Direct Market Access (DMA) brokers are transforming the trading landscape, offering direct access to exchange order books for improved pricing and execution across futures, options, and CFDs. Yet, navigating the array of DMA brokers requires careful consideration of factors like security, affordability, reliability, and more. To ease this process, we decided to conduct extensive research and compiled below a list of the best DMA brokers in the UK. Our guide also offers invaluable tips to kick-start your trading journey on the right foot.

Essence

- Investing or trading in the financial market using a DMA broker involves taking risks. Therefore, before investing your money, set clear trading objectives and develop a comprehensive trading plan.

- Beginners looking to explore the financial space using DMA brokers should start using demo accounts to test the broker’s performance and gauge their skill level.

- To mitigate the risks of online trading using DMA brokers, use stop-loss and take-profit orders and diversify your trading portfolio across different asset classes.

- The best DMA broker in the UK should be FCA-regulated and meet your trading requirements for maximum experience.

- Keep trading journals to track your performance and identify areas for improvement when participating in DMA trading.

- As professionals in online trading, we thoroughly test hundreds of brokers and only recommend those meeting our specifications.

List of the Best DMA Brokers in the UK 2026

- Pepperstone – Best DMA Broker with the Tight Spreads

- Spreadex – Best DMA Broker for Beginners

- Interactive Brokers – Best DMA Broker for Advanced Traders

- Saxo – Best DMA Broker For Futures Traders

- XTB – Best DMA Broker For Stock Traders

How We Choose DMA Brokers

As professional traders with decades of experience in the financial space, we understand how challenging it can be to select a suitable DMA broker. With hundreds of options out there, the research process can be lengthy and overwhelming. Fortunately, we are here to help by doing all the legwork and only listing the best of the best.

We begin our research process by selecting as many DMA brokers UK as we can, prioritising FCA regulation. This ensures we recommend secure DMA platforms for our readers. We then create trading accounts with these brokers to test their performances and compare their features to select those that meet our criteria.

Our research process doesn’t conclude there. Since we value other traders’ opinions, we analyse what they have to say regarding their experiences with the brokers we shortlist. Therefore, we visit Google Play, the App Store, and Trustpilot to sample hundreds of user comments and overall broker ratings. We then combine our findings with the test results to ensure we remain unbiased and that every trader is guaranteed an option that will maximise their experience.

Compare Best DMA Brokers in the UK

Comparing DMA brokers before selecting the best was not easy as we spent hundreds of hours in this procedure. We considered various elements, including security, reliability, demo accounts, and more. Below, we share a table highlighting some of the features of our top DMA brokers in the UK. We hope the table will give you the insight you need to make the best choice.

| Best DMA Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple Pay, Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer | Yes | Yes (up to £85,000) |

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank transfer, Neteller, Apple Pay & Google Pay | No | Yes (up to £85,000) |

