Hargreaves Lansdown is the largest private investor and investment platform in the UK.

- Trusted and well-respected industry leader

- Comprehensive range of services

- Good customer support

- Clear desing

- Commissions and fees a quite high

- Charting and technical analysis are not good enough

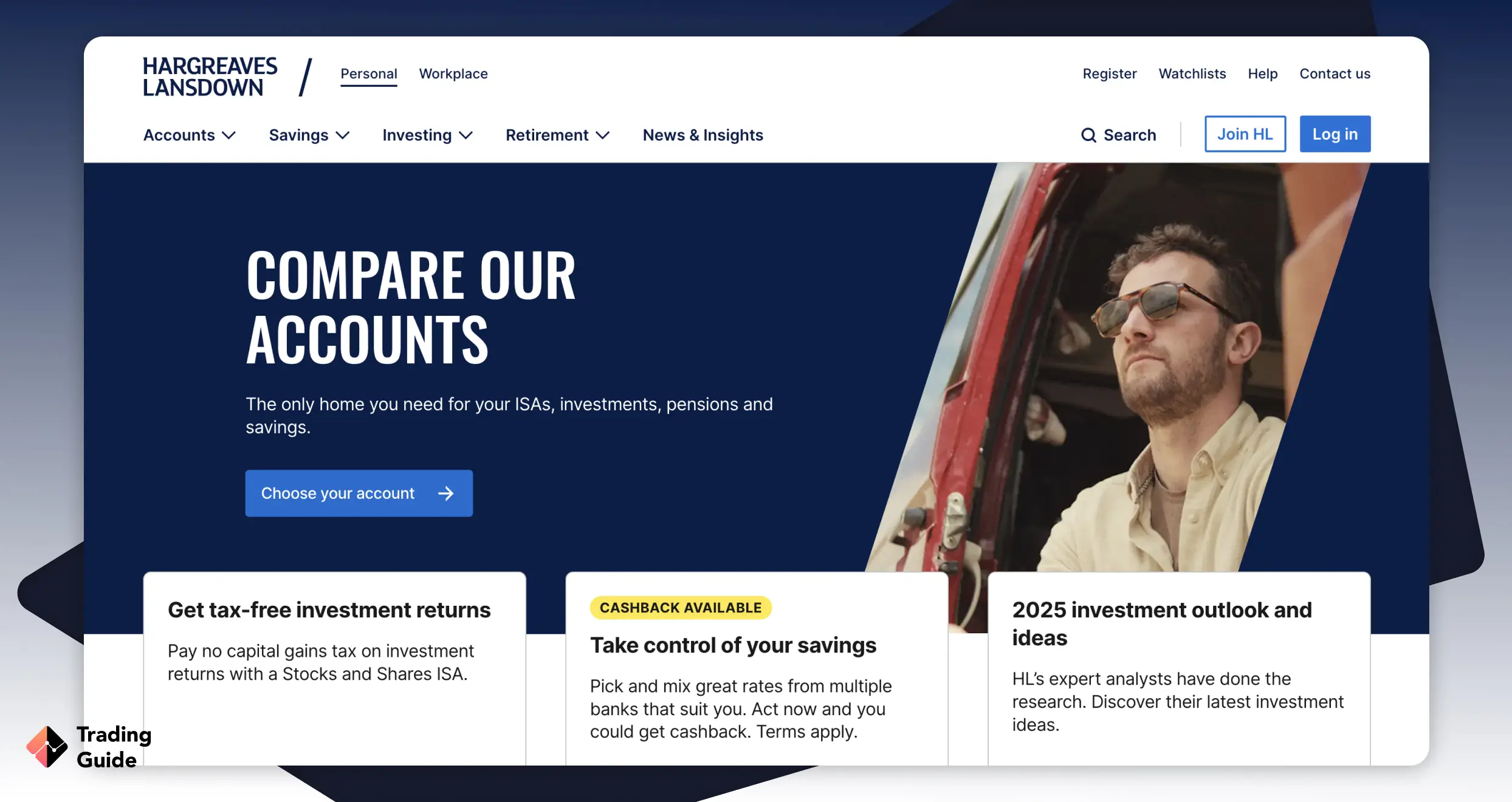

Hargreaves Lansdown allows its investors to achieve their financial goals by providing personal and diverse financial guidance. They do this through tailored advice, online investment tools, and access to investment products from around 200 fund providers, with an impressive range of funds to choose from at competitive prices.

Hargreaves Lansdown Fund Managers Limited is authorised and regulated by the Financial Conduct Authority (FCA) and so they strictly follow FCA’s rules and regulations in the conduct of investment.

