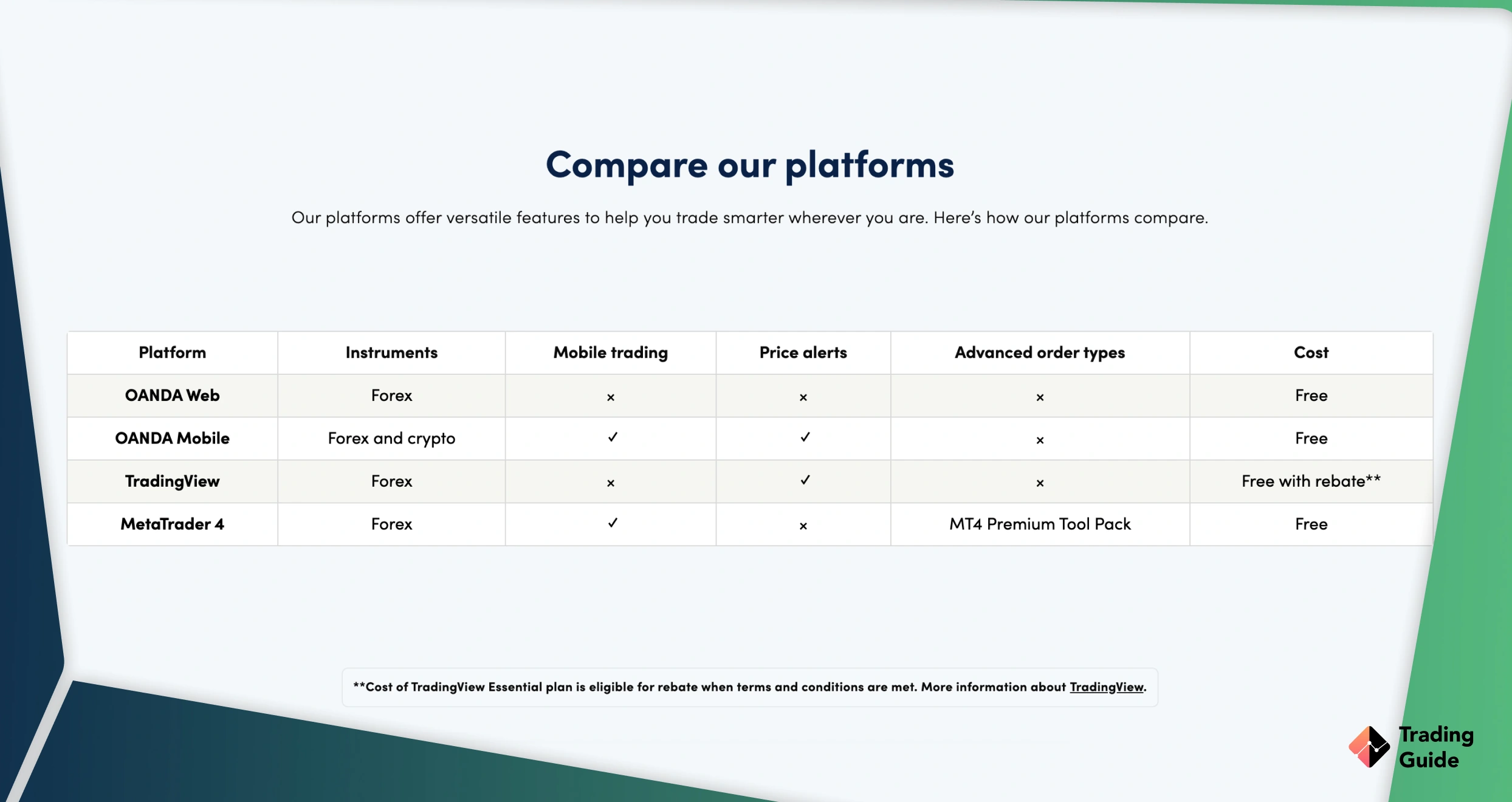

4. OANDA Europe LTD

OANDA Europe LTD is another forex broker that we were really impressed with because of its superior features. For instance, the broker has a fast trade execution speed, allowing you to trade more frequently and take advantage of rising opportunities. Additionally, it has a trading app for Android and iOS devices and a virtually-funded demo account for testing it out before creating the GBP/USD live trading account.

