Whether you are a novice investor or an expert looking for UK’s best stock trading apps, you have landed in the right place. We understand that there are many stock trading apps in the UK market, and finding a reliable one can be a pain in the neck. In this article, we simplify the search for you.

Our team of experts has spent more than 150 hours testing and reviewing trading apps in the UK to ensure we recommend the best of the best. So, if you allow us, let’s get into and see if you can’t find yourself the best app for stock trading in the UK, specifically based on your needs.

List of the Best Stock Trading Apps 2025

- Capital.com – Top Option for Spread Betting

- FxPro – Best With an Excellent Support Team and a Help Centre

- Plus500 – One of the Best CFD* Trading App For Stocks

- FP Markets – Top Option With Direct Market Access (DMA) Execution

- eToro – Best Stock Trading App for Beginners in the UK

- XM – Stock Trading Apps for Beginners and Experienced Traders

- Pepperstone – Best Stock Trading App For MT5 Users

*76% of CFD retail accounts lose money

In this guide

Best Stock Trading Apps in the UK

Compare The Best Stock Trading Apps in the UK

We take our brokers’ testing and reviewing procedures very seriously and have specific standards that the best trading apps in the UK that we recommend here must meet. We mostly base our research on the following metrics:

That said, here is our ratings of the best stock trading apps in the UK according to Trustpilot, Google Play, and App Store honest user reviews.

| Best Stock Trading App | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google Pay, Apple Pay | Yes | Yes (up to £85,000) |

| FP Markets | ASIC, CySEC, FSCA, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trading App, MT5 Mobile Trader | Credit/debit cards, International bank transfer, Domestic bank transfer, Neteller, Skrill, Fasapay, PayTrust88, Ngan Luong, PayPal, Bank of China Online Pay | Yes | Yes (up to €20,000) |

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit cards, Bank transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes | Yes (up to $250,000) |

| XM | IFSC, ASIC, CySEC, DFSA, FSC, FSA | 24/5 | MT4, MT5, XM WebTrader, Mobile App | Credit/Debit Cards, Bank Transfer, Skrill, Neteller for withdrawal, Sticpay for Deposit (under FSC) | Yes | Yes (up to €20,000) |

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple Pay, Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer | Yes | Yes (up to £85,000) |

1. Capital.com – Top Option for Spread Betting

Capital.com has built one of the strongest stock trading apps for spread betting in the UK. We’ve found the app smooth to use, with live market prices updating instantly and advanced charting tools. You can spread bet on more than 2,900 global shares tax-free, with spreads starting from 0.1 pips and no added commissions. We also discovered additional securities for portfolio diversification. They include forex, cryptocurrencies, indices, and commodities.

The app supports unlimited watchlists and features a bias-detection system that tracks your trading habits to help you avoid mistakes. Risk management is also well covered, with tools like price alerts and trailing stops. Moreover, deposits and withdrawals are free, with a minimum deposit requirement of just £20.

If you prefer trading on third-party platforms, Capital.com integrates with MT4 and TradingView, known for advanced features like automated and social trading. For learning, the Investmate app is a standout. It features a variety of learning materials, including 30+ courses with short lessons that take as little as 3 minutes to complete.

