When choosing a broker, traders and investors often prioritise access to efficient trading software that can automate their activities while enhancing their overall trading experience. If you’ve been searching for a dependable automated trading software, this guide is tailored just for you. We not only provide recommendations for the best options in specific categories but also offer insights into what automated trading entails. Additionally, we will walk you through effective strategies for using such software within a broker’s platform and outline the essential steps to get you started on your automated trading journey.

Essence

- The best automated trading software relies on computer programs with predefined mathematical instructions to make trading decisions.

- The most accessible ways to engage in automated trading in the UK include using brokers that seamlessly integrate with automated trading software.

- One of the primary benefits of automated trading is the removal of emotions from trading decisions.

- The best automated trading systems operate at high speeds, executing trades with precision and efficiency.

- The best automated trading software in the UK offers Expert Advisors that enable traders to create and use their own automated trading strategies. They provides a user-friendly environment for algorithmic trading.

- To establish a connection between the API and a broker’s system, traders should refer to the instructions provided on the broker’s website.

List of the Best Software for Automated Trading

- MetaTrader 5 (MT5) – Overall Best Automated Trading Software in the UK

- MetaTrader 4 (MT4) – Best Forex Automated Trading Software in the UK

- NinjaTrader – Best Options and Futures Automated Trading Software in the UK

- cTrader – Best Automated Software for Day Trading

- TradingView – Best Cryptocurrency Software For Automated Trading in the UK

- Trade Ideas – Best Stocks Automated Trading Software in the UK

Automated Trading Software Comparison

We understand that assessing and comparing the best automated trading software in the UK can be overwhelming and time-consuming. Since we are dedicated to ensuring our readers find the best trading software, we have decided to prepare a comparison table below. In this table, you will find some of the significant elements that will help you make the best choice and kickstart your automated trading or investment journey on a good note.

| Best Automated Trading Software | Price | Order Types | Mobile App | Broker Integration | Simulated Trading |

|---|---|---|---|---|---|

| MT5 | Varies based on broker | Market Orders, Limit Orders, Stop Orders, Trailing Stops, One-Click Trading, | Yes (Google Play, App Store) | Yes | Yes |

| MT4 | Varies based on broker | Market Orders, Limit Orders, Stop Orders, Trailing Stops, One-Click Trading | Yes (Google Play, App Store) | Yes | Yes |

| NinjaTrader | Varies based on broker | Market Orders, Limit Orders, Stop Orders, Trailing Stops | Yes (Google Play, App Store) | Yes | Yes |

| cTrader | Varies based on broker | Market Orders, Limit Orders, Stop Orders, Trailing Stops, One-Click Trading | Yes (Google Play, App Store) | Yes | Yes |

| TradingView | Varies based on broker | Market Orders, Limit Orders, Stop Orders, Trailing Stops | Yes (Google Play, App Store) | Yes | Yes |

| Trade Ideas | Subscription based (From $84 monthly) | Market Orders, Limit Orders, Stop Orders, Trailing Stops | No | Yes | Yes |

Brief Overview of Our Recommended Automated Trading Software

As seasoned researchers and investors, our top priority is guiding our readers to select the best automated trading software for an optimal and enduring trading experience. This means meticulously assessing various elements to ensure their suitability for the long term. We fully recognise that among the critical factors to prioritise in this selection process are the fees associated with trading and the range of available assets.

The good news is that most of the automated trading tools we recommend here are readily accessible to traders and investors without any direct charges. However, note that these tools are hosted by different brokers, and as such, one must exercise due diligence in confirming a broker’s trading fees to ensure they align with their budget and trading goals. To facilitate this, we invite you to explore our comprehensive broker reviews on this page. These reviews offer in-depth insights into featured assets and fee structures, empowering you to make well-informed decisions in your automated trading journey.

Our Opinion & Overview of the Auto Trade Software in the UK

Before recommending the best automated trading software in the UK, we tested and compared as many options as possible. The process was overwhelming and time-consuming, but it paid off in the end, as we came up with the best findings. Keep reading for comprehensive insights into the best software for automated trading. You can compare them to select a suitable one for your trading or investment needs.

