The cryptocurrency market is ever-changing, requiring brokers that combine stability with adaptability. For UK traders, finding a platform that keeps pace with this evolution while maintaining rigorous standards is paramount.

After months of hands-on testing and comparative analysis, I’ve identified the brokers that truly stand out in 2026. This guide cuts through the noise, focusing on what matters most: security, efficiency, and transparency in your trading experience.

Essence

- UK cryptocurrency traders should choose FCA-regulated brokers for maximum safety.

- Choosing a cryptocurrency investment broker that fits individual needs is crucial for an exciting experience.

- User opinions offer insights into platform reliability, thus influencing the best decision-making.

- As TradingGuide experts, we conduct extensive research to recommend credible and suitable crypto brokers.

- The cryptocurrency market is highly volatile, meaning trading the tokens comes with significant risks.

- Practice crypto trading with demo accounts provided by brokers before risking real capital.

List of the Best Cryptocurrency Brokers in the UK

- Capital.com – Best For Mobile Trading

- eToro – Overall Best*

- Pepperstone – Leading Broker With MetaTrader Platforms

- Spreadex – Best for Spread Betting

- XTB – Top Option With No Minimum Deposit Requirement

- Coinbase – Top Option With Numerous Asset Offerings

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How We Choose Crypto Brokers

At TradingGuide, my team and I personally test and review cryptocurrency brokers in the UK to provide accurate, data-driven, and unbiased recommendations. Our process ensures that every platform meets high security, usability, and performance standards.

As a trader who has worked with top financial companies in the UK, I start by identifying as many brokers as possible. My priority is always on FCA regulation, encryption technology, and investor protection to keep your funds secure. Given that over 12% of UK adults now own cryptocurrency, security remains a key concern.

After shortlisting potential platforms, I sign up for demo accounts to test features like execution speed, fees, and trading tools firsthand. I then compare my findings with user reviews on Trustpilot, Google Play, and the App Store. Only those with many positive reviews are shortlisted for the final choice.

Compare Best Crypto Brokers in the UK

I’ve carefully tested and reviewed multiple cryptocurrency brokers in the UK to bring you the best options. Below, you’ll find a detailed comparison table highlighting their key features. I believe this will help you confidently choose the right platform.

| Crypto Brokers | Licence | Minimum Deposit | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|---|

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | £20 | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes |

| eToro | FCA, MAS, CySEC, FSCA, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | £50 | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | £0 | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple Pay, Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer | Yes |

| Spreadex | FCA | £0 | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank Transfer, Neteller, Apple/Google Pay | No |

| XTB | CIRO, FCA, CNMV, KNF | £0 | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, e-wallets, Bank transfers | Yes |

| Coinbase | BitLicense from the NY Department of Financial Services | $2 | 24/7 | – | Debit Card, PayPal, Wire Transfer, SEPA Transfer | – |

Brief Overview of Our Recommended Cryptocurrency Brokers’ Fees

I always believe that affordability matters when choosing a cryptocurrency broker. Fees can eat into your profits, so it is advisable to settle for a broker with costs that fit your budget. Also, traders must check the listed instruments to ensure they settle with brokers hosting the right tools.

In this regard, I share below tables with crypto brokers’ fee structure and asset offerings summary for informed decisions.

Fees

| Cryptocurrency Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| eToro | From 2 pips | £50 | $5 withdrawal | $10 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

| Coinbase | From $0.99 | From £1 | 1% | Free |

Our Opinion & Overview of the Best Cryptocurrency Brokers

Never randomly select a broker without conducting the necessary due diligence. Do you know its charges? What assets does it list? Is the support team reliable? My mini-reviews below will help you answer these questions and more for informed decisions.

1. Capital.com – Best For Mobile Trading

Capital.com’s mobile platform stands out, and many users highly rate it on Google Play, the App Store, and Trustpilot. While testing it, I found the app fast, responsive, and intuitive, making it easy to trade Bitcoin, Ethereum, and additional 400+ cryptocurrencies directly from a smartphone or tablet. The best part is that prices update in real time, and trades are commission-free with low spreads, starting from 0.0 pips.

Capital.com’s trading app also comes loaded with advanced features. I particularly liked the advanced charting tools, price alerts, and risk-management options like trailing stops. They make it easier to react to crypto’s notorious volatility. Plus, setting up watchlists and tracking multiple markets at once was straightforward. Its interface never felt cluttered, even during busy trading sessions.

Accessibility is another strong point. The minimum deposit required to get started is only £20. Deposits and withdrawals are also free across various multiple payment methods. For more advanced strategies, Capital.com also connects to MT4 and TradingView. On the learning side, the broker delivers quality resources, including guides, articles, and an Investmate app. These proved very handy for building confidence while learning the nuances of crypto CFD trading.