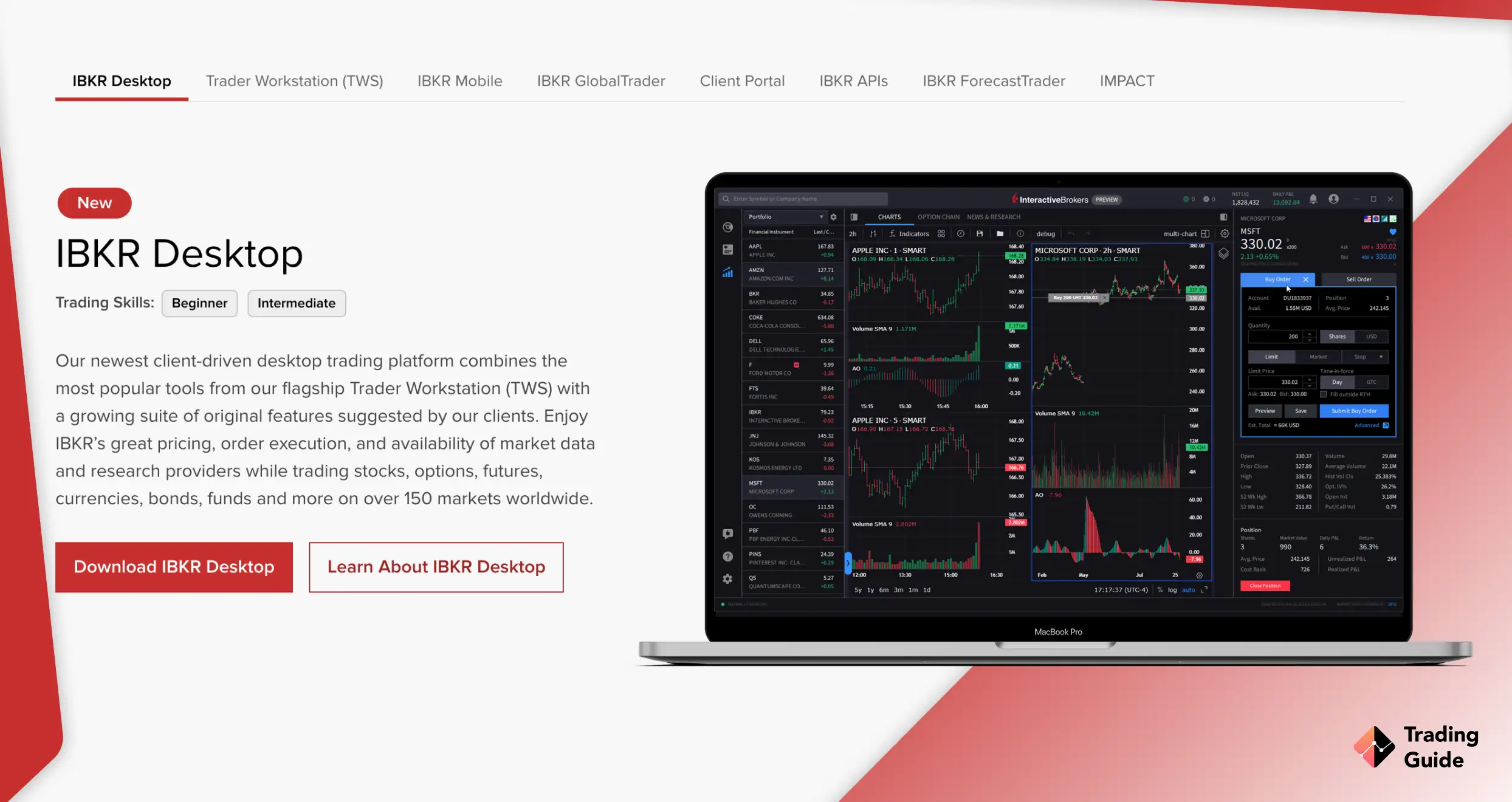

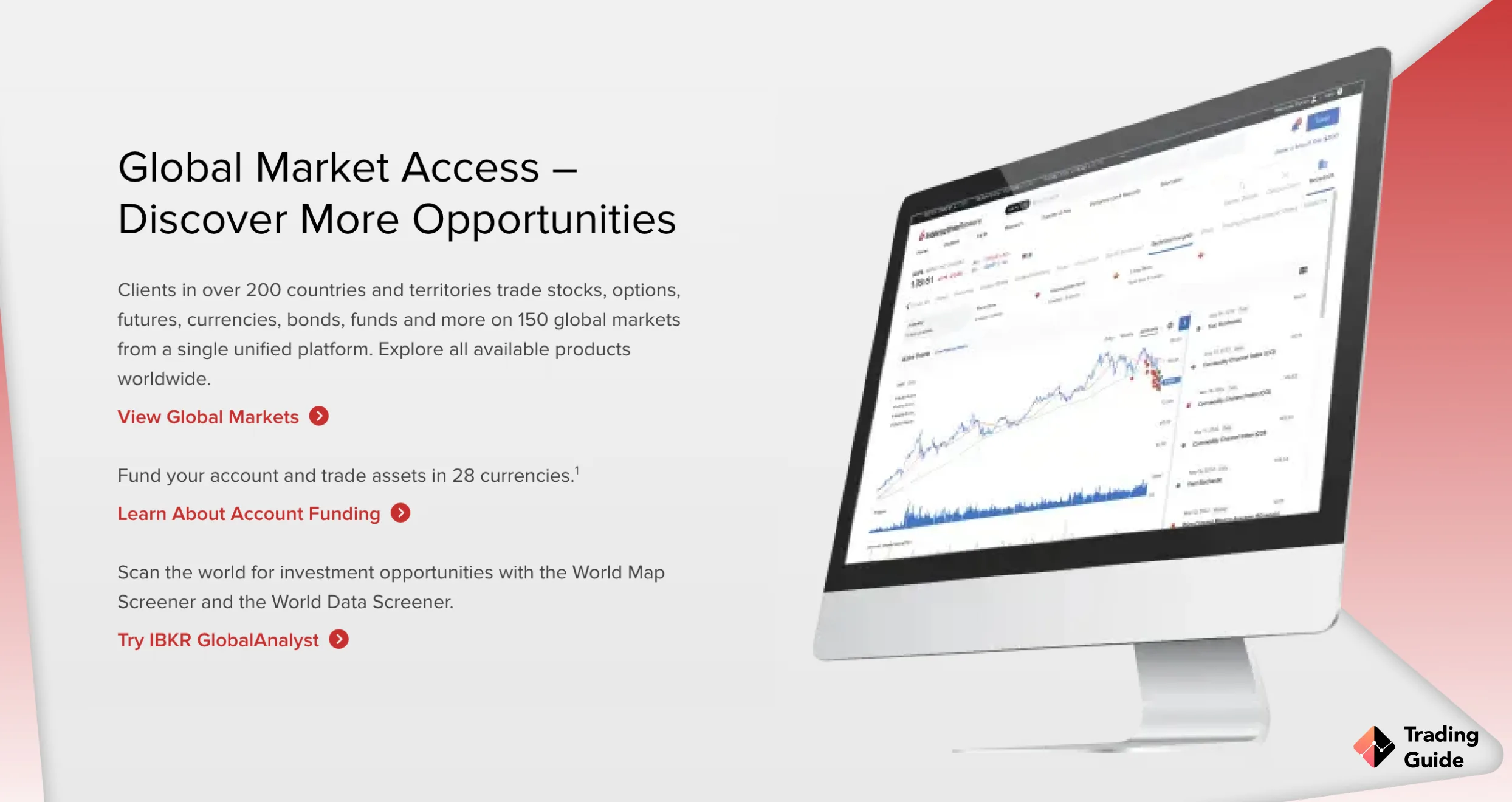

| Interactive Brokers | FCM, CFTC, SEC, FINRA, MAS, ASIC, CBI, FCA, SFC, IIROC/CIRO, NYSE (exchange member), NFA | 24/5 | IBKR Desktop, Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader, Client Portal, IBKR APIs, IMPACT | Bank Wire Transfers, ACH Transfers | Yes | Yes (up to £85,000) |

