Lifetime Independent and Savings Account (ISA) is a tax-free investment account specifically tailored to help you save money and purchase your first home or retire with enough savings. It is ideal for individuals between 18-39 years, and you get to earn £1 for every £4 saved up to a maximum savings of £4,000. This means that if you save more than £4,000 in a year, you won’t receive a bonus for the additional amount.

So, do you want to be part of the Lifetime ISA and are looking for the best and cheapest provider? Below are our top picks based on thorough research and analysis. Remember, Lifetime ISAs come in two categories: cash and stocks and shares LISAs. Therefore, ensure to compare their features and select the best for your investment needs.

List of the Best Cheapest Lifetime ISA Providers in the UK

- Nutmeg – Best and Cheapest Lifetime ISA Provider For Passive Investors

- AJ Bell – Best and Cheapest Lifetime ISA Provider With More Flexibility

- Moneybox – Best and Cheapest Lifetime ISA Provider With The Lowest Fees

- Hargreaves Lansdown – Best and Cheapest Lifetime ISA Provider for Advanced Investors

- Beehive Money – Best and Cheapest Lifetime ISA Provider For Mobile Devices

- Paragon Bank – Best and Cheapest Lifetime ISA Provider With the Best Customer Service

- Newcastle Building Society – Best and Cheapest Lifetime ISA Provider For Desktop Devices

- Foresters Friendly Society – Best and Cheapest Lifetime ISA Provider for Stocks and Shares

Compare Best Lifetime ISA Providers

As mentioned above, we did thorough research and comparisons on as many Lifetime ISAs in the UK as we could to ensure we recommend the best to choose from. We spent hours in this process, considering various elements, including costs and fees, reputation, level of transparency, support service, etc.

Besides testing and comparing Lifetime ISAs, we also analysed user recommendations and ratings on various platforms, including Google Play, the App Store, and Trustpilot. We then combined the results from these two processes to come up with the list below.

