When it comes to trading financial markets, every penny counts. Many traders’ careers have come to a frustrating conclusion due to high costs and diminished returns. I don’t want you to face a similar end. For this reason, I’ve decided to help you avoid costly providers and find the cheapest broker UK.

Don’t get me wrong; my sole aim is not to help you find any cheap trading platform. My ultimate goal is to ensure you are trading with a service provider who not only prioritises affordability but is also credible, reliable, and trustworthy. Before recommending the cheap brokers you’re about to discover, I spent weeks researching and testing scores of service providers.

List of the Best Discount Brokers

- Capital.com – Beginner-Friendly

- eToro – Cheapest With Social Trading Features

- Plus500* – Best With Excellent Support Service

- Pepperstone – One of the Cheapest With Multiple Platforms

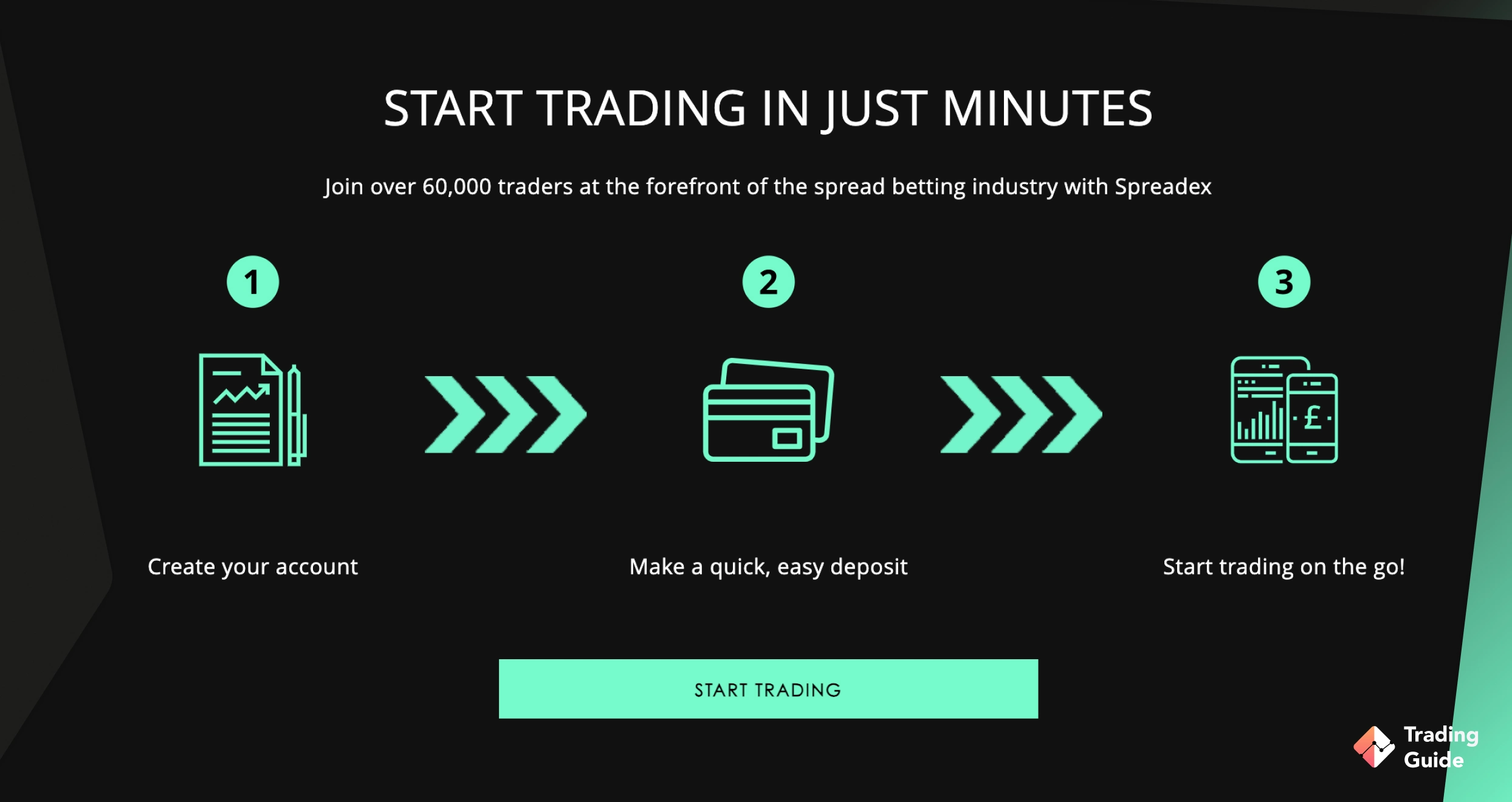

- Spreadex – Cheapest With Spread Betting Options

- XTB – Best for Long-Term Investors

*76% of CFD retail accounts lose money with this provider

Broker reviews

I dedicated weeks to researching and testing the UK’s trading platforms. Afterwards, I eliminated those that don’t fit to be called providers and then pitted the remainder against each other. Days of gruelling work eventually concluded with me picking 5 FCA-regulated brokers that reigned supreme. While selecting the supreme 5, I weighed all critical factors, from regulation and reputation to support and product range.

Here are reviews of the best 5 discount brokers UK. I have highlighted each provider’s strongest suit, features, and downsides. Dig in!

1. Capital.com – Beginner-Friendly

If you’re just getting started with stock trading in the UK, Capital.com is a broker I found very approachable. Its interface is clean and intuitive, making it easy to navigate even for those with little prior experience. You can trade over 4,000 global shares, from popular names like Tesla and Amazon to lesser-known companies and upcoming IPOs. All these are available commission-free through spread betting or CFDs.

Capital.com has a low minimum deposit requirement of only £20, coupled with free deposits and withdrawals. This lets new traders start without committing large sums. Moreover, spreads are competitive, and trades execute smoothly on both the web platform and mobile app. For those wanting more advanced options, Capital.com integrates seamlessly with MT4 and TradingView platforms.

Education resources and support service are another highlight. As a beginner, this helps you manoeuvre the financial landscape as you build your confidence step by step. And if you want to trade CFDs without leverage, there is a 1X platform to consider.

- Beginner-friendly interface and mobile app

- £20 minimum deposit, with free deposits and withdrawals

- Commission-free trades with competitive spreads

