Many traders, including yours truly, often leverage the knowledge and expertise of seasoned professionals through copy trading in the UK. This is one of the most popular strategies today for many reasons. For starters, it is recognised and permitted by the Financial Conduct Authority (FCA). It’s also beginner-friendly, saves time, and is ideal for generating passive income.

As an avid copy trader and expert, I must emphasise the importance of using a reliable, FCA-regulated trading platform. It’s the only way to ensure you enjoy unparalleled regulatory protection, fair treatment, and other perks. I tested hundreds of service providers that support copy trading and cherry-picked the finest, which I’ve reviewed in this guide.

Essence

- Copy trading allows you to replicate others’ trades in their own trading accounts, essentially mirroring the actions of experienced traders or investors.

- Opting for a copy trading platform that’s trustworthy and suits your specific trading preferences is crucial to your success.

- I vetted tens of FCA-regulated copy trading platforms and selected 8 that stood out from the rest in terms of everything from security and credibility to costs and reputation.

List of the Best Copy Trading Platforms in the UK 2026

- eToro – Overall Best Copy Trading Platform in the UK

- FxPro – Best Platform for Mobile Traders

- FXTM – Best Platform for Forex Enthusiasts

- FP Markets – Best Platform for MetaTrader Users

- Interactive Brokers – Best Platform for Professionals

- Saxo – Best Platform for Institutions

- Pepperstone – Best Platform for Beginners

How We Choose Copy Trading Platforms

At TradingGuide, our approach to selecting copy trader platforms is grounded in thorough research and meticulous testing. We understand the importance of choosing a reliable platform for copy trading, so we take our research process seriously.

We start by casting a wide net and identifying as many regulated service providers as possible. We prioritise platforms that are secure and regulated by the Financial Conduct Authority (FCA) or equivalent regulatory bodies.

Once we have identified reliable trading providers, we thoroughly test each. This enables us to assess the platform’s usability, functionality, and reliability firsthand. While conducting our tests, our gurus focus on a defined array of critical functions, like performance, security, and support.

In addition to our testing, we source insights from user testimonials on Google Play, the App Store, and Trustpilot. This ensures that our recommendations are informed not only by our firsthand findings but also by the real-world experiences of other users.

Compare the Best Copy Trading Platforms in the UK

| Best Platforms | License & Regulation | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| eToro | FCA, ASIC, MAS, CySEC, MFSA, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/ debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes |

| FxPro | FCA, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | Yes |

| FXTM | FCA, CySEC, CMA, FSC | 24/5 | Desktop, Trading App, MT4, MT5 | Credit/debit cards, Skrill, Neteller, Bank transfers, Local transfers | Yes | Yes |

| FP Markets | FCA, FSCA, ASIC, CySEC | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | Yes |

| Interactive Brokers | FCA, BaFin, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, CySEC | 24/7 | Online Platform, Trading apps, MT4, ProRealTime, L2 Dealer, US options and futures | Credit/debit cards, Bank transfer, Apple Pay | Yes | Yes |

| Saxo | FCA, ASIC, DFSA, MAS, JFSA, SFC, FINMA | 24/5 | SAXO Investors, SaxoTraderGO, SaxoTraderPRO | Bank wire transfer, credit/debit cards | Yes | Yes |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes | Yes |

Brief Overview of Our Recommended Copy Trading Platforms’ Fees

It’s also my mission to help you find a platform that offers fair trading costs and the right assets. During my assessment, I reviewed the fees of every prospective service provider. I’ve outlined my findings regarding the best brands below.

Fees

| Best Platforms | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| eToro | $50 | From 1 pip | Free | $10 monthly |

| FxPro | £100 | From 0.0 pips | Free | £15 one-time + £5 monthly |

| FXTM | £200 | From 0.0 pips | £3 fee for deposits and withdrawals <£30 | £10 monthly |

| FP Markets | £100 | From 0.0 pips | Free | Free |

| Interactive Brokers | £0 | From 0.1 pips | Free | £0 |

| Saxo | £0 | From 0.05% commission | Free | £0 |

| Pepperstone | £0 | From 0.0 pips | Free | £0 |

1. eToro – Overall Best Copy Trading Platform in the UK

Since its launch in 2007, eToro has continued to offer its CopyTrader feature, which enables you to identify experts who match your trading requirements and replicate their trades. You can focus on one or multiple trading gurus depending on your preferences. While testing this provider, I had an easy time finding my perfect match, as eToro has an extensive list of the most profitable traders and their stats.

If you are an expert trader, eToro will compensate you for every trade copied through its popular investor programme. For you to receive notifications about expert traders’ new trades, eToro offers the social news feed feature. You can use it to post your trading ideas, comment on other traders’ posts, and learn their strategies to improve your trading skills.

eToro is also the overall best because the platform has a wide variety of assets. They range from CFDs on 7,000 securities to 6,000+ stocks and cryptocurrencies for investment enthusiasts.

- Premier platform for copy traders

- CFDs on 7,000+ products like forex pairs and shares

- 1000s of investment assets, including stocks and crypto

- A free online academy with 100s of materials

- Better perks for bigger traders and investors

- $10 monthly inactivity fee

- Higher spreads than its peers

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

2. FxPro – Best Platform for Mobile Traders

If you rely on your mobile phone, download the FxPro app today. I used it and was impressed by its support for copy trading. The app allowed me to access and leverage the amazing copy trading features associated with cTrader. I was able to browse and copy a wide variety of trading strategies with amazing ease. The best part is that every strategy provider came with detailed metrics.

Copy trading aside, my FxPro app allowed me to manage my MT4 and MT5 accounts, which was incredibly convenient. I also discovered that, while using the app, I had the uncapped opportunity to exploit TradingView’s next-level charting features.

