The world of CFD trading in the UK demands cutting-edge apps to keep you in sync with the ever-evolving market. Our extensive guide unveils the best CFD trading apps for UK traders. These apps are backed by FCA-regulated brokers, boasting a reputation for trustworthiness. Some even come under the watchful eyes of global regulatory bodies, guaranteeing maximum safety. Besides listing the best CFD trading UK apps, we will highlight other elements to ensure you are fully prepared to start your CFD trading journey.

Essence

- Choose a CFD trading app that aligns with your trading style and preferences.

- Prioritise risk management when using the best CFD trading app to protect your investments.

- Start with a small investment and increase as you gain experience.

- Continuous learning is essential to adapt to changing market conditions.

- Regularly assess and adjust your trading strategy as needed.

- Be cautious when applying leverage in CFD trades, as you can be left with a massive loss.

List of the Best CFD Trading Apps in the UK 2026

- IG – Excellent for Stock Trading

- FxPro – Best CFD Trading App For Professional Traders in the UK

- Capital.com – Top For Cryptocurrency Trading

- Pepperstone – Best CFD Trading App for Android

- Plus500 – Excellent CFD* Trading App** in the UK (Overall)

- eToro – Most Trusted CFD Trading App in the UK

- Spreadex – Best CFD Trading App With Excellent Support Service

- XTB – Best CFD Trading App With Excellent Learning Resources

*76% of CFD retail accounts lose money

**Investment Trends 2022

Compare the Best CFD Trading Apps

We’ve selected the best CFD apps in the UK. Compare their unique features, benefits, and drawbacks in the table below for an informed decision.

We prefer turning all the tables during our research. That is why we also review user opinions. Although we can’t go through all the comments from Google Play, Trustpilot, and the App Store, we sample a few, which give us the results we need. Below are our experts’ ratings from user comments.

| CFD Trading App | Licence | Minimum deposit | Money insurance | Software | Payment |

|---|---|---|---|---|---|

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | £0 | Yes (up to £85,000 by FSCS) | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal |

| FxPro | FCA, FSCA, SCB | £100 | Yes (up to €20,000) | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill |

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | £20 | Yes (up to £85,000) | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | £0 | Yes (up to £85,000) | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple/Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer |

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | $100 | Yes (up to £85,000) | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google/Apple Pay |

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | £50 | Yes (up to $250,000) | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit cards, Bank transfer, PayPal, Neteller, Skrill, Trustly, iDEAL |

| Spreadex | FCA | No | Yes (up to £85,000) | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank transfer, Neteller, Apple Pay & Google Pay |

| XTB | FCA, KNF, CNMV | No | Yes (up to £85,000) | xStation 5, xStation Mobile | Credit/debit cards, Bank Transfer, Skrill |

Brief Overview of Our Recommended CFD Apps’ Fees and Assets

We understand the importance of choosing the best CFD trading app with features aligning with your trading requirements. For this reason, we have prepared tables below highlighting the fees and assets associated with our recommended CFD trading apps in the UK.

Fees

| CFD Trading App | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| IG Markets | From 0.1 points | £0 | Free | None |

| FxPro | From 0.0 pips | £100 | Free | £15 once + £5 monthly |

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Plus500 | From 0.0 pips | $100 | Free | £10 monthly |

| eToro | 2 pips | £50 | £5 withdrawal | £10 monthly |

| Spreadex | From 0.6 pips | £0 | Free | None |

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

Assets

| Best CFD Trading App | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| IG Markets | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | No |

| Capital.com | Yes | Yes | Yes | Yes | No |

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Plus500 | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | No |

Our Opinion & Overview of the Best CFD Trading Apps

In this section, we present our expert ratings and insights into the best CFD trading apps in the UK. We’ve meticulously assessed these apps, considering user feedback from platforms like Google Play, Trustpilot, and the App Store to ensure accuracy and reliability.

1. IG – Excellent for Stock Trading

If your priority is stock trading, IG is one of the most complete CFD apps available in the UK. It gives access to 12,000+ global equities, including popular names like Tesla, Microsoft, Netflix, Amazon, and more. You can go long or short with CFDs, use flexible position sizing, and work in the underlying market currency. The best part is that there is no minimum deposit requirement to access the shares, and all transactions are free.

