As the popularity of exchange-traded funds (ETFs) continues to soar in the UK, investors are increasingly drawn to their cost-effectiveness and the opportunity to diversify their portfolios across various assets. To capitalise on the potential returns, selecting the best ETF broker in the UK is paramount.

As an expert in this field, I took it upon myself to conduct extensive market research and share our top picks with you. Whether you are seeking a low-cost option or a platform with expansive offerings, rest assured, I have got you covered. I will also shed light on additional information regarding trading an ETF, helping you start off on the right foot.

List of the Best ETF Brokers

After a thorough market analysis, here are my top ETF providers in the UK.

- Plus500 – Top Option* for Desktop Trading**

- FxPro – Best Option for MT5 Users

- eToro – Beginner-Friendly Option

- FP Markets – Top Option For Advanced Traders in the UK

- Spreadex – Best With No Minimum Deposit Requirement

- XTB – Commission-Free Option

- Admiral Markets – Overall Best

- Pepperstone – Best With Social Trading Features

*Investment Trends 2022

**76% of CFD retail accounts lose money

How We Choose ETF Brokers

At TradingGuide, our mission is to equip you with the most trustworthy recommendations for options trading platforms in the UK. Our selection process is thorough, ensuring that only the finest options make it to your consideration.

We kickstart our process by conducting extensive research, subjecting each ETF trading platform to rigorous testing. Our team of seasoned experts leaves no stone unturned, examining every aspect to gauge performance and usability.

Furthermore, we compare platforms based on our hands-on experience, categorising them according to their distinct strengths and suitability for various trader types. We integrate real user testimonials from reputable platforms like Google Play, the App Store, and Trustpilot to maintain unwavering objectivity and transparency. By amalgamating our findings with genuine user feedback, we provide you with a comprehensive understanding of each platform’s performance and user satisfaction.

Platforms Reviews

I have been trading and working as a financial analyst in some of the top UK-based firms for over 5 years. My knowledge and experience in this landscape have helped me mentor various individuals and businesses looking to profit from the financial space.

Today, I am pleased to present my informed opinion and overview of the best platform for ETF trading in the UK. This comprehensive assessment aims to offer valuable insights into the most reliable and effective platforms available. The mini-reviews will help you identify a platform that best aligns with your requirements.

1. Plus500 – Top Option for Desktop Trading

Among the brokers I tested using desktop and mobile devices, Plus500 stands out as the best for desktop trading. I like the seamless operation I received on my desktop device. Getting started was easy, and accessing all its features was a breeze. Note that Plus500’s minimum deposit requirement is £100, and you get to enjoy free transactions.

This broker provides access to over 100 ETFs to trade as CFDs, including the USO-Oil fund, iShares Silver, Global X Lithium & Battery Tech ETF, and moore. With the Plus500 platform, you gain access to all the essential tools for analysing and trading global ETFs. What’s more, this platform is entirely proprietary to Plus500 and designed in-house. It supports CFD trading only.

*note that Plus500 provides CFD trading only

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Zero commission for trading an ETF on an award-winning platform

- One of the best mobile trading platforms in the industry

- Low minimum deposit requirement

- A user-friendly and modern design platform

- Flexible leverage limits up to 1:300 for professional clients

- A somewhat limited selection of markets, especially ETFs

- A unique platform that can feel unfamiliar to experienced traders

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

2. FxPro – Best Option for MT5 Users

FxPro’s MT5 platform is ideal for traders who want a balance of advanced technology, speed, and a broad market range, including ETF CFDs. Through FxPro MT5, users can access over 2,100 CFD instruments, covering ETFs, forex, cryptocurrencies, shares, indices, metals, energies, and futures. All of these are accessed through a single, seamless interface. It’s a strong choice for traders looking to diversify portfolios or gain exposure to entire market sectors through ETF trading. This is from bonds and commodities to real estate and volatility indices.

Built with professional-grade tools, MT5 at FxPro supports Depth of Market (DoM), 1-click trading, and customisable charts with 44 chart types, 38+ indicators, and 21 timeframes. Integration with Trading Central enhances technical analysis, while MetaEditor and Strategy Tester allow users to design, test, and automate strategies using MQL5. FxPro’s VPS hosting also ensures round-the-clock EA trading with minimal latency.

