UK futures trading is a dynamic market, yet choosing the right broker doesn’t have to be complicated. As a veteran in this market, I’ve winnowed out many options to share with you the top of the line brokers in the market. Whether you’re refining your strategy or just starting out, this guide will give you a good head start. Also, I will inform you on how to start and move around the futures market so you’re on the right path towards your financial goals.

List of the Best UK Futures Brokers

Below is my top list of the most regulated and reliable futures trading brokers in the UK. I’ve tested them personally using real money, so you can be assured of the best experience with them.

- Pepperstone – Best With Multiple Platforms

- FxPro – Leading Multi-Asset Futures Broker

- IG – Leading Service Provider With Multiple Trading Platforms

- eToro – Beginner-Friendly

- Spreadex – Best For Commodity Futures

- XTB – One of The Cheapest Options

Brokers Reviews

The number of futures traders in the UK continues to increase. This demands the services of quality brokers and the employment of solid strategies to take advantage of emerging opportunities. Below, I have created mini-reviews on the top futures UK brokers. I do not just give their pros but also cons so you are well-informed and make the best decisions.

1. Pepperstone – Best With Multiple Platforms

Pepperstone has built a solid reputation among traders. I tried it out against the competition, and I can see why. The site is designed with all traders in mind. It is simple to use, intuitive, and chock full of features that make trading the markets a breeze.

For those who want to trade futures, Pepperstone offers CFD and spread betting forwards across various asset classes, such as commodities, indices, and more. If you wonder how CFD forwards differ from standard futures, they are the same thing. The only difference is that forwards are traded over-the-counter (OTC) directly between two parties rather than on an exchange.

Apart from futures, Pepperstone gives you access to more than 2,400 CFD instruments like forex, shares, cryptocurrencies, indices, and others. This implies that you can diversify a portfolio all in one place. You can also trade CFD forwards on both the MT5 and cTrader platforms, which are widely known to have advanced tools like copy and algorithmic trading.

- No minimum deposit requirement to trade futures

- Free deposits and withdrawals

- Quality learning and market analysis tools on its advanced platforms, including MT4, MT5, cTrader, and TradingView

- A user-friendly and intuitive design trading platform for desktop and mobile devices

- You can only trade futures as CFD and spread betting

- No buying and taking full ownership of its listed securities

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

2. FxPro – Leading Multi-Asset Futures Broker

After testing several futures brokers in the UK, I found FxPro to be one of the best for trading multiple assets. Right from the start, the platform is extremely friendly, with a reasonable £100 minimum deposit requirement that makes it accessible to an extensive range of traders.

FxPro offers futures trading across various instruments like commodities and indices to give you more than enough opportunities to try out the market. Besides that, you are also able to diversify further with 2,100+ CFD instruments like forex, shares, and more all in one account.