1. Nutmeg – Best and Cheapest Lifetime ISA Provider For Passive Investors

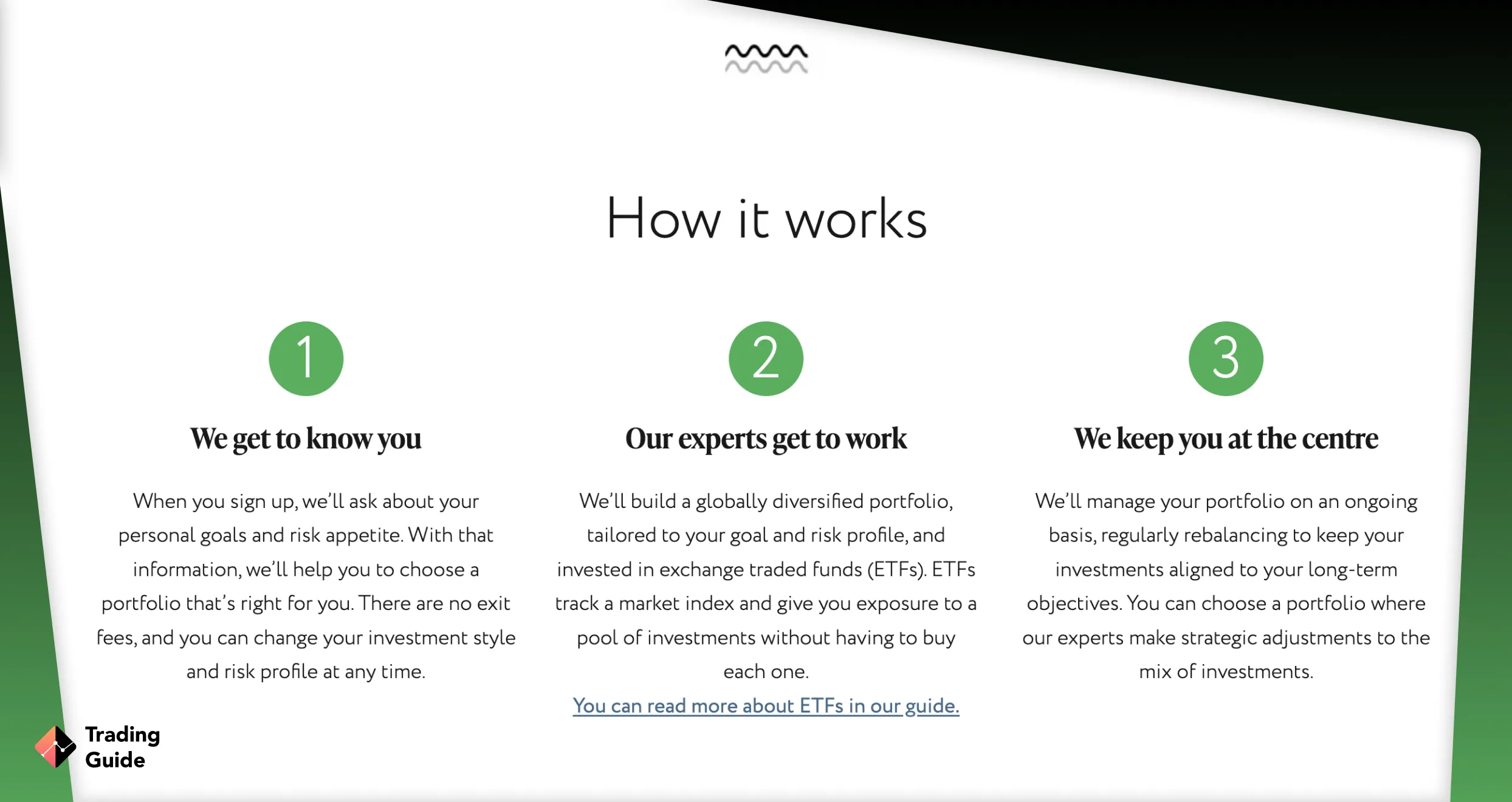

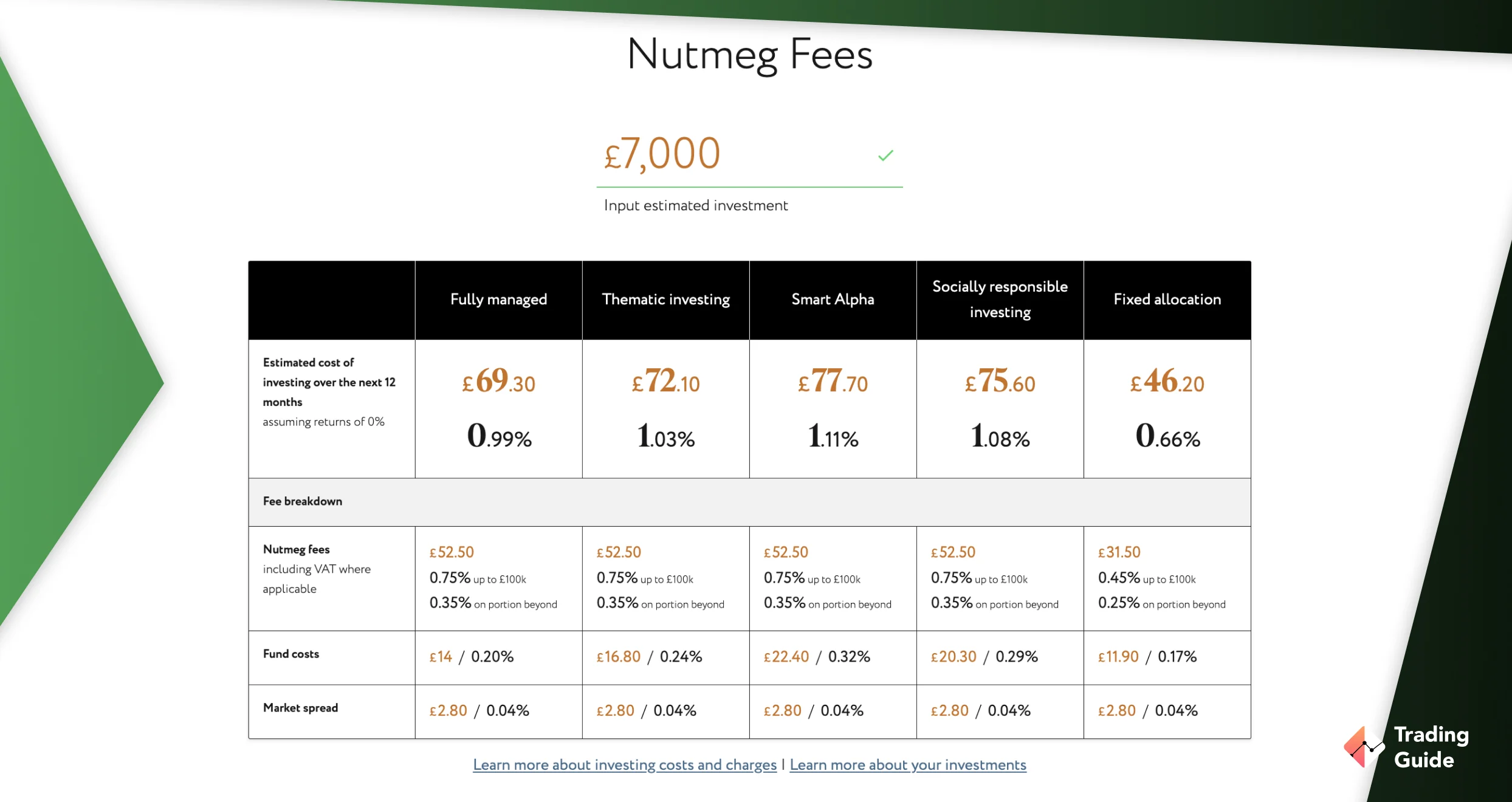

This is a stock and shares Lifetime ISA that easily helps you save towards purchasing your first home or retirement. It is an app/Robo-advisor that makes your investment based on the amount you are willing to risk. Keep in mind that Nutmeg has four LISA options, including a fully managed portfolio, a socially responsible portfolio, a smart alpha portfolio, and a fixed allocation portfolio. All these portfolios are available at a small fee, and you get to choose one based on your investment needs.

To apply for Nutmeg LISA, you must be 18-39 years. The best element about this provider is that it allows you to preview how your portfolio could be and let you decide whether it’s worth investing with. Its minimum initial investment is £100, and you only get to withdraw your funds once you are ready to purchase your home or retire. Making withdrawals for other reasons attracts a penalty fee of 25% of the amount withdrawn.

