UK investors can now automate trades 24/7 using FCA-regulated platforms with algorithmic tools. These systems help reduce emotional bias, speed up execution, and improve consistency, even when you’re away from your screen.

Essence

✓ Automated trading systems follow strict, rule-based algorithms — eliminating hesitation during volatile swings. For example, a bot programmed to sell a stock after a 5% drop will execute instantly, avoiding the emotional delay that often leads to deeper losses.

✓ Platforms like MetaTrader or API integrations enable users to build or apply trading strategies automatically.

✓ Key benefits include faster trade execution, consistent performance, and better risk management.

✓ Many brokers support tools like Expert Advisors (EAs), letting users automate trades based on defined signals.

✓ Choose brokers regulated by the FCA or other trusted authorities to ensure security and reliability.

✓ All platforms featured here are tested, verified, and trusted by both experts and UK retail traders.

Top Automated Trading Platforms in the UK

Here are the best UK platforms for automated trading in 2026, each suited to different needs, from copy trading to advanced algorithmic strategies:

- eToro – Beginner-Friendly

- FxPro – Best for Advanced Traders Using Custom Algorithms

- IG Markets – Leading Share Investment Platform

- Pepperstone – Best for MT4 and Expert Advisor (EA) Users

- Capital.com – One of the Cheapest Platforms

- Spreadex – Leading Spread Betting Platform

How We Choose Automated Trading Platforms

To recommend the best automated trading platforms in the UK, we use a strict selection process focused on performance, safety, and user experience.

We begin by reviewing regulated UK brokers that offer algorithmic or copy trading tools. We check their licences, track records, platform uptime, and client protections. Only platforms backed by trusted authorities like the FCA make it to the next stage.

Next, we test each platform hands-on. This includes opening demo accounts to evaluate real-time features such as:

- Execution speed

- Algorithm integration (e.g. Expert Advisors, API tools)

- Mobile vs desktop usability

- Spread consistency and platform stability

- Customer service response times

We also cross-check platform reviews on Google Play, the App Store, and Trustpilot to capture user feedback.

Our research is ongoing. We update this guide regularly to reflect market changes, user trends, and new trading technologies, ensuring you always get accurate, unbiased insights.

Compare Top Automated Trading Platforms in the UK

Each broker offers unique tools, fee structures, and trading platforms. Use the table below to compare licences, software, deposits, and features, and choose the one that fits your trading goals.

| Automated Trading Platforms | Licence | Minimum Deposit | Support Service | Trading Platforms | Payment Method | Demo Account |

|---|---|---|---|---|---|---|

| eToro | FCA, MAS, CySEC, FSCA, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | £50 | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| FxPro | FCA, FSCA, SCB | £100 | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill | Yes |

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | £0 | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes |

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | £0 | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple/Google Pay, Credit/Debit Cards, PayPal, Domestic/International Bank Transfer | Yes |

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | £20 | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes |

| Spreadex | FCA, SEBI | £0 | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | Yes |

Fees on Automated Trading Platforms

Trading costs access can vary widely across platforms. The table below shows the core fees across the UK’s top automated trading platforms in 2026, helping you find the right match for your strategy.

Platform Fees Overview

| Best Automated Trading Platform | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| eToro | From 1 pip | £50 | Free | £10 monthly |

| FxPro | From 0.0 pips | £100 | Free | £15 once + £5 monthly |

| IG Markets | From 0.1 points | £0 | Free | £18 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| Spreadex | From 0.6 pts | £0 | Free | None |

1. eToro – Beginner-Friendly

While eToro does not offer traditional AI-driven automated trading, its CopyTrader and Smart Portfolios features provide a unique semi-automated investing experience. The CopyTrader feature allows users to replicate the trades of experienced investors in real time. You can start copying from a minimum of £200 per investor, with the option to diversify across up to 100 traders. Smart Portfolios take this concept further by bundling multiple assets or traders around specific strategies or themes, periodically rebalanced to optimise performance.

eToro is beginner-friendly because it is user-friendly on both desktop and mobile devices. Plus, it has a low minimum deposit requirement of £50 for UK clients. The best part is that deposits are free, even though you will incur a £5 fee while making withdrawals.

