If you are looking for a profitable activity that is legal in the UK, try spread betting. This venture allows you to speculate on the constantly changing prices of financial assets and earn tax-free returns. That said, not all brokers allow UK traders to bet on spreads. I’ve compiled a review of top spread betting platforms to make your work easier.

Before you proceed, note that I’ve recommended the service providers I picked after days of diligent work. I thoroughly researched and tested each platform to ensure everything is right, from regulatory status and security to performance and customer support. Read through each review and compare spread betting platforms recommended.

Essence

- Spread betting is legal, tax-free and regulated by the FCA in the UK

- Many FCA-regulated brokers offer spread betting

- I tested UK spread betting brokers and picked the best

- Spread betting is risky; invest what you can afford to lose

List of the Best Spread Betting Brokers in the UK

- Capital.com – Leading Broker For Margin Trading

- FxPro – Top Spread Betting Broker For Professional Traders in the UK

- Pepperstone – Leading Spread betting Broker from Australia

- IG Markets – Leading Broker in the UK

- Spreadex – Spread Betting Broker with the Lowest Fees in the UK

- City Index – Spread Betting Broker for Beginners in the UK

How We Choose Spread Betting Brokers

Finding the best UK spread betting brokers wasn’t easy, primarily because many service providers are available today. But this didn’t stop me; I love a good challenge. The first thing I did was weed out shoddy providers and shortlist spread betting firms authorised and regulated by the UK Financial Conduct Authority (FCA) and a couple of other respected regulators.

Then, I evaluated, tested, and compared the shortlisted service providers. While executing this crucial undertaking, I paid close attention to a number of vital factors, including the performance of available trading software, spreads/commissions, and support service. I rated each broker based on these elements and picked top contenders, which I’ve discussed here.

In this guide

Best Spread Betting Brokers in the UK

Compare The Best Spread Betting Brokers in the UK

Allow me to introduce you to a brief comparison of the best UK spread betting companies based on the first set of factors I considered while vetting available providers. They range from licenses and regulations to payment methods and support for demo trading in the UK.

| Best Spread Betting Platforms UK | Licence & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes |

| FxPro | FCA, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes |

| Pepperstone | FCA, MAS, ASIC, FSCA, DFSA, CySEC, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfers, Neteller, Skrill, PayPal | Yes |

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 25/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes |

| Spreadex | FCA | 24/5 | Online platform, Mobile trading, Charting package, TradingView | Credit/debit cards, Apple Pay, Bank transfer | No |

| City Index | FCA, CIRO, CFTC, FSA, ASIC | 24/5 | MetaTrader 4, WebTrader, Mobile App, Trading View | Bank transfer, Credit/debit cards, PayPal | Yes |

Brief Overview of Our Recommended Spread Betting Brokers’ Fees and Assets

I vetted every service provider’s assets to ensure you have access to the best overall broker. The ones I have outlined here offer the most popular options in the UK, like forex pairs, stock CFDs, and ETF CFDs.

Additionally, I researched and confirmed all fees and charges, from spreads and commissions to overnight and inactivity fees. I did that mainly to make it easier for you to estimate costs beforehand and to help low-budget traders find cost-friendly service providers. I’ve highlighted my findings in the table for top spread betting platforms compared below.

Fees

| Best Spread Betting Platforms | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| FxPro | From 0.0 pips | £100 | Free | £15 once + £5 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | £0 |

| IG Markets | From 0.1 points | £0 | Free | £18 monthly |

| Spreadex | From 0.6 pips | £0 | Free | £0 |

| City Index | From 0.0 pips | £0 | Free | £12 monthly |

*Commission charges apply.

1. Capital.com – Leading Broker For Margin Trading

Trading on margin can be intimidating, but our experience with Capital.com made it surprisingly approachable. The broker handles spread betting with precision, offering competitive spreads and fast execution across 2,900+ instruments, including forex, shares, indices, cryptocurrencies, and commodities. Spreads on major pairs start from 0.0 pips, and all trades are commission-free. This makes managing leveraged positions far less costly.

We also appreciated the platform’s flexibility. The web and mobile app are intuitive, while MT4 and TradingView integration give more advanced traders access to automated strategies and sophisticated charting tools. Risk management is well-covered, too. Features like trailing stops, stop losses, and price alerts help protect positions in volatile markets, which is crucial for margin trading.

