Commodities trading has a rich history spanning decades. With the advent of online technology, numerous trading platforms have emerged. However, selecting a suitable platform amidst so many choices can be daunting for traders, especially newbies. To solve this problem, our TradingGuide experts have researched and compiled this comprehensive guide listing the best commodity trading platforms in the UK. We have also highlighted additional information, including understanding what is commodity trading, how to get started in this landscape, and more.

Essence

- Commodity trading involves the buying and selling of raw materials or primary goods such as metals, energy resources, agricultural products, and more, aiming to profit from price fluctuations.

- Opt for an FCA-regulated commodity broker to ensure compliance, security, and a trustworthy trading environment.

- Selecting a commodity trading platform that aligns with individual needs for maximum experience is crucial.

- User reviews on Google Play, the App Store, and Trustpilot offer valuable insights into platform reliability.

- The daily volatility of commodity markets provides opportunities for traders to capitalise on price movements, presenting potential profit-making opportunities.

- Trading commodities has become more accessible for individuals. This is because many commodity platforms offer quality advanced trading tools and mobile apps for efficient activity management.

- Factors like supply and demand dynamics, weather conditions, geopolitical events, and global economic trends influence commodity prices.

*Don’t invest unless you’re prepared to lose all the money you invest.

List of the Best Commodity Trading Brokers 2026

- IG – Best for MT4 Users

- FxPro – Reliable Option For Spread Betting

- Capital.com – Leading Option For Low-Budget Traders

- Pepperstone – Top Option for Beginners

- FP Markets – Commodity Broker For Professional Traders

- eToro – Top Social Trading Broker

- Plus500 – Great Commodity CFD Provider for Mobile Trading*

- Spreadex – Best For Futures Trading

- XTB – Top Option With an Excellent Support Service

*76% of CFD retail accounts lose money

How We Choose Commodity Brokers

At TradingGuide, we take our research process for selecting and recommending the best commodity trading brokers very seriously. Our methodology is thorough, leaving no stone unturned to ensure that our readers have access to the most reliable and reputable commodity options in the market.

We begin by compiling an extensive list of commodity brokers available. This involves thorough research and exploration to ensure we consider a wide range of options. We prioritise the safety and security of our readers’ investments. Therefore, we verify that the brokers we select are licensed and regulated by the Financial Conduct Authority (FCA).

Once we have identified regulated brokers, we sign up for trading accounts on their demo platforms. We conduct multiple tests through these accounts to evaluate each broker’s performance and features. We then compare the brokers’ performances based on our predefined criteria and specifications. Only those that meet our high standards are considered for inclusion in our recommendations list.

Our research process doesn’t stop with our proprietary tests. We also analyse user reviews and ratings on Google Play, the App Store, and Trustpilot. This helps us gain valuable insights into real users’ experiences and further helps our evaluation process. We then combine our own test results and user feedback analysis findings to formulate the final list of recommended commodity brokers above.

Compare Best Commodity Trading Brokers in the UK

In our research process, we test commodity brokers and compare their features to ensure we recommend the best options for your trading needs. Below, you will find a table comparing some of the leading brokers in the UK. Take a closer look at their features to make an informed decision for your commodities trading journey.

| Commodities Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple/Google Pay, Credit/Debit Cards, PayPal, Domestic/International Bank Transfer | Yes | Yes (up to £85,000) |

| FP Markets | ASIC, CySEC, FSCA, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trading App, MT5 Mobile Trader | Credit/Debit Cards, International/Domestic Bank Transfer, Neteller, Skrill, Fasapay, PayTrust88, Ngan Luong, PayPal, Bank of China Online Pay | Yes | Yes (up to €20,000 to EU clients) |

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit Cards, Bank Transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes | Yes (up to $250,000) |

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google/Apple Pay | Yes | Yes (up to £85,000) |

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank Transfer, Neteller, Apple/Google Pay | No | Yes (up to £85,000) |

| XTB | FCA, FSC, CySEC | 24/5 | xStation 5, xStation Mobile | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal | Yes | Yes (up to £85,000) |

Brief Overview of Our Recommended Commodity Brokers’ Fees and Assets

As a commodity trader, choosing a broker with features that align with your trading needs is essential. Brokers’ fees and featured assets are among the elements to consider in your choices. Below, we have prepared tables showing these elements for informed choices.

Fees

| Commodities Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| IG Markets | From 0.1 points | £0 | Free | None |

| FxPro | From 0.0 pips | £100 | Free | £15 one-off maintenance fee |

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| FP Markets | From 0.0 pips | £100 | Free | None |

| eToro | From 2 pips | £50 | £5 withdrawal | £10 monthly |

| Plus500 | From 0.0 pips | $100 | Free | $10 monthly |

| Spreadex | From 0.6 pips | £0 | Free | None |

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

Assets

| Commodities Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| IG Markets | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | No | No |

| Capital.com | Yes | Yes | Yes | Yes | No |

| Pepperstone | Yes | Yes | Yes | Yes | No |

| FP Markets | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | No |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Commodity Trading Platforms

As experienced traders in this field, we conducted multiple tests on hundreds of commodity brokers in the UK. Below, we share our opinion and overview of these brokers based on our hands-on experience. We aim to give you accurate information, ensuring you make the best choice that aligns with your commodity trading requirements.

1. IG – Best for MT4 Users

If you prefer trading commodities through MT4, IG is one of the strongest choices in the UK. From our experience, the broker offers a wide, flexible set of commodity markets, covering 35+ assets across metals, energy, and agricultural products. You can trade commodity spot or futures, and the spreads are among the most competitive, starting at 2.8 points on Brent Crude and 0.3 points on gold.

What stands out for MT4 users is how stable and fast IG’s execution feels when trading short-term opportunities. MT4 connects smoothly to IG’s pricing, letting you place orders directly from charts, use EAs, apply custom indicators, and monitor live price movements without delays. If you want more advanced charting, you can also switch between TradingView, ProRealTime, the IG web platform, or the mobile app. There is also the L2 Dealer platform, but tailored for shares and forex CFDs.

IG’s range of trading styles adds another layer of flexibility. You can spread bet tax-free on commodity prices, trade CFDs with commission-free access on commodities, or invest in commodity-linked shares and ETCs through a Stocks and Shares ISA or a SIPP. On top of that, the broker lists additional asset classes, including forex, IPOs, indices, ETFs, futures, and more, for portfolio diversification.

68% of retail investor accounts lose money when trading CFDs with this provider.

