WebMoney is becoming a popular payment method in the UK. Brokerage firms are now embracing it since it is highly secure and affordable. As investors, we understand the importance of trading using an affordable transaction method. Therefore, we decided to conduct thorough market research to come up with the best WebMoney brokers for you. Our goal is to inform our readers accordingly. So, if you are looking to make the most of such brokers, we are here to give you proper guidance.

The Best WebMoney Brokers in the UK February 2026

In this guide

The Best WebMoney Brokers in the UK

Compare WebMoney Brokers UK

Identifying top WebMoney brokers in the UK was a lengthy and overwhelming procedure. We had to collect and test hundreds of options to ensure they met our stringent specifications. We also compared them based on various elements. These include security, platform reliability, support service, demo account, charges, and more.

In Addition, we analysed user testimonials on Google Play, the App Store, and Trustpilot. We wanted to understand the brokers’ strengths and weaknesses from a user perspective before choosing our top options for recommendations.

Simply put, we created this list of WebMoney UK brokers based on multiple test results and user testimonial findings. Below is our comparison table highlighting the features of our top brokers, which can help you make informed decisions.

| Best WebMoney Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Forex.com | FCA, CFTC, NFA, CIMA, CIRO, CySEC, FSA | 24/5 | MT4, MT5, TradingView | Bank transfer, Credit/debit cards, Skrill, Neteller | Yes | FCA, CFTC, NFA, CIMA, CIRO, CySEC, FSA |

| HYCM | CySEC, FCA, CIMA | 24/5 | MT4, MT5 | Bank transfer, Credit/debit cards, Skrill, Neteller, WebMoney | Yes | Yes (up to €20.000) |

| FXTM | CySEC, FSC | 24/5 | MetaTrader 4, MetaTrader 5, Mobile Trading | Credit/debit cards, e-Wallets, crypto, Bank Wire transfers | Yes | Yes (up to €20,000) |

| XM | CySEC, ASIC, FSC, DFSA | 24/5 | MetaTrader 4, MetaTrader 5 | Credit/debit cards, Neteller, Skrill, UnionPay, WebMoney, Bank Wire | Yes | Yes, up to €20,000 (£17,178) |

Brief Overview of Our Recommended WebMoney Brokers’ Fees and Assets

We always encourage our readers to choose brokers with features aligning with their trading requirements. Among the features to consider are broker fees and asset offerings, which are crucial when it comes to planning your activities.

Unfortunately, comparing brokers’ fees and asset selection for a suitable choice can be a daunting process for traders. Therefore, we did all the legwork and share these elements in our tables below.

Fees

| Best WebMoney Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Forex.com | From 0.7pts | £100 | Free | £15 monthly |