To get started with Capital.com, a minimum deposit of £20 is required. All deposits and withdrawals are free, making it suitable for traders starting with smaller accounts. Beginners will appreciate high-quality learning tools and a demo account that enables risk-free practice of margin trading.

- Competitive spreads from 0.0 pips with commission-free trades

- Flexible platforms, including MT4 and TradingView

- £20 minimum deposit requirement with free deposits and withdrawals

- Comprehensive risk-management tools

- Strong educational resources for beginners and experienced traders

- No copy trading feature

- Higher leverage is only available for professional accounts

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

2. FxPro – Top Spread Betting Broker For Professional Traders in the UK

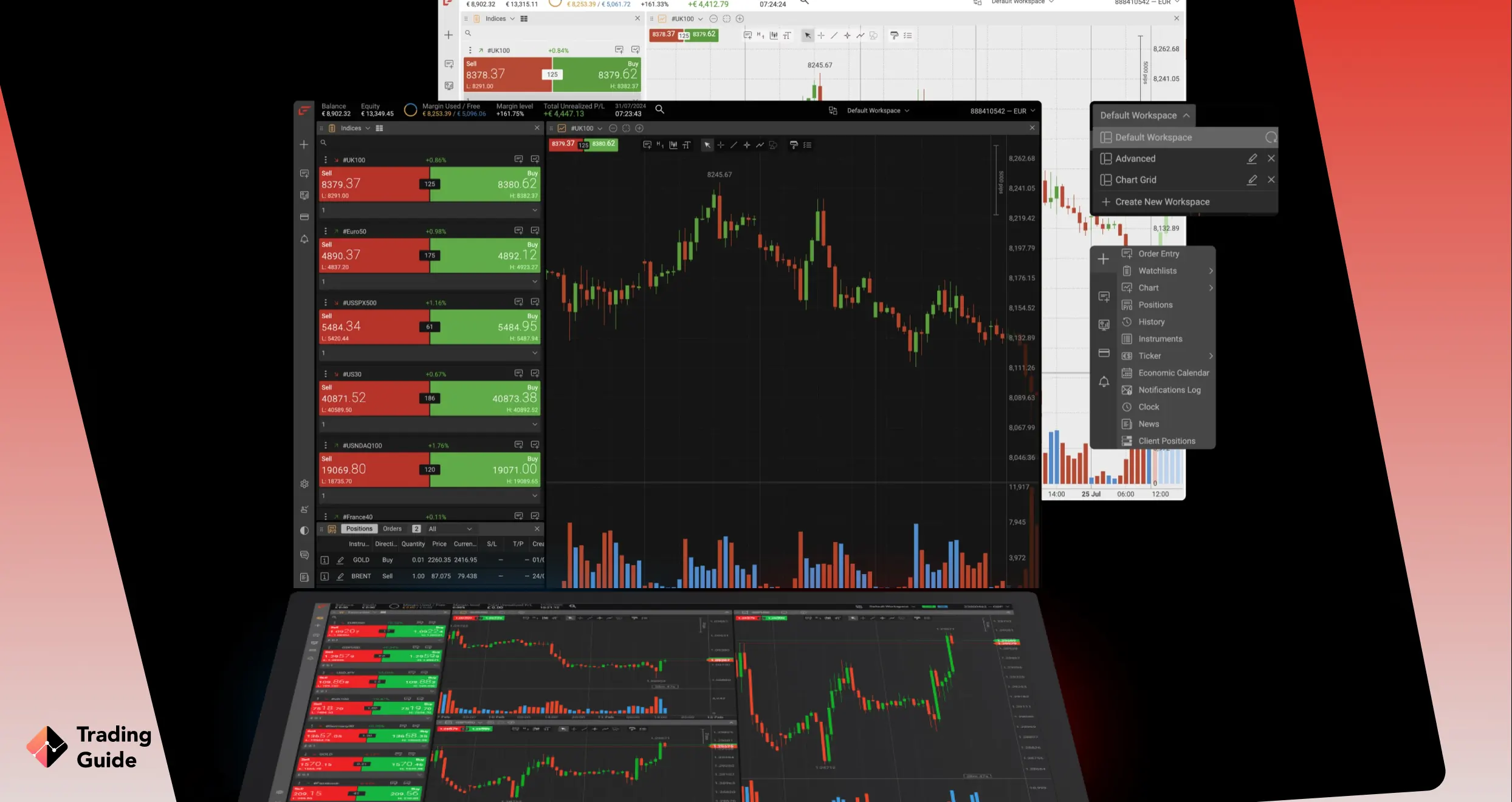

After testing and comparing spread betting platforms in the UK, I believe FxPro is a viable choice for professional traders. I encountered user-friendly platforms that made placing and managing orders a breeze on both desktop and mobile devices. They range from the FxPro mobile app to MT4 and MT5.

FxPro lists over 2,100 CFD assets across six classes, including forex, shares, futures, and metals. All you need to do is create an account and make a minimum deposit of £100 to get started. The commission-free model, featuring competitive spreads as low as 0.6 pips on major currency pairs, enhances FxPro’s allure.

- Reasonable minimum deposit requirement

- Advanced trading platforms with quality research resources for professional traders

- High leverage limit for professional traders

- Reliable and responsive support service

- 2,100+ financial instruments

- High inactivity fees

- Up to 2.6% charge for withdrawing funds without trading

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. Pepperstone – Leading Spread Betting Broker from Australia

Pepperstone is an Australian-based CFD, forex and spread betting broker in the UK. It’s licensed by the FCA (reference number: 684312) and provides a large number of assets for everyone looking to spread bet. In addition, the brokers offer four of the most popular trading platforms on the market right now: TradingView, Metatrader 4, Metatrader 5, and cTrader.

If you’re experienced, you can open a professional spread betting account with Pepperstone to gain even more benefits such as higher leverage and advanced tools. Just be aware that some protective measures, such as negative balance protection, do not apply to professional traders.