- Excellent MT4 integration with fast trade execution and EA support

- 35+ commodities across various sectors

- Low spreads from 0.3 on gold and 2.8 on Brent Crude

- Multiple platforms, including MT4, TradingView, ProRealTime, IG web and mobile

- Spread betting, CFDs, and share dealing on commodities are all supported

- There is currently no access to MT5 platform for UK clients

- Beginners may find the number of platforms overwhelming

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | None |

| Advanced graphs (ProRealTime) | £30 per months |

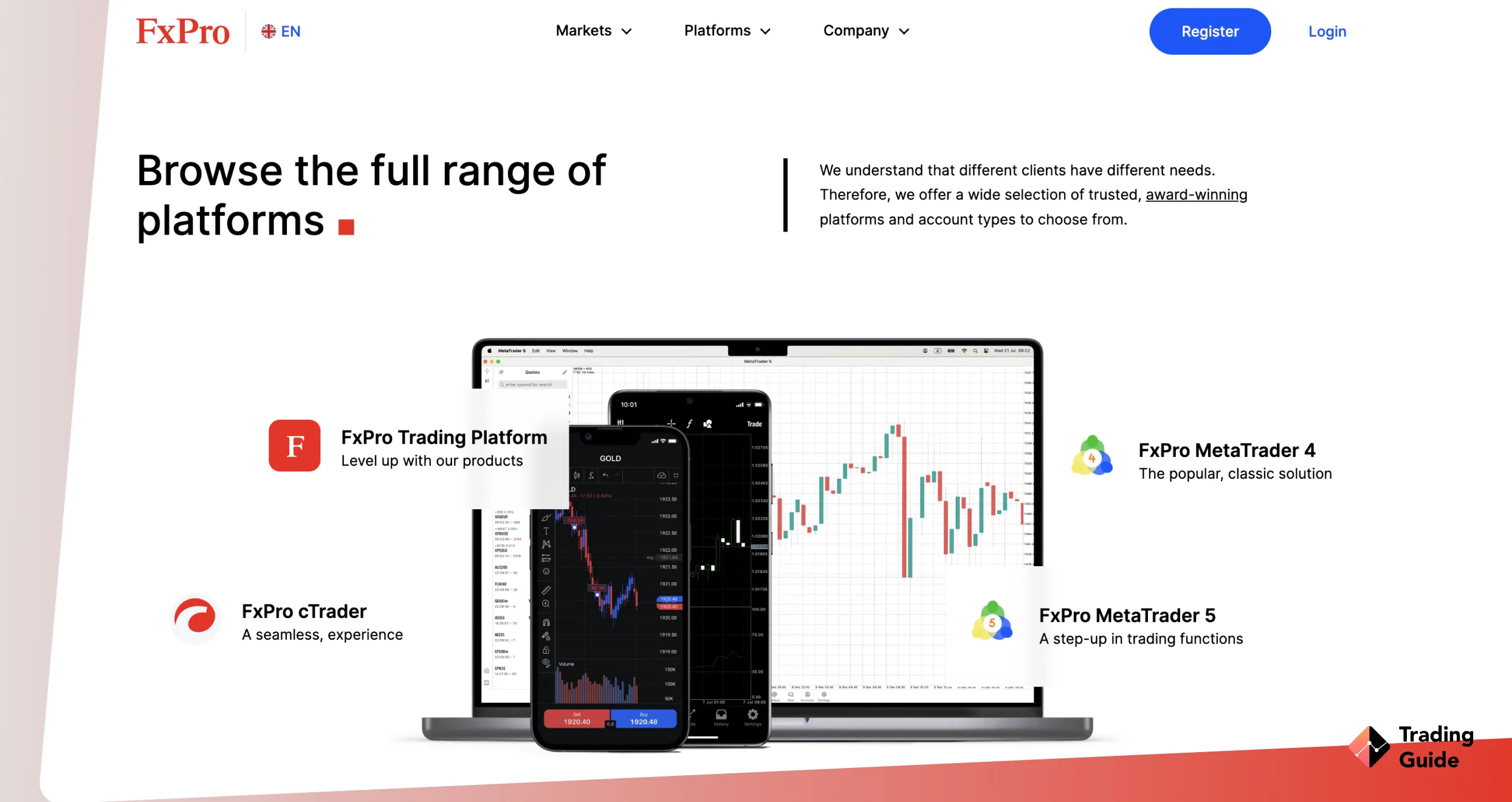

2. FxPro – Reliable Option For Spread Betting

Commodity trading is skyrocketing in the UK, and FxPro attracts several traders with a host of options. While testing it, we traded various commodity options on the platform, including gold, silver, platinum, aluminium, zinc, and more. Commodity trading fees on FxPro are also low, and we can confidently recommend the broker to beginners and low-budget traders. Besides a basket of commodities, FxPro lists an additional 2,100+ CFD and spread bets assets, including shares, forex, indices, and more, providing traders with a diverse range of markets.

To get started with FxPro, you need to make a minimum deposit of £100. With such a low initial deposit requirement, FxPro ensures accessibility for all types of traders interested in CFD trading and spread betting on commodities. The competitive spreads, automated trading options, and reliable support service contribute to the overall appeal of FxPro as a top commodity broker.

- £100 minimum deposit requirement, which we believe is among the industry’s lowest