- Fast, intuitive mobile trading app for cryptocurrencies

- Commission-free trades with competitive spreads

- £20 minimum deposit and free deposits/withdrawals

- Advanced charting, alerts, and risk-management tools

- MT4 and TradingView integration for experienced traders

- CFDs only, so no direct crypto ownership

- No copy trading

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

2. eToro – Overall Best*

My experience with eToro has been nothing short of impressive. After testing it thoroughly, I found it to be the top crypto broker for all types of traders. It offers 100+ cryptocurrencies and the option to invest in crypto shares. This gives traders a wide variety of choices.

One of the things I appreciate about eToro is its transparency with its fee structure. There are only spreads as charges, with no hidden fees. Plus, the low £100 minimum deposit makes it easy to start trading without a large upfront investment. I also like the broker’s user-friendly interface, combined with advanced analysis tools and social trading features. They made my trading experience even more engaging.

For newcomers, eToro’s demo account is a great feature. It allows you to practice with no risk involved. On top of that, I find its support team reliable and responsive via all the supported channels.

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

- 0% commission on crypto trading

- CopyTrader platform

- Regulated by tier-one authorities, including the UK’s FCA

- Various cryptocurrencies are available

- Limited educational and research tools

- Does not feature third-party platforms like MT4, MT5, etc

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

3. Pepperstone – Leading Broker With MetaTrader Platforms

Pepperstone earns its place among the best cryptocurrency brokers in the UK thanks to its strong focus on advanced trading technology and a wide range of supported platforms. While crypto trading is reserved for professional clients, the broker still delivers one of the most impressive setups for anyone who relies on MetaTrader tools for fast execution and algorithmic strategies.

You can choose between MT4 and MT5. Both are fully integrated with Pepperstone’s deep liquidity, rapid execution from around 50 milliseconds, and access to Smart Trader tools such as correlation matrices, trade terminals, and advanced indicators. Note that this broker has no minimum deposit requirement, but professional traders must meet eligibility requirements to qualify for the Pro account.

Beyond MetaTrader, Pepperstone also connects to TradingView and cTrader, making it ideal for traders who prefer charting-heavy strategies or algorithmic setups through cTrader Automate or API integrations. And when it comes to asset offerings, you have access to 2,700+ CFDs and spread betting markets, including forex, shares, indices, commodities, ETFs, and more.

- No minimum deposit requirement for UK clients

- Ultra-fast execution and tight pricing

- Lists 2,700+ CFD and spread betting assets for diversification

- Low trading fees from 0.0 pips on its Razor account

- Features API and algo trading capabilities on the MT4 and MT5 platforms

- Crypto trading is only for professional clients

- No buying and taking ownership of the featured securities

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

4. Spreadex – Best for Spread Betting

When I tested Spreadex’s crypto trading platforms, the pricing stood out immediately. Crypto trading starts from a 40-point spread, which is extremely competitive for a platform built around spread betting rather than direct crypto ownership. There’s also no minimum deposit, so you can start small without feeling pressured to commit large amounts upfront.

Spreadex offers access to the major cryptocurrencies, including Bitcoin, Bitcoin Cash, Litecoin, Ripple and Ether. I find this list to be shorter than what you’ll find on pure crypto exchanges. The best part is that it lists an additional 10,000+ assets for portfolio diversification. These include forex, shares, commodities, indices, and more.

The platform itself is fast, stable and easy to customise on both mobile and desktop. Features like pattern recognition, pro trend lines, automated charting tools, and trade via charts made it easier for me to react quickly during periods of crypto volatility. I also like its TradingView platform, which offers additional features like social trading. Add in 24/7 customer support and clear pricing, and Spreadex becomes a strong pick for traders prioritising crypto spread betting.

- Competitive spreads, starting from 40 points on Bitcoin

- No minimum deposit requirement for UK clients

- Excellent for crypto spread betting with 10,000+ extra markets

- Strong charting tools, including pattern recognition and pro trend lines

- Quality learning materials and a professional support service team

- Limited crypto selection compared with major exchanges

- No demo account

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

5. XTB – Top Option With No Minimum Deposit Requirement

After putting XTB to the test, I can confidently say it’s one of the top crypto brokers in the UK. It supports over 10 digital assets, including Bitcoin, Ethereum, and Litecoin. So, whether you’re a beginner or a seasoned trader, there’s something for you.

What really stands out is its xStation 5 and xStation Mobile platforms. They come loaded with smart research tools, making technical and fundamental analysis effortless. Plus, unlike many brokers, XTB has no minimum deposit, giving you the freedom to start trading on your own terms.

Another perk? You can earn interest on uninvested funds. These include 3.8% for EUR and 5.0% for USD. That’s extra cash in your pocket, even when you’re not actively trading.