When it comes to asset offerings, eToro lists over 7,000 options, including shares, ETFs, forex, indices, commodities, and cryptocurrencies. Its eToro Academy is a plus, as it offers courses for all levels of experience. We also like that the broker features AI-powered tools like Tori and Alpha Portfolios, which provide insights and strategy suggestions.

- It has an intuitive platform for desktop and mobile

- Features CopyTrader and Smart Portfolios for semi-automated investing

- Lists over 7000 instruments for CFD trading and investing

- Free educational resources via eToro Academy

- Commission-free stocks and ETFs

- No full AI or algorithmic trading

- The minimum amount for CopyTrader is £200, which can seem high for low-budget traders

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

2. FxPro – Best For Advanced Traders

FxPro is a top choice for experienced traders who require fast execution and flexible platform options. With support for MT4, MT5, cTrader, and its own FxPro WebTrader, it enables advanced technical trading across global markets. The broker offers commission-free CFD trading with spreads from 0.6 pips and leverage up to 1:500 for professional clients.

- Wide platform access: MT4, MT5, cTrader, FxPro WebTrader

- Fast order execution, ideal for scalpers and active traders

- Commission-free trading across most asset classes

- Supports algorithmic trading and EA strategies

- FCA-regulated with multiple international licences

- CFD-only platform, no ownership of physical assets

- Minimum deposit of £100 may be high for casual traders

- No fixed-cost pricing structure

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

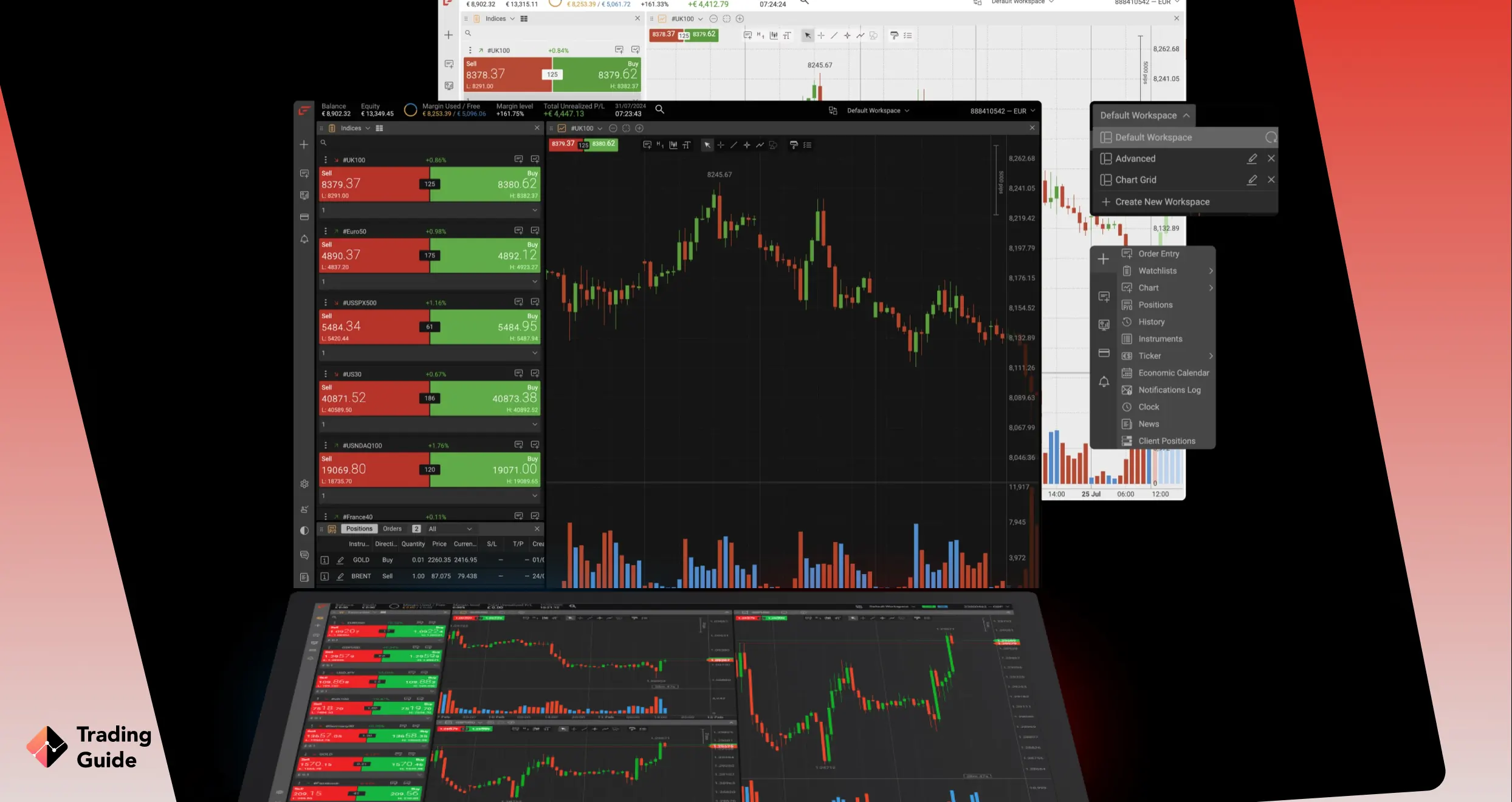

3. IG – Leading Share Investment Platform

Our experience with IG was one of the best for many reasons. We find it to be an all-in-one trading platform, considering that we never lacked any resources besides access to the MT5 platform. Automated trading is supported on its ProRealTime and MT4 platforms only. You can also enjoy this feature through its native APIs to capitalise on rare opportunities while limiting human errors.

When it comes to share investing, IG lists over 12,000 global equities. You can buy and take ownership of your favourite stocks through the IG Invest app or web-based share dealing accounts, whether GIA, ISA, or SIPP. IG also provides Smart Portfolios. These are expertly managed portfolios aligned to different risk levels, allowing hands-off, automated investing.