To get started with OANDA Europe LTD, you must create a trading account and make a deposit with no minimum deposit. All transactions using supported payment methods are free, and you get to incur low spreads starting from 1 pip. If you have been looking to trade GBP/USD currency pair on advanced platforms, the broker hosts the MT4 to take advantage of. You can also rely on its amazing collection of research materials to maximise your experience and potential.

- Hosts the MT4 and TradingView platforms for advanced forex traders

- No minimum deposit requirement

- Additional 45+ currency pairs for portfolio diversification

- Low trading and non-trading fees, making it an excellent option for low-budget traders

- Limited learning resources compared to its peers

- Charges a £13 monthly inactivity fee after 12 months of no activity

Note: 76.6% of retail investor accounts lose money when trading CFDs with this provider.

How to Trade GBP / USD Currencies With Forex.com

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

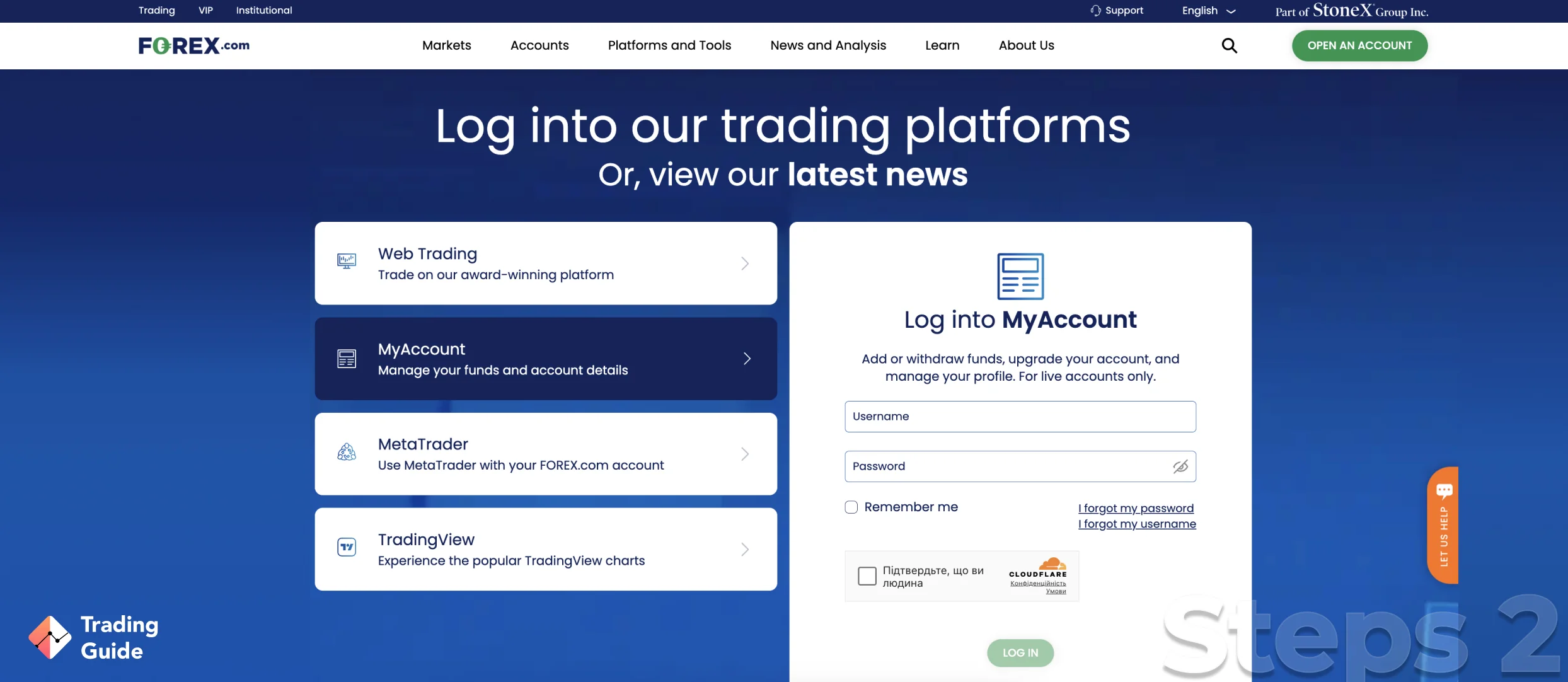

Having the right forex broker in your corner is essential for maximum experience trading the GBP/USD currencies. While we list above the top brokers to consider in the UK, you probably must be wondering how to get started. Below, we shed light on the step-by-step procedures involved in trading this currency pair using Forex.com as an example.

