ECN trading in the UK has rapidly emerged as a preferred method for traders seeking direct access to the financial markets with enhanced transparency and execution speed. This financial landscape is rich with options, offering a plethora of ECN brokers vying for your attention. Since identifying a suitable option can be daunting, we have prepared this guide to share the best ECN brokers in the UK today. Our primary goal is to inform our readers accordingly, ensuring they make the best decisions for their activities.

Essence

- ECN (Electronic Communication Network) trading in the UK provides direct access to liquidity providers, facilitating transparent and efficient trade execution.

- The best ECN forex broker should be licensed and regulated by the Financial Conduct Authority (FCA) to ensure fair practices and investor protection.

- Always prioritise your needs when choosing an ECN broker in the UK for maximum experience and potential.

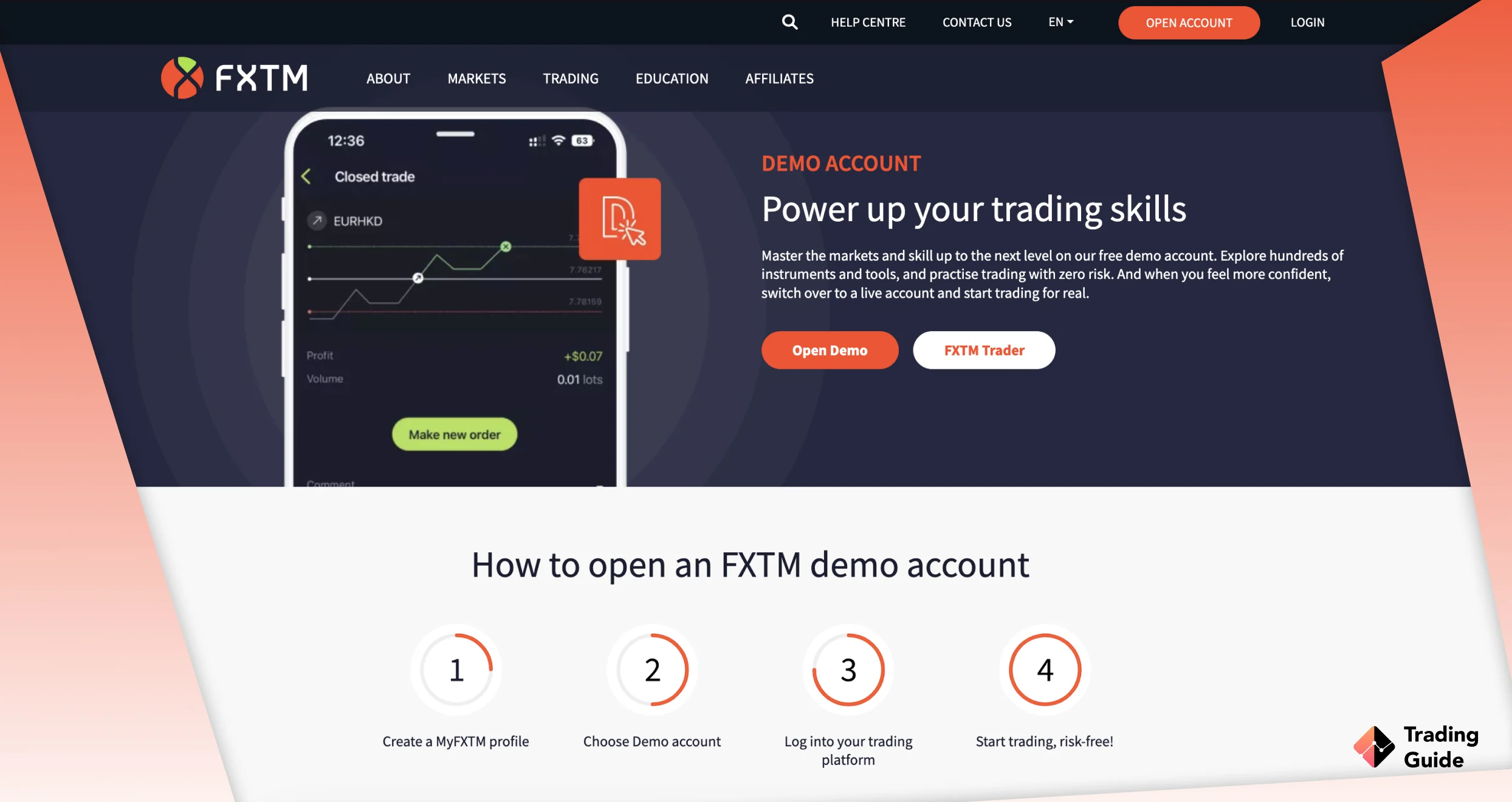

- Beginner ECN traders should opt for brokers’ demo accounts to test their performances and gauge their skill level risk-free.

- Consider implementing risk management controls such as setting stop-loss orders, diversifying your portfolio, and avoiding over-leveraging while trading ECN.

- At TradingGuide, we conduct thorough research before recommending the best ECN brokers in the UK.

List of the Best ECN Brokers in the UK 2026

- Pepperstone – Overall Best ECN Broker

- FxPro – Best ECN Broker for Beginners

- IC Markets – Best ECN Forex Broker in the UK

- FP Markets – Best ECN Broker for Advanced Traders

- HotForex – ECN Broker with the Lowest Spreads

- FXTM – Most Trusted ECN Broker in the UK

How We Choose ECN Brokers

Our team at TradingGuide comprises professional traders and researchers with decades of experience in this field. This means that our research process for selecting and recommending the best ECN brokers in the UK is thorough, as we leave no stone unturned. Rest assured that with us, you will find an option that not only fits your preferences but also maximises your experience and potential.

When choosing ECN brokers, we start by collecting as many options as possible, prioritising their regulatory status. We want to ensure all the brokers we recommend are FCA-regulated, thus guaranteeing your safety. Then, we sign up trading accounts to test the brokers’ performances and compare their features, including trade execution speed, assets available, fee structure, support service response rate, and more. From this procedure, we shortlist only those that meet our specific criteria.

To ensure we remain unbiased, we visit Google Play, the App Store, and Trustpilot to analyse user comments and ratings. The best element about comparing user testimonials is that you get to fully understand the brokers’ strengths and weaknesses from a user perspective, thus making the best decisions. We then compare our findings and test results to come up with our recommendations list above.