- Free deposits and withdrawals

- Multiple trading platforms to choose from

- Reliable and responsive support service via phone, email, and live chat

- You can only trade gold as CFD or spread bets

- Support service operates on weekdays only

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

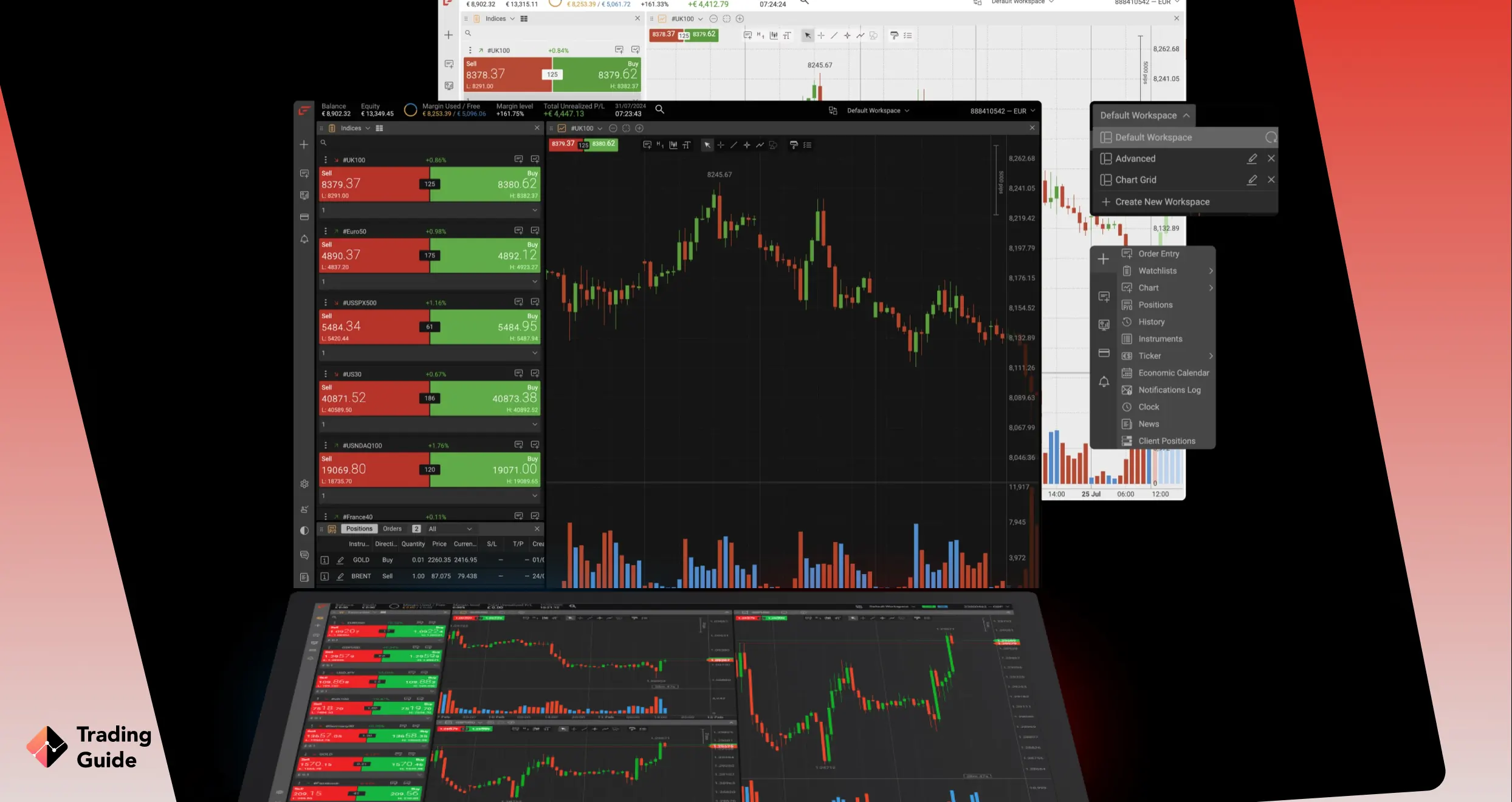

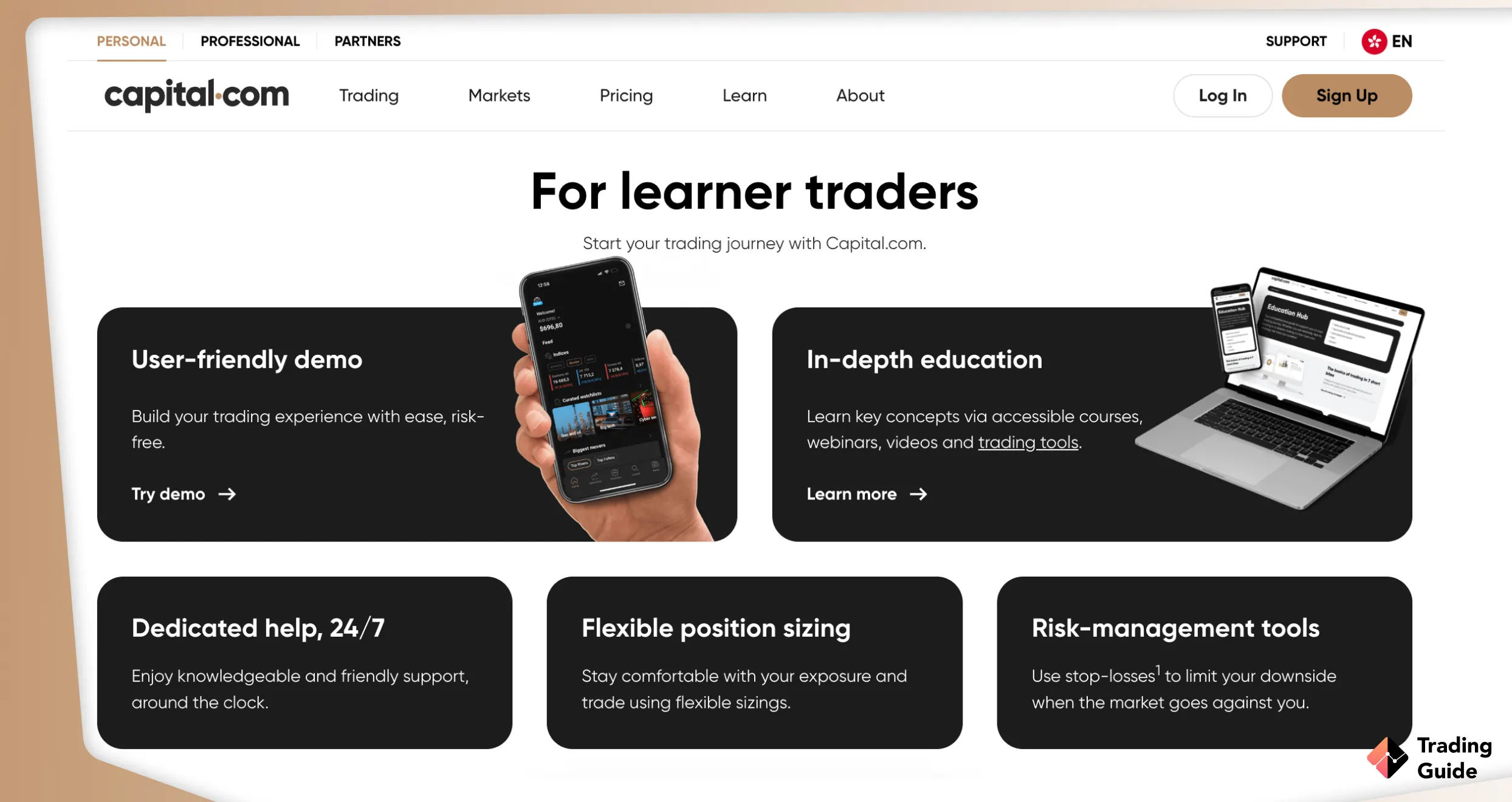

3. Capital.com – Leading Option For Low-Budget Traders

If you are looking to get into commodities trading without needing a large account balance, Capital.com is one of the most approachable platforms we’ve tested. The £20 minimum deposit is far lower than many rivals. Plus, its free deposits and withdrawals ensure you don’t lose money on the basics before you’ve even placed a trade.

In terms of markets, the coverage is broad. You can trade over 80 commodities like gold, silver, oil, and agricultural products, all through CFDs. They trade at low spreads that start from 0.0 pips with zero commission. Other assets we discovered include shares, forex, indices and cryptocurrencies.

The platform itself is flexible, and we like the fact that it provides a 1X platform for leverage-free trading. When it comes to advanced platforms, Capital.com allows you to link your account to MT4 and TradingView for advanced charting and analysis. Its 24/7 support service is worth mentioning. We got prompt responses and relevant solutions when we contacted the team via email, phone, and live chat.

- Low minimum deposit requirement for UK clients

- Wide commodity range, including energies, metals, and agriculture

- Spreads from 0.0 pips, no commissions

- Supports MT4, TradingView, app, and web platforms

- Strong education and risk-management features

- No copy trading feature

- You can only trade commodities as CFDs and spread betting. No physical purchases

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

4. Pepperstone – Top Option for Beginners

Novice traders need a trading platform that can help them develop their trading skills gradually while giving them a shot at making profits. From our experience with Pepperstone, we believe it is a suitable option for beginner commodity traders in the UK due to its user-friendly platform. We identified over 1,200 assets for trading on the platform, including commodities such as gold, silver, Spot Crude, Spot Brent, natural gas, and more. All these commodities are traded as CFDs on a platform that is intuitively designed.

When it comes to trading, Pepperstone charges one of the lowest spreads in the industry. We believe this is perfect for beginners as it allows them to gain enough experience before they are ready to invest a larger amount of capital. Pepperstone’s customer support is also reliable and responsive. Therefore, anytime a trader faces any issue, they can quickly reach out to them and get it resolved.

- Free transactions.

- Low spreads.

- Excellent educational material to learn more about commodities trading.

- No minimum deposit requirement for UK clients

- Limited product portfolio.

- Customer service is only available five days a week.