- No strict minimum funding requirement

- Spread betting on a massive selection of assets

- Some of the best educational material on the market

- The option to open a professional trading account

- Premier tools like MT4, MT5, and cTrader

- No guaranteed stop loss

- You need a portfolio worth at least £5,000 to enjoy pro benefits

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

4. IG Markets – Leading Broker in the UK

If you prefer trading with homegrown firms, IG Markets is your best option. Founded in 1974 in London, this trading company has been around for decades and boasts hundreds of thousands of clients. I have unwavering trust in it since it has solidified its reputation over the years and is fully regulated by the FCA (reference number 208159).

I bet on spreads with IG Markets via the broker’s mobile app and web-based platform. I had the smoothest experiences imaginable. Then I tried out the provided specialist platform and got star-struck. I got full exposure to 17,000+ financial instruments and had a blast profiting from both rising and falling markets.

- UK-based, with its head office in London

- No minimum deposit requirement

- 17,000+ financial instruments

- Powerful trading platforms, including MT4

- Also supports DMA trading, investing and more

- £18 monthly inactivity fee

- £250 minimum deposit for card users

| Type | Fee |

| Minimum deposit | £5 |

| Overnight fee | Yes |

| Deposit fee | 3% |

| Withdrawal fee | $0 |

| Inactivity fee | $10 |

5. Spreadex – Spread Betting Broker with the Lowest Fees in the UK

Spreadex is a global spread betting, CFD, and forex broker established in 1999. It’s registered with the FCA (registration number 190941) and offers more than 10,000 tradable instruments across various markets, including shares, commodities, and indices. It’s forex and stock trading fees are also low, and it does not charge an inactivity fee.

Based on my experience, opening a trading account on Spreadex is straightforward. There’s no minimum deposit requirement, so budget constraints are a non-issue. I also recommend this broker because its trading platform is user-friendly and customisable to suit your investment requirements. The platform is also fast and backed up with advanced orders and charting tools for market analysis.

