Admiral Markets is a leading UK online broker.

- Strict regulation

- Clean design

- Negative balance protection

- Great variety of trading conditions for different levels of traders

- No fixed spread accounts

- No spread betting

Admiral Markets is an STP and market maker broker dedicated to providing traders with the industry’s appealing market conditions. The broker has built up a strong reputation on the UK market aince 2012. The broker under the brand ‘Admiral Markets’ is UK regulated.

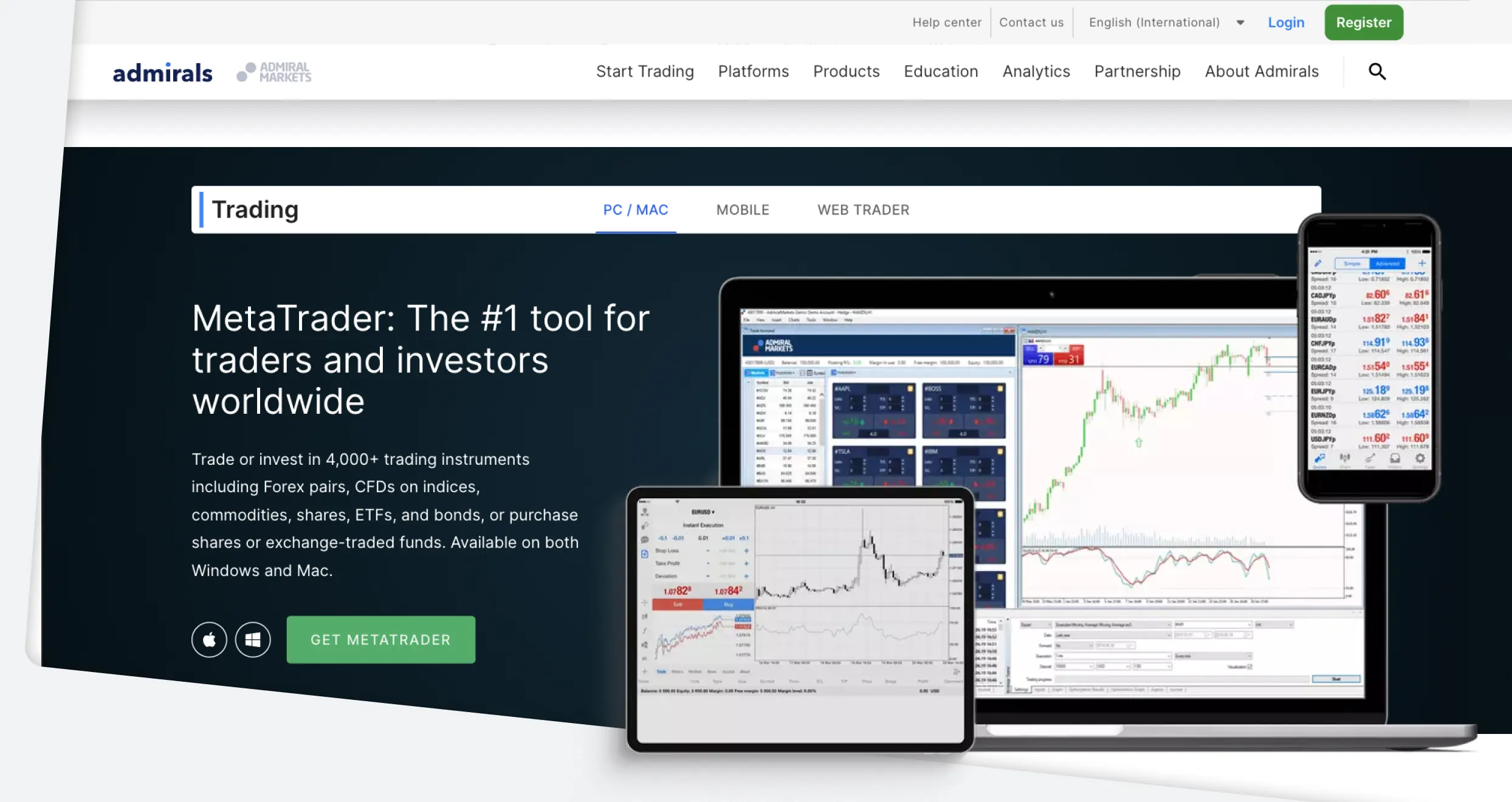

Admiral Markets offers a large selection of trading instruments on advanced trading platforms with flexible accounts, tight spreads, fast execution, and various funding options.

