You probably must have come across the USD/JPY pair, which is one of the most popular in the foreign exchange market. The pair represents the exchange rate between the US dollar and the Japanese Yen, and you can trade it using an online forex broker. Note that the USD/JPY currency pair attracts traders due to many benefits, including high liquidity and low spreads.

Want to learn more about how to trade USD/JPY currencies? This guide is tailored for you. Not only will you understand the basics of this currency pair, but also its history, advantages, and more. Ultimately, you will know the best time to trade USD/JPY and meet some of the top brokers to trade the asset.

7 Simple Steps for Trading USD/JPY Currencies in the UK

Trading USD/JPY currency pair requires a reliable forex broker. The process is pretty straightforward, and below, we take you through an overview of how to get started.

- Gain a solid understanding of the Forex market, currency pairs, and the factors influencing the USD and JPY. Familiarise yourself with fundamental and technical analysis, risk management strategies, and trading tools.

- Choose a reliable forex broker like the ones we recommend in our mini reviews below.

- Open a trading account using your personal details and the necessary documentation as required by the broker.

- Make a deposit per a broker’s minimum deposit requirement.

- Conduct thorough market analysis using both fundamental and technical analysis methods.

- Based on your analysis, enter trades by placing USD/JPY sell or buy orders on your trading platform.

- Implement proper risk management techniques, such as setting stop-loss and take-profit levels, to protect your capital. Continuously monitor your trades and make adjustments as necessary.

Top 3 Brokers to Trade USD/JPY Currencies

When it comes to trading USD/JPY currencies, selecting the right broker is essential. Note that the UK market is dominated by hundreds of credible forex brokers, thus making it challenging for traders to identify the best.

Below, we have handpicked our top three forex brokers we believe will maximise your potential when trading the USD/JPY currencies. Remember, these brokers have varying features, so comparing them to ensure you meet the best for your trading requirements is crucial.

1. Plus500

*Illustrative prices

If you are new to the currency market and looking to explore the USD/JPY currencies, Plus500 is the best broker* to get started with. Note that the broker is known for its simplicity and ease of use. It also charges low spreads for trading this currency pair, allowing you to explore the asset without spending a lot of money. Plus500 also has a minimum deposit requirement of £100, which we consider among the lowest in the industry.

Besides the USD/JPY currencies, this broker hosts other major, minor, and exotic currency pairs to diversify your portfolio with. You can also trade other instruments, including shares, commodities, ETFs, and more. On top of that, Plus500 supports users with adequate learning materials and a virtually funded demo account for testing it before trading using real money.

*Investment Trends 2022

- Low minimum deposit requirement

- Zero commissions on USD/JPY trades

- User-friendly and intuitive design platform

- Additional 60+ currency pairs to explore

- Primarily recommended for newbies due to availability of limited advanced trading resources