- No minimum deposit requirement

- Friendly trading and non-trading fees

- Advanced user-friendly and customisable trading platform

- Access to more than 10,000 markets

- Very responsive customer support

- Limited advanced tools and features

- No demo account

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

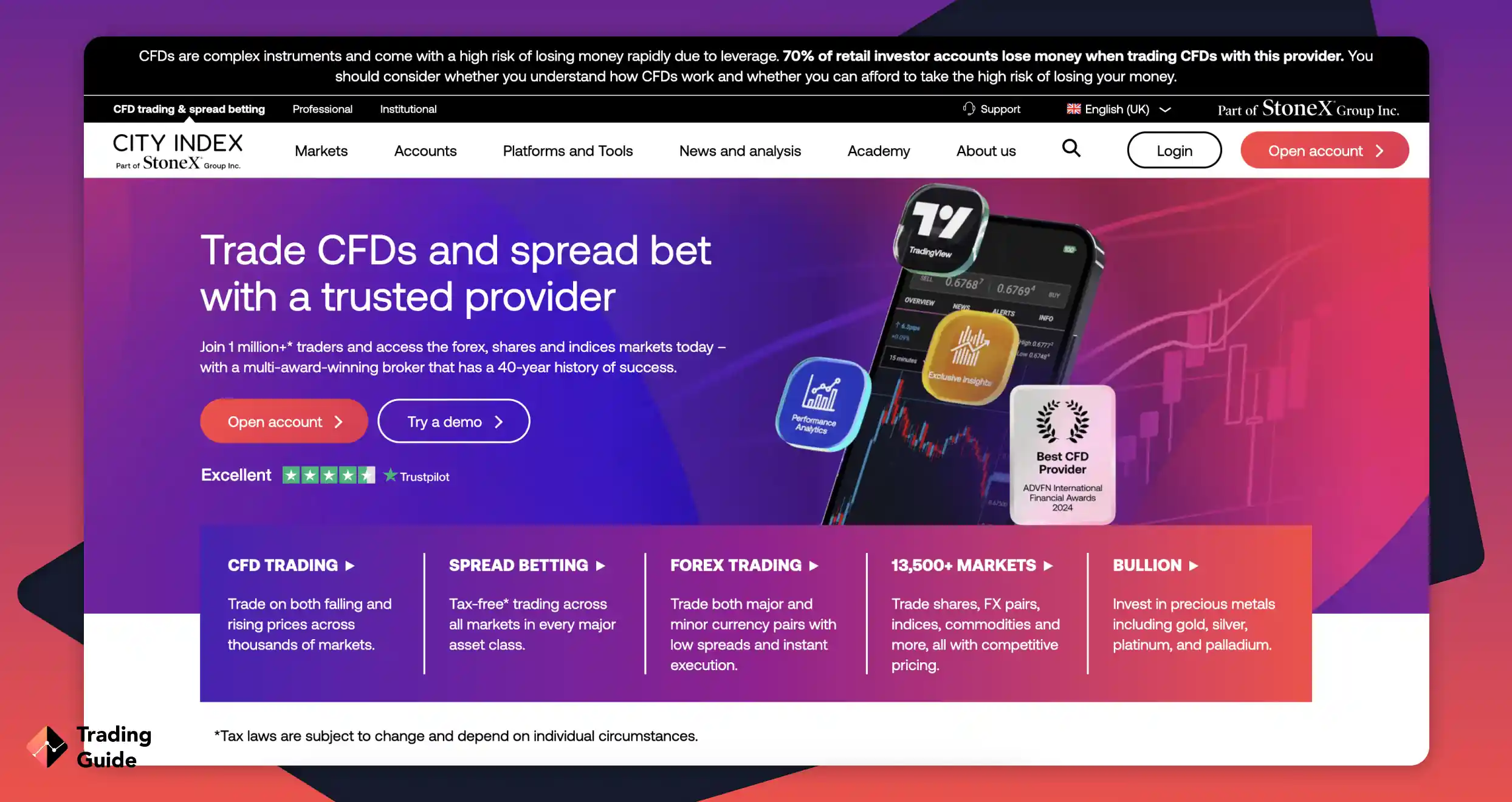

6. City Index – Spread Betting Broker for Beginners in the UK

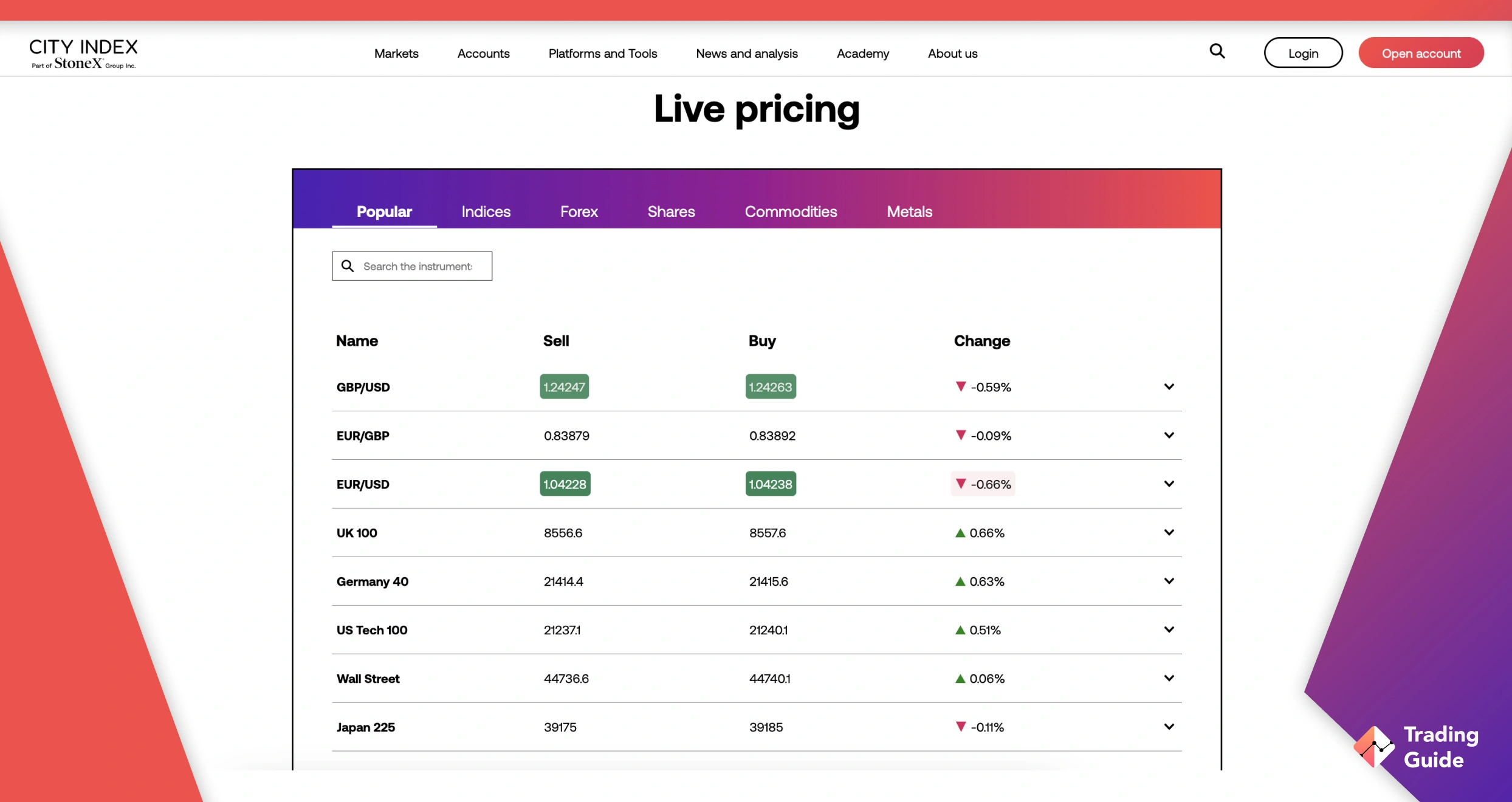

City Index is one of the best spread betting brokers for beginners in the UK for multiple reasons. For starters, it is backed up with plenty of educational and research tools to improve your trading skills. The technical indicators, charting tools, and Reuters news feeds are what beginners in the UK need to quickly analyse the trading markets and make informed decisions.

Regulated by the FCA (registration number 446717), City Index broker began its operations in 1983 and has become one of the global spread betting brokers offering more than 12,000 tradable instruments. This broker’s spreads are among the industry’s tightest, starting from 0.5 pips. Novice investors wouldn’t have a hard time placing and monitoring trades because of its many research tools for market analysis.