We like IG’s support for multiple platforms. Clients can trade on the main web platform, the mobile app, MT4, ProRealTime, L2 Dealer, or TradingView platforms, depending on how much analysis they need. Live market updates, in-platform news, and advanced charting tools allow you to track corporate events, earnings, and sector moves with accuracy.

Note that IG does not support share CFD trading only. You can also spread bet on shares or invest and take ownership through its IG Invest app or web-based share dealing ISA, GIA, and SIPP accounts. And if you want additional assets for portfolio diversification, the app hosts plenty of options. These include forex, commodities, indices, and more.

68% of retail investor accounts lose money when trading CFDs with this provider.

- A user-friendly app with fast trade execution on Android and iOS mobile devices

- Gives access to third-party platforms, including MT4, ProRealTime, L2 Dealer, TradingView

- Lists 12,000+ global stocks to trade and invest in

- Gives access to ISA and SIPP accounts

- Reliable and responsive 24/5 support service

- There’s currently no access to MT5 platform for UK clients

- Share CFD charges are high compared to some of its peers

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | None |

| Advanced graphs (ProRealTime) | £30 per months |

2. FxPro – Best CFD Trading App For Professional Traders in the UK

Following our comprehensive research on CFD trading apps in the UK, it is evident that FxPro stands out as the best option for professional traders. We explored over 2,100 CFD assets, including forex, shares, indices, commodities, and more, which made it easier for us to diversify our portfolios. We also noticed that the broker lists cryptocurrencies, but they are exclusively for professional traders. With leverage limits up to 1:500 for professional traders, you are guaranteed an exciting experience.

Besides the web platform, FxPro’s CFD trading app supports cTrader, MT4, and MT5 platforms, each equipped with advanced trading resources and automated trading capabilities. Our research also highlights the reliability of FxPro’s support service, which is accessible via phone, email, and live chat, thus ensuring seamless assistance for users.

- Low minimum deposit requirement

- Advanced trading platforms with quality research resources for professional traders

- High leverage limit for professional traders

- Reliable and responsive support service

- Limited asset offerings compared to its peers

- No buying and taking ownership of the listed assets

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. Capital.com – Top For Cryptocurrency Trading

Crypto markets move fast, and that’s exactly where Capital.com’s CFD app comes into its own. From the moment we tried it, the speed of execution and clarity of the interface stood out. The app gives access to a broad mix of coins, not just Bitcoin and Ethereum, but plenty of altcoins too. All are traded commission-free with low spreads. For anyone keen to speculate on crypto price swings without owning the assets directly, it’s a very practical option.

We liked how the platform combines simplicity with depth. Price alerts, trailing stops, and advanced charting make it easier to react quickly, while the design keeps things from feeling overwhelming. Starting out is affordable too, with a minimum deposit requirement of just £20. Together with free deposits and withdrawals, we never felt pressured to commit more than we were comfortable with.

For those who want extra firepower, Capital.com also connects seamlessly with MT4 and TradingView, allowing automated strategies, social trading, and advanced technical analysis. And for learning on the go, the Investmate app adds real value with its short, easy-to-digest courses.

- Wide choice of cryptocurrencies available as CFDs

- Commission-free with competitive spreads

- Risk-management tools like trailing stops and alerts

- £20 minimum deposit and free withdrawals

- Supports MT4 and TradingView for advanced crypto strategies

- No direct crypto ownership (CFDs only)

- No copy trading

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

4. Pepperstone – Best CFD Trading App for Android

Our experience with Pepperstone on Android devices has been exceptional, thanks to its lightning-fast trade execution. While analysing user testimonials, Pepperstone is among the most highly rated by the majority of users. Its user-friendly platforms, including TradingView, cTrader, MT4, and MT5, offer high customizability, allowing users to enjoy their activities even as they keep advancing. While research tools are somewhat limited, there’s a wealth of learning resources to enhance your skills, along with robust risk management features. These and more made us give Pepperstone a 5-star rating.

- Third-party trading platforms (MT4 and MT5).

- Advanced risk management tools on cTrader.

- No transaction fees.

- Financing fees for overnight positions are high.

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

5. Plus500 – Excellent CFD Trading App in the UK (Overall)

Plus500 has emerged as the top CFD trading app, and it’s highly rated on both the App Store and Google Play. Whether you use an Android or iOS device, Plus500 delivers a seamless experience. With a low minimum deposit requirement of £100, it’s accessible to a wide range of UK traders, although it does charge fees like inactivity and overnight fees. We also noticed that trading with this app attracts low spreads, starting from 0.0 pips. Therefore, we give it a 5-star rating.

