Traders who place multiple trades in a day or who are always on the move need reliable spread betting apps that they can use to stay connected to the trading market. The apps should execute trades fast and be loaded with charting packages that let you take full control of your trading activities.

Below, we have recommended the best spread betting apps in the UK. We spent more than 150 hours testing and reviewing these brokers, so we guarantee you that they are the best. Feel free to compare their offerings and see which one complements your investment requirements.

List of the Best Spread Betting Apps in the UK 2025

- Spreadex – Best App for Sports and Finance Spread Bets in the UK

- Capital.com – Leading App With Leverage-Free Trading

- Pepperstone – Best Spread Betting App with Low Spreads in the UK

- IG Markets – Leading Provider With Investment Options

- FxPro – Best Spread Betting App With an Automated Function

Compare the Best Spread Betting Apps in the UK

During our research process, we tested our recommended brokers on all levels, including:

Our team of experts have specific requirements that these spread betting apps must meet, in order to make it onto our recommendations list. Additionally, we combined our findings with the honest user reviews from Google Play, Apple Store, and Trustpilot.

| Spread Betting App | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank transfer, Neteller, Apple Pay & Google Pay | No | Yes (up to £85,000) |

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple Pay, Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer | Yes | Yes (up to £85,000) |

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes | Yes, (up to £85,000 by FSCS) |

| FxPro | FCA, FSCA, SCB | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill | Yes | Yes (up to £85,000) |