- Powerful mobile app that integrates with multiple systems, including cTrader

- Sleek, user-friendly app interface

- Available on both Android and iOS

- Advanced full-screen charting capabilities

- Top-tier security protocols, including 2FA and fingerprint

- Inactive accounts are subject to a £15 one-off maintenance fee + £5 monthly charges

- The available asset range is quite restrictive

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. FXTM – Best Platform for Forex Enthusiasts

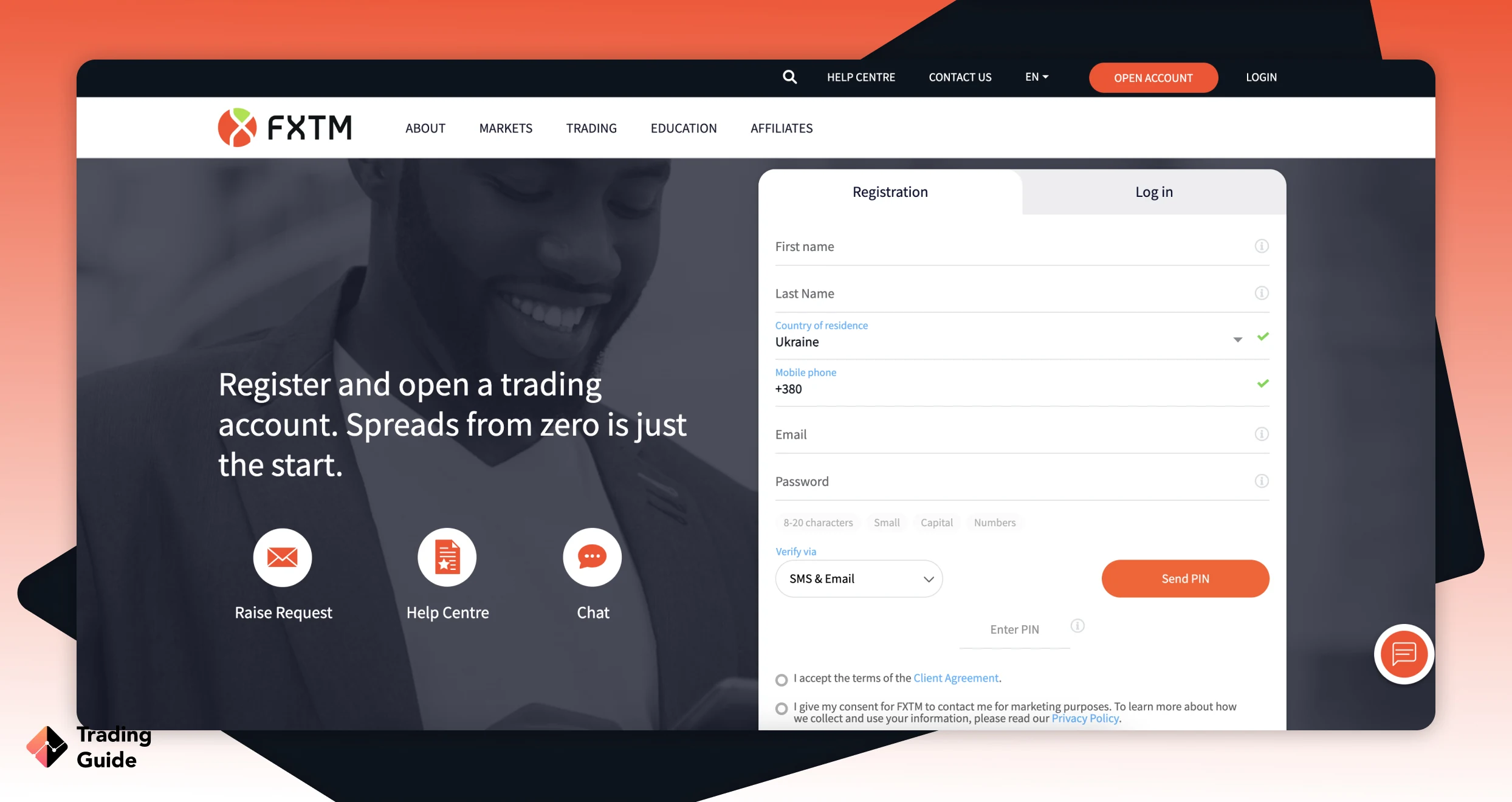

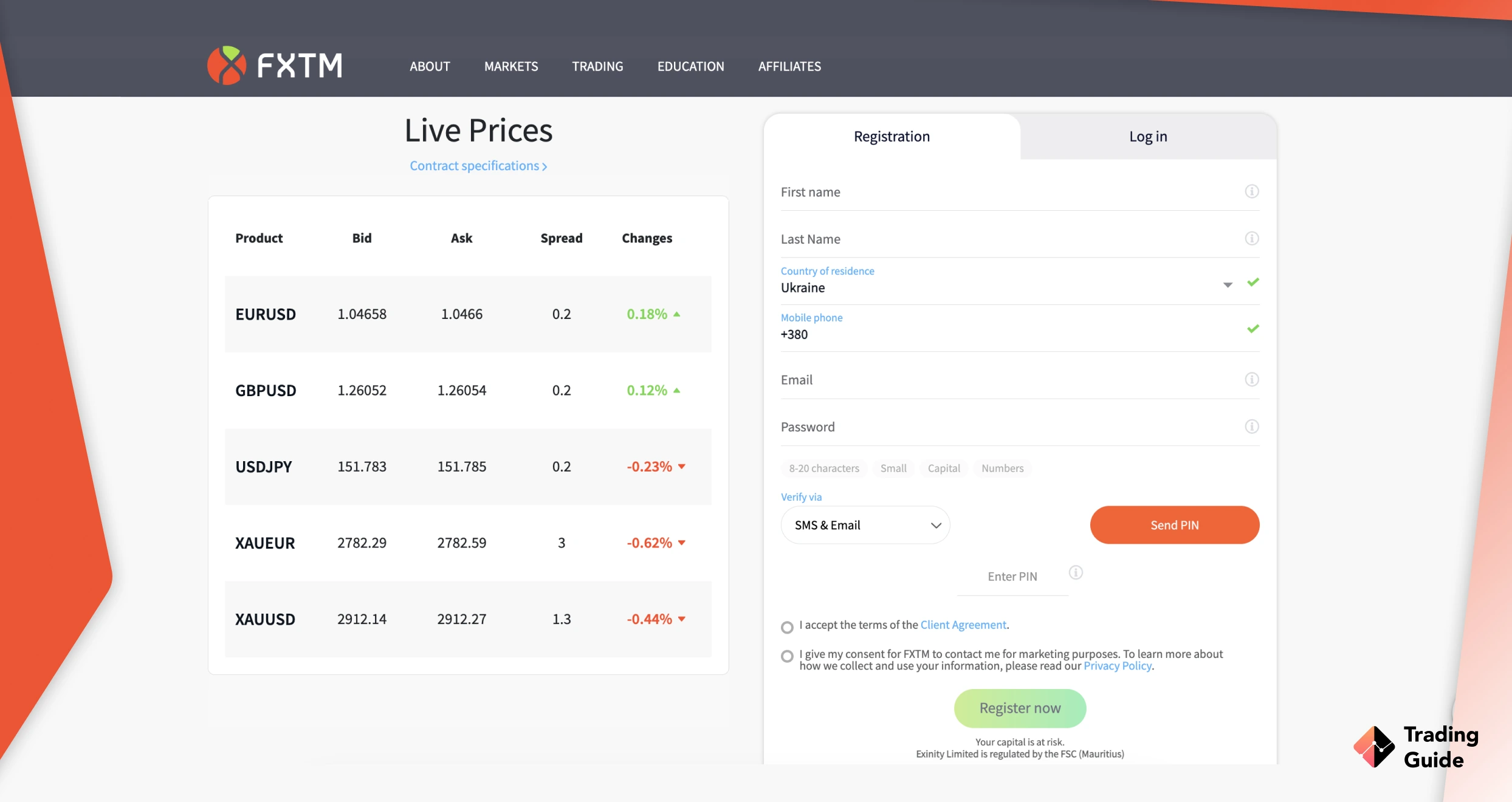

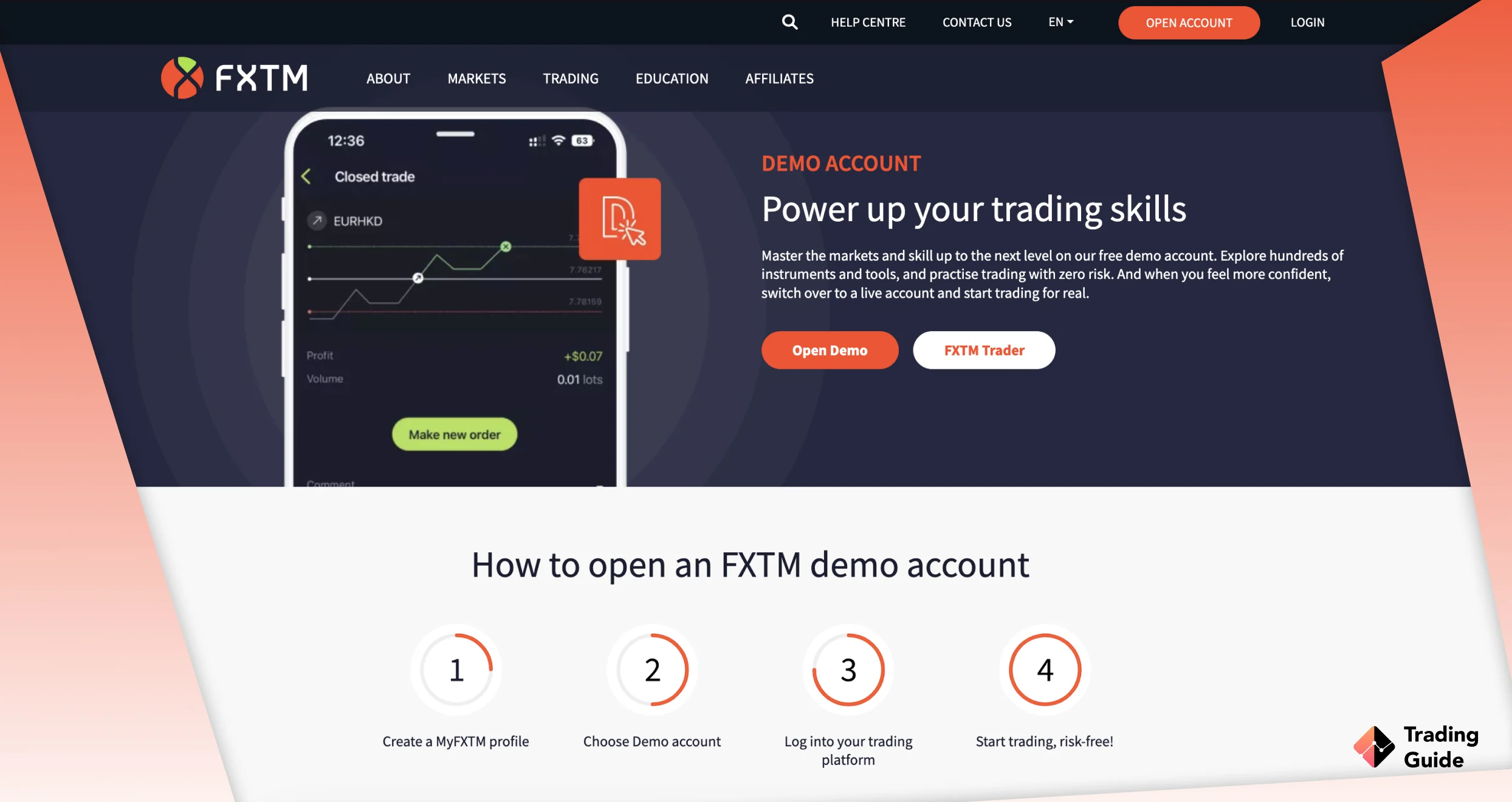

After testing all available brokers, FXTM stands out as the best forex copy trading platform. I found the account setup process seamless, taking only a few minutes to complete, and I was able to explore the markets with as little as £200. FXTM excels in minimising trading charges with spreads as low as 0 pips, which allowed me to trade efficiently without significant expenses.

Another thing that truly impressed me was the flexibility FXTM offers in copy trading. Users can choose to replicate their preferred traders’ positions, and trading fees are incurred only when strategy managers generate profits. Beyond its outstanding copy trading feature, MT4 hosted on FXTM offers extensive resources tailored for advanced traders. With over 1000 trading instruments encompassing forex, stocks, commodities, and more, the platform caters to diverse trading preferences. We, therefore, give it a 4.6-star rating.

- Low spreads from 0 pips

- Users have access to MT4

- Supports VPS trading

- Up to 1:2000 leverage for pros

- 60+ major, minor, and exotic pairs available

- £10 inactivity fee

- Limited asset range

| Type | Fee |

| Minimum deposit | $200 |

| Overnight fee | $5 |

| Deposit fee | $0 |

| Withdrawal fee | $3 |

| Inactivity fee | Yes |

4. FP Markets – Best Platform for MetaTrader Users

FP Markets offers a top-notch copy trading platform for MetaTrader users in the UK that I tested extensively. I loved it because it’s designed for traders of all levels and provides a user-friendly interface with a wide range of tools and features to help traders make informed decisions. You should take advantage of this broker’s copy trading feature to follow and copy the trades of successful traders. This is more so if you are a new MT4 or MT5 user looking to learn from experienced traders.

FP Markets’ copy trading platform is also suitable for traders who want to diversify their portfolios without having to do all the research and analysis themselves. The platform offers a range of customisation options, enabling you to select the professional traders you want to follow based on their performance, risk tolerance, and trading style. Moreover, FP Markets doesn’t limit the number of traders you can follow and copy, making it easier for you to identify suitable trading systems.