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

Risk warning: 61% of retail CFD accounts lose money.

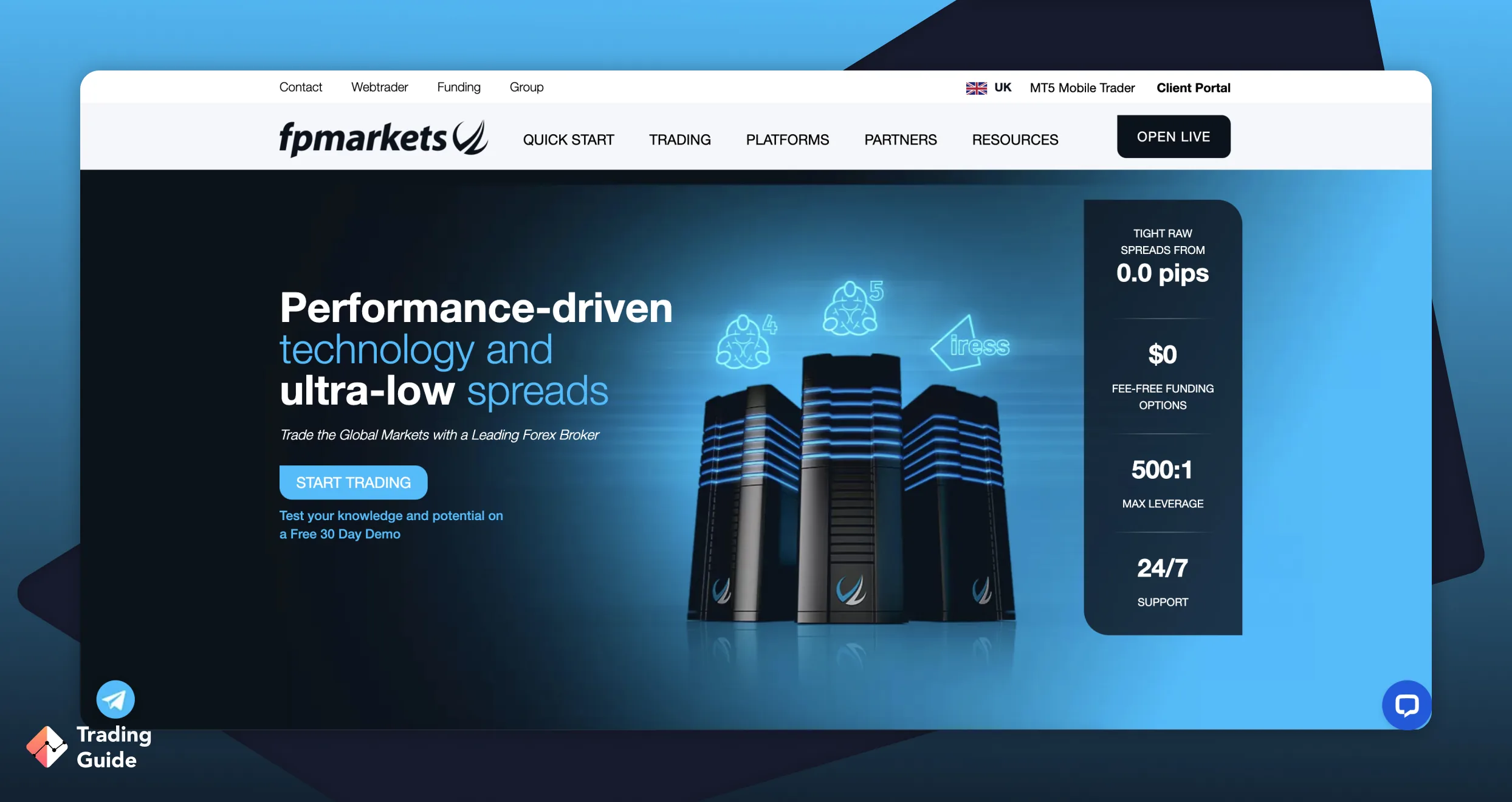

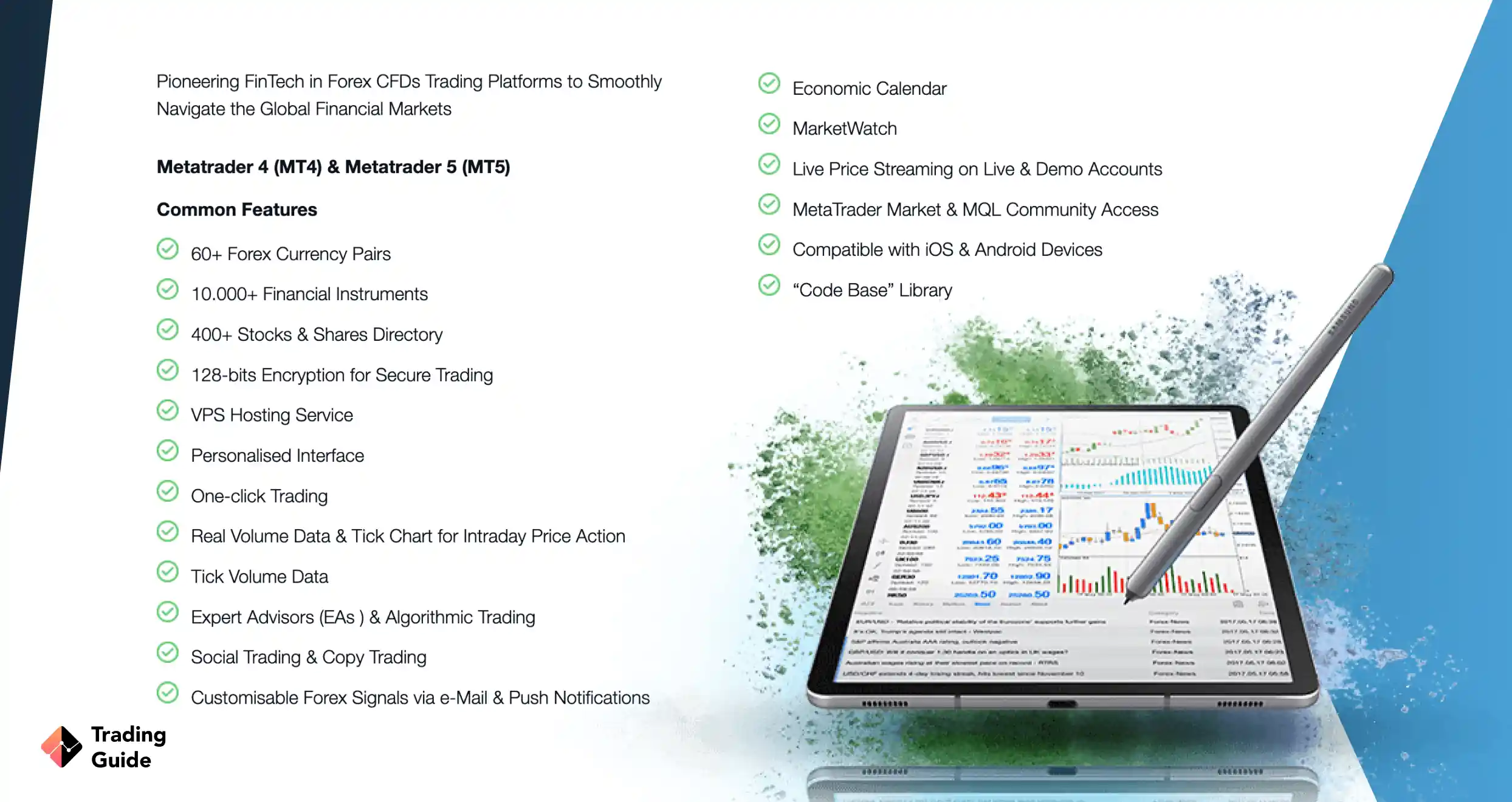

5. FP Markets – Commodity Broker For Professional Traders

From our analysis, FP Markets stands out as an excellent choice for experienced traders in the UK due to its superior technology. You can trade multiple commodity futures on the platform, including crude oil, gold, silver, natural gas, etc. Regarding the commodity market analysis tools, we like the broker’s advanced resources on its superior MT4, MT5, and Iress platforms. You simply need to deposit at least £100 to get started. Remember, deposits at FP Markets are free, and you can transact using various payment methods, including e-wallets, bank transfers, and debit/credit cards.

While trading at FP Markets, we explored a fast, secure, and reliable commodity trading environment. The broker uses top-of-the-line security measures, including SSL encryption, to protect traders’ personal and financial information. In addition, FP Markets provides 24/7 customer support which you can access via phone, email, and live chat. This ensures that professional and active traders in the UK have access to expert assistance whenever needed. Lastly, commodities trading fees on the platform are low, and you get to enjoy leverage of up to 1:500.

- Advanced resources for maximum experience

- Low commodity trading fees from as low as 0.0 pips

- Fast trade execution speed

- Additional asset offerings, including forex, stocks, cryptocurrencies, bonds, and more for diversification purposes

- Zero transaction fees

- Can only trade commodities as CFDs

- Commodity product offerings could be improved

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

6. eToro – Top Social Trading Broker

After testing and comparing eToro with other brokers, we find it suitable for users who are primarily seeking social trading features in a commodity broker. Overall, eToro lists 44 commodities, including popular commodities like gold, silver, crude oil, copper, and more. The broker is user-friendly for beginners and features a £100,000 virtually funded demo account to test it with. On the eToro platform, you will also enjoy quality learning materials through which you can quickly boost your skill level using your desktop or mobile device.

When it comes to social trading, eToro’s award-winning CopyTrader platform stands out among its peers. If you are a beginner or commodity trader with limited time for conducting research, we advise you to try this social trading platform, which will help you learn various trading ideas from like-minded traders. You can also follow the most successful experienced traders on the platform, easily copy their trades and earn profits when they do.

- Over 40 tradable commodities to trade

- A user-friendly and customisable platform

- Low minimum deposit requirement

- Additional securities for portfolio diversification

- High commodity trading fee

- Charges withdrawal fee

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

7. Plus500 – Great Commodity CFD Provider for Mobile Trading

*Illustrative prices

Commodity traders who are always on the move need a reliable trading app that executes orders seamlessly on mobile devices. While it has numerous positive reviews from users, we tested it and agree it is one of the best trading apps. Plus500 app has an intuitive design platform that is user-friendly and customisable. What’s more, the platform doesn’t charge any fee when you trade commodities. This means that Plus500’s profits are mainly generated from spreads, which are also among the lowest in the industry.

Besides low spreads on commodity CFDs, you will incur additional charges, including overnight funding, a currency conversion fee, a guaranteed stop order fee, an inactivity fee, and more. Another notable feature of Plus500 is that it has excellent customer service that is available 24/7. So, you can still trade any time of the day you see fit and be confident that any issue that crops up during trading will be looked into within a short period.

*Investment Trends 2022

- £100 minimum deposit requirement, which ranges among the lowest.

- 24/7 customer service.

- Zero commission.

- No transaction charges.

- Limited product portfolio.

- Limited educational and research materials.

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

8. Spreadex – Best For Futures Trading