- Inactivity fees kick in after only three months of account’s dormancy

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

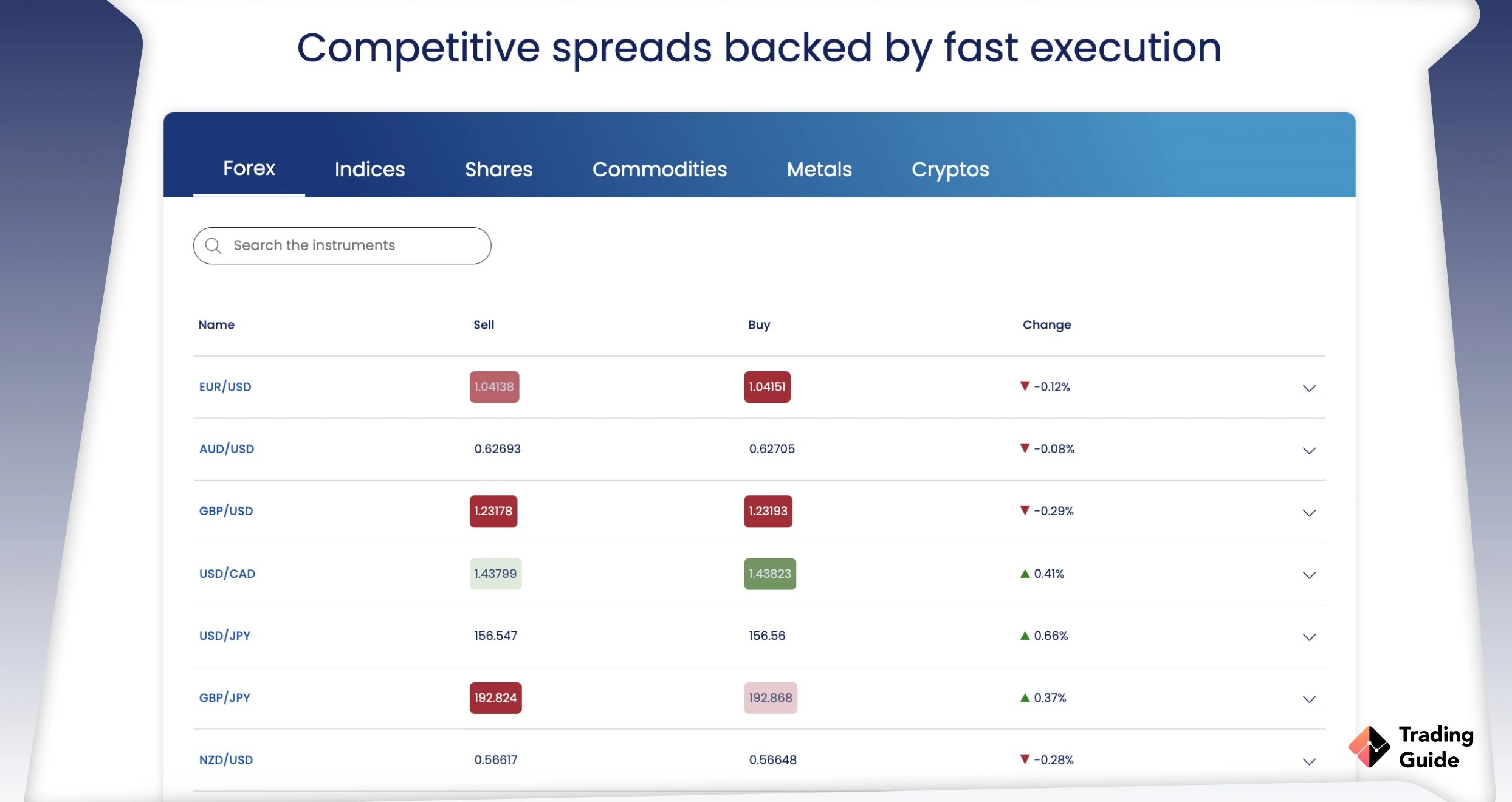

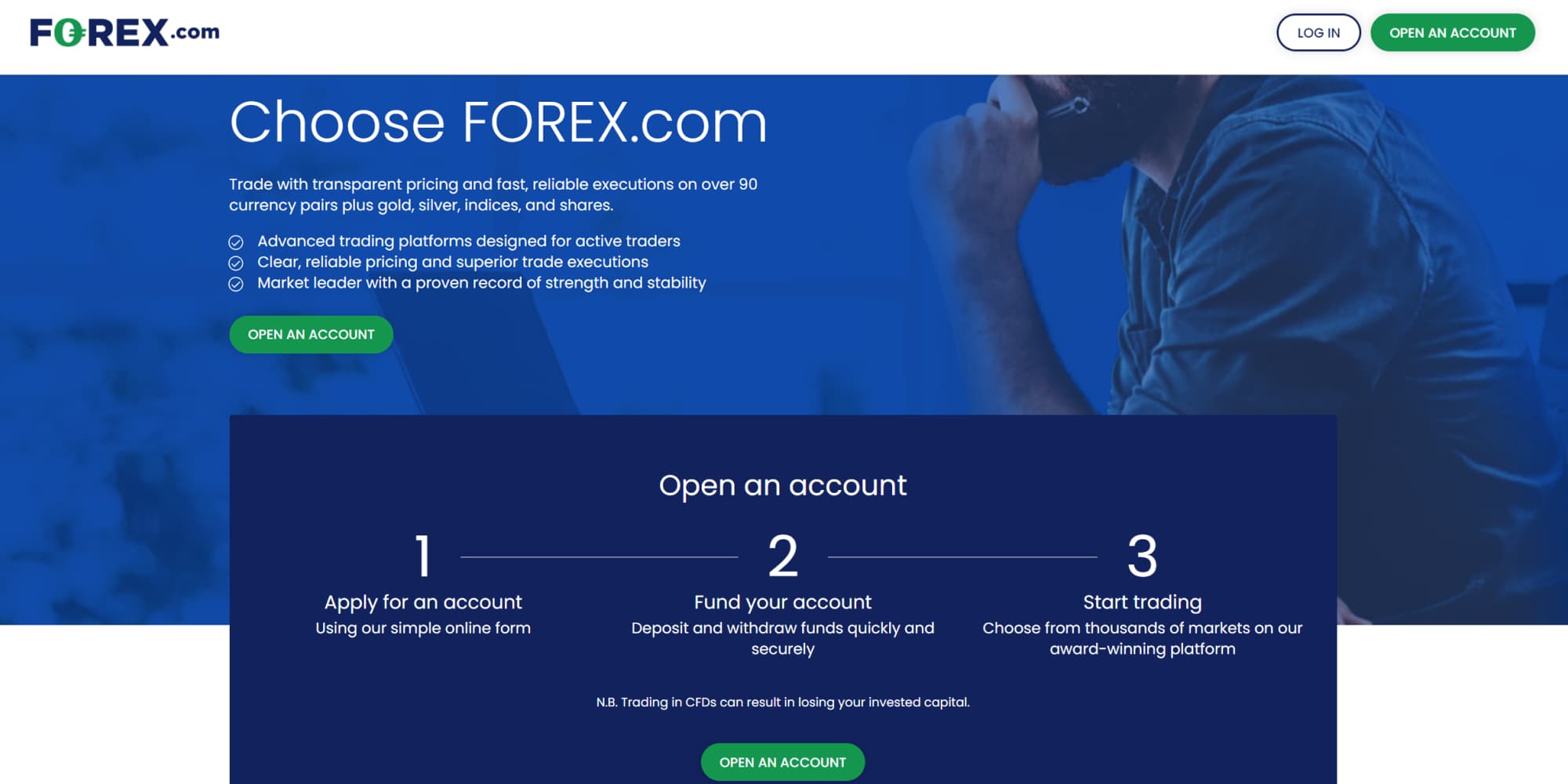

2. Forex.com

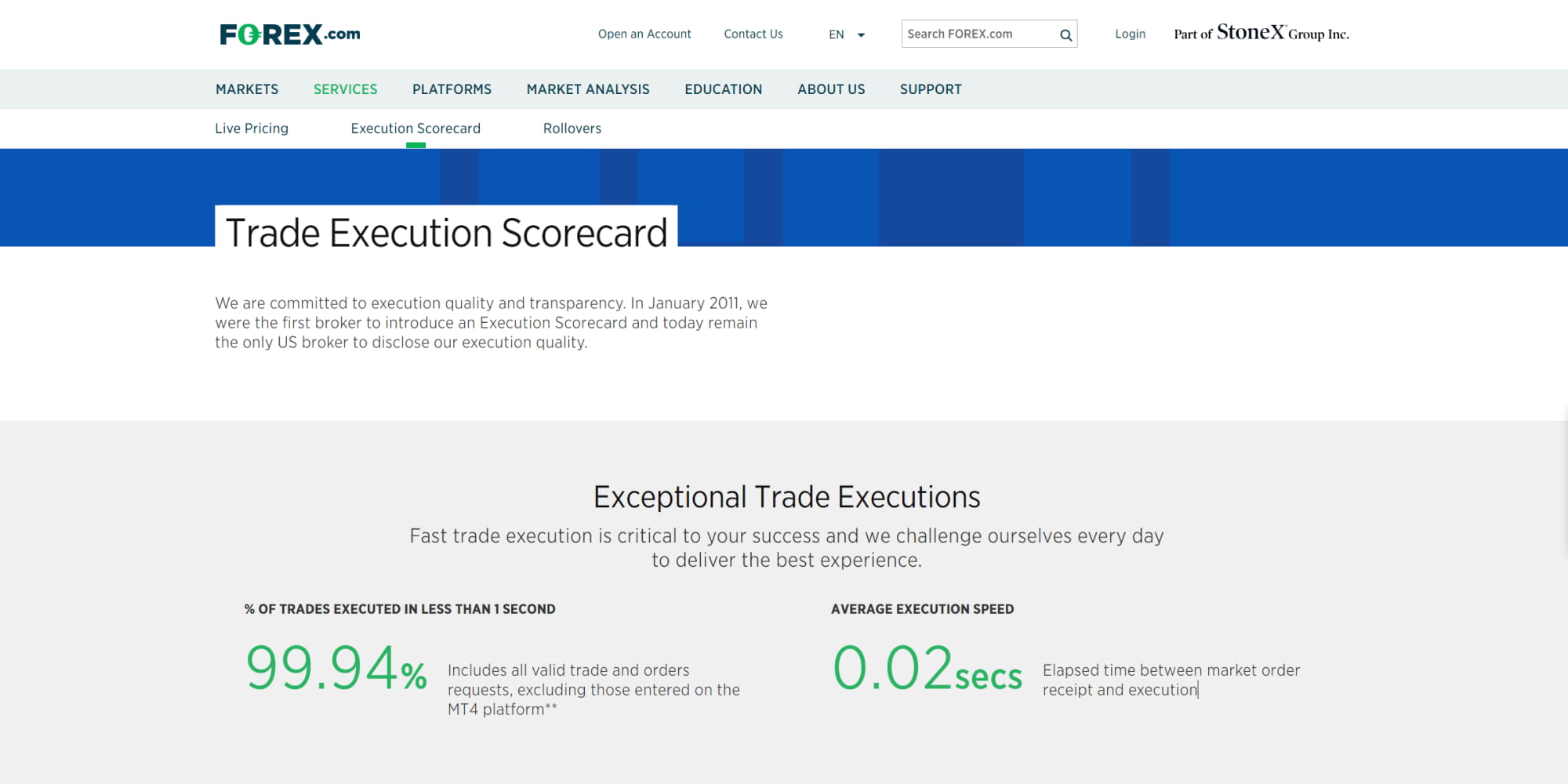

Forex.com is a globally recognised forex and CFD broker that stands out as one of the best options for trading the UK USD/JPY currency pair. With its establishment in 2001 and regulation by top-tier authorities such as the FCA, the broker offers high trust and reliability. Besides the USD/JPY currencies, you get to enjoy additional 80+ currency pairs and other assets such as stocks, cryptocurrencies, commodities, and more. All you have to do is register for an account and deposit at least £100 to get started.

Note that Forex.com offers a Direct Market Access account with spreads as low as 0.1 pip, catering to professional traders seeking competitive pricing. With the availability of MetaTrader 4 and 5 platforms, you can access advanced trading tools and features. These resources can simplify your market analysis process and strategy development. For beginners, the broker hosts a virtually funded demo account and plenty of learning resources to kickstart your trading ventures with.

