Barclays is a multinational investment bank and financial services company headquartered in London, England.

- Low stock, ETF, fund, and bond fees

- Good customer support

- No withdrawal fee

- Volume-based monthly customer fee

In addition to investing, Barclays has four core businesses:

- Wealth management

- Investment management

- Retail banking

- Corporate banking

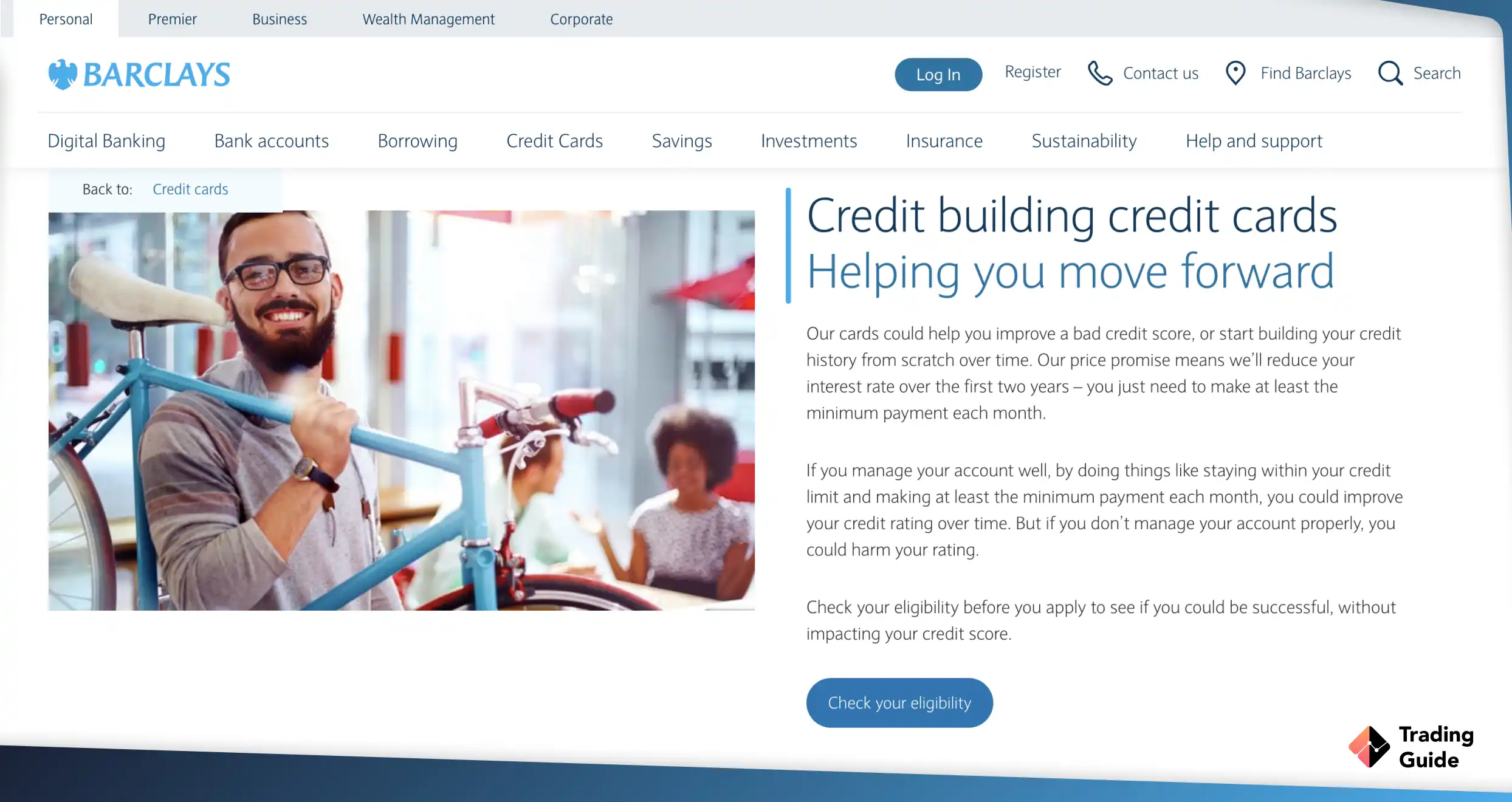

We consider Barclays Smart Investor to be safe because it has a long banking experience market and is very reputable. The bank is listed on the stock exchange, transparently discloses its financial performance and is regulated by a top-tier financial authority.