Spreadex is unquestionably one of the best choices for traders seeking a reliable and versatile platform to engage in commodity futures trading in the UK. With its extensive history, Spreadex has cultivated a reputation for excellence in facilitating commodity futures trading. We noticed that the broker offers a comprehensive range of commodity futures contracts, encompassing precious metals like gold and silver, energy commodities such as crude oil and natural gas, and more. We believe this extensive offering ensures that investors have the tools they need to manage diversified commodity portfolios and capitalise on price movements in these essential markets.

Trading commodity futures at Spreadex was streamlined, considering its user-friendly platform. We explored valuable tools and resources on its web and TradingView platforms. On top of that, Spreadex’s competitive pricing and low spreads enhance the overall appeal of the platform. This ensures traders can engage in cost-effective commodity futures trading. Another element that made us like this broker is its dedicated and reliable support service for assistance.

- Low spreads starting from 0.4 points on Gold

- Deal in spread betting or CFDs

- No minimum deposit requirement

- Additional 10,000+ securities for portfolio diversification

- No demo account

- No 24/7 support service

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

9. XTB – Top Option With an Excellent Support Service

While evaluating XTB, we focused on gauging the responsiveness of its support team, a key concern for every commodity trader. Through our interactions with XTB’s support team, we discovered dedicated professionals who skillfully provided relevant solutions to our inquiries. Besides being responsive and friendly, the team conducts follow-ups to ensure users’ issues have been resolved and they are satisfied with their trading experience.

XTB platform offers a wealth of learning resources, comprising guides, articles, webinars, and more. XTB also gives market access to over 20 commodities. Other asset classes we explored include forex, shares, commodity indices, and more, which can help traders to easily diversify their portfolios. Furthermore, we like its competitive interest rates on uninvested funds, allowing traders to potentially earn up to 5% for GBP deposits. For those with USD and EUR base currencies, the rates go up to 2.0%. The broker’s compatibility across both desktop and mobile devices enhances accessibility and flexibility for traders seeking a comprehensive commodity trading experience.

- A reliable and responsive support team via email, phone, and live chat

- Compatible with desktop and mobile devices

- Plenty of learning and research materials

- Highly secured and regulated by the FCA

- Offers traders an opportunity to earn interest rates on uninvested funds

- Commodity assets are available for CFD trading only

- Support service operates five days a week, thus inconveniencing clients trading 24/7

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

What do Other Traders Say?

As mentioned earlier, we visit Google Play, the App Store, and Trustpilot to sample user ratings and comments to ensure we remain unbiased in our research process. We share a few of the comments we gathered so you can also get insight into other traders’ experiences and make a suitable choice.

FxPro

FxPro is lauded for its competitive pricing and robust trading infrastructure. Traders commend the broker’s educational resources and professional customer support.

-

“I just love this app, everything is clear, it’s perfect for all types of investor also for long term invest.” – Dibakar Barua

-

“While providing the services, they did it quickly and proactively. The provides a wide range of functions that are useful while generating monthly and yearly returns. The dashboard is designed to be easy to use and understand” – Nitesh Saini

Pepperstone

Pepperstone is praised for its transparent pricing and excellent customer service. Traders value the platform’s advanced trading features and seamless user experience.

-

“Andrea ? Was a fantastic customer service consultant to solve my issue with in a minute that other consultant was struggling to find out. 5 Star for Andrea ?” – Sajid

-

“I’ve used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features.” – Jana from Gold Coast

FP Markets

Traders speak highly of FP Markets’ tight spreads and fast execution speeds. The broker’s robust trading tools and educational materials also receive positive feedback.