- A user-friendly and modern design spread betting app

- Spreads from 0.1 pips with zero commissions on share trading

- MT4, TradingView, and web platform supported via mobile devices

- £20 minimum deposit with free deposits/withdrawals

- Strong risk-management and education tools

- No copy trading feature

- No buying and taking ownership of the listed shares

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

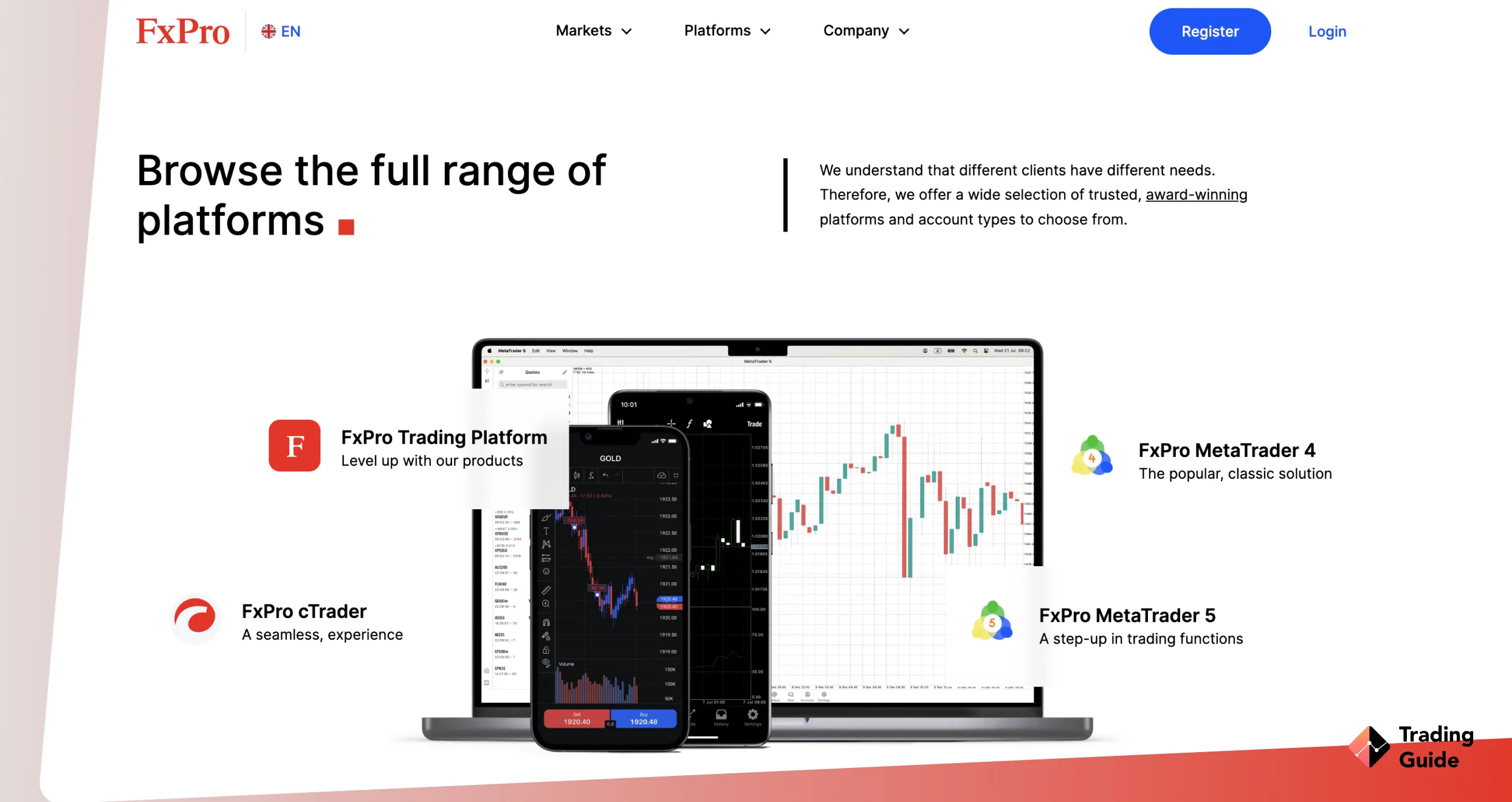

2. FxPro – Best With an Excellent Support Team and a Help Centre

If you are looking for a stock trading app with a team that is committed to supporting its clients, FxPro should be your go-to option. Having conducted multiple tests on it and compared it with its peers, it’s evident that this broker values its clients’ interests. We contacted the team via phone, email, and live chat. All responses we received through these channels were prompt, with relevant solutions that helped elevate our experience.

The support service is available 24/5. We like that it offers a callback request option, and you can also reach them via WhatsApp, Messenger, and Telegram. The best part is that FxPro has a comprehensive FAQ section, where you can find answers to some of the commonly asked questions. From account opening and trading platforms to security and transactions, you will find answers provided by FxPro’s professionals.