| HYCM | From 0.1 pips | £20 | Free | £10 monthly |

| FXTM | From 0.0 pips | £200 | Free | £10 monthly |

| XM | From 0.6 pips | £5 | Free | £10 monthly |

Assets

1. Forex.com - Best CFD WebMoney Broker in the UK

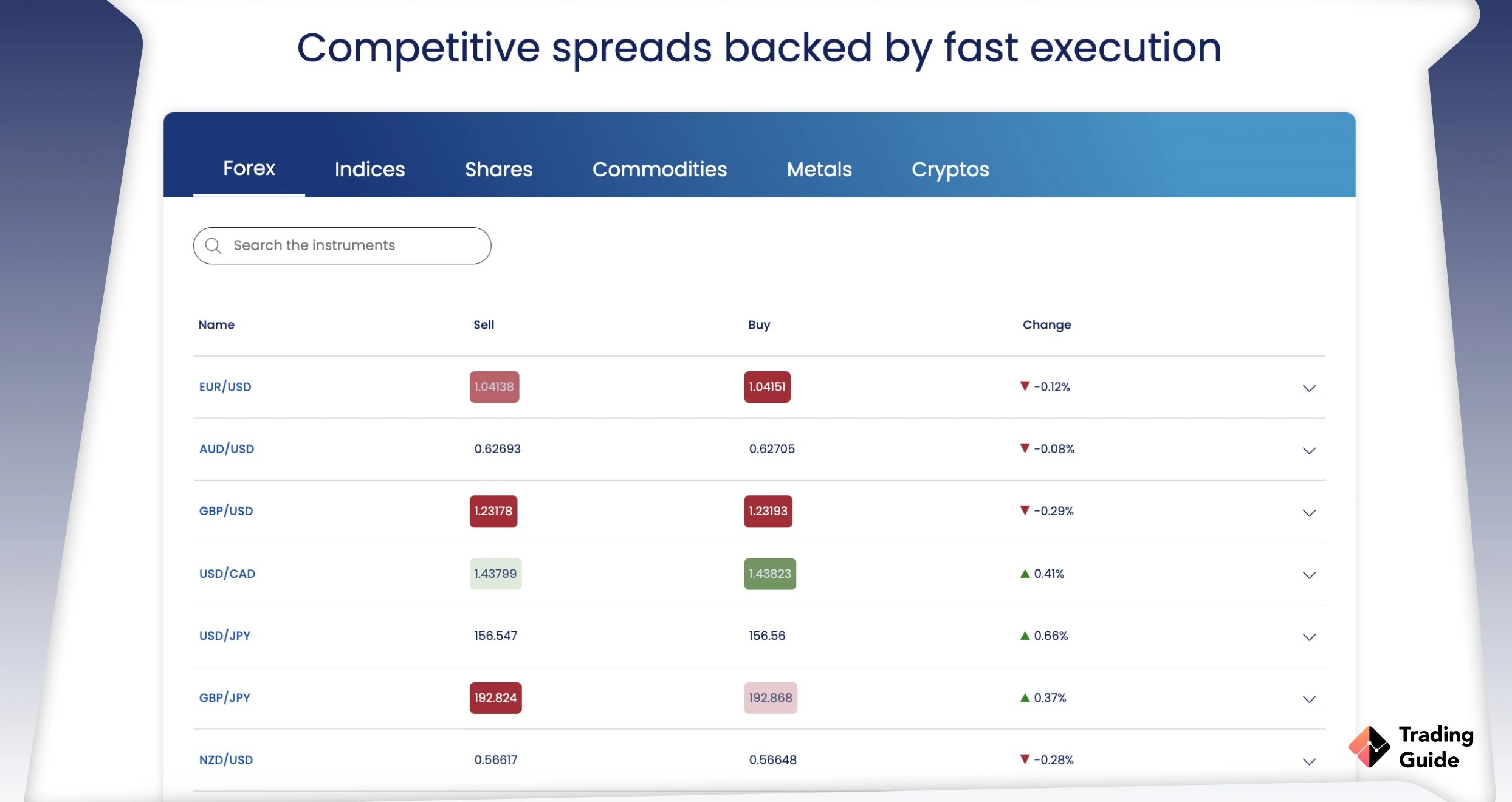

Forex.com is among the most user-friendly brokers we have used so far. Its customisable features enable traders, whether newbies or intermediate, to enjoy their experiences long-term without seeking other alternatives. From our experience, the broker has a streamlined account opening procedure with a low minimum deposit requirement of £100. All transactions using WebMoney and other payment methods are free, and users get to enjoy commission-free trades.

