Bitcoin trading and investing in the UK can be a complex endeavour, especially when it comes to selecting the optimal broker. A mismatched broker choice might significantly disrupt trading activities, potentially leading to financial setbacks.

Understanding the pivotal role of partnering with reputable Bitcoin brokers in the UK, we’ve conducted exhaustive research. This involved meticulous testing and comprehensive reviews to ensure you find a broker that perfectly aligns with your specific trading requirements. We will also guide you through getting started with our recommended Bitcoin and provide additional elements to help you get started on a good note.

Essence

- Bitcoin brokers act as intermediaries, facilitating the buying, selling, and trading of Bitcoin on digital platforms.

- The best Bitcoin brokers offer various trading options such as spot trading (buying/selling Bitcoin for immediate delivery), margin trading (using borrowed funds to amplify potential profits), and futures trading (contracts to buy or sell Bitcoin at a predetermined price on a future date).

- The best Bitcoin brokers in the UK provide access to a broad spectrum of cryptocurrencies beyond Bitcoin. Diversification allows for a more balanced investment strategy.

- Opt for brokers that prioritise robust security measures, including encryption, two-factor authentication, and cold storage, to protect your Bitcoin holdings from cyber threats.

- Brokers with high liquidity ensure smoother and more efficient trades at preferred prices, minimising the impact of slippage.

- It’s crucial to comply with tax obligations related to Bitcoin trading. Seeking professional advice can offer guidance and ensure adherence to regulatory requirements.

List of the Best Bitcoin Brokers in the UK

- eToro – Best All-Round Bitcoin Broker* in the UK

- FxPro – Leading Provider With Multiple Trading Platforms

- Coinbase – Beginner-Friendly

- FP Markets – Best Bitcoin Broker For Professional Traders

- Crypto.com – Best For Mobile Trading

- Saxo – Best Broker For Bitcoin FX Trading

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Compare the Bitcoin Brokers

Finding the ideal Bitcoin broker for your trading journey involves meticulous comparison. Our concise breakdown in the table below highlights key differences among brokers, providing a streamlined view to aid your decision-making process.

| Bitcoin Brokers | Licence | Minimum Deposit | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|---|

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | £50 | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit cards, Bank transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes |

| FxPro | FCA, FSCA, SCB | £100 | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes |

| Coinbase | BitLicense from the NY Department of Financial Services | £2 | 24/7 | – | Debit Card, PayPal (Withdraw Only), Wire Transfer, SEPA Transfer | – |

| FP Markets | ASIC, CySEC, FSCA, FSA | £100 | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trading App, MT5 Mobile Trader | Credit/debit cards, International bank transfer, Domestic bank transfer, Neteller, Skrill, Fasapay, PayTrust88, Ngan Luong, PayPal, Bank of China Online Pay | Yes |

| Crypto.com | Licences | £0 | 24/7 | – | Visa, Mastercard, American Express, JCB, Discover, and Diners Club credit/debit cards | – |

| Saxo | FCA, MAS, FSMA, ASIC, FSA | £0 | 24/5 | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO | Bank Transfers | Yes |

Brief Overview of the Fees and Assets Offered by Our Recommended Bitcoin Brokers

Before diving into Bitcoin trading, understanding the fee structures and available assets offered by your broker is crucial. Our tables below shed light on the fee dynamics and the diverse range of assets offered by our recommended Bitcoin brokers in the UK. By examining these crucial aspects, you can easily make informed decisions, thus optimising your trading strategies and potential returns within the cryptocurrency market.

Fees

| Bitcoin Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| eToro | From 2 pips | £50 | £5 withdrawal | £10 monthly |

| FxPro | From 0.01 pips | £100 | Free | £15 one-off maintenance fee |

| Coinbase | From £0.99 | From £2 | Free | None |

| FP Markets | From 0.0 pips | £100 | Free | None |

| Crypto.com | From 0.04% | From £1 | Free | None |

| Saxo | From £0.02 commission | £0 (for Classic account) | Free | £0 |

Assets

| Bitcoin Broker | Forex | Stocks | Commodities | ETFs | Options | Crypto |

|---|---|---|---|---|---|---|

| eToro | Yes | Yes | Yes | Yes | No | Yes |

| FxPro | Yes | Yes | Yes | No | No | Yes |

| Coinbase | No | No | No | No | No | Yes |

| FP Markets | Yes | Yes | Yes | Yes | No | Yes |

| Crypto.com | No | No | No | No | No | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Bitcoin Brokers in the UK

1. eToro – Best All-Round Bitcoin Broker in the UK

Based on our comprehensive analysis and hands-on testing, eToro emerges as the best all-around Bitcoin broker UK, earning our highest rating of 5 stars. What sets eToro apart is its seamless offering of unparalleled speed and convenience.

We also like the fact that eToro offers a social trading platform, fostering interaction among traders to share ideas and strategies. The availability of a free demo account loaded with $100,000 virtual funds allows users to navigate the platform and test various market scenarios using real market data. eToro’s user-centric approach and innovative features position it as the premier choice for Bitcoin trading in the UK.

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

- Heavily regulated by top-tier authorities, including the FCA in the UK

- Social trading platform for learning new strategies

- Easy-to-use and customisable trading platform

- Customer service is only available five days a week

- Withdawal charges apply

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

2. FxPro – Leading Provider With Multiple Trading Platforms

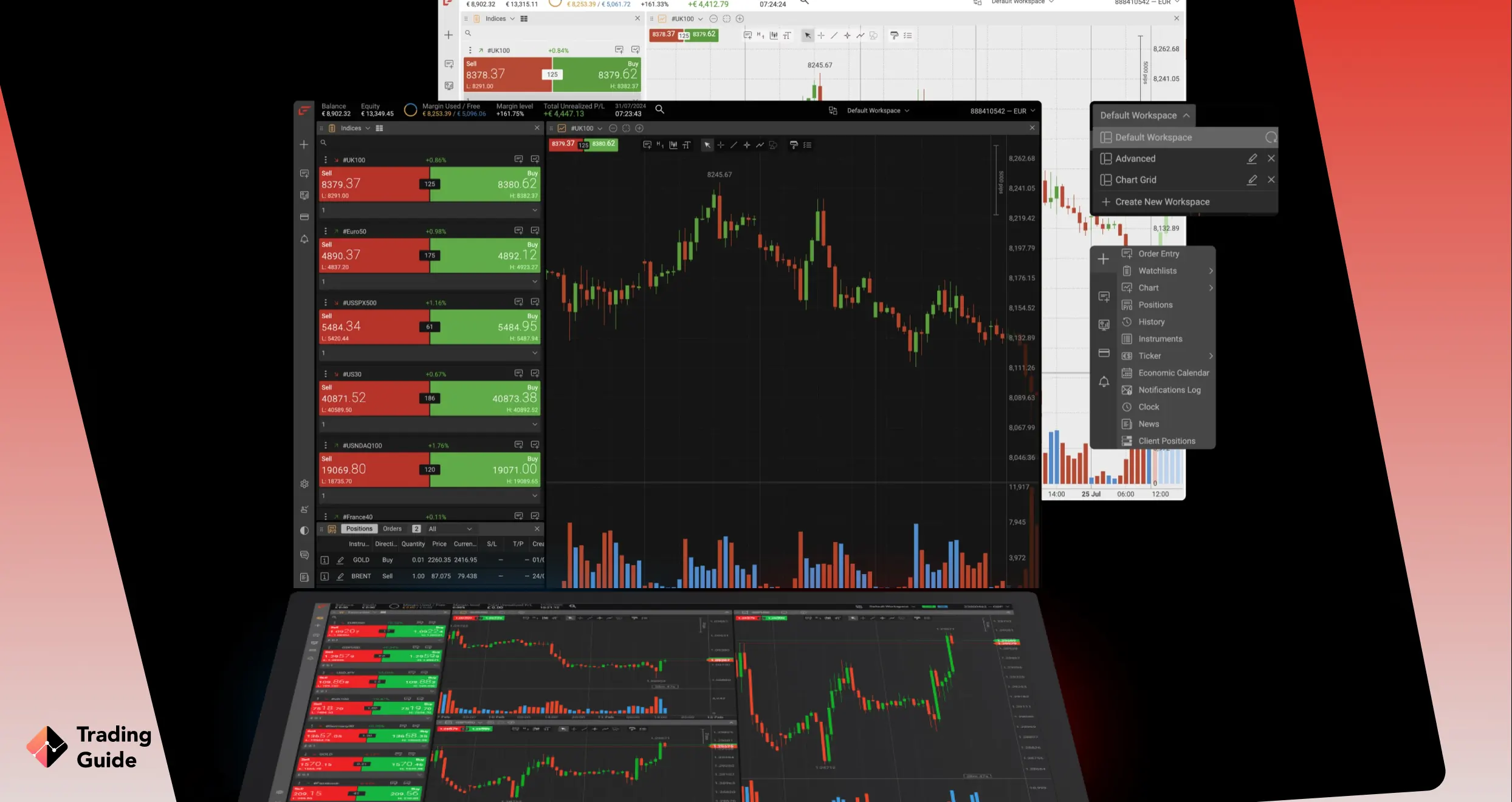

When it comes to trading Bitcoin and other cryptocurrencies, FxPro stands out for its flexibility and robust platform offering. Rather than locking traders into a single system, FxPro provides access to MT4, MT5, cTrader, and its proprietary FxPro Platform. This gives users the freedom to trade digital assets however they prefer.