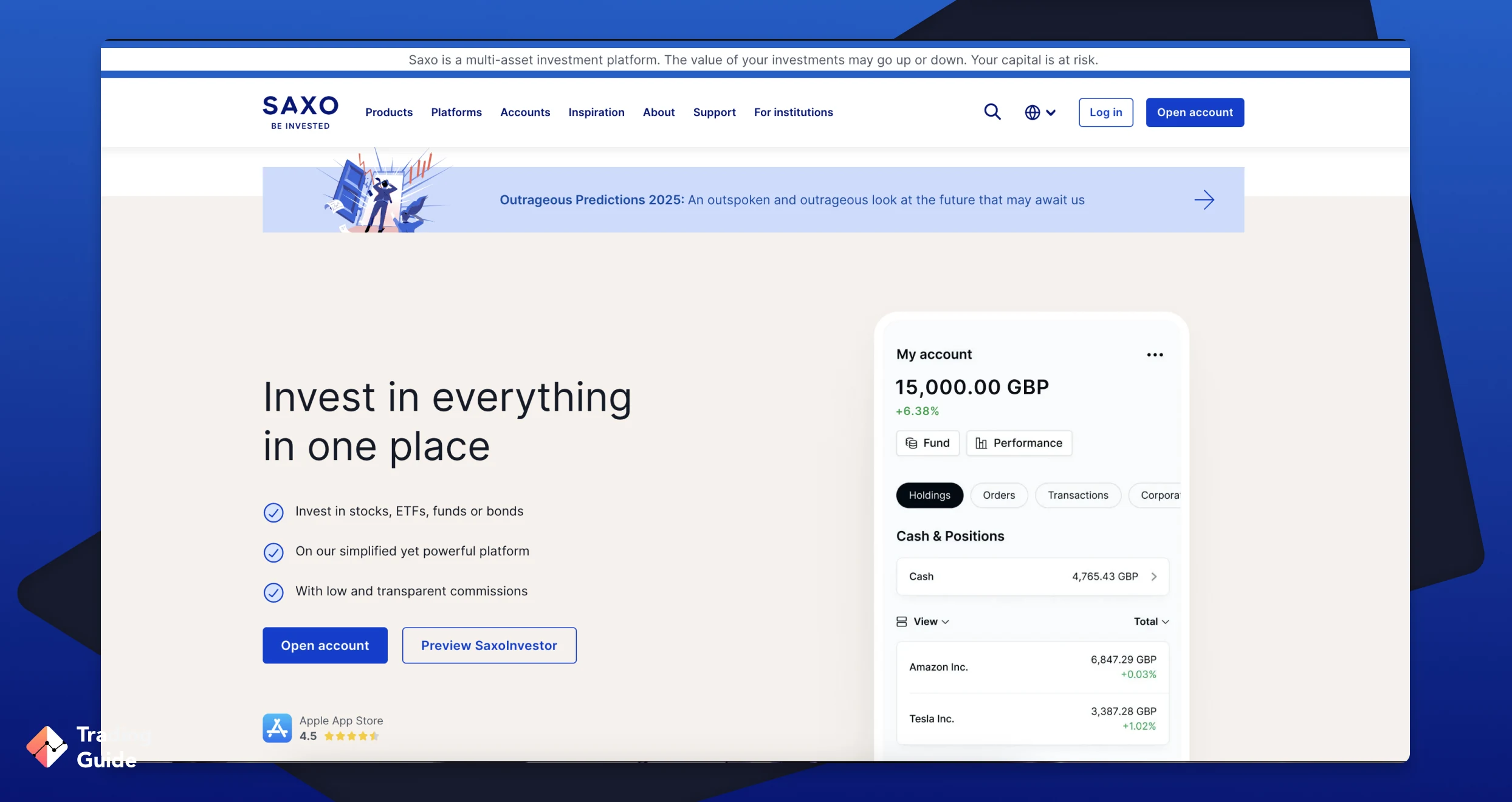

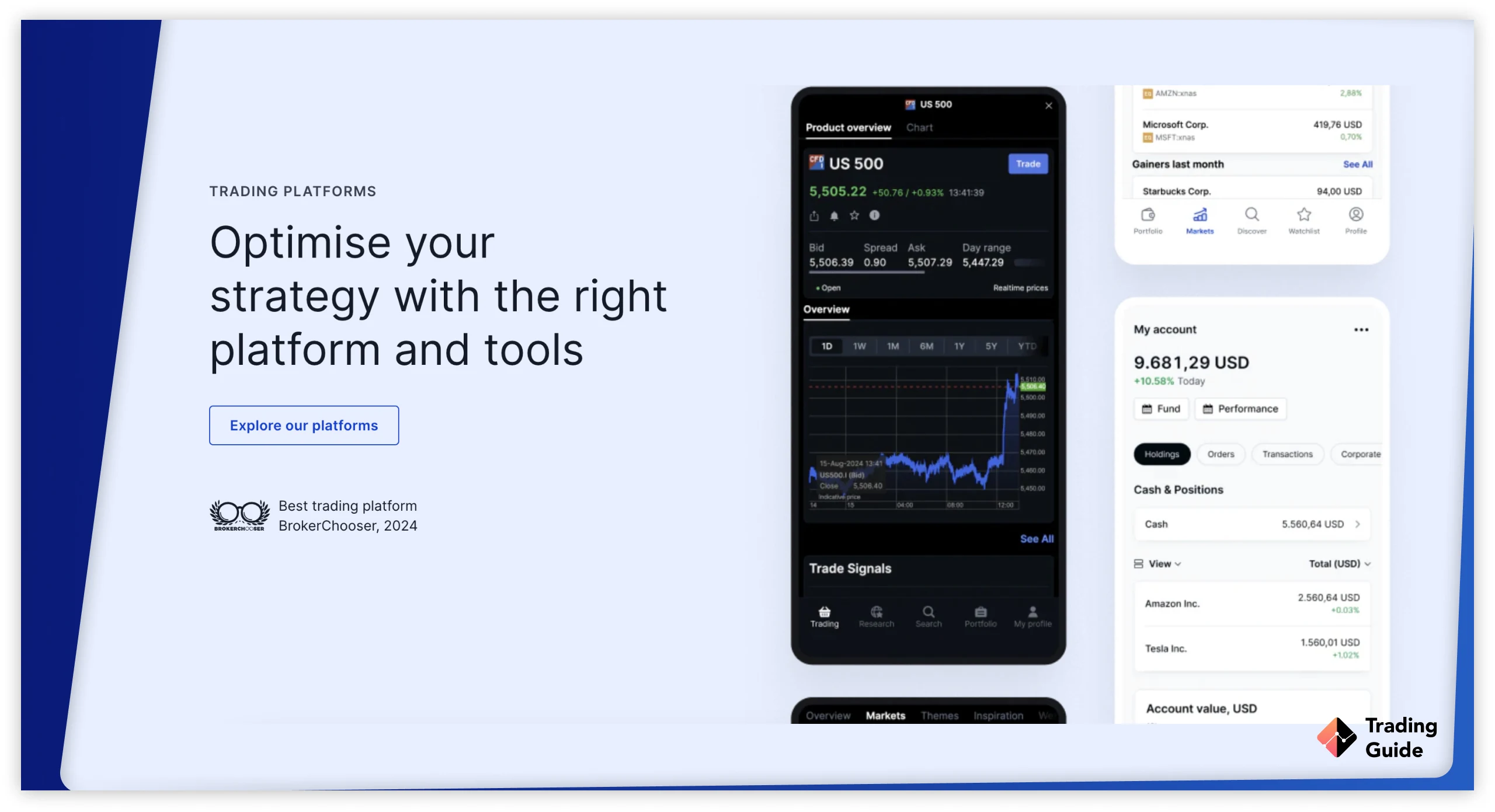

| Saxo | FCA, MAS, FSMA, ASIC, FSA | 24/5 | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO | Bank Transfers | Yes | Yes (up to €100,000) |

| XTB | FCA, FSC, CySEC | 24/5 | xStation 5, xStation Mobile | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal | Yes | Yes (up to £85,000) |

Brief Overview of Our Recommended DMA Brokers’ Fees and Assets

When choosing the best DMA broker in the UK, prioritise your need to identify a suitable option. Among the features you need to consider include the broker’s fees and assets, which we have highlighted in the tables below for informed decisions.

Fees

| Best DMA Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| Interactive Brokers | From $0.01 commission on US stocks | £0 | Free | None |

| Saxo | From £0.02 commission | £0 | Free | £100 monthly |

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

Assets

| Best DMA Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| Interactive Brokers | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best DMA Trading Platforms

As professionals, we always share our experience after testing various brokers, whether in the UK or other global regions. Below are our mini reviews and opinions based on our exploitation with the best DMA brokers in the UK. Our goal is to fully inform you with accurate details that will help in making the best decisions.

1. Pepperstone – Best DMA Broker with the Tight Spreads

Pepperstone is an Australian-based online broker offering CFD, forex and DMA trading, among other things. Their DMA trading platform is award-winning and the broker has made a name for itself for offering tools that suit beginners just as well as experienced traders.