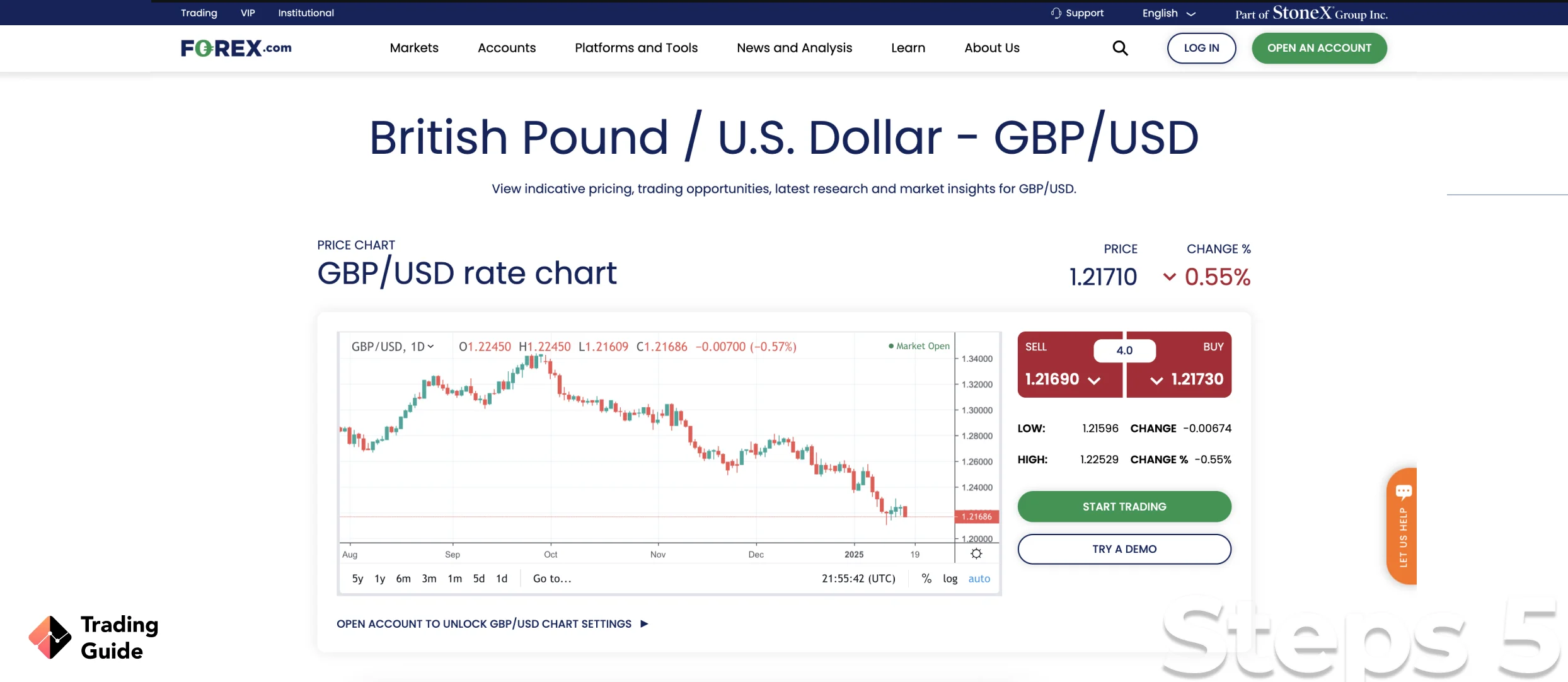

To get started with trading the GBP/USD currency pair, visit Forex.com’s website and click the ‘Open an Account’ button. Before you begin registering, ensure you understand the broker’s terms and conditions. Also, consider installing its trading app on your mobile device for seamless trading activities while on the move.