2. AJ Bell – Best and Cheapest Lifetime ISA Provider With More Flexibility

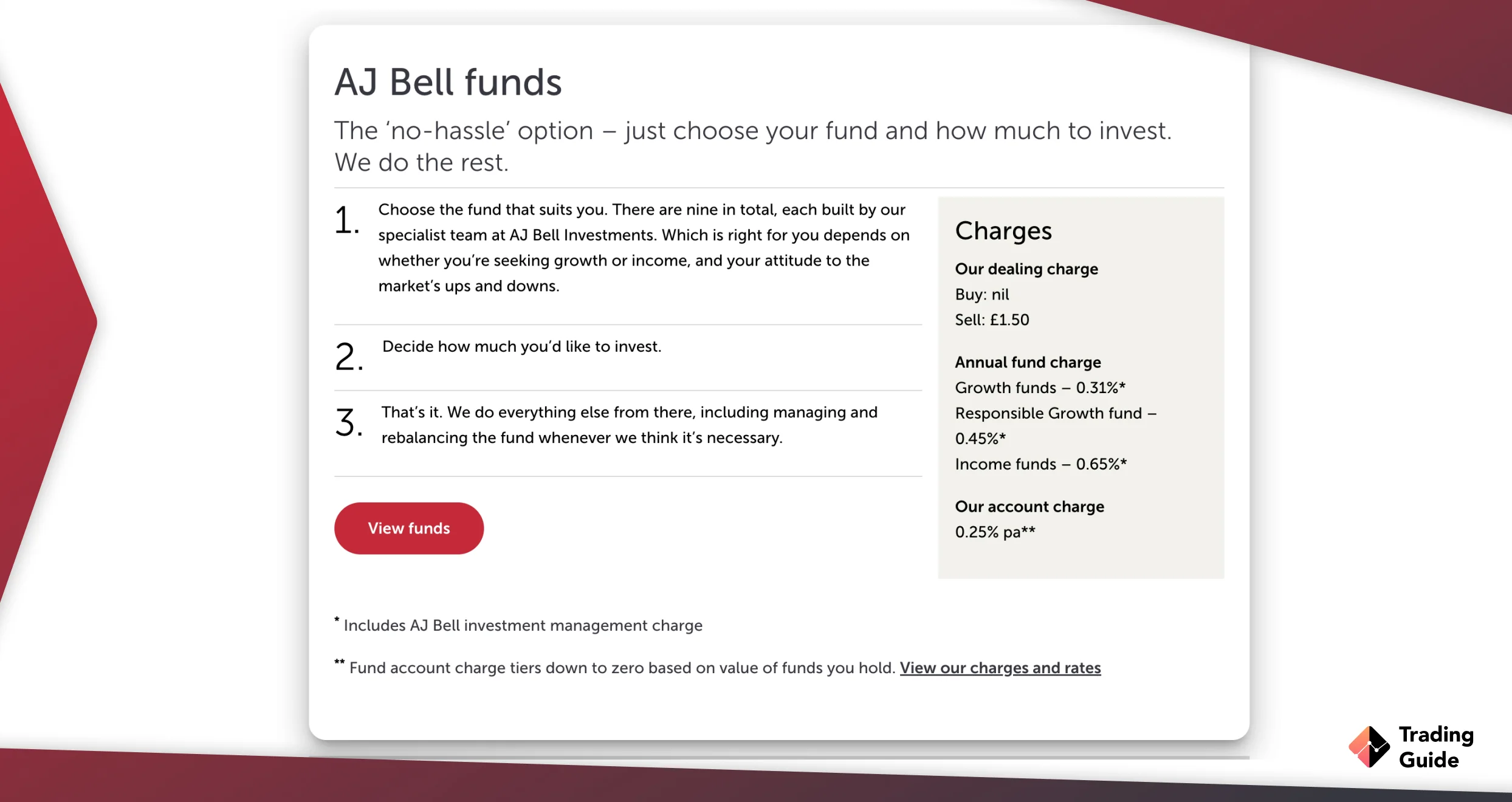

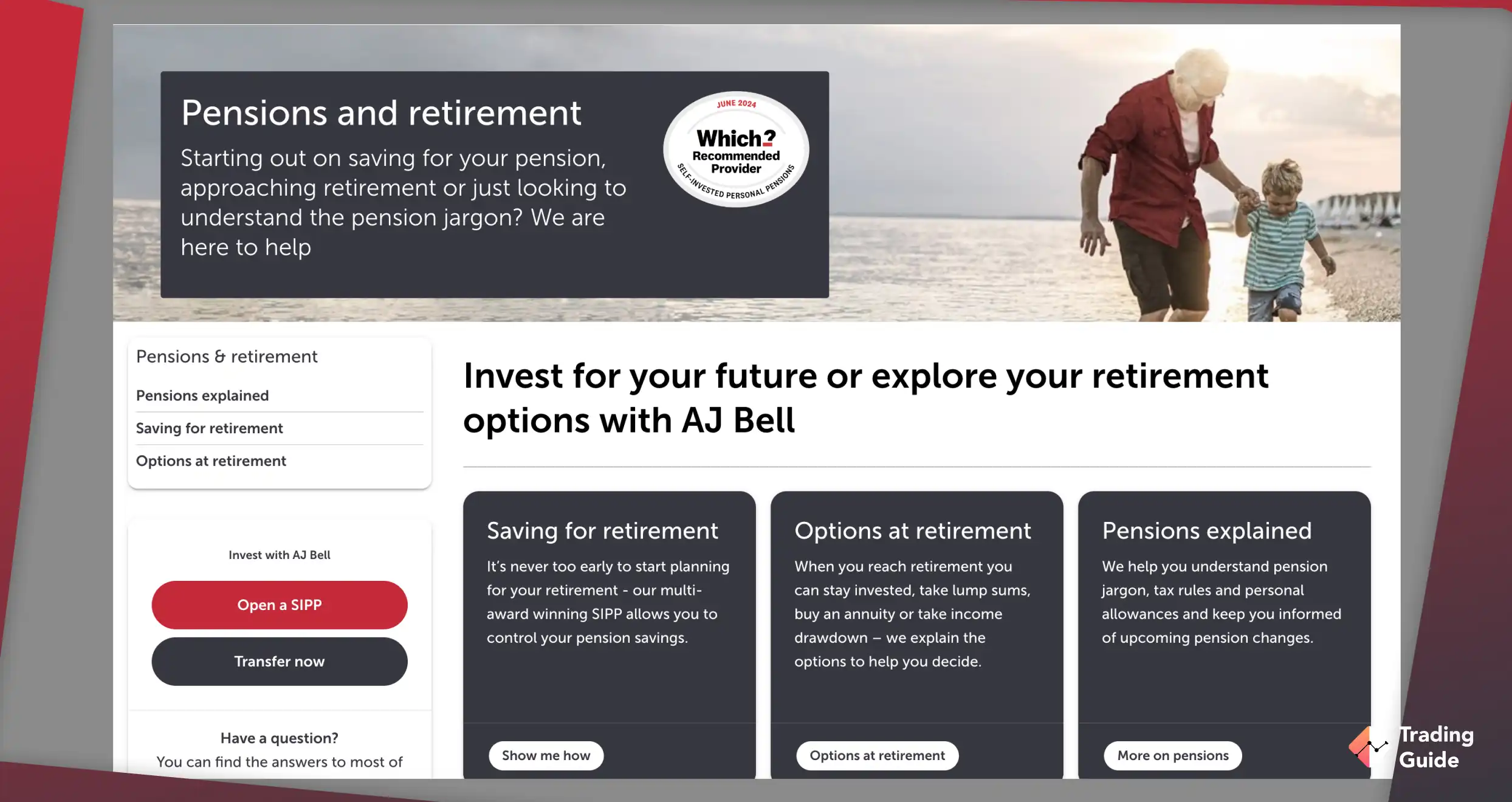

We consider AJ Bell a flexible Lifetime ISA because it can hold money in cash or allow you to invest in stocks and shares. Its minimum initial investment requirement is £500 lump sum of £25 monthly. It also has an annual fee of 0.25% plus additional withdrawal charges. Regarding dealing fees, AJ Bells charges £1.50 for online cash purchases and sales and £9.95 for share investments, which reduces to £4.95 if you have over 10 share dealings in the previous month.

Note that AJ Bells features a massive range of investment options, including shares, funds, corporate bonds, gilts, investment trusts, and ETFs. LISA payments cannot exceed £4,000 annually, and its services are available 24/7 via desktop or mobile devices. Besides Lifetime ISA, AJ Bell also features Stocks and Shares ISA, Junior ISA, SIPP, Dealing Account and Junior Dealing Account.

- Easy to set up platform

- Wide range of investment options to choose from

- Low-cost LISA provider with dealing fees starting from £1.50

- Has a mobile app to help you manage your portfolio on the go

- Highly secured service provider regulated by the FCA

- No financial or investment advice offered

- A 25% penalty fee applies if you withdraw your funds before the maturity date.