Compare Best ECN Brokers in the UK

As mentioned above, we test and compare as many ECN brokers UK as we can, considering various elements. Below, we have prepared a table highlighting some of these features we consider during our research. We hope it will help you gain enough insights and make the best choice for your trading requirements.

| Best ECN Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple Pay, Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer | Yes | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| IC Markets | FSA, CySEC, ASIC | 24/7 | MT5, MT4, WebTrader, cTrader, WebTrader, IC Social, Signal Start, ZuluTrade, TradingView | Bank transfer, Credit/debit cards, Paypal, Neteller, Skrill, UnionPay, Fasapay, Poli, Bpay, Rapidpay, Klarna | Yes | Yes (up to $1,000,000) |

| FP Markets | ASIC, CySEC, FSCA, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trading App, MT5 Mobile Trader | Credit/debit cards, International bank transfer, Domestic bank transfer, Neteller, Skrill, Fasapay, PayTrust88, Ngan Luong, PayPal, Bank of China Online Pay | Yes | Yes (up to €20,000 to EU clients) |

| HotForex | FCA, DFSA, FSCA, FSA, CMA, CySEC | 24/5 | MT4, MT5, HFM Platform | Bank transfer, Credit/debit cards, Skrill, Neteller, WebMoney, FasaPay, PayRedeem, Crypto, Trustly | Yes | Yes (up to EUR 5,000,000) |

| FXTM | FSC, FCA, CySEC | 24/5 | Mobile App, MT4, MT5 | Credit/Debit Cards, Bank Transfers, PayPal, Upi, Equity, Ghanian Local Transfer, Africa Local Solutions, M-Pesa, fasapay, TC Pay, GooglePay, GlobePay, Skrill, PayRedeem, PerfectMoney, Neteller | Yes | Yes (up to €20,000) |

Brief Overview of Our Recommended ECN Brokers’ Fees and Assets

As professionals in this field, we know the importance of trading with an affordable ECN broker that features your preferred assets. For this reason, we have prepared tables below showing some of the assets and applicable fees for our recommended ECN brokers in the UK. Feel free to compare them for the best choices aligning with your trading budget.

Fees

| Best ECN Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Pepperstone | From 0.0 pips | £0 | Free | None |

| FxPro | From 0.1 pips | £100 | Free | £15 one-off maintenance fee |

| IC Markets | From 0.0 pips | £200 | Free | None |

| FP Markets | From 0.0 pips | £100 | Free | None |

| HotForex | From 0.1 pips | £0 | Free | £5 monthly |

| FXTM | From 0.0 pips | £200 | Free | £5 monthly |

Assets

| Best ECN Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | No |

| FxPro | Yes | Yes | Yes | No | No |

| IC Markets | Yes | Yes | Yes | No | No |

| FP Markets | Yes | Yes | Yes | Yes | No |

| HotForex | Yes | Yes | Yes | Yes | No |

| FXTM | Yes | Yes | Yes | No | No |

Our Opinion & Overview of the Best ECN Trading Platforms

Below is our honest opinion and overview of the best ECN trading platforms in the UK based on our hands-on experience. We believe these reviews will help you understand what each broker has to offer and help you make the best decisions.

1. Pepperstone – Overall Best ECN Broker

Pepperstone is a no-dealing desk broker with a global reputation as one of the most reliable ECN brokers. In addition, it offers straight-through processing (STP) methods that improve Pepperstone’s efficiency.

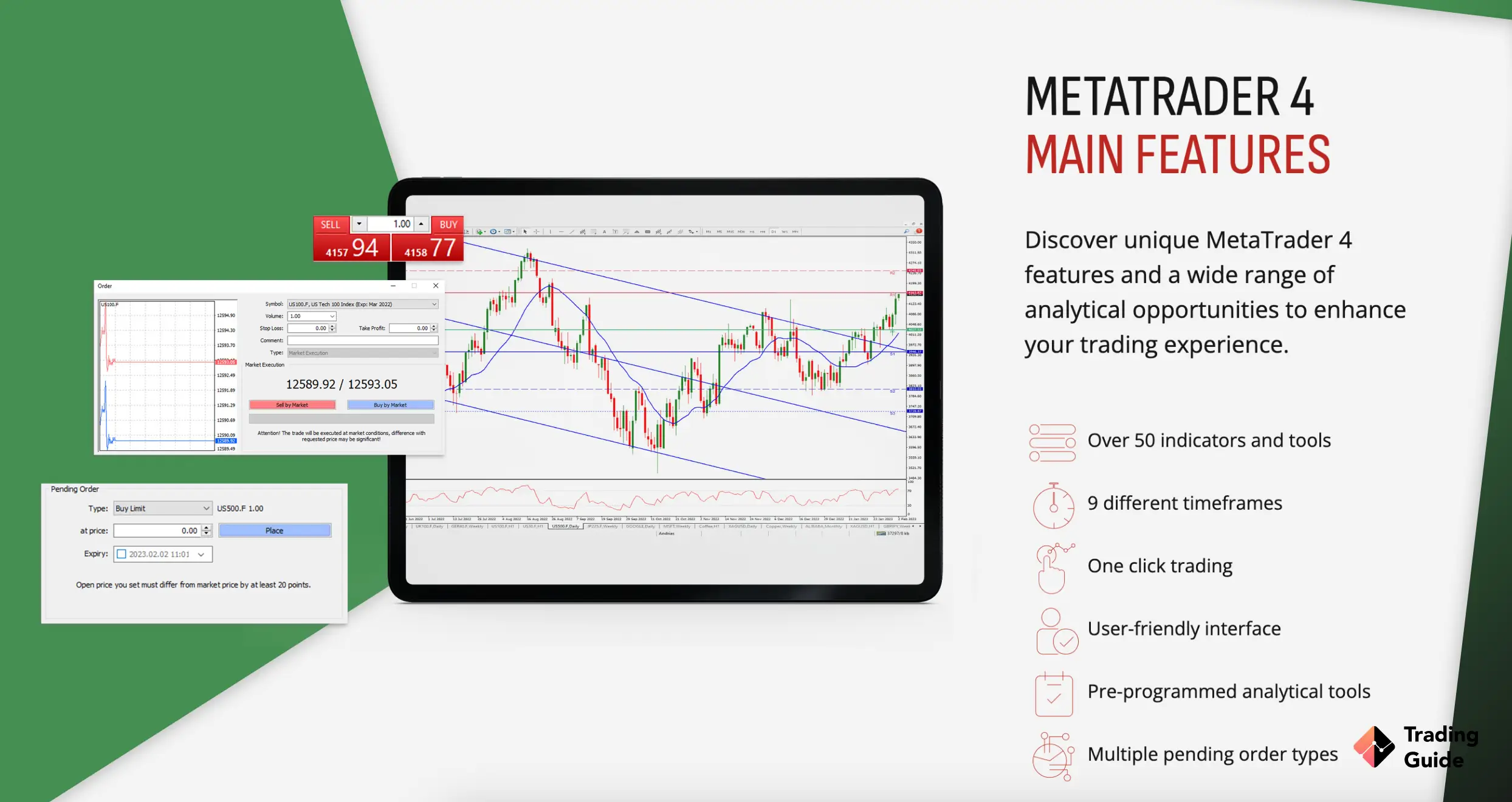

This best ECN broker charges low spreads. It has the necessary infrastructure that makes it ECN-friendly, including high execution speed and low spreads. In addition, you will find the TradingView, cTrader, MetaTrader 4, and MetaTrader 5 platforms that are compatible with all traders.