- Access to 4,000+ global shares

- Strong educational tools and risk-management features

- No copy trading available

- Some advanced tools may be overwhelming for new traders

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

| Broker Features | Availability |

| Minimum Investment Amount | £20 |

| Demo Account | Yes |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Bank transfer, bank cards, Apple Pay, TrueLayer |

| Transaction Fees | Free |

2. eToro – Cheapest With Copy Trading Features

If you are a newbie who’s still learning the ropes but would like to start trading and earning right off the bat, you should check out eToro. This platform has one of the biggest social networks today. Join it today and get the opportunity to learn from more experienced traders. While gathering more knowledge, you can use the available copy trading features to copy your chosen gurus and earn substantial returns.

Spend as much time as possible learning and copying experienced pros on eToro. When ready, you can branch out solo and do your own thing. After trading for a while and raking in steady profits, feel free to join eToro’s Popular Investor program. Through it, you can help beginners by giving them the chance to copy your trades, the same way you benefited from other gurus when you were a newbie. You’ll also stand to earn incredible rewards from the broker.

In addition to amazing social trading features, I highly recommend eToro because of its impressive asset catalogue. You can trade over 7,000 securities with this broker. You also add real shares to your portfolio since this service provider allows its clients to buy 6,000+ stocks.

*A conversion fee may be applied as withdrawals and deposits are conducted in USD. Any other currency will have to be converted.

- Unmatched social and copy trading features

- Over 7,000 financial assets for traders

- Traders can buy and sell real stocks

- Extensive educational materials

- Offers a world-class crypto exchange

- £10 inactivity fee

- Higher spreads than its peers

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

| Broker Features | Availability |

| Minimum Investment Amount | £50 |

| Demo Account | Yes |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Bank transfers, debit cards |

| Transaction Fees | Withdrawal fees apply |

3. Plus500 – Best With Excellent Support Service

Plus500 earns its place among the best cheap stock brokers in the UK this year thanks to its low-cost structure and genuinely strong customer support. Traders can open an account with just a £100 minimum deposit, and all CFD trades are commission-free. However, you will incur spreads, which I find to be among the lowest in the industry. I discovered over 2,000 global shares plus additional securities, including indices, forex, commodities, ETFs and options, for portfolio diversification.