We were also pleasantly surprised by the number of positive reviews on Google Play and the App Store. Many users are satisfied with the good performance of the trading platforms. Also, we noticed that the company has an excellent customer support service that responds to all negative reviews, helping to solve customers’ problems.

Barclays – Who Are They?

Barclays has been in the banking business for over 100 years. In 1896, several large London banks merged into a joint-stock bank called Barclays and Co, which marked the beginning of the famous British multinational investment bank operating.

Barclays Smart Investor is renowned for its long history and solid trust, and its pleasantly low commissions on stocks, funds, and bonds. Barclays has a solid track record as it operates on multiple stock exchanges, has banking experience, and is regulated by the highest authorities.

You should note that Barclays Smart Investor is only available to UK residents and offers a selection of UK-only investment products. The company also has a user-friendly mobile trading platform that allows you to manage your investments on the go.

The great thing about it is that Barclays has reasonably low commissions for trading stocks, ETFs, bonds and funds. This is very beneficial for many novice traders. There is also no fee to pay for a deposit, withdrawal or inactivity. Unfortunately, the company charges a monthly customer fee, which depends on the amount of holding assets.

| Type | Fee |

|---|---|

| Minimum deposit | £0 |

| Overnight fee | Yes |

| Monthly account fee | £0 |

| Withdrawal fee | £0 |

| Deposit fee | £0 |

| Inactivity fee | £0 |

Compare Barclays Features With Other Brokers

Compare brokers

Our Opinion About Barclays

We have long appreciated Barclays and its high performance on the trading market. We love the fact that they value their customers and try to provide answers to help each user.

They also frequently update their mobile app, which helps optimise its work and make it more user-friendly. The mobile app itself is very easy to use and has an intuitive interface and clean design. It is convenient to use, regardless of the gadget you’re using. However, the application still has room to develop, as we found some bugs, including the fact that we did not always receive push notifications when pending or receiving money.

Otherwise, we are very pleased with the work of Barclays.

FAQs

Yes. Barclays has an exceptional track record and is one of the leading banks in the United Kingdom. Barclays Smart Investor offers reasonably low commissions for trading stocks, ETFs, funds, and bonds. In addition, it has a user-friendly mobile trading platform that allows users to manage investments on the go. There is also no deposit, withdrawal, or inactivity fee.