Available on web, desktop, and mobile, FxPro MT5 combines flexibility with security. Support is available 24/5 via phone, email, live chat, WhatsApp, Messenger, and Telegram, backed by a rich educational hub and a FAQ section.

- Advanced MT5 features with Trading Central tools

- Wide range of ETF CFDs and global markets

- Strong EA and backtesting capabilities

- Reliable 24/5 customer support

- Low minimum deposit requirement for UK clients

- Features additional asset classes for portfolio diversification

- No buying and taking ownership of ETFs and other securities

- Lacks built-in AI trading tools

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. eToro – Beginner-Friendly Option

eToro is one of my personal favourite online brokers and definitely one of the best ETF brokers in the UK at the moment. With over 700 different ETFs on offer, you should not have an issue finding a few that suit your strategy and ability. I also like that this platform is user-friendly, has a simple account set up process, and hosts quality learning resources to boost your skill level.

Trading with eToro is always an enjoyable experience, especially if you make use of its CopyTrader feature that allows you to participate in social and copy trading. For those into portfolio diversification, this broker lists an additional 6,000+ instruments for buying and trading as CFDs. They include stocks, forex, commodities, indices, and more. You can test the broker via its virtually funded demo account or deposit at least £50 per its minimum deposit requirement to get started.

- Supports both trading and investments (on certain markets)