-

“Customer support is really marvelous, my problem was taken seriously and solved within no time. Thanks to the team for their efforts. Great!” – Tariq

-

“The app is user friendly. Even for beginners, it is easy to use, and the customer service live chat is quick in replying.” – Wayne K

eToro

Traders highlight eToro’s innovative social trading features and user-friendly interface. The platform’s copy trading functionality and diverse asset selection are particularly well-received.

-

“I just love this app, everything is clear, it’s perfect for all types of investor also for long term invest.” – Dibakar Barua

-

“While providing the services, they did it quickly and proactively. The provides a wide range of functions that are useful while generating monthly and yearly returns. The dashboard is designed to be easy to use and understand” – Nitesh Saini

-

“Etoro is a great place to trade with personalised support. I’m lucky to have Callum as account manager who is always a very useful point of contact which is a key part of my trading experience. Also super chuffed with the occasional VIP experiences!” – Francois Jardin

Plus500

Many traders praise Plus500 for its user-friendly and customisable platform. Some appreciated its trading app’s efficiency, while others love the responsiveness of its support service.

-

“After many years of trading on this platform I had the chance to learn and improve my trading skills. It’s the best app and easy to use. I’ve tried other platforms but this one it’s far better ?” – Ludovic Gyorfi

-

“Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here.” – ramzyki

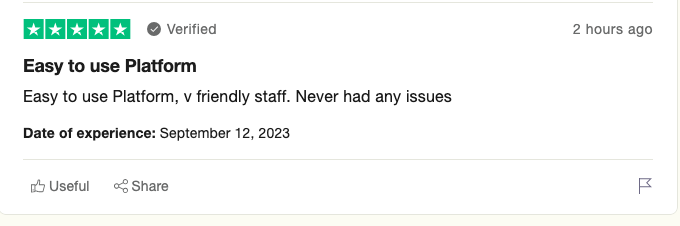

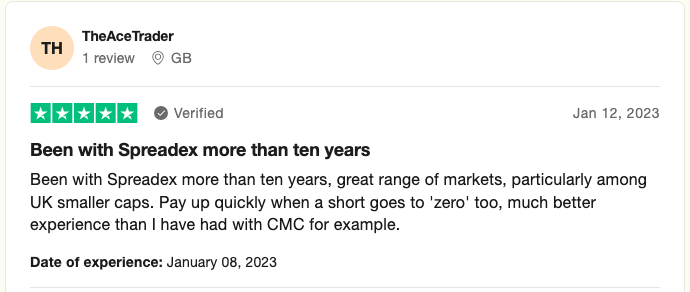

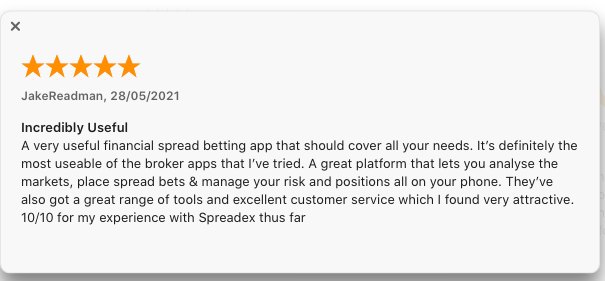

Spreadex

Spreadex receives an acknowledgement for its diverse range of markets and flexible trading options. Traders appreciate the platform’s simplicity and efficient customer support.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

-

“A very useful financial spread betting app that should cover all your needs. It’s definitely the most useable of the broker apps that I’ve tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. They’ve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far” – JakeReadman

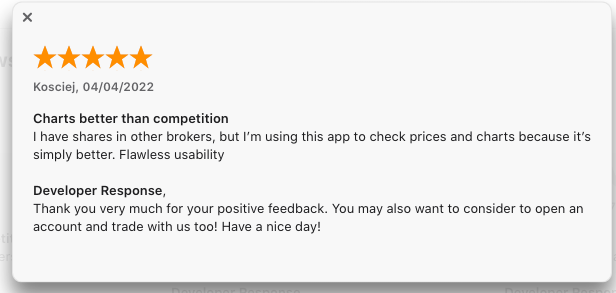

XTB

Traders commend XTB for its extensive and quality educational resources. The platform’s intuitive interface and reliable execution are also highlighted as notable strengths.

-

“I have shares in other brokers, but I’m using this app to check prices and charts because it’s simply better. Flawless usability” – Kosciej

-

“Very good app. Customer service is welcoming. Lots of information for new traders available for free. Feel very valued and accepted as a beginner. Best app I have found after trying 10+ others.” – Thomas Ashley

The Ultimate Guide to Commodity Trading

Besides testing, comparing, and recommending commodity trading brokers or platforms in the UK, we aim to educate our readers regarding what commodity trading is and how to manoeuvre the market. We have prepared the following sections to educate you more on commodity trading and ensure you get started on a good note.

What is Commodities Trading?

Commodity trading is the buying and selling of raw materials or primary products like agricultural goods, energy resources, and metals. These commodities serve as essential components of various industries worldwide. For instance, oil is crucial for transportation and manufacturing, while gold is sought after for its value and use in jewellery and electronics.

In commodity trading, investors and traders speculate on the future price movements of these raw materials. They aim to profit from fluctuations in supply and demand, geopolitical events, and macroeconomic factors. For example, a trader might anticipate a rise in the oil commodity prices due to geopolitical tensions or increased demand during winter.

Commodity trading can be conducted through various financial instruments, including futures contracts, options, exchange-traded funds (ETFs), and physical trading. Each instrument offers its own key advantages and risks, catering to different trading strategies and preferences.

Is Commodities Trading Risky?

Trading commodities carries risks such as market volatility, leveraged positions, and the potential for substantial losses. To manage these risks, diversify your investments, use stop-loss and take-profit orders, and trade with funds you can afford to lose. Additionally, stay informed about market factors, adhere to a well-defined trading plan, and guard against emotional decision-making.

It is also crucial to comply with commodity market regulations and be cautious of counterparty risk. Regularly reassessing your risk tolerance and trading strategies will help you trade responsibly and maximise profitability. Simply put, commodity trading is all about whether you can afford to take the high risk in the financial space.

Trading commodities in the UK is risky, much like trading or investing in any other asset class. Commodities are known for being highly volatile. The commodity market exhibits twice the volatility of stocks and four times that of bonds. This volatility magnifies the risk of losing your money, making commodities trading daunting for some.

Low liquidity further contributes to the risk factor in commodities trading. Unlike stocks, bonds, and forex, many commodities on futures exchanges witness lower trading volume, impacting their liquidity and stability.

Moreover, commodities are susceptible to geopolitical events, such as wars and conflicts, which disrupt supply chains, causing scarcity and price spikes. For instance, the Russia-Ukraine war disrupted wheat exports, triggering a surge in wheat prices globally.

Natural disasters also pose significant risks to commodity markets. Consider the impact of hurricanes on oil production facilities in the Gulf of Mexico, leading to disruptions in oil supply and subsequent price fluctuations.