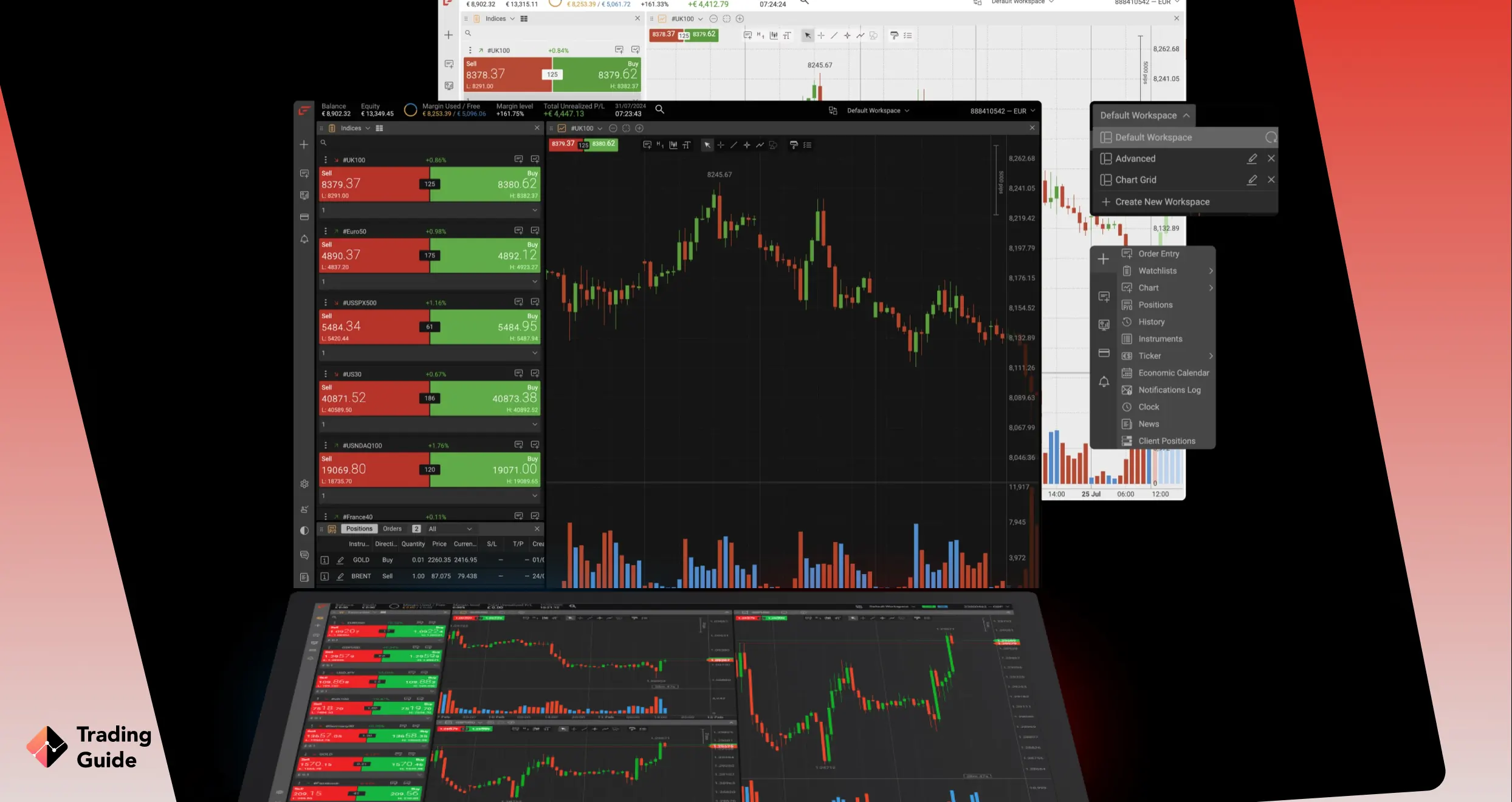

What really impressed me was the focus of FxPro on trader discretion. You get the choice of MT4 and MT5 for trading futures, both of which are extremely powerful platforms for analysis and automation. I also appreciate the responsive customer service of the broker, which is to say that you’re never left high and dry when you need assistance.

For professional traders, FxPro supports margin trading with leverage limits that go up to 1:500. The service is a good choice if you need added flexibility. Furthermore, its automation-friendly setup helps professional traders design their strategies.

- Trade futures across various asset classes

- Low minimum deposit requirement

- High leverage limit for expert traders

- Additional 2,100+ securities for portfolio diversification

- High futures trading fees compared to its peers

- Support service is only available on weekdays

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. IG – Leading Service Provider With Multiple Trading Platforms

IG is one of the most reliable futures trading providers I have used, mainly because it gives you access to listed and OTC futures through both spread betting and CFDs. You can trade underlying index, commodity, bond, rate, share, forex, and ETF futures, all backed by IG’s deep internal liquidity. This makes order execution smooth, even when the markets move quickly.

Another strength is the flexibility of platforms. You can trade directly on the web platform, the mobile app, or MT4. All three are reliable and easy to operate, whether you are analysing price action or placing short and long futures positions. IG also provides round-the-clock access to index futures, giving you the ability to react to global market events as they unfold.

For diversification, IG lists more than 17,000 OTC markets. This range includes forex, commodities, shares, indices, ETFs, and more, supporting both short- and long-term strategies. Futures trading remains commission-free across all supported platforms.

67% of retail investor accounts lose money when trading CFDs with this provider.

- No minimum deposit requirement to trade futures

- Access to OTC and listed futures across multiple asset classes

- Free deposits and withdrawals

- Futures trading is supported on the web platform, mobile app, and MT4 platform

- Over 17,000 OTC markets for diversification

- Currently, no MT5 or cTrader support

- You cannot trade futures on ProRealTime, L2 Dealer, and TradingView platforms

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

4. eToro – Beginner-Friendly

If you’re new to futures trading and looking for a trustworthy UK broker, give eToro a go. Having tried it myself, I can confidently say that it’s one of the most secure platforms out there. It’s licensed by multiple international authorities and uses top-grade encryption, so you can trade online safely. And to top it all off, its clean, easy-to-use interface makes it possible for newbies to have a walkover exploring the markets without being overwhelmed.