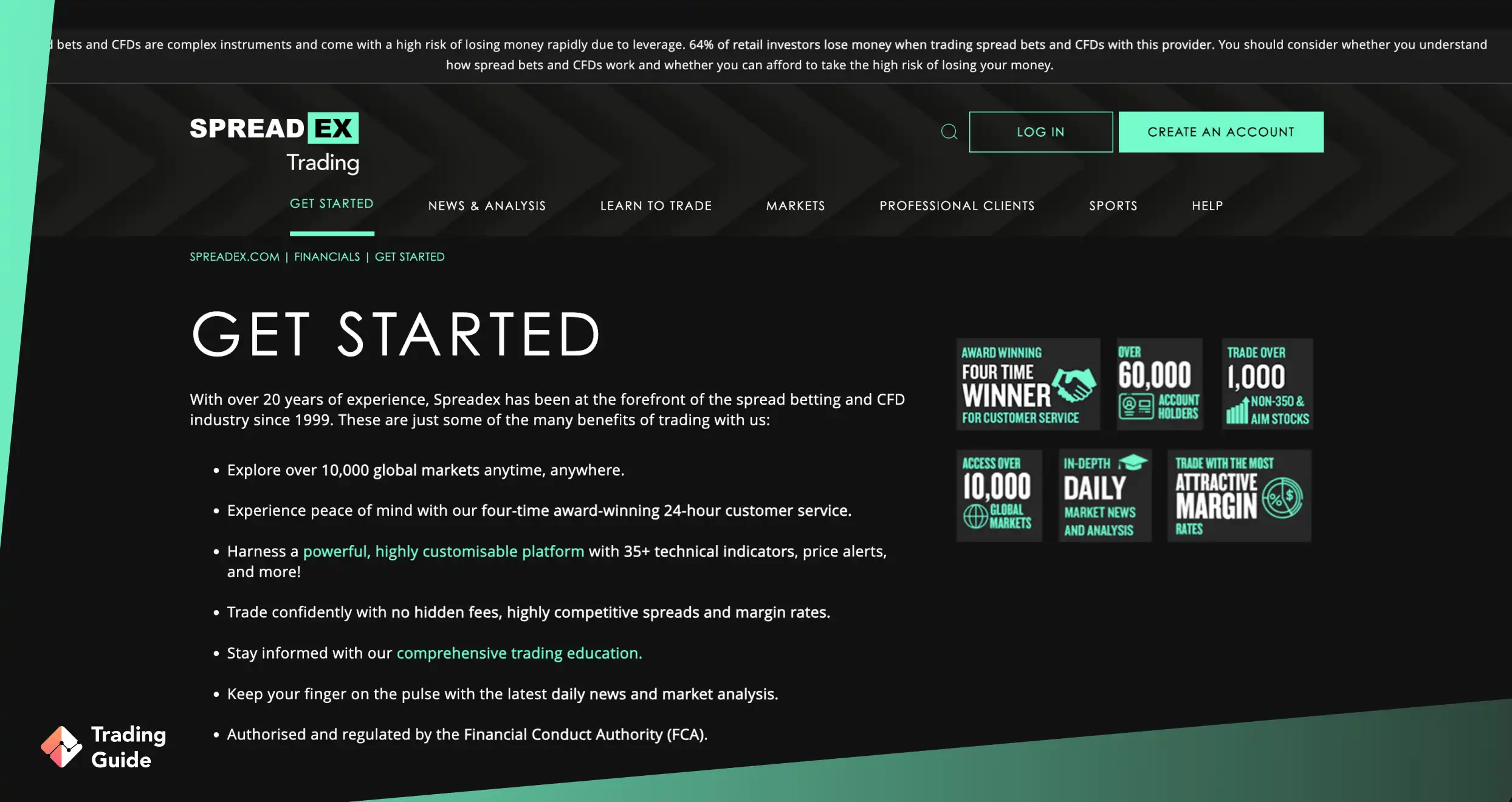

1. Spreadex – Best App for Sports and Finance Spread Bets in the UK

Spreadex is a spread betting, forex, and CFD broker that has been around for more than two decades, since 1999. It is considered a safe broker because top-tier authorities regulate it, including the Financial Conduct Authority (FCA).

What makes Spreadex’s app the best for sports and finance spread bets in the UK is that it owns a separate sports betting service where you can access sports and spread betting on a single platform. You will find more than 10,000 tradable instruments on this broker’s platform. This allows you to expand your options on various markets as you familiarise yourself with how it works. These markets include forex, shares, commodities, and indices.

Spreadex is known for its competitive spreads, starting from 0.6 pips. If you are an investor on a low-budget, then we primarily recommend this broker for you. This is because its trading charges are low, and you will not incur any inactivity fees should you stop opening positions. Additionally, you can also apply leverage, which is a plus point for Spreadex.

Operating your trading activities on this broker’s platform is straightforward. Spreadex’s spread betting platform is also customisable to suit every investor’s requirements. On top of this, you will have access to plenty of charting tools and technical indicators for market analysis.

Read about the best commodity brokers in the UK in our other complete guide.

- +10,000 market assets.

- Low trading and non-trading fees.

- Regulated by world-class authorities, including the FCA.

- Competitive spreads starting from 0.6 pips.

- No demo account.

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

2. Capital.com – Leading App With Leverage-Free Trading

When we tested Capital.com for spread betting on mobile, the first thing that stood out was how well the app balances simplicity with genuinely advanced tools. You can choose to trade without leverage on its 1X account while still accessing a wide product range. Its mobile app supports spread betting on 2,900+ markets and 3,000+ CFDs, covering shares, indices, currency pairs and commodities.

Additionally, Capital.com’s interface responds quickly, price alerts update instantly, and the charting system includes 75+ indicators. The app is very useful, especially when trading on the go. The smart news feed constantly pushes relevant market stories, and unlimited watchlists make it easy to group markets the way you prefer.

We also found the risk tools simple to set up, with stop loss and take profit available on every trade. Capital.com also offers one of the best education ecosystems. Its Investmate app gives you 30+ short courses, with six structured learning paths that genuinely help new traders understand the basics before placing trades. All these and more are accessible with a minimum deposit of just £ 20.

- Commission-free trades with low spreads from 0.0 pips on major currency pairs

- Lists 3,000+ CFDs and 2,900+ spread betting assets

- A reliable trading app with fast trade execution speed

- Low minimum deposit requirement for UK clients

- Supports multiple trading platforms with advanced resources like automated and social trading

- No buying and taking ownership of the listed securities

- You can only trade shares and indices on the 1X account

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

3. Pepperstone – Best Spread Betting App with Low Spreads in the UK

Since its inception in 2010, Pepperstone has quickly grown to become one of the most celebrated spread betting and forex brokers in the UK. Rest assured that your investment capital is safe with Pepperstone since tier-one authorities regulate it, including the UK’ Financial Conduct Authority.

Investing with Pepperstone is easy and cost-effective. You will need a minimum deposit of £0 once you sign up for an account on its platform. Additionally, its trading and non-trading charges, including deposits and withdrawals, are low. The spreads are among the most competitive in the industry, which can go as low as 0 pips. This makes it a go-to spread betting broker for investors with a low budget.