Another example is the effect of droughts on agricultural commodities like corn and soybeans, affecting crop yields and driving commodity prices higher. Such unforeseen events highlight the inherent risks associated with commodities trading, necessitating thorough risk management strategies for traders. Remember, over 76% of commodity trading accounts lose money when trading. Therefore, always strategise accordingly before opening a position.

How to Choose the Best Commodity Trading Broker in the UK

Whether you are conducting your own research or choosing a commodity trading UK broker from our recommendations list, there are various elements to consider before deciding which platform is best for you. Below, we shed light on some of those factors so you can identify a broker that can enhance your experience and potential to earn profits in commodity trading.

First and foremost, ensure that the commodity broker UK you are considering is licensed and regulated by well-respected authorities such as the UK’s Financial Conduct Authority (FCA). Regulatory oversight assures fair practices, security of funds, and adherence to industry standards. The best commodity trading broker should also be highly encrypted with added security measures such as two-factor authentication for increased safety.

The best broker should offer your preferred commodities, allowing you to plan your trading activities with ease. It’s also beneficial to choose a broker that includes additional asset classes like stocks, forex, cryptocurrencies, and more. This way, you can easily diversify your portfolio and limit the risks that come with trading a single asset.

Assess the broker’s trading platform for its functionality, ease of use, and reliability. A user-friendly platform with advanced trading tools and features can enhance your trading efficiency and experience. The platform should also host quality learning resources to boost your skill level as you become more acquainted with trading.

Prompt and efficient customer support is essential for resolving queries and addressing concerns. The best broker for commodity trading should be accessible through multiple communication channels such as live chat, email, and phone support, ensuring assistance is readily available when needed. They should also have a very responsive team that provides relevant solutions to any concerns or challenges.

Consider the broker’s fee structure, including commission fees, spreads, and any additional charges. Opt for brokers offering competitive market access pricing while maintaining transparency in fee disclosure to avoid unexpected costs. You should also confirm the non-trading charges, such as minimum deposit requirement, inactivity fees, transaction costs, and more.

A demo account provides a risk-free environment to test the broker’s platform and trading services before committing real funds. Ensure the broker offers a demo account with access to real-time market data and features simulating live trading conditions.

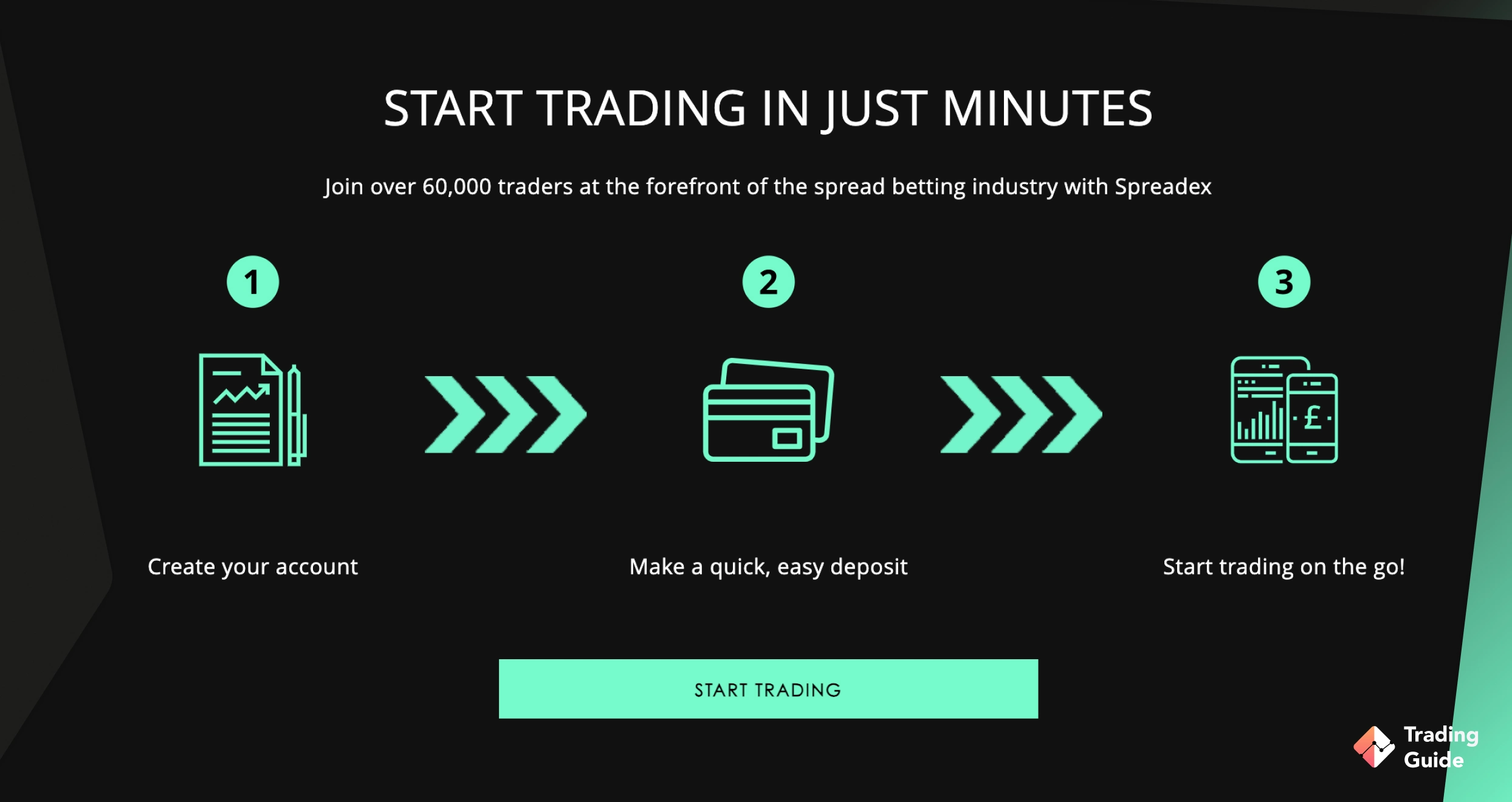

How To Register an Account with a Commodity Broker

As a beginner, you must be wondering how to register an account with a commodity broker with streamlined market access. Before we guide you through the process, ensure you are fully informed about the commodity asset you plan to trade. Also, identify a broker from our list above and install its trading app on your mobile device to effectively manage your positions while on the move. Then, proceed with the procedures below to get started.

With your chosen broker, visit its website to begin the account registration procedure. If you have selected from our list, click on any of the links on this page for quick access. Ensure you understand the broker’s terms and conditions before you click the register form. This is to avoid future inconveniences once you are fully invested.

Once you’ve chosen a broker, visit their website and locate the option to open an account. You’ll typically be required to fill out an online application form with personal details such as your name, address, contact information, and financial information.

To comply with regulatory requirements, brokers often ask for documents to verify your identity and address. This may include a copy of your passport or driver’s licence for identification purposes and a recent utility bill or bank statement as proof of address. Upload these documents securely through the broker’s online portal.

After verifying your identity, you’ll need to fund your trading account. Most brokers offer multiple funding options, including bank transfers, credit/debit cards, and electronic payment methods. Choose the most convenient option for you and follow the instructions provided to deposit funds into your account.

Once your account has been funded, you’re ready to start trading commodities. Log in to your trading platform using the credentials provided by the broker and familiarise yourself with the platform’s features and tools. You can then place trades, monitor your positions, and manage your portfolio directly from the platform. For those looking for CFD trading alternatives, consider exploring commodity ventures via the spread betting method, which comes with no capital gains tax.