One of the benefits of eToro is its low £100 minimum deposit requirement for UK traders. Futures trading is offered on thousands of assets like commodities, stocks, indices, and more. While eToro’s fees are slightly higher than some competitors, the site makes up for it with good market analysis tools.

In addition to futures, eToro also provides you with access to 7,000+ instruments, including stocks, commodities, ETFs, and more, so you can diversify your portfolio in one place. And if you want to master your craft, eToro Academy provides world-class learning tools. There’s also the CopyTrader feature, which enables you to copy trading and follow successful traders’ actions in real time—ideal if you’re still learning the ropes.

- Wide range of futures trading assets

- Automated CopyTrader platform

- Popular investor program for expert and advanced traders

- Low minimum deposit requirement for UK clients

- No third-party platforms like the MT4/5

- Withdrawal charges apply

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

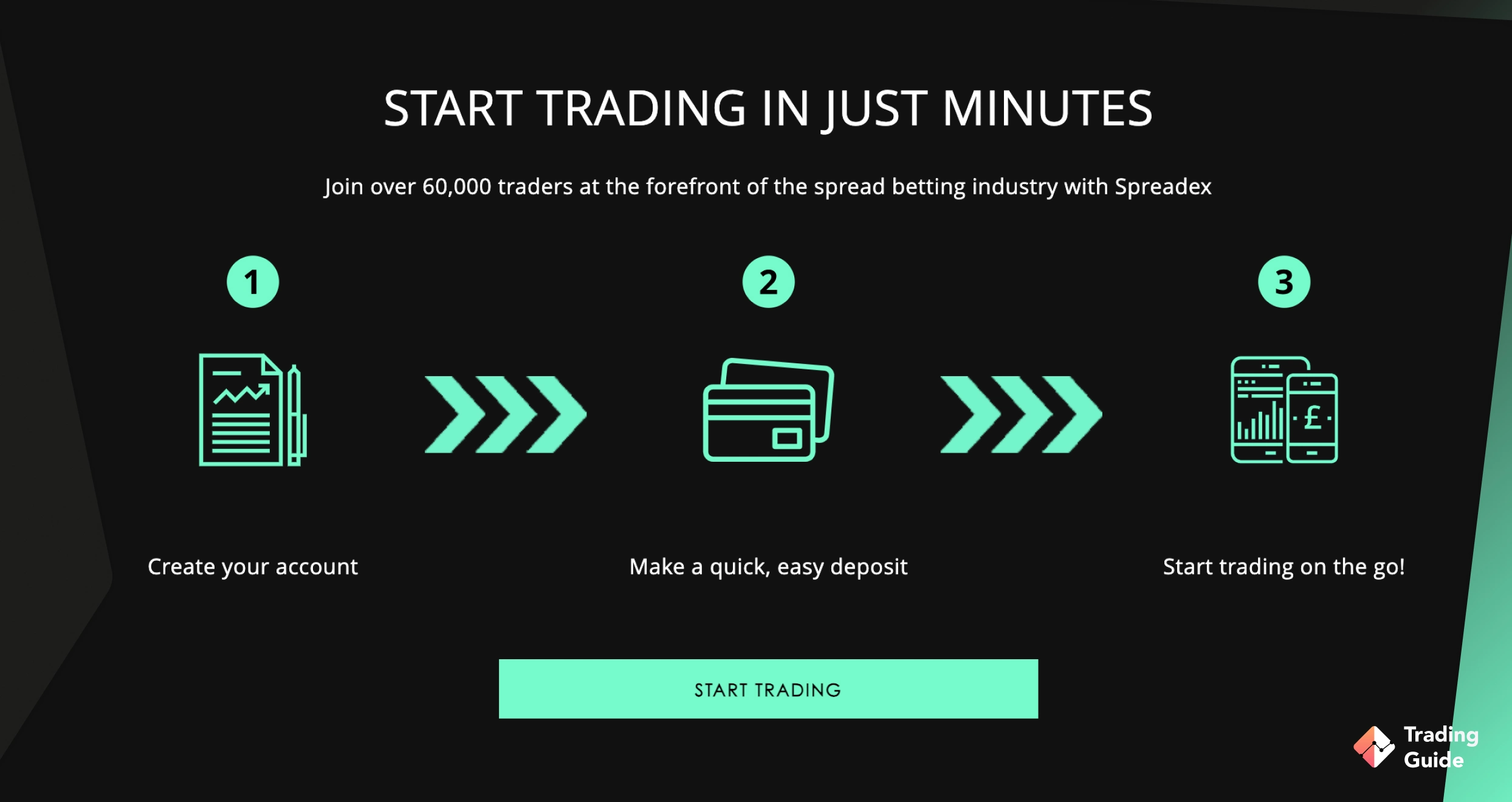

5. Spreadex – Best For Commodity Futures

If you want to trade commodity futures in the UK, Spreadex is a good option. I tried it and discovered that its platform is intuitive and easy to use, even for beginners. I believe this makes it simple to navigate the markets. One of the best features is that it is affordable. There is no minimum deposit required, which is excellent if you are just beginning with a limited budget.

Spreadex has earned a good name in the commodity futures market with access to multiple contracts. From precious metals like gold and silver to energy commodities like crude oil and natural gas, you will have plenty of options to trade.

Beyond futures, this broker provides access to other asset classes, including shares, forex, ETFs, indices, and bonds. These can be traded as CFDs or through spread betting, meaning you’re speculating on price movements rather than owning the underlying assets.

Another aspect that I like is the flexibility in trading platforms. You can trade commodity futures either on Spreadex’s in-house platform or using TradingView platform, both of which can be accessed from a desktop or mobile device.

- Features social trading, allowing users to mingle with other global traders

- No minimum deposit requirement

- Low spreads starting from 0.4 points on Gold

- User-friendly trading platform suitable for both novice and experienced traders

- No demo account

- Limited collection of research and learning materials compared to some of its peers

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

6. XTB – One of The Cheapest Options

For a UK trader looking for an affordable futures broker, XTB is one of the best options available with its low costs and sophisticated trading tools. Its rich set of market analysis features was the most impressive to me since it gives in-depth insights for strategy formulation as well as real-time decision-making.