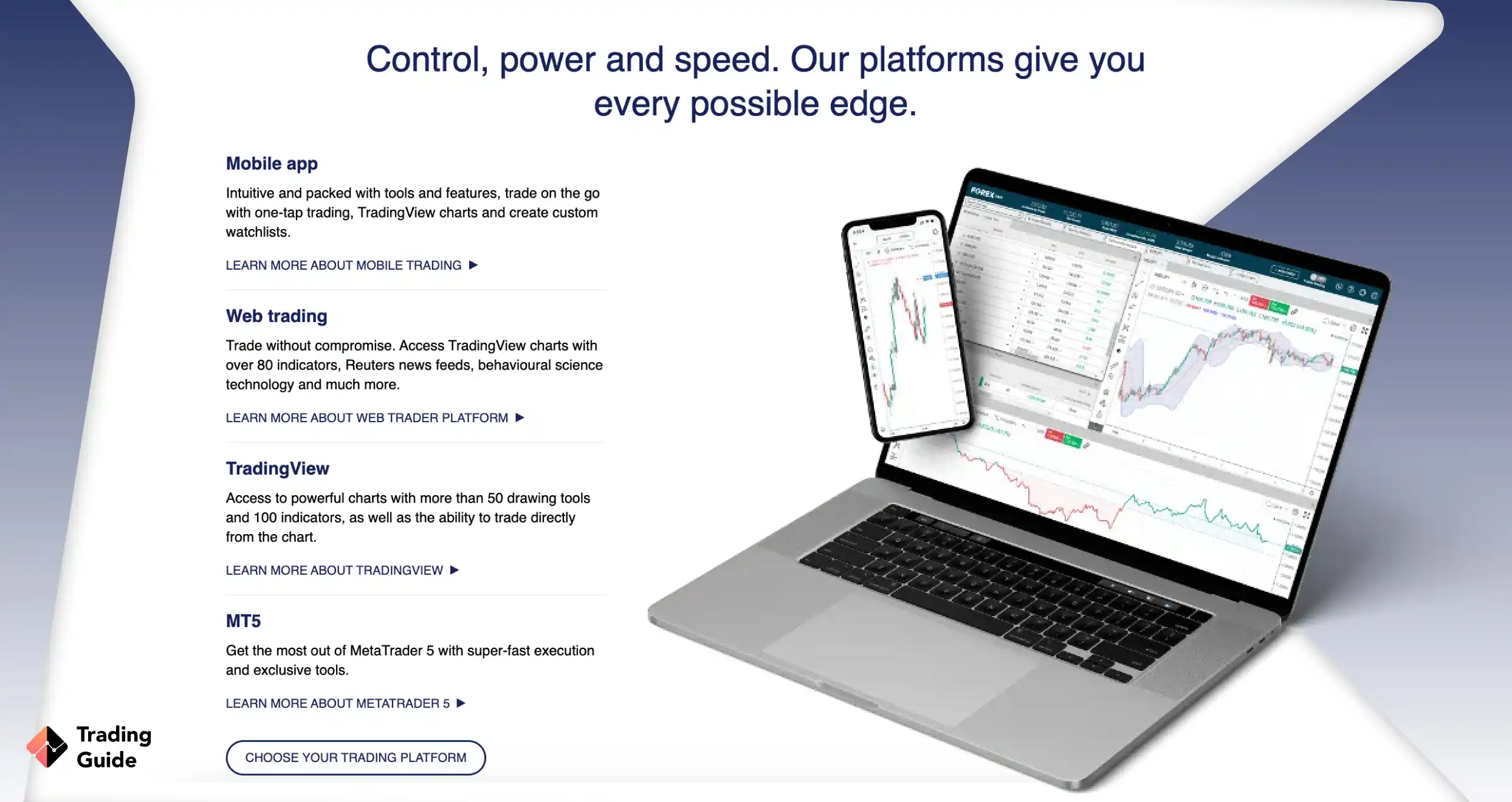

We also noticed that Forex.com hosts quality resources for all types of traders. The resources are listed on its WebTrader, TradingView, and MT5 platforms. For beginners, this broker hosts quality resources, from articles and guides to recorded videos and webinars. There is also a £50,000 virtually-funded demo account to test the broker and gauge your skill level before making a commitment.

- Low minimum deposit requirement.

- Lists over 4,500 instruments across various asset classes, including forex, stocks, commodities, and more.

- A user-friendly and intuitive design platform.

- Quality learning and market research tools.

- You can only trade the featured assets as CFDs.

- We find its forex trading spreads a bit higher compared to its peers.

| Type | Fee |

| Minimum deposit | $100 |

| Inactivity fee | $15 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Overnight fee | $0 |