- No minimum funding requirement

- Plethora of research and educational tools

- Competitive spreads

- Easy-to-use and customisable trading platform

- Powerful tools like MT4 and TradingView

- £12 monthly inactivity fee

| Type | Fee |

| Minimum deposit | £0 |

| Overnight fee | +2.5% on long positions |

| Deposit fee | 2% |

| Withdrawal fee | 0$ |

| Inactivity fee | $15 |

| EUR/USD spreads from | 0.5 pts |

| Trade major indices with spreads from | 0.4 pt |

| Commission on shares | 0.08% |

| Trade US Crude with spreads from | 1.5 pts |

| Spot gold spreads from | 0.5 pts |

How To Choose the Right Spread Betting Broker in the UK

The right broker for spread betting is your key to success. While searching for one in the UK, vet available options based on the following:

Pick brokers that are regulated by the FCA in the UK. Authorisation from multiple respected authorities is a huge plus. Regulated UK spread betting companies are the best to use because they are fair and transparent. Plus, many offer investor compensation, like the ones reviewed here.

High costs will reduce potential profits by a significant margin. Check every broker’s trading and non-trading fees and compare them to other service providers’ charges. Sign up with an affordable broker to ensure you keep most of your capital and profits.

The best broker should have a wide range of markets and offer the most popular products, like CFDs on forex, stocks, and commodities. Access to a good number of markets will give you maximum opportunities to trade, experiment, diversify, and more.

You will hit a snag at some point while spreading betting. This may turn into an incredibly frustrating and costly issue if it’s not addressed promptly. That is why you must sign up with top spread betting firms with premier customer support.

Always read customer reviews on Google Play, the App Store, and Trustpilot before making the final decision. They will help you understand aspects like performance, reliability, and customer support service. Choose brokers with the best reviews and ratings.