- Award-winning intuitive design platform

- MetaTrader platforms for enhanced trading

- 24 hour, five days a week, reliable support service

- Only CFD products offered

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

2. FxPro – Best ECN Broker for Beginners

This no-dealing desk (NDD) ECN broker will get you started on the right track. Most features on FxPro are beginner-friendly, including its trading platform that will not lag your trading activities. It is also known to be one of the best straight-through processing (STP) brokers for UK traders.

The execution speed on FxPro is relatively high, allowing beginners to tray various instruments within a short period. There are also essential learning tools to get you off to a good start.

- Beginner-friendly ECN platform

- Fixed or variable spreads

- Excellent educational materials, including demo accounts

- Some stock CFD fees are high

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

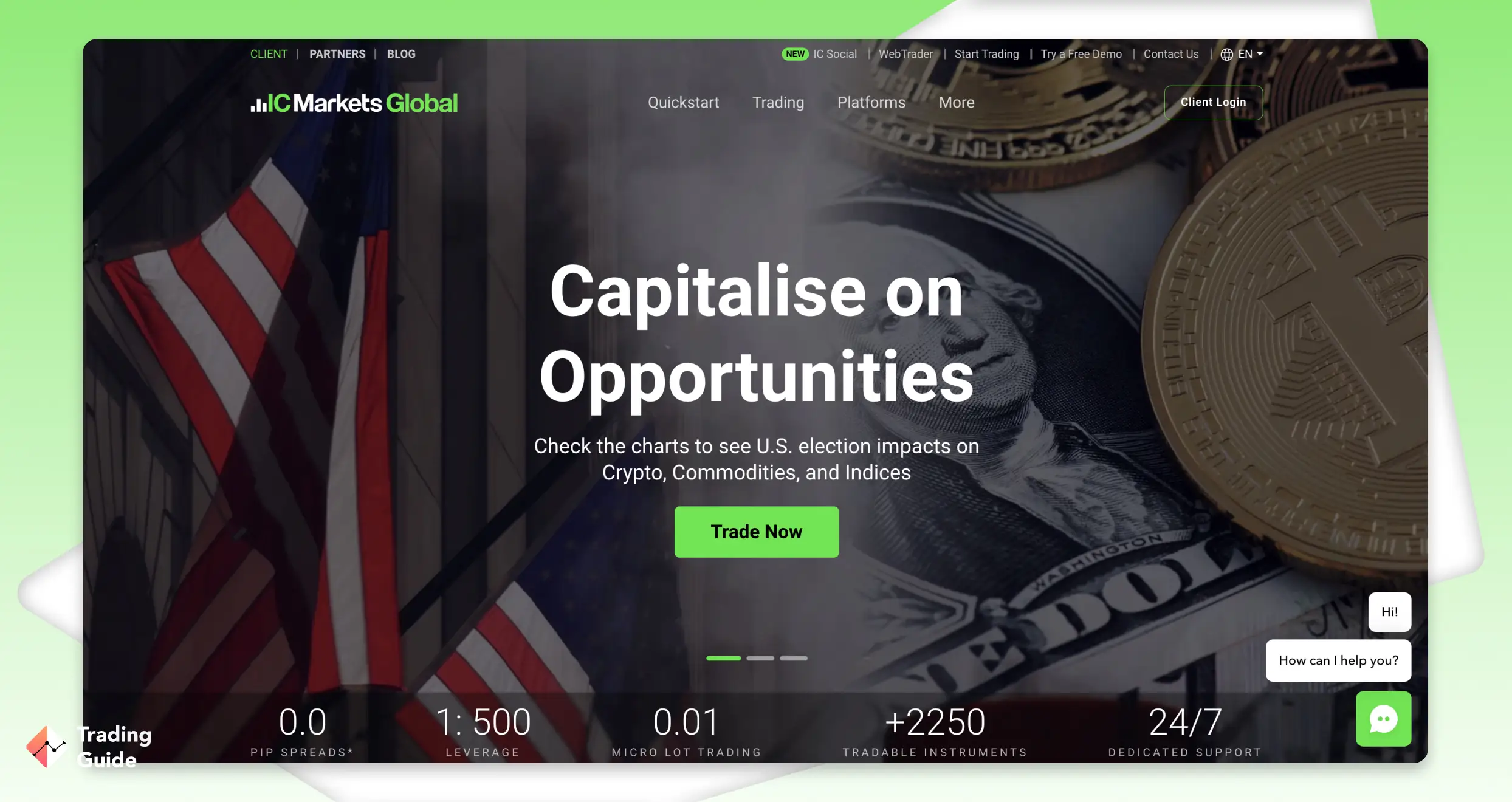

3. IC Markets – Best ECN Forex Broker in the UK

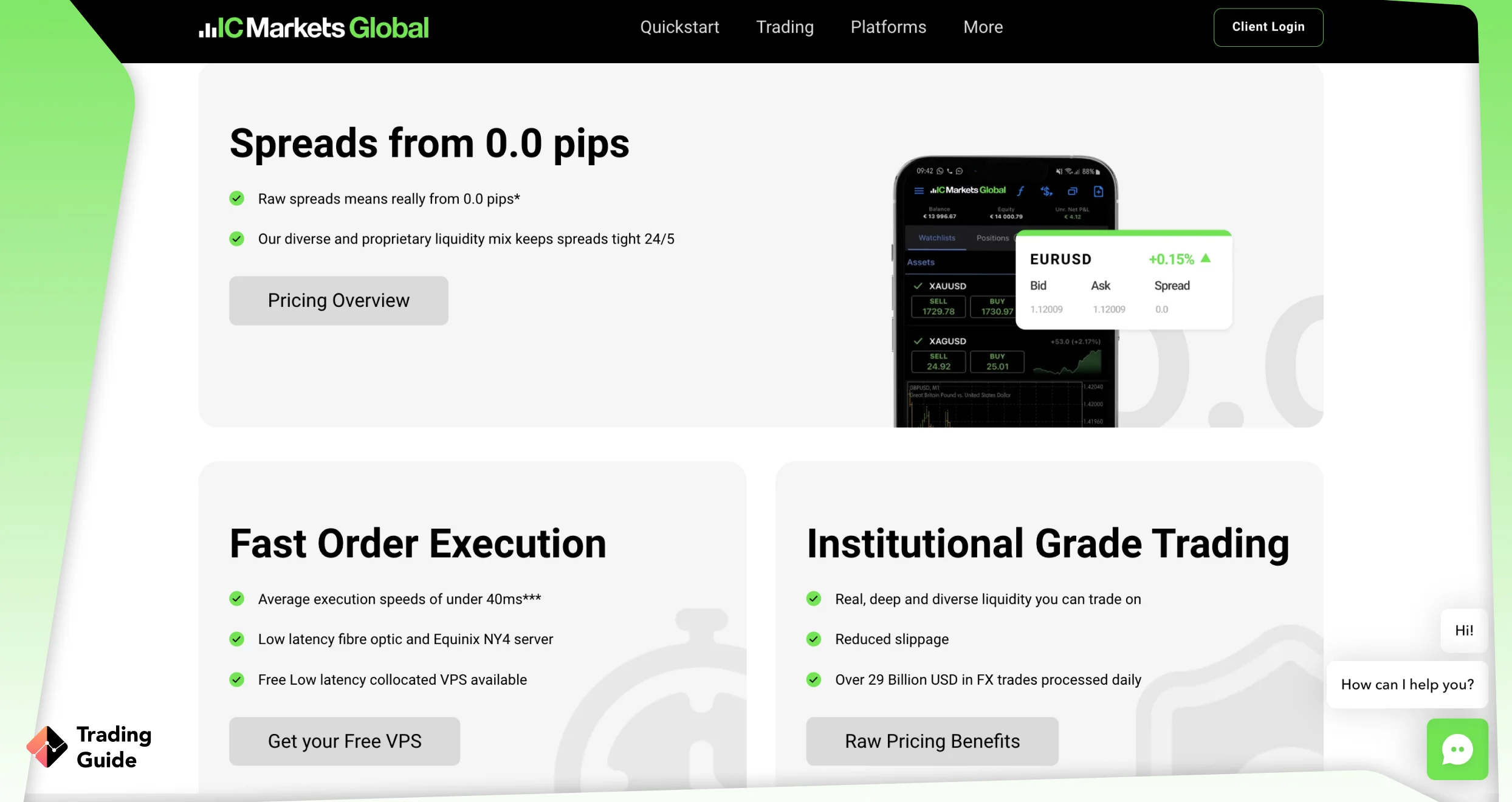

You can trade forex at IC Markets across various trading platforms, namely cTrader, MetaTrader 4 and MetaTrader 5. Furthermore, all these three platforms allow ECN trading, which shows that any trader will have an excellent experience with IC Markets.

IC Markets host one of the largest and liquid markets globally. The charges for forex trading are also low, with spreads starting at 0.1 pips. In addition, its low latency feature makes it easier for active and traders with expert advisors to enjoy their experience.

- Fast order execution speed

- Wide range of forex trading assets

- True ECN model

- 24/7 customer service

- No fixed spreads

| Account cTrader | Account Raw Spread | Account Standart | |

| Trading platform | cTrader | MetaTrader | MetaTrader |

| Comission (per lot) | $3 ($6 per lot roundturn) | $3.5 ($7 per lot roundturn) | $0 |