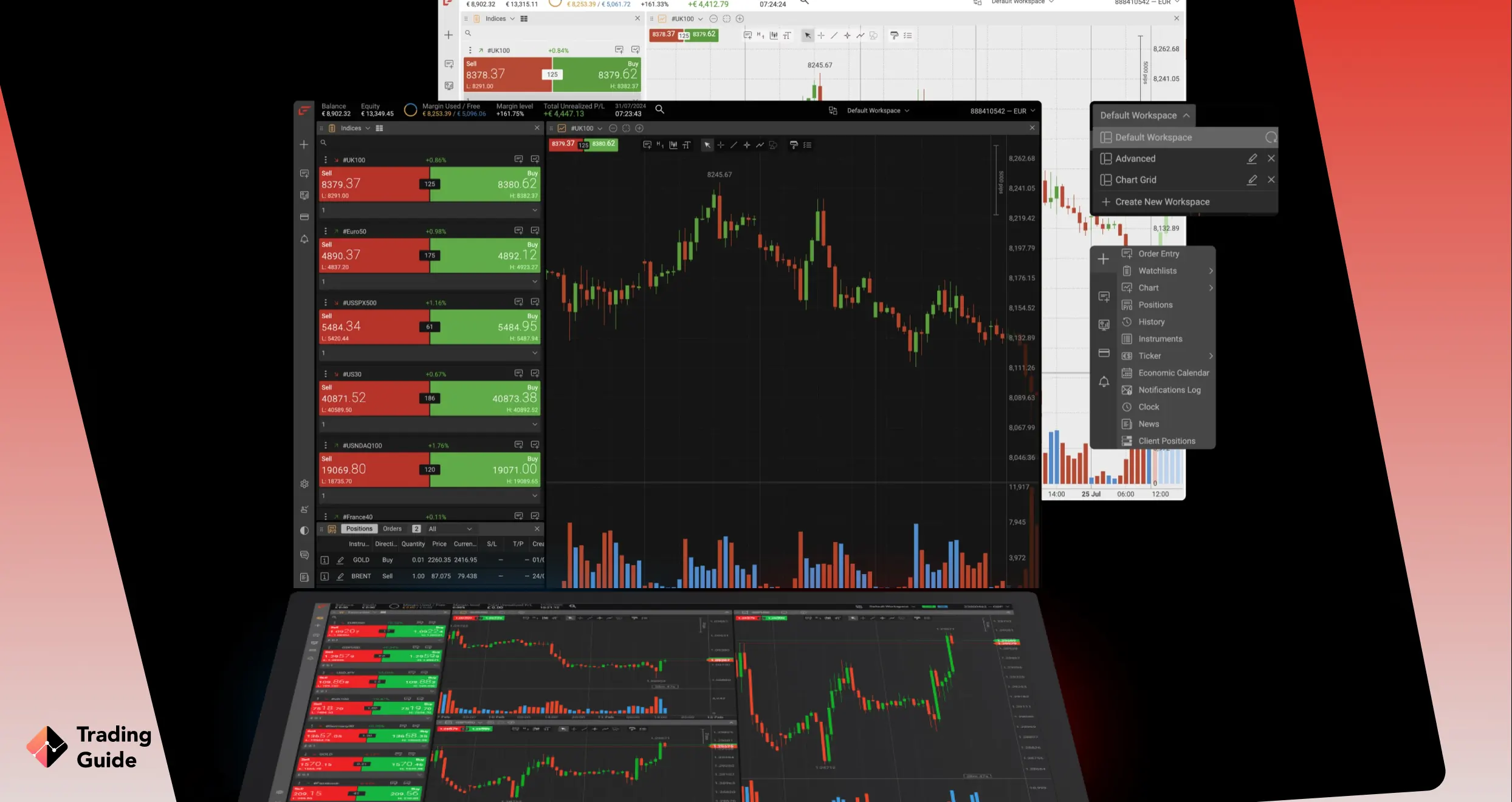

Overall, this app has a fast trade execution speed and operates seamlessly on both Android and iOS mobile devices. All features available on its web version are accessible via mobile, including access to MetaTrader platforms, trading signals from Trading Central, and more. Over 1800 shares are available to trade at low fees.