Besides shares, IG supports ETF investing. And if you want to take short-term positions, there are 17,000+ CFD and spread betting assets to explore. These include forex, IPOs, futures, options, commodities, indices, and more. We also like the availability of multiple third-party platforms. Depending on your preference, you can choose from MT4, ProRealTime, TradingView, or L2 Dealer.

67% of retail investor accounts lose money when trading spread bets and CFDs with this provider

- Lists 12,000+ global equities

- Multiple trading accounts to choose from

- No minimum deposit requirement for UK clients

- Offers active traders an opportunity to earn up to 4.00% AER variable interest on cash balances

- Reliable and responsive support service across multiple channels

- No access to the MT5 platform

- No automated trading on TradingView and L2 Dealer platforms

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

4. Pepperstone – Best for MT4 and EA Traders

If you’re an experienced trader looking to automate your strategy, Pepperstone is one of the best choices in the UK. It supports Expert Advisors (EAs), backtesting tools, and a wide range of automated trading platforms – all with no minimum deposit and low-cost execution.

- Full support for EAs and strategy automation

- Access to MT4, MT5, cTrader, and TradingView

- Spreads from 0.0 pips

- No deposit, withdrawal, or inactivity fees

- Over 2,400 CFDs across multiple asset classes

- All instruments are offered as CFDs

- Cryptocurrencies only available to Pro users

- No support for options trading

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

5. Capital.com – One of the Cheapest Platforms

We find Capital.com to be a highly cost-effective platform that can appeal to both beginners and experienced traders. For instance, deposits and withdrawals are completely free, with a minimum deposit and withdrawal requirement of just £20.

Note that Capital.com charges no commissions, but spreads start at 0.0 pips on major currency pairs. For UK clients, the 1X account allows CFD trading without leverage, enabling traders to use only their deposited funds while avoiding overnight fees. Those seeking leveraged trading can access up to 30:1 on CFD accounts, but remember that leverage magnifies both gains and losses.

Automated trading is supported at Capital.com’s MT4 platform. Other platforms to explore include its proprietary web, mobile app, and TradingView. They are loaded with quality tools, including over 75 indicators, 6+ chart types, drawing tools, unlimited watchlists, price alerts, and smart news feeds. There is also a learning section that covers courses, videos, webinars, and market insights for all skill levels. Customer support is available 24/7 via phone, email, and live chat.