| Spreads from (pips) | 0.0 | 0.0 | 0.6 |

| Starting deposit | $200 | $200 | $200 |

| Leverage | 1:500 | 1:500 | 1:500 |

4. FP Markets – Best ECN Broker for Advanced Traders

Seasoned traders require a reliable ECN broker like FP Markets, especially if they execute multiple trades daily. This Australia-based broker was founded in 2005 and has grown to become one of the best ECN brokers in the UK. And with a broker licence from ASIC (Australian) and CySEC, you can rest assured that FP Markets is a safe and trustworthy broker.

You can trade forex and CFDs on various assets, including commodities, shares, indices, bonds, and ETFs. With major currency pairs, spreads go as low as 0.0 pips, and you only need a minimum deposit of £100 to get started. On top of that, the broker does not charge any fees for deposits or withdrawals.

FP Markets offers four advanced trading platforms, including MetaTrader 4, MetaTrader 5, Iress, and WebTrader, to help you develop efficient trading strategies. This ECN broker also has a fast order execution speed, allowing traders to make quick moves from the volatile markets.

- Plenty of trading platforms to choose from

- Availability of adequate learning and research materials

- £100 minimum deposit

- Reliable mobile trading platform that is highly rated on the App Store and Google Play

- You only get to trade forex and CFDs

- No safe two-step login procedure for mobile devices

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

5. HotForex – ECN Broker with the Lowest Spreads

HotForex ECN broker charges low trading and non-trading fees, especially on the forex markets. It has no hidden fees or charges, so what they display on their platform is what you will trade with.

HotForex is a multi-regulated broker, and we assure you that you can entrust your trading funds with it. It is one of the most preferred platforms because of its execution speed that is very fast when using the MetaTrader platforms.