*Investment Trends 2022

- Various assets for CFD trading, including forex, shares, and commodities.

- User-friendly CFD trading platform.

- Customer service is available anytime, any day.

- No third-party trading platform such as MT4, MT5, etc.

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

6. eToro – Most Trusted CFD Trading App in the UK

After rigorous testing and analysis, we found eToro to be the most trusted CFD trading app in the UK for several compelling reasons. Firstly, the app boasts a highly intuitive CFD platform that offers an extensive selection of CFD assets to choose from. Secondly, eToro introduces its innovative CopyTrader platform, allowing users to effortlessly follow and replicate the trading strategies of seasoned experts. Moreover, eToro has a £50 minimum deposit requirement and robust risk management tools to safeguard your CFDs UK investments. There is also a demo account loaded with £100,000 in virtual funds to allow users to test its capabilities. Based on our findings, we give the app a 5-star rating.

- Low minimum deposit requirement

- Free money deposits

- Offers a CopyTrader platform for an exciting experience

- Withdrawal fees apply

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

7. Spreadex – Best CFD Trading App With Excellent Support Service

Exploring Spreadex’s CFD trading app revealed an exceptional support service, complementing its array of features. While trading, we decided to contact the app’s support team and were impressed by its dedication to client satisfaction. The team was very responsive and provided relevant solutions to the questions we raised. Plus, there is an FAQ section where we believe users can get answers to the commonly asked questions.

Besides a reliable support team, we liked Spreadex’s 10,000+ asset offering, including forex, shares, indices, commodities, ETFs, and more. The integration of the TradingView platform further amplifies its appeal, providing powerful analytical tools for informed decision-making. The best part is that Spreadex does not have a minimum deposit requirement, thus making it easier for users to get started.

- Regulated by the FCA, ensuring the highest levels of safety and reliability

- Reliable and responsive support service team proven to provide relevant solutions

- Hosts over 10,000 tradable securities

- No minimum deposit requirement

- Limited advanced trading features

- The support service team is not available 24/7

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

8. XTB – Best CFD Trading App With Excellent Learning Resources

After thorough research, we’ve found XTB to be the go-to CFD trading app with excellent learning tools for UK traders. The user-friendly platform offers a demo account, ideal for beginners and experienced traders. With dedicated mobile apps for both iOS and Android, XTB keeps you in control, even when you’re out and about. But what truly sets XTB apart is its wealth of educational resources. Whether you’re brushing up on technical analysis or diving into market fundamentals, XTB has you covered. With over 5,400 CFD instruments, XTB offers a wide range of options to match your trading style. We therefore give it a 5-star rating.

- User-friendly CFD trading app with a demo account for practice

- Compatible with iOS and Android mobile devices

- A vast selection of learning materials covering diverse trading topics

- Superior execution speed for timely order execution

- No 24/7 support service

- Supports only forex and CFD instruments

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

What do Other Traders Say?

Choosing the best CFD trading app in the UK is crucial, and user feedback provides valuable insights. For this reason, we’ve examined reviews on Google Play, the App Store, and other platforms to share fellow traders’ experiences.

Pepperstone

Pepperstone users value the app’s fast trade execution, especially on Android devices. The app offers a variety of trading platforms, including TradingView, cTrader, MT4, and MT5, making it suitable for traders with diverse preferences.

-

“I’ve used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features.” – Jana from Gold Coast

-

“Easy to open. Easy to use. Easy to add money. Easy to withdraw money. Good customer service. Fast execution. Less spreads. Just learn how to trade and have fun.” – Pruthviraj Rathod.

Plus500

Users of the Plus500 app have praised its ease of use and accessibility on both Android and iOS devices. It’s considered an excellent choice for traders looking for a straightforward and reliable platform. Plus500’s competitive minimum deposit requirement is also seen as a positive aspect.

-

“Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here.” – ramzyki

-

“I had a good experience with Plus500.