- Supports copy trading through cTrader, MT4, and MT5

- Integrates seamlessly with Signal Start

- 10,000+ tradable securities available

- No inactivity fees

- Low spreads from 0.0 pips

- Signal Start doesn’t have a free version

- Only CFD trading is available

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

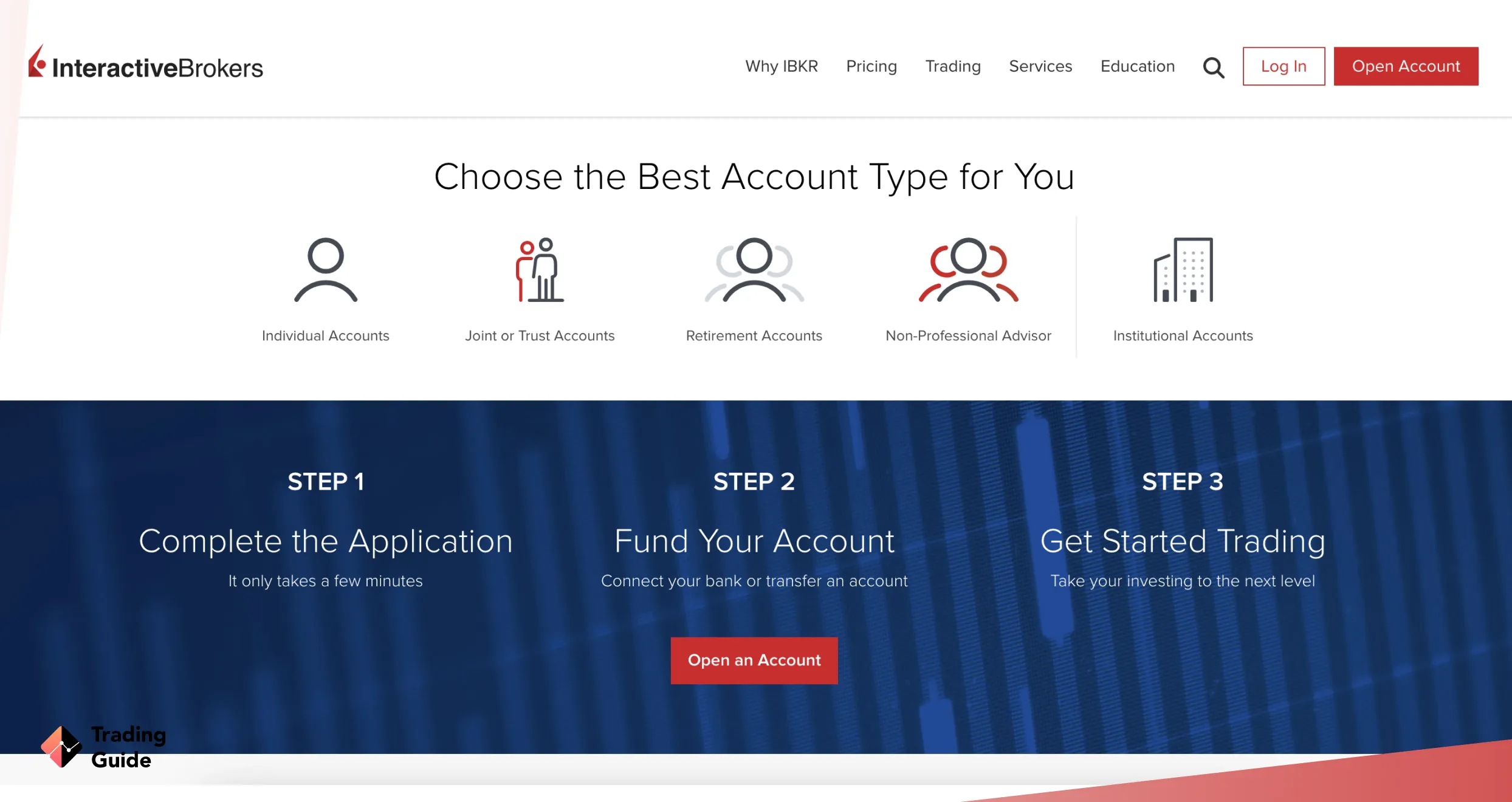

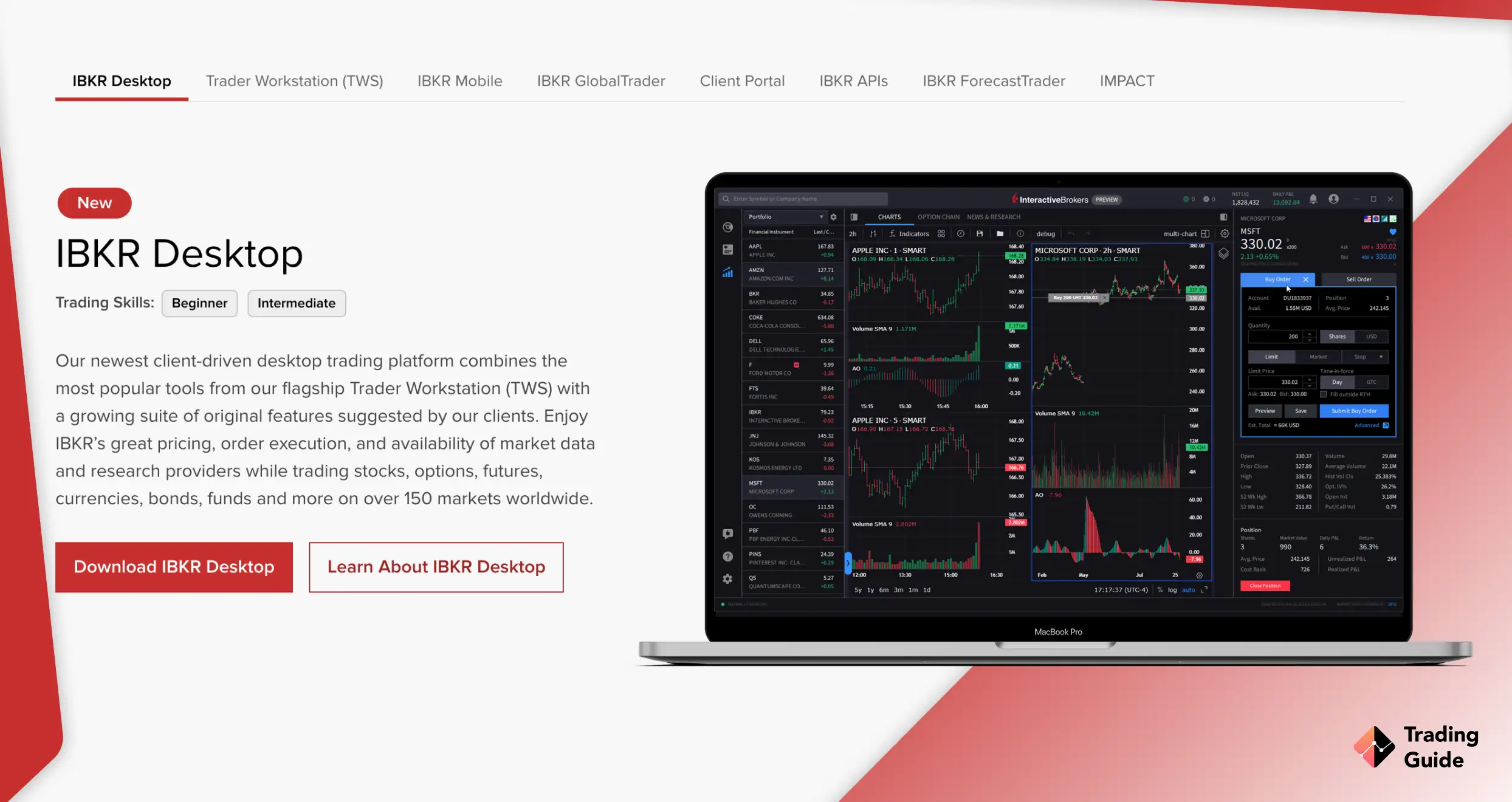

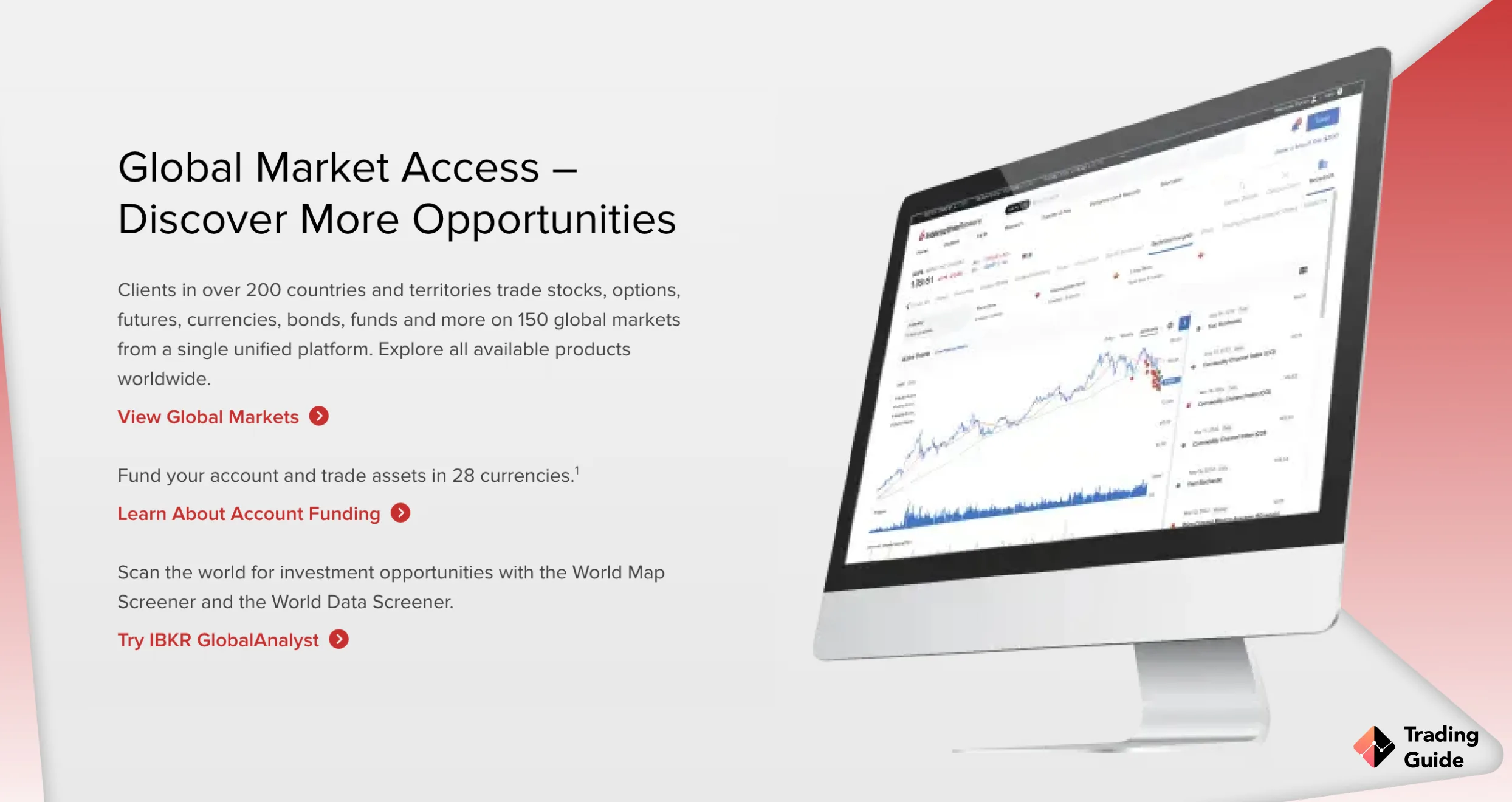

5. Interactive Brokers – Best Platform for Professionals

To seasoned pros, I recommend Interactive Brokers. With an IBKR account, you can mirror the trades of your peers or superiors with the best third-party copy trading software, including coInvesting. Through the supported systems, you can not only copy other top pros’ trades but also create unique strategies that others can follow.

IBKR has multiple powerful platforms ideal for professional trading, with Trader Workstation leading the pack. I was impressed by TWS’s execution speed, out-of-the-box usability, and research tools. I also hold this service provider in high regard because, despite being top-tier, it’s very pocket-friendly, with no minimum deposit and spreads as low as 0.1 pips.