- Fast execution on its ECN and STP accounts

- It’s easy to diversify your portfolio at HotForex

- Zero spread account

- No ECN trading restrictions

- Customer service is available five days a week

| Type | Fee |

| Minimum deposit | 0$ |

| Deposit fee | 0$ |

| Withdrawal fee | 0$ |

| Inactivity fee | 5$ |

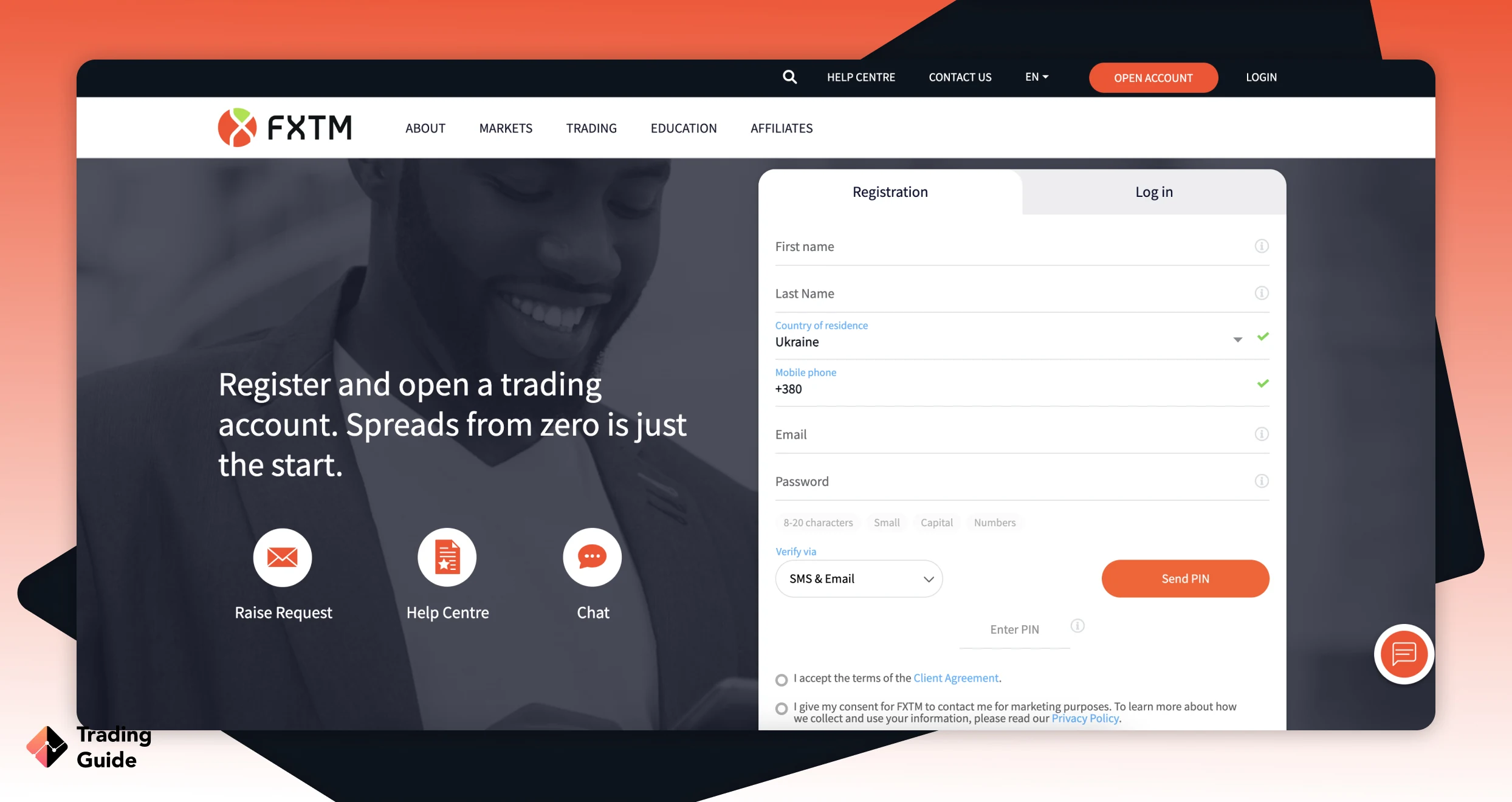

6. FXTM – Most Trusted ECN Broker in the UK

If you want an ECN broker that will not limit your trading activities, then FXTM is a choice to consider. It has competitive spreads depending on market volatility and a MetaTrader 4 platform with instant execution for your trading efficiency.

Many ECN traders trust FXTM because of its world-class trading platform. It has trained experts, including a reliable customer support service, to help you solve your trading issues when they arise.

- Low spreads during volatility periods

- Competitive bid and ask pricing

- MT4 ECN platform with instant execution

- No limit and stop levels

| Type | Fee |

| Minimum deposit | $200 |

| Overnight fee | $5 |

| Deposit fee | $0 |

| Withdrawal fee | $3 |

| Inactivity fee | Yes |

What do Other Traders Say?

While it is crucial to test various ECN brokers before making a choice, you should also consider sampling user testimonials on Google Play, the App Store, and Trustpilot. We analysed user comments and ratings on these platforms and share below a few to help you understand our recommendations from other users’ perspectives.

Pepperstone

Pepperstone receives praise for its lightning-fast execution speeds, tight spreads, and reliable customer support. Most traders highlight the robustness of its trading platform and the transparency in pricing, making it a preferred choice for both novice and experienced traders alike.

-

“One of best broker of the world. Nice support, brazilian account manager, trading view plataform, local brazilian withdraw.” – Juninsm

-

“I’ve used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features.” – Jana from Gold Coast

FxPro

FxPro earns users’ credit for its cutting-edge technology, competitive pricing, and robust risk management features. Traders highlight its reliable execution and extensive range of trading instruments, coupled with exceptional customer support.

-

“I just love this app, everything is clear, it’s perfect for all types of investor also for long term invest.” – Dibakar Barua

-

“While providing the services, they did it quickly and proactively. The provides a wide range of functions that are useful while generating monthly and yearly returns. The dashboard is designed to be easy to use and understand” – Nitesh Saini

IC Markets

IC Markets is praised for its competitive pricing, low latency, and seamless trading experience. Some traders also commend its advanced trading tools and customisation options and the reliability of its ECN execution.

-

“I have been trading with IC markets since begginer to intermediate…and i am impressed with the platform of C trader….its pretty advanced and easy to trade….i am satisfied also with the low spread that they offer. But it would be much appreciated if more indicators could be added..like Mt4.. anyways i gave IC market an A+++” – Joy Jesyaraj

-

“I had some queries which I did not understand, so I started chat to resolve my query. John is the person who was providing me information via chat, amazing customer care, through knowledge and solve my query in no time. Amazing service! Thank you John” – Avani Sachin

FP Markets

Users laud FP Markets for its extensive range of trading instruments, including CFDs, forex, and commodities. They appreciate the broker’s commitment to client satisfaction, evidenced by its responsive customer support and educational resources.

-

“Customer support is really marvelous, my problem was taken seriously and solved within no time. Thanks to the team for their efforts. Great!” – Tariq

-

“The app is user friendly. Even for beginners, it is easy to use, and the customer service live chat is quick in replying.” – Wayne K

-

“Awesome! I’ve been trading with their mobile app for a while now and no issues or lags have occurred; their UI is also clean and smooth.” – Edwina G

HotForex

HotForex stands out for its user-friendly platform, a diverse range of account types, and extensive educational materials. Users highlight the broker’s responsive customer support and competitive trading conditions as key factors in their positive experiences.