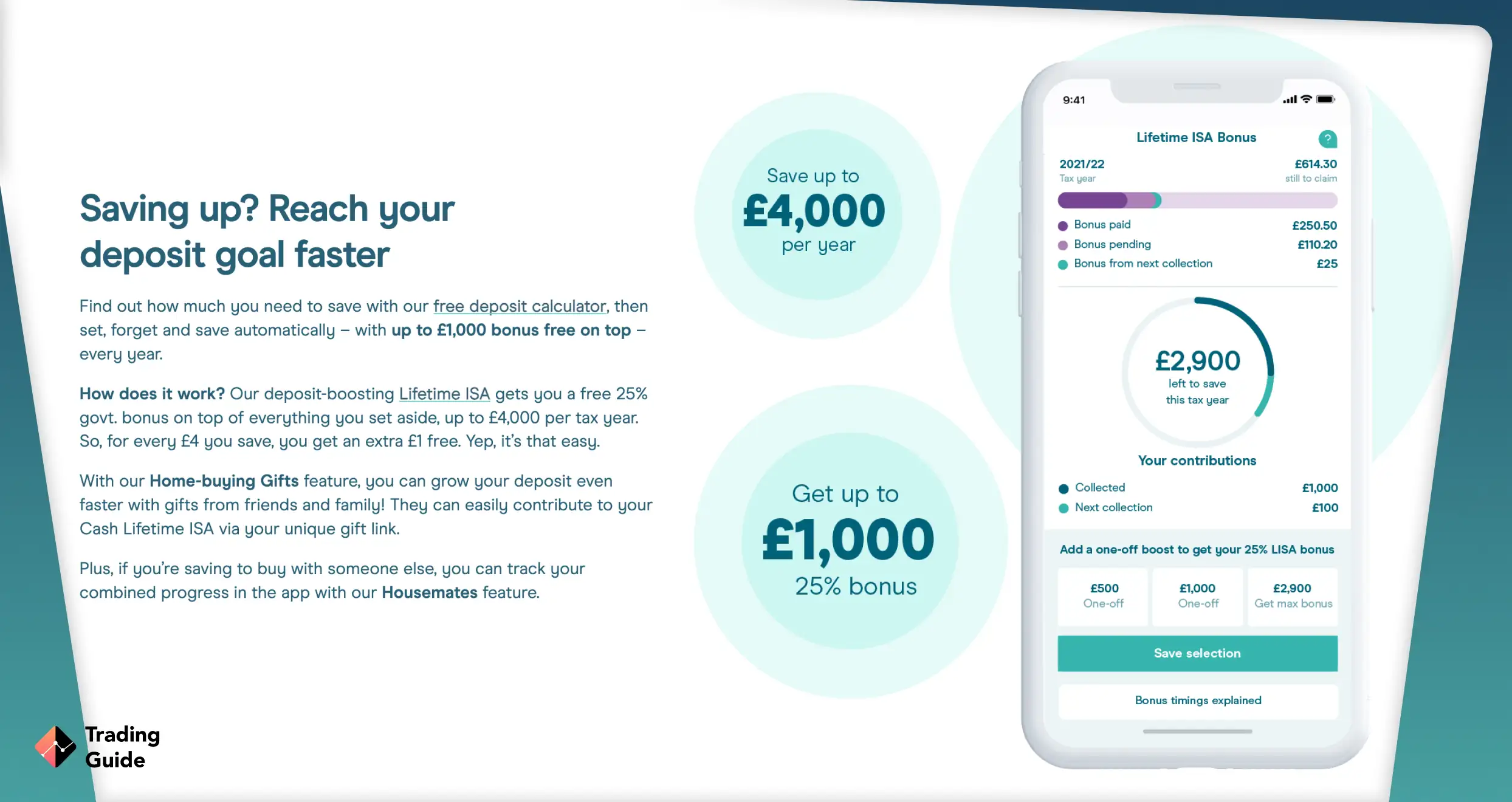

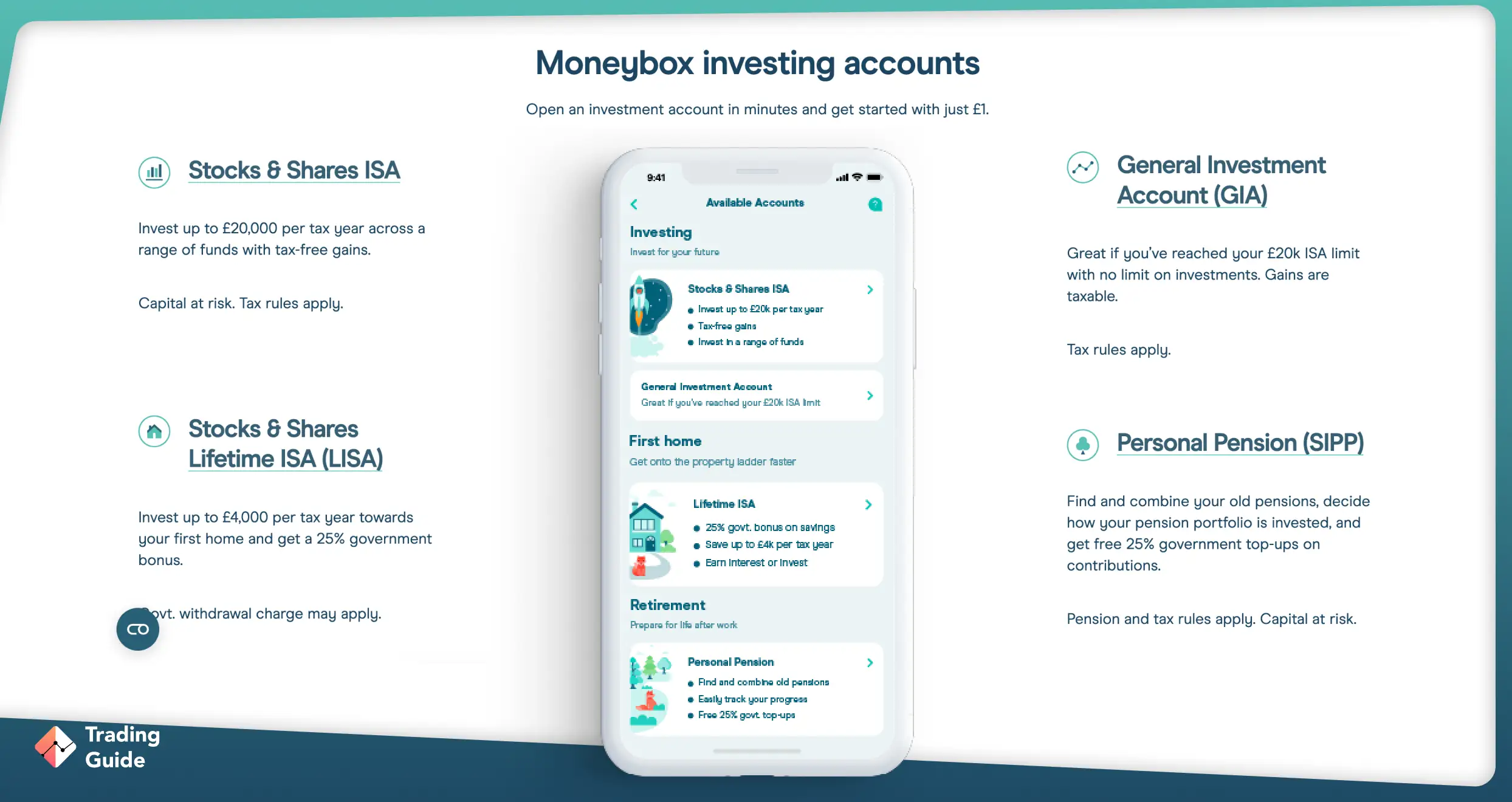

3. Moneybox – Best and Cheapest Lifetime ISA Provider With The Lowest Fees

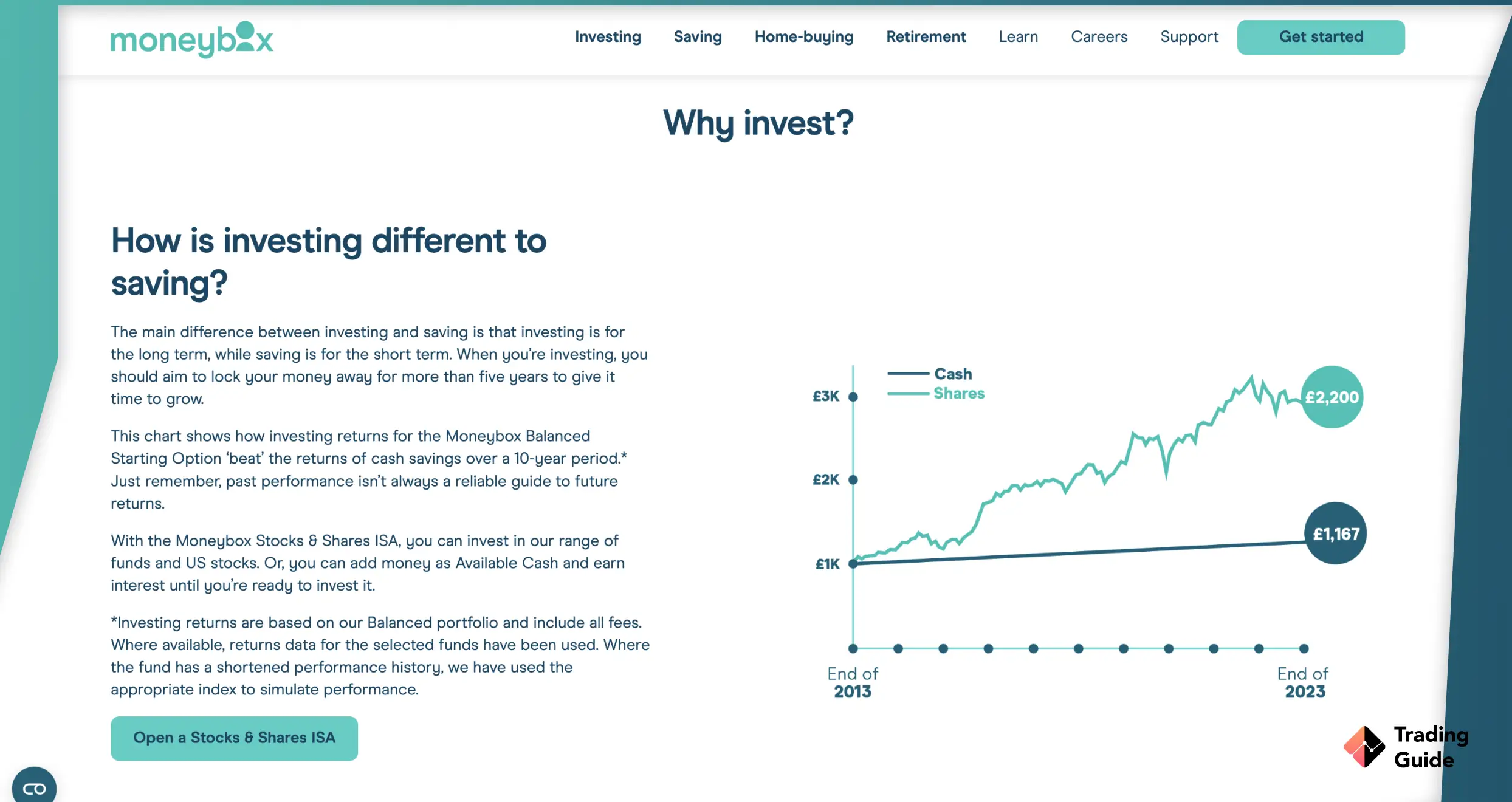

Moneybox is a low-cost Lifetime ISA with a minimum initial investment requirement of £1. It is a cash Lifetime ISA also offering personal pension and stocks and shares ISA. If you want to open a junior ISA for your child or dependent below 18 years, Moneybox offers a separate app for you. Moneybox’s annual fee is £1 per month and a monthly platform fee of 0.45%. There is also an in-fund manager fee ranging from 0.12% to 0.3%.

We primarily recommend Moneybox to newbies not only because of its lowest fees but also because it is user-friendly. Plus, you have access to three investment options to choose from based on the risk you are willing to take, including cautious, balanced, or adventurous. And the best element about this LISA provider is that it can automatically invest your spare change by rounding off an amount you spend in making purchases to invest the difference.