- Low minimum deposit requirement with free transactions

- Additional 80+ currency pairs

- Trade with leverage and maximise your profitability

- Multiple account types, including DMA, TradingView, MT4, and MT5 for professional traders

- Spreads can be high for low-budget forex traders

- A £15 monthly inactivity fee kicks in should your account remain inactive for over 12 months

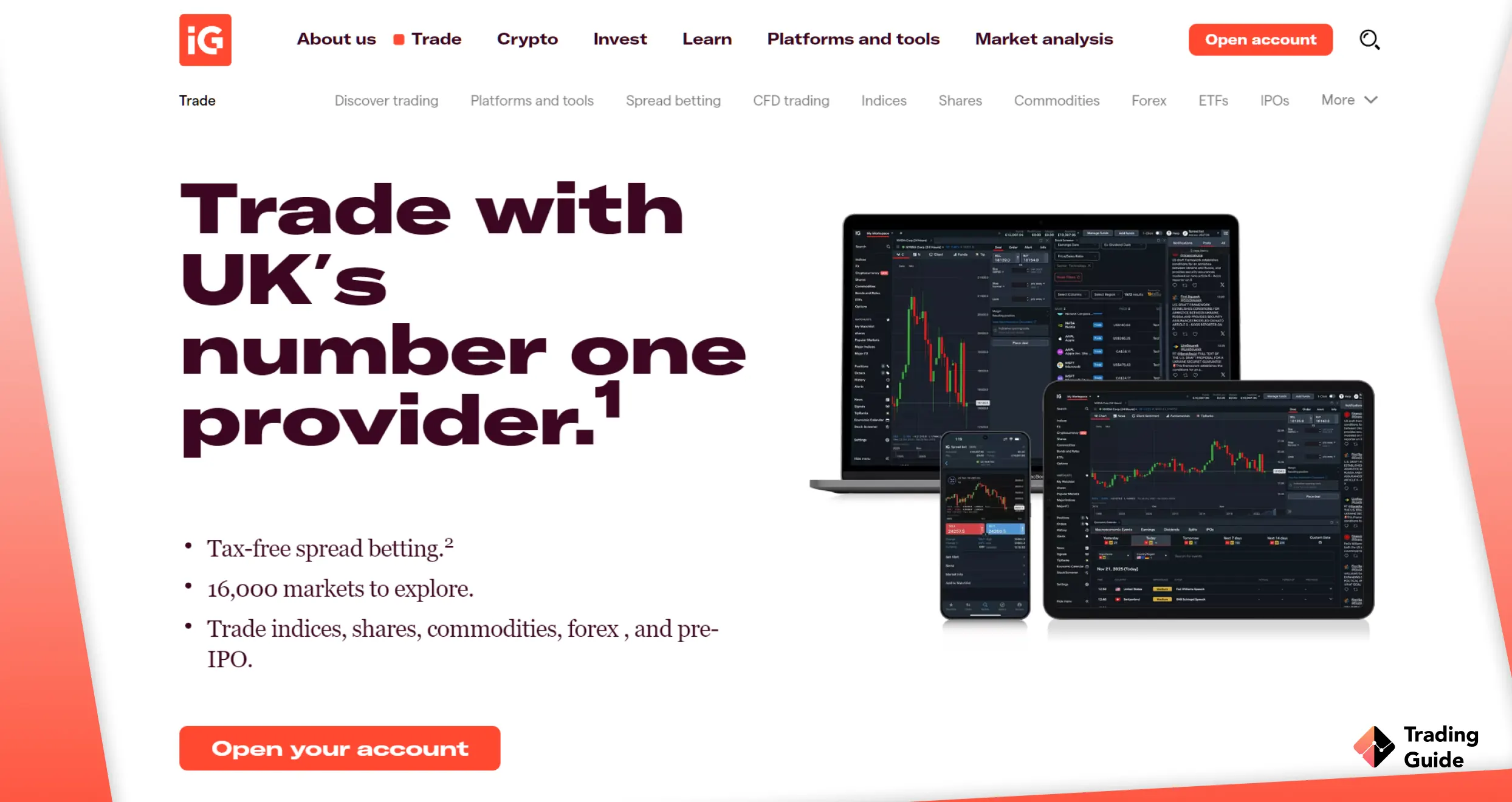

3. IG Markets

IG Markets is considered one of the top brokers for trading the USD/JPY currency pair in the UK. Having been in operation for over four decades, IG Markets has gained a reputation as a trusted and established forex broker. Not only does IG Markets list additional 90+ currency pairs, but it offers you an opportunity to diversify your portfolio using additional CFD assets, including stocks, commodities, cryptocurrencies, and more.

Trading USD/JPY using IG Markets exposes you to advanced resources for skills and strategy development. You will also explore superior platforms, including L-2 Dealer, ProRealTime, and MT4. While the broker is primarily recommended for advanced traders, it also welcomes confident newcomers who possess sufficient trading skills. However, keep in mind the IG Markets’ USD/JPY currencies trading fees can be high. The broker does not have a minimum deposit requirement.