1. MetaTrader 5 (MT5) – Overall Best Automated Trading Software in the UK

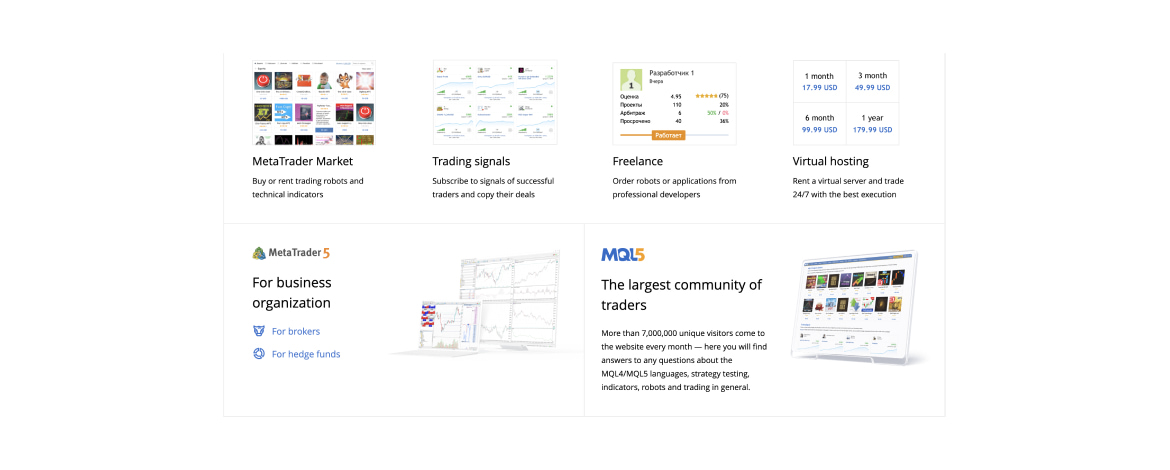

MetaTrader 5 (MT5) stands tall as the unequivocal champion among automated trading software solutions in the UK, and our extensive experience underscores this accolade. With a comprehensive range of features and tools, MT5 exemplifies excellence in the world of automated trading. Its MQL5 IDE provides comprehensive functionality and user-friendly options for developers of any skill level. Beginners may also use the MQL5 Wizard to generate a simple trading robot in just a few clicks.

Our journey with MT5 revealed its remarkable capacity to seamlessly execute trading strategies across multiple asset classes, including forex, stocks, commodities, and cryptocurrencies. One standout feature is its extensive library of technical indicators and analytical tools, which empower traders to craft and fine-tune strategies with precision. Overall, MT5’s support for algorithmic trading and expert advisors enables traders to automate their strategies effectively, making it deserve a 4.5-star rating from us.

- Wide range of trading instruments, including forex, commodities, stocks, and cryptocurrencies.

- Advanced charting tools with 21 timeframes and over 80 technical indicators.

- Expert Advisors (EAs) for automated trading with high customisation options.

- MQL5 community for sharing and accessing algorithmic trading strategies.

- Multilingual support and a robust mobile app for on-the-go trading.

- Learning curve for beginners.

- Limited compatibility with certain brokers.

2. MetaTrader 4 (MT4) – Best Forex Automated Trading Software in the UK

MetaTrader 4 (MT4) emerges as the unrivalled leader in forex automated trading software in the UK, and our hands-on experience reaffirms its prestigious status. Having rigorously tested this platform, we can confidently assert its supremacy in the realm of forex trading, thus giving it a 4.8-star rating.

MT4’s enduring popularity among traders is attributed to its user-friendly interface and unmatched versatility. Its intuitive layout allows traders of all levels to swiftly adapt. At the same time, its powerful charting tools, technical indicators, and expert advisors empower traders to craft and execute forex strategies with precision. Our extensive trials demonstrated that MT4’s execution speed is second to none, ensuring that traders can seize forex opportunities in the blink of an eye. Its support for algorithmic trading amplifies its appeal, making it the go-to choice for both manual and automated forex trading.

- Broad availability with numerous forex brokers in the UK.

