Trading 212 is a UK-based brokerage firm dedicated to democratizing trading by making it accessible to everyone.

- Quick and easy account opening

- Easy-to-use trading platforms

- Low minimum deposit

- Strict regulation

- Limited product portfolio

- Withdrawals are limited to funding payment methods

Since its inception, Trading 212 has worked hard to become one of the leading brokers in the industry. With well-developed trading platforms and a powerful back-end engine, the company has managed to grow exponentially over the years.

We have reviewed our experience with Trading 212 in terms of their user interface experience, customer support and their suitability for both beginner traders, as well as experienced ones.

Trading 212 – Who Are They?

The company was founded in 2004 and has a London office, as well as one in Cyprus, which is the base of operations for international clients.

It’s been a wild ride since Trading 212 was launched as a platform for FX trading. Since then, it has become a powerful force that securely connects millions of traders to multiple financial markets worldwide, daily.

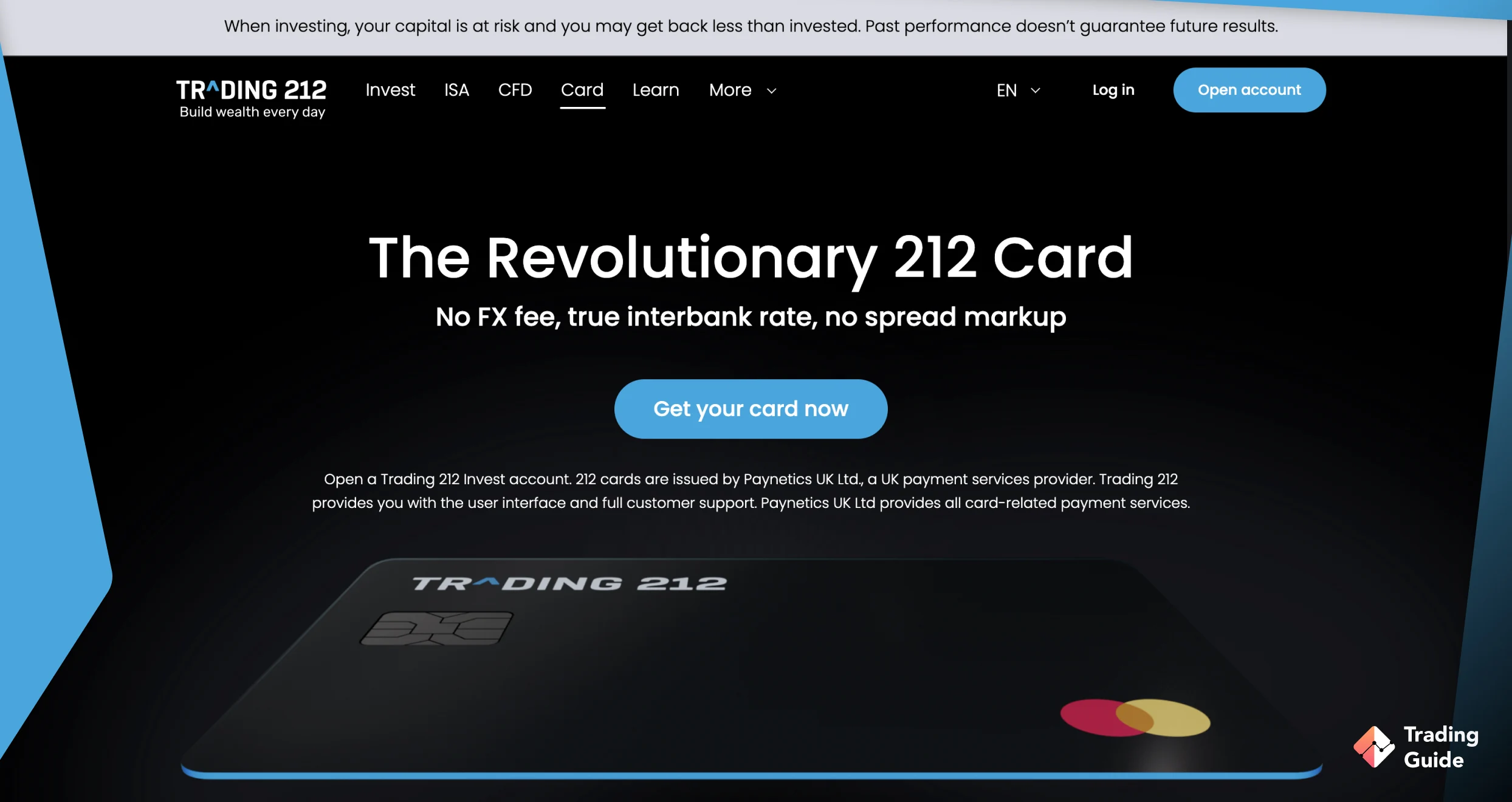

Clients can trade on 8,000+ instruments and leverage their investment, using the MetaTrader 4 platform. Trading 212’s platforms have access to various financial instruments, from the major EU stock exchanges and global currency markets, to a myriad of commodities. Trading 212 is an online trading platform for commodities, stocks, indices, currency pairs, futures, and more.