We’ve spent many hours researching and testing Hargreaves Lansdown’s trading platform, of which you can check out the results below.

Hargreaves Lansdown – Who Are They?

Hargreaves Lansdown, with the trading name of HL Investments Limited, was founded in 1981 by Peter Hargreaves and Stephen Lansdown. It is the largest private investor and investment platform in the UK today.

In 2016, it handled £113 billion of investments. In late 2018, they had £91.6 billion of investments for over one million clients.

Investment trusts are funds that are publicly listed as companies on the London Stock Exchange and are traded like shares. The market for investment trusts is huge. Hargreaves Lansdown has over 300 trusts that deal in a range of markets. Each is managed by an investment manager, whose aim is to create a profitable portfolio over the long term.

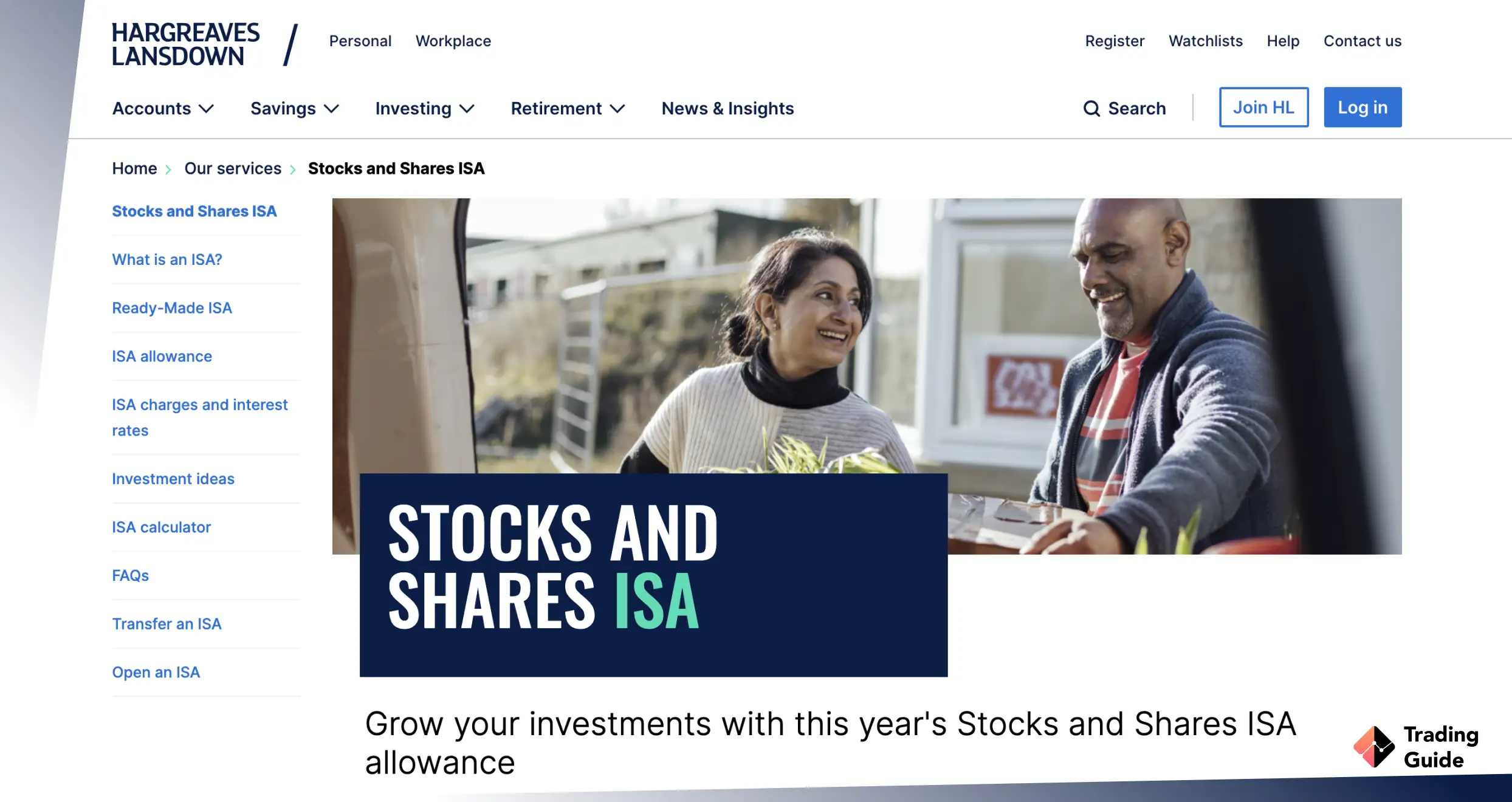

Moreover, Hargreaves Lansdown has several account types. For example, the Stocks and Shares ISA account is suitable for both experienced and newer investors. It offers a wide range of investment classes. It’s possible to make tax-free investments in over 2,500 different funds, shares, and investment trusts.