- User-friendly interface with customisable charting tools.

- Access to a vast library of third-party indicators and EAs.

- Stable and widely adopted, ensuring reliable execution.

- Limited asset diversity compared to MT5.

- Aging interface compared to more modern platforms.

3. NinjaTrader – Best Options and Futures Automated Trading Software in the UK

Our rigorous evaluations have crowned NinjaTrader as the premier choice for options and futures automated trading software in the UK. Our extensive hands-on experience with this platform revealed its exceptional capabilities in these markets. NinjaTrader’s comprehensive toolset, including advanced charting, market analysis, and a user-friendly interface, empowers traders to excel in options and futures trading.

This platform’s robust automation features, such as customisable trading strategies and algorithmic trading support, elevate it to the top spot. NinjaTrader’s real-time data feeds and lightning-fast execution ensure traders can navigate the complexities of options and futures markets with precision and agility. Our testing underscored the reliability and efficiency that traders demand in these fast-paced markets, solidifying NinjaTrader’s status as the preferred choice. We give the software a 4.8-star rating.

- Comprehensive market analysis tools.

- Advanced trade management features.

- A wide range of supported data feeds.

- Robust ecosystem for third-party indicators and strategies.

- Limited support for other asset classes.

- Steeper learning curve for beginners.

4. cTrader – Best Automated Software for Day Trading

cTrader earns its well-deserved accolade as the best automated software for day trading, a distinction forged through our comprehensive testing. This platform’s sleek and intuitive design is tailored for intraday traders seeking speed and precision in their trading endeavours. cTrader’s user-friendly interface, advanced charting, and lightning-fast execution ensure day traders can swiftly react to market fluctuations.

One standout feature is cTrader’s algorithmic trading support, allowing day traders to automate strategies seamlessly. Our experience with this platform revealed its unwavering commitment to providing a reliable, real-time trading environment. Whether you’re a novice day trader or a seasoned pro, cTrader’s dynamic features and robust automation capabilities make it an ideal choice. We rank it with 4.6 stars.

- Quick order execution with Level II pricing.

- User-friendly interface suitable for beginners and experts.

- A wide array of technical analysis tools.

- cAlgo for algorithmic trading development.

- Fewer supported brokers compared to MetaTrader.

- Limited asset variety.

5. TradingView – Best Cryptocurrency Software For Automated Trading in the UK

TradingView reigns supreme as the best cryptocurrency software for automated trading in the UK, a title firmly established through our extensive evaluations. Cryptocurrency markets demand agility and versatility, and TradingView delivers precisely that. Its user-friendly interface, extensive library of technical analysis tools, and customisable alerts cater to traders navigating the crypto landscape.

TradingView’s compatibility with various cryptocurrency exchanges or brokers and its support for automated trading scripts and bots offer traders the tools needed to thrive in this volatile market. During our testing, TradingView demonstrated its real-time data accuracy and rapid execution, essential attributes for cryptocurrency traders aiming to capitalise on price fluctuations. With high efficiency and reliability, we give this software a 4.8-star rating.

- Advanced cryptocurrency charting with real-time data.

- A vibrant community of traders sharing insights.

- Integration with top crypto exchanges.

- User-friendly interface with web-based access.

- Limited support for traditional asset classes.

- Full automation capabilities may require third-party integration.

6. Trade Ideas – Best Stocks Automated Trading Software in the UK

Trade Ideas claims its well-deserved position as the best stocks automated trading software in the UK, validated through our thorough examination. This platform is a powerhouse of innovative stock trading tools, offering traders a competitive edge. Its real-time stock scanners, alert systems, and dynamic strategies empower traders to make informed decisions in the fast-paced world of equities.

One standout feature is Trade Ideas’ AI-powered Holly, which provides valuable insights and trading suggestions. Our hands-on experience revealed that Trade Ideas consistently delivers top-notch performance, making it an indispensable tool for stock traders looking to automate their strategies or enhance their decision-making processes. Whether a novice or experienced stock trader, Trade Ideas is your trusted partner for success in the UK market. We therefore give it a 4-star rating.