Pepperstone’s spread betting app is supported on all mobile devices. You will have access to its MetaTrader 4 platform that is packed with technical indicators and tools that are fully customisable for your trading requirements. Spread betting also is available on TradingView (USP). Adequate educational and research materials are also available to help with your strategies.

If you need a spread betting app that allows margin trading, then Pepperstone is your broker of choice. It enables you to leverage (trade with borrowed funds) up to 30:1 for UK investors. On the flip side, you will incur high financing costs if you leave your leveraged positions held overnight.

- Low trading and non-trading commissions.

- Highly competitive spreads.

- Advanced trading platform that is fully customisable.

- Spread betting on TradingView

- High financing costs for positions held overnight.

- Customer support service is only available 5 days a week.

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

4. IG Markets – Leading Provider With Investment Options

We’ve always felt that IG Markets sits in its own category when you look at spread betting apps in the UK, mainly because it blends short-term trading tools with proper long-term investing options in a way most platforms simply don’t. Spread betting gives access to 15,000+ markets, covering indices, forex, shares, commodities and more. Moreover, we found the app to be user-friendly, with charts loading quickly.

Besides spread betting, IG supports CFD trading, so anyone who switches between both styles can do it inside the same app. On top of that, users can invest in over 15,000 global shares and ETFs commission-free. You can do so through share dealing, a Stocks and Shares ISA, or a SIPP account. And if you prefer a hands-off approach, IG Smart Portfolio does the management for you.

To get started, deposit any amount you are comfortable with, as IG doesn’t have a minimum deposit requirement. Transactions are also free, but expect an inactivity fee of £12 monthly should your spread betting or CFD account remain dormant for over 24 months.

- Spread betting available on 15,000+ markets

- Also supports CFDs and share dealing on ISA and SIPP accounts

- IG Smart Portfolio for hands-off investing

- Multiple trading platforms to choose from, including L2 Dealer, MT4, ProRealTime, and TradingView