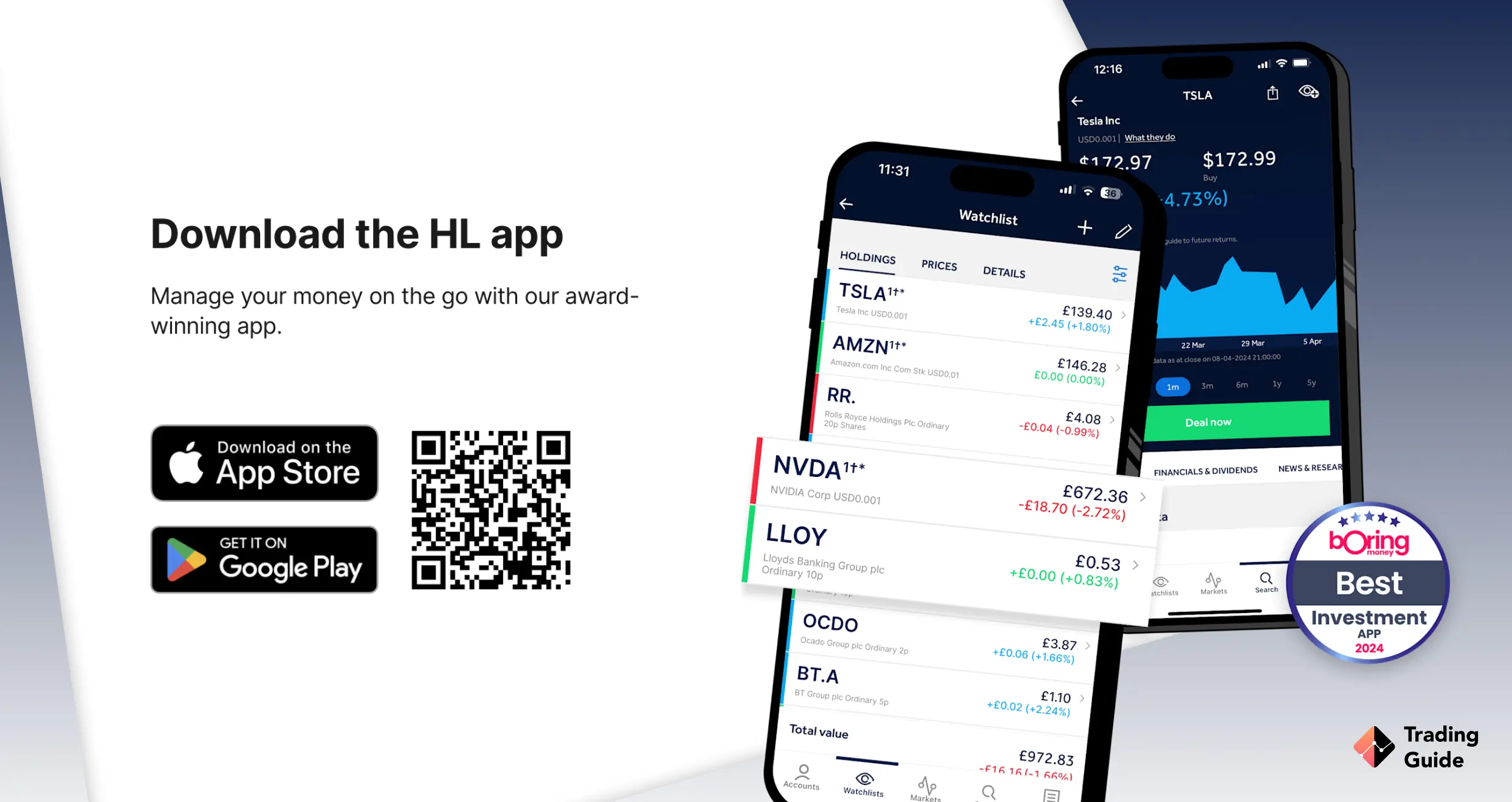

4. Hargreaves Lansdown – Best and Cheapest Lifetime ISA Provider for Advanced Investors

Hargreaves Lansdown is one of the UK’s largest Lifetime ISA with over 2,500 investment options to choose from. It also has a gazillion investment tools to help you make the most of your investment. Its annual fees are capped at 0.45% and keep reducing the more you invest. There are also additional charges on various dealings, including ETFs, shares, and investment trusts. Hargreaves Lansdown is definitely the best place for advanced investors willing to be more hands-on when choosing where to invest.

Hargreaves Lansdown can also be an excellent option for newbies looking for ready-made options. The LISA provider has professionals with vast experience to help you take care of your investment decisions. There are also financial advisors to help you choose the best investments at a small fee. Besides Lifetime ISA, Hargreaves Lansdown’s additional investment products include Stocks and Shares ISA, Junior ISA, Fund and Share Account and SIPP.