- A user-friendly and intuitive design crypto platform

- No minimum deposit requirement

- Fast trade execution speed

- Great research materials

- Crypto trading costs can be high for low-budget traders

- A £10 monthly inactivity fee applies after 12 months of no account activity

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

You can read about “Best Crypto apps in the UK” in our article

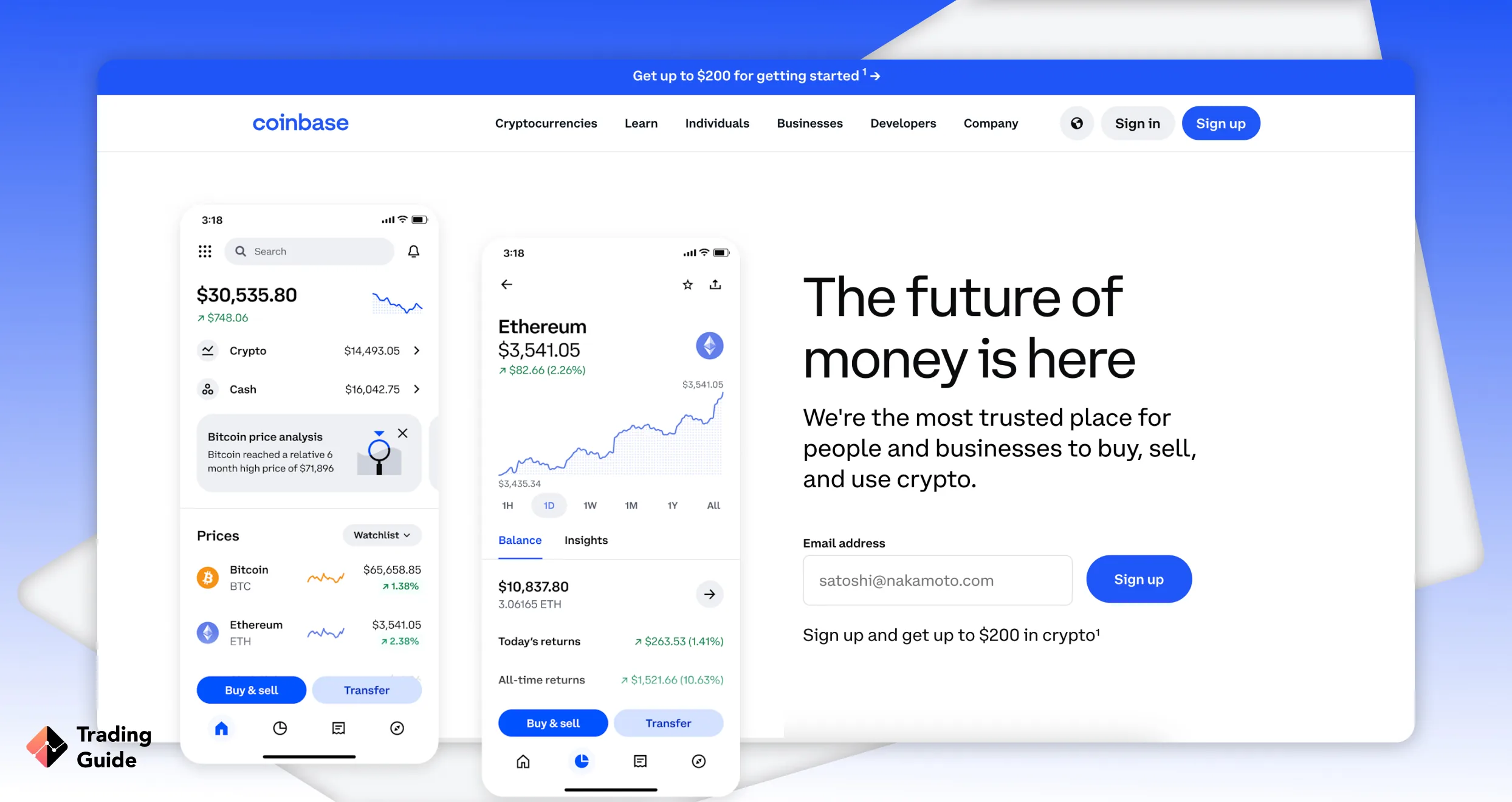

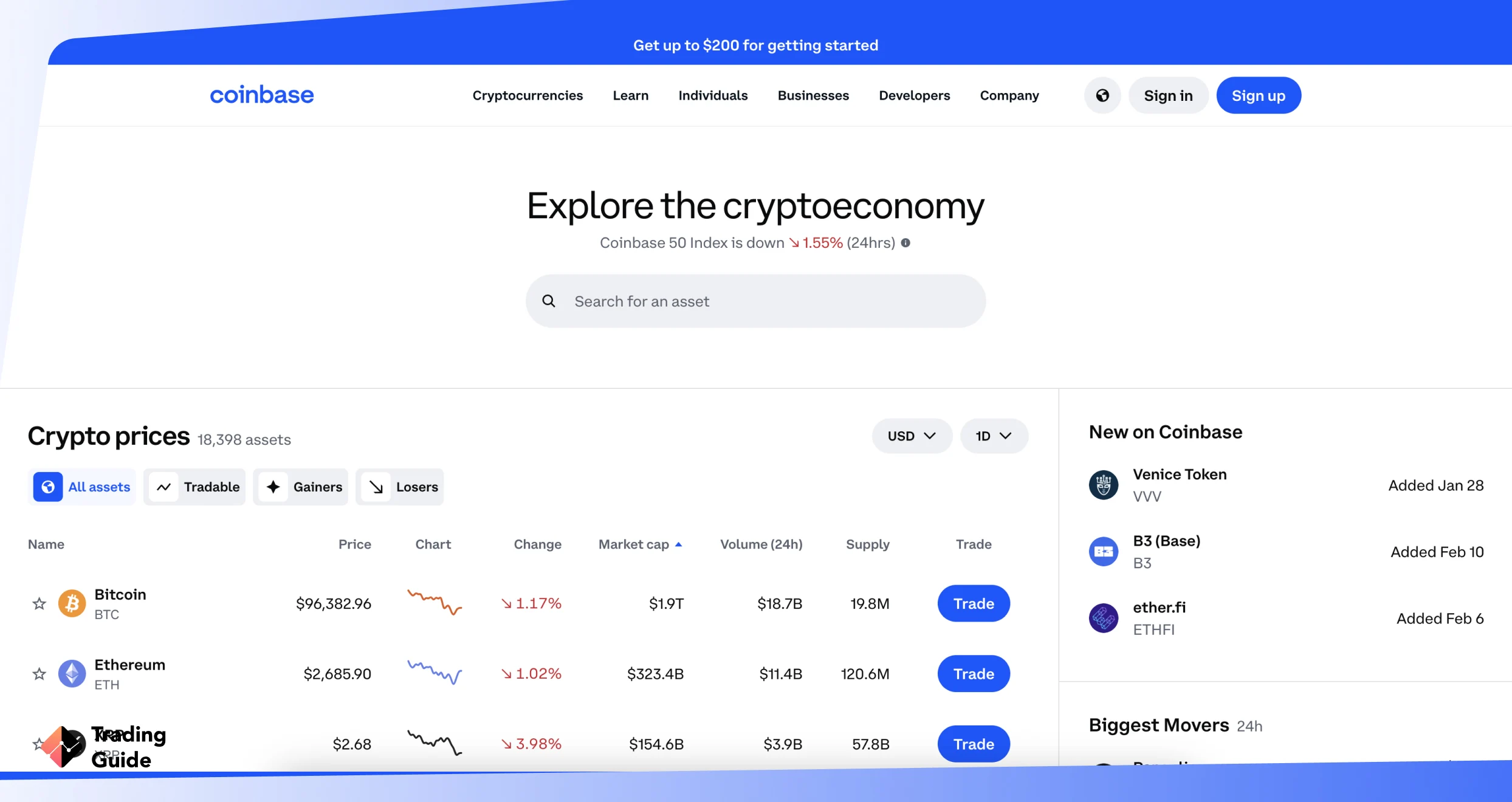

6. Coinbase – Top Option With Numerous Asset Offerings

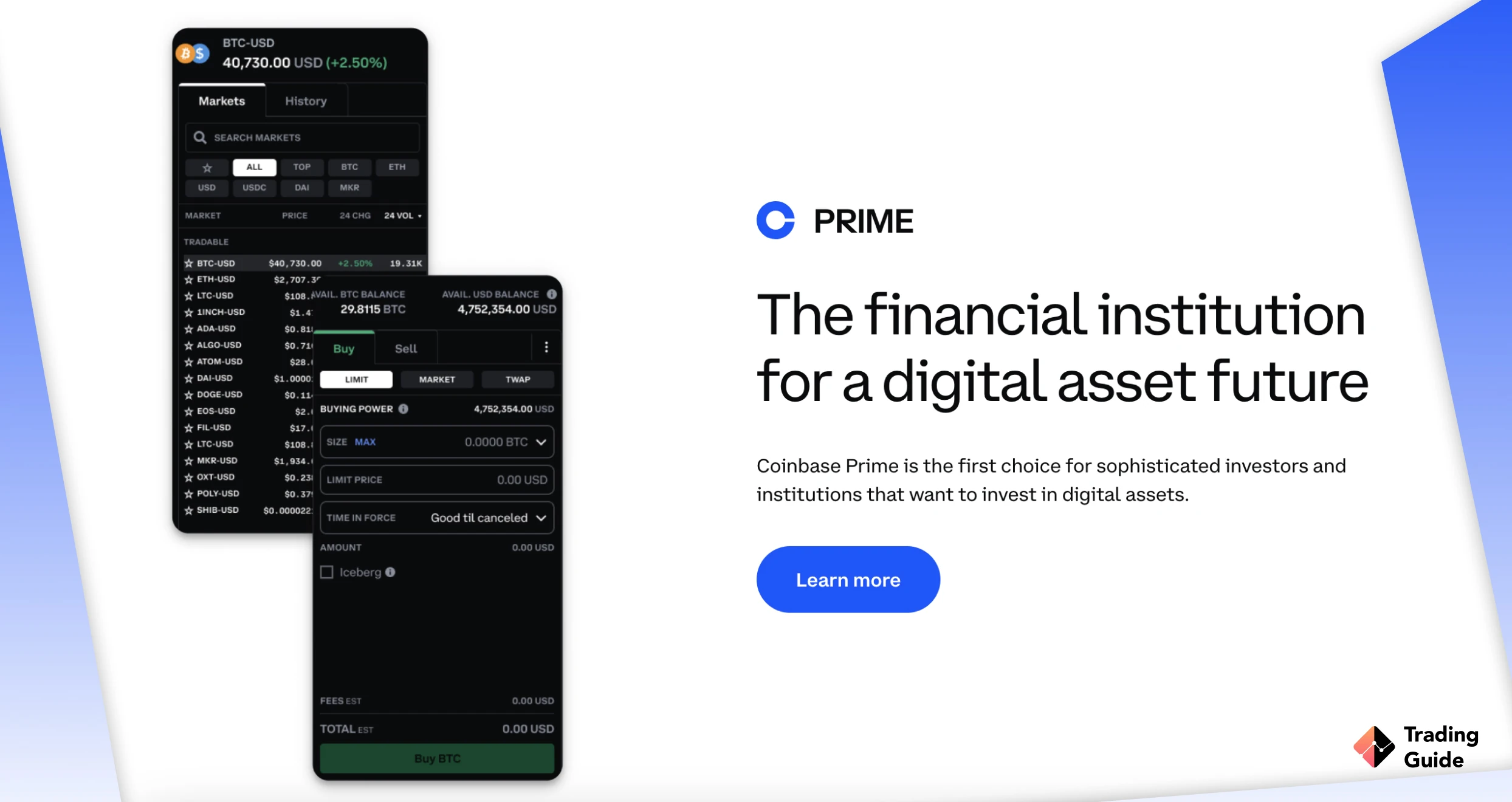

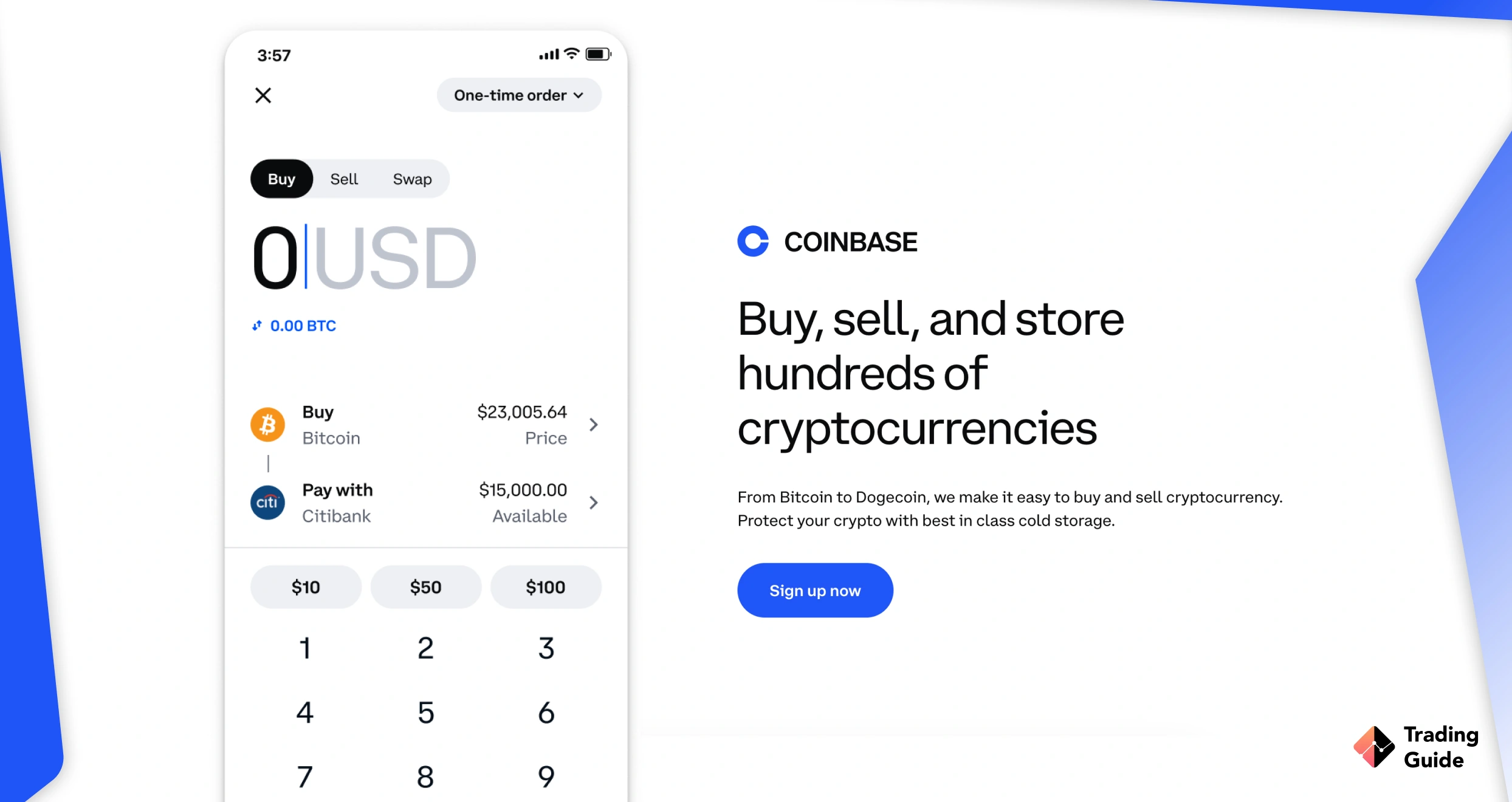

Coinbase has been in the cryptocurrency space for over a decade and continues to deliver the best trading services for users in the UK and globally. I rank it the best in this category since it lists over 200 digital tokens, including Bitcoin, Ethereum, Litecoin, Ripple, and more. Moreover, I like that this broker allows its users to get started with as little as £2 — an element that attracts budget-conscious cryptocurrency traders.

Besides desktop, Coinbase has a user-friendly and reliable trading app you can download from Google Play or the App Store to manage your crypto trades on the go. And although it doesn’t have numerous learning resources, rest assured of quality trading tools. These include risk management resources and charts powered by TradingView. Spot crypto enthusiasts can also explore the broker’s “Coinbase One” section, which comes with exclusive benefits for only £19.99/month.