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

- Advanced trading resources for maximum potential

- Excellent collection of learning materials on its IG Academy platform

- Offers a reliable trading app for both iOS and Android devices

- High USD/JPY currencies trading fees

Read about what is lot in trading in our other guide.

How to Trade USD/JPY Currencies with Forex.com

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

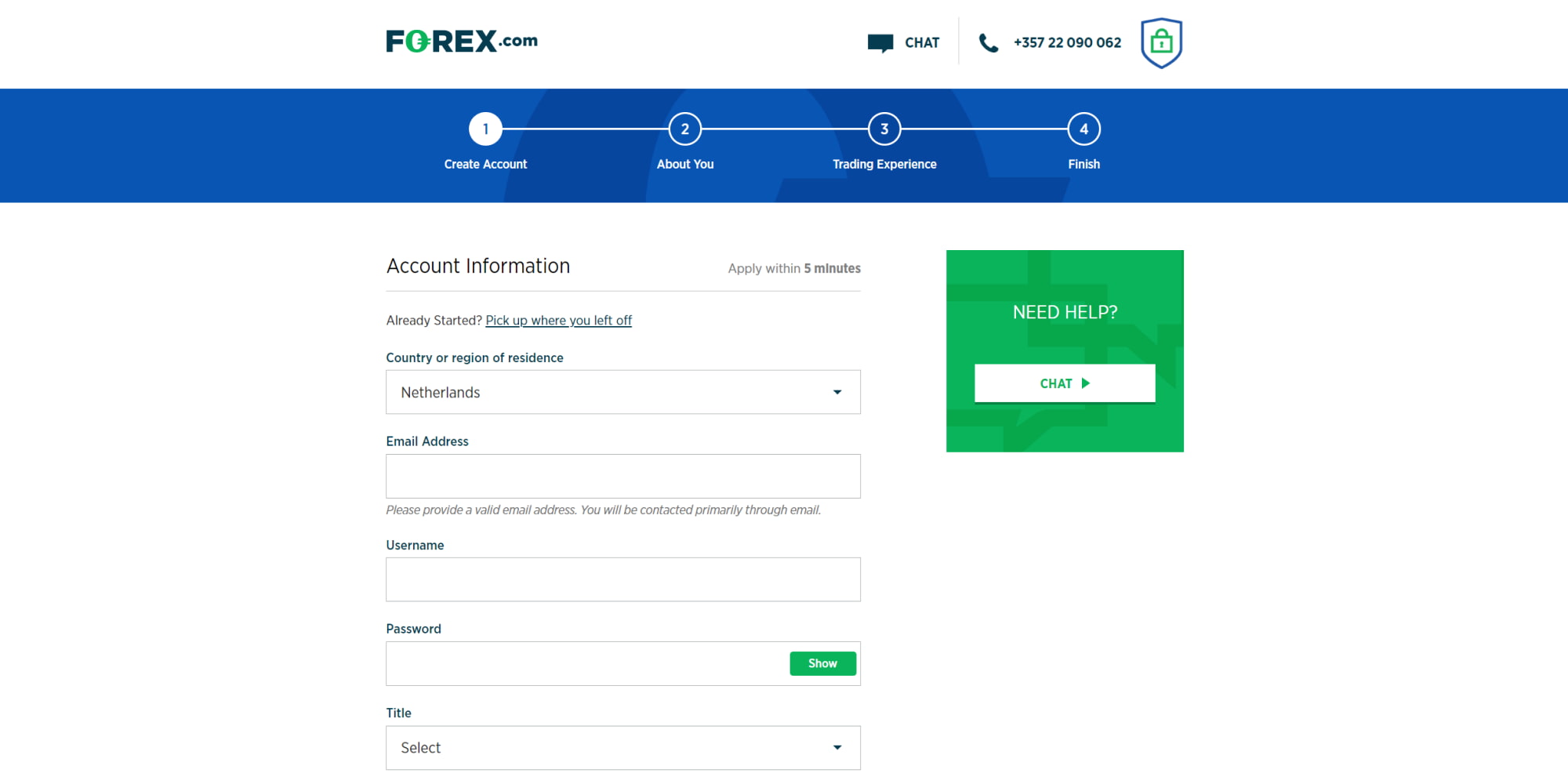

Now that you know the top brokers for trading the USD/JPY currency pair in the UK, you probably must be wondering how to get started. If you are new to trading forex, we guide you below on how to trade this pair using simple steps. Remember, these procedures are the same for any FCA-regulated broker in the UK, and we use Forex.com as an example for better understanding.