Our expert traders have an in-depth analysis of the Admiral Markets trading platforms, checking their work, as well as testing the most important trading instruments. So, we are ready to share it with our readers.

Admiral Markets – Who Are They

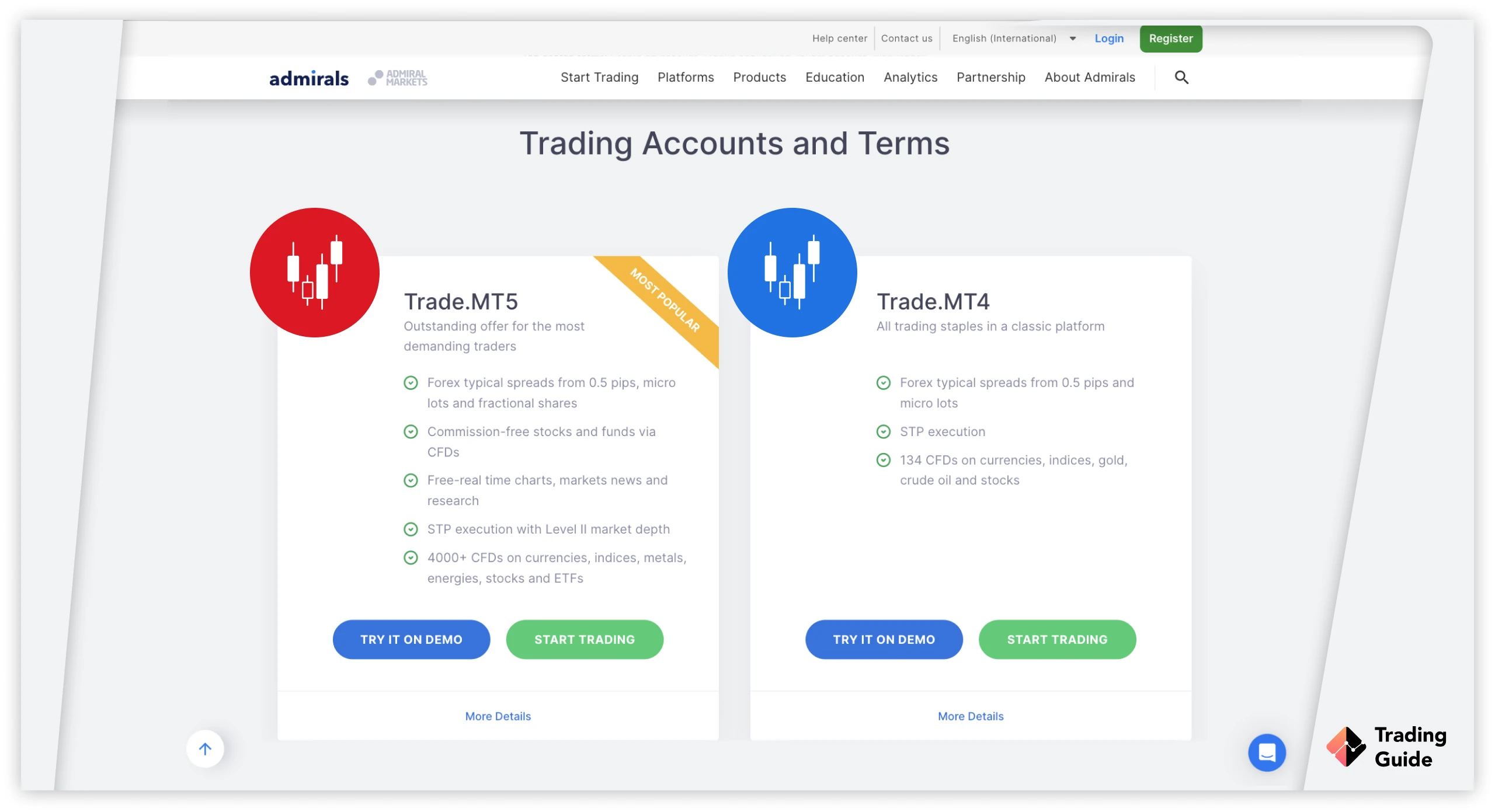

Admiral Markets UK Ltd is a multi-asset broker that was incorporated in 2012 with the office in London. Currently, the company’s office is registered at Aldgate Tower, 2 Leman Street, London. The broker offers the most popular financial instruments to clients, including a wide variety of leverage for CFD trading from 1:2 to 1:30 lower-leveraged CFDs, such as forex, real stocks and ETFs.