- Wide range of investment options in the UK and oversees

- Numerous investment resources for the best experience

- Low minimum initial investment requirement of £100 lump sum or £25 monthly

- In-built calculator and guides to help you work out your potential bonus

- Low annual fees for holding your investment in the Lifetime ISA

- Charges relatively high transaction cost compared to its peers

- Primarily tailored for advanced investors

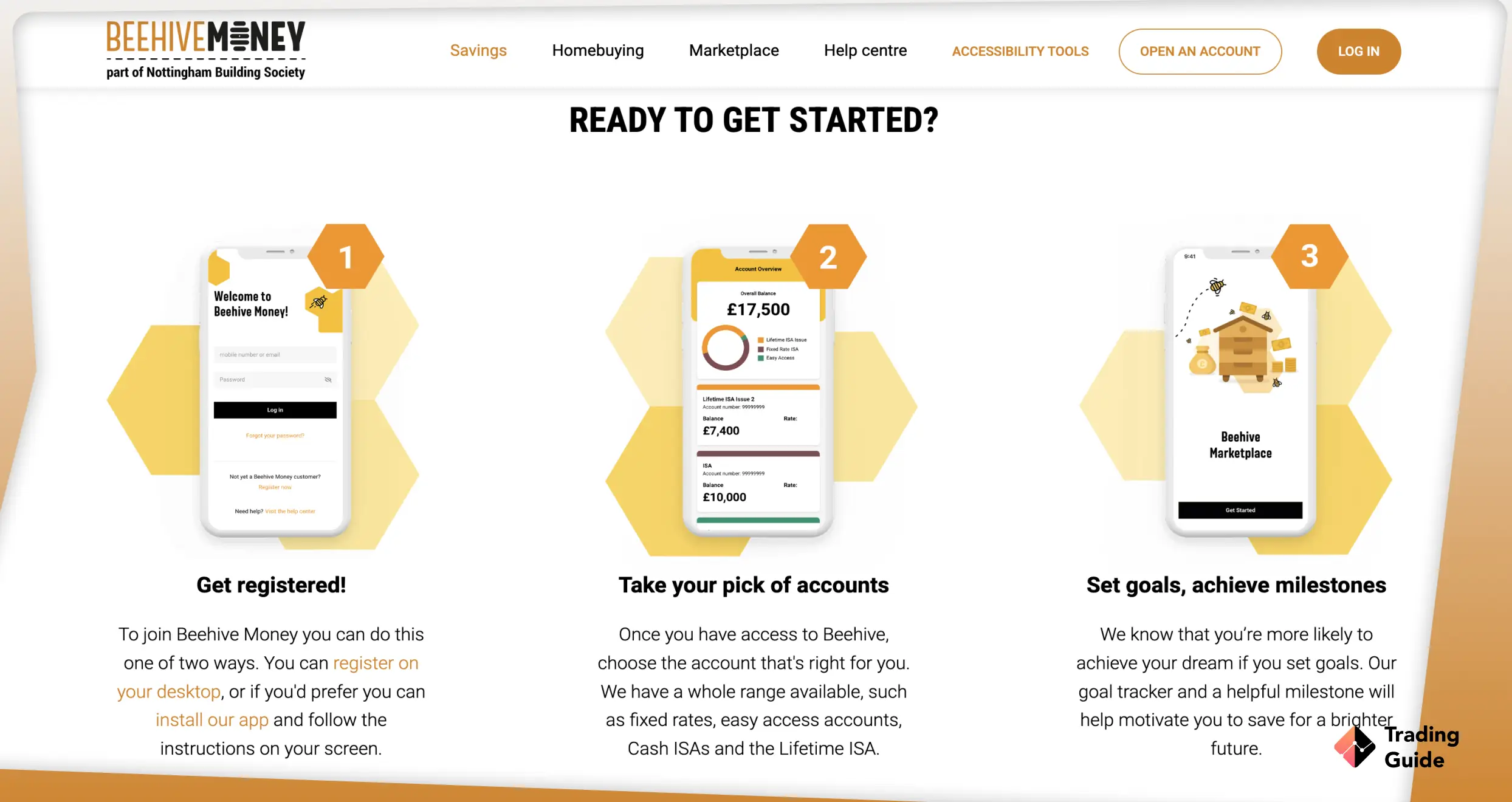

5. Beehive Money – Best and Cheapest Lifetime ISA Provider For Mobile Devices

Beehive Money is another affordable Lifetime ISA available for UK residents between the age of 18-39. The provider is available through its app that you can easily download and install on your mobile device to invest on the go. Its minimum initial investment requirement is £10, making it an excellent option for low-budget investors. Beehive Money is a cash Lifetime ISA with a rate of 1.70%.

Note that Beehive Money partners with the Mortgage Advice Bureau to ensure you get professional advice in your journey to purchase your first home. They also help you find the best deals by searching thousands of mortgages from over 90 lenders. On top of that, free mortgage advice is given as an added bonus to investors who have saved enough to purchase their first homes. Beehive Money is safe for your funds since it is FCA regulated, and your savings are protected by the Financial Services Compensation Scheme.

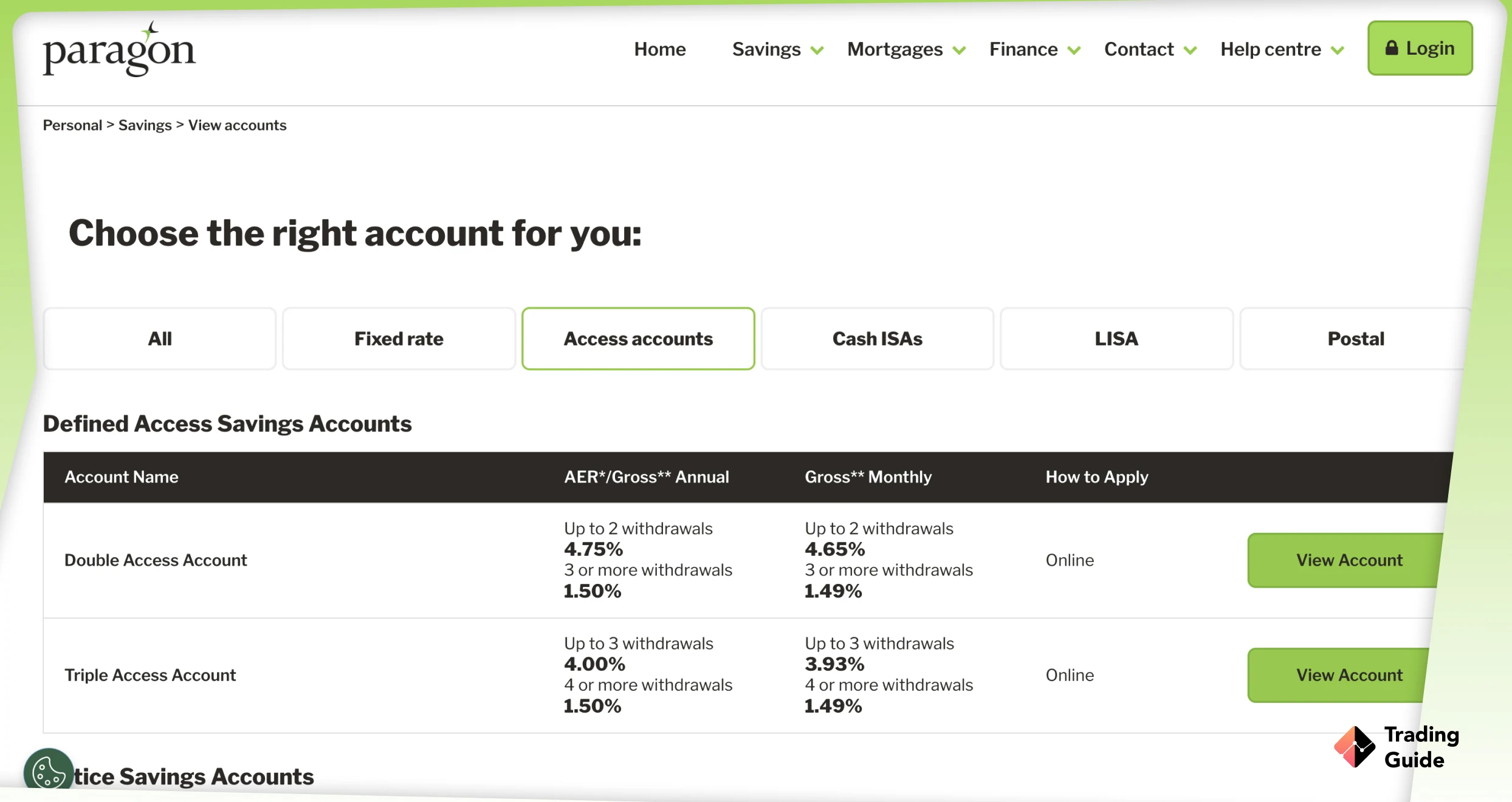

6. Paragon Bank – Best and Cheapest Lifetime ISA Provider With the Best Customer Service

Paragon Bank launched its cash Lifetime ISA in 2019, and it is today one of the best investment platforms to consider. With only a minimum initial investment amount of £1, you get access to a LISA savings scheme offering a variable interest rate of 1.60% annually. You can access Paragon Bank Lifetime ISA via desktop or mobile devices.

One of the best elements of Paragon LISA is that it allows transfers of existing LISAs at any age within the required bracket. Deposits are made via electronic bank transfers and cheques only. Besides supporting its users with adequate investment resources, Paragon Bank continues to gain excellent user testimonials regarding its support service. You are guaranteed fast response and relevant solutions to arising concerns during their operating hours.

7. Newcastle Building Society – Best and Cheapest Lifetime ISA Provider For Desktop Devices

Newcastle Building Society launched its Lifetime LISA in 2018 and has become one of the most popular financial service providers in the UK. You can open an account with as little as £1 using your desktop or mobile device and earn an interest of 1.20% on your savings. It is a cash Lifetime ISA managed online and supports various payment methods for funding your account. The account opening procedure is also straightforward and has a dedicated and reliable support service to contact if need be.