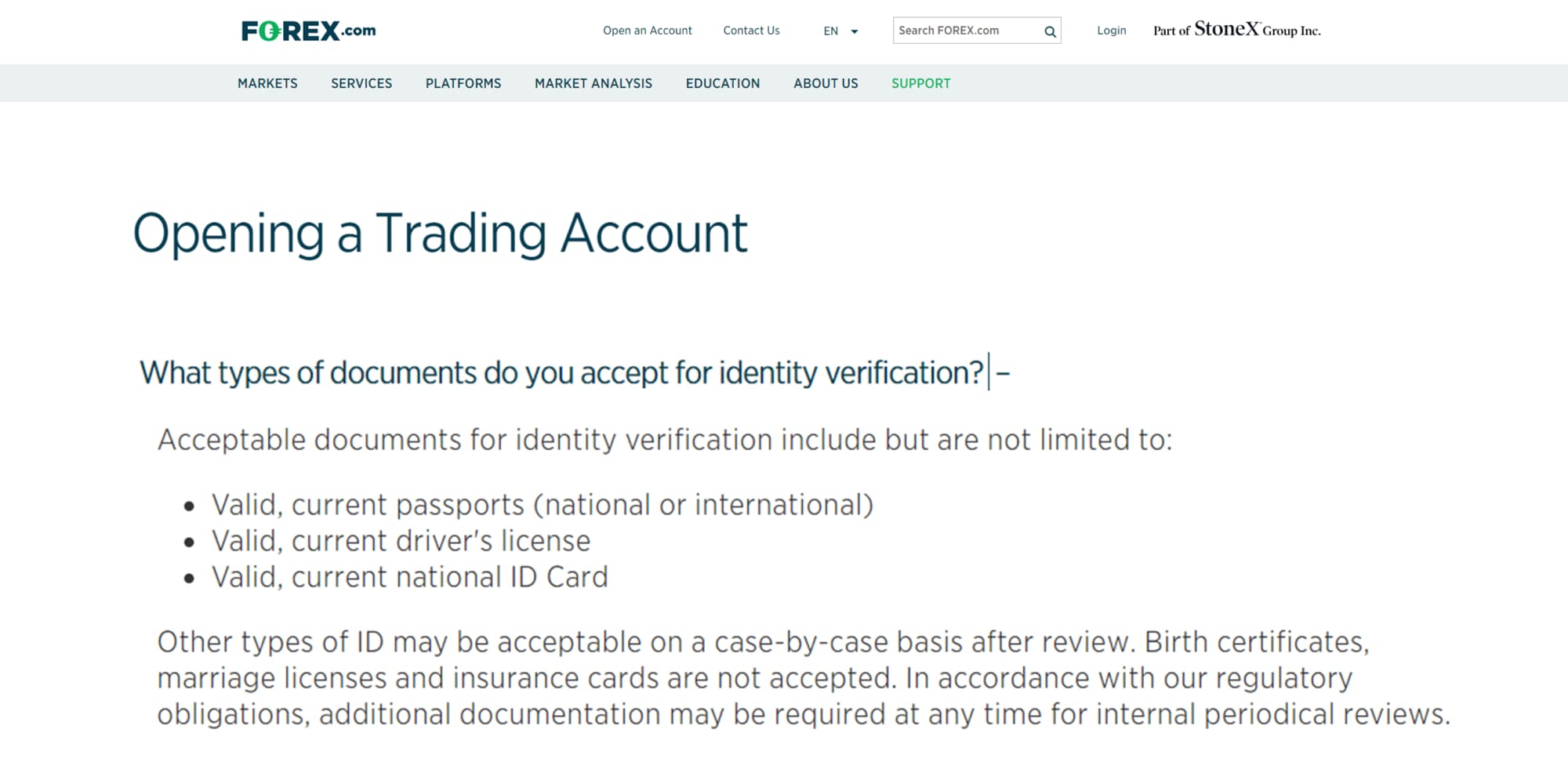

You need access to Forex.com’s website to create a trading account to explore the USD/JPY currencies. On this page, we have links to click for quick access to the broker’s website. Once on site, start by reading and understanding the broker’s terms and conditions to ensure you are on board with all the requirements.

Click the “Open an Account” button to begin the account registration. On the online form, fill in your personal details, including name, phone number, email, residential area, etc. You should also create a unique username and password for additional security of your account.

Your account will not be fully activated until you engage in this step. Forex.com will request you share a copy of your ID card or passport for identity verification. You should also share a copy of a recent utility bill (not more than three months) or bank statement to verify your location. Remember that this procedure is standard for all FCA-regulated brokers and is tailored to ensure online trading platforms remain safe from scammers or imposters.