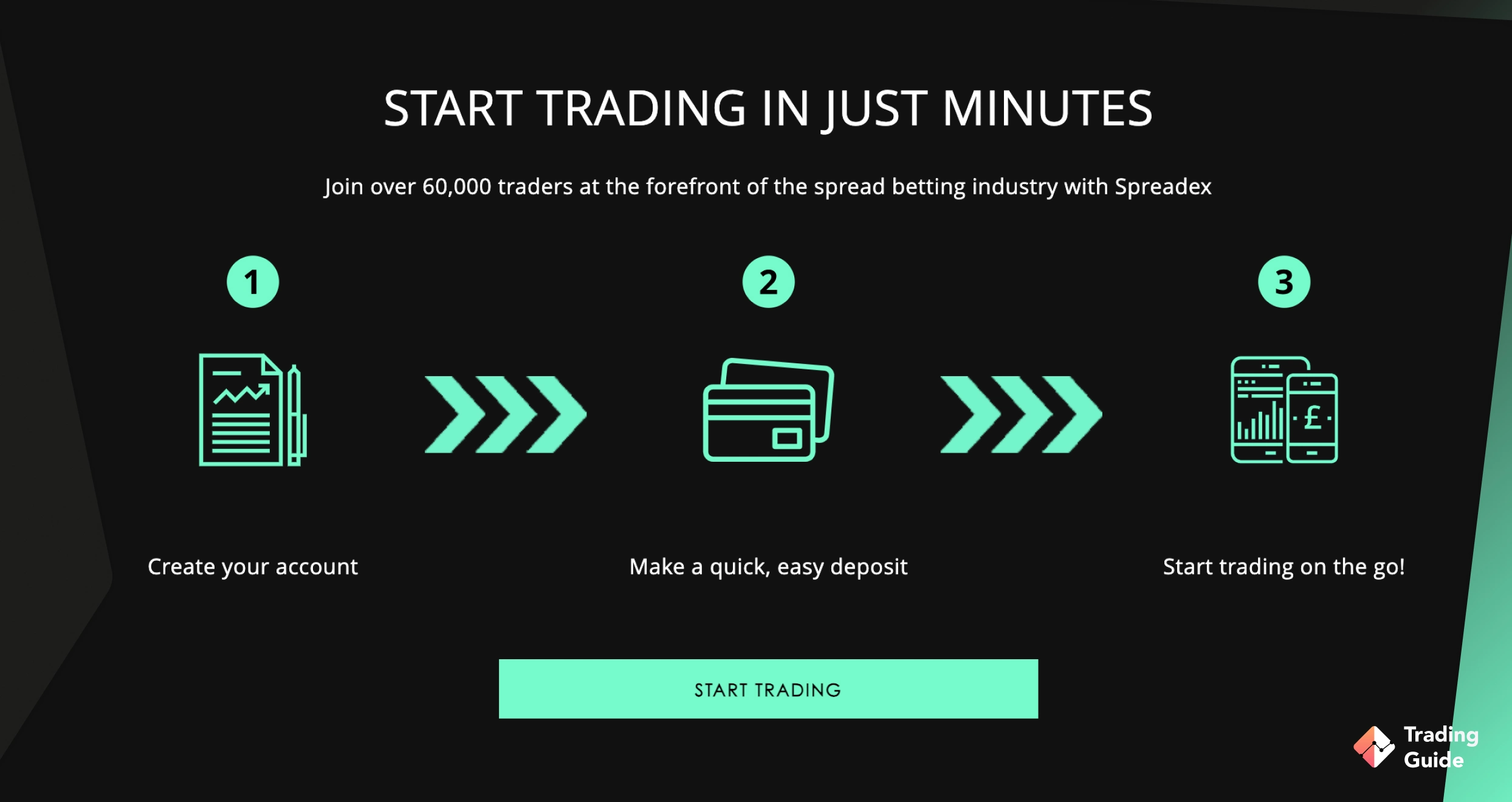

How to Register a Spread Betting Account

After you’ve found the best spread betting broker for you, you need to register an account, verify your identity, and fund your account. The process is surprisingly easy, and if you’ve ever registered for an online account before, you should be familiar with the process.

Moreover, the registration process is universal and follows the Financial Conduct Authority’s (FCA) strict regulations. Here are the general steps you’ll follow:

Start by following the links on this page; they will take you directly to your chosen broker. Brokers allow you to register an account on any device that they support, meaning you can register using your computer or smartphone. The account will be available on both devices after the process. You might have to download a trading app from the broker before you can get started. But today most brokers offer browser-based platforms that require no download.

During the next step, you’re asked to provide personal information as a foundation for your account. This is the same information that you provide when registering on social media and other online services, i.e. full name, address, email address, etc. Before you get access to your account, you will have to verify your identity and address. Therefore, make sure that you only provide accurate and verifiable information.

You are now going to verify your identity and prove to the broker that you are you. This involves providing at least two different documents: a copy of your passport (Proof of Identity) and a recent utility bill (Proof of Residence). In some cases, the broker might ask you to provide more information to verify your identity further.

At this stage in the process, you have access to your account and can also use your broker’s demo account. However, before you can start spread betting properly, you need to fund your account. Now, most brokers in the UK have a minimum requirement that you have to fulfill. These requirements vary from £50 to £300, so pick a broker you can afford. Also, some brokers have no minimum deposit requirements, meaning you can fund your account with any amount.

That is all you have to do. As soon as your deposit reaches your account, you can start spread betting. We suggest that you study spread betting before you get started; that way, you will improve your chances of making a profit while limiting unnecessary losses.

What is a Spread Betting Broker?

A spread betting broker is a financial intermediary that allows traders to speculate on the price movements of various financial instruments, such as stocks, commodities, indices, currencies, and more, without owning the underlying assets. While spread betting, traders bet on whether the price of an asset will rise or fall. The broker then provides the platform for placing these bets and typically earns its revenue from the spread, which is the difference between the buying and selling prices of the asset.

What Does Spread Mean in Trading?

Spread in trading refers to the difference between the buy and sell price of an asset. Simply put, it is the cost you, a trader, incur when you enter a trade. Spread exists in every financial market, including forex, stocks, and commodities, and it can either be fixed or variable. A fixed spread means that the difference between the buy and sell price remains constant, regardless of market conditions, while a variable spread can fluctuate depending on market volatility.