-

“I don’t like rating apps but this Broker is the best, in terms of customer service, account management, deposit and withdrawing funds they are the best. And i will recommend it to everyone who is looking for liable broker to chose them. Kudos to your team.” – Oloyede Adedayo

-

“I like how smooth the transactions is. The app itself is easy to understand. When I have any enquiries,their respond is fast & efficient.” – Aqilah

FXTM

FXTM receives praise for its innovative trading platforms, educational resources, and diverse range of trading instruments. Traders commend its user-friendly interface and the availability of various account types tailored to different trading styles and preferences.

-

“Having used the FXTM mobile app a short while now, it’s quick and simple to navigate. The UI is very intuitive and efficient. It has some great features and FXTM is top of the list when I recommend trading apps. I look forward to using FXTM Trader for the foreseeable future!” – James Ventris

-

“Your money is safe here no doubt and the support team here do their best to clarify your queries and simplify the difficult matter to understand it easily.” – Indranil Bar

The Ultimate Guide to ECN Trading

In this guide, we not only make recommendations but also educate you on getting started in the financial space. The sections below shed light on everything you need to know about ECN trading, from how to create an account to choosing the best broker and more. In the end, we hope you will have all doubts cleared (if any) and kickstart your ventures on a good note.

What is the Electronic Communications Network (ECN)?

An ECN/Electronic Communication Network broker is an intermediary that links traders and the financial markets via an online trading platform. Unlike conventional stock brokers or investment platforms, an ECN broker provides traders with unrestricted access to the forex market.

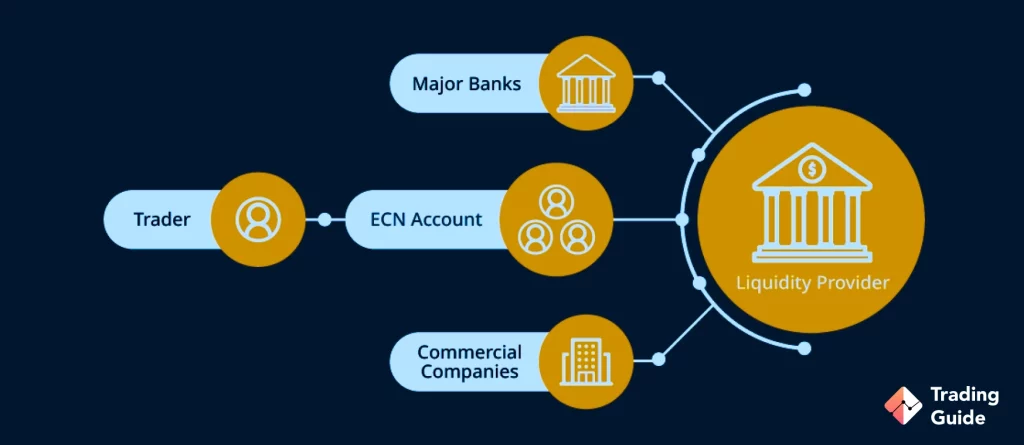

When you trade with an ECN broker, your orders are routed directly to liquidity providers. These include major financial institutions such as banks, hedge funds, and investment corporations, as well as other traders. This direct connectivity grants traders immediate access to market liquidity without the need for intermediaries.

One of the key benefits of trading through an ECN broker is the transparency it offers. ECN platforms display the best available prices from various liquidity providers, enabling traders to select the most competitive rates for their trades, rather than being confined to the offerings of a single broker.

This transparency can translate into cost savings for traders, as ECN brokers typically do not profit from spreads. Instead, they charge commissions or account fees, which can often be more cost-effective than trading with brokers who offer less competitive spreads.

Moreover, trading through an ECN allows for flexibility in trading hours. Unlike market makers, which may impose overnight fees for rolling over trades to the next trading day, ECN trading enables traders to engage in trading activities virtually around the clock.

In addition to forex pairs, many UK ECN brokers also offer trading opportunities in stocks. However, it’s important to note that these are typically the primary financial markets available for trading through ECN platforms in the UK.

How Does ECN Trading Work?

ECN trading operates as a direct electronic network connecting traders with liquidity providers such as banks and financial institutions. When a trader places an order through an ECN broker, it’s routed directly to the network, where it’s matched with available bids and offers from various participants. This transparent process allows traders to see the best available prices and execute trades without the interference of a middleman.

ECN trading offers rapid execution speeds and access to deep liquidity, ensuring trades are executed efficiently and at competitive prices. Unlike traditional brokers who may profit from spreads, ECN brokers usually charge commissions, which eliminates conflicts of interest. With ECN trading, traders benefit from increased transparency, reduced trading costs, and the ability to implement diverse trading strategies with ease.

Overall, ECN trading simplifies the trading process by providing direct market access and fostering a fair and efficient trading environment for participants.

Find out about the best options trading platforms and trading and investment apps in our other guides.

How to Choose the Right ECN Broker in the UK

As a new ECN trader, you must identify a suitable broker that aligns with your trading needs. This way, you can focus on strategy development and tracking your open positions without being inconvenienced. Below are some of the factors to consider in ensuring you identify the best ECN broker.

Security and regulations should be a top priority when selecting an ECN broker in the UK. Look for brokers regulated by the Financial Conduct Authority (FCA) to ensure peace of mind since the broker adheres to strict standards and safeguards client funds. Additionally, assess the broker’s security measures, including encryption protocols and data protection policies, to mitigate cyber threats.

Understanding an ECN broker’s fee structure is crucial for effectively managing trading costs. Compare commissions/spreads, minimum deposit requirements, inactivity fees, and more to ensure they align with your budget. Consider how these costs may impact your trading profitability over time and whether the broker offers competitive pricing compared to industry standards. Look for transparency in pricing and avoid brokers with hidden fees that could affect your profits.

Payment methods offered by the broker play a significant role in facilitating deposits and withdrawals. Evaluate the range of payment options supported by the broker and consider factors such as transaction fees, processing times, and accessibility. The best ECN broker should offer convenient and secure payment methods that align with your preferences.

The best ECN broker’s platform should positively impact your trading experience. Therefore, test the platform’s functionality and usability to ensure it meets your needs. Look for features such as customisable interfaces, fast order execution, advanced charting tools, real-time market data, learning resources, and more. There should also be a demo account for testing the broker and gauging your skill level risk-free.