- 24/5 multilingual support via multiple channels

- Has a low minimum deposit requirement of £100 for UK clients

- The trading app is highly encrypted with extra layers of protection, like two-factor authentication, a passcode, and fingerprint setting options

- Access to third-party platforms, including MT4, MT5, and cTrader

- Offers quality learning and market analysis resources

- Only CFD trading is supported

- A demo account is only provided for 180 days

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. Plus500 – One of the Best CFD Trading Apps for Stocks in the UK

*Illustrative prices

Any stock investor in the UK will attest that Plus500’s stock trading app is the most preferred when it comes to CFD trading. Supported on both Android and iOS devices, this app offers various trading instruments, including commodities and options.

Plus500 offers two types of accounts: a Real Money account and a demo account. Trading on these two accounts is almost similar. The difference is the leverage level one can use to trade. Leverage up to 1:300 is available for professional traders who meet specific criteria: sufficient trading activity in the last 12 months, a financial instrument portfolio of over €500,000, and relevant experience in the financial services sector. Also, with a professional account, traders do not have ICF rights.

Another factor that made us like the Plus500 app is its zero commissions on stock CFD trading. It also has tight spreads, making it an ideal choice for stock investors with a low budget. Day traders who invest multiple times in a day can also find Plus500 a broker of choice. Note that the broker charges inactivity fees, which kicks in after three months. The broker also charges overnight, currency conversion, and stop-order fees. Therefore, before you commit to this CFD trading app, make sure you are a frequent investor.

- Investors can trade using leverage

- An easy-to-use trading app that is highly customisable

- 2,200+ CFD trading instruments

- Zero commission on stock CFD with tight spreads

- Charges inactivity fees after three months

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. FP Markets – Top Option With Direct Market Access (DMA) Execution