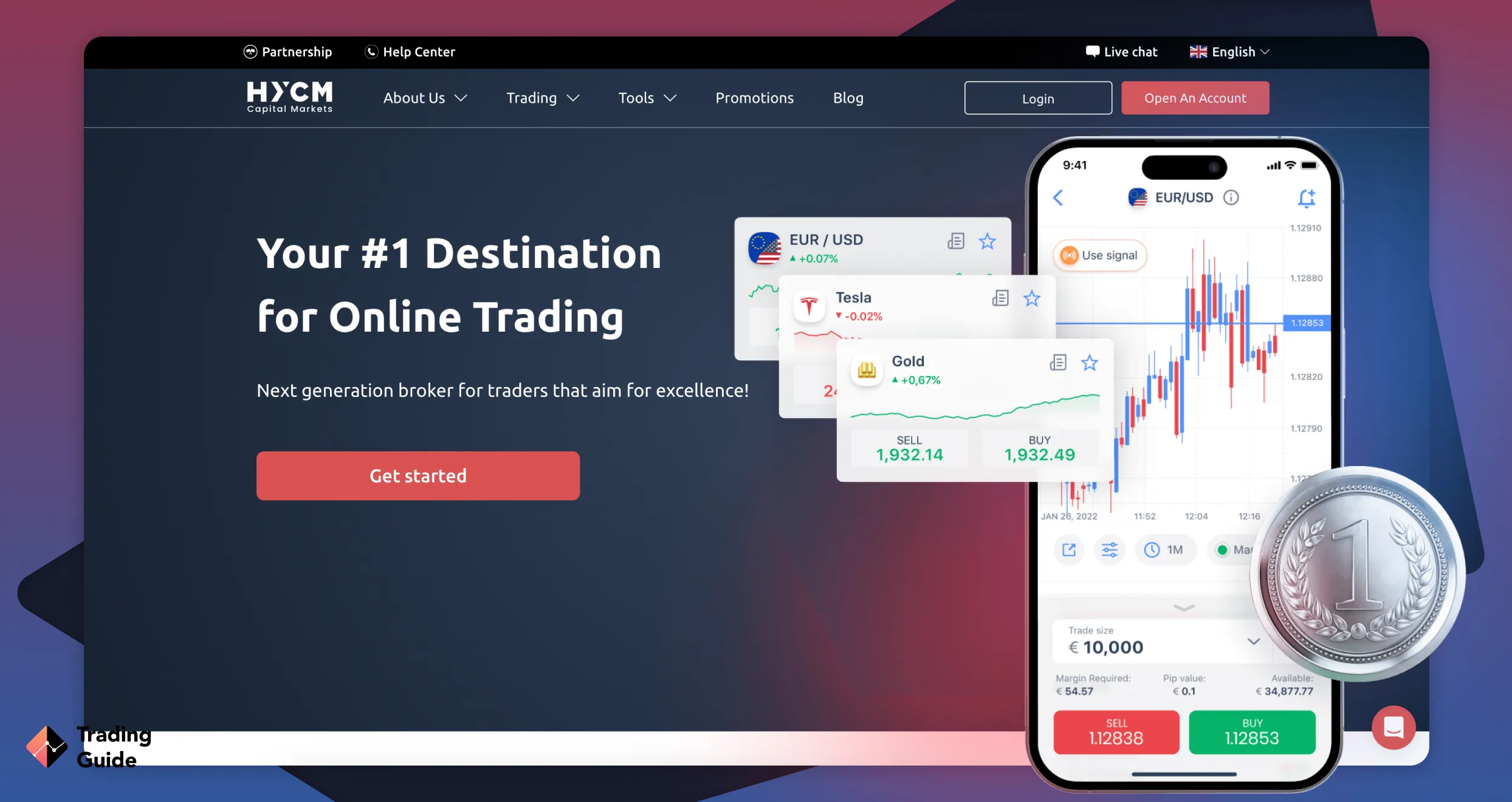

2. HYCM - WebMoney Broker for Advanced Traders in the UK

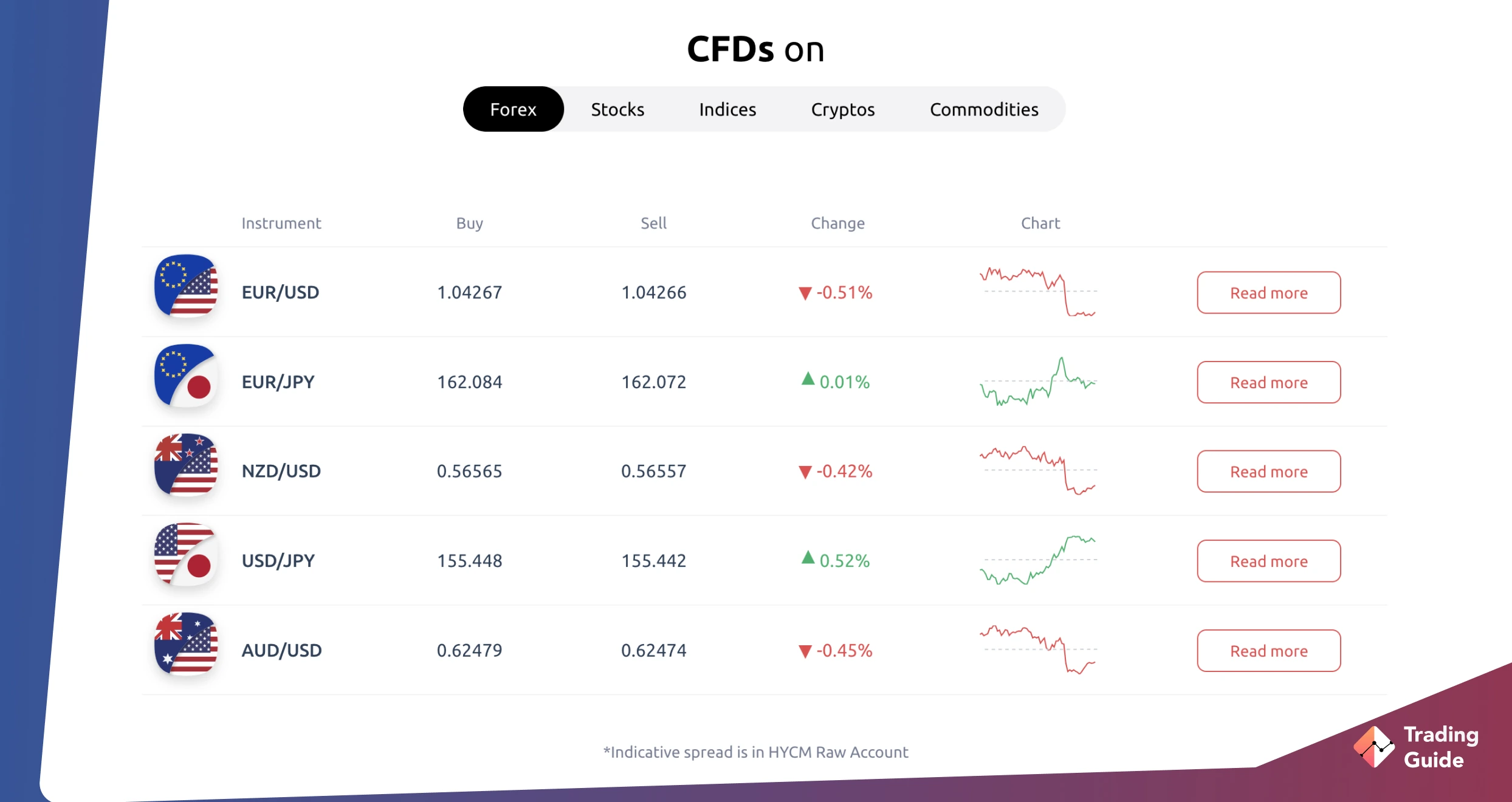

HYCM has a long track record and is one of the pioneer WebMoney brokers today. It is multi-regulated, which assures you that your funds are stored in a segregated account. From our experience, the broker has a fast trade execution speed. We primarily recommend it to active traders who open multiple positions within a day.