- Low minimum deposit requirement for UK clients

- Commission-free trading with transparent spreads from 0.0 pips

- Lists over 4,500 CFD instruments

- Multiple platforms, including MT4 and TradingView

- 24/7 customer support and educational resources

- Automated trading only via MT4, not native platform

- No physical purchasing of the listed assets

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

6. Spreadex – Leading Spread Betting Platform

Spreadex is a top choice for UK traders seeking a powerful spread betting and CFD platform. While it does not support automated trading, EAs, or API integration, it offers some semi-automated tools, including Pro Trend Lines, Chart Pattern Recognition, and price alerts, which help manual traders make informed decisions. The platform is fully customisable and fast, available on desktop and mobile devices.

Spreadex spread betting advanced charting features include over 35 technical indicators, sophisticated drawing tools, macro-data overlays, and templates that can be saved and edited. Traders can use advanced orders such as guaranteed stops, one-click dealing, and Force Open to go long and short on the same market.

When it comes to trading fees, Spreadex imposes spreads starting from 0.6 pips on major currency pairs. You will spread bet on more than 10,000 global markets, including indices, shares, forex, commodities, ETFs, options, IPOs, interest rates, and bonds. On top of that, there are quality learning materials plus an award-winning 24/7 customer service via phone, email, and live chat.

- Has a user-friendly and highly customisable platform

- Offers access to 10,000+ markets

- Quality learning and market analysis tools

- Low trading fees from 0.6 pips on major currency pairs

- No minimum deposit requirement

- No fully automated trading or copy trading

- No demo account

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

What is an Automated Trading System?

An automated trading system is software that executes trades using pre-set rules, including price, volume, and timing – without manual input. Also known as algorithmic or AI-powered trading, this approach helps investors reduce emotional decision-making, react faster to market changes, and manage multiple trades more efficiently.

These systems have grown in popularity among UK traders seeking more consistent execution. From retail investors using bots to hedge funds deploying advanced algorithms, automation is reshaping how financial markets operate.

There are different types of AI trading software, from simple rule-based tools to systems powered by machine learning. They support trading across a wide range of asset classes, including stocks, forex, cryptocurrencies, commodities, and indices.

Common Automated Trading Strategies in the UK

Automated trading strategies vary in how much control you retain and how trades are executed. Understanding the key types available in the UK helps you choose the right method for your goals and experience level.

1. Automated Copy Trading

This strategy lets you automatically replicate the trades of professional or high-performing traders. It’s especially popular among beginners or time-poor investors. When the expert makes a move, your account mirrors it in real time, helping you benefit from their market insights without manual input.

2. Semi-Automated Trading

Semi-automated trading combines algorithmic tools with manual decision-making. The platform analyses markets and generates trading signals, but you decide whether to act. It’s a flexible option for users who want data-driven suggestions while retaining control over entries and exits.

3. Expert Advisors (EAs)

Expert Advisors are scripts or software programs that execute trades automatically based on predefined conditions. Attached to MetaTrader 4 or 5, EAs can monitor markets around the clock, follow programmed strategies, and place trades without human intervention.

How Does Automated Trading Work?

Automated trading uses computer programs to execute trades based on predefined criteria. Once the system is set up, it monitors the markets and places trades automatically when conditions are met, without manual intervention.

This approach is fully legal in the UK and allows traders to set rules around price, timing, volume, and technical indicators. For example, you can define entry and exit points using tools like stop-loss orders (which cap potential losses), moving averages, or price breakouts.

More advanced systems may support complex strategies that react to external variables or combine multiple asset classes. The key benefit is consistency: the system follows your instructions exactly, without emotion or delay.

Because automated tools track the markets continuously, they can respond faster than a human trader. This helps improve efficiency, avoid hesitation, and maximise your exposure to profitable setups.