- Great selection of more than 700 different exchange-traded funds

- Social trading tools that help make trading much easier

- Opportunity to invest in ETFs or trade them as CFDs

- Low minimum deposit requirement for UK clients

- One of the more expensive online brokers in the UK

- Charges a £5 withdrawal fee

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

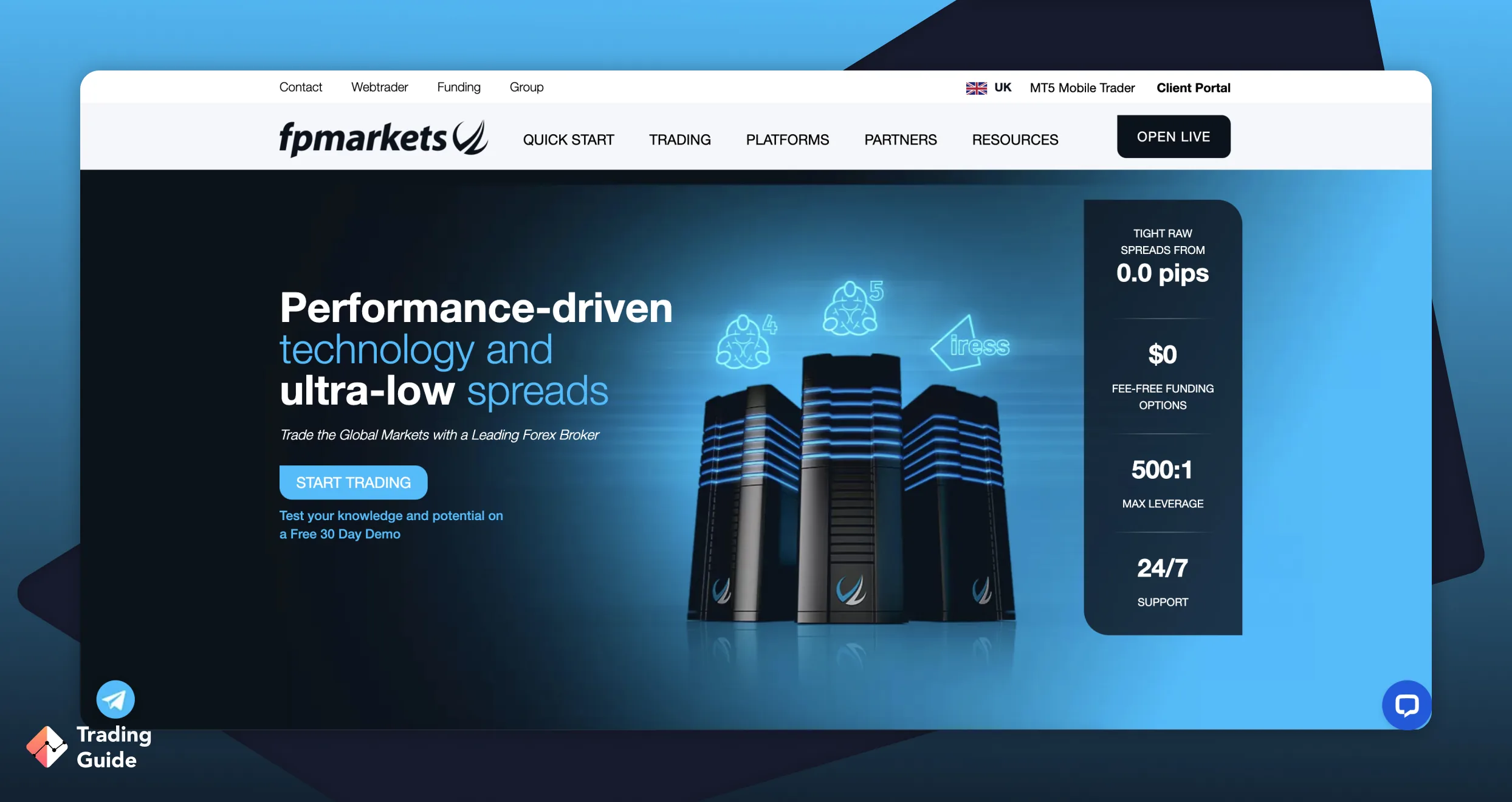

4. FP Markets – Top Option For Advanced Traders in the UK

FP Markets is another ETF broker for UK traders offering over 290 ETF products to choose from. These ETFs include those that track various indices, commodities, currencies, and bonds. As a result, you will have access to a broad range of options when building your portfolio.

I primarily recommend this broker to advanced ETF UK traders because of its vast collection of learning resources. Rest assured of a seamless research experience using FP Markets’ technical indicators, charting tools, a news feed, an economic calendar, and more. On top of that, the broker provides advanced MT4 and MT5 trading platforms, which are widely regarded as one of the best trading platforms available. There is also the Direct Market Access feature on the FP Markets’ Iress platform to ensure you enjoy your activities without intermediaries.

Lastly, FP Markets has competitive pricing for ETF trades starting from 0.0 pips. This allows professional ETF traders to manage their costs effectively when exploring different types of ETFs.

- Low minimum deposit requirement (£100)

- Its MT4, MT5, WebTrader, and Iress platforms operate seamlessly on mobile devices

- Features an advanced client portal to track trades in real-time

- Supports automated trading

- No deposit and withdrawal fees

- No safe two-step login procedure for the web and mobile devices

- No price model on trading ETF

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

5. Spreadex – Best With No Minimum Deposit Requirement

Spreadex has an extensive offering of over 200 ETFs from around the world. I also like that it features additional securities, which empower traders to easily diversify their portfolios. What’s more, the broker is committed to providing traders with the freedom to start trading ETFs without any minimum deposit requirement. This makes it an ideal choice for investors of all experience levels, from beginners to seasoned traders.

Spreadex offers the versatility of trading over 200 ETFs through both spread betting and CFD trading products. It gives traders the flexibility to choose the approach that best aligns with their investment strategy. Whether you’re interested in tracking global indices, commodities, or specific market sectors, Spreadex’s comprehensive selection of ETFs caters to various investment preferences. On top of that, I discovered quality market analysis resources on its proprietary and TradingView platforms.

- Features social trading on its TradingView platform

- No minimum deposit requirement

- Versatile options for trading ETFs through spread betting or CFD trading products

- Over 200 ETFs covering global indices, commodities, and market sectors

- No demo or Islamic account

- Limited availability of advanced research and educational materials

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

6. XTB – Commission-Free Option

After multiple comparisons, I find XTB to be one of the top platforms that provides an effective gateway for investing in global companies, commodities, and sectors through ETFs. With a user-friendly interface and a minimum transaction value of £10 for ETF trades, the broker ensures accessibility and ease of use. Plus, I like its commission-free ETF investing, which applies to up to 100,000 EUR of equivalent monthly turnover for accounts in any currency.