The trading platforms provide real-time trading of the world’s most popular financial instruments, monitoring your account and market quotes, customer support chat, and more.

Admiral Markets is a great broker with great trading opportunities. You can start investing with just £1 and trading with £250 minimum deposit on more than 4,000 stocks from the New York Stock Exchange, Nasdaq, FTSE, and more.

Admiral Markets offers the most advanced trading tools and services and sophisticated operations, including technical analysis indicators and trading strategy templates.

Compare Admiral Markets Features With Other Brokers

Compare brokers

Commissions and Fees

| Type | Fee |

|---|---|

| Minimum deposit | £250 |

| Deposit fee | $0 |

| Withdrawal fee | 1 free withdrawal request every month, after – 1% |

| Inactivity fee | Monthly €10 |

| Overnight fee | Yes |

Our Opinion about Admiral Markets

Admiral Markets offer a collection of educational programs: webinars, e-books, trading videos, articles, and tutorials. Some of these are related to the forex and CFDs trading on Admiral Markets’ platform and online marketing strategies that help traders grow their trading knowledge.

Admiral Markets allows trading with a demo or live trading accounts. The mobile trading application of the broker is looking nice and clean and user-friendly. We also noticed that the support team responds fairly quickly to questions asked and feedback left.

You can contact Admiral Markets customer support through:

- Live Chat

- Online Contact Form

- Telephone

- Request for Remote Support

FAQs

Admiral Markets is a well-established, regulated and reputable online broker offering a range of CFD financial instruments for trading, including forex, stocks, CFDs (commodities, indices, bonds, ETFs, shares). The broker under the “Admiral Markets” brand is UK. Most importantly, Admiral Markets offers attractive trading conditions and a range of trading platforms, making it a popular choice for traders.