- £0 minimum deposit requirement

- Powerful proprietary platforms

- Competitive spreads starting from 0.1 pips

- No inactivity fee

- A managed robo-advisor is available

- Can overwhelm first-timers and novices

- No support for third-party trading platforms

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

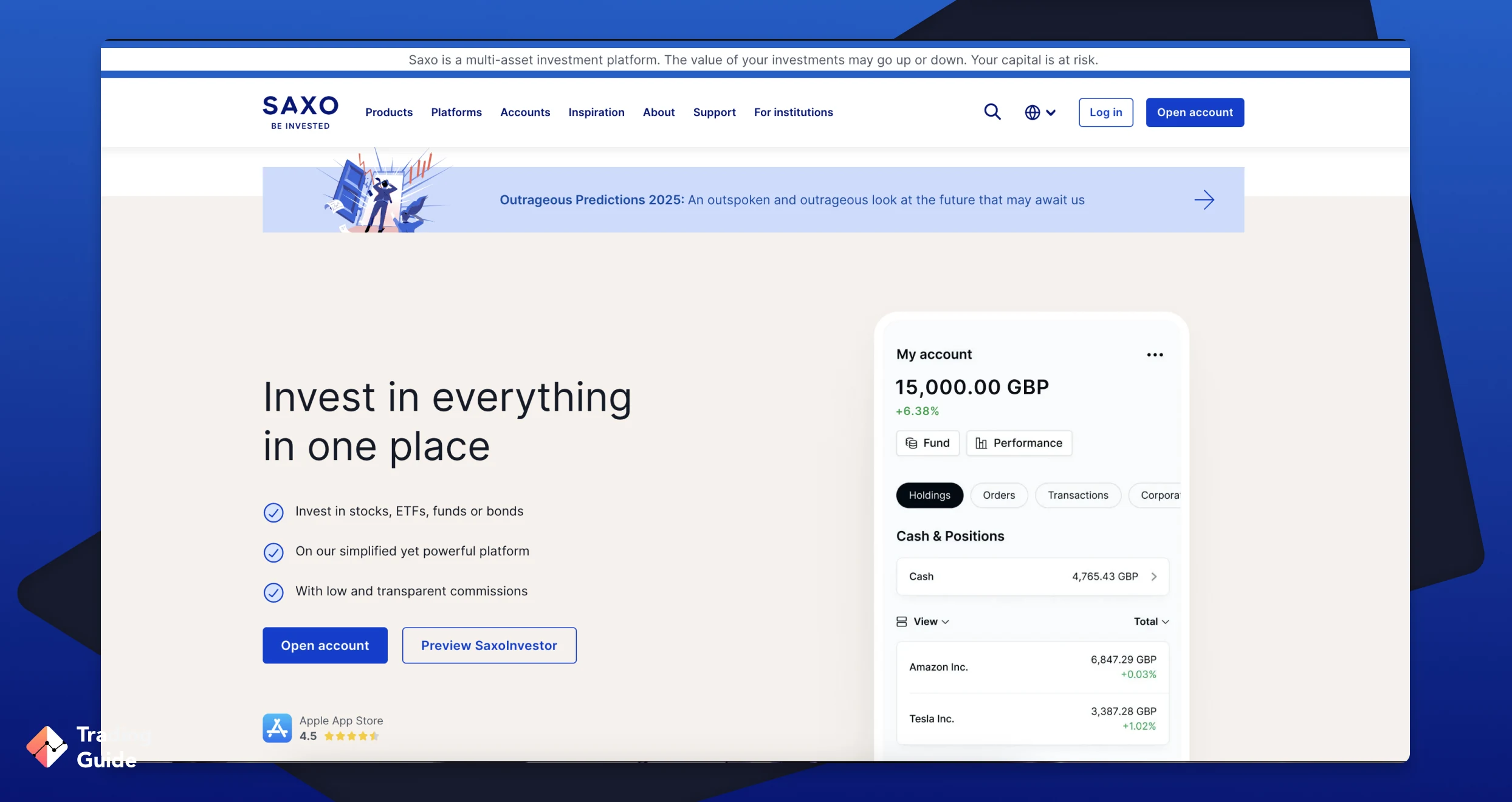

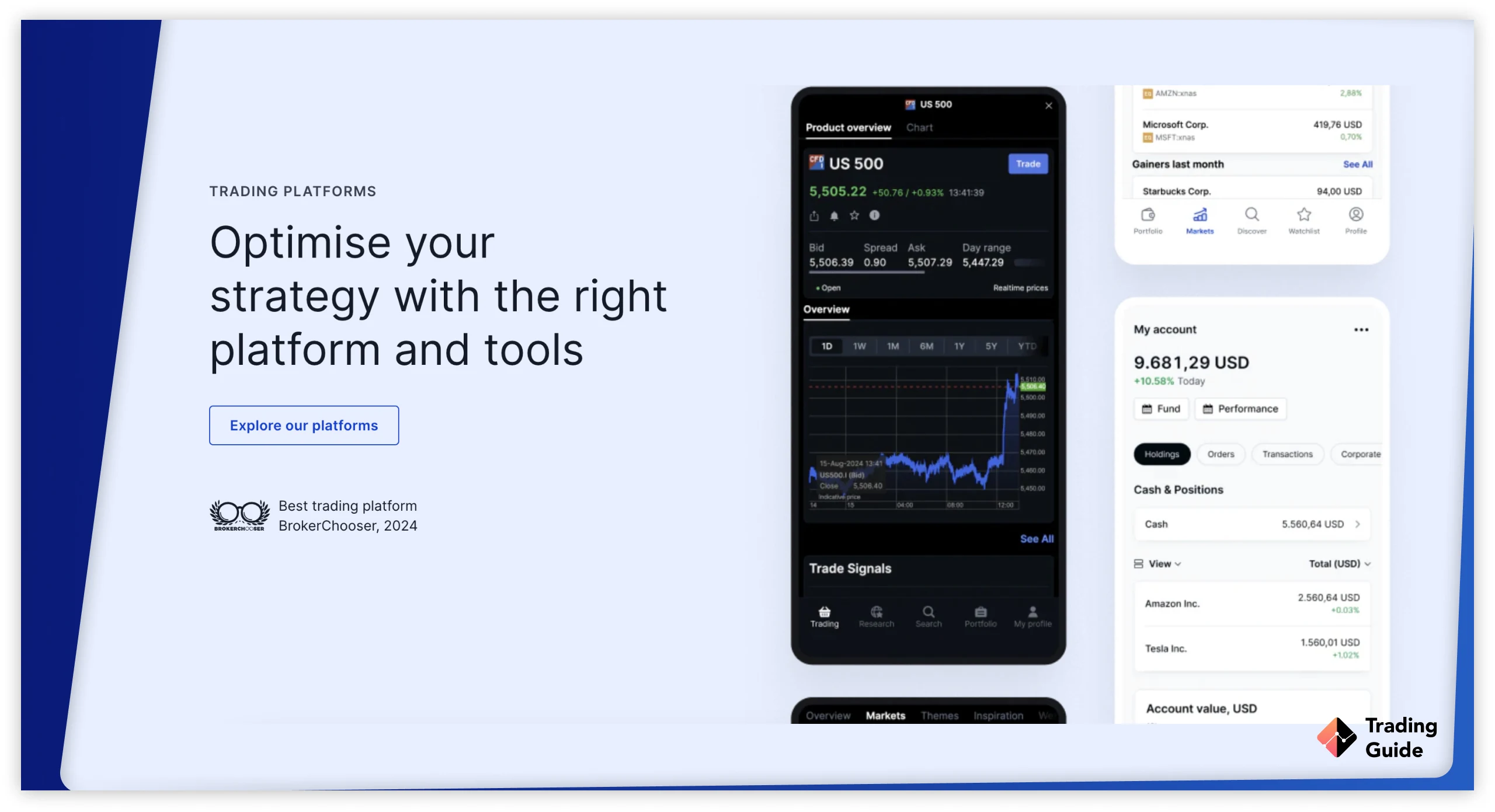

6. Saxo – Best Platform for Institutions

When it comes to serving institutions, Saxo is the best broker I’ve come across. I loved several features and functions that it offers, especially Trade Signals, a technology that uses automated pattern recognition to identify and recommend trading opportunities. The best part is it’s designed to make trading a dream; I was able to switch from analysis to placing orders at the click of a button.

Saxo is ideal for a diverse range of clients, including banks, brokers, fund managers, and prop traders. With a live account, you’ll have the opportunity to trade and invest in 71,000 financial instruments, from real UK stocks to leveraged securities like forex pairs.

- 71,000+ financial instruments, including real and leveraged assets

- Automated pattern recognition software for better decision-making

- Caters to a wide variety of institutional traders

- Prompt and helpful support representatives

- No inactivity fee

- Only proprietary systems are available

- Interest is exclusively for unused balances above GBP 10,000

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

7. Pepperstone – Best Platform for Beginners

I’m an expert, but I was a beginner at some point. That said, I strongly recommend that less-experienced copy traders use Pepperstone. This is a beginner-friendly platform with no minimum deposit requirements and super-tight spreads starting from 0.0 pips. I guarantee you’ll love it, and if you find it wanting, you can simply switch to any other provider I’ve recommended here and never worry about any repercussions since this broker doesn’t charge inactivity fees.

I also consider Pepperstone a top provider because it integrates with TradingView, cTrader, and MT4/5. Most of these support copy trading, but my favorite is MT4, which comes with an unmatched number of strategies to choose from and is less resource-intensive compared to the other options.

- £0 minimum deposit requirements

- Spreads as sharp as 0.0 pips

- Supports cTrader, TradingView, and MT4/5

- No charges for dormant accounts

- Expert support available 24/7

- Reasonable range of educational materials

- Smaller product range compared to its peers

- Supports CFD trading exclusively

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

What is Copy Trading?

Copy trading allows you to manually or automatically replicate the trades of seasoned investors, leveraging their experience and knowledge to generate profits. This approach is applicable across various markets, including forex, shares, commodities, cryptocurrencies, and more. While copy trading offers profitable opportunities, it also carries significant risks, necessitating thorough research and understanding before making a full commitment.

Pros & Cons of Copy Trading

I’ve engaged in copy trading for many years and have discovered several pros and cons that I believe everyone should be aware of, especially newcomers.

- It doesn’t require extensive knowledge

- It’s ideal for novices who want to earn as they learn

- Pros can use it to save time

- Copying multiple successful traders is possible

- It’s legal in the UK

- Copy traders can become over-reliant on others

- Not all strategy providers are solid traders

Example of Copy Trading

Let’s assume you want to trade forex but lack extensive experience, or your schedule doesn’t allow you to spend hours analysing the markets. You can find a broker that supports copy trading, like eToro, sign up, and fund your account.