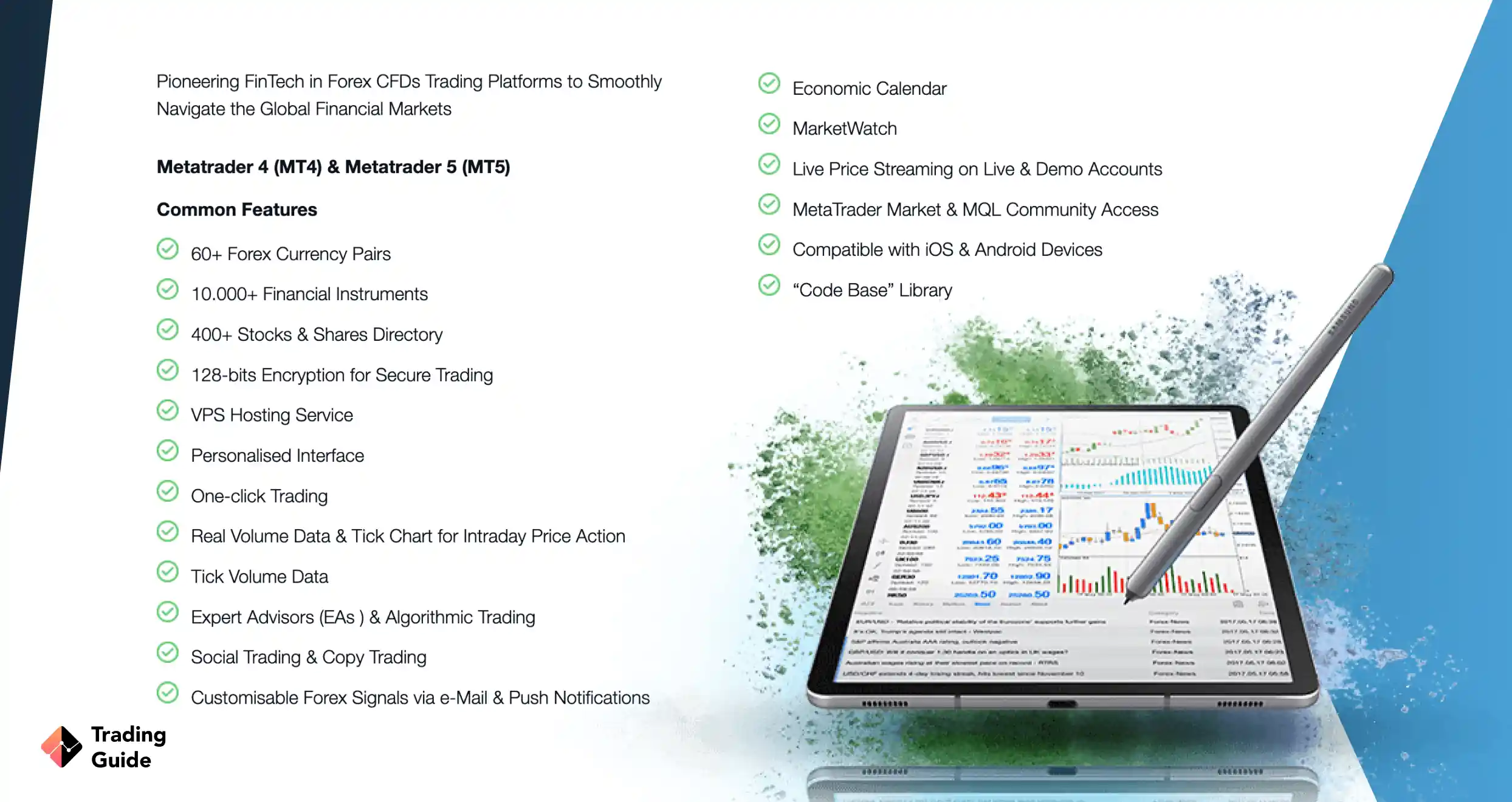

From my experience, FP Markets’ app executes trades seamlessly on iOS and Android mobile devices. I noticed that the broker hosts over 10,000 stocks, including popular options like Apple, Adidas, Microsoft, Nike, and more. While you cannot buy and take full ownership of these shares, FP Markets allows you to trade them as CFDs. You simply need a trading account and deposit at least £100 per its requirement to get started.

I like that FP Markets offers stock trading across multiple platforms, including MT5 and Iress. The Iress CFD platform supports the DMA feature that allows users to execute trades by directly interacting with electronic order books. You can choose between Iress Pro and Iress Retail account depending on your skill level. If you are looking to diversify your portfolio, this app hosts plenty of asset classes, including forex, ETFs, commodities, bonds, and more. Other platforms at FP Markets with quality resources are MT5, cTrader, and TradingView.

- Has a user-friendly trading app with fast trade execution speed

- Low minimum deposit requirement

- Lists over 10,000 global shares and additional asset classes for portfolio diversification

- Quality support service operating 24/7

- You can only trade the shares as CFDs

- Accessing the Iress accounts requires a minimum deposit of £1,000, which can be high for low-budget traders

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

5. eToro – Best Stock Trading App for Beginners in the UK

Our extensive hours of research have led us to conclude that eToro is the best stock trading app in the UK because of its easy-to-use features. If you are a beginner looking for a stock trading app, this broker will serve you best. Not only does it offer a wide range of stock market assets, but trading stocks with eToro is commission-free. On top of that, the app’s trading platform is very responsive, and traders do not need to worry about lagging activities.

One thing that sets eToro apart from the others is its copy and social features. Beginners can interact and copy trades from the professionals, making it easy for them to learn trading strategies quickly. Its CopyTrader and CopyPortfolios tools, included in eToro’s copy feature, are among the reasons why the app is the best for beginners in the UK.

Being the pioneer of social trades, eToro is also licensed and regulated by tier-one authorities, including the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). This makes the trading app safe for your investments.

- Advanced trading platform with an attractive user interface design

- Social trading features to copy and interact with experts

- It is licensed and regulated by various top-tier authorities such as the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC)

- Commission-free trading on stocks

- Has a minimum deposit requirement

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

6. XM – Stock Trading Apps for Beginners and Experienced Traders

The XM broker provides three different platforms that are available on desktops, tablets, and smartphones. When trading stocks, we suggest that you use the Metatrader 5 or the XM Trader as your main stock trading app since they have the most comprehensive stock trading tools.