- Advanced stock scanning and alerting algorithms.

- Real-time market intelligence.

- Highly customisable trading strategies.

- Accessible via web and mobile apps.

- Primarily focused on stocks, limited support for other asset classes.

- Higher subscription costs for advanced features.

What do Other Traders Say?

To provide our readers with the most impartial and well-rounded recommendations, we have integrated our test results and comparative analysis with feedback from users across reputable social platforms such as Trustpilot, Google Play, and the App Store. It is imperative for traders and investors to take into account the perspectives of other users when making an informed choice. Here are some of the comments we’ve collated from these legitimate sources.

MT5

The majority of users on Trustpilot, Google Play, and the App Store consistently praised MT5 for its robustness and versatility. They mentioned its vast array of technical indicators, diverse asset coverage, and user-friendly interface. Traders appreciated its seamless execution and efficient order processing. However, some users noted a learning curve for beginners.

-

“I have experiences with this platform 3 years and it is a good trading platform I earned good profits from it” – Jennie Teh

-

“Loving this app, everything is there, however I wish it’s possible to write on the chart, and also with the stop loss. To have it possible to enter the stoploss in usd, and not with chart numbers” – Jasonlee Gerber

-

“As someone who has been trading the Forex, Metals & Indices markets for the past 2 1/2 years, I have to say that the MetaTrader 5 trading platform is one of the greatest ones to trade from. One of the best improvements from its predecessor Metatrader 4, is the on screen SL and TO adjustments. Instead of having to memorize the price number and plug in when modifying orders like MT4, on MT5, you can simply tap your buy/sell which brings up to the Stop Loss and Take Profit buttons and you can drag and adjust based on where you want them to be. Takes less time and is less of a hassle. Sleek and Clean user interface as well. Definitely recommend.” – NYSCE

MT4

MT4 garnered high ratings across platforms for its reliability in forex trading. Most users lauded its charting capabilities, expert advisors, and customisation options. The platform’s simplicity was particularly appealing to both novice and experienced traders.

-

“MT4 on both PC and Android looks a bit old school, but functions fluidly and exactly as intended. In addition, the mobile version makes it easy to scale out of winning positions, which I haven’t been able to do yet on PC. That increased functionality is greatly appreciated!” – Sam Fitz

-

“Some of the features are hard to use compared to the desk top but all an all it’ great I enjoy the convince of being able to trade on my phone and being able to check my investments at anytime no matter where I am. I see some negative reviews but I think that is for lack of knowledge I’m not expert but a lot of people treat forex like a scratch ticket and get upset when they lose. Do your homework and you can make money doubt you’ll be a millionaire but you can make a decent check. Good luck everyone and do yourself and wallet a favor and do as much research as you can daily to be able to succeed. If it was easy everyone would do it, Chaka he yourself to become successful!” – Rzrtrailmaker

-

“This platform is very good for me.

Easy to trade to get profit and especially when u are able to trade with the tips.

i highly recommend this to anyone who want to make profit quickly.

Ciao a tutti,” – giovanni piccolo

NinjaTrader

NinjaTrader received positive feedback for its suitability for options and futures trading. Most users praise its comprehensive tools, algorithmic trading support, and real-time data. The platform’s flexibility and customisation options were well-received. A few users mentioned a preference for a more intuitive interface.

-

“Adrian Was awesome, very helpful, understood my problem, and took the time to address my issues and make sure they were resolved. Thanks” – Ernie Bartista

-

“Love love this app. It really has what i need to succeed in trading. Charts are a little difficult to do analysis, but the order entry and execution are on point.” – Larry quality1plus

-

“I’m happy NinjaTrader finally has an app. I’m not stupid enough to try trading from a phone with any broker, but it’s great to be able to check balances, close positions in an emergency, and look at the performance metrics and achievements!” – MichaelKB_1977

cTrader

Traders applauded cTrader’s user-friendly interface, quick order execution, and advanced charting features. Many users highlighted its suitability for day trading. However, some noted limited asset coverage compared to other software. Overall, users expressed satisfaction with cTrader’s performance.