One of the features that impressed me when testing this broker is Plus500’s support service. The broker offers 24/7 service through email, WhatsApp and live chat, and the FAQ section is detailed enough to solve most routine questions without waiting for an agent. For beginners or anyone trading across multiple markets, having that level of help available at any hour makes a noticeable difference, especially when you need quick clarification before opening or closing a trade.

When it comes to transactions, Plus500 does not charge deposit or withdrawal fees. I discovered a few features that will cost you a few pounds, including guaranteed stops, currency conversions, and overnight funding. There is also an inactivity fee of £10 monthly that kicks in after only three months.

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- 24/7 support via email, WhatsApp and live chat

- Commission-free CFD trading

- Low £100 minimum deposit requirement for UK clients

- No internal deposit or withdrawal fees

- Wide selection of markets for portfolio diversification

- No telephone support option

- CFDs only, not traditional stock ownership

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

| Broker Features | Availability |

| Minimum Investment Amount | £100 |

| Demo Account | Yes |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google/Apple Pay |

| Transaction Fees | Free |

4. Pepperstone – One of the Cheapest With Multiple Platforms

I’m a big fan of third-party trading platforms, like the MetaTrader solutions. If you’re like me, Pepperstone is the best discount broker to trade with, whether it’s forex or CFDs on indices, shares, and other financial assets. Why?

Pepperstone has a host of trading platforms, both third-party and proprietary. After signing with this broker, you can trade with MT4 or MT5, two of the most popular trading tools today. If your strategies require advanced charting tools and a vibrant social network, TradingView is within easy reach. Or, you can opt for cTrader, which boasts robust charting and customisation features.

Besides third-party solutions, you can trade the markets with Pepperstone’s proprietary app. Having tested it, I highly recommend the app to mobile traders. With it, you can trade on the go from your Android or iOS smartphone. You can also use Quick Switch to swap between charts, build custom watchlists, and mitigate losses with the best risk management tools.

Platforms aside, I urge you to consider trading with Pepperstone because it is cost-friendly. The broker doesn’t require you to deposit a specific amount of money before you can trade and has zero transaction fees. Furthermore, as a Pepperstone user, you won’t expose yourself to inactivity penalties whenever you let your account idle for any amount of time.

- Multiple third-party and proprietary platforms

- No minimum deposit

- No transaction fees

- Low spreads from 0 pips

- Simplified UI

- It could have more financial products

- Most available assets are CFDs

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

| Broker Features | Availability |

| Minimum Investment Amount | £0 |

| Demo Account | Yes |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | E-wallets like PayPal, Bank transfers, credit/debit cards |

| Transaction Fees | None |

5. Spreadex – Cheapest With Spread Betting Options

Spreadex is one of a handful of discount brokers that support spread betting. Sign up today and start betting on rising and falling asset prices. You’ll get the uncapped opportunity to earn significant returns. The best part is that you’ll keep most of your profit since the UK government doesn’t tax spread bettors.

If you are worried about investing huge sums before you can bet on spreads with Spreadex, let me brighten your day with excellent news. This broker doesn’t have a minimum deposit; therefore, you can register, top up your account with whatever you can manage, and dive in. Plus, your capital and returns will remain untouched because the platform doesn’t have fees for deposits or withdrawals.

The other good news is, if you are a professional trader, signing with Spreadex will put you in the best position to enjoy boons that most average traders only hear of. They range from more financial markets and tight margins to increased leverage and advanced trading tools.

Finally, besides trading and spread betting, Spreadex supports sports betting. If you are a fan of this activity, signing up with this broker will allow you to trade and bet on sports events from the same platform, which is more convenient than having to switch between multiple sites constantly.