Despite being based in Australia, Pepperstone is hugely popular in the UK as well. And with a broker license from both ASIC (Australian) and the FCA (the UK), you can rest assured that Pepperstone is a safe and reliable DMA broker.

The one thing that makes Pepperstone more exciting than their competitors is that they offer tight spreads on most of the instruments. Therefore, DMA trading with Pepperstone can be much more affordable than with their competitors.

- Fully licensed from Australia to the UK

- One of the best DMA platforms in the industry

- Long experience from the online trading market

- Based in Australia means that it’s more limited than some UK brokers

- The selection of assets could be improved

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

2. Spreadex – Best DMA Broker for Beginners

Most experts agree that DMA trading is not suitable for complete beginners. This is because the strategies used to trade are more advanced, the platforms are typically more complicated than their CFD counterparts, and there is a risk of losing large amounts of funds in a short period of time.

With that being said, thousands of beginners start DMA trading every year and certain brokers are better DMA brokers for beginners than others, more specifically Spreadex.

Spreadex is a simple yet effective broker that offers CFD trading, spread betting, and an impressive DMA service that allows you to place trades directly on the exchange’s order books. In turn, this creates a more “traditional” trading experience compared to electronic derivatives such as spread betting.

- Easy to use for beginners

- Cheap to get started with an to trade with

- Offers several derivatives, from spread betting to CFD trading and DMA access

- Too focused on spread betting for those looking to trade using DMA

- Limited functionality for expert traders

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

3. Interactive Brokers – Best DMA Broker for Advanced Traders

Interactive Brokers (IBKR) is an online broker with over 40 years of experience and customers all across the world. IBRK is fully licensed and has a great reputation in the industry.

Besides a massive selection of CFDs, currency pairs, and stocks, Interactive Brokers offers a great DMA trading platform. With a clear focus on more advanced graphs and analytic tools, it’s obvious that this is the best DMA broker for advanced traders.

- International broker available in most of the Western World

- Works as good for beginners as for professionals

- Expensive to trade with even trading “popular” instruments

- Too many tools and platforms on offer can make trading complicated

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

4. Saxo – Best DMA Broker For Futures Traders

After thorough research of testing and comparing multiple DMA brokers in the UK, Saxo stands out as the best for futures traders. For instance, it lists over 320 futures from global exchanges, covering forex, equity indices, metals, agriculture, and more. We also like the fact that it charges one of the lowest fees for futures trading from as little as $1 per lot. The broker also guarantees quality trading resources, which you can use to trade directly from the charts.