XTB’s xStation 5 and xStation Mobile trading platforms have built-in automation, which allows traders to execute strategies with ease. No minimum deposit as the default, along with low futures spreads on commodities, makes this broker attractive for price-sensitive traders.

Beyond futures, XTB provides access to over 5,500 securities across various asset classes, including forex, commodities, shares, and indices. This broad selection ensures that traders can diversify their portfolios without needing multiple accounts.

Even though its customer support is only available during weekdays, I find the personnel to be highly responsive and professional. XTB also features a “Professional Trader” section where eligible users can apply for professional status, with perks such as higher leverage and personalized account terms.

- A user-friendly and intuitive design trading platform

- No minimum deposit requirement

- Fast trade execution speed

- Great research materials

- Limited futures assets compared to its peers

- A £10 monthly inactivity fee applies after 12 months of no account activity

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

Compare Brokers Table

When I initially began trading, I spent hours comparing the brokers, trying to determine which one was the right fit. It was a drawn-out and exhausting process. If you’ve experienced the same, you’re in good company. I made this comparison table for you so that you can make an informed decision without the effort.

| Best Futures Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | 24/7 | MetaTrader 4, MetaTrader 5, cTrader, TradingView | Credit cards, Bank transfer, PayPal | Yes | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, credit/debit cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes | Yes (up to £85,000 by FSCS) |

| eToro | ASIC, CySEC, FCA, FSAS | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Debit card, Bank transfer, eToro Money, Online Banking | Yes | Yes (up to $250,000) |

| Spreadex | FCA | 24/5 | TradingView | Bank Wire Transfers, Credit cards | No | Yes (up to £85,000) |

| XTB | FCA, KNF, CNMV | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, Bank Transfers, Skrill | Yes | Yes (up to £85,000) |

How to Choose Futures Brokers

Choosing the right futures broker can feel like a frightening ordeal—and it should be! Your broker is your trading counterparty, and the correct one will make an enormous difference in your success. But if there are that many options out there, how do you decide on which one to use? Don’t worry, I’ve got your back. Below are the things I look at when choosing a UK futures trading broker.

Most importantly, I always check if the broker has a reputable regulatory agency behind it. In the UK, ensure that a broker is regulated and approved by the Financial Conduct Authority (FCA). To be regulated simply means that the broker complies with stringent guidelines to protect your money and keep everything in the open. It’s like having a safety net, where in the event of anything going wrong, you have a way to act. For me, my money being safe is not negotiable.