During my analysis, I discovered over 1,311 ETFs and an additional 5,600+ asset classes for portfolio diversification. This means that besides investing and trading ETFs, XTB allows you to invest and trade stocks, shares, forex, indices, and commodities. And the best part is that the broker charges low spreads and hosts excellent market analysis tools, including a market calendar, news feed, and price tables, aiding in informed decision-making. You also get to enjoy competitive interest rates on your uninvested funds up to 4.5% on GBP.

- A user-friendly and intuitive design

- No minimum deposit requirement

- Over 300 ETFs to choose from

- Reliable and responsive 24/5 support service

- ETF spreads can be high

- Some transactions attract a fee

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

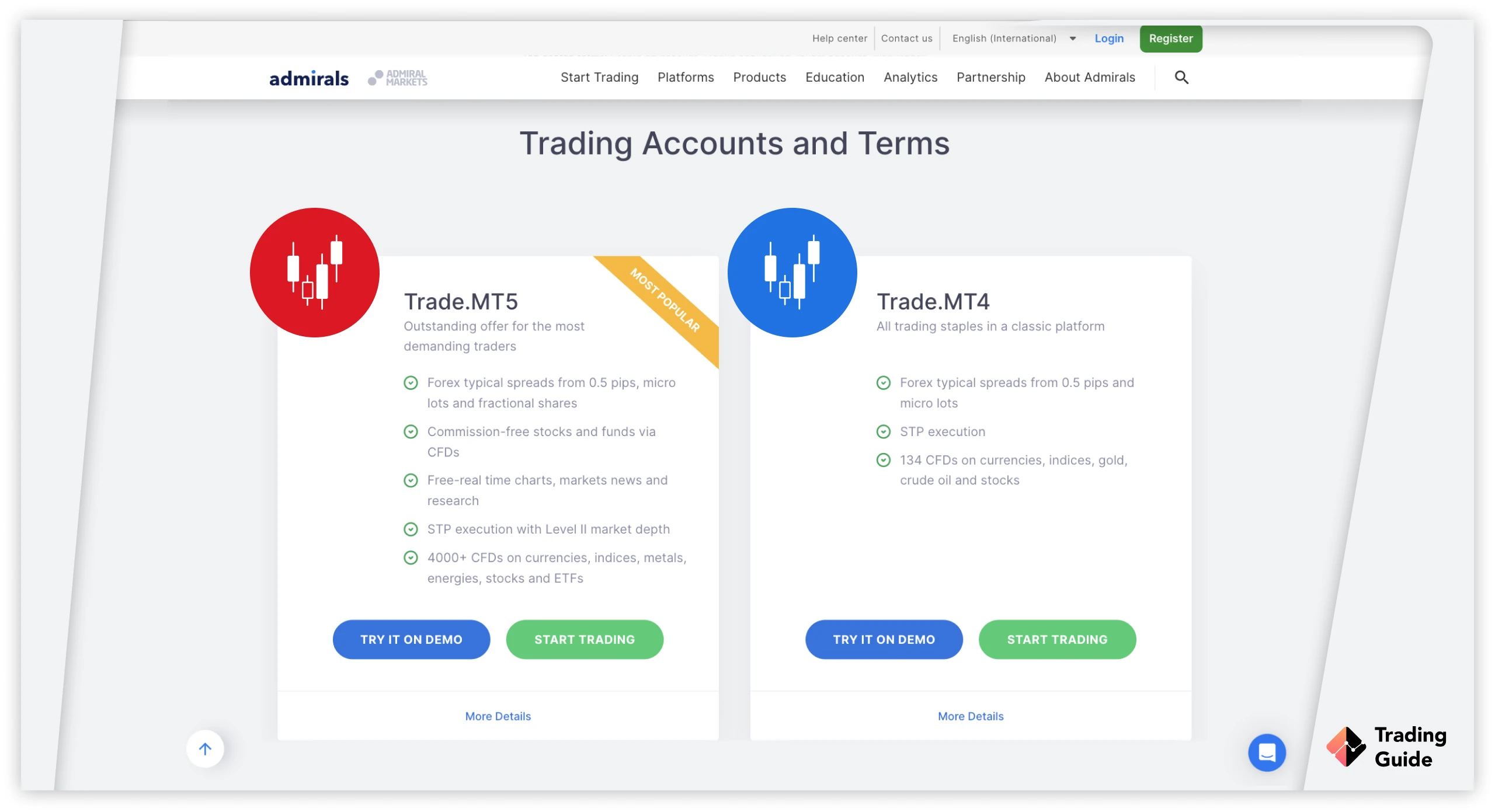

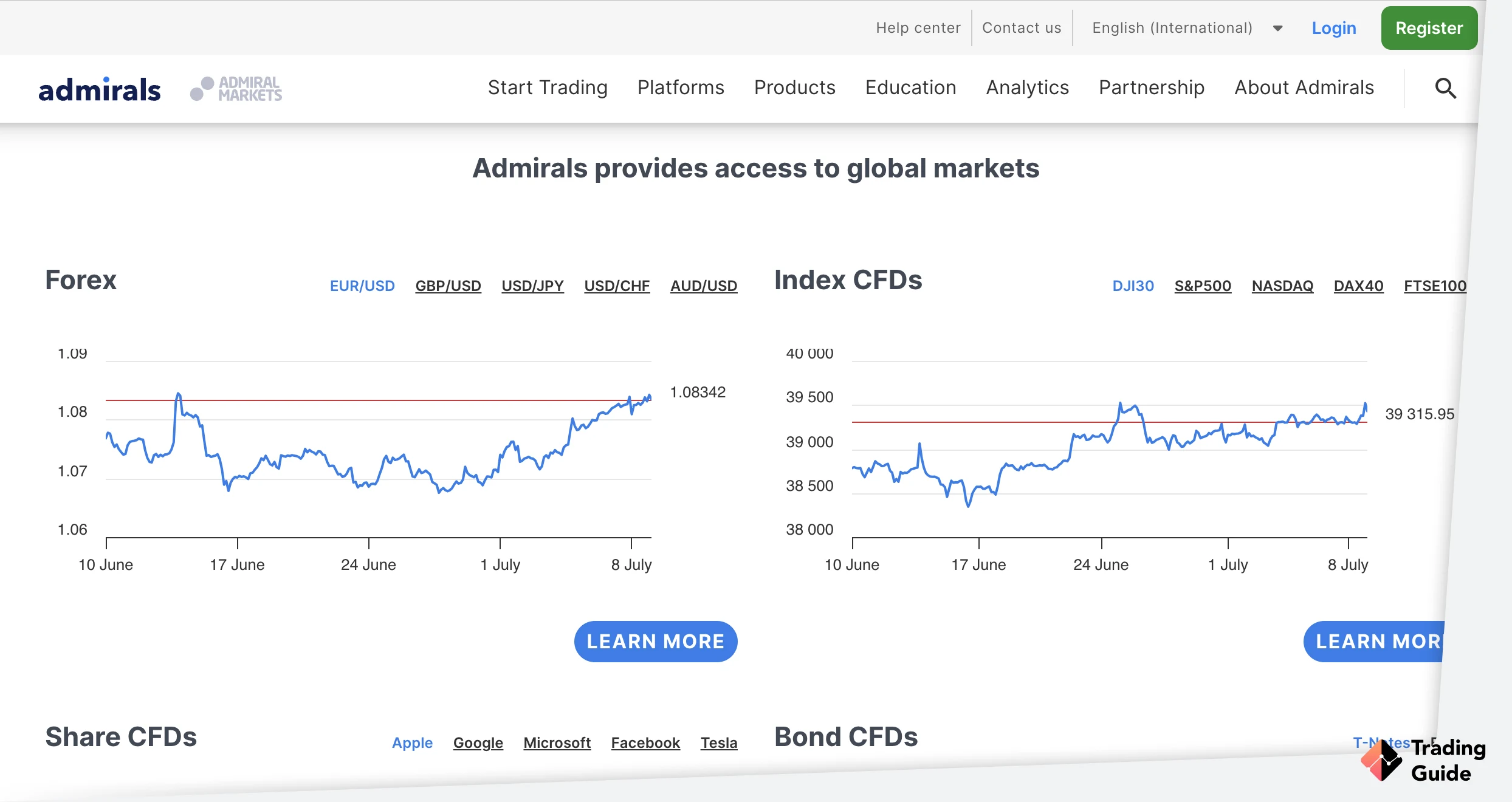

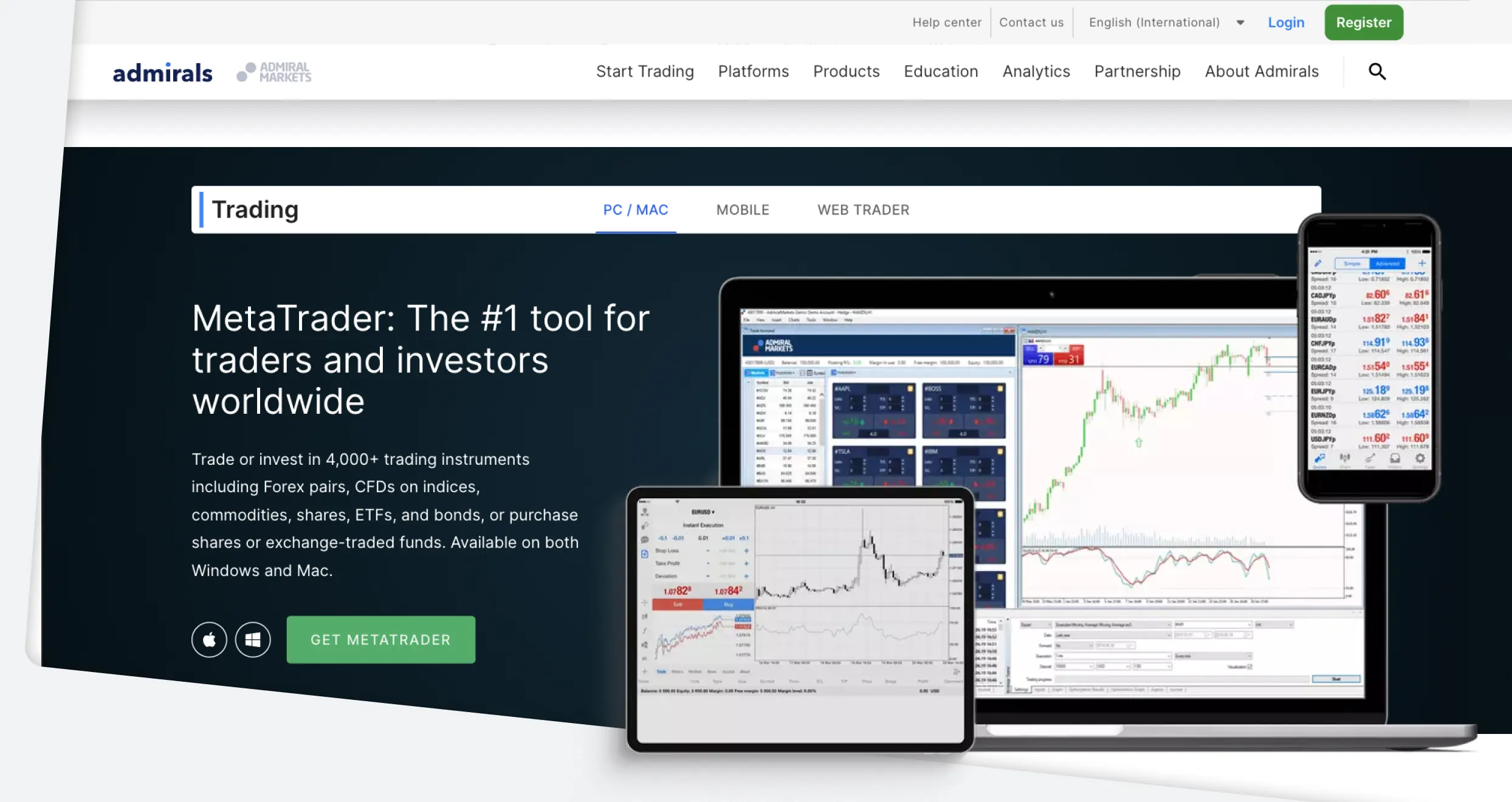

7. Admiral Markets – Overall Best

Admiral Markets is another top ETF broker I find worth recommending to any UK trader looking for a secure and flexible option. It lists over 300 global ETFs across the US, UK, Europe, and more, giving users plenty of options to choose from. You can invest in the featured ETFs and potentially earn dividends or trade the securities as CFDs. All these are available with a minimum deposit requirement of £100 for UK clients.