While many traders will overlook this element, it is very crucial in maximising your trading experience in the UK. Ensure the ECN broker you choose has a reliable and responsive support service team accessible via multiple channels, including phone, email, and live chat. The team should also provide relevant solutions to any concerns or challenges.

The best ECN broker should not only offer forex but also additional asset classes, including stocks, commodities, cryptocurrencies, indices, futures, and more. This way, you can easily diversify your portfolio without seeking another broker. If you are a beginner, ensure you learn more about portfolio diversification, as it mitigates the risks of investing in a single asset.

Besides assessing an ECN broker’s features and offerings, consider analysing reviews from other traders on Google Play, the App Store, and Trustpilot. This procedure enables you to gauge the broker’s reputation, customer service quality, and overall trading experience. Gathering insights from other traders can provide valuable insights to inform your decision-making process.

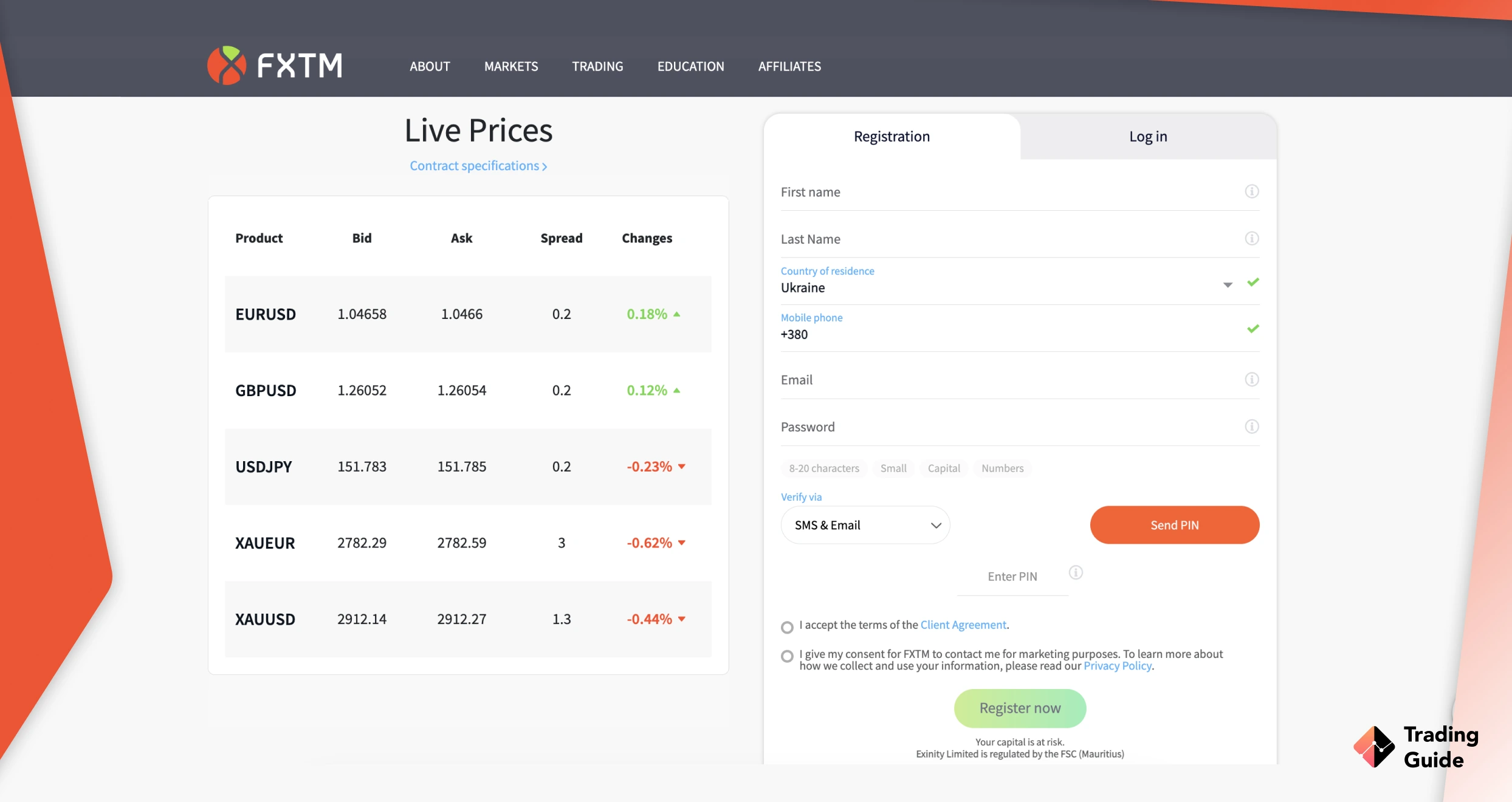

How to Open an ECN Broker Account

Many traders are sceptical about taking the first step into ECN trading, which involves creating a trading account with their favourite broker. Whatever the reason, note that the process is very straightforward, as it is usually similar for all FCA-regulated brokers like the ones we recommend above. Keep reading to understand how to open a trading account with an ECN broker.

At this point, we believe that you will have already selected a suitable ECN broker from our recommendations list above. Therefore, click on any of the links we have shared here to quickly access its website and begin the account registration process. Before you click the register button, understand the broker’s terms and conditions. Also, install its app on your mobile device so you can easily manage your positions whenever you step away from your trading station.

With your chosen broker, click the “Register” or “Join Now” button to create a trading account. In this procedure, your broker will require you to share your personal details, including your name, email, phone number, email, and more. You will also have to create a username and strong password for an added layer of safety, especially when trading using your mobile device. Ensure you share accurate details so you can easily participate in the verification procedure below.

It is a standard protocol for all FCA-regulated brokers to verify their clients’ identities and locations to keep online trading platforms safe from imposters. Therefore, you will be required to participate in account verification by sharing copies of your personal documents. These include your ID card, passport, or driver’s licence to verify your identity and a copy of a recent utility bill or bank statement to verify your location. The verification time frame varies with a broker but might take up to 48 hours to complete.

Your broker will send you an email notification once your account is fully verified and active to trade. At this point, make a deposit per the broker’s minimum deposit requirement. The good news is that most FCA-regulated brokers, including our recommended ones above, support transactions using multiple payment options, including bank transfers, credit/debit cards, or e-wallets. Choose the most convenient option for you for seamless transactions.

With your account funded, your broker will give you access to its ECN trading platform to choose your preferred currencies or assets to trade. Start with familiarising yourself with the broker’s features and consider practising with its demo account before executing live trades. Remember to adhere to sound risk management principles and track your open position to benefit from any potentially profitable opportunities.