This broker offers more than 1,200 different assets in 6 different asset classes, with stocks being the biggest. There are also more than 90 indicators ensuring that you always have the best opportunity to analyze stock price movements correctly.

Getting started with the XM stock trading app is easy, and if you want to test the broker before you start trading, we suggest that you open an XM demo account.

- Stocks are the biggest of the 6 asset classes offered by this broker

- 90+ indicators provide all the help you need to analyze market movements

- Tight spread will help you save on each trade

- There are no small or blue cap stocks offered

| Type | Fee |

| Minimum deposit | 5$ |

| Overnight fee | 0$ |

| Deposit fee | 0$ |

| Withdrawal fee | 0$ |

| Inactivity fee | $15 one-off maintenance fee |

7. Pepperstone – Best Stock Trading App For MT5 Users

Having extensively tested Pepperstone’s stock trading app for MT5 users, we discovered an exceptional platform. Its global shares trading opportunity and low commissions of just 0.10% truly stand out. The quality research tools integrated into MT5 enhance decision-making, while access to social trading adds a collaborative dimension. Seamless transitions between cTrader and MT4 platforms and desktop and mobile trading were impressive.

Despite the £0 minimum deposit for UK traders, the offering of over 1,200 CFD assets, including forex, commodities, and cryptocurrencies, solidifies Pepperstone’s position. Therefore, we recommend it to traders seeking a user-friendly and comprehensive stock trading experience, giving it a 4.5-star rating.

- Highly rated app on Google Play and the App Store

- Lists quality research materials on the MT4 and MT5 platforms

- Low stock trading fees

- Seamless mobile device trade execution

- Limited stock offering compared to its peers

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

How To Choose the Right Stock Trading App in the UK

Finding the best app for stock trading in the UK is not a walk in the park. You need to research by testing and comparing them, which can be exhausting and time-consuming. Worry not, because we have streamlined the process for you by outlining the significant factors to help you along the way.

The best trading apps in the UK should be licensed and regulated by the Financial Conduct Authority (FCA), which is the UK’s financial regulator. Confirming this credibility secures your investment capital, letting you focus on managing your trades.

Brokers’ fees vary in that some charge variable while others prefer a flat rate. For example, a variable fee is the percentage of the trade size, whereas a flat rate is the fixed amount regardless of your trade size. So, make sure you confirm which one works best for you.

Finding a stock trading app offering various tradable assets is of utmost importance. You do not want to choose a trading app to realise later that they do not provide what you wanted to invest in.

Just because a trading app has all the necessary offerings does not mean that its payment methods are suitable for you. Most brokers are still using the traditional techniques of debit/credit card and bank transfers. Others have gone further to allow e-wallets like Skrill, Neteller and PayPal.

Who doesn’t like a business partner with a reliable customer support service? As an investor, you should also choose a broker with round-the-clock customer support that can be reached on different channels, including email, phone, and live chats.

The best stock trading app in the UK must have an advanced trading platform with an attractive user interface. It should also be easy-to-use, making it suitable for all traders. You will notice a good trading platform from the word go when making your first deposit.

It’s always advisable to choose a stock trading app with a demo account to test instead of running the risks of losing your money.

Check out the list of the best cryptocurrency apps in the UK in our other guide.

How to Register a Stock Trading App Account – Step by Step

Once you’ve located the stock trading app that you want to use, you have to register an account, verify your identity, and make a deposit. It might sound like a lot, but the process is really quick and universally the same across all brokers. This is because brokers and customer registration is strictly regulated by the FCA.

Naturally, the first step involves you following one of the links of this page to the broker that you’ve chosen. By following the provided links, you will be directed to the sign-up page. If that fails, you can easily start the registration by clicking the “Join Now” button on the broker’s website.