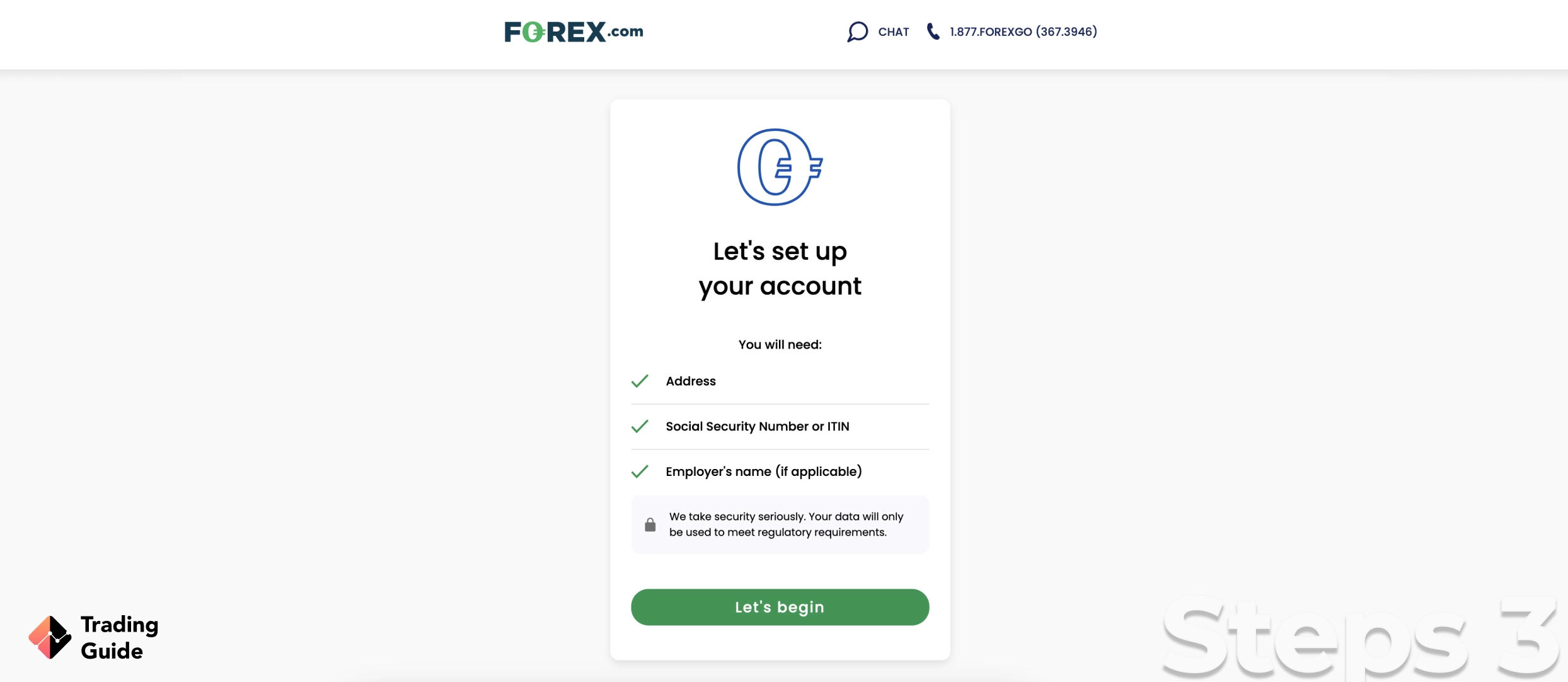

You can now continue with the account registration procedure, whereby Forex.com will require you to fill out a form with your personal details. This will include your name, email address, phone number, country of residence, and more. You will also be asked to create a username and password for your account.

After completing step 2 above, Forex.com will need to verify your details, as this is a standard protocol set by the FCA to keep all trading platforms secure. The broker will request a copy of your original ID card, driver’s license or passport for identity verification. You will also share a copy of your recent utility bill or bank statement to prove your location.

Once your account is verified, Forex.com will send an email notification, after which you can deposit funds into your trading account. Forex.com’s minimum deposit requirement is £100, and you can transact using various payment methods, including bank transfers, credit/debit cards, and e-wallets.