Each platform supports advanced charting tools, EA trading, and 1-click order execution, while MT5 and cTrader users can enjoy features like Depth of Market, custom indicators, and strategy backtesting. FxPro also offers tight spreads, fast execution, and no dealing desk intervention, which helps reduce slippage during volatile crypto moves.

When it comes to asset offerings, FxPro lists Bitcoin, Ethereum, Litecoin, and other major cryptos to trade as CFDs. Plus, you are free to diversify your portfolio with additional asset classes, including forex, shares, indices, metals, energies, and ETFs. And the best part is that FxPro has a low minimum deposit requirement of £100, which you get to deposit using Visa, Maestro, bank transfer, or Mastercard, all free of charge.

- Trade Bitcoin and major crypto CFDs across 4 platforms

- Fast execution and tight spreads from 0.6 pips

- Supports algorithmic and EA trading

- Access to 2,100+ other CFD assets

- A user-friendly and modern design desktop and mobile platform

- Low minimum deposit requirement

- No direct Bitcoin purchases for UK customers. You only trade them as CFDs

- No crypto deposits for UK clients

- Its demo account is limited to 180 days

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

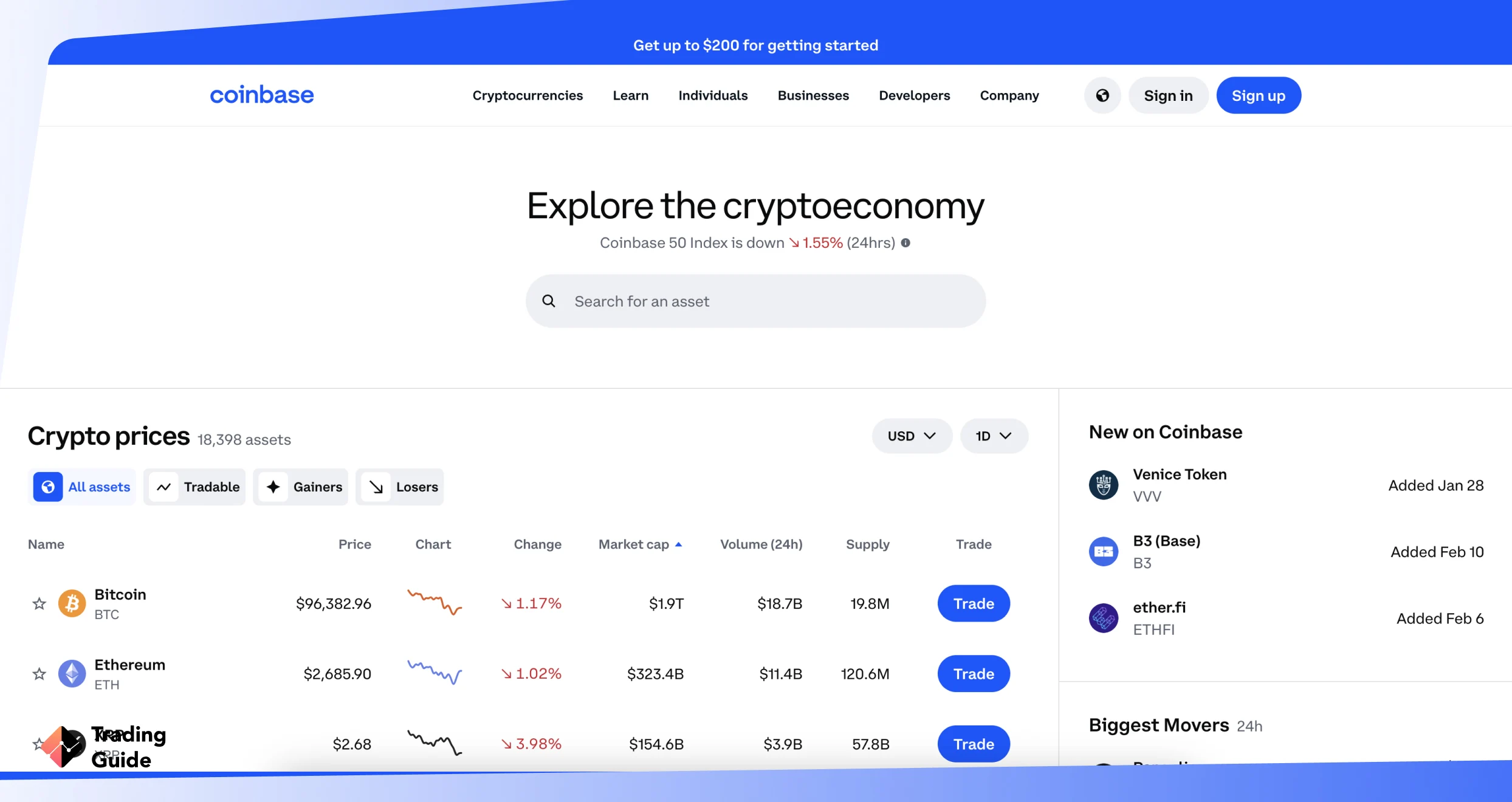

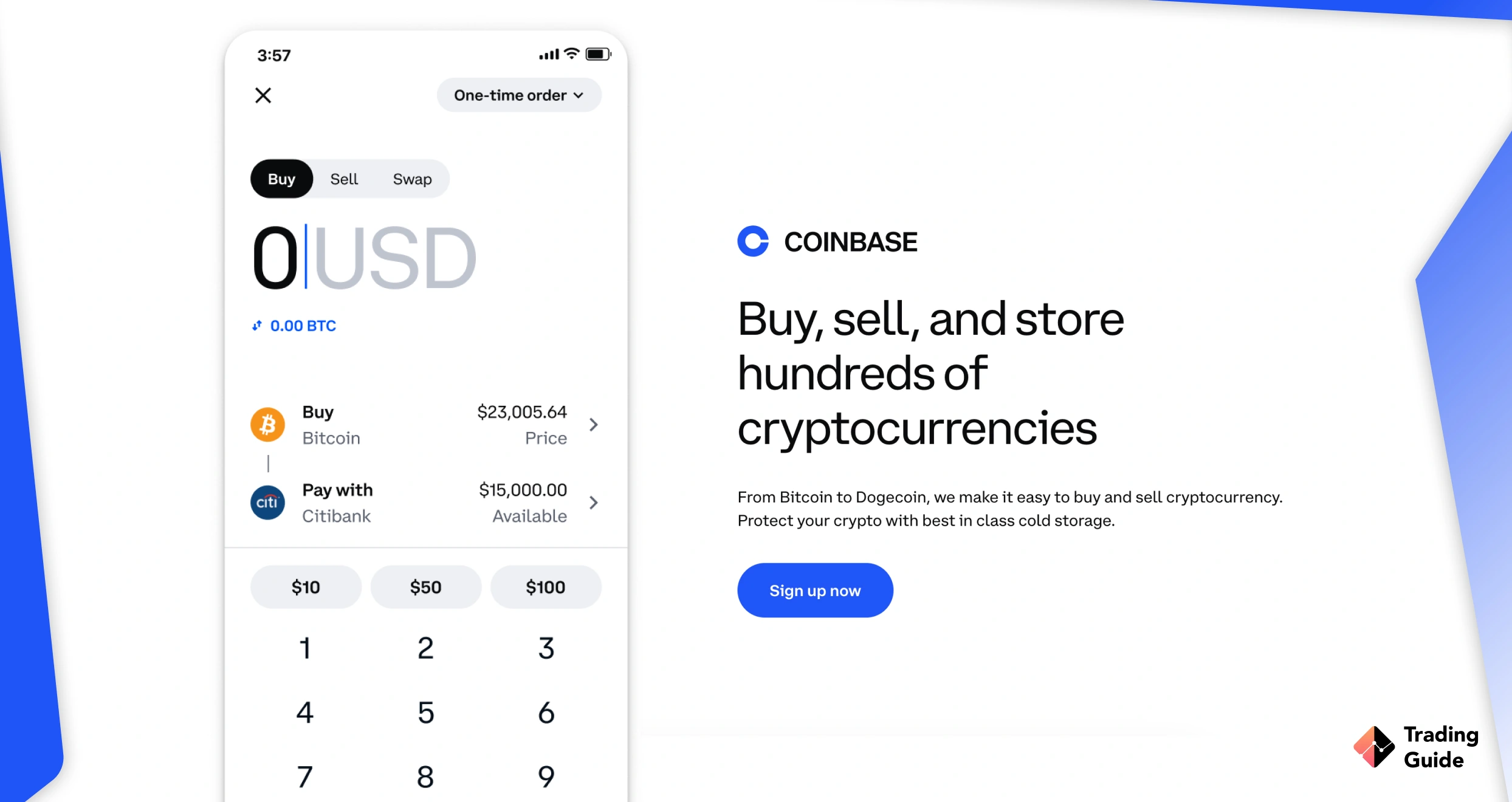

3. Coinbase – Beginner-Friendly

Coinbase has been a go-to platform for beginners since its launch in 2012, offering a seamless entry into the world of cryptocurrency. As a publicly traded company on NASDAQ, it provides transparency and trust, making it an appealing choice for UK users.

After testing it, I believe that Coinbase simplifies crypto trading with an intuitive interface. This allows users to easily buy, sell, and store over 270 digital assets. Some of the cryptos you will find on Coinbase’s platform include Bitcoin, Ethereum, and various ERC-20 tokens. Payment options like debit/credit cards and PayPal add to its convenience.

For beginners, Coinbase’s low £2 minimum purchase and features like automated recurring buys make getting started easy. While its fees are higher than some of its competitors, the platform compensates with extensive educational resources and a user-friendly experience. Its mobile app also ensures trading on the go. If you are a cost-conscious trader, ensure you consider the fees before committing.