Pros and Cons of Spread Betting

Here’s an overview of the pros and cons of spread betting:

| Pros | Cons |

|---|---|

| Returns are tax-exempt | High potential losses, especially when using leverage |

| You can profit from falling and rising markets | Not suitable for generating long-term wealth |

| Covers a wide range of financial markets | |

| No need to own actual assets | |

| Zero commission charges |

How to Reduce Risks in Spread Betting

Spread betting is profitable but risky. That said, with careful planning and risk management strategies, you can mitigate potential losses and increase your chances of success. Here are some effective ways to reduce risks in spread betting.

- Educate Yourself

- Practice Risk Management

- Diversify Your Portfolio

- Start Small

- Use Leverage Wisely

- Control Your Emotions

Spread Betting vs Forex Trading

To save you from confusion, I’ve highlighted the difference between spread betting, forex trading, and regular trading in the comparison table below.

| Feature | Spread Betting | Forex Trading | Regular Trading |

|---|---|---|---|

| Nature of trading | Betting on price movements | Trading currency pairs | Buying and selling underlying assets like stocks |

| Ownership of underlying assets | No ownership | No ownership | Ownership is involved |

| Capital gains tax | Exempt | Subject to CGT | Subject to CGT |

| Leverage | Available | Available | Available |

| Duration of trades | Short-term/ long-term | Mostly short-term | Depends on the market |

FAQs

Spread betting brokers are compensated from the spreads charged to their clients. They also make money by adding a small margin to the usual market spread. For example, if a share’s buying price is £200, and the selling price £202, a broker may quote it as £199 buying price and £203 selling price in a spread bet.

Yes. With a good strategy and broker, spread betting can yield you good tax-free profits. You can find all the top companies in our spread betting broker reviews above.

Yes. Spread betting in the UK is classed as gambling and so any profits you earn spread betting will not be taxed.

First, You need to identify your investment capital and tradable instruments. Then, you can proceed to determine the best spread betting broker for your investment requirements. Sign up for a trading account and have access to multiple instruments to spread bet on. Click either buy or sell, place your stake, add stop loss and monitor your trading activity.

Yes. Spread betting is legal only if you are investing in a broker that is licensed and regulated by world-class authorities, including the UK’s stringent Financial Conduct Authority (FCA). The icing on the cake is that spread betting is tax-free!

Both CFD and spread betting are high-risk investments that can be highly profitable if you have the right strategy and brokers like the ones we recommend above. However, what makes spread betting better is that, unlike CFDs, its profits are free from capital gains tax.

While spread betting is legal in few countries globally, it remains popular in the UK because it is tax-free. To succeed in spread betting, make sure that you choose a suitable best broker like the ones we recommend in our mini-reviews above.

Yes, spread betting is free in the UK.

Yes, making a living from spread betting is possible. But it requires adequate knowledge, skills, and discipline.

Spread betting brokers make money through spreads and other fees.

Conclusion

Spread betting in the UK has become popular. Therefore, make sure you start your investment journey by choosing a suitable broker for your investment needs. With the best spread betting broker in your corner, you have a higher chance of making profits. Additionally, be knowledgeable and strategic and take losses as a learning process. You will find yourself being a successful and independent spread betting investor after a few trades.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Do CMC Markets have any hidden fees? Or inactivity fees? Can’t find this info

Like all brokers, CMC Markets has fees for certain services and products, including a $15 inactivity fee. You can find more information about CMC Markets in our review and by following one of the CMC Markets links in this guide.

What is the most important information to view when spread betting?

You need practice. First, create your spread betting account. You need right select a market to trade. Choose a more suitable broker for you and always monitor your position until close your trade. Good luck

Currently, I navigate gold and oil trading effortlessly. The advice on selecting a spread betting broker proved invaluable. The step-by-step registration guide facilitated my seamless entry into an FCA-regulated broker. The ease of use and diverse market options add joy to my trading experience.Many thanks to the creators for breaking down intricate concepts and making trading not just understandable but enjoyable!

I use the AvaTrade platform and I have been impressed with its user-friendly interface, diverse asset selection, extensive educational resources, responsive customer support, robust risk management tools, competitive pricing and compliance. Whether you are a newbie or an experienced trader, AvaTrade offers a reliable platform for trading success.

Great comparison! As a trader, I have found that brokers like IG Markets and Pepperstone are fantastic for their low spreads and variety of trading platforms.

Spread betting confused me at first, but Spreadex made it easy to learn without spending too much.