-

“Its the greatest platform existing on this planet. I highly recommend it to all traders. Overall Its excellent. Still number one trading platform i have tried. Thanks, to the team for a great art. Still the best. Always the best. I love this app?????❤️❤️❤️❤️❤?️.” – Kris Olokpa.

-

“Best trading platform by far. Built for the professional and beginner trader.” – Johan Bender

-

“Ctrader is definitely a game changer. Quick to access, their app very well done. Easy to set up. Excellent result.”and not forgetting helpful staffs.” – Robert Njoroge

TradingView

TradingView garnered praise for its extensive technical analysis tools, customisable charts, and community features. Users appreciated its support for cryptocurrency trading. While the majority of feedback was positive, some users wanted more robust automation capabilities.

-

“Very excellent trading platform have been using it by a couple of years and think for professionals probably is surely among the first ones.

-

“İt’s very comfortable program???” – ?A.Y.E?

-

“Absolute best charts and timeline. So detailed. I can’t explain. Exactly what I was looking for after trying many other apps. If you are looking for patterns, specific times of any day, any range… This is it. No guessing. Editing to add that the paid version is well worth the $$. Time is money. Hooked on the crypto setups. Ty!” – Kati Fear

Trade Ideas

Trade Ideas impressed users with its stock scanning and alert systems. Many highlighted the value of its AI-powered Holly. Users found it particularly useful for enhancing their stock trading strategies. Some users wished for more affordable pricing options.

-

“Their customer service is 100% awesome ! Prompt and so helpful” – Mike Mason

-

“The only scanner that truly uses real-time data against a database for the same symbol. Swing trader or Day trading scalper. This program is irreplaceable in my method of trading. The Test Drive offers are a good way to try it out.” – Steve Gomez

The Ultimate Guide About Online Trading

Online trading has redefined financial accessibility, allowing individuals to invest from their homes or offices via online brokerage firms. The advent of automated trading has further enhanced this convenience as traders and investors can delegate routine tasks to algorithms while they concentrate on refining strategies. In the sections below, we’ll delve into the world of automated trading, providing insights and guidance to help you get started. In the end, you will be well-equipped to harness the power of automation, enabling you to trade more efficiently and effectively while enjoying the flexibility it offers.

How to Start Automated Trading?

Automated trading offers a world of opportunities, but it’s essential to set the right expectations and strategies to thrive in this dynamic field. Below are some of the elements you must note before embarking on your automated trading journey.

Even in automated trading, a reliable online broker is indispensable. Your broker facilitates trade execution, provides access to markets, and offers trading platforms. Choose one that aligns with your specific needs and trading preferences, ensuring they support the assets you want to trade and have robust automation capabilities.

While automation can handle trade execution, it doesn’t replace the need for market knowledge. Continuous learning is essential. Stay updated on market trends, news, and evolving strategies. This knowledge will help you develop, adapt, and fine-tune your automated trading strategies effectively.

Automation executes your trading plan, so focus on creating a winning strategy. Your strategy should be well-researched, tested, and capable of adapting to changing market conditions. Think about entry and exit criteria, risk management, and trade sizing.

Automated trading can amplify losses if not managed properly. Implement effective risk management strategies such as setting stop-loss orders and managing position sizes. This protects your capital and ensures you don’t wipe out your account due to unforeseen market fluctuations.

Don’t assume that once you automate your trading, it’s a set-and-forget process. Regularly monitor your automated systems, keeping an eye on their performance. Be prepared to make adjustments as market conditions change or if your strategies aren’t delivering the expected results.

Ensure you have access to technical support from your broker or the platform you’re using for automated trading. Technical issues can arise, and having a responsive support team can be critical in resolving any problems promptly, minimizing downtime, and preventing potential losses.

How to Choose the Best Software for Automated Trading Software

Selecting the ideal automated trading software is a pivotal decision for traders seeking efficiency and profitability. Here are seven comprehensive considerations to help you make an informed choice.

Ensure the software you select aligns with your trading strategy. Different platforms may excel in specific markets or trading styles, so choose one that suits your approach, whether it’s day trading, swing trading, or algorithmic trading.