We explored over 100 CFD instruments at HYCM, including forex, shares, commodities, and indices. Moreover, HYCM hosts a plethora of the most advanced trading tools listed on its HCYM Trader, MT4, and MT5 trading platforms. There are no commissions with this broker but spreads, starting from 0.1 pips on major currency pairs. Plus, HYCM has a low minimum deposit requirement of £20 with free transactions.

- Commission-free trades.

- Excellent trading tools on its advanced platforms.

- A user-friendly and intuitive design platform.

- Free WebMoney transactions.

- Limited asset offerings compared to its peers.

- Only CFD assets supported.

| Type | Fee |

| Minimum deposit | £20 |

| Overnight fee | Yes |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $10 each month |

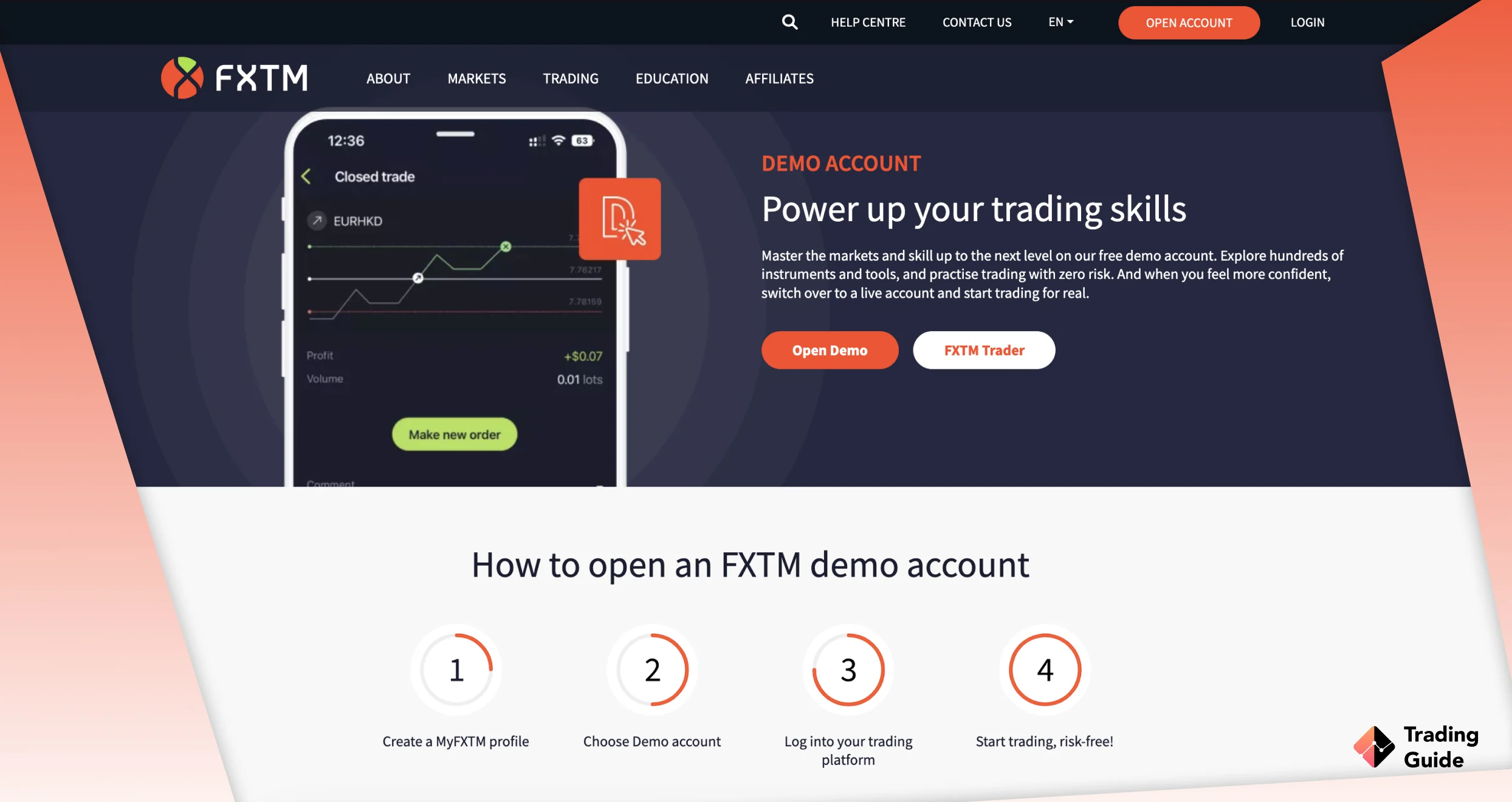

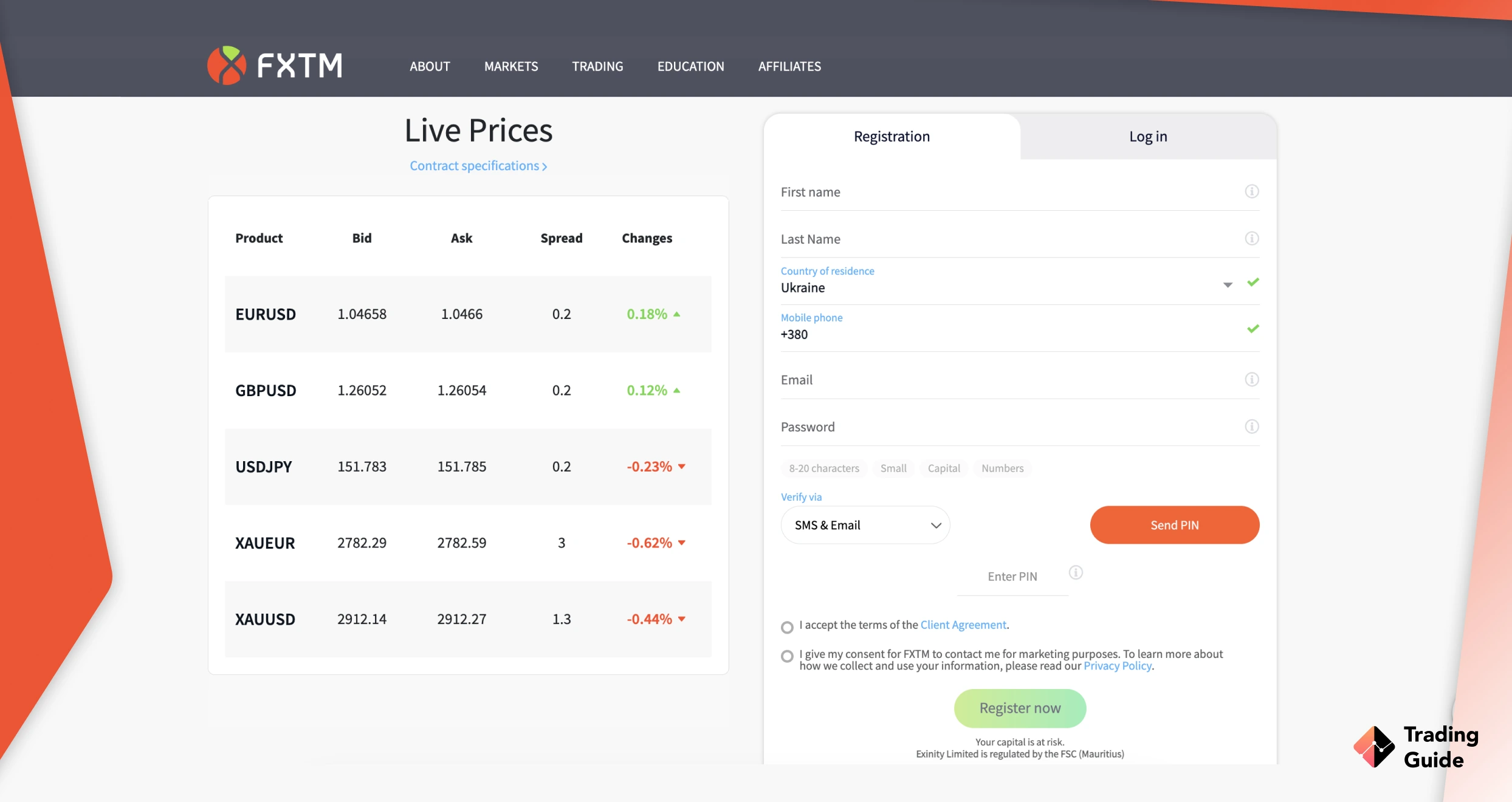

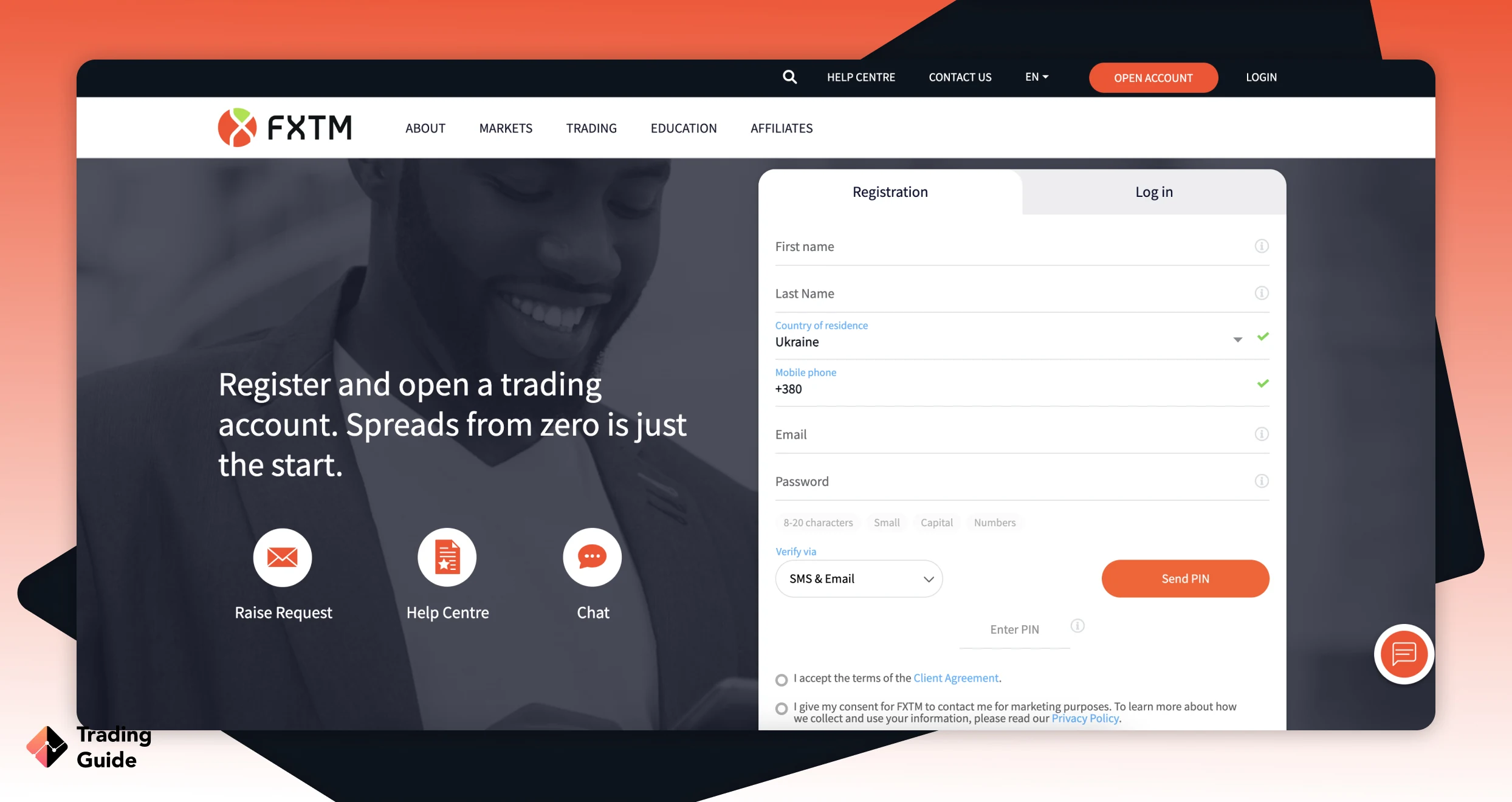

3. FXTM - Best Forex Broker that Accepts WebMoney

We explored over 1,000 securities at FXTM, making us easily diversify our portfolios across various asset classes. We traded forex, stocks, metals, indices, and more via CFDs. Plus, the broker lists quality learning materials, which can help newbies advance their skill levels while becoming familiar with the financial space.

When it comes to currency pairs, this broker lists over 40 options, which you get to trade at low spreads starting from 0.0 pips. The best part is that FXTM hosts multiple trading accounts, enabling every user to select what best suits their skill level. Users must deposit at least £200 to access the broker’s Advantage and Advantage Plus accounts.

- There is a variety of currency pairs to choose from.

- A user-friendly and intuitive design platform.

- Low forex trading charges, starting from 0.0 pips.

- Quality learning and market analysis tools.

- The product portfolio is limited.

- High minimum deposit requirement for low-budget traders.

| Type | Fee |

| Minimum deposit | $200 |

| Overnight fee | $5 |

| Deposit fee | $0 |

| Withdrawal fee | $3 |

| Inactivity fee | Yes |

4. XM - Best WebMoney Broker for Mobile Trading

Mobile traders looking for a reliable WebMoney broker in the UK should consider XM. From our findings analysing user testimonials, we noticed that the broker is among the most highly rated. Many users find its app user-friendly and customizable, which we confirmed while testing the broker. You can get started with as little as £5, and enjoy trading with low spreads from 0.6 pips on major currency pairs.

Regarding asset offerings, XM lists over 1,000 instruments, including forex, shares, commodities, indices, and more. All transactions using WebMoney and other supported methods are free of charge, and its inactivity fee of £10 monthly kicks in after 90 days. By hosting advanced platforms like MT4 and MT5, rest assured of trading with quality resources at XM.

- Great quality trading tools on the MT4 and MT5 platforms.

- A user-friendly and highly secure trading app for mobile traders.

- There are no hidden charges with low spreads from 0.6 pips.

- Reliable and responsive 24/5 support service.

- Its inactivity fee licks in after only 90 days.

- Limited asset offerings.

| Type | Fee |

| Minimum deposit | 5$ |

| Overnight fee | 0$ |

| Deposit fee | 0$ |

| Withdrawal fee | 0$ |

| Inactivity fee | $15 one-off maintenance fee |

What is WebMoney Transfer?

WebMoney is a popular online payment system headquartered in Russia. It was launched in 1998 and facilitates secure and efficient transactions globally. To date, Webmoney is one of the most trusted e-wallets, particularly in Russia, Europe and other global countries.

The best element about WebMoney is that users can transact using multiple currencies. You can operate with multiple types of electronic currencies, each represented by a different “purse” within the system. These include WebMoney units tied to major currencies like USD (WMZ), EUR (WME), and more.

Additionally, this payment method is available for individuals and businesses alike. To benefit from it, you must register for a WebMoney Keeper account on its official website. This is like a digital wallet, where you will secure your funds and manage them for future transactions.

Overall, WebMoney is a secure digital payment system that is highly secured. It employs two-factor authentication, transaction confirmation codes, and more. Plus, we find it among the most affordable as its transaction charges are low.

How to Choose the Best UK WebMoney Broker

Choosing the right WebMoney broker in the UK requires a keen eye. You must ensure your broker aligns with your trading or investment requirements for maximum experience. If you are new to online trading, we guide you on the basic tips to never overlook if you want to find a suitable WebMoney broker in the UK.

In the UK, the best WebMoney broker must be licensed and regulated by the Financial Conduct Authority (FCA). Note that there are many fraudulent brokers looking to take off with your funds. Therefore, if you overlook this element, you might end up in the hands of scammers and lose your hard-earned money.

FCA-regulated brokers adhere to stringent rules set by the authority. They not only secure users’ funds in segregated accounts but also provide favourable trading conditions for an exciting experience.

A reliable WebMoney broker in the UK must be affordable. Confirm the transaction costs with the WebMoney payment method and other charges. These include commissions/spreads, minimum deposit requirements, inactivity fees, and more. Ensure your broker’s trading and non-trading charges align with your budget. You do not want to spend more than you are comfortable losing.

Settle with a broker that is user-friendly and features a modern design interface. It must also have a fast trade execution speed and support you with all the necessary tools for technical and fundamental analysis. For beginners, confirm the availability of learning materials and a demo account. This will ensure you can easily boost your skill level and gauge your performance before participating in live trading.

The best WebMoney broker must have a dedicated and supportive team of professionals at your beck and call. You should be able to easily contact them and rely on their response without pausing on your open activities. To confirm a support service’s reliability, contact the team via the supported channels and gauge their response rate. The support service must also be reachable during hours that are convenient for you. This is whether it’s 24/7 or five days a week.

Choose a WebMoney broker hosting your preferred securities, including forex, stocks, commodities, cryptos, and more. Depending on your preference, the broker must allow you to trade the assets using various methods, whether CFDs, indices, or buying and taking full ownership. Plus, you should be able to easily diversify your portfolio with a broker you select, thus reducing the risks that come with investing in a single asset.

Visit Google Play, the App Store, and Trustpilot to sample as many user comments as possible. You see, while it is crucial to consider the above elements, user testimonials allow you to understand the broker from a user perspective. You will easily understand its strengths and weaknesses for informed decisions.

Pros & Cons of Trading with WebMoney Broker

WebMoney brokers in the UK allow you to deposit and withdraw funds to and from your trading account using WebMoney. While this method is one of the most efficient in online trading, it has its drawbacks that you should note. Here are the advantages and disadvantages of using WebMoney brokers in the UK.

Pros

- The payment method is highly encrypted and employs high security measures. These include two-factor authentication, transaction confirmation codes, and more.

- WebMoney transactions are near instant. You will efficiently make deposits and withdrawals without inconveniencing your trading schedule.

- The payment method has lower transaction charges compared to other payment methods like bank transfers.

- WebMoney is a globally accepted payment method. It makes it easier for you to continue managing your traders even while travelling across borders.

- Features additional services like P2P trading, currency exchange, credit facilities, and more.

Cons

- Not all FCA-regulated brokers accept WebMoney for deposits and withdrawals. This may limit your choice of brokers.

- It requires users to create an account on its website to enjoy its services. The set-up procedure can be complex for some traders, especially when it comes to understanding the use of different “purses” for various currencies.

- Some brokers may limit the amount that can be withdrawn using WebMoney, inconveniencing high-volume traders who need to move large sums of money.

- Not supported in many global countries.

FAQs

Yes. Before you transact using Webmoney, you need to verify your information.

Absolutely. Webmoney is highly encrypted, which guarantees your funds safety.

Using the site that accepts Webmoney, select the product or service you want to be paid for and follow the necessary commands to complete the payment.

No. Any money transfer using Webmoney requires you to have a passport.

Yes. Webmoney is legal and accepted by various trading brokers such as our referenced ones above.

Conclusion

There are many WebMoney brokers in the UK financial landscape. However, our options above are the best when it comes to offering quality trading services and tools to users. Moreover, they feature additional payment methods like PayPal, Skrill, Neteller, credit/debit cards, and more. This allows you to try transacting with other options and decide whether they are worth using in your trading activities. Our recommended WebMoney brokers also have reliable support services and learning materials. They make it easier for newbies to confidently kickstart their ventures, knowing that the brokers have their backs.

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

Advertising Disclosure

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.