Besides listing ETFs, Admiral Markets is home to an additional 8,300+ instruments for portfolio diversification. These include shares, indices, forex, commodities, and bonds. ETFs are supported on Invest.MT5 and Trade.MT5 accounts, which are also known for hosting quality trading tools. On top of that, users get to incur low commissions, from £0.02 per share, with a minimum commission of £1.

- Competitive ETF pricing.

- Modern design and user-friendly desktop and mobile device platform.

- Features MT4 and MT5 platforms with quality trading tools

- Lists more than 300 ETFs to invest or trade as CFDs

- The broker charges inactivity fees

- Trading ETF and investing are not supported on its MT4 platform

| Type | Fee |

| Minimum deposit | £250 |

| Deposit fee | $0 |

| Withdrawal fee | 1 free withdrawal request every month, after – 1% |

| Inactivity fee | Monthly €10 |

| Overnight fee | Yes |

8. Pepperstone – Best With Social Trading Features

If you are looking for an ETF broker with social trading features in the UK, Pepperstone is your go-to option. From my personal experience, social trading is featured on its third-party MT4, MT5, cTrader, and TradingView platforms. With social trading, it’s easy to connect with other global traders and learn some trading tips that could benefit your activities. Plus, you will follow the most experienced traders and mirror their potentially profitable positions if need be. The best part is that these platforms are user-friendly and feature quality trading tools for all traders.

When it comes to trading an ETF, Pepperstone offers over 100 ETFs across global equity markets. The ETFs track the performance of sectors including mining, energy, technology, bond markets and retail. And although you can only explore ETFs as CFDs, expect to incur low commissions from £0.02 per share, per trade. Other 2,400+ CFD securities like forex, shares, indices, commodities, and more, are also at your disposal for portfolio diversification.

- No minimum deposit requirement for UK clients

- Low ETF commissions

- Social trading is supported on multiple platforms

- Responsive and supportive support service via live chat, phone, and email

- Featured assets are available to trade as CFDs and spread betting only

- Limited learning resources compared to its peers

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

Compare Brokers Table

To trade ETFs effectively in the UK, you need the best ETF platform UK that suits your specific requirements. To simplify your decision-making process, I have carefully compared the best ETF providers in the UK. Below, I present a detailed comparison table highlighting the key features of each platform for informed choices.

| Best ETF Brokers | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Plus500 | FCA, CySEC, ASIC, MAS, FSA | 24/7 | Plus500 Webtrader | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| eToro | ASIC, CySEC, FCA, FSAS | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Debit cards, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes | Yes (up to $250,000) |

| FP Markets | CySEC, ASIC, FCA, SEBI | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Yes | Yes (up to €20,000) |

| Spreadex | FCA, SEBI | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No | Yes (up to £85,000) |

| XTB | FCA, KNF, CNMV | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, Bank Transfers, Skrill | Yes | Yes (up to £85,000) |

Admiral Markets | FCA, CySEC | 24/5 | MT5, MT4, MetaTrader WebTrader, Admirals Mobile App, Admirals Platform, MetaTrader Supreme Edition, StereoTrader, Virtual Private Server, Parallels for MAC | Bank transfer, Credit/debit cards, Klarna, Skrill | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | MetaTrader 4, MetaTrader 5, cTrader, TradingView | Credit cards, Bank transfer, PayPal | Yes | Yes (up to £85,000) |

How to Choose an ETF Trading Platform

The UK’s ETF market is robust, with the LSE being a leading European center for ETF listing and trading, boasting over 2,300 ETFs. The increasing demand shows how lucrative these assets can be.

If you are looking to venture into ETFs in the UK, start by learning and understanding everything related to this investment. Plus, ensure you choose the right platform, aligning with your needs for an exciting experience that will maximise your potential. Keep reading to discover what to consider in the selection process.

Before selecting an ETF broker, I usually verify that the broker is licensed and regulated by reputable authorities such as the Financial Conduct Authority (FCA). Regulatory compliance ensures that the broker operates within the legal framework, providing investors with security and peace of mind. Plus, I check the encryption technology and whether I can secure my trading account with biometrics or strong passcodes.