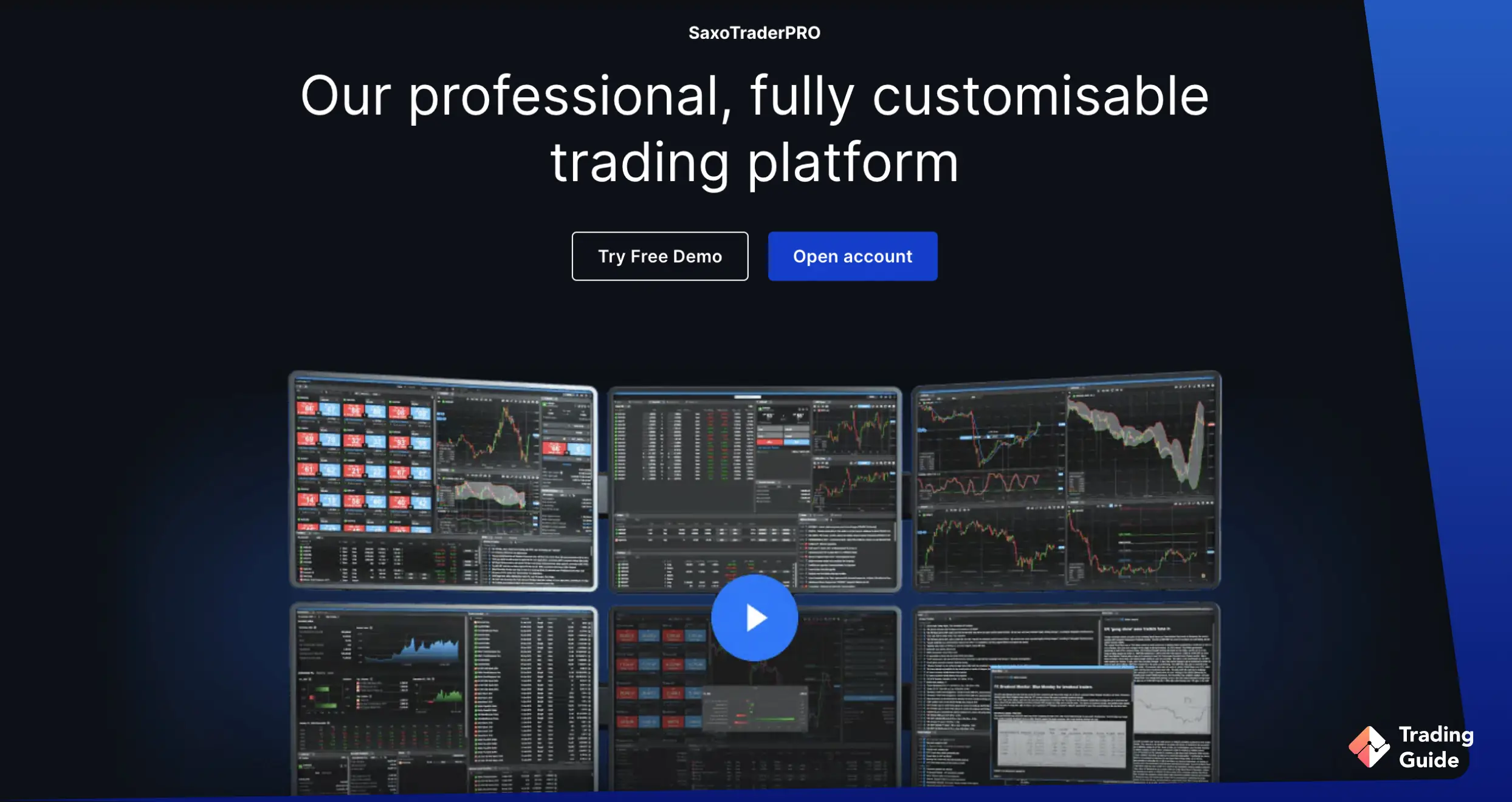

Besides being the best for futures trading, Saxo lists additional securities for portfolio diversification. There is also a SaxoTraderPro platform specifically tailored for professional traders, which lists advanced resources for maximum experience. Our in-depth analysis and expert opinion give this DMA broker a 4.3-star rating.

- Plenty of futures to explore

- A user-friendly and intuitive design platform

- Quality learning and research materials

- Additional assets, including forex, shares, commodities, and more, for portfolio diversification

- No MetaTrader platforms

| Type | Fee |

| Minimum deposit | $0 (for Classic account) |

| Inactivity fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Manual order fee | €50 per order |

| Stocks | from $1 on US stocks |

| Futures | $1 per lot |

| Listed options | $0.75 per lot |

| ETFs | from $1 |

| Bonds | from 0.05% on govt. bonds |

| Mutual funds | $0 |

5. XTB – Best DMA Broker For Stock Traders

XTB stands among the brokers facilitating UK traders to directly place trades into major stock exchanges’ order books. With over 3,400 stocks available, XTB offers a user-friendly and customisable platform, secured by robust encryption and regulated by the FCA. There is no minimum deposit requirement with this broker, providing flexibility for stock traders who can also explore additional securities like forex, commodities, and cryptocurrencies.

XTB’s DMA trading platform is equipped with top-notch market analysis and learning tools catering to all traders. Our interaction with XTB’s support service affirmed its reliability in providing quality assistance, albeit operating within specific hours. However, it’s important to note that XTB offers competitive interest rates on uninvested funds, potentially allowing traders to earn up to 5%, featuring rates of 3.8% for EUR and 5.0% for USD. These rates provide an avenue for potential passive income while actively participating in stock trading through its DMA platform.

- An award-winning DMA trading platform for stock traders

- Fast trade execution speed

- User-friendly and intuitive design platform

- Quality learning and research materials

- Transactions using e-wallets attract a fee

- Support service availability can be improved

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

What do Other Traders Say?

As mentioned above, we love hearing about other traders’ experiences with various brokers. In this regard, we visit Google Play, Trustpilot, and the App Store to sample as many comments and ratings as we can. With our recommended brokers above, we found many positive comments, and we share a few below to help you decide which broker best suits your DMA trading requirements.

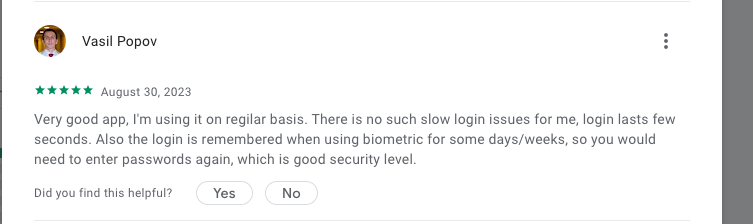

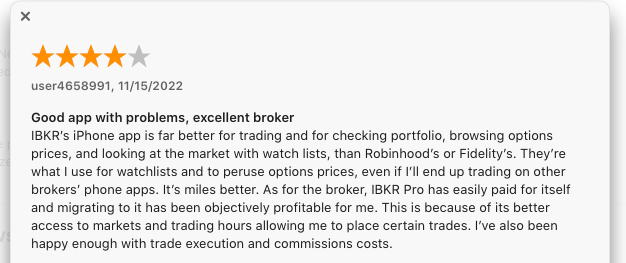

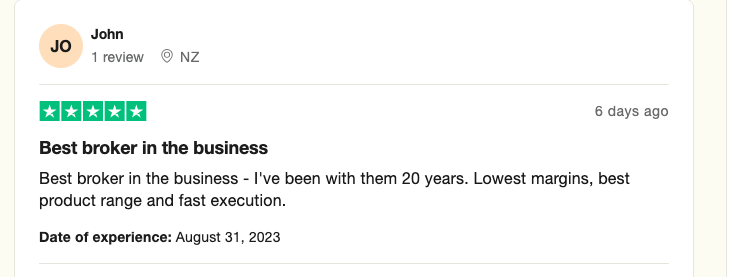

Interactive Brokers

Users appreciate Interactive Brokers’ advanced options trading capabilities and vast range of available markets. The platform’s competitive pricing and sophisticated tools appeal to experienced options traders.