- Easy-to-use interface

- Secure and reliable wallet

- Has a Coinbase Visa card for spending crypto worldwide

- Plenty of learning resources for skills development

- High fees with a complex structure

- Customer support can be slow

| Type | Fee |

| Minimum deposit | $2 |

| Transaction fee | 1% |

| Credit transactions | 2% |

| Inactivity fee | Free |

| Maker fee | Yes |

| Taker fee | Yes |

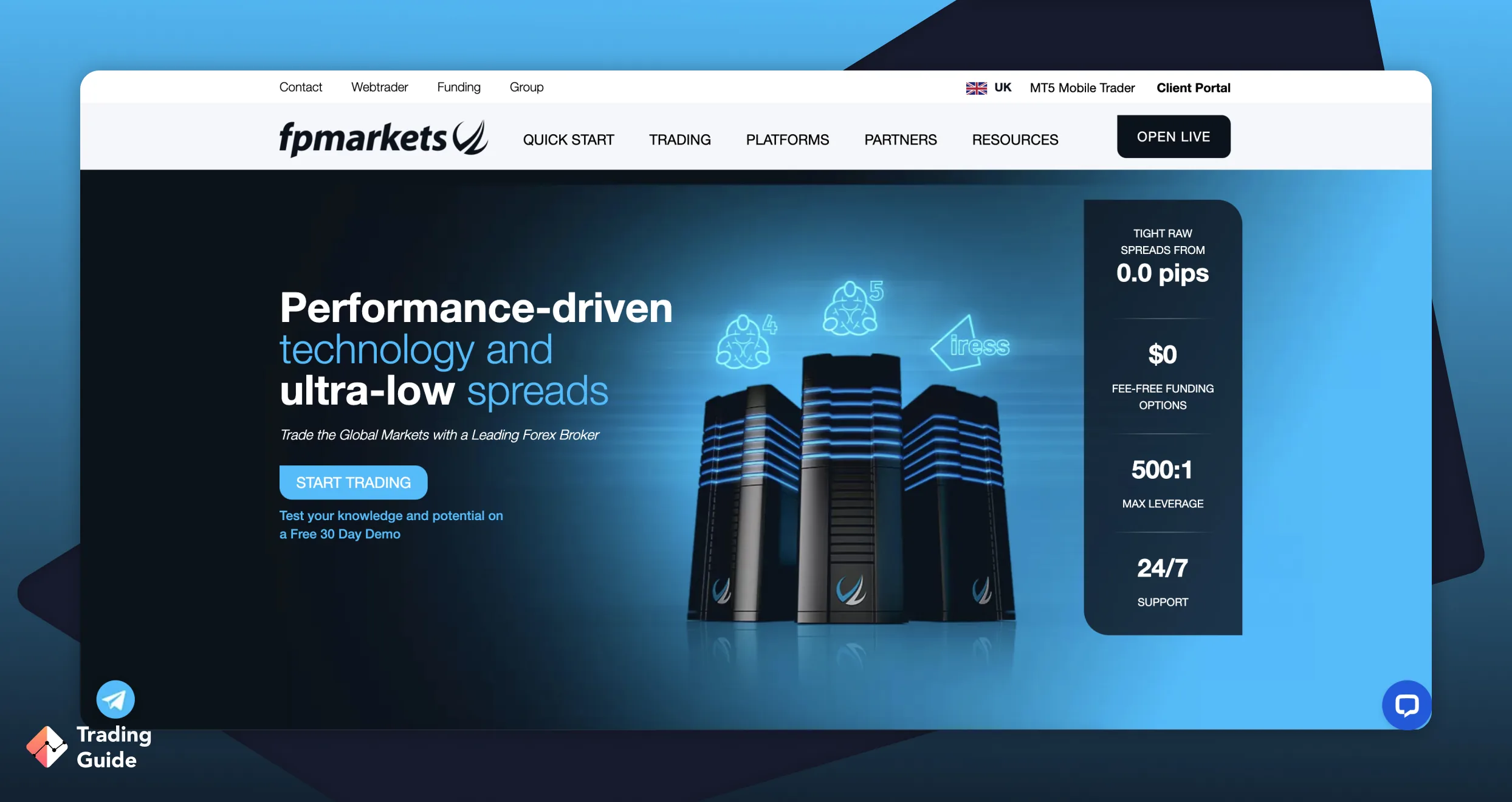

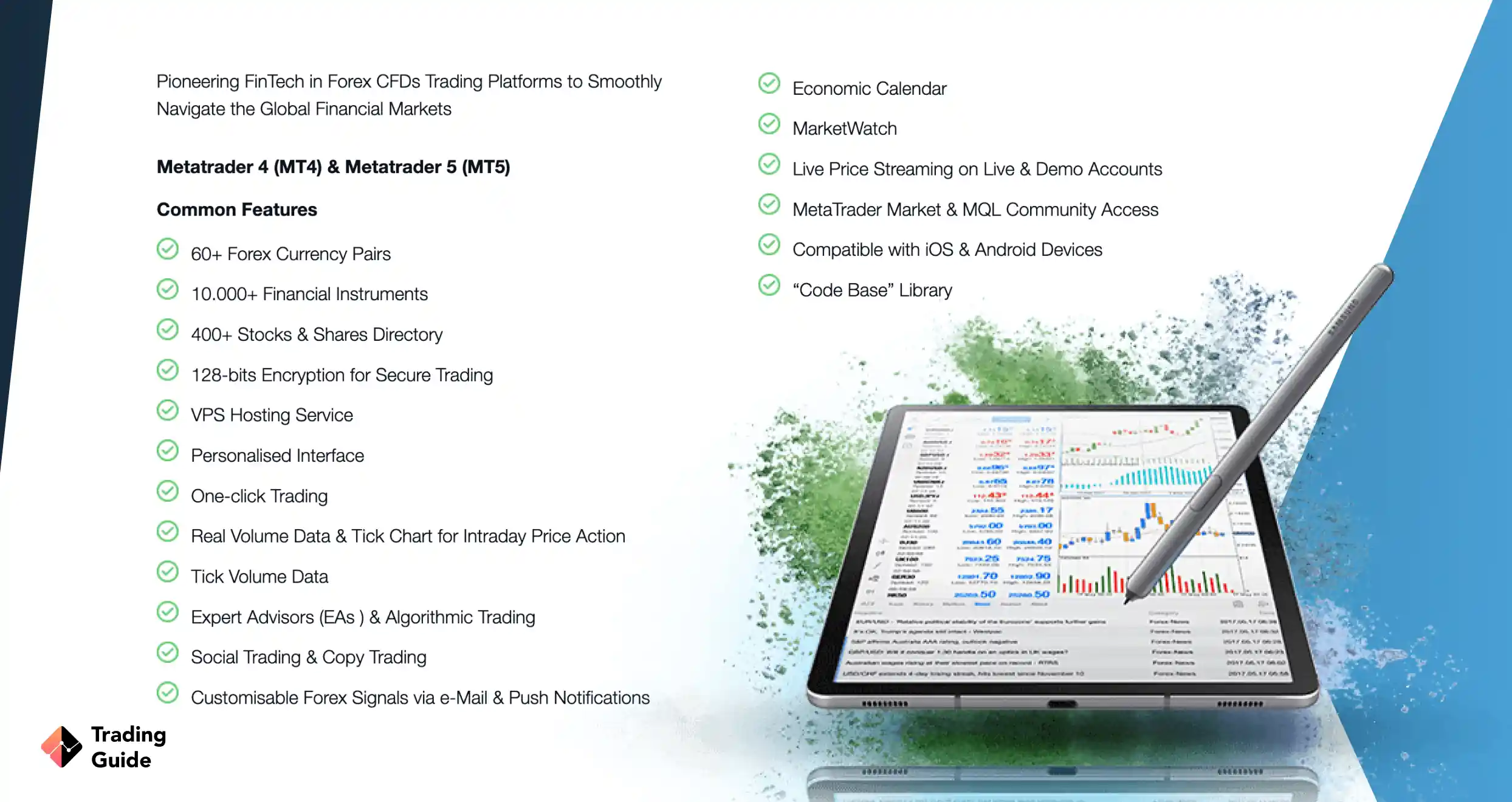

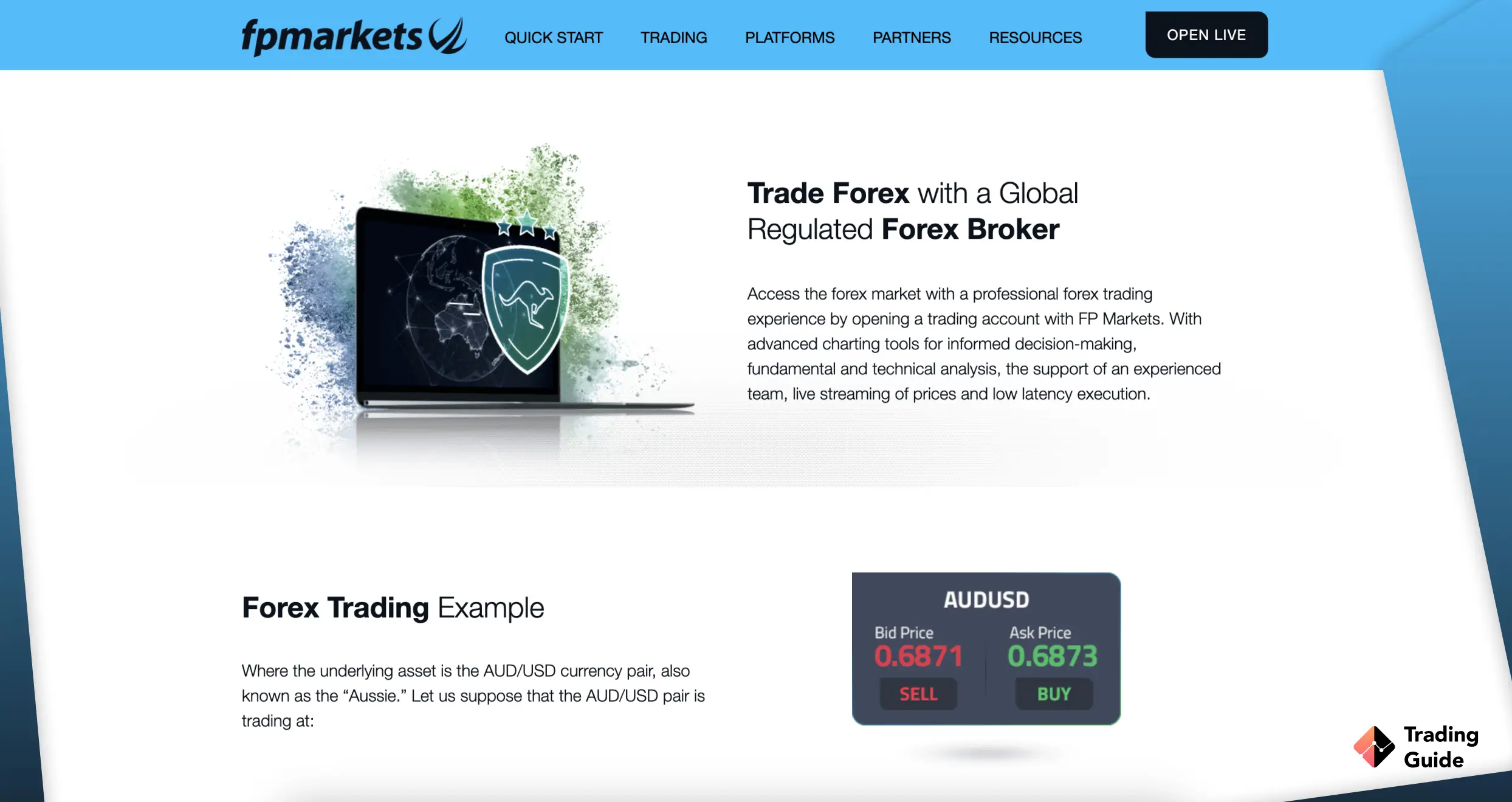

4. FP Markets – Best Bitcoin Broker For Professional Traders

Following thorough analysis and hands-on experience, FP Markets has emerged as the top choice for professional Bitcoin traders in the UK. Our exploration revealed tailored features specifically designed for seasoned traders, offering a diverse range of cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash for optimal portfolio diversification.

Note that FP Markets excels in lightning-fast execution and provides an award-winning trading app, empowering traders to seize market opportunities anytime, anywhere. Moreover, the platform offers advanced trading tools such as technical analysis indicators and charting options on both MT4 and MT5 platforms, enhancing trading precision. For aspiring professional traders, exploring FP Markets via its demo account comes highly recommended, warranting our rating of 4.5 stars.

- Low minimum deposit requirement of £100

- Lightning-fast execution for rapid trading.