ECN Account vs Standard Account

When comparing an ECN (Electronic Communication Network) account to a standard trading account, the main difference lies in how trades are executed and priced.

With an ECN account, trades are executed directly on the market, connecting traders with various liquidity providers like banks and other traders. This means you get access to real-time market prices and potentially tighter spreads as there’s more competition.

On the other hand, standard accounts often operate on a market maker or dealing desk model. The broker acts as the counterparty to your trades, offering fixed spreads and executing orders internally. While this can be simpler, it may come with potential conflicts of interest since the broker profits from spreads.

ECN accounts usually come with a commission-based fee structure, where you pay a fixed commission per trade in addition to any spreads. This model offers transparency and reduces the risk of conflict, compared to standard accounts where the broker’s revenue is mainly from spreads.

Overall, the choice between an ECN and a standard account depends on your trading style and preferences. ECN accounts are favoured by those seeking transparency and competitive pricing, while standard accounts may suit traders prioritising simplicity. It’s important to weigh the pros and cons of each account type before making a decision.

Pros and Cons of ECN Trading

As an ECN trader, it is crucial to understand the pros and cons of ECN trading to make the best decisions. The last thing you want is to get inconvenienced once you have already invested your funds in this activity. Besides connecting traders directly to liquidity providers, ECN trading has other benefits and pitfalls, including:

Pros

- Competitive Spreads – Aggregated pricing from multiple liquidity providers often results in tighter spreads, reducing trading costs for traders.

- No Conflict of Interest – With brokers acting solely as intermediaries, there’s minimal risk of conflicts of interest, enhancing transparency and trust.

- Deep Market Depth – Access to a broader pool of liquidity allows for smoother execution of larger orders with reduced slippage.

- Lower Risk of Manipulation – Real-time market prices and direct execution mitigate the risk of price manipulation compared to other models.

- Greater transparency – ECNs provide real-time market data, allowing traders to see bid and ask prices and the depth of the market. This transparency can help traders make more informed trading decisions.

Cons

- Commission Costs – Traders may incur commission fees on each trade, potentially adding up, particularly for high-volume traders.

- Possibility of Slippage – Despite access to deep liquidity, traders may still experience slippage, especially with large orders or volatile markets.

FAQs

Identifying an ECN broker in the UK is not easy, considering that there are plenty of them in the market. However, since ECN trading continues to be popular in the UK, our professional researchers tested and recommended the above brokers so that you can easily choose one and start investing. Note that these brokers have demo accounts, and you can practice ECN trading before signing up for a live account. Also, the ECN brokers referenced on this page operate seamlessly on mobile devices. Alternatively, if you want to conduct the research for a suitable broker on your own, we also guide you on significant factors to consider to avoid making mistakes that can cause you lots of money in the long run.

Yes. Trading in the liquidity markets with an ECN broker costs less than using a non-ECN broker. You also have plenty of instruments to select from and enough resources to conduct your research and market analysis. However, not all ECN brokers are good. Therefore, ensure they are licensed and regulated by the Financial Conduct Authority (FCA) and complement your trading requirements. These include trading and non-trading charges, minimum deposit requirement, platform performance, asset availability, etc.

ECN (Electronic Communication Network) is a network that connects you automatically with liquidity traders for various products such as forex, shares, commodities, and more. ECN trading gives you multiple opportunities to explore financial markets and make money with the right approach. You should also identify the best asset that you are fully familiar with to maximise your potential. Most importantly, find a reliable ECN broker that the FCA regulates to safeguard your trading funds and enjoy the best trading environment.

ECN trading does not include a third party since you will be dealing directly with the buyer or seller. The broker’s duty here is to offer a platform at a fixed commission for every trade. This works differently from trading other assets like physical stocks, forex, etc. Therefore, you must be careful with all your moves, whether conducting research or identifying the best entry and exit points.

ECN brokers feed orders directly and automatically with liquidity providers offering the best price. They offer traders or investors more attractive prices and better market conditions than market makers. The best element about trading using ECN brokers is that they operate in a transparent environment.

In contrast, market makers are brokers that set their bid/ask spreads or commissions and present them to investors for trading. Unlike ECN brokers that make money when you succeed in a trade, market makers earn when you lose and lose when you profit. Undoubtedly, ECN brokers are a more viable option than the market makers. However, it all depends on the asset you want to trade and how well you are familiar with a broker.

ECN brokers are dominating the UK market, and choosing the best depends on your trading needs. For instance, the best ECN broker should have a dedicated team to offer support when need be. In addition, it should be affordable and host all the assets and tools for successful trading. Most importantly, the best ECN broker should secure your trading funds since many brokers are only scammers waiting for innocent victims to swindle. To confirm a broker’s credibility, ensure the FCA regulates them.

Conclusion

ECN trading in the UK offers both opportunities and challenges for traders, regardless of their experience level. For beginners, it’s essential to start with thorough research, utilise demo accounts, and gradually build skills and confidence. Professional traders can benefit from the transparency and efficiency of ECN platforms by implementing advanced strategies and risk management techniques. Regardless of skill level, maintaining discipline, staying informed about market conditions, and continuously adapting to changes is key to success in ECN trading. Remember, every trade is a learning opportunity, so approach ECN trading with patience, diligence, and a commitment to continuous improvement.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I recommend HotForex to everyone. I do not agree that Pepperstone is considered the best, HotForex is on top!

Pepperstone of all brokers is my favorite!

Believe me, I trade a lot of brokers before...everything at pepperstone is great

How many instruments do IC Markets have? Can I change the market for free staying with them?

IC Markets is currently offering 2,000+ instruments spread across 7 different markets. And yes, it is completely free to switch between markets with an IC Markets account. In fact, you can trade on several different markets at the same time, if you’d like to.

how do ECN brokers make money?

Hi Basil, ECN brokers make money from fixed commissions charged to the customer on each trade.

This article about ECN brokers truly opens up the eyes to the benefits of trading. I didn't know before that ECN helps to get better prices and allows trading at any time of the day. It is clearly explained that ECN brokers provide direct market access, making execution fast and efficient. I like the idea of lower commissions and more anonymity. The article also helped me understand the differences between ECN and standard accounts. Now I'm confident that choosing an ECN broker is an excellent decision for successful trading.

This article was really helpful for me as a beginner learning about ECN brokers in the UK. The tables and comparisons made it easier to see which brokers might be good for me. I still have a lot to learn, but this is a great place to start.