Pros and Cons of Automated Trading Platforms

Before using an automated trading system, it’s essential to weigh the advantages and potential drawbacks. Here’s a balanced overview to help you make an informed decision:

| Pros | Cons |

|---|---|

| Maintains discipline – Automated systems follow pre-set rules, removing emotional bias from trading. | Technical failures – Software can crash or lose connection, interrupting trades at critical moments. |

| Faster execution – Many platforms place trades in milliseconds, helping users capitalise on opportunities quickly. | Requires human oversight – You still need to monitor the system to ensure trades behave as expected. |

| Encourages diversification – Algorithms can help spread investments across multiple markets, improving your risk management strategy. | Over-optimisation – Tuning strategies too tightly to past data can reduce performance in real markets. |

| Operates 24/7 – Systems monitor global markets around the clock, even outside standard trading hours. |

Read about the UK Penny stock brokers in our other article.

How to Get Started with an Automated Trading Platform

Getting started with automated trading in the UK is straightforward, especially when using an FCA-regulated broker. Here’s a step-by-step guide to help you begin:

Choose a reputable FCA-regulated broker from our recommended list and go directly to their official site. Read the platform’s terms of service and install its mobile trading app if you plan to manage your portfolio on the go.

Click ‘Register’, ‘Sign Up’, or ‘Join Now’ on the broker’s homepage. Fill in your personal details, such as name, email address, source of income, and location. Set a secure password and username to protect your account.

FCA-regulated platforms require identity verification to prevent fraud and money laundering. Upload a copy of your passport, driving licence, or national ID, along with a recent utility bill or bank statement to confirm your address.

Once verified, choose a payment method (e.g. debit/credit card, e-wallet, or bank transfer) and fund your account. Each platform has its own minimum deposit; check the requirement before proceeding.

After funding, explore the available assets and go to the platform’s automated trading dashboard. Select your settings and activate the trading robot or algorithm of choice. Set your trade size, confirm the parameters, and let the system execute trades on your behalf.

Important: Automated trading doesn’t eliminate risk. Most systems are used for CFD (Contract for Difference) trading, where leverage can amplify losses. According to FCA data, over 76% of retail investors lose money when trading CFDs. Always use stop-loss tools and never invest more than you can afford to lose.

How to Choose the Right Automated Trading Platform

Not all automated trading platforms are built the same. To succeed in the UK market, you need a broker that aligns with your trading strategy, asset preferences, and budget. Choosing the best broker means finding one that meets strict FCA requirements and delivers the features you actually need.

Here’s what to consider before opening an account:

Your broker must be authorised and regulated by the Financial Conduct Authority (FCA). FCA regulation ensures that your funds are protected in segregated tier-one bank accounts and that the broker operates under strict UK financial laws. Always check the broker’s licence number on the FCA register.

A strong automated trading platform should offer a wide selection of tradable assets to suit your strategy. Whether you’re interested in forex, equities, indices, or commodities, make sure the platform supports your preferred instruments. Broad asset coverage allows for better portfolio diversification and gives you flexibility to adapt as market conditions change.

Choose an automated trading platform that combines speed, reliability, and smart design. Look for features like demo accounts for strategy testing, fast execution speeds, and customisable layouts that suit your workflow. The best platforms also include built-in trading tools for technical analysis, helping you make informed decisions and develop your skills over time.

Check third-party reviews from actual users. Look at Google Play, the App Store, and Trustpilot to find feedback about reliability, customer support, and platform experience. Pay attention to consistent complaints or unresolved issues.

Make sure your broker accepts convenient and secure payment options such as debit cards, e-wallets, or bank transfers. Fast deposits and withdrawals are crucial; you don’t want delays when funding your account or cashing out profits.

Don’t overlook support. Choose a platform with responsive service teams that are available when you need them, whether by phone, email, or live chat. This is especially important during high market volatility or technical issues.

Compare the full fee structure:

- Trading commissions and spreads

- Inactivity or overnight swap fees

- Minimum deposit requirements

A lower-cost platform helps you preserve profits, but always balance affordability with features and security.

Read more about the best trading platforms in the UK and the best gold trading brokers in 2026 in our other comprehensive guides.

Future of Automated Trading

Automated trading, underpinned by artificial intelligence (AI) and increasingly sophisticated algorithms, is continuing to transform financial markets. The trend is expected to accelerate in the years ahead.

Looking forward, automation is set to become more adaptive and data-driven. Advanced trading systems now analyse real-time market data, respond to news sentiment, and adjust position sizing based on volatility. This enables faster execution, more efficient order flow, and improved price discovery.