- Supports tax-free spread betting

- No minimum deposit

- Free deposits and withdrawals

- Allows sport betting

- No inactivity fee

- Higher spreads than its peer

- Can overwhelm beginners

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

| Broker Features | Availability |

| Minimum Investment Amount | £0 |

| Demo Account | No |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Bank Wire Transfer, Credit cards |

| Transaction Fees | No |

6. XTB – Best for Long-Term Investors

As someone who invests in global stocks, I’ve found XTB to be one of the best cheap stock brokers in the UK for long-term investing. What really appeals to me is its low-cost structure. You can trade over 6,600 stocks across 14 markets and 1,800+ ETFs with zero commission on trades up to a monthly turnover of €100,000. Beyond that, the fee is a modest 0.2%, which still keeps costs competitive for frequent investors.

There’s no minimum deposit required to open an account at XTB, which makes it accessible even if you prefer to start small. Its flexible Stocks & Shares ISA is another big plus. I was able to invest in a broad range of global stocks and ETFs tax-efficiently. I also like that this stock broker gives users an opportunity to earn up to 4.25% interest on uninvested cash.

When it comes to platform performance, the xStation 5 is intuitive and reliable on both desktop and mobile devices. You are guaranteed access to real-time charts, research tools, and market analysis. And if you are a beginner, XTB has its knowledge base section with a plethora of learning resources for skills development.

- Commission-free trading up to €100,000 monthly turnover

- No minimum deposit required for UK clients

- Gives access to 6,600+ global stocks and 1,800+ ETFs for long-term investment

- Flexible ISA with tax efficiency

- Reliable, user-friendly mobile and desktop platform

- Currency conversion fee (0.5%) may apply to non-GBP trades

- Does not feature third-party platforms like MT4 and MT5

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Broker Features | Availability |

| Minimum Investment Amount | £0 |

| Demo Account | Yes |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Credit/debit cards, e-wallets, Bank transfers |

| Transaction Fees | No |

Compare Brokers

In our quest to provide you with the best discount brokers in the UK, we invested significant time and effort into thorough testing and comparison. We assessed numerous brokers, taking various factors into consideration. These factors included the security measures implemented by the brokers, the performance of their trading platforms, the range of products, the charges involved, the availability of demo accounts, and the level of customer support services.

Furthermore, we analysed user feedback from reputable sources such as Google Play, Trustpilot, and the App Store. This allowed us to gain insights into the experiences of real users and gauge the overall satisfaction level with each broker.

Below, we present you with our summarised ratings, which entail the key aspects of each broker. This comprehensive comparison will assist you in making an informed decision and selecting the cheapest broker UK that aligns with your specific requirements and preferences.

| Best Low-Cost Brokers | Licence | Support Service | Software | Payment | Demo Account | Money Insurance (Negative money protection) |

|---|---|---|---|---|---|---|

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes (up to £85,000) |

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit Cards, Bank Transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes | Yes (up to $250,000) |

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google/Apple Pay | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple/Google Pay, Credit/Debit Cards, PayPal, Domestic/International Bank Transfer | Yes | Yes (up to £85,000) |

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank Transfer, Neteller, Apple/Google Pay | No | Yes (up to £85,000) |

| XTB | CIRO, FCA, CNMV, KNF | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, e-wallets, Bank transfers | Yes | Yes (up to £85,000) |

How to Choose the Cheapest Trading Platform

I have recommended service providers that, based on my research and experience, rank higher than the rest. Now, I need to show you how to choose the most credible and reliable cheapest trading platform in the UK and avoid second-rate providers. It’s 100% doable; you just have to screen the brokers you encounter based on the following:

When choosing a trading platform, considering regulatory status is non-negotiable. You want a platform that’s licensed by trusted authorities such as the FCA, ASIC, and CySEC (Europe). These enforce strict standards that protect you, the trader, ensuring transparency and fair practices.

Without proper regulation, you’ll likely face many issues like unfair trading conditions and unpaid withdrawals. I also recommend verifying every platform’s regulatory status before committing since a well-regulated provider gives you peace of mind, knowing your funds and personal information are secure.

I can’t overemphasise how crucial factoring in costs is when selecting the best platform. Many platforms advertise low costs but have myriad hidden elements that counter that, including high spreads, withdrawal charges, and inactivity fees.