Then, click on the provider’s copy trading feature, scroll through the list of verified traders, and pick the best one to follow. While choosing an ideal strategy provider, you consider factors like profits/losses, risk level, and preferred assets.

Suppose you pick a trader called AlexFX. If they buy a specific currency pair, such as GBP/USD, so will you; your account will automatically mirror their actions. If AlexFX profits, so will you, and vice versa. That is how copy trading works in a nutshell.

How to Choose the Best Copy Trading Platform in the UK

Since I’ve been doing this for many years, sifting through countless providers and picking the top ones is quite easy. However, I know it can be incredibly challenging for a normal trader, especially since there are almost too many brands available today, ranging from reliable ones to the shoddiest providers imaginable.

Let me make things simpler for you and help you avoid unscrupulous brands easily. Here’s a condensed list of factors I usually consider first while vetting whether or not a trading tool is credible and suitable for me:

Following the UK’s trading laws, a credible platform must be under a broker that is licensed and regulated by world-class authorities, including the UK’s Financial Conduct Authority. Confirming a copy trading platform’s credibility through licensing and regulation is one way of ensuring your capital and assets are secure.

I always check the reputation of every trading platform before signing up. You should do the same because it’s one of the surest ways to gauge credibility through past user insights. Read as many reviews as possible, from positive comments with 5-star ratings to 1-star-rated comments.

When searching for a copy trading platform, you have a defined list of the markets you wish to trade and invest in. Not all brokers will let you copy trade on all market assets. Therefore, choose a copy trading platform according to your trading needs.

Opening a new account and copying trades on most brokers’ platforms is typically free. However, you will still incur the usual trading charges when you open a position, including a spread or commission. Verify that your chosen copy trading platform has trading fees that you can afford. I also urge you to research hidden fees, like inactivity and overnight charges.

The best copy trading platforms in the UK have customer support representatives that you can rely on in case of any trading issues. You can reach them through various communication channels, including phone, email, and live chat. Test every service provider’s support team before committing.

Read more about the best trading platforms in the UK and best Bitcoin trading platform in the UK in our other guides.

How to Start a Copy Trading Account in 5 Steps

To copy trades and strategies from professionals, you first need to find a broker that offers a copy trading platform and then register a new account. Based on my experience, the registration process for most service providers is standardised and created with FCA regulations in mind. Therefore, you can use the following 5 easy steps to register an account with almost all copy trading brokers in the UK.

First, use the links on this page to go to your chosen service provider’s official site. Brokers allow you to register an account from their sites on any device that you prefer, such as a laptop or smartphone. In some rare cases, you might have to download a trading app from the broker before you can get started. But today, most brokers offer browser-based platforms.

You will be asked to provide information that will help you set up a new account. Information that you will need to provide includes your full name, date of birth, and phone number. In the next step, you will need to verify this information, so please provide accurate and up-to-date details.

In the next step, you will have to verify this information so make sure that you provide accurate and up-to-date information. Also, since you will get access to financial services, you have to clarify your financial situation.