Let’s be honest. Nobody likes unexpected costs. That’s why I always scrutinize brokers’ fees before committing. I compare commissions, spreads, overnight funding fees, and minimum deposits. Some brokers might look good on the surface, but you could be paying an arm and a leg for add-ons that eat into your profit. I want to find brokers with open, transparent fees so I can see clearly what I’m getting.

This is another element I never overlook. I want to be able to trade a high number of futures contracts and other instruments like commodities, currencies, indices, and so on. I like this because diversification helps me to spread my risk and study different markets. If a broker only offers me a low number of options, it’s as if I’m missing out on something.

The platform is where the magic happens, so it needs to be intuitive, responsive, and reliable. I look for those with advanced charting features, variable layout, and speedy execution rates. If the broker offers a mobile app for trading, that is a bonus as I will be able to manage my trades on the move.

Here’s a lesson I’ve learned the hard way. A great customer support is a lifesaver. I always make an effort to observe how quickly a broker responds before investing. Can I reach its team via live chat, email, or phone? Do they actually resolve my problems? A broker providing instant, intelligent support makes me confident that I will never be kept in the dark when things don’t work out.

If you are a beginner in the futures trading market, you would want to test the waters first. When I first started out in this venture, I gave much priority to brokers with demo accounts. They enable me to practice trading without risks and gauge my skill level. Demo account availability is useful if a broker has high fees or an exorbitant minimum deposit. I also confirm whether the brokers have learning resources like articles, videos, webinars, and so forth. Trading is a craft, and you need a broker that helps you grow.

The best futures broker should also support different payment options like bank transfers, credit/debit cards, e-wallets, or even cryptocurrencies. This way, it will be easier for you to choose a convenient method that you are comfortable with. I also make sure that the broker I settle with has strong security measures to protect my money and personal information.

While the above points are important to consider when deciding on a good futures broker, I would also recommend analysing users’ opinions. Therefore, head over to Google Play, the App Store, and Trustpilot and sample as many ratings and comments as possible. Futures brokers who have more positives than negatives are definitely worth your time. Understanding the strong and weak points of a broker from a user perspective can give you a clearer idea of what you can expect.

Conclusion

Futures trading is gaining momentum in the UK at a phenomenal pace, providing lucrative opportunities. You can start this business as a trader by choosing the best futures broker like the ones I recommend above.

For beginners, utilise demo accounts to get accustomed to futures trading before switching to live accounts. Most importantly, apply risk management strategies to preserve your investments from loss. And for the ever-busy traders, consider installing your broker’s trading app on your mobile device so you can monitor your activities easily and respond in a timely manner. With diligence, learning, and the right tools, you can easily walk through the futures contract market and aim for profitable outcomes.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I know from personal experience that Oanda is also great for beginners. They have great educational tools that will make a great and smooth start.

what about trading fees?

I use Interactive Brokers. IB has the most comprehensive platform for the most competitive price. But you need to spend the time to learn. The only disadvantage that I have found to their data feed is that the tick data is bundled. This can cause a little of a delay in trade execution and/or trade management. However, this will not matter to most traders, including me.

Great article about futures! I liked how it explained what futures are and how they work. Everything is described in a simple and understandable way. Now I understand how to profit from price differences. Important tips on choosing a broker and trading strategies. I recommend it to everyone who wants to understand this topic!

I really enjoyed reading your blog post on the best futures brokers in the UK. It was very informative and I learned a lot. I especially liked the comparison section. It was very helpful.

Thank you, Apkmomo for your comment! We appreciate your point of view.

Amazing article! As a UK-based trader, I'm always on the lookout for reputable and trustworthy futures brokers. It's great to see a list of the top 7 brokers in the UK, along with their pros and cons. I'll definitely be considering these brokers for my future trading needs. Thanks for sharing!

I've been involved in trading for two years, and, of course, I've heard about futures, but I always wanted to deepen my knowledge. This article turned out to be exactly what I needed! The authors brilliantly delve into the essence of futures contracts and emphasize the importance of education in trading. The coolest part – the difference between futures and CFDs is now clear to me, something I couldn't grasp before. The article not only provided me with information but also offered new insights into the world of futures. For those who want not only to trade but also to understand the process, it's worth a read.

I'm new to the world of futures trading and was struggling to find a reliable broker. Thank you for this helpful list, I'm excited to explore the options you've recommended and hopefully find the one that suits me best!

The comparison table is really helpful, thank you!