Hargreaves Lansdown Main Fees and Charges:

| Type | Fee |

|---|---|

| Minimum Deposit | £1 |

| Deposit Fee | No |

| Withdrawal Fee | No |

| Inactivity Fee | No inactivity fees |

| Annual Fee | 0.45% |

Compare Hargreaves Lansdown Features With Other Brokers

Compare brokers

Our Opinion About Hargreaves Lansdown

Hargreaves Lansdown is a British financial services company, with over 40 years of experience. Hargreaves Lansdown’s trading platform offers investors a comprehensive range of products and services to choose from, which makes them a good overall choice for investors of various experience levels.

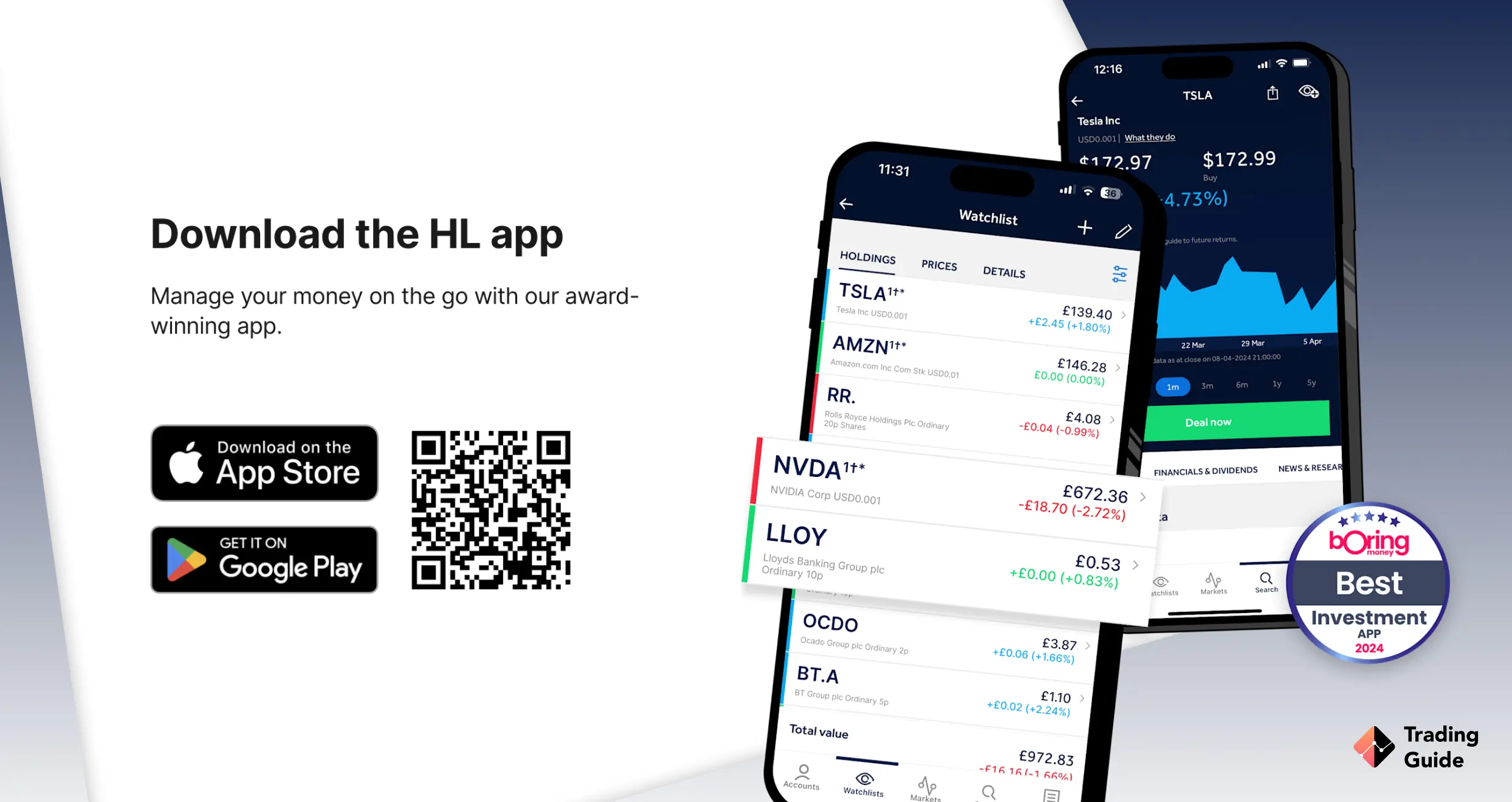

Its website has powerful research tools and an online account gives you various innovative features, including general and market news sections, research, and tips. Hargreaves Lansdown’s clients can also use market insights and statistics, as well as a range of guides and calculators.