- Advanced trading tools and analysis resources on MT4 and MT5 platforms

- Low Bitcoin trading fees

- Limited cryptocurrencies available compared to its peers

- No price plans

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

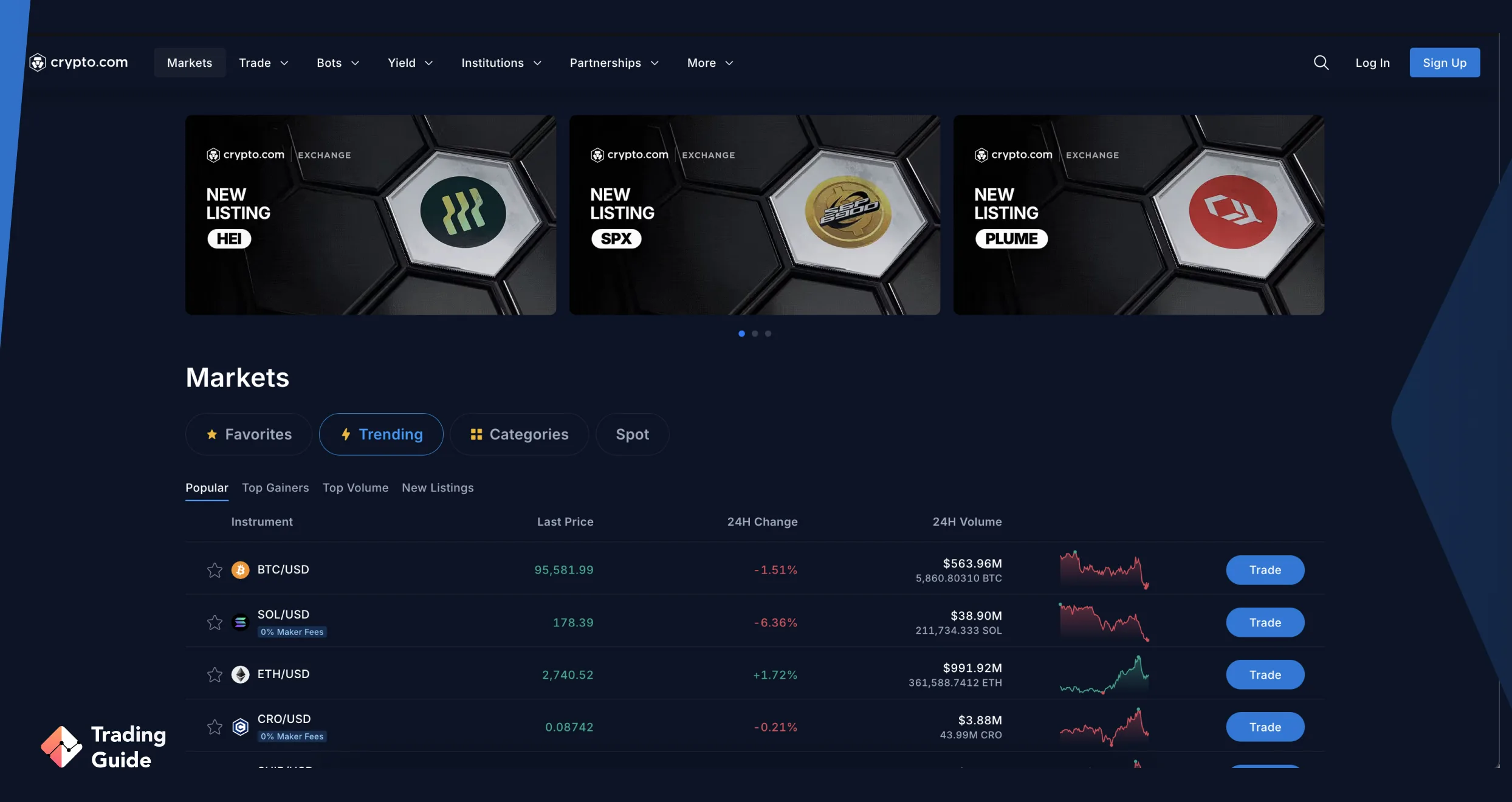

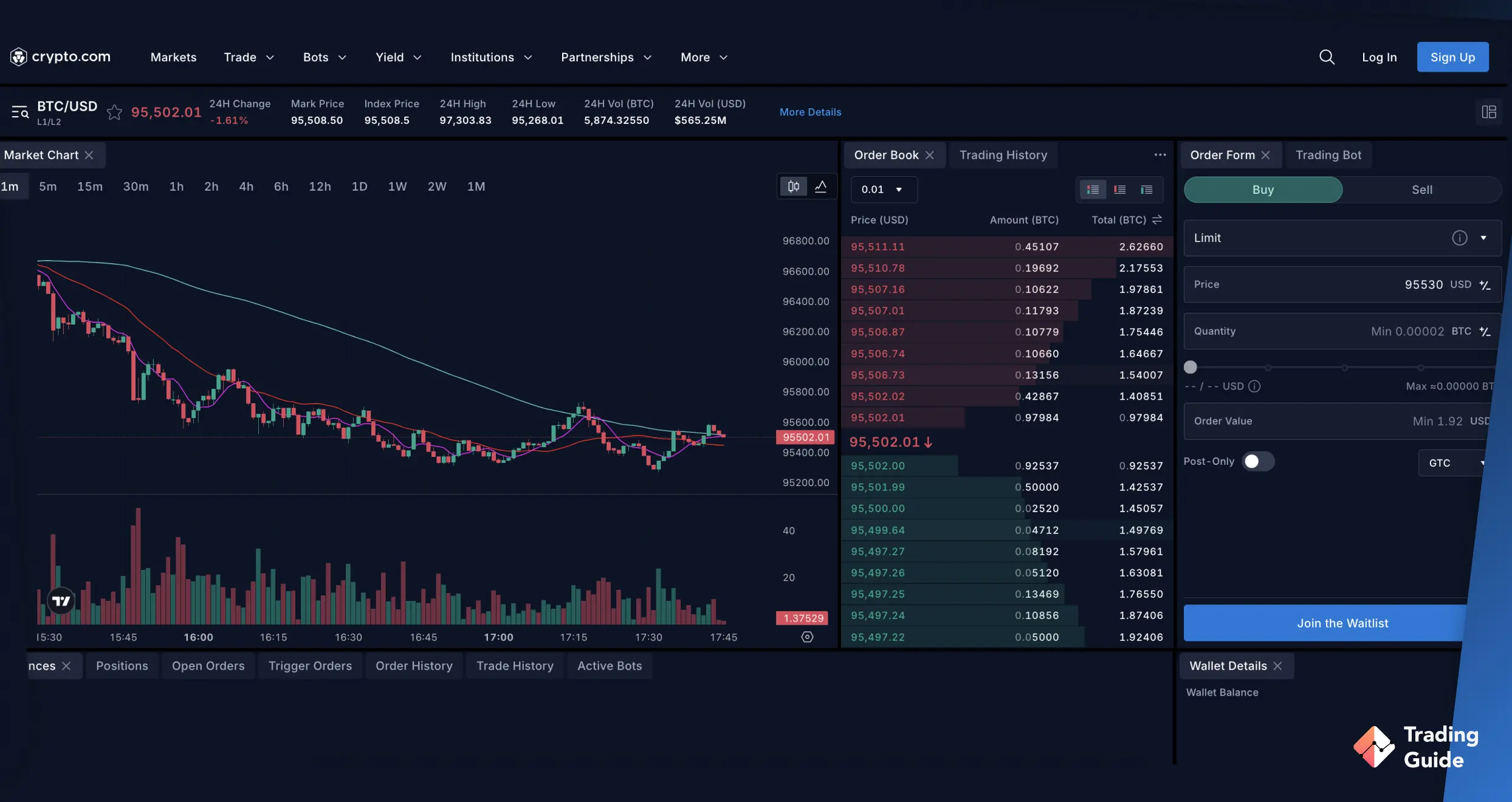

5. Crypto.com – Best For Mobile Trading

Crypto.com offers Bitcoin and an additional 400+ digital assets to explore. I rank it the best in this category because of its seamless operation on both Android and iOS mobile devices. Besides, many users on Google Play and the App Store highly review it for its efficiency and security. It is trusted by over 100 million global users.

Installing the app on your mobile device and signing up for an account is pretty straightforward. I like that this exchange features recurring buys, where you can automatically build your portfolio without a lot of human input. Plus, users can stake their cryptos to generate passive income. And if you plan to invest in Bitcoin or other cryptos long-term, Crypto.com has a self-custody DeFi wallet to secure your acquired tokens. Other features worth mentioning include NFT trading Visa card perks, Crypto Basket, and more.

- Lists over 400 cryptocurrencies, including Bitcoin, Ethereum, and more

- Has a user-friendly and intuitive design trading app

- Minimum deposit requirement is $1

- Offers an opportunity to earn up to 8% cash back on purchases with Crypto.com Visa Card