- Lists more than 200 cryptocurrencies

- Fast trade execution speed on both desktop and mobile devices

- Allows users to buy, sell, and trade cryptocurrencies

- You can get started with as little as £2

- You can only use Coinbase to trade crypto tokens. It does not host other asset classes

- You get to pay more for lower balances

| Type | Fee |

| Minimum deposit | $2 |

| Transaction fee | 1% |

| Credit transactions | 2% |

| Inactivity fee | Free |

| Maker fee | Yes |

| Taker fee | Yes |

The Ultimate Guide About Crypto Trading Online

Venturing into cryptocurrency demands a mix of knowledge, strategic thinking, and well-informed choices. If you have chosen a broker from my list of recommendations but do not know how to get started, keep reading to discover more.

What Is Cryptocurrency Trading?

Cryptocurrency trading involves buying, selling, and exchanging digital currencies through online platforms. Unlike traditional financial markets, the cryptocurrency market operates 24/7, allowing traders to engage at any time.

There are two primary methods of cryptocurrency trading, including spot and derivatives trading. Spot trading means purchasing and selling actual digital currencies. You can also store them in a digital wallet. In derivatives trading, traders get to speculate on the price movements of cryptocurrencies. This is without owning the underlying assets.

Overall, there are over 2.4 million cryptocurrencies in the market. This is with a total global market capitalisation of $2.67 trillion, per CoinMarketCap data. These digital tokens continue to gain popularity, thus attracting global investors looking to benefit from the financial landscape.

How to Start Crypto Trading?

Stepping into the world of crypto trading is akin to setting sail on a captivating voyage. Here’s your compass for navigating the initial stages:

The cryptocurrency market is growing, primarily due to potential profits that come with it. Besides choosing the best broker, you must be strategic and understand the crucial steps to getting started. Since I have years of experience in this field, I believe my guidance below will put you on the right path.

If you haven’t selected a suitable crypto broker, refer to our list above. Then, visit your broker’s official website to understand the applicable terms of service. You can also install its trading app on your mobile device. This will ensure you continue managing your activities even when you step away from your trading station.

On your broker’s website homepage, click the Join Now, Register, or Sign Up button to register a trading account. You will be required to share some of your personal details for this procedure. These include your name, email, phone number, source of income, and more.

Any FCA-regulated crypto broker like the ones we recommend will engage you in an account verification procedure. It is a standard protocol laid down by the FCA to secure the UK’s online financial landscape. You will share copies of your government-issued ID and utility bill as proof of identity and location. Some cryptocurrency trading brokers will also accept copies of your passport and bank statement.

Once the verification process is complete, you will receive an email notification from your broker. At this point, you can make a deposit per its requirement and access the featured cryptocurrencies to explore. The good news is that our recommended crypto brokers above have flexible payment methods. These include credit/debit cards, e-wallets, and bank transfers.

As a beginner, start by familiarising yourself with your broker’s features and offerings. Sign up for a demo account and gauge your skill level with an underlying crypto before risking your real money in live trading. And once you are ready to take a risk in this market, ensure you choose a trade size and apply risk management controls like stop-loss and take-profit orders. Most importantly, track your open positions to ensure everything works out as expected.