As mentioned, you must verify your identity and prove to the broker that you are who you claim to be. That is done by submitting two sets of documents. The first is a copy of your ID, and the other is either a recent utility bill or a bank statement with your address on it. Please follow the instructions carefully; otherwise, you may need to repeat the entire process or provide additional supporting documents.

The last step required before your account is fully opened is to make an initial deposit. Your first deposit must match the broker’s minimum deposit threshold, which can vary from £0 to a few hundred pounds. Once you’ve made your first deposit, you are allowed to deposit any amount you want to.

With money in your copy trading account, all that’s left for you is to start copy trading. Try to spend some time studying and analysing different traders before you decide on whom or which system you’re going to copy. By preparing, you increase your chances of making decent profits as a copy trader.

Copy Trading Risk Management

As with any form of trading, developing and maintaining a risk management strategy is essential when copy trading. Copy trading can be a great way to get started in the investment world. However, without proper risk management, your next trade could potentially end your trading journey.

Proper risk management starts with research. Before dabbling in copy trading, research and study how it works and its risks and perks. When you’re ready, dive in and prioritise top-level discipline. Stick to specific rules, ensure your portfolio is diversified at all times, and regularly monitor your investments.

What Assets Can You Use for Copy Trading

Numerous assets are traded daily in financial markets. Fortunately, it is possible to engage with most of them while copy trading. But when it’s all said and done, everything boils down to the broker you choose. While testing the platforms I’ve recommended here, I discovered their copy trading offers cover most common securities, including forex pairs, stock CFDs, commodities, and crypto CFDs.

Read about the crypto apps in UK and the best ECN brokers in our other guides.

Social Trading Vs Copy Trading

Social trading and copy trading are often used interchangeably, but here’s what sets the two apart. A social trading platform mainly allows traders and investors to connect and share ideas. I consider it ideal for beginners who want to learn from experts, but professionals can also discuss the markets and share crucial tips here. On the other hand, in copy trading platforms, traders copy each other’s strategies either manually or automatically.

Learn about best share dealing platform in the UK and how to trade options in the UK in our other article.

Some Final Tips Before You Start Copy Trading

I’ve listed some useful tips that can help you get started with copy trading below. They are definitely aimed at beginners, but even more experienced traders who are trying out copy trading for the first time can probably find some use in them.

Research every trader thoroughly before copying their trades. Check all crucial factors, including win/loss ratio, trade frequency, and drawdown levels.

Keep a close eye on all positions, even while copying the most successful traders on your chosen platform. Remember that the traders you are copying are human too, and their decisions aren’t foolproof.

Start small, especially if this is your first time copying a specific guru. You can increase your investment after ascertaining the trader’s performance.

FAQs

Absolutely. Copy trading is a practical means of potentially increasing your chance of earning profits. Just note that we say potentially because there are no guarantees in online trading regardless of which platforms or tools you use.

In short, copy trading is an efficient way of limiting the amount of time that you have to spend keeping track of your positions or potential trades. It is not a way to improve your profits or completely stop trading and analyzing markets. In order for copy trading to work as good as possible, you still have to put the time into setting the right parameters for your copy trading platform.

Because of this, we kindly ask you to learn how to copy trading actually works and the risks it carries before engaging in it. This way, you will improve your chances of using a copy trading broker in the most efficient way possible.

Yes, you can make money from any form of trading. However, there are also always risks involved and when there is profit to be made, there are also losses to be had. This is why it is extremely important that you learn the ins and outs of online trading and copy trading before you get started.

Also, since you will be imitating the trades of expert investors, you will make money only when they execute successful trades. And even the most experienced traders lose money on some trades.

*Up to 80% of all retail traders lose money in the long run, even when using copy trading platforms.

Copy trading is a form of trading that allows you to imitate the trades of professional investors. It is an advantage to novice investors who are still familiarising themselves with the trading markets.

By copying another, more experienced trader, you can limit the amount of time you need to spend analysing assets and markets. In many ways, this makes trading easier, especially for beginners. However, it does not guarantee that you will make profits since there are never any guarantees in online trading and investing.

In addition, copy trading is a great way to learn how to trade since you can follow the strategies and plans of another trader with more experience.

Yes. Copy trading is legal in most countries across the world, including the UK. Note that you can only copy trade on brokers that are licensed and regulated by tier-one authorities, including the Financial Conduct Authority (FCA).

Please ensure that you know the applicable trading rules in the country and/or jurisdiction where you reside before you start trading. For example, what qualifies as a “legal online broker”, which type of tools are you allowed to use to analyse markets, and what are your obligations to pay taxes on your profits? All of this is your responsibility.

Copy trading allows you to mimic the trades of expert traders automatically. On the other hand, social trading lets you interact with other traders and share trading ideas and strategies to improve your trading activities. When it comes to mirror trading, it slightly differs from copy trading by allowing you to copy trades executed by automated trading and signal services. It is best suited for advanced investors.

Yes, copy trading is good for beginners because it doesn’t require extensive market knowledge or expertise.

Yes, copy trading is profitable, but it doesn’t guarantee nonstop returns and is definitely not a get-rich-quick scheme.

Copy trading isn’t inherently the same as forex because, besides currency pairs, it also covers other assets, like commodities and stocks.

Conclusion

Novice traders in the UK should note that copy trading is not a sure-fire way to make profits. You need to learn how to strategise, manage your trading activities, and choose a suitable broker for your trading requirements. We advise you to consider our recommended brokers that have been tested and proven to deliver the best service there is.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I think you should add Avatrade to the list. They offer really great copy trading opportunities, don't they?

AvaTrade does offer a great selection of platforms and copy trading features. However, its selection of assets is rather limited, thus AvaTrade did not qualify for this specific guide.

With that being said, we have recommended AvaTrade in several other articles and guides, including in “The Best Automated Trading Platforms”

eToro has been my choice for copy trading, and it's been fantastic. The platform is incredibly user-friendly. The platform's supportive community make it a standout choice for anyone entering the world of copy trading. I'm really satisfied with my experience on eToro.

I wanted to find out if copy trading is legal and if it's possible to make money with it. I found the answers to these questions. I learned that copy trading is completely legal and can be an effective tool for earning, especially for beginners. I was also pleased to see that the article emphasizes the importance of discipline and independent analysis even when using copy trading. Thanks for the clear and helpful guide!

AvaTrade’s new AvaSocial app looks interesting. I believe it has potential.

As someone who's dabbled in copy trading myself, I really appreciate how this reviewer breaks down the platforms by user type rather than just declaring one "best overall"