- Doesn’t feature other asset classes like stocks, forex, commodities, and more

- I find it trading fees a bit higher than most of its peers

| Type | Fee |

| Minimum deposit | £1 |

| Deposit fee | No |

| Withdrawal fee | Depending on the crypto you trade |

| Maker fee | 0.04 – 0.20% |

| Taker fee | 0.10 – 0.20% |

| Inactivity fee | £5 |

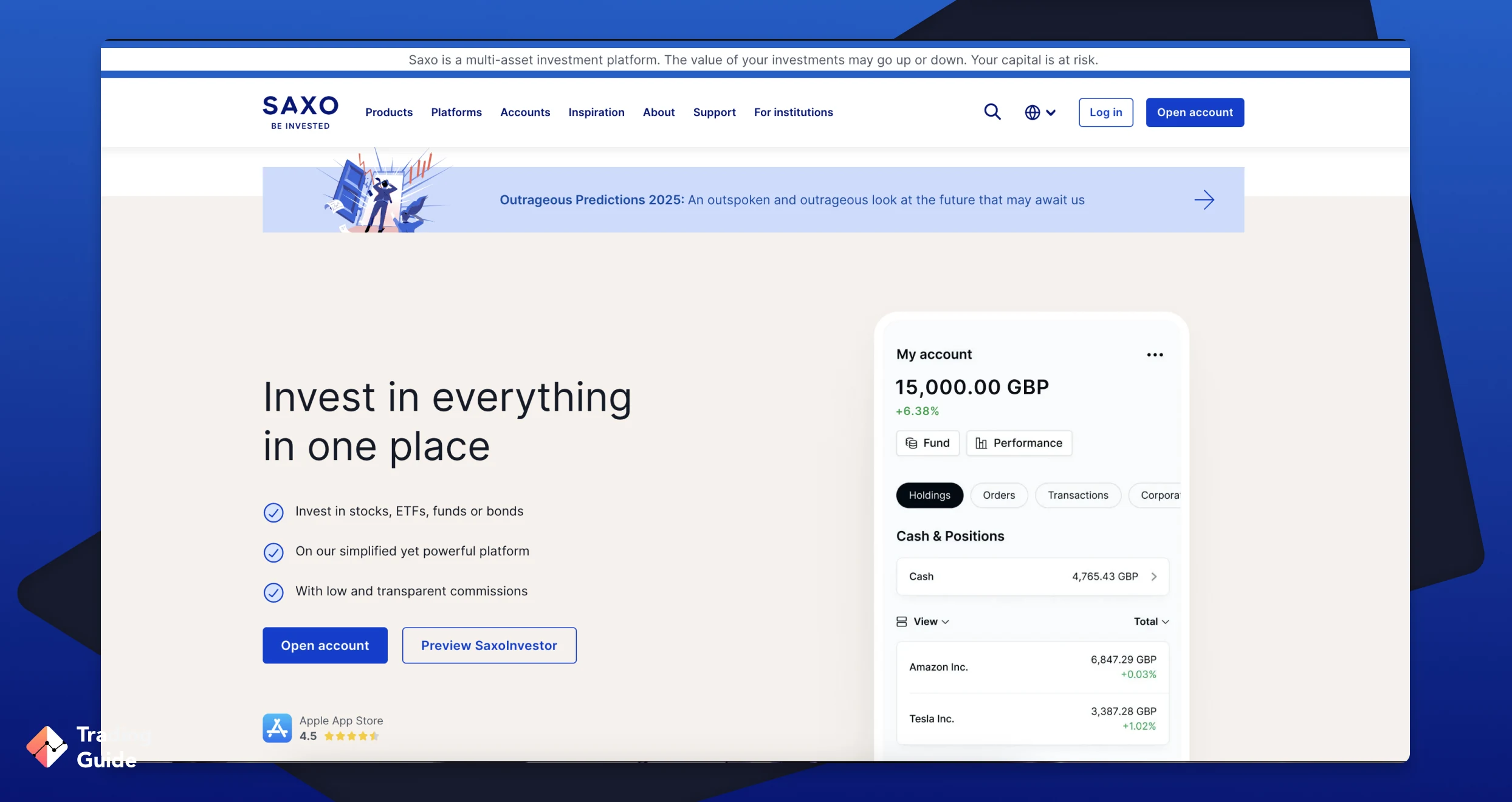

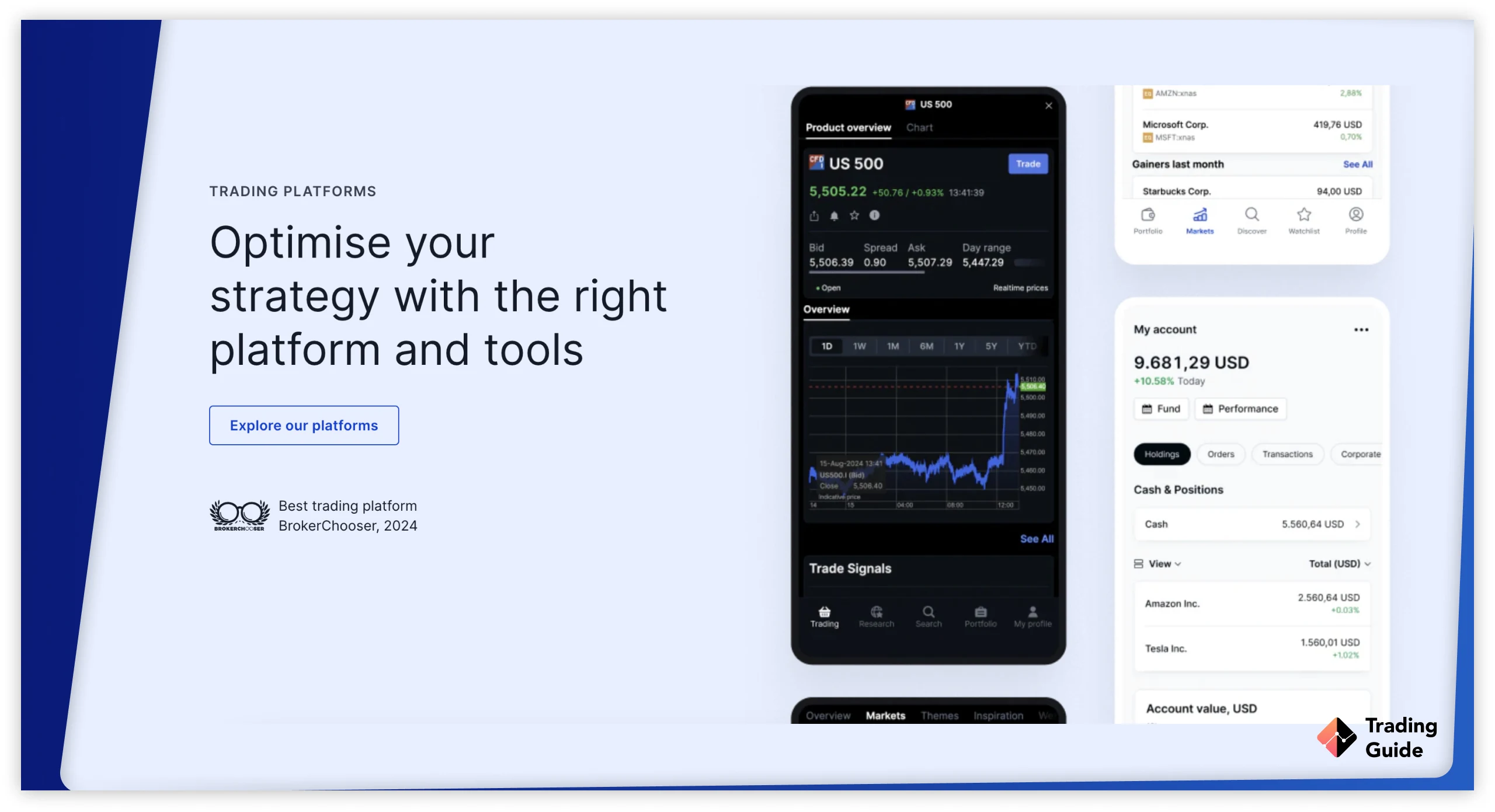

6. Saxo – Best Broker For Bitcoin FX Trading

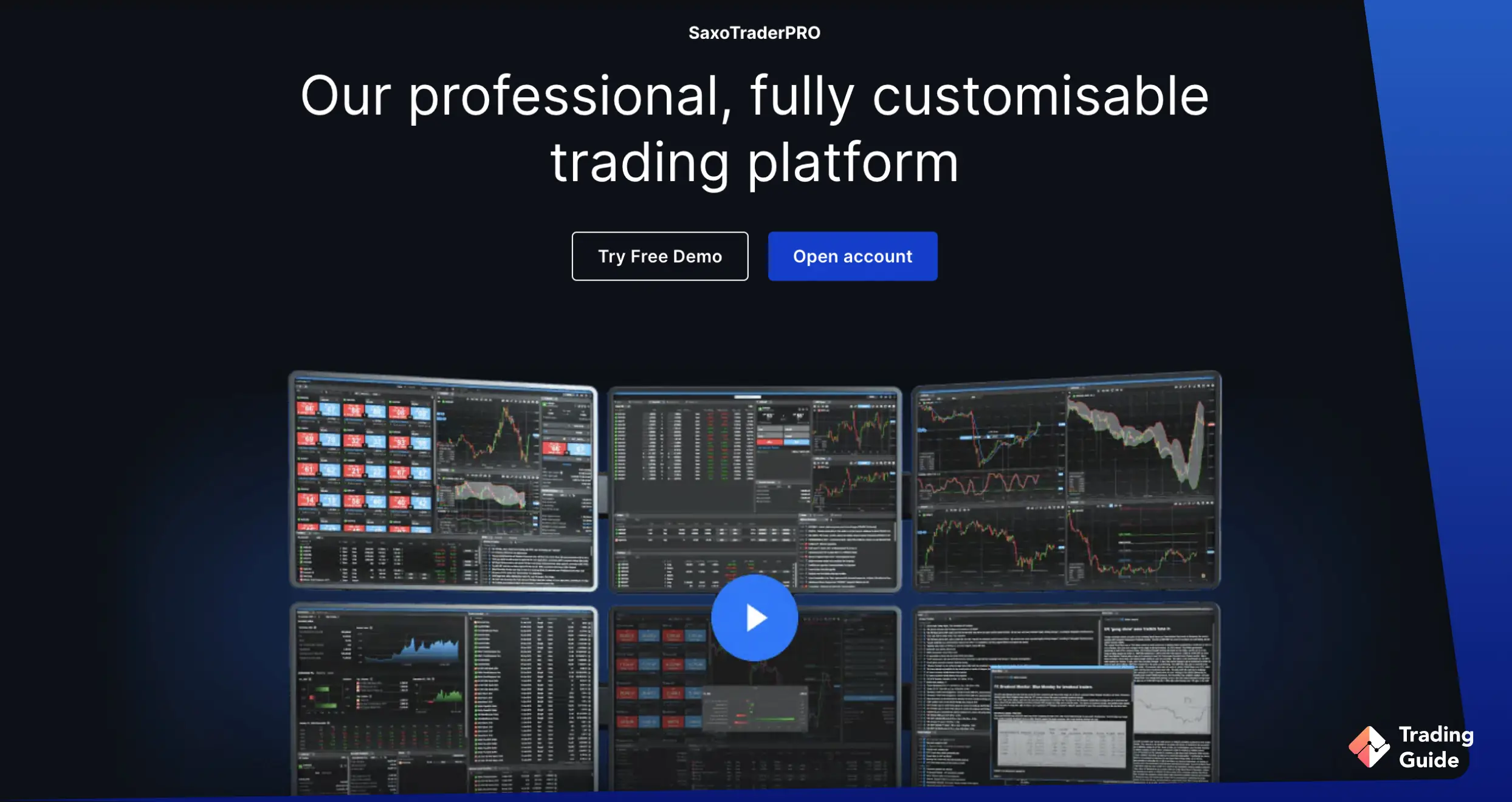

After extensive testing and analysis, our experience with Saxo as the foremost broker for Bitcoin FX trading has been exceptional. The sophisticated SaxoTraderPRO platform, tailored particularly for professional traders, impressed us significantly. This platform provides seamless exposure to Bitcoin via foreign exchange trading. Saxo’s stellar reputation in the financial industry is reflected in its competitive spreads and extensive range of currency pairs, ensuring diverse trading opportunities.

Despite lacking the MT4 platform, the SaxoTraderPRO offers advanced charting tools, in-depth market analysis, and robust risk management features, thus enhancing precision in Bitcoin FX trading. Furthermore, while offering a plethora of instruments beyond Bitcoin, including forex, stocks, and ETFs, Saxo ensures a comprehensive trading experience. These and more make this broker earn the highest commendation of 4.5 stars from us.

- Competitive spreads and a broad selection of currency pairs

- Advanced charting tools and market analysis resources

- Additional asset classes for portfolio diversification

- Strong regulatory oversight for security and reliability

- May not be suitable for beginners due to its professional focus

| Type | Fee |

| Minimum deposit | $0 (for Classic account) |

| Inactivity fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Manual order fee | €50 per order |

| Stocks | from $1 on US stocks |

| Futures | $1 per lot |

| Listed options | $0.75 per lot |

| ETFs | from $1 |

| Bonds | from 0.05% on govt. bonds |

| Mutual funds | $0 |

What do Other Traders Say?

Understanding the experiences of fellow traders is pivotal when choosing the right Bitcoin broker in the UK. To provide you with a comprehensive view, we’ve meticulously sampled authentic user comments from Google Play, the App Store, and Trustpilot. This extensive sampling enables us to present genuine sentiments and opinions about these brokers to ease your decision-making process.

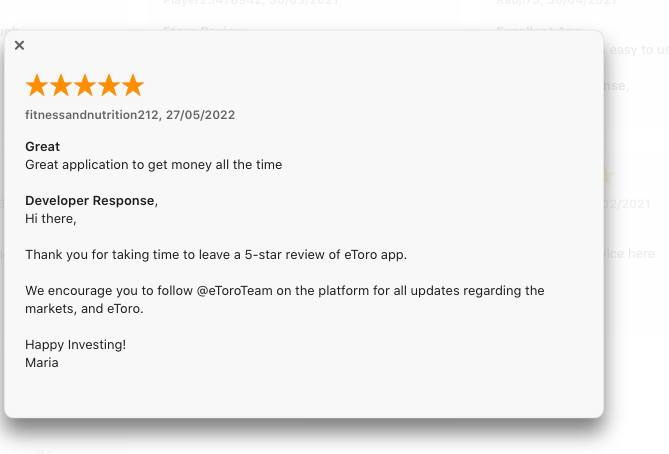

eToro