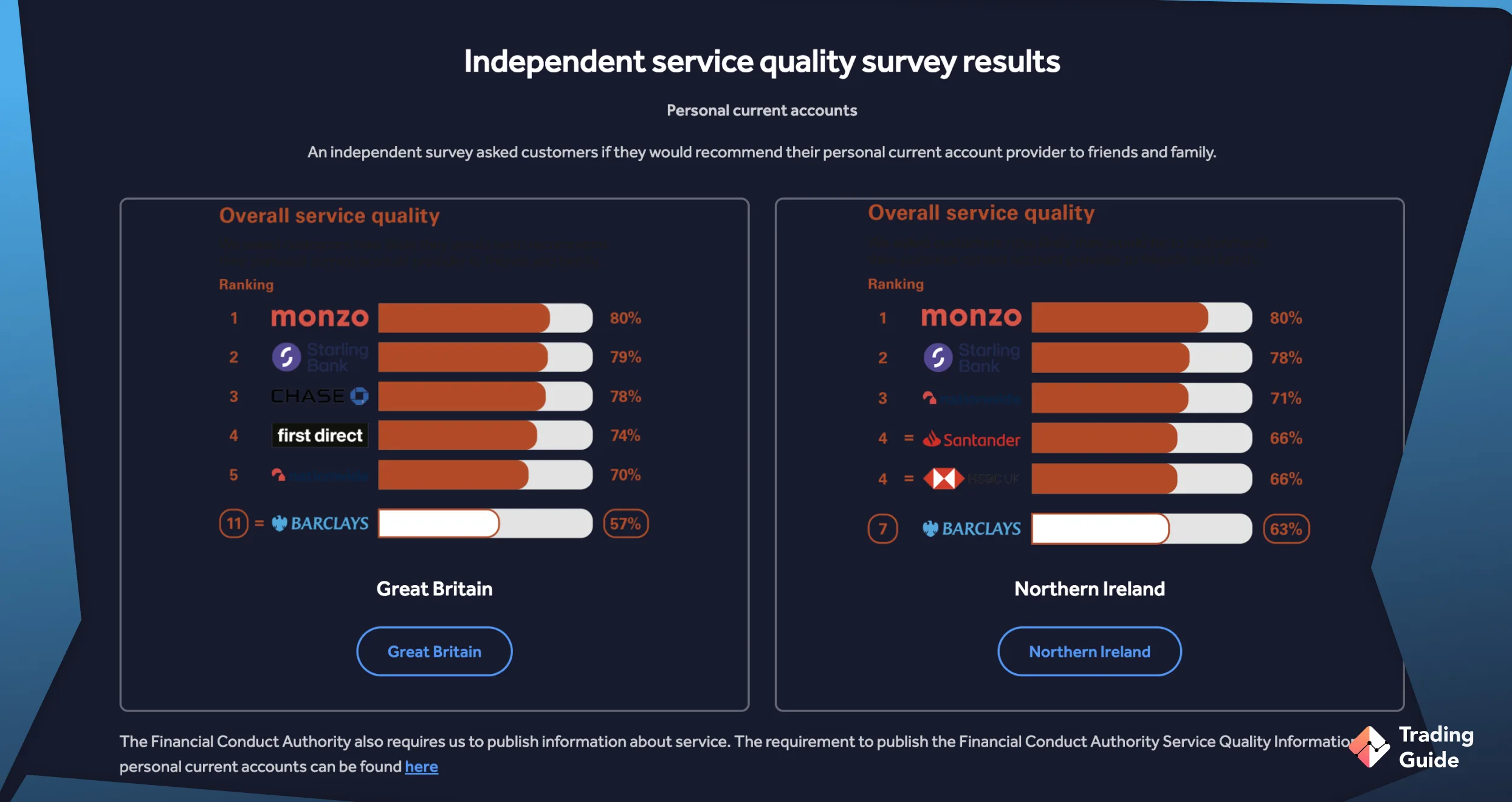

Absolutely. Barclays is a safe bank and investment platform regulated by the Financial Conduct Authority (FCA). All eligible investments at Barclays are protected by the Financial Services Compensation Scheme (FSCS).

Barclays is one of the leading banks in the UK, serving millions of customers and offering numerous financial products and services. Moreover, the bank is highly encrypted to protect users’ information.

Yes. Barclays’ revenue has been increasing throughout the years, and we believe buying its shares is a good investment. However, this doesn’t mean you should buy Barclays shares without fully familiarising yourself with the company and the stock market performance. To maximise your profit potential in this investment, ensure you conduct extensive research and analysis.

You can open a Barclays Smart Investor account through the Barclays mobile banking app if you already have a current account with the bank. You can also open one through the Barclays website if you don’t already have an account. Note that Barclays Smart Investor is only available to UK residents.

Great service, except for having to wait for a phone call to confirm transactions, but this way the system protects my money from scammers, thanks Barclays, keep up the great work.

I've been with Barclays for 10 years, never had any major issues, customer service has always been good, no fees, easy to use.

I use Barclays as my main and daily bank. Best customer service I have had with a bank ever. Would 100% recommend, I have been a customer for many years.

I have been with Barclays now for the coming up to 5 years and have 3 separate accounts with them. I have always had great, but not fast service. However, they have great trading tools, so I am with them and totally satisfied.

Used their business Banking for 2 years now - no complaints at all. Very straightforward online banking. Very friendly and professional customer service. Had different troubles abroad with my cards but the customer service was professional and dealt successfully with my issue. They're available 24h/7. Wouldn't hesitate in making a recommendation to friends or family.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal