Forex trading has become an appealing venture for UK traders who want to increase their income or diversify their investment portfolios. As of 2026, over 340,000 forex traders call the UK home. Some of these individuals are pulling in impressive payouts for several reasons. First and foremost, they rely on UK top forex brokers who have their best interests at heart.

As a Brit, you’re fortunate simply because you can trade with some of the most highly regulated, trusted, and largest forex brokers in the world. But you have to wade in a sea of sketchy and second-rate service providers to find them; I’ve done that on your behalf. I spent days researching, testing, and rating UK brokers. Based on my findings and experience, I picked the cream of the crop, which I’ve recommended and reviewed in this guide.

Essence

- Forex trading is legal and regulated by the FCA in the UK

- To profit from forex trading, you simply buy and sell currency pairs

- Access to reliable and trusted forex brokers is crucial to your success as a forex trader

- I tested hundreds of trading providers and identified the best online forex brokers in the UK

List of the Best Forex Brokers in the UK

- IG Markets – Best for Leverage Trading in the UK

- FxPro – Best MT4 Broker in the UK

- Capital.com – Best For Spread Betting

- Pepperstone – Trade Forex and Forex Indices on Award-Winning Platform

- Spreadex – Best Broker With No Minimum Deposit Requirement

- Plus500 – One of the Best CFD Platforms/Providers in the UK*

- XTB – Beginner-Friendly Broker

- eToro – Best for Copy Trading in the UK

- Forex.com – Best Advanced Broker

*76% of CFD retail accounts lose money with this provider

How We Choose Forex Brokers

Selecting the right forex broker in the UK is a critical decision for any trader, and at TradingGuide, we take this process seriously. Our methodology for choosing and recommending brokers is comprehensive and meticulous, aimed at ensuring our readers have access to reputable and reliable platforms.

To begin, we conduct thorough research to compile a list of as many FCA-regulated brokers as possible within the UK market. Next, we evaluate each broker’s platform and services by opening accounts and conducting extensive testing. We assess factors such as trading conditions, execution speed, customer support, and more.

Plus, we consider feedback and reviews from other traders to gain insights into the broker’s reputation and customer satisfaction levels. This helps us make informed recommendations that align with our readers’ needs and preferences. Rest assured, our research in identifying the best UK forex brokers is thorough and exhaustive.

Compare the Best Forex Brokers

First, a quick look at where the most outstanding forex brokers stand based on what I consider to be the most crucial factors. Since my list of critical factors is quite extensive, with 10+ elements, I have covered the first 8 in the comparison table below. We’ll cover the other 2, which demand their own sections, in a jiffy.

With that said, here is how we rated the best forex brokers in the UK according to Trustpilot, Google Play, and App Store honest user reviews.

| Recommended Brokers | Licence & Regulation | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes | Yes |

| FxPro | FCA, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | Yes |

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView, cTrader | Credit/debit cards, PayPal, Skrill, Neteller, POLI | Yes | Yes |

| Spreadex | FCA | 24/5 | Online platform, Mobile trading, Charting package, TradingView | Credit/debit cards, Apple Pay, Easy Bank Transfer | No | Yes |

| Plus500 | FSCA, CySEC, FCA, ASIC, MAS | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes | Yes |

| XTB | MiFID, FSCA, ASIC, CySEC, FCA | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, Bank transfer, Paysafe, PayPal | Yes | Yes |

| eToro | FCA, ASIC, MAS, CySEC, MFSA, SEC | 24/5 | CopyTrader, Multi-Asset Trading Platform, Investing Platform, eToro Mobile App | Credit/debit cards, Bank transfer, Neteller, Skrill, PayPal, online banking | Yes | Yes |

| Forex.com | FCA, CFTC, CIRO, CySEC, FSA, ASIC | 24/5 | WebTrader, Mobile App, MetaTrader 4, MetaTrader 5, TradingView | Credit/ debit card, PayPal, Wire transfer | Yes | Yes |

Brief Overview of Our Recommended Forex Brokers’ Fees

Now, let’s highlight fees. I must outline the costs associated with the recommended brokers to enable you to pinpoint elements that can make or break your forex trading experience, from tight spreads and commissions to sneaky, hidden charges.

Fees

| Recommended Brokers | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| IG Markets | £0 | From 0.1 points | Free | None |

| FxPro | £100 | From 0.0 pips | Free | £15 monthly |

| Capital.com | £20 | From 0.0006 pips | Free | £10 per month after 12 months of inactivity |

| Pepperstone | £0 | From 0.0 pips | Free | £0 |

| Spreadex | £0 | From 0.6 pts | Free | £0 |

| Plus500 | £100 | From 0.6 pips | Free | £10 monthly |

| XTB | £0 | From 0.1 pip | Free | £10 monthly |

| eToro | $50 | From 1 pip | Free | $10 monthly |

| Forex.com | £100 | From 0.0 pips | Free | £15 monthly |

Our Opinion & Overview of the Best Forex Brokers in the UK

We’ve done the legwork and vetted countless UK forex trading platforms – now here’s our take. Before you dig in, note that, besides my findings, I’ve also factored in what I discovered from past user testimonials and concerns. And before taking third-party comments to heart, I researched their validity to ensure my reviews are free from bias and as accurate as humanly possible.

1. IG Markets – Best for Leverage Trading in the UK

FCA-approved IG Markets is the best platform to trade forex with leverage. While testing it out, I had the opportunity to trade over 80 currency pairs and increase potential profits with a standard leverage of up to 1:30. This offer is for retail traders. Supposing you’re a professional, you can exploit higher leverage up to 1:222 while trading pairs like EUR/USD, AUD/USD, and USD/JPY.

Forex trading isn’t the only available option on IG Markets. This broker also supports CFD trading and spread betting on over 15,000 markets. What’s more, it allows its clients to invest in 11,000+ shares and ETFs. I enjoyed trading and investing with it, especially since I received rapid assistance 24/5 from its professional support team. Based on my experience, this broker deserves 5 stars.

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider

- 80+ currency pairs

- 15,000+ financial securities

- Supports shares and ETF investing

- Competitive retail and pro leverage

- Top-tier proprietary and third-party platforms

- Higher leverage than its peers

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | None |

| Advanced graphs (ProRealTime) | £30 per months |

2. FxPro – Best MT4 Broker

My hands-on experience with forex brokers in the UK led me to believe that FxPro is the best for MT4 users. While testing this platform, I noticed that it hosts some of the best trading tools for forex trading. The best element about FxPro’s MT4 platform is that I could seamlessly use it on desktop and mobile devices. Plus, the platform supports automated trading, which allows users to save time or trade even when not online.

Besides the MT4, FxPro supports forex trading on its web, cTrader, and MT5 platforms, thus making it easier for all types of traders to explore the currency market. My forex trading endeavours involved 70+ currency pairs, enjoying the benefit of low spreads starting from 0.0 pips on major pairs. The broker’s commitment to an additional 2,100 CFD assets, leverage options up to 1:30 for retail traders and 1:500 for professionals, and the provision of quality learning materials further solidify its standing in the UK financial space. I give this broker 4 stars.

- Features automated trading across various markets

- Low trading costs, with free deposits and withdrawals

- Advanced tools and platforms, including MetaTrader 4

- 70+ forex products, including local pairs

- Tight spreads from 0.0 pips on Raw+

- Superior customer support service

- Standard spreads start from 1.2 pips

- Higher inactivity charges than its peers

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. Capital.com – Best For Spread Betting

Spread betting has become a popular way for UK traders to approach forex, and Capital.com stands out as one of the best platforms offering it. What I liked most is how cost-effective the setup is. Spreads start from just 0.0 pips on major currency pairs, and all trades are commission-free. Add in a low £20 minimum deposit with no fees on deposits or withdrawals, and it’s clear why this broker is so appealing for spread betting.

The platform itself feels smooth whether you use the web version, the mobile app, or connect through MT4 and TradingView for more advanced tools. During my testing, execution was quick even at busy market times, which is crucial for leveraged spread betting. I also found the interface beginner-friendly, while still offering depth for traders who want detailed charting and analysis.

Another big plus is the learning support, which is designed to break down CFD trading and spread betting into manageable lessons. Overall, this broker lists over 120 currency pairs with an additional 4,000 instruments for portfolio diversification. These include shares, commodities, cryptos, and indices.

- Commission-free forex spread betting with low spreads

- Low minimum deposit requirement and free deposits/withdrawals

- Fast execution across web, app, MT4, and TradingView

- Beginner-friendly design with advanced tools available

- Excellent educational resources and risk management

- No copy trading feature

- No cryptocurrency payment methods

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

4. Pepperstone – Trade Forex and Forex Indices on Award-Winning Platform

The award-winning Pepperstone, based on my comprehensive user analysis, lists over 90 currency pairs and indices to explore. These indices, including the US Dollar Index (USDX), Euro Index (EURX), and Japanese Yen Index (JPYX), add depth to your forex trading experience.

My experience also confirms that Pepperstone caters to various trading preferences with four different systems: MT4, MT5, TradingView, and cTrader. Notably, the option to connect cTrader to TradingView ensures the most accurate pricing data for currency pairs and other instruments, enhancing your trading precision. Overall, Pepperstone is worth trying, and I give it a 5-star rating.

- 90+ currency pairs available, such as GBP/USD and EUR/USD

- No minimum deposit requirement

- Currency indices to make the most of the volatile forex market

- Rated as the best broker based on satisfaction and value for money

- Tight spreads from 0.0 pips

- Hosts cTrader, TradingView, and MT4/MT5

- Limited asset offerings in general

- Only CFDs are available

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

5. Spreadex – Best Broker With No Minimum Deposit Requirement

Spreadex, the top choice for no-minimum-deposit UK forex brokers, offers flexibility to start with any amount. While testing the broker, I noticed it features an intuitive platform with 60+ currency pairs and reasonable spreads (from 0.6 points on major pairs). Spreadex also stands out with fee-free transactions, which are ideal for cost-conscious exploration of the forex market.

As a professional trader, you’ll benefit immensely from the TradingView platform that Spreadex offers for advanced analysis. Social trading and diverse securities for portfolio diversification are also supported. I also recommend this broking firm and give it a 5-star rating because it supports both CFD trading and spread betting.

- No minimum deposit requirement

- Intuitive design and user-friendly interface

- A wide selection of over 60 currency pairs to explore

- Competitive spreads starting from just 0.6 points

- Access to the TradingView platform for advanced technical analysis

- Doesn’t support demo trading

- Limited research and learning tools compared to its peers

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

6. Plus500 – One of the Best CFD Platforms/Providers in the UK*

Plus500 is the best CFD broker in the UK for a couple of reasons. Regulated by the FCA, this company offers one of the best trading platforms for forex in the UK, which has an impressive collection of CFD assets that I unearthed during my escapades. First, I discovered and sampled 60+ FX products, including GBP pairs like EUR/GBP and GBP/USD. While doing so, I had unlimited chances to enhance potential returns with up to 1:300 leverage.

Start trading forex CFDs with Plus500 today; you’ll have more than enough opportunity to diversify your portfolio with many other CFD financial instruments. The ones I discovered and tried out range from crypto CFDs and commodity CFDs to CFDs on shares, options, and indices. This platform has a sophisticated design that deserves nothing short of a 4-star rating.

- 60+ FX instruments, including local pairs

- Up to 1:300 leverage for professional forex traders

- Simple, sophisticated platform interface

- Prompt support available 24/7

- Impressive variety of educational resources

- Superior risk management tools provided

- Only one trading platform is available

- £10 monthly inactivity fee

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

7. XTB – Beginner-Friendly Broker in the UK

If you’re a newbie or an amateur searching for a beginner-friendly trading platform, let me introduce you to the best option I came across – XTB. Based in Poland, this multi-regulated broker has offices in different regions, including the UK. It helps beginners start on the right foot by offering a vast number of educational guides and articles in its Knowledge Base learning section.

Enhance your understanding of forex trading on XTB’s education centre, then proceed to trading with this FCA-regulated broker’s beginner-friendly web and mobile platforms. Upfront costs should not be a problem since there’s no minimum deposit requirement and zero funding charges. With a funded account, you can trade 69+ currency pairs, diversify with 2,300+ CFD instruments, and invest in 4,300+ stocks and ETFs. XTB is inarguably a 5-star broker.

- Rich educational materials and resources

- No minimum deposit requirements

- Simple, newbie-friendly interface

- 2300+ CFD products, including currency pairs

- 4,300+ real stocks and ETFs

- Reasonable spreads and commissions

- Limited trading platforms

- £10 monthly inactivity fee

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

8. eToro – Best for Copy Trading in the UK

I consider eToro the best online broker for forex copy trading. Established in 2007, eToro is recognised and regulated by the FCA for secure trading. The broker has an innovative social and copy trading platform, fostering interaction, learning, and copy trading. It’s free and available on the web, Android, and iOS.

Besides a low minimum deposit requirement of $50, eToro offers free deposits and withdrawals for GBP accounts. Users will explore over 50 currency pairs and 7,000+ additional securities for portfolio diversification. Available assets range from CFD instruments to investment products like stocks and crypto. From my experience and findings, I give eToro a 5-star rating.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

- User-friendly trading platform with the copy feature

- Low minimum deposit requirement for UK traders

- Quality learning materials

- 7,000+ tradable and investment products

- Supports crypto trading and investing

- Responsive, knowledgeable support representatives

- No third-party trading platforms like MT4

- $10 monthly inactivity fee

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

9. Forex.com – Best Advanced Broker in the UK

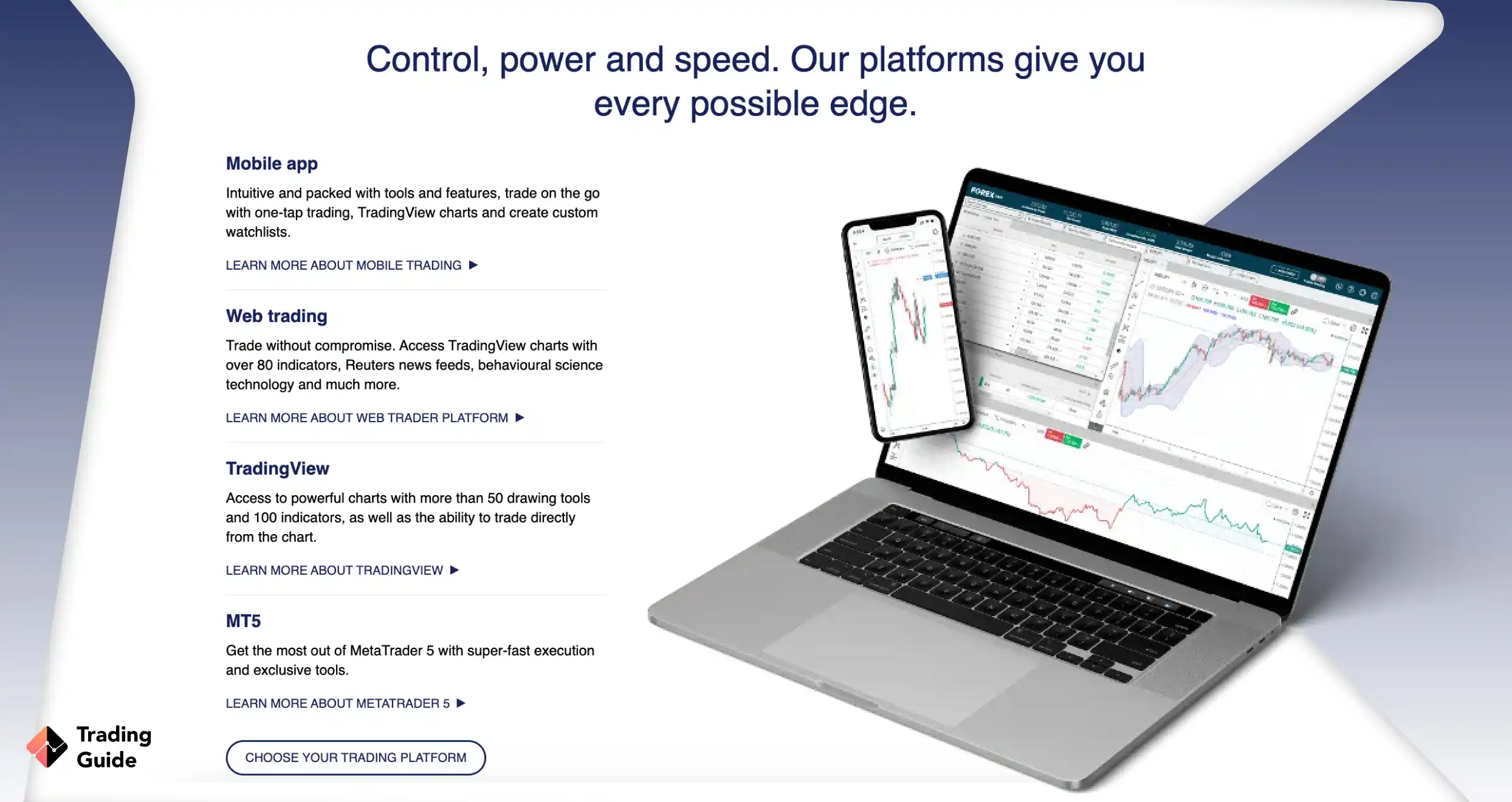

Forex.com shines as the premier broker for advanced traders in the UK. Boasting the title of the world’s largest Meta Trader broker, it offers over 90 currency pairs, making it a comprehensive hub for forex trading instruments. Besides that, I found out that this broker has some of the best forex platforms in the UK, which are remarkably secure, user-friendly, and customisable.

Moreover, Forex.com has a micro account you can sign up for with a minimum deposit of £100. Forex trading is commission-free, with highly competitive spreads and leverage options that allow traders to take greater control of their activities and potentially increase their profits. Based on my experience, I wholeheartedly recommend this broker and give it a 4.0-star rating.

- More than 90 currency pairs

- Offers the best forex trading platforms in the UK, including MT5

- A plethora of research and educational tools

- Low spreads from 0.0 pips

- 5,500+ securities for diversification

- Broad range of educational materials

- £15 monthly inactivity fee

- High spreads for Standard users

| Type | Fee |

| Minimum deposit | $100 |

| Inactivity fee | $15 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Overnight fee | $0 |

The Ultimate Guide to Forex Trading

Mastering forex trading extends beyond signing up with top-rated online forex brokers; it is also about familiarising yourself with the intricacies of this dynamic market. Explore the sections below to gain valuable insights and prepare yourself for informed decisions in the world of forex trading.

How to Choose the Right Forex Broker

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

Hundreds of unscrupulous service providers are lurking in the shadows, waiting to rip you off. And some of the legit ones have issues with everything from fees to support. That is why you must be extra cautious and spend as much time vetting every broker. Use the following factors to separate the best forex trading brokers in the UK from shoddy providers:

Verify that the broker is licensed and regulated by reputable authorities like the Financial Conduct Authority (FCA). Regulatory oversight ensures the safety of your funds and a secure trading environment. I never trade with unregulated providers because I know legal recourse won’t be an option if things go south. You should do the same.

Given the fast-paced nature of forex markets, a swift execution platform is essential. Look for a broker offering a platform optimised for quick trade execution. If initially the site seems laggy or clunky, ditch it. Additionally, ensure you have uncapped access to essential trading tools, including research materials and educational resources. Demo account availability is also crucial.

Forex trading doesn’t cost much, especially when affordable major forex brokers like the ones I’ve recommended are involved. That said, having a clear trading budget is crucial. Different brokers have varying trading and non-trading charges. Scrutinise details such as minimum deposit requirements, transaction costs, inactivity fees, and any potential hidden charges, then check if they match your budget restrictions.

A reputable broker should offer a diverse range of currency pairs and other assets, enabling you to trade across various markets. Access to a wide selection of assets allows you to experiment with different trading pairs and increase potential profits. It also enables you to diversify your portfolio and avoid getting wiped out when certain markets misbehave.

Quality customer support is vital in forex trading. Choose a broker with responsive and dedicated customer service. The support system should offer prompt solutions to any issues you may encounter while trading. Be mindful of the support hours, as some UK top forex brokers offer 24/5 assistance while others provide round-the-clock support.

Pay attention to recommendations and reviews from other users who have experienced the broker’s products and services. Insights on platforms like Google Play, the App Store, and Trustpilot can offer valuable perspectives on the broker’s reliability and customer satisfaction. Don’t be misled by generic comments meant to either encourage or discourage you from signing up.

What is Forex Trading?

The simplest definition of forex trading is the act of buying and selling currency pairs on the financial market. Forex traders buy/sell these assets, hoping to make profits. As a forex trader, you primarily predict whether one currency will appreciate or depreciate compared to its counterpart. Accurate predictions go hand in hand with juicy returns, and vice versa.

How Forex Traders Make Money

Forex traders make money by buying one currency while selling another, profiting from currency exchange rate fluctuations. While trading forex products, you use strategies like spot trading, leverage, swing trading, day trading, scalping, and carry trades. You must also employ risk management, technical and fundamental analysis, and sometimes automated trading systems for maximum returns. Understanding the market, using a well-defined trading plan, and managing risks are vital to succeed in forex trading.

*Don’t invest unless you’re prepared to lose all the money you invest.

Read about the best forex trading robots in the UK in our other article.

5 Quick Steps To Start Trading Forex

Would you like to trade forex and reap the associated benefits? Follow these steps:

Choose a suitable service provider from the recommended list of UK forex brokers. While doing so, factor in your goals and needs. Don’t fret about issues like licensing and reputation because I’ve already vetted them. Visit your chosen broker’s official site to sign up.

When you reach your preferred broker’s website, hit the sign-up button. The following steps should be quick and easy. All you have to do is provide the requested information, including personal details, and answer a few basic questions. Your broker may also ask you to set a strong password for protecting your assets.

FCA-regulated brokers must follow strict AML and KYC rules. As such, you’ll be required to verify your identity and address with valid documents. Ensure whatever you share, be it copies or pics, is clear and legible. Give the company enough time to complete verification.

You can fund your account as soon as your broker has verified it and it’s live. Choose a funding method that you have easy access to and deposit as much money as your budget allows. The amount should comply with the service provider’s minimum and maximum deposit mandates.

Choose your first currency pair and open a position. You can invest in as many FX products as possible for diversification purposes. I also urge you to spread your risk exposure by adding other categories of assets to your portfolio.

Pros and Cons of Trading Forex

| Pros | Cons |

|---|---|

| Juicy potential returns due to high volatility | High volatility goes hand in hand with high risk |

| Easy to enter and exit positions due to high liquidity | Forex traders are highly susceptible to overtrading and emotional trading risks |

| Most top-ranking forex brokers have low minimum deposit requirements | |

| Low-budget traders can use leverage to control large positions | |

| Newbies can practise and test the waters with demo accounts |

FAQs

Although it is possible to trade forex without a broker, it is not a walk in the park. We advise that you find a good forex broker, like the ones we recommend, to give you easy access to the market instruments. Simply make sure that the broker is licensed and regulated by top-tier jurisdictions.

Yes. All profits you make in forex trading are taxable except for those you earn from spread betting. The reason why profits from spread betting in the UK are tax-free is that spread betting is classed as gambling.

Yes. Forex trading is legal in the Uk for as long as you invest in a broker that is licensed and regulated by the Financial Conduct Authority (FCA). You must also be more than 18 years old to qualify.

Absolutely. Many of the brokers in the UK and the ones we recommend above have many educational tools that can help beginners improve their trading skills. However, as a beginner, you should not have high expectations entering into forex trading. Since it is a risky investment, you need to be patient and learn from your losses.

Yes. Some of the forex traders who have now become professionals learned forex on their own. However, the learning process can be slow and time-consuming. So, if you are not a patient individual, we suggest finding a forex trading institution where you will learn directly from the experts.

You can start forex trading with as little as £10. This is because forex brokers in the UK have varying minimum deposit requirements. While some have as low as £10, others will require as high as £1000 or even more.

You can check if a broker is regulated in the UK by visiting the FCA’s official site and searching for the company’s regulatory status.

If you are a retail trader in the UK, the highest leverage you can access is 30:1. However, pros can enjoy higher ratios of up to 500:1.

Yes, regulated UK brokers provide negative balance protection.

CFDs allow you to speculate on a wide variety of assets, from FX products to stocks, commodities, and crypto. But forex is all about trading currency pairs exclusively.

Conclusion

Remember to give the taxman his dues while trading with the best UK forex trading platforms. Your gains will be subject to Capital Gains Tax, as mandated by the UK government. The only way to avoid taxes is through spread betting. Beware of online “gurus” and “trading communities” that offer risk-free trading and guaranteed income. These concepts are non-existent in the risky but profitable world of online forex trading.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I want to start using CMC Markets but cannot quite understand their payment system. Do they have PayPal?

CMC Market supports a range of popular payment options, including debit and credit cards. And yes, you can use PayPal to fund your live CFD account with CMC Markets.

Which Forex broker has the lowest spread?

There are many Forex brokers with low spreads, but not all of them provide you with the features and benefits that you need. I recommend you to try FXTM, Pepperstone, and Hotforex.

Pepperstone is THE BEST! I've been with this broker for a time, maybe over a 1 year, and so far they've been great in all matters, I don't have any complaints so far

When choosing your forex broker, you ought to contemplate commercialism platforms and tools, the number of currency pairs offered, leverage maximums, client service, and, of course, costs. Best brokers for forex commercialism overall - Tickmill, BDSwiss, Vantage FX, ECN market.

I am looking for a company that can help me start work with forex. I heard good reviews about eToro, Plus500, and Forex.com

Who trades with them for a long time? I need some advice about these brokers

I trade with Etoro. If you are new to trading this broker is very suitable for you. The platform is very easy to use and has good support services. I recommend! Good luck

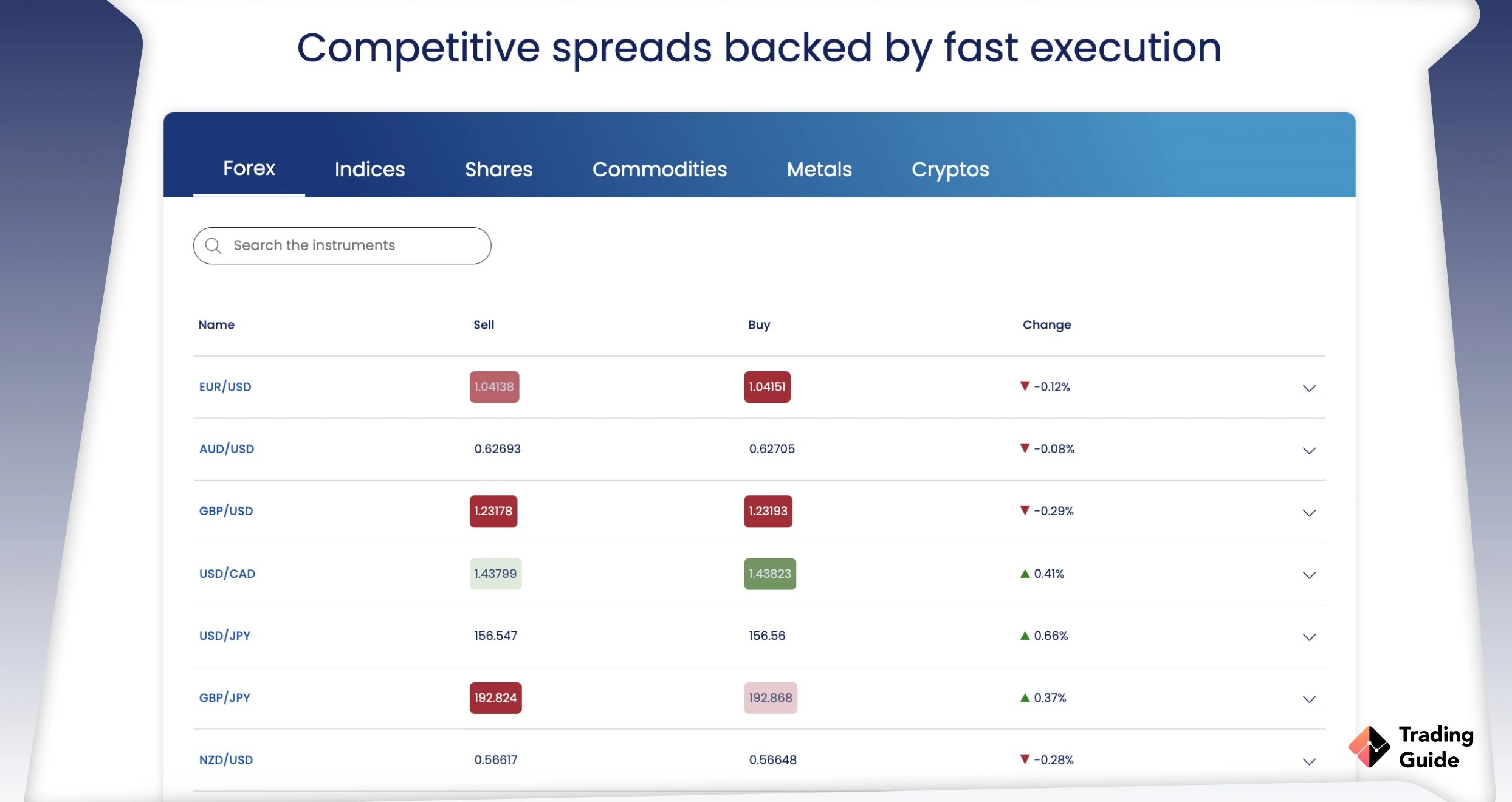

Competitive spread is an important feature in the forex market. A trader needs to choose a platform with tighter spreads in the market. Brokers that provide the tightest spreads in the market are - AvaTrade, Forex.com, and CMC Markets. These brokers are trustworthy and execute the trades at the best price available in the market. Spreads are necessary for a way as it is counted as a cost that is incurred by the trader at a broker's platform. It is as low as 0.0 pip in the case of major currency pairs.

When you are all geared up to trade forex, you have the investment, you have the knowledge, you are ready to trade, what often gets overlooked is your own mental health.

Trade after trade, stress keeps piling up, until you can take no more. It is very easy to slip into overtrading because of the thrill of trading or to make profits back to back or to test new strategies, this is where newcomers let all those tips about avoiding overtrading slide and fall into the trap. This further pushes them into an emotionally volatile state which leads to revenge-trading and rash trading decisions.

Also, most beginners think managing everything on their own will be easy, they fail to see the importance and relevance of signal providers in forex trading. Do hire one and trust them with the market updates of when to buy, when to sell, and when to set stop-loss.

Lastly, maintain a trading journal to analyze your trades and find the loopholes in your trading plan and fix them before your next trade.

These are a few of the things which are often overlooked even by experienced traders. Keep them in the loop and see how your trades get better.

All the best!

Where is XTB?? In my opinion, XTB is way better suited for forex trading with 50 currency pairs on offer and all the tools you could ever wish for. On the other hand, AvaTrade has a more exciting selection of CFDs and other assets, as well as a newly-launched social trading platform that allows you to interact with other traders and copy some of them.

The best forex brokers for beginners offer three essential benefits. The first and most important is that they are a regulated and trusted brand that provides a user-friendly web-based platform. Second, they offer a strong variety of educational resources. Third, they provide access to quality market research.

Here are some of the best Forex brokers you can start trading with:

Plus500 - Overall winner for beginners and ease of use

IG - Excellent education, most trusted

eToro - Best trading platform for copy trading

AvaTrade - Quality educational resources

CMC Markets - Best web trading platform, excellent education

XTB - Best customer service, great education

OANDA - Quality research, user-friendly platform

I read the article and was impressed! It provided exactly what I needed to analyze the best trading platforms in the field of artificial intelligence.

The article offered an extensive overview of the leading forex brokers in the UK, along with an assessment of their user experience. The ratings for licensing, quality of support, software, and other factors gave me a clear idea of what to look for when choosing a platform.

An interesting article about Forex brokers, incredibly relevant for anyone who wants to start trading on Forex. Detailed comparisons, user reviews and own experiences with other brokers, detailed reviews provide a solid basis for making informed decisions. The inclusion of user reviews adds depth to the research on this topic, making it a trustworthy resource. From licenses to custom recommendations, every aspect is covered, ensuring a smooth and successful entry into the world of Forex trading. A must read for traders!

Most of these brokers are decent, but the reality is, spreads, execution speed, and hidden fees can vary a lot. Always test a broker with a small deposit first before going all in. Personally, I've found that user reviews don’t always match actual trading experience.

Most people don’t ‘fail’ because the market is too hard — they fail because they’re using brokers with awful spreads and slow execution. Switching to a proper low-spread broker was a game-changer for me. Costs matter more than most beginners realise, and shaving even 0.2–0.5 pips off your average spread adds up fast. Good breakdown overall, and glad to see someone emphasising the basics that actually move the needle.