I recommend for those who want to achieve their goals come and invest with Plus500 and you will never be regret.” – Anonymous user

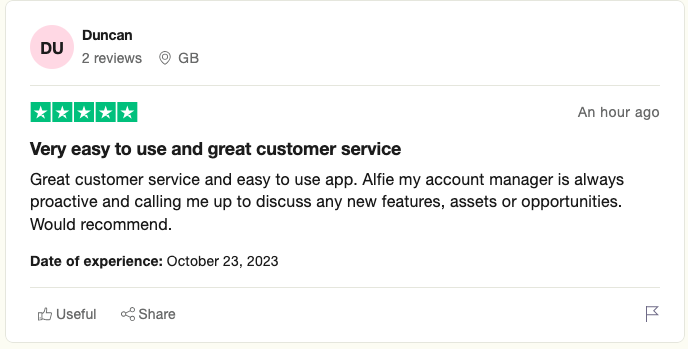

eToro

Many traders appreciate eToro’s social trading features, which allow them to connect with other investors and even copy their trades. Users find the platform’s social feed and the ability to follow experienced traders particularly beneficial for learning and making informed decisions.

-

“Great customer service and easy to use app. Alfie my account manager is always proactive and calling me up to discuss any new features, assets or opportunities. Would recommend.” – Duncan

-

“Great application to get money all the time” – fitnessandnutrition212

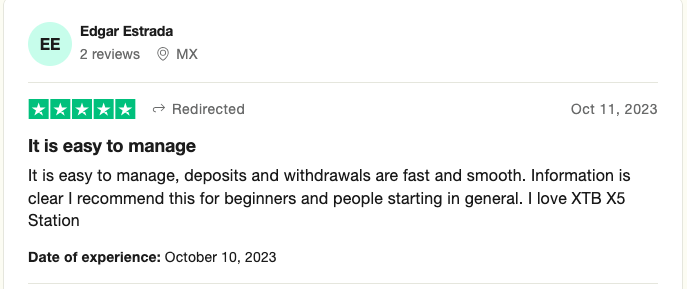

XTB

Traders using XTB’s app have highlighted the abundance of educational materials available. Whether you’re a beginner or a seasoned trader, the access to various learning resources helps enhance trading skills and understanding. Users also laud the inclusion of a demo account for practice.

-

“I have shares in other brokers, but I’m using this app to check prices and charts because it’s simply better. Flawless usability” – Kosciej

-

“It is easy to manage, deposits and withdrawals are fast and smooth. Information is clear I recommend this for beginners and people starting in general. I love XTB X5 Station.” – Edgar Estrada

The Ultimate Guide to CFD Trading

To excel in CFD trading, it takes more than just the right app. Our guide below delves into the mechanics and strategies that drive this financial practice. We’ll equip you with the knowledge to succeed, whether you’re new to CFD trading or a seasoned pro.

How to Start Trading with a CFD Trading App

Before you kickstart your CFD trading journey with the best apps in the UK, there are some essential tips to remember. These tips will help you start your CFD trading journey on the right foot and make the most of CFD trading apps in the UK.

- Educate Yourself: Take the time to learn about CFD trading. Understand the basics, risk management, and how to use the app effectively.

- Choose the Right App: Select a CFD trading app that suits your style and preferences. Consider factors like available assets, fees, and user-friendliness.

- Demo Account: Most apps offer demo accounts. Use these to practise trading with virtual funds and get comfortable with the platform.

- Risk Management: Develop a solid risk management strategy. Set stop-loss orders and be cautious about leveraging your trades.

- Start Small: When trading with real money, start with a small investment. As you gain confidence and experience, you can gradually increase your position sizes.

- Stay Informed: Keep up with market news and trends. This knowledge will help you make informed trading decisions.

How to Choose the Right CFD Trading App

It is essential to note that the UK’s CFD brokers do not offer the same market assets for trading. That is why you need to choose one that matches your needs before venturing into CFD trading. Consider the following factors.

The Financial Conduct Authority (FCA) has set stringent regulations that CFD brokers should comply with. Most of these regulations favour traders and protect their funds. This means that a broker regulated by the FCA should be your choice.

You can trade CFDs on assets such as forex, stocks, and more. However, some brokers have limited assets or do not offer them at all. Therefore, choose a broker with market assets that complement your needs.

CFD trading apps should have trading platforms that keep you engaged. They should also allow access to learning materials, demo accounts, and market analysis tools.

Choosing an app with affordable fees will not limit your options, making you enjoy the experience.

We all need a reliable after-sale service that caters to our trading issues. So, make sure you confirm availability and reliability.

What is a Contract for Difference (CFD)?