Different Types of Commodities

Commodities are classified into various categories based on their characteristics and usage in the market. Understanding these different types of commodities is essential for diversifying investment portfolios and navigating the complexities of the commodities market. Here’s an overview of some common types of commodities.

- Agricultural commodities – Agricultural commodities include a wide range of soft commodities grown on farms or cultivated in agriculture. These can include rice, wheat, maize, oil seeds such as soy and groundnut, and fruits and vegetables. Agricultural commodity prices are heavily influenced by factors like weather patterns, political conditions, and consumer demand.

- Energy – Energy commodities are essential hard commodities that are crucial in modern economies. This category includes crude oil, natural gas, coal, and electricity. Crude oil is the lifeblood of many industries, powering transportation, manufacturing, and other sectors. Natural gas is a vital source of energy for heating and electricity generation, while coal remains a significant contributor to global energy production.

- Metals – Metals are indispensable hard commodities that are applicable to various industries, including construction, transportation, and technology. Examples of metal commodities are gold, silver, and platinum, which are valued for their rarity. There are also industrial metals like copper, aluminium, and zinc, used in manufacturing and infrastructure development.

- Livestock and Meat – Livestock and meat commodities are essential to many people’s diets worldwide. This category includes beef, pork, poultry, and other meat products. Livestock and meat markets are sensitive to factors such as weather patterns, disease outbreaks (e.g., avian flu, swine fever), and global economic conditions.

Commodities vs Stocks and Shares

Commodities and stocks (or shares) represent distinct investment options with unique characteristics. Commodities are physical goods like oil, gold, and wheat, while stocks denote ownership in publicly traded companies, which in the UK are listed on the London Stock Exchange. One notable difference is that commodities often serve as a hedge against inflation, while stocks are viewed as investments in a company’s growth potential.

Commodities tend to be more volatile than stocks due to rapid price fluctuations driven by changes in supply and demand and geopolitical events. On the other hand, stocks offer lower volatility and can yield higher returns over the long term in low-inflation environments. Your choice on whether to trade commodities or invest in stocks should align with your investment goals, risk tolerance, and market understanding. Remember, many retail investor accounts lose money in the financial space so be wise with your decisions.

Pros And Cons Of Commodities Trading

Commodity trading has a lot of benefits, but the activity also comes with a few pitfalls. Here are the major pros and cons of trading commodities in the UK financial landscape.

Pros

- Diversification – Trading commodities allows you to diversify your portfolio across other asset classes, thus mitigating the high risk of losing your money.

- Inflation Hedge – Certain commodities, like gold, act as hedges against inflation, preserving purchasing power.

- Potential for High Returns – The commodities markets can be volatile, thus presenting opportunities for significant profits.

- Global Market Exposure – Trading commodities provides exposure to global economic trends and geopolitical events.

- Tangible Assets – Commodities represent physical assets, thus providing a sense of security for investors.

Cons

- Volatility – While volatility can present potentially profitable opportunities, it can also bring about losses due to sudden price swings.

- Lack of Income – Commodities do not generate income like dividend-paying stocks, relying primarily on price appreciation for returns.

- Limited Regulatory Oversight – Some commodities markets may have less regulatory oversight, potentially increasing the risk of fraud and manipulation.

FAQs

A commodity broker executes trade orders to either buy or sell commodities on behalf of traders at a specific fee, commonly known as commission or spread. So if you have been wondering whether you can trade commodities without a broker, it will be challenging for you to do so. The UK Financial Conduct Authority (FCA) is strict when it comes to securing traders’ funds and offering the best trading conditions. That is why it is essential that you only trade using FCA regulated broker. Besides, you will have the opportunity of taking legal action against a broker that goes against your agreement when necessary. Luckily, this page recommends the best commodities broker, so feel free to choose one meeting your needs.

Like other financial assets, commodities can be bought from a commodity’s market. However, you can only do so in the UK through a broker that is regulated by the Financial Conduct Authority (FCA). To purchase your preferred commodity, ensure you fully understand its market and have conducted extensive research and market analysis. Then, identify the best commodity broker from our list above based on your trading requirements. If you are a newbie, sign up for a demo account and explore how the broker works. You can then open a live account by providing the required information until your trading account if fully verified to start trading.

Yes. You can make a lot of money trading commodities if you are highly knowledgeable and competent. So, keep improving your experience, and before you know it, you will be a successful trader.In addition, find the best broker that offers adequate resources for skills and strategy development. Remember, your first try can bring about losses, so do not give up but take the losses as a learning experience. We advise that you start commodities trading with little amounts of money since you do not want to end up losing most of your capital before giving the activity your all.

Yes. Commodity assets, especially those that can be traded on margin, are highly risky. However, as much as they are risky and can make you lose a lot of money, they can also earn you a substantial amount of profits. That is why it is important that you conduct the necessary market analysis and come up with a solid strategy. Also, commodities brokers host risk management control tools to use and minimize your chances of losing a lot of money in case of a loss. Simply put, have a critical eye when choosing a broker and the commodity you want to trade to maximize your potential.

Futures contracts are one way to hold commodities long-term. You can also invest in commodities directly or as EFTs and mutual funds. To do so, you must find a reliable broker with excellent reputation. In this guide above, we list the most trusted brokers you can invest commodities with. All you have to do is make a choice while considering your trading needs.

Yes. You can start commodities trading with as little as ᆪ10. However, remember that you will not earn as much profits as you would trading with ᆪ100. Therefore, if you are a newbie who is sceptical of putting up a lot of funds, ensure you start investing with small amounts of money and increase slowly as you get familiar with how commodities trading work. The good news is that most brokers offer learning resources and demo accounts. Therefore, becoming skillful will only depend on how badly you want to.

Conclusion

Ultimately, having the best commodity trading platform or broker in the UK depends on your personal trading requirements and risk tolerance. With our guidance above, we hope you can make the best decision and kickstart your commodity trading journey on a good note. Simply start by signing up for a broker’s demo account, as it is a risk-free environment to learn how commodity trading works before investing any real money. Most importantly, do not forget to apply risk management controls while trading and spread your capital across various asset classes. This approach ensures you can mitigate the risk of losing money on a single asset.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I traded with Pepperstone for 10 months. Results were amazing: I increased the initial deposit around 50 times.

This informative guide breaks down complex concepts into easy-to-understand parts. Now, I confidently trade gold futures and oil contracts, diversifying my portfolio. The guide's insights on choosing a commodity broker were invaluable. Following its advice, I registered with an FCA-regulated broker hassle-free. The step-by-step account registration guide was a lifesaver! It's like having a knowledgeable friend guiding you. If you're new to commodities trading, this guide is a must-read. Kudos to the creators for simplifying a potentially daunting topic!

This article about commodity markets is really helpful! It covers everything about brokers and managing risks spot on! I recommend it, especially if you want to understand how to make money on commodities. I'm thrilled with materials like these!

Great list of brokers, but I'd recommend checking out AvaTrade as well. They offer a wide range of commodities, competitive spreads, and robust trading platforms like MT4/MT5.

Been trading commodities for about 3 years now and honestly, Pepperstone's low spreads have saved me tons of money compared to my old broker