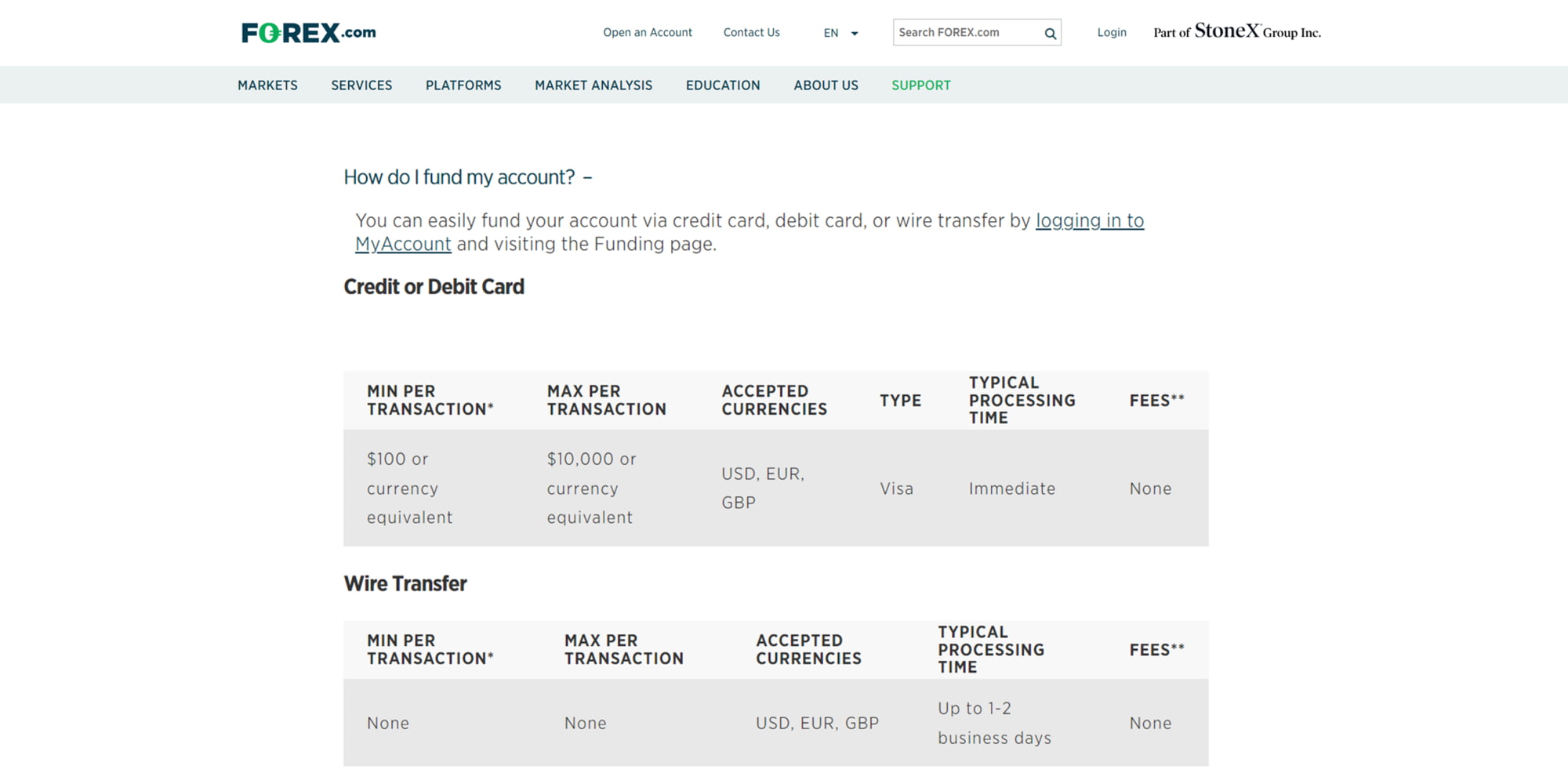

Deposit funds into your trading account using one of the available payment methods, including credit/debit cards, e-wallets, or bank transfers. Remember, Forex.com has a minimum deposit requirement of £100 and all transactions are free.

Forex.com provides a choice of trading platforms, including their advanced web platform and the popular MT4 recommended for forex trading. Select the platform that best suits your trading preferences. Also, utilise the various tools and resources provided by Forex.com to analyse the forex market. Conduct technical analysis, monitor economic indicators, and stay updated on relevant news events.

Once you have identified a trading opportunity, place your trades by specifying the trade size, stop-loss, and take-profit levels. Monitor your trades and manage them accordingly to limit trading risks and increase your success chances.

How to Choose the Best Broker to Trade USD/JPY

Choosing the best broker to trade the USD/JPY currency pair in the UK requires careful consideration of various factors. While there are numerous forex brokers available, the right broker for you is the one that aligns with your specific trading requirements. Here are some key aspects to consider when selecting a forex broker in the UK.

It is crucial to trade with a broker licensed and regulated by reputable authorities. In the UK, look for brokers regulated by the Financial Conduct Authority (FCA). Trading with a regulated broker ensures that you operate within the standards set by the regulatory authority, providing you with legal protection and safeguarding your trading funds from fraudulent practices.

Consider the availability of currency pairs when choosing a forex broker. If you specifically want to trade the USD/JPY pair, ensure that the broker offers a wide range of currency pairs, including this particular pairing. Additionally, decide whether you want to trade the actual currency pairs or if you prefer to speculate on their price movements through CFDs.

The broker you select must have a user-friendly platform to give you an exciting trading experience. It should also host adequate resources to help you with skills and strategy development. You can review user comments and testimonials regarding a broker’s platform reliability on Google Play, the App Store, and Trustpilot for the best decisions.

Pay attention to the trading charges the broker imposes. Consider factors such as minimum deposit requirements, commissions or spreads, financing costs, and any other charges that may impact your trading budget. Finding a broker whose fees align with your trading style and financial goals is essential.

The quality of customer service a broker provides can greatly impact your trading experience. Check the availability of customer support, including their operating hours. Some brokers offer 24/5 customer service, while others are available anytime every day. Also, consider the communication channels available, such as phone, email, or live chat, and ensure they align with your preferred method of communication.