- No minimum deposit requirement for UK clients

- Fees may feel higher for very active day traders

- The platform can be overwhelming for beginners due to its depth

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

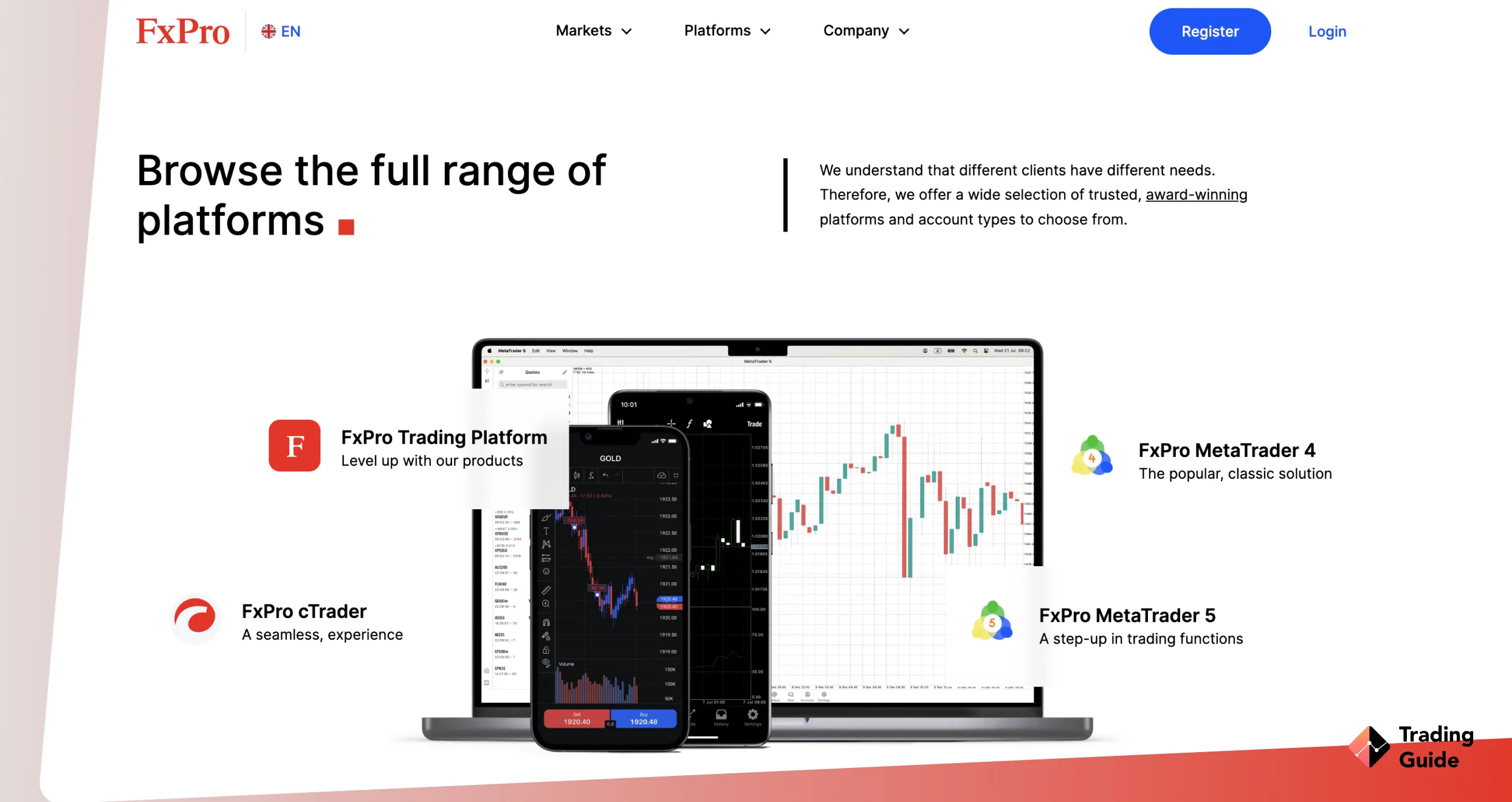

5. FxPro – Best Spread Betting App With an Automated Function

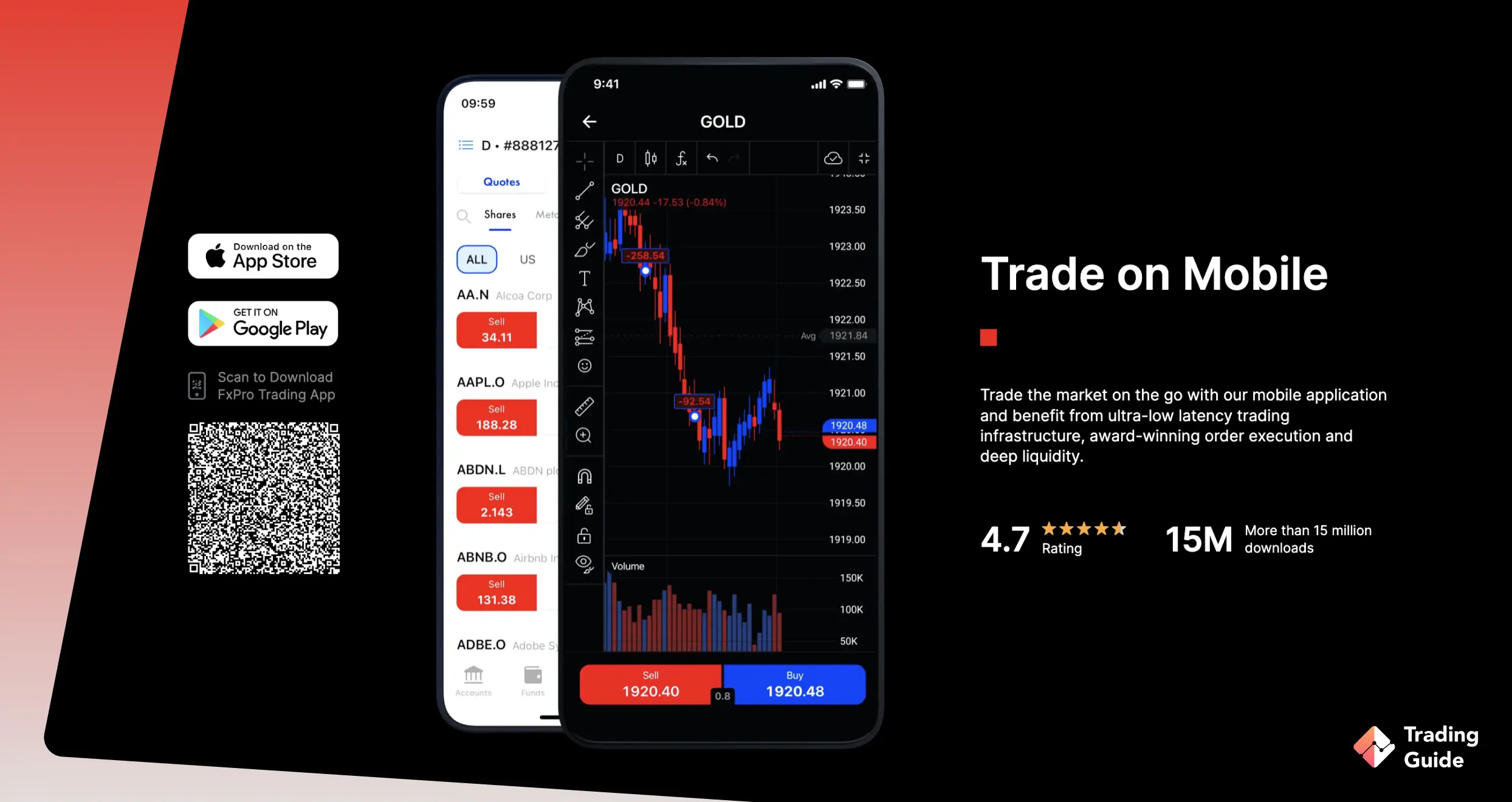

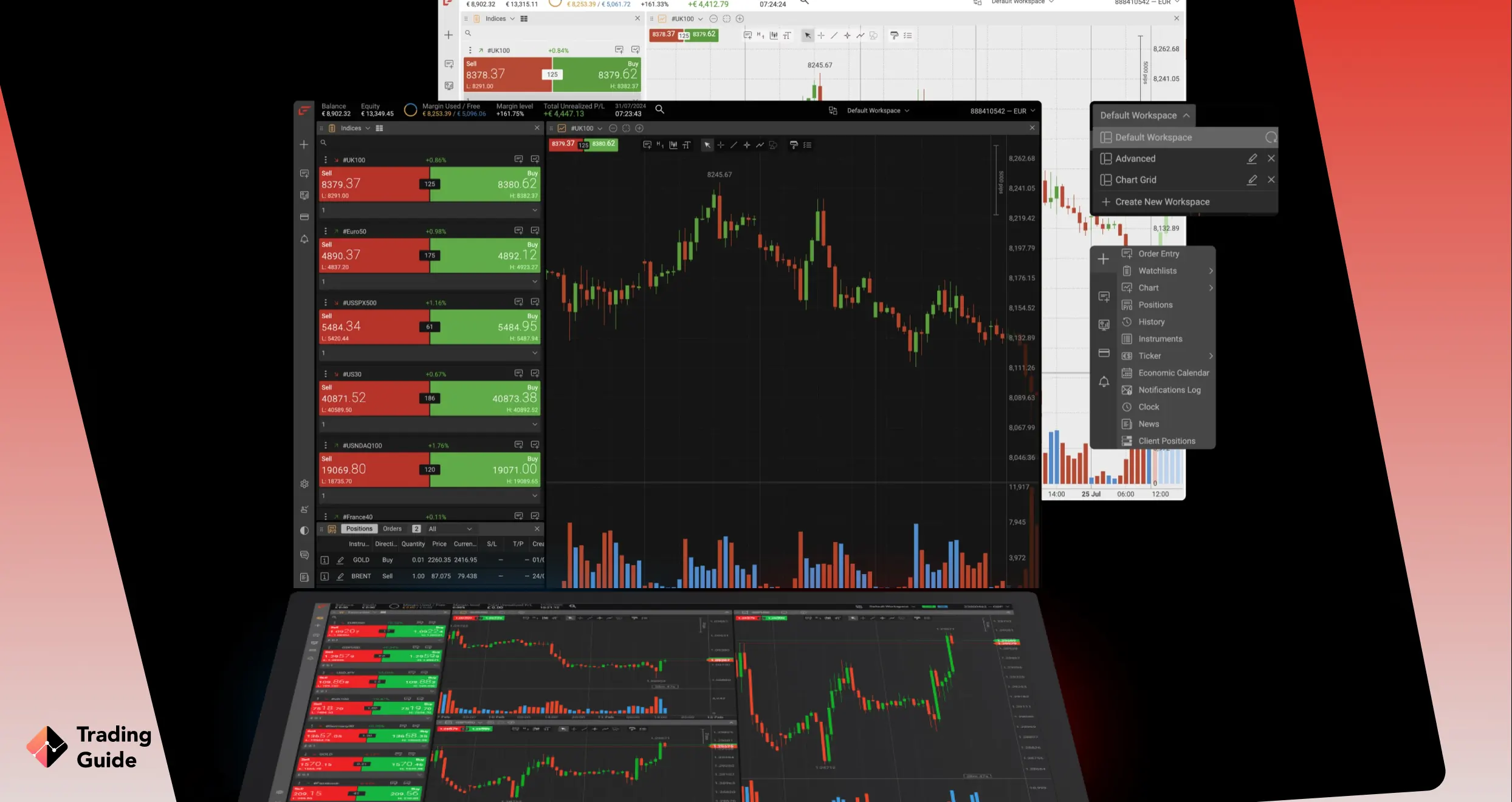

In our thorough exploration of spread betting apps in the UK, FxPro emerges as the unrivalled choice for automated trading. This is primarily because we noticed that it features automated trading on its cTrader, MT4, and MT5 platforms. This feature has become beneficial in the financial space as traders not only get to save time but also avoid getting too emotionally invested. FxPro’s spread betting platform boasts over 2,100 assets, including forex, spot indices, metals, and energy, making it easier for you to diversify your portfolio.

We also discovered that FxPro is highly rated by some of the users on Google Play, the App Store, and Trustpilot. With a minimum deposit of £100 and no transaction fees, beginners and low-budget UK traders will find it easier to join the FxPro community. The competitive spread starting from 0.6 pips on major currency pairs further enhances its appeal. Overall, with its automated function, we believe that FxPro’s spread betting app stands as the pinnacle of innovation and accessibility in the UK market.

- Low minimum deposit requirement

- Excellent support service via phone, email, and live chat

- Multiple trading platforms with the automated trading feature

- Quality research materials

- Limited asset offerings compared to its peers

- Five days a week support service

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