Prioritise software with an intuitive and user-friendly interface. You will spend a significant amount of time on the platform, so it should be easy to navigate. A cluttered or complicated interface can hinder your trading efficiency.

Evaluate the software’s asset coverage. Confirm that it supports the range of assets you plan to trade, including stocks, forex, commodities, cryptocurrencies, and more. A broader selection provides you with diversification options.

Examine the level of customisation the software offers for automation. Can you create, modify, and fine-tune trading algorithms to suit your specific needs? The ability to adapt your strategies is crucial for success.

Access to advanced technical analysis tools is essential. Seek software that provides a wide array of indicators, charting capabilities, and real-time data to empower your decision-making process.

The ability to conduct thorough backtesting is invaluable. Look for software with robust backtesting features, enabling you to evaluate the historical performance of your strategies and make data-driven improvements.

Reliability is paramount in automated trading. Investigate the software’s track record in terms of uptime and execution speed. Additionally, assess the availability of responsive customer support to address any technical issues promptly.

What is Automated Trading?

Automated trading, often referred to as algorithmic trading or algo trading, is a sophisticated method of executing financial trades with minimal human intervention. It involves the use of computer programs or algorithms to analyse markets, identify trading opportunities, and execute orders automatically. These algorithms are designed to follow predefined rules and criteria, enabling traders to implement their trading strategies systematically and efficiently.

Automated trading systems can be highly complex, capable of processing vast amounts of market data in real-time, and executing orders with split-second precision. Traders can create algorithms that range from simple strategies, like moving average crossovers, to complex ones involving mathematical models and artificial intelligence.

The primary advantages of automated trading include speed, consistency, and the ability to remove emotional biases from trading decisions. It allows traders to react to market conditions promptly, execute orders at optimal prices, and operate in multiple markets or asset classes simultaneously. Automated trading has become increasingly popular among institutional and individual traders, revolutionising the way financial markets operate.

Read about the crypto trading bots in our other article.

Strategies of Using Auto Trade Software

Automated trading strategies are pre-defined sets of rules and criteria that guide automated trading systems in making buy or sell decisions in the financial markets. These strategies are executed by computer programs or algorithms, and they can range from simple to highly complex. Here are some common automated trading strategies.

- Trend Following

This strategy aims to capitalise on price trends. It involves buying when an asset’s price is in an uptrend and selling when it’s in a downtrend. Moving averages and trend indicators are often used to identify trends. Trend following is popular in forex and commodity markets, where trends can persist for extended periods.

- Mean Reversion

The mean reversion strategy assumes that asset prices tend to revert to their mean or average values over time. Traders using this strategy buy when prices are below the mean and sell when they are above it. The strategy is common in equity markets, particularly for trading stocks with historically stable price ranges.

- Arbitrage

Arbitrage strategy seeks to profit from price discrepancies of the same asset in different markets or exchanges. Traders simultaneously buy low and sell high to capture risk-free profits. Arbitrage is prevalent in the cryptocurrency market, where price differences can occur between exchanges.

- Momentum Trading

When it comes to the momentum strategy, it focuses on assets that have exhibited recent strong price movements. Traders buy assets that have been performing well and sell those that have been underperforming. Momentum trading is often used in stock markets, especially for high-growth stocks.

5 Quick Steps To Start Using Top Automated Trading Software

Automated trading software can significantly streamline your trading activities and help you seize market opportunities even while you’re away from your computer. Here are five quick steps to get started with top automated trading software:

Selecting the right automated trading software is crucial. Research and compare different options, considering factors like asset coverage, customisation options, and user-friendliness. Popular choices include MetaTrader, cTrader, and NinjaTrader. Ensure the software aligns with your trading goals and strategy.

You will need a trading account with a compatible broker. Choose a reputable broker that supports the selected automated trading software. Verify their fees, trading instruments, and regulatory compliance. Once your account is set up, deposit the necessary funds.

Download and install the chosen trading software on your computer. Follow the software provider’s instructions for setup. Configure your trading preferences, including account details, risk management settings, and desired automation parameters.