Note: Cryptocurrency investing/trading involves risks due to market volatility. Therefore, it’s advisable to approach trading with caution and continuous learning. Many accounts lose money when trading cryptocurrency CFDs due to leverage. Therefore, stay informed about market developments and explore different strategies. You should also consider seeking advice from experienced traders or financial professionals when needed.

How to Choose the Best Crypto Broker in the UK

The best cryptocurrency brokers in the UK are challenging to find, and that is why we have recommended the top brokers to choose from. If our recommendations don’t suit your needs and you need to conduct further research, below and the main factors to consider.

It is only legal for you to trade cryptocurrency if you use a licensed and regulated broker by world-class authorities, such as the Financial Conduct Authority (FCA). The more licenses a broker holds, the better for proving their credibility.

If you are a beginner, we advise you to choose a broker that offers plenty of cryptocurrency instruments to invest in. This is so that you have different instruments to try before making a final choice.

The best broker to trade cryptocurrency should be backed up with a reliable, user-friendly, and intuitive design platform. It should execute trades fast and be supported on mobile devices so that even when you are not close to your desktop, you can still keep track of your trading activities.

You are likely to incur spread charges from a broker offering cryptocurrency CFD trading. These spread charges vary, and so, we advise you to confirm your investment capital before diving straight in.

It’s good to have a cryptocurrency broker in the UK with reliable and responsive customer service. Note that some of these services are available five days a week. However, it doesn’t mean that they are not responsive and reliable during their working days. So, choose depending on your trading needs and availability.

List of Most Popular Cryptocurrencies to Trade in 2026

When considering trading cryptocurrencies, exploring the most popular options can be a prudent start. In recent times, the following cryptocurrencies have consistently garnered attention in the trading sphere. The good news is that our best crypto brokers UK above lists them, thus making it easier for you to place your trades.

- Bitcoin (BTC): Known as the pioneering cryptocurrency, Bitcoin remains the market leader and is often considered a benchmark for the entire crypto market.

- Ethereum (ETH): With its versatile blockchain allowing for smart contracts and decentralised applications (dApps), Ethereum stands as a significant player in the crypto world.

- Ripple (XRP): Designed for quick and cost-efficient cross-border transactions, Ripple’s XRP continues to draw interest from financial institutions.

- Litecoin (LTC): Often dubbed as the ‘silver to Bitcoin’s gold,’ Litecoin focuses on faster transaction times and lower fees compared to Bitcoin.

- Tether (USDT): Tether is a stable coin backed up by fiat currencies, including the euro, dollar, and pound. This makes its value to be more consistent, thus making it a potentially lucrative asset.

- Binance Coin (BNB): This asset is used for trading and transacting on Binance, a popular cryptocurrency exchange. It can also be exchanged for other cryptos, such as Bitcoin and Ethereum.

- Solana (SOL): Gaining attention for its fast and scalable blockchain, Solana focuses on high throughput for decentralised apps and crypto projects.

- Dogecoin (DOGE): This token was initially created as a joke and has since skyrocketed in popularity and value over the years, making it a popular choice for traders.

Tax on Cryptocurrency in the UK

In the UK, His Majesty’s Revenue Services (HMRC) categorises cryptocurrencies as property, not currency. This means that crypto assets are treated like traditional investments, with their profits subjected to taxation. As a UK-based investor, expect potential liabilities for capital gains and income tax.

Capital gains tax is applicable upon selling or disposing of crypto assets, levying tax on profits garnered. This covers sales, swaps, spending on goods or services, gifting, or converting to fiat currency. For instance, if you earn a total income of less than £50,270, you will pay 10% on crypto gains. However, for income exceeding £50,270, you will pay 20% on crypto gains.

Note that the exempt amount was reduced to £3,000 in April 2024 and will remain the same throughout 2026. Ensure you stay informed about HMRC updates for accurate tax compliance in the ever-evolving crypto landscape.

What is the Difference Between A Broker And An Exchange?

Cryptocurrency transactions primarily occur through brokers or crypto exchanges, both serving as platforms for buying and selling digital assets. While these options may appear similar, they bear significant differences crucial for selecting the right fit.

Brokers act as intermediaries executing trades on behalf of clients, connecting them to the market. They purchase cryptocurrencies from exchanges in bulk and resell them to traders, offering various tools like technical analysis charts and trade order options.

On the other hand, crypto exchanges facilitate direct transactions among buyers and sellers. Traders engage directly with others in the exchange ecosystem, selecting assets, setting trade parameters, and even using automatic buy or sell orders.

Ways to Buy and Sell Cryptocurrencies

There are multiple secure ways to buy and sell cryptocurrencies in the UK. You can use brokers like eToro and XTB that act as intermediaries, offering a regulated and secure platform for transactions. They are ideal for investors seeking portfolio diversification across various assets, including forex and stocks. The best element about buying and selling cryptos using brokers is that you are guaranteed security in transactions. Simply ensure your broker is licensed by top-tier authorities like the FCA for peace of mind.