-

“Very good app, I’m using it on regilar basis. There is no such slow login issues for me, login lasts few seconds. Also the login is remembered when using biometric for some days/weeks, so you would need to enter passwords again, which is good security level.” – Vasil Popov

-

“IBKR’s iPhone app is far better for trading and for checking portfolio, browsing options prices, and looking at the market with watch lists, than Robinhood’s or Fidelity’s. They’re what I use for watchlists and to peruse options prices, even if I’ll end up trading on other brokers’ phone apps. It’s miles better. As for the broker, IBKR Pro has easily paid for itself and migrating to it has been objectively profitable for me. This is because of its better access to markets and trading hours allowing me to place certain trades. I’ve also been happy enough with trade execution and commissions costs.” – User4658991

-

“Best broker in the business – I’ve been with them 20 years. Lowest margins, best product range and fast execution.” – John

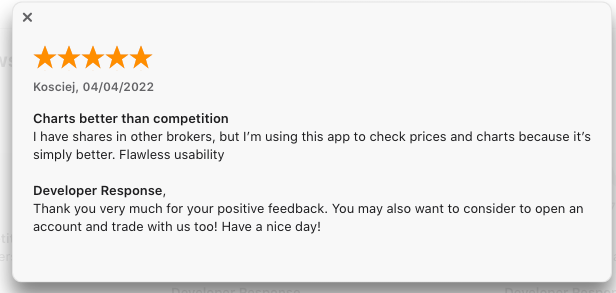

XTB

Traders appreciate XTB’s educational resources and the comprehensive stock trading platform. The platform’s analytical tools and customer support have been noted as valuable by users.

-

“I have shares in other brokers, but I’m using this app to check prices and charts because it’s simply better. Flawless usability” – Kosciej

-

“Very good app. Customer service is welcoming. Lots of information for new traders available for free. Feel very valued and accepted as a beginner. Best app I have found after trying 10+ others.” – Thomas Ashley

-

“Excellent account managers who keep in touch. Find the app easy to use. Lots of educational content to help me learn. Good use of news and kept up to date with any stock market changes.” – Ross

The Ultimate Guide About DMA Trading

While we aim to remain unbiased in making broker recommendations, we also want to educate our readers on other elements regarding online trading in the UK. This is to ensure they are fully prepared to not only make the best choices but also create trading accounts and effectively place their first trades. That being said, keep reading the sections below for more educational information on DMA trading in the UK.

What is DMA Trading?

Direct Market Access (DMA) trading is a method that grants traders direct access to financial markets without the need for intermediaries. Unlike traditional trading methods, where orders are routed through brokers or market makers, DMA trading allows traders to interact directly with exchange order books.

DMA trading is like a no-dealing desk trading method that enhances transparency, faster execution, and more. By bypassing intermediaries, traders can see the full depth of the market, including all available bids and offers, and choose the prices at which they want to trade. This transparency helps traders make more informed trading decisions and avoid potential conflicts of interest.

Additionally, DMA trading offers faster execution speeds compared to traditional methods, as orders are routed directly to the exchange with minimal latency. Overall, DMA trading provides traders with greater control over their trades, offering transparency, speed, and efficiency in the execution process.

How does DMA Trading Work?

As mentioned above, DMA trading allows traders to engage directly with the exchange, thus eliminating the need for intermediaries like brokers. Unlike traditional CFD trading where brokers set their own rates, DMA traders interact with the market’s actual rates. For instance, when trading CFDs through a broker, the broker may offer prices based on their pricing model. However, DMA trading provides access to the exchange’s order book, allowing traders to buy or sell assets at prevailing market rates.

Simply put, DMA trading grants traders direct access to the underlying market where the asset is listed. This means that traders can view real-time market prices, depth of market, and order sizes, enabling them to make informed trading decisions based on current market conditions.

By trading directly on the exchange, DMA traders benefit from enhanced transparency and fairer pricing.

Find out about the best forex signal providers in our ultimate guide.

How to Choose the Right DMA Broker in the UK

Choosing the right DMA broker in the UK is a crucial decision that can significantly impact your trading experience and outcomes. While our recommendations provide a reliable starting point, several factors must be considered when independently evaluating DMA brokers. These include:

Prioritise security by choosing a DMA broker with robust encryption measures to safeguard your sensitive data. Look for brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK. Regulation ensures compliance with stringent standards and offers protection for your funds through measures like segregated client accounts. You will also notice that some brokers are regulated by multiple authorities. This proves its credibility further in offering a secure and conducive trading environment.