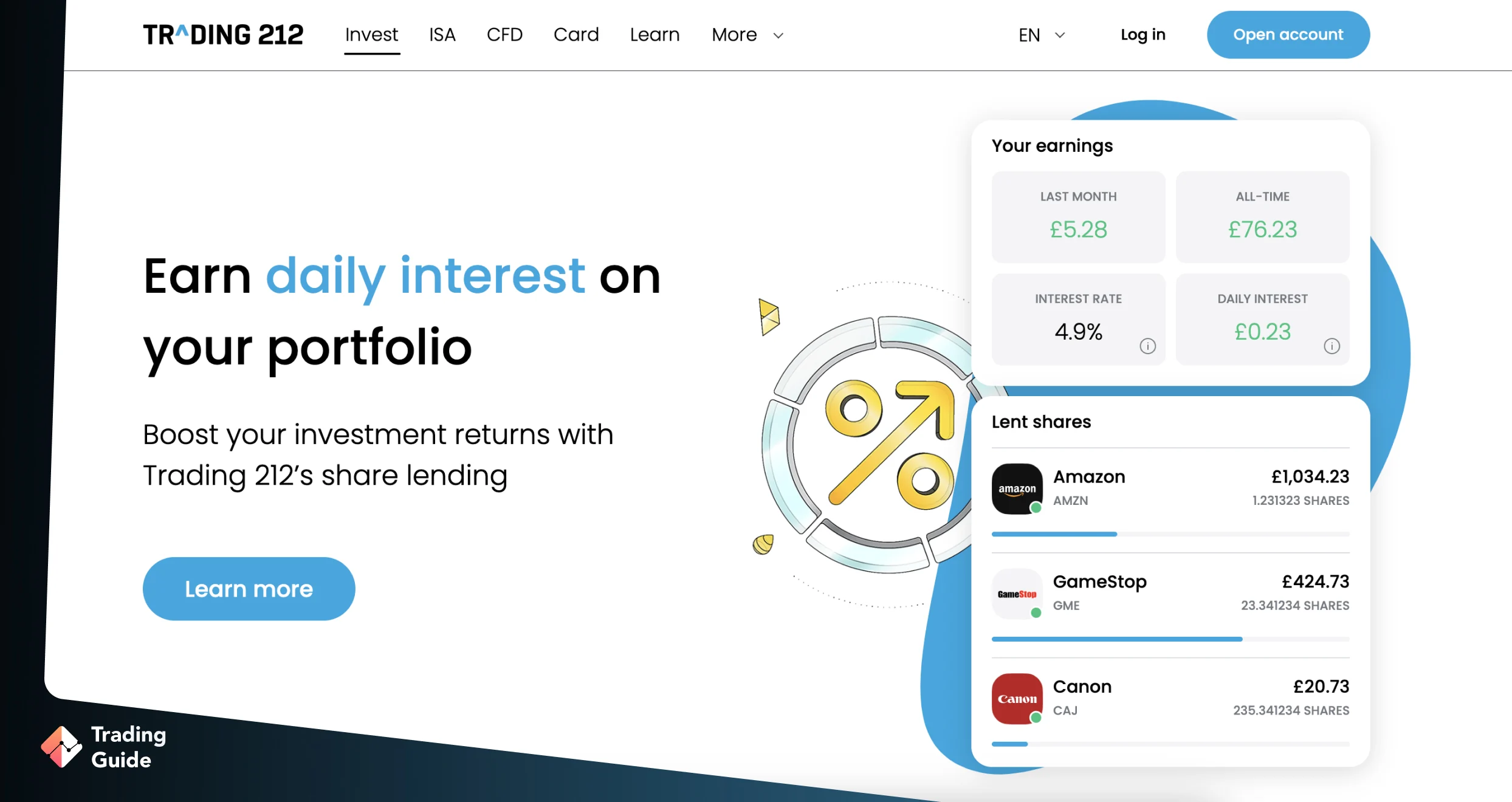

Trading 212 offers a great range of useful tools, including research ones that are both in-depth and crystal clear. Unlike many other investment companies, all of their research is free to use.