What’s the Difference Between Spread Betting and CFD Trading?

Spread betting and contract for difference (CFD) are leveraged products. They both share many similarities, and so, it is essential that you understand the difference.

You do not own underlying assets trading CFDs and spread betting. While spread betting involves speculating the rise and fall of market assets’ prices, CFD, on the other hand, is a financial derivative contract involving the exchange of the difference in price from which it was opened to when it got closed.

Another factor that differentiates these two is how they are taxed. Even though they are all free from stamp duty, the profits you make trading CFDs are subjected to taxation. However, spread betting profits are tax-free for UK traders because it is classed as gambling.

Additionally, spread bets do expire after specific periods, and all commissions are included in spreads. On the contrary, CFDs do not expire, except for futures, binaries, and options trading. You will also be charged commissions trading CFDs by your broker, depending on the instruments.

Lastly, with CFD trading, you can invest directly into the markets, unlike spread betting, which does not have the Direct Market Access feature.

How to Choose the Right Spread Betting App in the UK

Spread betting apps in the UK are essential tools for investors who want to stay abreast with the latest market trends. It’s challenging to stay connected to your desktop all the time. Therefore, we advise you to choose the right spread betting app for your investment requirements. To give you a headstart, consider the following factors:

A broker with the best spread betting app must be licensed and regulated by world-class financial authorities. Do not worry if a broker holds multiple trading licenses since this proves its credibility even more. You also need a spread betting app that secures your investment capital.

If you are a novice investor, it is advisable to choose a spread betting app that offers many tradable instruments. This is because, while you may have specific instruments for spread betting, you should consider having other options in case you want to try a new instrument.

Spread betting brokers offer different spreads depending on the available market assets. Therefore, before choosing a broker, identify your investment capital and then find a spread betting broker that complements it.

A good UK spread betting platform should be able to execute trades fast for you to stay on top of your investment activities. It should also be easy to use and customisable to suit your trading requirements. The last thing you need to experience is having a spread betting app with a platform that lags your trading activities.

We all have our preferred modes of payments, whether we are out shopping or placing a trade. Therefore, choose a broker that offers payment methods you are comfortable with, such as debit/credit cards, bank transfers, and e-wallets, like PayPal. The app should not only let you invest using your local currency, but you should also invest using currencies of your choice, including the euro and US dollar.

Once in a while, you are likely to experience trading issues. When such problems arise, it is the customer support service that you will contact, hoping to get your issues resolved. The sooner the resolution, the better for your investment strategy. Therefore, choose a trading app that is at your beck and call for when such trading issues arise.