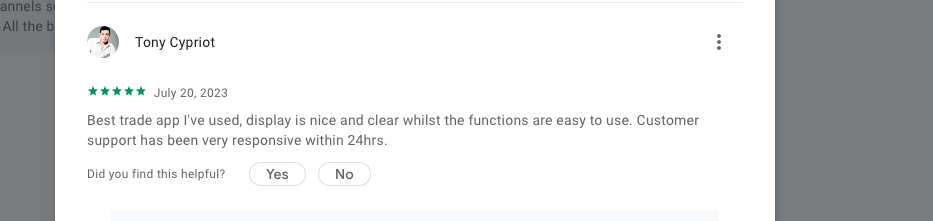

eToro stands out among traders for its user-friendly interface and diverse range of cryptocurrencies. Users appreciate its accessibility for beginners and the social trading features. Here’s a glimpse of what some users are saying.

-

“Great application to get money all the time” – fitnessandnutrition212

-

“Best trade app I’ve used, display is nice and clear whilst the functions are easy to use. Customer support has been very responsive within 24hrs.” – Tony C

Saxo

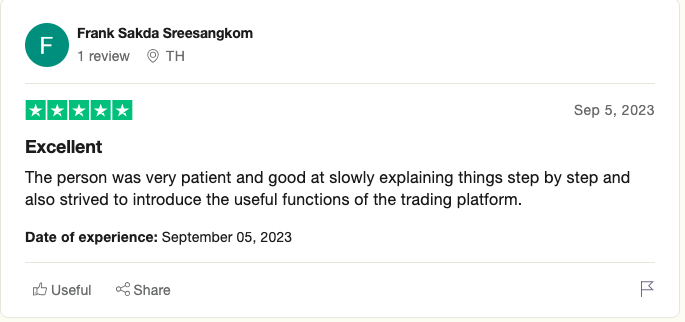

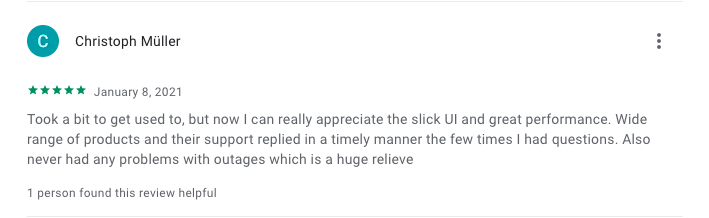

Saxo earns praise for its comprehensive research tools, diverse investment options, and personalised customer service. Here’s a peek into the sentiments shared by a few of its users.

-

“The person was very patient and good at slowly explaining things step by step and also strived to introduce the useful functions of the trading platform.” – Frank Sakda Sreesangkom

-

“Took a bit to get used to, but now I can really appreciate the slick UI and great performance. Wide range of products and their support replied in a timely manner the few times I had questions. Also never had any problems with outages which is a huge relieve” – Christoph Müller

-

“This app is fast and efficient. It has good information about all the assets you can trade and nice articles about each type of asset.” – Anders Sch

FP Markets

FP Markets receives positive feedback for its competitive pricing, diverse asset offerings, and robust trading tools. Users admire its transparent fee structure and professional customer service. See below a few testimonials we thought were worth sharing.

-

“Customer support is really marvelous, my problem was taken seriously and solved within no time. Thanks to the team for their efforts. Great!” – Tariq

-

“The app is user friendly. Even for beginners, it is easy to use, and the customer service live chat is quick in replying.” – Wayne K

The Ultimate Guide to Bitcoin Investments

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

Bitcoin, the pioneering cryptocurrency, has captivated the investment world with its meteoric rise and transformative potential. As you contemplate stepping into this venture, it’s essential to navigate the landscape with a keen understanding of its intricacies. In this regard, we have prepared the following sections, each a treasure trove of insights into the multifaceted world of Bitcoin investments. Our mission is to empower you with the wisdom needed to excel and thrive within this dynamic and transformative market.