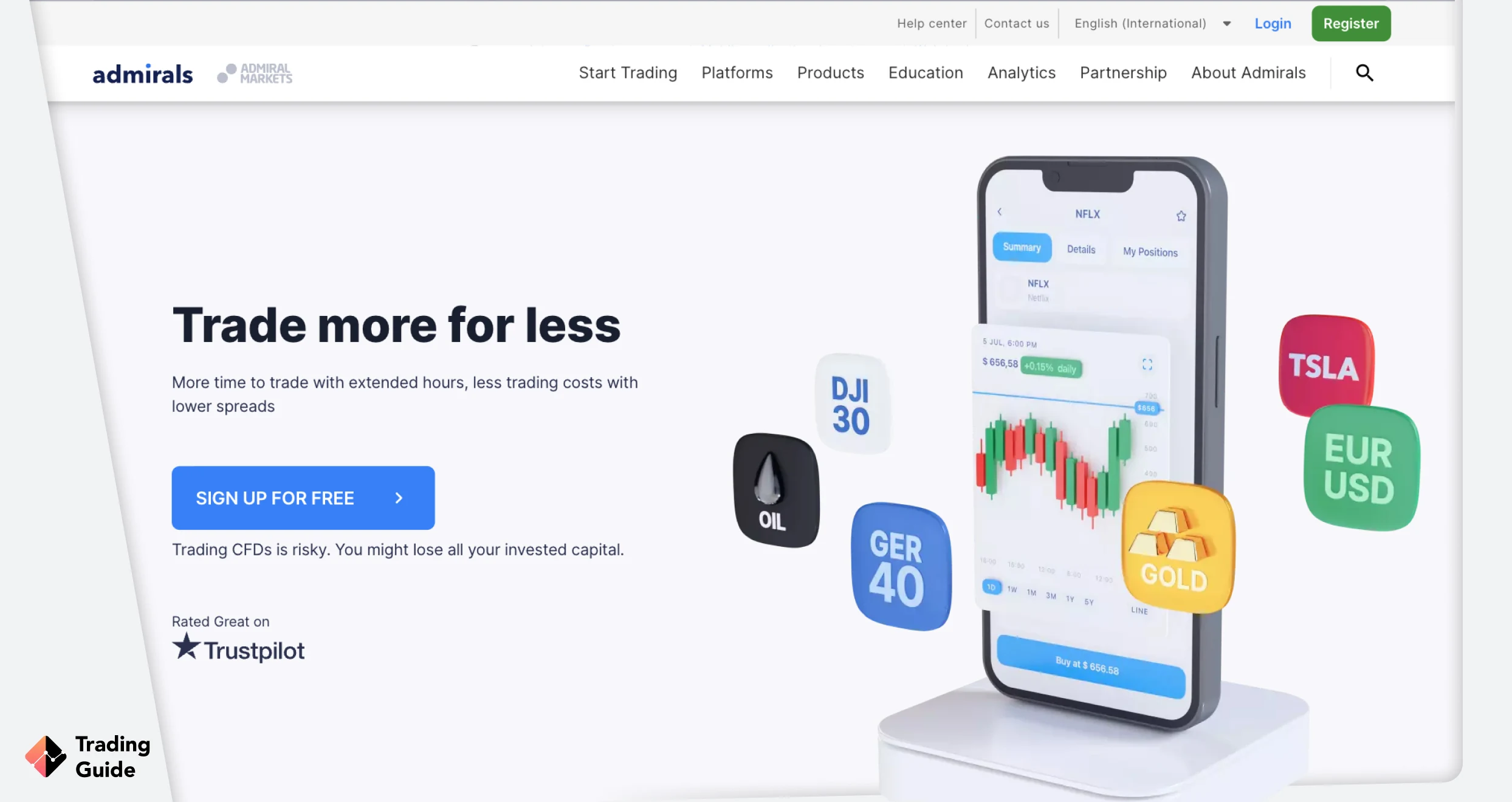

Admiral Markets UK is an STP and market-maker broker that was incorporated in 2012. It is a multi-asset CFD broker with the office in London. Admiral Markets prides itself on offering superior qualitative trading services and multiple platforms, including the MT4 and MT5, to suit all traders. With a low minimum deposit (https://admiralmarkets.com/start-trading/account-types) and tight spreads (https://admiralmarkets.com/start-trading/contract-specifications), we believe that this broker suits any CFD trader.

Admiral Markets is owned by Admirals Group AS, a holding company that was founded in Estonia and started operating under the Admiral Markets brand in 2007. Admiral Markets UK Ltd was founded in 2012.

The processing time for a withdrawal with Admiral Markets will depend on your payment method and the amount being withdrawn. Typically, the withdrawal processing time is between 1 and 3 business days.

Yes. Admiral Markets has a native Admirals Mobile App that you can download from Google Play or the App Store. With this app, you can trade all the featured securities whenever you leave your trading station. Remember that the broker’s trading app is designed with advanced security features and executes trades smoothly, offering the potential for an engaging trading experience.

I have only experienced with few brokers: Marketiva, Interactive Brokers, Forex.com, and Admiral Markets. From the 4th brokers, I could recommend easily two, that I have worked with the last two years: Interactive Brokers and Admiral Markets.

My current broker is Admiral Markets, but Interactive Brokers is good too. If your available balance is above $500 or even more, you could go with any of the two.

I was very happy to find this broker. I live in Australia and there is very tough financial legislation, so there are almost no brokers with good trading conditions. Therefore, I opened an Admiral Markets account. There are excellent trading conditions. This is really rare in my country. I opened a demo account here and now I am studying all the functions of the Metatrader5 trading platform. It is very convenient and there are many trading and ana/lysis tools available.

I've been trading with them for over a year now. Admiral Markets is honest and fair. They have a transparent system, I mean rules, commissions, swaps, and I think I made a good decision when I started trading here.

I have been trading with Admiral Markets for over 5 years. I have never had any problems and am very satisfied. They have a very good support team, my deposits are received instantly and withdrawals are made in 24 hours.

What can I say? It's one of the best brokers that I know! Super support service and very nice staff. Everything is on very high level. I have been using Admiral Markets for a few years now. I recommend them to anyone looking for a good broker.

Excellent app. There are all the vital timeframes for my successful tradings. Thank you so much, guys!

Highly professional and trustworthy broker, I feel my money is safe here. I also got the best spreads on CFD trades with Admiral Markets. I like their very complete website, with support, free valuable training programs, and guidance.

I am a newbie to trading but it is my best experience and decision about choosing this broker as well. Fast and responsive customer support. Specialists are friendly and professional. I had some problems with verification and they helped me through it.

Best customer service I know. Specialists are very friendly and professional. I can recommend this company to everyone, who is looking for a serious partner for trading and investments. Easy to access and trustworthy broker. I am very satisfied with the broker.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

I'd probably test them with small amounts