Your trading strategy is the heart of automated trading. You can choose a pre-designed strategy if offered by the software or create your custom algorithm. Ensure your strategy aligns with your risk tolerance and objectives. It should include entry and exit criteria, position sizing, and risk management rules.

Before going live, backtest your trading strategy. This involves running your algorithm on historical data to evaluate its performance. Make necessary adjustments based on backtesting results. Once satisfied, deploy your strategy in a live or demo trading environment, monitoring its performance closely.

Pros and Cons of Trading with Automated Software

Automated trading software offers both advantages and disadvantages, and understanding these can help you make informed decisions about its use in your trading endeavours. Lets explore below some of the pros and cons.

Pros

- Automated software operates without emotions, ensuring that trading decisions are solely based on predefined criteria, reducing the impact of fear and greed.

- Automated systems execute trades at lightning speed, reacting to market movements in milliseconds. This speed advantage can be critical in highly volatile markets.

- You can rigorously test and fine-tune your trading strategies with historical data, helping you identify and rectify weaknesses before risking real capital.

- Automated software can monitor multiple markets and assets simultaneously, allowing you to diversify your portfolio and capture opportunities across various instruments.

- Automated systems eliminate the potential for human errors, such as inputting incorrect order details or failing to execute trades as planned.

Cons

- Setting up and maintaining automated software can be complex. Traders must have a good understanding of software, APIs, and data feeds.

- Automated systems are not infallible. Technical glitches, power outages, or platform failures can lead to significant losses if not managed with backup plans or redundancy.

- Trading software, data feeds, and server hosting can incur ongoing costs, potentially eating into profits, especially for traders with smaller capital.

FAQs

Yes. Many automated trading software platforms offer backtesting capabilities, which allow users to assess how their trading strategies would have performed using historical data. It’s a valuable tool for evaluating the viability and profitability of your trading strategies before implementing them in live markets. The availability and depth of backtesting features may vary between different software platforms, so choosing one that meets your specific needs is advisable.

Yes. Many automated trading software platforms operate under regulatory oversight. The level of regulation can vary depending on the platform and the region in which it operates. Some platforms are regulated by financial authorities, ensuring a certain level of security and transparency.

The range of assets you can trade with automated trading software depends on your chosen platform and broker. Common assets include stocks, forex currency pairs, commodities, cryptocurrencies, and options or futures contracts. Before selecting a platform, ensure it offers the asset classes you are interested in trading to align with your investment strategy.

Yes. Automated trading software can be suitable for beginners, but it’s important to approach it with caution. While automation eliminates the need for in-depth market knowledge, it still requires a good understanding of how the software works and how to set up trading strategies. Beginners should start with demo accounts, thoroughly test their strategies, and gradually transition to live trading once they are confident in their approach. It’s also advisable to seek educational resources and, if possible, consult with experienced traders.

No. The investment required for automated trading software varies widely based on your chosen platform and trading strategy. Some platforms allow you to start with a small initial investment, while others may require more significant capital. Additionally, your strategy will dictate the minimum account size needed.

Conclusion

Automated trading software can be a game-changer for traders in the United Kingdom, helping them execute trades more efficiently and consistently. However, it’s essential to choose a software that aligns with your trading goals and strategies for increased success potential. Before diving in, consider conducting thorough market research, backtesting a software, and possibly consulting a financial advisor for the best options. Most importantly, stay updated with the latest developments in the automated trading space to ensure you’re using the best tools available.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I use NinjaTrader to trade cryptocurrencies. The platform is a bit complex initially, but it becomes powerful once you get the hang of it. Buying and selling cryptocurrency is hassle-free and the charting tools are top-notch. NinjaTrader offers a wide selection of cryptocurrencies. While it may not be the simplest platform, it is great for those who already understand cryptocurrency trading.

I've always doubted whether automated trading software is suitable for beginners. However, your article convinced me otherwise. It turns out that such systems can significantly simplify the trading process, even if you have limited experience. Thanks to detailed instructions and analytical tools, newcomers can quickly familiarize themselves with the software and even improve their trading results. This opens the door to financial independence for a wide range of people!

Great overview! Lots of useful information. thank you