As machine learning evolves, automated strategies will likely become more responsive to shifting market conditions. Some systems already optimise parameters dynamically, rather than relying solely on historical data. This capability may allow traders to identify short-term opportunities and manage risk without constant manual intervention.

However, automation also introduces new challenges. Flash crashes, algorithmic bias, and over-optimisation can lead to significant losses, particularly in unstable market conditions. Regulatory bodies such as the FCA are increasingly focused on transparency and accountability in algorithmic trading.

Ultimately, automation should be viewed as a complement to human judgement, not a replacement. Successful traders continue to monitor performance closely, apply critical thinking, and diversify strategies to avoid overreliance on any single system.

Discover the Best AI Trading Platforms and Best AI Trading Apps in our alternate guides.

FAQs

Automated trading involves using algorithms and computer programs to place trades based on predefined criteria. It eliminates emotional decision-making and allows for faster, data-driven execution.

Yes – many platforms offer beginner-friendly bots and copy trading tools. However, it’s essential to understand how they work before committing real funds.

Absolutely. Automated trading is legal in the UK and widely used by both retail and institutional investors. Just make sure to use FCA-regulated platforms and comply with tax rules.

Costs vary by platform. Some offer free access with spreads or commissions, while others charge monthly fees or take a share of profits. Always check the full fee structure before starting.

It depends on your experience and goals. FxPro, IG, and Pepperstone are popular choices for algorithmic trading. You can compare them in our guide to the best AI trading platforms.

SafeMoon remains a speculative and highly volatile token. While it gained popularity through social media, its long-term sustainability is uncertain. Regulatory pressure, limited exchange access, and lack of transparency raise concerns. Anyone considering an investment should proceed with caution and avoid allocating more than they can afford to lose.

Conclusion

Choosing the best automated trading platform in the UK can feel overwhelming, especially with so many providers now in the market. But with the right guidance, it becomes much easier to take the first step.

The key is to pick a regulated platform that suits your trading goals, asset preferences, and risk tolerance. Always trade with a clear plan and budget, and use risk management tools such as stop-loss orders to protect your capital.

Automation can improve speed and consistency, but it’s not a substitute for strategy. Stay informed, track your positions, and use automation as a tool to support smarter trading decisions.

How we test?

Our review process is detailed, transparent, and built to help you make confident decisions. We start by researching each broker’s official website, reviewing their features, fees, and terms. Then, we gather feedback from trusted sources like Trustpilot, Google Play, and the App Store to understand real user experiences.

Next comes testing. We use both demo and live accounts to evaluate trading platforms, tools, execution speed, and automation features. Our goal is to highlight each broker’s core strengths and potential drawbacks, not just repeat what’s on their website.

We do this because your trust matters. As part of the TradingGuide community, you deserve access to thoroughly vetted, FCA-regulated platforms. Learn more about our testing process.

I have using AvaTrade platform in demo mode. It's really useful to me but I am not sure how long it takes to transfer the profit I gain if in a real account.

I use only eToro! It's really an easy-to-use platform, I don't have a problem using

I use only eToro! It's really an easy-to-use platform 🙂

I don't have a problem using

This page definitely has all the info I needed concerning this subject and didn't know who to ask.

eToro has been my go-to for crypto trading, and I'm really pleased with it. TBuying and selling different cryptocurrencies is a breeze, and I like that you can copy what successful investors do. It's like having experts guide you.

Great review! I've been looking for a new automated trading platform and this article has been super helpful in narrowing down my options. I'm interested in trying out the ADFX platform, but would like to know more about the fees involved.

Fascinating read! I've been exploring automated trading options in the UK and this review has given me some great insights. I'm particularly interested in eToro. I am a beginner and really appreciate this guide that helped me a lot.

I completely agree with your assessment of eToro! I've been using it for a few months now and the user-friendly interface has made it a breeze to set up and manage my automated trading sessions. Would love to see more in-depth reviews of the other platforms in the future

Great breakdown! Always test with demo accounts first to see what fits your style.

On EAs specifically: they're not a magic solution. Most retail EAs are curve-fitted garbage that fall apart in live markets. If you're building your own, expect months of backtesting, forward testing, and constant tweaking. And even then, market conditions change.