Unlike other cash Lifetime ISAs, Newcastle Building Society doesn’t allow transfers of existing LISAs. The good news is that you can still open multiple LISAs, but remember, contributions restrictions apply. There is also a Junior cash ISA option if you want to secure the future of your kids or young dependents.

8. Foresters Friendly Society – Best and Cheapest Lifetime ISA Provider for Stocks and Shares Investment

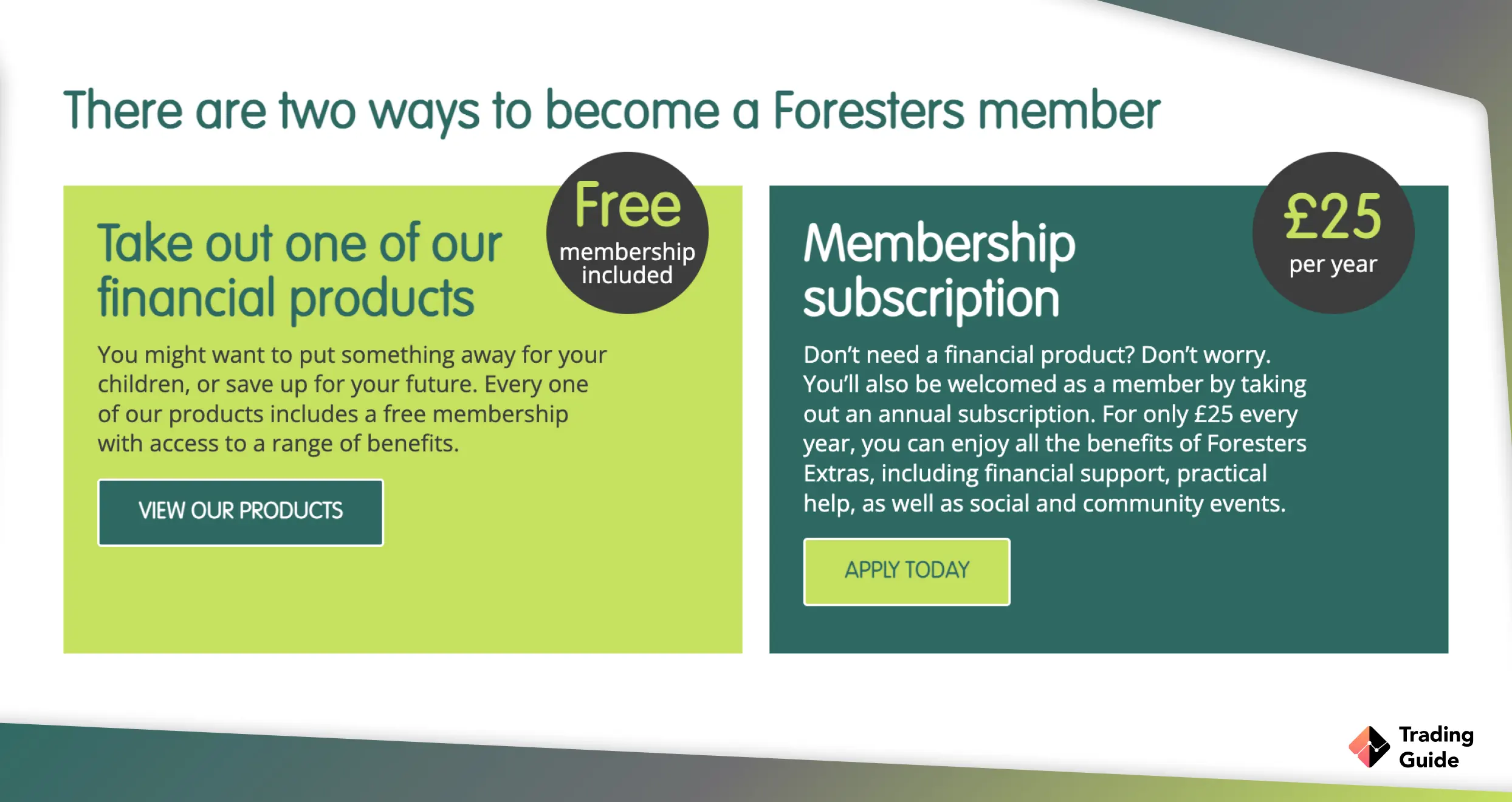

Foresters Friendly Society is an excellent option if you are looking for stocks and shares Lifetime ISA. Its website has a modern design and is user-friendly to accommodate both newbies and expert investors. You can open an account with new funds or transfer other ISA savings and quickly grow your nest egg for purchasing your first home or retiring. Like other providers listed here, Foresters Friendly Society LISA is protected by the Financial Services Compensation Scheme.

Foresters Friendly Society has a relatively high minimum initial deposit requirement of £500 lump sum with at least £250 top-ups or £50 per month. Its annual fee is 2% of the value of your LISA, which is taken into account when calculating policy bonuses. Besides offering a dedicated support service, Foresters Friendly Society has its own financial advisors that will help you clear any doubts and make the best investment decisions at a small fee.

FAQs

There are numerous financial service providers in the UK that do Lifetime ISAs, including those listed in our mini reviews above. Remember, these Lifetime ISA providers have different features, and it is crucial 6o compare them to select the best for your investment needs.

The interest rate on a Lifetime ISA will depend on the service provider you are using since some have high rates while others are low. However, you are guaranteed a 25% government bonus added to your savings, and there are no taxes imposed.

Absolutely. Taking a Lifetime ISA to buy your first home or retire is the best decision since you have the opportunity to benefit from a government bonus to boost your savings. This is unlike saving your money in a bank or investing in regular stock where there are no bonuses or interests.

If you invest in stocks and shares ISA, your money is not protected, and you can lose it with the fluctuating market price. However, cash investments are protected by the Financial Services Compensation Scheme (FSCS), and you only get to pay a 25% penalty fee if you make withdrawals before the due date.

Conclusion

Lifetime ISAs are a great way to help young individuals plan for their future by saving for retirement or purchasing their first homes. By saving your money through cash LISA, you get the opportunity to earn interest and government bonuses, thus watching your money grow. There are also the shares and stocks LISAs that can quickly boost your nest egg but carry high risks of losing your investment funds. Therefore, consider what works best for your investment needs and choose a suitable Lifetime ISA provider from our list above for a worthwhile experience.

Related Articles:

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

Practical tip: I set up a £333 monthly standing order to stay under the £4,000 annual limit automatically. In my first year, I tried saving lump sums irregularly and only contributed £2,400 - missing out on £400 worth of government bonus. Automation is your friend here, especially if you're not naturally disciplined with savings