In contrast to traditional brokers, Trading 212 does not require retail clients to come up with large capital deposits – this allows individuals and small businesses to start trading with as little as £1.

Compare Trading 212 Features With Other Brokers

Compare brokers

Commissions and Fees

| Type | Fee |

|---|---|

| Type | Fee |

| Minimum deposit | $1 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Overnight fee | Yes, if you plan to keep CFD positions open overnight |

| Inactivity fee | $0 |

| Stocks | $0 |

| Forex | $0 |

| Commodities | $0 |

| ETFs | $0 |

Our Opinion About Trading 212

After our detailed study of Trading 212, we have come to the conclusion that the trading platform is more suitable for novice traders. A minimum deposit of £100 is an advantage to start developing your trading skills. Its free demo account will also be the best assistant for in-depth market analysis and trading platform testing.

Trading 212 offers fantastic levels of customer support and easy withdrawal of funds. It has clear and easy-to-use trading platforms that are intuitively navigated. The educational materials of Trading 212 are also really great. They offer a variety of useful content, including affordable YouTube videos.

FAQs

Yes. If you own shares in dividend stocks, the dividend payment is sent to your Trading 212 account.

Yes. Trading 212 is a good platform for day trading and other short-term strategies. Its low charges and fast trade execution speed allow day traders to quickly enter and exit trades, thus limiting the risk of losing money. You can also use Trading 212 for long-term strategies, especially in stocks.

This depends on the payment method that you’re using. Trading 212 takes up to 3 business days to process withdrawal requests. Once the broker has processed your request, you can expect to receive your money within 2 to 5 business days for bank transfers and credit/debit cards.

If you’re withdrawing via your Skrill or PayPal account, your money should arrive almost immediately. Keep in mind that due to financial regulations, you must withdraw your money to the same payment method you use to fund your account.

Absolutely. Trading 212 offers favourable trading conditions suitable for both newbies and experienced traders. As a beginner, you can benefit from the broker’s demo account that enables you to practise trading and investing with a maximum of $50,000 in virtual funds.

Plus, the broker features MetaTrader 4 – the most popular trading platform for forex markets. Its intuitive design and functionalities such as copy trading makes it an excellent choice for beginners and experienced traders.

Trading 212 Invest allows you to use leverage while Trading CFD does not. Another difference is that CFD won’t give you ownership of the underlying asset, whereas Invest will.

Trading 212 CFD also allows you to trade various instruments, including forex, stocks, commodities, indices, and ETFs. Conversely, a Trading 212 Invest portfolio can only consist of stocks and/or ETFs.

The company was founded in 2004 and has a London office, as well as one in Cyprus, which is the base of operations for international clients.

Is Trading 212 safe?

Trading 212 is able to accommodate various levels of traders whether you are experienced or a beginner. Try creating two accounts when you are working with trading 212 free shares. One is the real account, with your real money and the other is your demo account. The demo account is your experimental account.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

I started off just a couple of days ago, and the platform works great for me.

I especially like the broker's fast withdrawal of money. Always just apply, one, two. And the money is on the card. No need to strain your nerves, will they come or not come.

The best broker. The output is fast. Convenient and clear interface, easy to use and no commissions. I have been using Trading 212 for almost a year and would recommend it to anyone! One minus is the impossibility to choose the withdrawal method. As you put money in, it will be withdrawn. It is not convenient when working with several accounts and virtual cards.

One of the best apps for trading and investing for beginners. I would consider Tinkoff Investments more convenient, but it is only for Russian citizens and Tinkoff Bank cardholders themselves. This same application is available to anyone, regardless of where they live. Very convenient and clear interface. There are no commissions.

So far, Trading 212 has been an excellent broker in terms of ease of opening and maintaining an account. Also, their support has been very responsive and efficient in the few times I needed it. Highly recommend!

There are no unnecessary processes and corporate cultures! There are only mature and independent people in the teams. Management will openly and accessiblely provide the information and tools necessary for work.

I usually don't write comments, but this time I decided to make an exception. Good app with fast withdrawal, I recommend it to all my friends.

Trading 212 is an easy to use investing platform - the team has been quick to respond to any issues I’ve had - I would recommend. Once I had a card issue, which was resolved very quickly. If only more companies operated like this. I like their great customer service.

Best trading platform out there for the UK. Easy to use, responsible, and trusted. Recommend to all. Service is also good because I had one issue and was quickly transferred to a quick chat with a very helpful and kind assistant. He helped me and it was so great, thank you.

My experience was very good and extremely easy to deal with. The best trading app I have ever used. Very easy to use and a nice way to trade forex and shares.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?