Another way to buy and sell cryptocurrencies is via crypto exchanges. For instance, Coinbase and Crypto.com provide direct trading with buyers and sellers, typically at lower fees than brokers. They also list a wide range of tokens, allowing investors to explore diverse opportunities in the crypto market.

Crypto Trading Risk Management

When engaging with cryptocurrencies, it’s crucial to recognise that these digital assets are characterised by their extreme volatility and speculative nature. This can result in swift and substantial price fluctuations. To safeguard your crypto holdings, it is imperative to utilise reputable wallets and exchanges, prioritising the security of your investments.

Also, exercise vigilance and due diligence to guard against crypto-related scams and fraudulent schemes that can potentially threaten your financial well-being. You can also spread your investments across multiple digital tokens and avoid making decisions based on emotions.

Managing risks in crypto trading is vital due to the market’s inherent volatility and constant activity. The round-the-clock nature and unpredictable price fluctuations pose unique challenges, making effective risk management essential.

To safeguard your investments, never invest more than you can afford to lose. This is especially if you are new to crypto trading. Plus, consider assessing the risk/reward ratio before initiating any trade. Trades with a higher risk/reward ratio offer the potential for greater profits relative to the risk undertaken.

Traders and investors must also apply stop-loss or take-profit orders in crypto trading as a risk mitigation strategy. Moreover, diversification across various cryptocurrencies can mitigate risks associated with individual asset volatility.

Pros & Cons of Using Cryptocurrency Brokers

Before venturing into the cryptocurrency space using a brokerage firm, understanding the applicable pros and cons will aid your decision making. Here’s what you need to know.

- It’s easy to deposit and withdraw funds

- Brokers are more secure since they are typically regulated by financial authorities

- Bigger liquidity than exchanges

- Offer market analysis tools and research materials

- Often have better customer service

- Some brokers charge higher fees or spreads than an exchange, thus making the end price less favourable

- Brokers typically list fewer cryptos than exchanges

Read about Best Crypto Wallets in the UK 2026 in our guide in order to choose a wallet to store your cryptocurrency.

FAQs

Starting Bitcoin trading as a beginner requires extensive knowledge about Bitcoin and how it works. You must also understand the trading method you want to use, whether buying Bitcoin and taking ownership, trading as CFDs, or investing in its shares.

The cheapest cryptocurrency to buy in 2026 is Shiba Inu, which is currently priced at less than £1. However, before investing in this cryptocurrency, understand the risk it carries and whether it has growth potential in the future.

No. Cryptocurrency is not real money and can not be used as a fiat currency. However, many countries allow it for online transactions, making it an excellent investment asset.

Yes. We have seen many traders become millionaires trading cryptocurrencies. However, becoming successful is not easy, and you need to be strategic and patient. Most importantly, be willing to learn from your mistakes and take advantage of available resources to develop the best trading strategy.

We usually advise newbies to take their time before taking the plunge into the live markets. Fortunately, many brokers, including our recommended ones above, have demo accounts that you take advantage of to practice your activities. Once you are ready, start with small amounts of upto £100. With time, you can adjust your investment and potentially enjoy high returns.

The best beginner-friendly crypto broker is eToro, since it hosts numerous learning materials and a CopyTrader platform.

FP Markets is one of the best platforms for professional UK crypto traders.

Conclusion

Navigating the volatile cryptocurrency market poses challenges for UK traders in price determination and investment decisions. Mitigating these challenges involves partnering with FCA-regulated cryptocurrency brokers. These brokers not only secure your funds but also provide robust resources for an enriched trading journey. This ensures efficient position management and fosters independence in your trading endeavours.

Moreover, exploring avenues like crypto copy trading and bots can amplify your trading strategy. Crypto copy trading allows the replication of successful traders’ positions, leveraging their expertise. Meanwhile, utilising crypto trading bots automates and refines your trading decisions, adapting to the dynamic nature of the crypto market. Embracing these tools and regulated platforms can significantly enhance your overall crypto trading experience.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

This article about cryptocurrency is really great! I've figured out how to choose a broker without headaches. Licenses, platforms, no-nonsense issues. And the steps for a beginner are right there on the tray. Top cryptos will also come in handy. Important! And also taxes and viruses - caution does not hurt. I recommend it; it's worth the time to read.

Within the United States, the biggest and most sophisticated financial market in the world, crypto derivatives such as Bitcoin.

Great read! Choosing the right broker is so crucial in the volatile crypto world, and I love how this article breaks it all down.

I've been trading crypto in the UK for a few years now and started with Coinbase because it felt like the safest, most established option – the huge selection of coins was great, but those fees really added up quickly, especially when I was making smaller trades. Eventually I moved most of my active trading to Pepperstone because the MT4 integration and tighter spreads made a massive difference to my P&L, though I had to jump through hoops to qualify as a professional client just to access crypto, which was honestly a pain but worth it for the execution speed and lower costs.