During the initial stage of the registration, you need to provide basic information about yourself including name, address, income, and phone number. This information will be used as the foundation for your trading app account and will also have to be verified so make sure that you provide accurate details.

With your account registered, you can log in to the stock trading app and browse around. However, to unlock all the features you have to verify your identity. This is done by submitting proof of identity (national ID, driver’s license, passport) and proof of residence (utility bill or bank statement). This information will be manually reviewed before you are verified. Also, note that brokers may ask you for more documents to help verify your identity.

The last step is maybe the easiest. All you have to do is pick a payment method that suits you, a trading amount that fits into your budget, and make a transfer. As soon as the funds land in your trading account, you will be up and running.

And that is it. You have now registered a stock trading app account and can start trading and investing in stocks at will. To ensure that you hit the ground running, we strongly advise that you study stock trading and the pros and cons of using a stock trading app before you get started.

Stock trading is complex and trading on a smartphone makes it even more complex, although also much more available. So please make sure that you are prepared and feel comfortable with stocks and stock trading apps!

FAQs

To start investing in stocks in the UK, you will need a reliable stock broker that is licensed and regulated by the Financial Conduct Authority. Check if their offerings match your trading requirements. Once you make your deposit, you will have access to various market assets to invest in.

No. Unfortunately, Robinhood’s plan to extend its services in the UK was put on hold. However, there are better alternative trading apps in the UK to choose from, like the ones we recommend in our mini-reviews above.

Yes. It is legal to invest in day trading brokers in the UK. For your investment safety, we still insist that you choose a broker that is licensed and regulated by the Financial Conduct Authority (FCA).

If you choose a broker that is licensed and regulated by tier-one authorities, then yes, online trading is safe. Before committing to an online broker, make sure that their offerings match your trading needs. You can also take advantage of the demo accounts and test if they work best for you.

Online trading apps are only safe if they are from a reputable broker. To know if a broker is safe, they must be licensed and regulated by tier-one financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the U.S.

The only way you can easily buy stocks in the UK is through a stock broker. When you have the best stock brokers like the ones we recommend above, you will have access to various stock markets and buy stocks quickly.

Yes. You can easily buy and sell stocks using your phone. Receiving the latest market updates using your phone will also help you manage your trading activities.

To buy stocks, you need a brokerage firm that has access to various stock markets. Make sure that the broker is licensed and regulated by top-tier financial authorities and their offerings align with your trading requirements.

Conclusion

The advantage of including stock trading apps in your investment tools is that you can invest and monitor your trading activities anywhere, anytime. If you are a frequent investor, consider downloading the best stock trading apps on your mobile devices. You do not want to miss any trading opportunity. Do you?

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I really enjoy trading with eToro 🙂 I have started trading for 9 months and they pay my earning.

I trade with AvaTrade, but my friend has more profit from eToro... how much is your profit for these 9 months?

This may sound like obvious advice - but you need to make trading choices that you are comfortable with. If you don't fully understand the orders you are making, you shouldn't be doing them. Instead, spend some time learning a bit more about how to play on the stock market or look for free stock market advice available on the internet.

Read the article and wanted to highlight this. It's about automated trading apps in the UK. Truly valuable information! Reviews of the best, insights - all on point. Even recommendations for choosing. If you're in the know, like me, definitely give it a read. It might be helpful for you too.

Awesome guide for finding the best stock trading apps! It breaks things down so well, making it a breeze to pick a reliable app. The focus on safety, fees, and choices really helps. The steps for signing up are straightforward, making it super user-friendly. I highly recommend it!

This is what I was looking for! Thanks to the article, I quickly found the best stock trading apps. I was seeking information on the safety of trading - the article recommends choosing apps licensed by the FCA, ensuring their reliability. Their detailed reviews and key selection criteria saved me a lot of time. The straightforward registration and step-by-step instructions made the start of trading easy. All questions were pre-answered in the FAQ section. I highly recommend this article to stock investment beginners.

I’ve used eToro for a while now, and I agree with the review—it’s an excellent choice for beginners.

Good overview, though it's worth noting that MT5's charting tools really do make a difference for technical analysis compared to basic broker apps.