When dealing with CFDs, it’s vital to comprehend that employing leverage can amplify your potential losses significantly. As a trader, a profound understanding of the associated risks is paramount. Note that between 70-80% of retail investors lose money with leveraged products — a clear indication that CFD trading may not be suitable for every investor.

To mitigate the risks associated with CFD leveraged products, always assess your risk tolerance and level of trading experience before venturing into this market. Moreover, be mindful of the UK’s regulatory framework, which imposes a 1:30 leverage cap on CFDs. This limitation aims to mitigate risk but can still result in substantial losses in the event of an unexpected downturn.

Contract for Difference (CFD) trading is how a trader speculates on the movements of prices for market assets. This means that you will not take ownership of the asset. Simply go long or go short on its price and manage your activities. You can decide to trade CFD on any broker that offers the market assets that interest you. Therefore, choosing a broker is a crucial part of CFD trading.

5 Quick Steps To Start Trading with a CFD App

Ready to dive into the world of CFD trading via mobile apps? Let’s take you through five quick steps to kickstart your CFD trading journey.

Visit Google Play or the App Store on your mobile device. Search for the CFD trading app you prefer and download it. We have listed some of the best options above to consider.

Launch the app and create your trading account. Provide your details, such as name, email address, and phone number. Most CFD trading apps will also require you to create a username and strong password for an added layer of security.

Complete the account verification process, which may include confirming your email and providing copies of identification documents. You may also be required to verify your location by sharing documents of your recent utility bill or bank statement.

Fund your trading account by selecting your preferred deposit method, such as bank transfers, credit/debit cards, or e-wallets. Deposit an amount you’re comfortable with or per your trading app’s minimum deposit requirement.

With your account verified and funded, you can begin trading. Explore the available CFD instruments, select the assets you want to trade, and execute your trades. Keep a close eye on your positions and adjust your strategies as necessary for increased potential.

Pros and Cons of Using a CFD Trading App

- Easy access and convenience for trading from your mobile device.

- Opportunity to diversify investments across different assets.

- Potential for higher returns with the use of leverage.

- Tools like stop-loss orders to limit potential losses.

- Access to valuable market data and analysis.

- Risk of significant losses due to leverage.

- Exposure to market volatility, which can lead to rapid changes in value.

- Costs involved, including spreads and financing charges.

- You don’t actually own the underlying assets.

FAQs

No. CFD trading is not illegal in the UK, as long as you’re trading with a regulated broker.

Yes. Since CFD trading is speculating on assets’ prices, day traders can use CFDs.

Yes. CFD trading is classified in the business venture category, so any gains from it are taxable.

Yes. If you apply leverage and do not use risk management tools, then the chances are that you can lose more than your investment.

With CFD, you do not own the assets that you trade. You only trade on the price difference for a short period. On the other hand, investing is buying an asset and holding it for more than a year before selling.

Conclusion

Our top picks for CFD trading apps in the UK offer a comprehensive toolkit to support your trading journey. From their intuitive interfaces to stringent security measures and responsive customer service, these apps have you covered. But, the key is to explore various options to find the CFD trading app that complements your trading style. Bear in mind that CFD trading, while potentially rewarding, carries risks, so it’s wise to trade sensibly and only with funds you can afford to lose.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

eToro can be much better than Avatrade for beginners, you know. It really opened the world of trading for me, and I still use it successfully. Recommend it for new traders.

I have used ICM and Capital.com but never tried eToro, though I have heard eToro is quite good for stocks...maybe I will try.

eToro isn’t strong in use plenty of indicators and a lot of technicals. eToro doesn't offer enough stock varieties as compared to other brokers.

eToro offers weekly webinars and a lot of educational content on its blog, so it is the BEST broker for beginners.

Hello everyone! I just noticed this website... I see this is a lot of comments about eToro broker

I just started to trade with them

I liked how the review authors included introductory tips on choosing an app that aligns with my trading style and emphasized the importance of risk management. I also appreciated the reviews of each app based on user feedback from various platforms such as Google Play and Trustpilot. This adds an extra layer of confidence that the provided ratings and reviews have real support from those who have already used these applications. Reading this article will help you better understand the current state of the CFD market in the UK and make decisions.

Thank you! I was looking for a CFD trading app and couldn’t decide which one to choose. After reading this guide, I’ve decided to go with Pepperstone.