You may find the best broker, but how can you tell if their offerings complement your trading requirements? One way is to test them using their demo account. By opening a demo account, you can get a feel for how the spread betting app works, without investing your money. Once you create your demo account, the broker will reward you with virtual funds that you can use for your experience.

Read our list of the best crypto apps in the UK in our other guide.

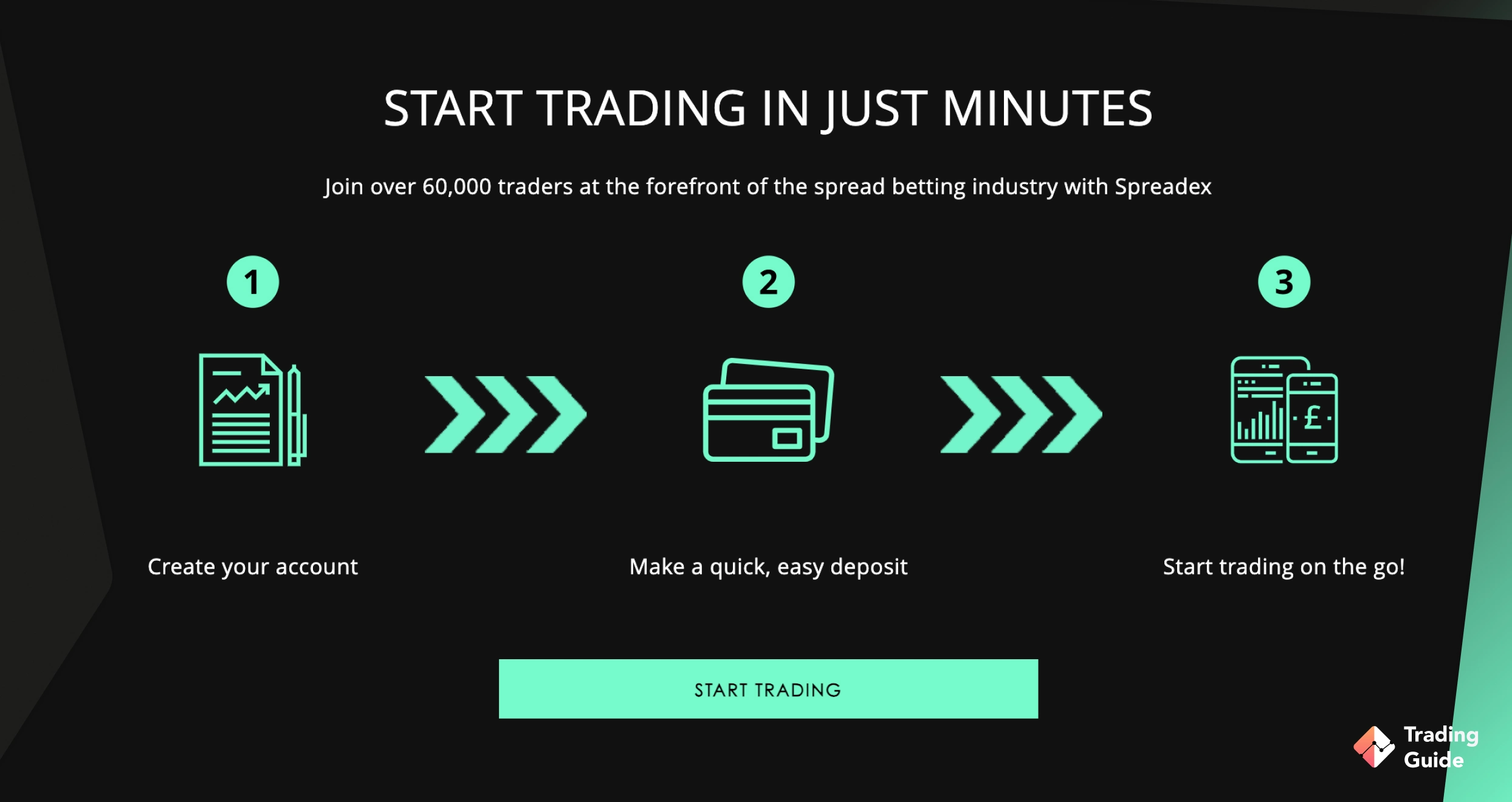

How to Register an Account with a Spread Betting App

Once you’ve found a spread betting app – preferably using our recommendations – that you feel comfortable with, you need to register an account. This involves providing personal information, answering basic financial questions, verifying your identity, and making a deposit. Even though this might sound like a lot at first, the process is actually very straightforward.