We consider this broker to be completely safe and a good choice for achieving your investing goals.

FAQs

Yes. Hargreaves Lansdown has existed for over 40 decades and remains popular among traders because of its impeccable services and tools. In addition, the broker is regulated by the Financial Conduct Authority (FCA), indicating that your funds and personal information will be in safe hands.

In addition, the broker secures your funds in segregated accounts only accessible to you. Therefore, there is no reason not to trust Hargreaves Lansdown with your personal information and money.

Hargreaves Lansdown can be a great option for beginners. This is because it offers a comprehensive range of products and services, including market insights and statistics, as well as guides and calculators for maximum experience.

On top of that, the broker offers a demo account to users on its platform. Beginners can use the demo account to get familiar with the trading platform, trading strategies, risk management tools, and more without any risk to their portfolios.

Yes. Hargreaves Lansdown is a reliable and safe broker. It operates according to FCA regulations, meaning there are measures to protect investors.

For example, the broker has to keep customer funds and assets in segregated bank accounts, where they are free from any type of interference. Therefore, you can rest assured that your shares and funds are protected even if Hargreaves Lansdown goes bust.

No. Hargreaves Lansdown does not support buying or selling cryptocurrencies like Bitcoin or Ethereum. However, Hargreaves Lansdown customers can gain cryptocurrency exposure by investing in crypto-related stocks or exchange-traded funds (ETFs) on the platform.

Examples of stocks closely tied to the crypto industry include MicroStrategy, Riot Blockchain, and Marathon Digital.

Hargreaves Lansdown has several segregated bank accounts at core UK clearing banks, such as HSBC, Barclays, Bank of Scotland and Lloyds.

Hargreaves Lansdown, with the trading name of HL Investments Limited, was founded in 1981 by Peter Hargreaves and Stephen Lansdown. It is the largest private investor and investment platform in the UK today.

HL is one of the major investment managers in the UK, with Billions under their care. Excellent service, knowledgeable and dedicated team answering all manner of questions regarding investments. Have been a client for some years, and have always been satisfied with their service.

One could easily create an account here and start trading almost immediately! The broker is very cool 🙂 🙂 🙂

You need to have a plan of action in your investment, especially if you are looking for how to trade and you don't know how to go about it. Is having a plan the roadmap to winning trading? You can test your strategy on a demo account and run it on a real account with small positions. Your trading plan should have at least the following: a position entry and exit point, a profit and loss target, a stop loss and take profit level (if you want to use one).

You need to have a plan of action in your investment, especially if you are firtly trade with Hargreaves Lansdown. Having a plan is the roadmap to winning trading. You can test your strategy on a demo account and run it on a real account with small positions. Your trading plan should have at least the following: a position entry and exit point, a profit and loss target, a stop loss and take profit level (if you want to use one).

I first came here to trade stocks. I decided to open a real trading account with this broker after I reviewed their trading conditions and found them acceptable. By the way, it was my friend who told me about this broker. He’s a professional stock trader and he pictured this broker very positively. Among the company’s strong points he mentioned no-commission and no swap trading and also tight spreads. So, I came here with a firm decision to trade stocks. However, over time I started to drift from stock trading. I can’t say that I quitted it but I also started to trade in the long term and I should say that I earn more exactly in the long term.

Hargreaves Lansdown talks a lot about market news, which can be useful in trading. Also, broker provides many-many assets, no delays, money out goes smoothly. I'm ok with that. Thanks to broker!

I have been working with Hargreaves Lansdown for several years now. Tried different companies for investing, but this one turned out to be the best. The site is easy to use. Lots of information is available.