After you have deposited funds into your trading account, you can start trading the GBP/USD currency pair. To do this, simply select the GBP/USD currency pair from the list of available forex trading instruments. Then, choose your position size, apply risk management controls, and execute your trade. You should also track your position’s performance using your desktop or mobile device to ensure nothing affects your trade.

Find out about the Trade Nation broker in our other article.

How to Choose the Best Broker to Trade GBP/USD

UK traders looking to invest in the GBP/USD currencies must find a credible and reliable forex broker suitable for their trading needs. This means that you must conduct thorough market research and compare as many brokers as possible to ensure you find the best. To help you in your research, we list below some of the significant elements to consider.

The best broker should be licensed and regulated by the Financial Conduct Authority (FCA). This is to ensure it adheres to strict FCA regulatory standards, which can help protect you as a trader. Note that some forex brokers in the UK are regulated by multiple global authorities, which proves their credibility even more.

Look for a broker that offers a wide range of trading assets, including GBP/USD. This will give you more flexibility in your trading strategies, as you will be able to trade multiple assets and diversify your portfolio.

Trading fees can exhaust your profits, so it’s essential to find a broker offering competitive charges. Look for a broker with low spreads, commissions, and transparent pricing. You must also confirm a broker’s non-trading charges, including deposit and withdrawal fees, inactivity costs, currency conversion charges, and more, to ensure they fit your budget.

A reliable trading platform is crucial for executing trades quickly and efficiently. In this regard, look for a forex broker with a user-friendly and intuitive design platform. It should also offer fast trade execution speed and advanced trading tools suitable for your skill level.

A demo account makes it easier for you to practice trading on a broker’s platform without spending real money. You will hone your skills and test different trading strategies to decide whether a forex broker suits you. In this regard, look for a broker offering a demo account so you can get a feel for its trading platform and services.

Good customer support can make a big difference in your trading experience. Therefore, find a forex broker with responsive and helpful customer support available through multiple channels such as email, phone, and live chat. You can also review user testimonials regarding a broker’s reliability for the best decisions.

Find out about TradeStation broker in our other article.

The GBP/USD Basics and History

The GBP/USD currency pair represents the exchange rate between the British pound and the US dollar. In forex trading, exchange rates are quoted as a currency pair, with the base currency listed first, followed by the quote currency. For example, in the GBP/USD pair, the British pound is considered the base currency, while the US dollar is the quote currency.

Note that the value of the GBP/USD pair represents the amount of US dollars that can be exchanged for one British pound. For instance, if the exchange rate is 1.24, it means that one British pound is worth 1.24 US dollars.

The GBP/USD pair is affected by various factors, including economic indicators, geopolitical events, and central bank policies. Traders and investors often analyse these factors to predict the direction of the currency pair and make informed trading decisions.

If you want to know more about forex trading for beginners in the UK read our other guide.

History of GBP / USD

The GBP/USD currency pair history goes way back to the 1700s when the British pound became the world’s dominant currency. Many countries used the pound as a reserve currency, and its value was closely tied to the gold standard. However, in the 20th century, the US dollar emerged as a dominant currency, leaving the pound to lose its status. The exchange rate between the two currencies has since fluctuated over the years, with periods of stability and volatility.

One of the most significant events in the history of the GBP/USD pair was the decision by the UK to leave the European Union, known as Brexit. The vote in 2016 and the subsequent negotiations and uncertainty affected the exchange rate between the two currencies, with the pound experiencing high volatility against the US dollar.

Reasons to Trade GBP and USD

As mentioned earlier, there are hundreds of currency pairs in the UK to trade using forex brokers. Each currency pair has its own benefits, and understanding them will help you make the best choice that could bring about good returns. For those interested in the GBP/USD currency pair, here are the reasons you should trade the asset.

- High Liquidity: The GBP/USD currency pair is highly liquid, meaning there are always buyers and sellers in the market. This means you can easily enter and exit trades at any time without experiencing significant slippage or price gaps.

- Volatility: The GBP/USD currency pair is known for its volatility, which can present both opportunities and risks for traders. High volatility means there is potential for large price movements, which can lead to increased profits or losses.

- Economic Indicators: The UK and the US are major economic players, and their economic indicators can affect the value of the GBP/USD currency pair. Traders and investors often analyse economic data such as GDP, inflation, and employment figures to predict the direction of the currency pair and make informed trading decisions.

- Central Bank Policies: The Bank of England (BoE) and the Federal Reserve (Fed) are two of the world’s most influential central banks. Their policies, including interest rates and quantitative easing, can affect the value of the GBP/USD currency pair. Traders and investors often monitor central bank announcements and decisions to stay informed about potential market moves.

- Geopolitical Events: Geopolitical events such as elections, referendums, and trade agreements tend to affect the GBP/USD currency pair. For example, the UK’s decision to leave the European Union, known as Brexit, significantly impacted the pound’s value against the US dollar.

Understand Two Economies

Understanding the relationship between the US and the UK is essential when trading the GBP/USD currency pair. The US is the leading destination for UK exports, which include cars, medical supplies, and turbines, among other products. The UK’s trade balance with the US can impact the value of the GBP/USD currency pair.

As a forex trader, analyse the US economy, including monetary and fiscal policy, employment figures, inflation, and political developments, for the best trading decisions. You must also stay abreast with the UK economy considering that it is heavily influenced by the service sector.

Overall, trading GBP/USD currency pair requires that you monitor key economic indicators such as gross domestic product (GDP), inflation, employment figures, and Brexit developments. For instance, the decision by the UK to leave the European Union affected the pound’s value against the US dollar.

Understand Two Politics

When trading the GBP/USD currency pair, you must understand the politics of both the United States and the United Kingdom. Both countries share similar political behaviours and are part of the same political and economic blocks, such as NATO, OECD, and G20.

Traders need to stay informed about how these affiliations affect currency movements. For example, during G20 or G10 meetings, traders must understand how the discussions will impact the currency pairs.

Similarly, events such as the UK’s referendum on whether to remain part of the EU or not or the United States presidential elections can also have an effect on the GBP/USD currency pair. Therefore, constantly monitor these events closely and understand how they may influence the currency pair’s movements for informed trading decisions.

GBP/USD Best Time to Trade

You should consider trading the GBP/USD during the overlapping hours of the London and New York markets, from 1:00 pm GMT to 4:00 pm GMT. During this time, traders can take advantage of the high liquidity and trading volume that occurs as traders from both markets are active. This results in tight spreads, which makes it easier to enter and exit trades.

Trading during this time also allows you to explore the highly volatile currency market. You can take advantage of the opportunities arising in this period to profit from frequent price movements. However, note that trading during overlapping hours can be risky, as sudden market movements can result in losses.

As a trader, always track your activities and be on the lookout for economic news releases and geopolitical events that may affect the currency pair’s exchange rate. By staying informed and analysing market trends, you can make the best decisions that increase your chances of success when trading GBP/USD.

FAQs

Although many financial analysts believe and hope that the GBP will remain stronger than the USD, it is challenging to tell whether the currency pair’s value will rise or fall. We advise you to always conduct your market analysis and track the pair’s price performance for the best trading decisions.

GBP is the currency code for the Great British Pound, commonly referred to as the pound sterling. In forex trading, GBP is one of the major currencies and is often paired with other currencies like USD, EUR, JPY, and CHF.

Yes. When writing this guide, the GBP was stronger than the USD and considered the fifth strongest currency globally. However, the future is uncertain, and you should always check the currency exchange rate between the two currencies to make the best trading decisions. Remember, exchange rates can fluctuate due to various factors such as economic indicators, political developments, and market sentiment.

The daily USD/GBP rate varies depending on the foreign exchange market’s conditions and is subject to constant fluctuations. You can check the current USD/GBP rate on financial news websites or through a reliable currency converter.

Conclusion

Forex is the largest capital market globally, with over $6 trillion daily turnover. It is also the most liquid market, making it a considerable investment tool. The GBP/USD is among the major currency pairs in the forex market, and trading it can be profitable with a proper approach. For instance, staying abreast with the latest economic indicators and political developments in the UK and the US is crucial for the best trading decisions. You must also find the best forex broker and apply risk management strategies to minimise losses and maximise profits.