Before opening a live trading account, take advantage of demo accounts offered by brokers. A demo account allows you to test the broker’s trading platform, features, and tools without risking real money. Utilise this opportunity to familiarise yourself with the forex markets and assess if the broker’s platform meets your trading needs.

The USD/JPY Basics and History

The USD/JPY currency pair is one of the most actively traded pairs in the forex market, representing the exchange rate between the US dollar (USD) and the Japanese yen (JPY). It is known for its high liquidity and volatility, making it appealing to traders seeking opportunities in the forex market. The pair is quoted in terms of how many Japanese yen are needed to purchase one US dollar. For example, if the USD/JPY exchange rate is 110.50, it means that 110.50 yen is required to buy one US dollar.

History of USD/JPY

The history of the USD/JPY pair dates back to the post-World War II period when Japan underwent significant economic growth and development. Various factors, including the economic policies of the Japanese government, interest rate differentials between the US and Japan, geopolitical events, and market sentiment, have influenced the value of the Japanese yen.

Over the years, the USD/JPY exchange rate has experienced notable fluctuations, reflecting changes in the economic landscape of both countries. Traders interested in trading the USD/JPY pair should closely monitor economic indicators, central bank announcements, and other factors that can impact the exchange rate. As a result, they can easily make informed trading decisions.

Advantages to Trade USD and JPY

Trading the USD/JPY currency pair offers several advantages for forex traders. These advantages stem from the unique characteristics of both currencies and the dynamics of the global forex market. They include:

- Liquidity: The USD and JPY are two of the most actively traded currencies in the world, resulting in high liquidity for the USD/JPY currency pair. This liquidity ensures that traders can easily enter and exit positions, even during volatile market conditions.

- Volatility: The USD/JPY pair is known for its volatility, making it appealing to traders who seek opportunities in fast-moving markets. Volatility creates the potential for significant price fluctuations, translating into higher profit opportunities for traders.

- Diversification: The USD/JPY pair offers diversification benefits to traders who already hold positions in other currency pairs. By including the USD/JPY in their portfolio, traders can mitigate risk by spreading their exposure across different currency pairs and potentially reducing their dependency on a single currency or market.

- Trading Hours: As the USD and JPY are associated with major financial centres in the United States and Japan, respectively, the USD/JPY pair allows for extended trading hours. This provides traders with flexibility in terms of when they can actively participate in the market, catering to different time zones and allowing for increased trading opportunities.

Disadvantages to Trade USD and JPY

While trading USD/JPY has its advantages, it also presents some challenges as follows:

- Market Complexity: The USD/JPY pair can be influenced by various economic and geopolitical factors, requiring traders to stay informed and conduct a thorough analysis.

- Risk Factors: Volatility in the USD/JPY pair can result in rapid price fluctuations, leading to potential losses if not managed properly.

- Correlations: The USD/JPY pair can exhibit correlations with other currency pairs or assets, which may complicate trading strategies.

USD/JPY Best Time to Trade

The best time to trade the USD/JPY currency pair aligns with the overlapping trading sessions between the United States and Japan. As the UK is in a similar time zone as the European markets, the optimal trading window for UK traders typically falls during the overlap of the New York and Asian trading sessions. This occurs between 12:00 and 15:00 GMT. During this period, market liquidity, volatility, and trading volume tend to be higher, resulting in tighter spreads and potentially more favourable trading conditions.

As a forex trader, always pay close attention to economic news releases from both the US and Japan. Key economic indicators such as employment reports, GDP figures, and central bank announcements can significantly impact the USD/JPY exchange rate. Being aware of the scheduled release times and adjusting trading strategies accordingly can help you take advantage of potential price movements and volatility in the market.

FAQs

The USD/JPY exchange rate indicates how many Japanese yen (JPY) are required to buy one United States dollar (USD). For example, if the USD/JPY rate is 110.50, it means that 110.50 JPY is needed to buy 1 USD.

Aside from USD/JPY, other popular JPY pairs to trade include EUR/JPY, GBP/JPY, and AUD/JPY. The choice depends on your trading strategy and preferences.

The direction of the USD/JPY pair can vary based on economic factors, market sentiment, and geopolitical events. It is essential to conduct a thorough analysis to determine the potential direction of the pair.

The USD/JPY market opens with the Asian trading session, which typically begins around 11:00 PM GMT. This is when the forex market becomes active for trading the USD/JPY currency pair. However, note that market opening and closing times may vary slightly due to daylight saving time changes in different regions. Therefore, always be mindful of economic news releases and other events that can impact market volatility during specific times, as these can present trading opportunities or increased risks.

Conclusion

Trading the USD/JPY currencies in the UK opens up a world of possibilities for forex traders. With its rich history and global significance, this currency pair offers unique opportunities for profit and portfolio diversification opportunities. By choosing the right broker, considering the advantages and disadvantages, and being mindful of the best trading times, traders can optimise their chances of success. Whether you’re a beginner or an experienced trader, mastering the art of trading USD/JPY requires continuous learning, adaptability, and a solid trading strategy. So, embrace the challenge, seize the potential, and confidently embark on your trading journey.