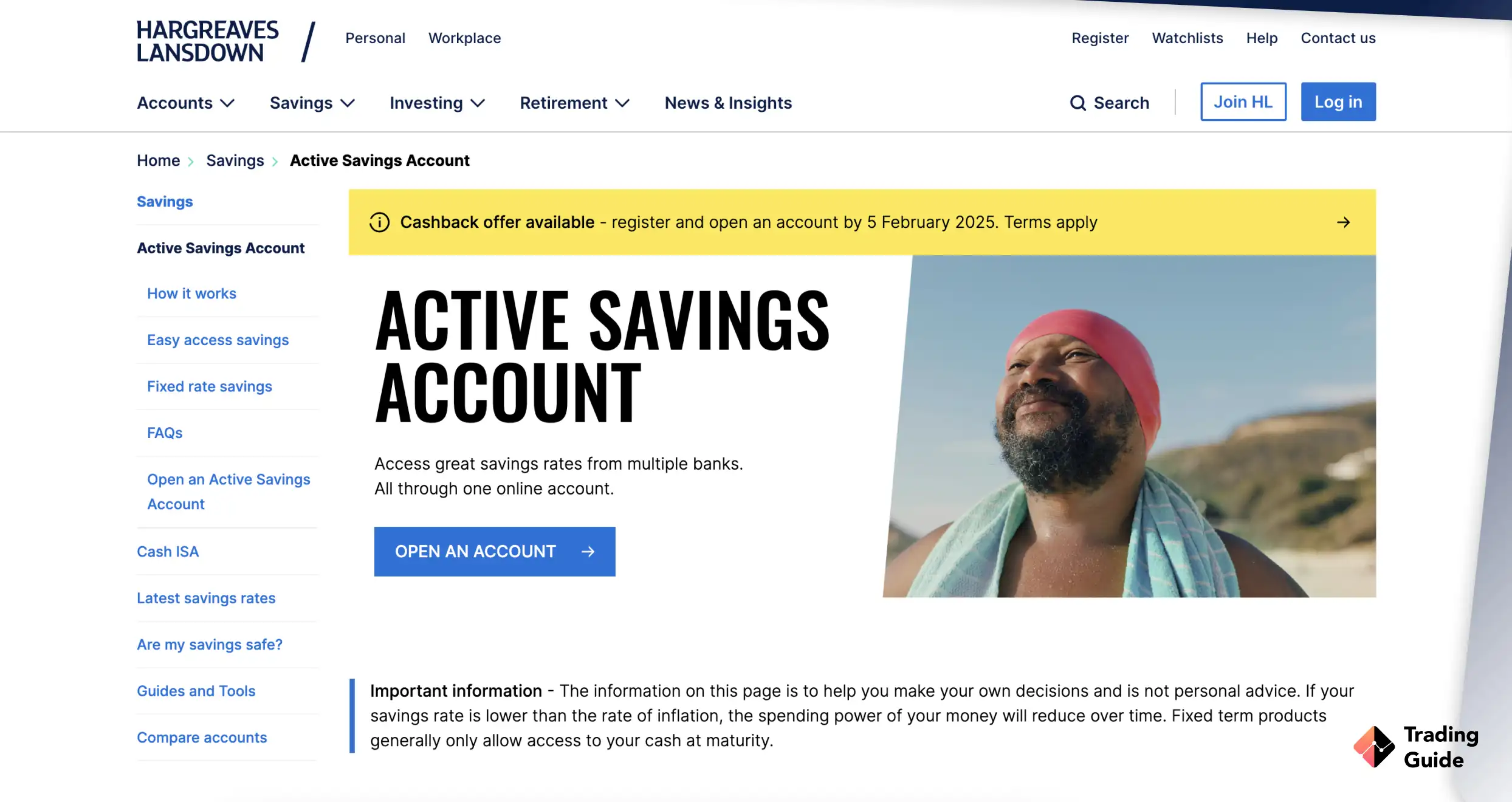

I’m not good with computers however setting up an Active Account with Hargreaves Lansdown was so easy, furthermore I had a query on another matter the response was immediate and professionally answered. The staff knows their job. It is a good platform for beginners, I highly recommend it!

Very easy to set up an account on the HL app and very easy to make monthly payments. I like that it is easy to manage the stocks and shares ISA account and track the different funds.

Easy to use platform. Good service. The HL service is always very polite and helpful. They make it easier than I sometimes fear. Quick and easy to buy and sell shares. Thank you.

Having used several other companies before, I have been with HL for 3 years and am still happy with their services. Hargreaves Lansdown provides a really easy platform to use for any investments or savings or impartial financial advice. Stable company with a wide range of services and good customer facing staff.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

I've used Hargreaves Lansdown and really appreciate how comprehensive and trustworthy it feels – it's perfect for long-term investing in ISAs, pensions, and funds with tons of research and educational content