Evaluate the range of ETFs offered by the broker. Look for a diverse selection of ETFs covering various asset classes, sectors, and geographical regions. A broad range of ETF options allows you to build a well-diversified portfolio tailored to your investment objectives. In my search, I also factor in the availability of other asset classes like stocks, forex, commodities, and more. This can benefit any beginner, as you will not have to jump from one broker to another testing various securities.

I always compare the fee structures of different ETF brokers to ensure I choose one with transparent and competitive pricing. Pay attention to factors such as spreads, management fees, and any additional charges associated with trading ETFs. Non-trading fees like minimum deposit requirements, transaction costs, and inactivity fees are also worth looking into. You want a broker that fits your budget.

Assess the broker’s trading platform for its usability, reliability, and features. A user-friendly platform with advanced charting tools, real-time market data, and order execution capabilities is essential for executing trades efficiently. I also check the availability of a demo account and how compatible a platform is with desktop and mobile devices.

Check the payment methods supported by the best ETF trading platform in the UK for depositing and withdrawing funds from your trading account. Look for brokers offering secure and convenient payment options, including bank transfers, credit/debit cards, and e-wallets.

Evaluate the quality of customer support provided by the broker. Settle with a trading platform for an ETF that offers responsive and reliable customer support through multiple channels, including phone, email, and live chat. Prompt and helpful assistance is essential for resolving any issues or queries promptly. You should also confirm availability and ensure it aligns with your trading schedule. Remember, some platforms’ support operates round the clock, while others only five days a week.

While I list above the best ETF brokers and trading platforms in the UK, you must conduct your own thorough due diligence before making a suitable choice. This includes sampling user testimonials on platforms like Google Play, the App Store, and Trustpilot to understand the ETF platforms’ strengths and weaknesses for informed decisions.

Conclusion

The right ETF trading platform will streamline your activities and ensure you have a worthwhile experience. Above, I share the top options I find credible and reliable for any trader or investor. However, not all will suit your requirements, so follow my guidelines in selecting what aligns with your requirements. And once you have made a choice, do not dive straight in, risking your funds before understanding how trading/investing an ETF works and gauging your skill level. Luckily, many FCA-regulated ETF brokers have demo accounts to help you practice trading risk-free.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Can I start with Interactive Brokers without experience? Do they have any educational materials?

Yes, Interactive Brokers can be used by all traders regardless of their previous experience. Just make sure that you have a basic understanding of trading with IBRK before you get started.

Interactive Brokers is also known for providing great educational material to all their customers, giving you the tools you need to trade more efficiently.

XTB has been my choice for crypto trading , and I'm really happy with it. The platform is easy to use, especially if you're just getting into crypto. Buying and selling different cryptocurrencies is simple, and they offer plenty of options. The platform is clear, and whenever I had questions, their support team was quick to assist. If you're looking for a straightforward and reliable platform for crypto trading, XTB is a good pick

Great post! As an active trader in the UK, I'm always on the lookout for the best ETF brokers and platforms. It's great to see this list of reputable options, and I appreciate the detail on each one's pros and cons. I'll definitely be using this resource to compare and choose the best fit for my trading needs. Thanks for sharing! ?

I was trying to understand ETF investing and faced many questions. I wanted to learn about choosing a broker and trading strategies. This article provided all the answers! The advice on selecting a broker and popular ETFs was particularly valuable. Everything was explained so simply and clearly that I had no more questions left.

Really informative post! Useful to know about the top ETF brokers and platforms in the UK. I'm thinking of investing in ETFs for the first time and this post has given me a great starting point to research and compare the options. Thanks for sharing!

Great write-up! I've been looking for a reliable ETF broker for my investment portfolio and this list has been super helpful. I've bookmarked it for future reference. Would love to see more reviews and compeer installations for other investment products as well

As an experienced trader, I found this article very helpful, giving a clear overview of the ETF platforms

Great insights in this post! I'm particularly interested in the comparison of fees and user experience across different platforms. It’s helpful to see the pros and cons laid out so clearly—definitely gave me some ideas on where to start my ETF investment journey!