You must consider the total cost of trading, not just the advertised rates. For example, a platform with a tight spread but high withdrawal fees might end up costing you more over time. Always read the fine print while keeping an eye out for aspects that will ultimately make trading expensive and undermine your returns.

A good reputation is a must-have for every reliable trading platform. I always look for platforms with a solid track record of transparency, reliability, and positive reviews from other traders. Online forums, social media groups, and third-party review sites are great for getting a feel for a platform’s reputation. Like me, you should avoid any platform with a history of unresolved complaints or poor customer service because it can lead to major headaches.

Trustworthy platforms usually have positive feedback, reliable performance, and a track record of handling issues responsibly. While weighing reviews left by other traders on Google Play, the App Store, etc., check the company’s reputation when it comes to offering prompt assistance and responses.

Customer support is an often overlooked but vital factor. You don’t want to get stuck with a platform that leaves you hanging when you encounter a problem. Whether it’s during a trade or a technical issue, having reliable, fast customer service can save you a lot of stress.

Look for platforms that offer multiple contact options: live chat, phone support, or email. Ideally, customer support should be 24/7, especially if you’re trading in different time zones. Fast, professional help ensures your questions are answered quickly, allowing you to stay focused on your trades instead of dealing with frustrating delays.

Having access to a wide range of assets is crucial for building a diversified portfolio. You want to trade not only forex but also stocks, commodities, cryptocurrencies, futures and more. A platform that offers limited assets could restrict your trading opportunities, especially as your strategy evolves. It’s important to choose a platform that can accommodate your future goals.

With more asset variety, you have the flexibility to shift strategies, explore different markets, and react to new opportunities without switching platforms. Always check the platform’s asset offering to ensure it aligns with your trading preferences and long-term objectives.

The trading platform itself plays a huge role in your experience. Look for platforms that support advanced charting tools, technical indicators, and order management systems. Compatibility with popular trading platforms like MetaTrader 4/5 and TradingView can offer additional functionality and ease of use.

It’s also important that the platform is available on both desktop and mobile so you can trade on the go. A solid, easy-to-use platform can make a huge difference, ensuring you can execute trades efficiently and analyse markets in real time, whether at home or travelling.

Read about the best NinjaTrader brokers in the UK and the best UK micro account brokers in our other comprehensive guides.

Conclusion

With the cheap brokers recommended here, you can trade your favourite financial assets and earn solid returns. That said, trading with these service providers isn’t the alpha and omega of succeeding while trading the markets. If you lack sufficient knowledge, a broker’s cost-friendliness won’t save you from what you will encounter in a short while- immense financial losses.

With that in mind, if you are a noob, I strongly suggest studying the fundamentals and practising with virtual money in demo mode before taking the final plunge. It shouldn’t be a hassle since many brokers have free educational materials you can access anytime, anywhere, including trading courses, webinars, and podcasts. Use them to build sufficient trading knowledge and better your chances of succeeding.

Read also the full Trade Nation review in our other article.

How we test?

The entire TradingGuide team never holds back when it comes to searching for service providers to recommend to you, our beloved reader. We always research extensively and factor in feedback on multiple sites, like Google Play and Trustpilot. Our team never relies on its opinions exclusively since we don’t want to be biased.

Furthermore, before reviewing and recommending each broker, our gurus conduct tests with demo and live accounts. We want to be factual and base every sliver of information on our own experience, not third-hand information and testimonials alone.

DeGiro is a broker good for beginners? Or do I need to start with a broker with a demo account?

Honestly, I didn't quite understand how to choose a broker before. But after reading this article, everything became clear! I chose Pepperstone, and I don't regret it. Their transparency and quick execution amazed me. Also, excellent reviews about AvaTrade convinced me of their reliability. Now I feel like a confident trader. My experience with Pepperstone is simply delightful! Fast trades, responsive support, and, most importantly, the growth of my portfolio. Thanks for the useful information!

It’s good to see a comparison like this that lays everything out clearly. For anyone just getting started, I’d recommend testing the demo accounts first to get a feel for the platform. Thanks for putting this together!

I really appreciate how this reviewer emphasizes that "cheap" doesn't just mean low costs - it means finding reliable, regulated brokers that won't nickel-and-dime you to death.