Better yet, since all the top spread betting apps in the UK are licensed and regulated by the FCA, they all use the same universal process. This means that you can follow the below steps to register with any spread betting app that you want to use in the UK.

You start the process by following the links provided on this site. As mentioned, our team has spent countless hours reviewing and testing all the spread betting apps in the UK and has listed the best ones on this page.

By following the provided links, you will be directed to the sign-up page. If that fails, you can easily start the registration by clicking the “Join Now” or “Register” button on the broker’s website.

The first step involved providing basic information about yourself including name, address, income, and phone number. Keep in mind that you will have to verify the provided information at a later stage. Therefore, you must provide accurate information.

With your account registered, you can log into your spread betting app from your smartphone. However, you will automatically create a desktop account as well, meaning you can visit the broker from any device you see fit. At this point, you will also gain access to your demo account so that you can test the broker and practice a bit before you start betting with real money.

You will also have to verify your identity and residence. This is done by submitting proof of identity (national ID, driver’s license, passport) and proof of residence (utility bill or bank statement).

The last step is maybe the easiest. All you have to do is pick a payment method that suits you, a trading amount that fits into your budget, and make a transfer. As soon as the funds land in your trading account, you will be up and running.

Now, you have registered, verified, and funded your spread betting app account and can start spread betting. Please note that we strongly advise that you learn the ins and outs of spread betting before you risk your real money. This way, you can avoid unnecessary losses and improve your chances of making a profit.

Lastly, keep in mind that there are big differences between CFD trading, investing, and spread betting. So make sure you understand all the differences as well as the pros and cons before you pick a broker and start benefiting from the financial markets.

FAQs

To spread bet in the UK, you need a broker that is licensed and regulated by top tier authorities, including the Financial Conduct Authority (FCA). Once you create a spread betting account, you will have access to many market instruments to spread bet on.

Yes. In the UK, spread betting is classed as gambling, and so any profits you make spread betting are tax exempt.

Yes. Spreadex is not only safe, but it is also the best app for sports and finance spread bets in the UK. It has been in existence for more than two decades, and world-class financial authorities also regulate it. This makes it a safe spread betting broker for your investment needs.

Although both CFD and spread betting are leveraged products, they differ in how they are taxed. You do not own underlying assets when investing in both CFD and spread betting, making them all free from stamp duty. However, spread betting in the UK is tax-free because it is classed as gambling. On the other hand, CFD trading profits are subjected to capital gains tax. Additionally, CFD is available worldwide, whereas spread betting is only legal in the UK and Ireland.

Yes. Spread betting is a risky investment, but it can also be highly profitable if you understand the risks of applying leverage and market volatility. You also need the best spread betting broker for your trading requirements, like the ones we recommend above.

No. Spread betting involves speculating the rise or fall of market assets’ prices, while day trading consists of buying and selling financial instruments within a day. With spread betting, you do not own the underlying assets.

Conclusion

Spread betting is a risky form of investment that requires close monitoring. Whether you are a beginner or an experienced investor, you will find the right app for you in our mini-reviews above. Once you make your choice, we advise you to conduct further tests on the broker to see if it’s suitable for your trading activities. Remember, it is only legal to spread bet in the UK if you are using a licensed and regulated broker. So, choose carefully.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

What devices can I trade on IG?

Hello B. Schwartz, IG app is designed for iOS and Android devices, including smartphones and tablets. On iOS devices, you can use the app on the iPhone, iPad, or iPod Touch. For Android, the app is compatible with smartphones or tablets with an operating system of 5.0 or above.

City Index was my choice for cryptocurrency trading and it was a positive experience. I have been using City Index for one year. The platform is user-friendly, making it easy to trade various cryptocurrencies. Buying and selling is easy and they provide a good selection of cryptocurrency options. Very responsive support service

I’ve tried a few of these apps, and I’ve found that Pepperstone's low spreads and ease of use work best for me. It’s been a solid choice for keeping my trading simple and cost-effective.

I’ve tried a few of these apps, and Pepperstone stands out with its low spreads and solid platform. It's definitely a great choice for traders looking for flexibility and competitive fees.