How to Choose the Right Bitcoin Brokers

Trading Bitcoin in the UK requires adherence to legal regulations, strategic knowledge, and a reliable Bitcoin broker that aligns with your trading needs. Before getting started with top Bitcoin brokers, here are crucial factors to contemplate. These elements not only ensure legal compliance but also empower you to make well-informed decisions.

Look for a Bitcoin broker complying with stringent global regulations, particularly being regulated by the Financial Conduct Authority (FCA) in the UK. Holding multiple licences further reinforces their credibility and commitment to compliance. Plus, it will be easier for you to take legal action against the broker in case of an agreement breach.

A top-notch Bitcoin broker must provide a trading platform that is swift, user-friendly, and customisable. The platform’s seamless performance across devices, including mobile phones and tablets, ensures you can monitor and execute trades conveniently at any time.

Reputable Bitcoin brokers should not only list Bitcoin and other cryptos but also additional market assets encompassing forex, shares, commodities, cryptocurrencies, indices, and futures. Opt for a Bitcoin broker listing your desired trading instruments to cater to your specific requirements.

Consider the varying trading and non-trading charges across Bitcoin brokers in the UK. Choose a broker with affordable trading fees that suit your budget, allowing you to diversify your investments across different markets without significantly impacting your capital.

Efficient deposit and withdrawal processes are facilitated by diverse payment methods. Look for brokers supporting payment options such as debit/credit cards, bank transfers, and e-wallets to ensure ease and convenience for your transactions.

For newcomers, reliable and responsive customer support is paramount. Assess the broker’s customer service, ensuring it meets your requirements in terms of accessibility via phone, email, and live chat within your preferred time frame.

Demo accounts serve as crucial tools for evaluating if a Bitcoin broker suits your trading style. While not all brokers offer demo accounts, they are invaluable for testing platforms, especially if complemented by robust research and educational tools for an enhanced trading experience.

Read about How to Open a Bitcoin Account in our other guide in order to get more detailed information.

Bitcoin Broker Vs Bitcoin Exchange

When it comes to trading Bitcoin, there are two primary methods: using a Bitcoin broker or a Bitcoin exchange. While both cater to Bitcoin traders, they diverge in several significant ways, as highlighted below.

Bitcoin Broker

A Bitcoin broker operates as an intermediary, providing a platform where buyers and sellers of Bitcoin, especially those dealing with larger amounts, can meet and conduct trades. This intermediary role allows for faster settlement periods, making it a more convenient method for Bitcoin trading. Brokers typically facilitate transactions with set prices, offering additional services like leveraged trading or diverse asset options.

Bitcoin Exchange

In contrast, a Bitcoin exchange functions as a marketplace where buyers and sellers can trade Bitcoin based on the current market price. Similar to a stock exchange, it matches buyers and sellers, allowing transactions at prevailing market rates. However, this setup can involve transaction costs and relies on market demand and supply dynamics, which might not be as suitable for trading large amounts due to potential price fluctuations.

Considerations

- Settlement Speed: Brokers offer quicker settlement times due to their intermediary role, while exchanges rely on market demand and can be more volatile.

- Transaction Costs: Exchanges may involve transaction fees, while brokers might have set prices with different fee structures.

- Control and Convenience: Brokers might offer more convenience and control over trade execution, while exchanges cater to a more market-driven approach.

Determining the most suitable method between using a Bitcoin broker or an exchange depends on factors such as trade volume, desired settlement speed, transaction costs, and personal preferences in trading styles. Both methods have their advantages and limitations, catering to different needs within the Bitcoin trading landscape.

5 Quick Steps To Start Bitcoin Trading

Bitcoin trading can be a thrilling venture, but getting started requires a strategic approach. Here are five swift steps to embark on your Bitcoin trading journey.

Begin by gaining a solid understanding of Bitcoin and how the cryptocurrency market operates. Explore resources, articles, and reputable websites to comprehend the fundamentals, including blockchain technology, market trends, and trading strategies.

Select a reputable and user-friendly Bitcoin trading broker like the ones we recommend in our mini reviews above. Ensure the broker aligns with your trading goals, offers adequate security measures, and provides essential tools for analysis and execution.

On the broker’s website, complete the account registration process using your personal details, including your name, email, phone number, date of birth, etc. You may also be required to create a unique username and strong password for an added layer of security. Then, participate in the account verification process, which typically involves providing identification documents to comply with regulatory requirements.

Deposit funds into your trading account using your preferred payment methods accepted by the Bitcoin broker. Consider factors such as transaction fees and processing times while choosing the most suitable funding option.

Once your broker confirms the deposit, begin trading by strategising and setting clear goals. Practice risk management techniques, such as setting stop-loss orders and diversifying your portfolio. Start with small trades while gaining confidence and gradually increase your involvement as you become more comfortable with the market dynamics. And if the broker has a demo account, consider taking advantage of it to test the broker’s performance and gauge your skill level before investing real money.

Read the article about Best Crypto Brokers in the UK 2026 in order to find more appropriate for yourself.

Pros and Cons of Bitcoin Trading

Venturing into the dynamic world of Bitcoin trading offers both promising prospects and inherent challenges. Like navigating any investment landscape, comprehending the distinctive advantages and potential drawbacks is fundamental before immersing oneself in this evolving market. See below the pros and cons of Bitcoin trading.

| Pros | Cons |

|---|---|

| Bitcoin’s volatile nature can lead to substantial short-run profits for adept traders who can capitalise on price fluctuations. | Bitcoin’s price volatility can lead to substantial fluctuations, resulting in significant gains or losses, posing a high level of risk for traders. |

| As a decentralised currency, Bitcoin offers accessibility to anyone with an internet connection, bypassing traditional banking systems. | The regulatory landscape surrounding Bitcoin varies across regions, leading to uncertainty and potential changes in laws affecting its use and trading. |

| Adding Bitcoin to an investment portfolio can diversify risk, especially given its lower correlation to traditional assets like stocks and bonds. | Cybersecurity threats, hacks, and scams targeting exchanges or individual wallets pose risks of loss due to theft or fraud. |

| Bitcoin trades 24/7, allowing traders to engage in activities anytime, unlike traditional stock markets that operate during specific hours. | |

| Bitcoin transactions often have lower fees than traditional banking systems, especially for international transfers. |

You can read about best Bitcoin wallets in the UK 2026 in our other article.

FAQs

There are two ways in which you can buy Bitcoin. Either through a broker or Bitcoin exchange. Trading with a broker is the most preferred and efficient method because it not only allows you to trade Bitcoin using PayPal, but its settlement period is usually faster than the Bitcoin exchange.

Yes. Apart from using Bitcoin exchange, you can also trade Bitcoin using a broker. The brokers should be licensed and regulated by top-tier authorities, such as the Financial Conduct Authority (FCA).

Yes. In the UK, Bitcoin trading is considered federal property, and as such, the profits you make from Bitcoin trading must be subjected to capital gains tax.

Yes. Some brokers charge little or no Bitcoin trading commissions. With such brokers, you will be able to access the tradable markets and invest in Bitcoin, without additional charges.

Yes. There is a risk that Bitcoin can be hacked on a Bitcoin exchange. Therefore, we highly recommend trading with Bitcoin brokers that are licensed and regulated for your investment capital’s safety. Examples of such brokers are recommended above.

No. In the UK, Bitcoin trading is a personal investment, and during cash out, you are liable to taxation. However, traders in foreign countries are tax-exempt if they have been residing in the diaspora for over five years.

Conclusion

Venturing into Bitcoin trading demands caution and a strategic mindset. As a trader/investor, embracing volatility as both a risk and an opportunity is crucial. Prioritise education, understand the market’s intricacies, and approach trading with a long-term perspective. Most importantly, choose a trusted broker from our recommendations list above, manage risks wisely, and start with a small, diversified portfolio. Remember, emotions can influence decisions, so maintain a disciplined approach and never invest more than you can afford to lose. If you engage prudently and explore Bitcoin trading as a journey and not a get-rich-quick scheme, it will only be a matter of time before you become an independent and successful Bitcoin investor.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

This article opened my eyes to the differences between brokers and exchanges. As someone who has been studying cryptocurrency for a year, he explained the important aspects of choosing the right broker, avoiding scams, and using secure wallets. The FAQ is a bonus for newbies like me. This is a valuable guide for people like me.

This is exactly what I was looking for! The article on Bitcoin trading provided me with all the necessary information to start trading bitcoins. The detailed description of the steps made choosing a broker and subsequent actions much easier. I am very grateful for this comprehensive resource!

I’ve tried a few of these platforms and FP Markets has been solid for low spreads and fast execution

eToro is great for social trading and getting started