Opt for DMA brokers offering a diverse range of assets beyond the primary market you intend to trade. While focusing on DMA trading, having access to additional asset classes, such as forex, commodities, cryptocurrencies, and more, allows for portfolio diversification and flexibility in trading strategies.

Transparent and competitive pricing structures are essential considerations when selecting a DMA broker in the UK. Assess both trading and non-trading charges, including commissions/spreads, minimum deposit requirement, transaction charges, and more, to determine the overall cost of trading. Choose brokers with clear fee structures aligned with your trading budget and objectives.

Evaluate the performance and functionality of a DMA broker’s trading platform. Look for platforms that are user-friendly, customisable, and equipped with advanced charting tools and technical indicators. Lightning-fast order execution is crucial for capitalising on market opportunities, and a mobile trading app ensures access to your portfolio on the go.

For novice traders, selecting a DMA broker offering a demo account is invaluable. A demo account allows you to practise trading strategies and familiarise yourself with the broker’s platform risk-free before committing real funds. Additionally, access to educational resources like guides, articles, seminars, and more enhances your trading knowledge and skills.

Reliable customer support is essential for resolving queries and issues promptly. Therefore, choose a DMA broker with a responsive support service accessible via multiple channels such as live chat, email, and phone. Prompt and efficient customer support ensures a smooth trading experience and timely resolution of any concerns.

Besides testing and comparing UK DMA brokers, consider seeking feedback from fellow traders on independent review platforms to gauge their reputation and service quality. Positive user testimonials provide valuable insights into reliability, customer service, and overall satisfaction, guiding your decision-making process. You can find honest user testimonials on Google Play, the App Store, and Trustpilot.

Read about the best high-leverage forex brokers in the UK and how to trade options in 2026 in our other guide.

How to Register an Account with a DMA Broker

Before we let you go, it is proper to walk you through the steps for registering an account with a DMA broker. Note that this process is simple and usually takes minutes to complete as long as you are honest and share the correct personal details. See below the 5 simple steps involved in getting started with a DMA broker in the UK.

Begin by visiting the website of your chosen DMA broker from our recommended list. Click on any of the provided links to quickly access the broker’s website and take the time to explore its offerings. Familiarise yourself with the trading platform and consider installing the broker’s trading app on your mobile device for convenient access to your account on the go.

Once you have selected a suitable DMA broker, proceed to create your DMA trading account. This typically involves filling out a registration form with your personal details, including your name, email address, phone number, date of birth, currency, and more. Ensure that the information provided is accurate to expedite the account creation process. You may also need to set up secure login credentials, such as a username and password, to access your account.

Most FCA-regulated DMA brokers require account verification as part of their compliance with regulatory standards. The verification process may involve submitting identification documents, such as a passport or driver’s licence, to verify your identity. Additionally, you may be asked to provide proof of address, such as a copy of a recent utility bill or bank statement. Once you have submitted the necessary documents, your broker will review and verify your account, typically within a few business days.

After your account has been successfully verified, it is time to fund your DMA trading account per your broker’s minimum deposit requirement. DMA brokers offer various payment methods for depositing funds, including bank transfers, credit/debit cards, and electronic wallets. Choose the payment method that suits you best and follow the instructions provided by the broker to complete the deposit process. Be mindful of transaction fees and processing times.

With your trading account funded, you are now ready to start DMA trading in the UK. Log in to your trading platform using your credentials and navigate to the desired market. Take some time to explore the platform’s features and tools, such as price charts, technical indicators, and order types. Conduct thorough market analysis, develop a trading strategy, and execute your trades based on your analysis and risk management principles.

If you are a beginner, we advise you to start on your broker’s demo account, as this is a risk-free environment for you. Although you will not earn real profits with a demo account, you have an opportunity to test the broker and gauge your skill level before making a commitment.

Pros and Cons of DMA Trading

Direct Market Access, or DMA trading, is one of the most preferred investment methods for UK traders. While it allows you to trade directly on an exchange using actual rates, there are also some challenges that come with this trading method. Take a look below at the pros and cons of DMA trading to note.

Pros

- Faster execution: With DMA, you can execute trades faster than traditional trading methods. This is because orders are submitted directly to an exchange’s order book, thus getting your trades instantly executed.

- Transparency: DMA provides traders with transparent pricing and market data, which helps them make informed trading decisions. They can see the order book and the prices at which other traders are willing to buy or sell a particular security.

- Complete control: DMA trading allows you to fully control your trading activities. This means you can set your own limit, stop losses, and take-profit orders, thus making it easier for you to manage risks.

- Lower costs: DMA eliminates the need for intermediaries like brokers or market makers, which can significantly reduce trading costs. Traders can also benefit from lower spreads and commissions.

- Access to multiple markets: DMA allows traders to access multiple markets, including equities, options, futures, and foreign exchange markets, all from a single platform. This provides traders with increased flexibility and the ability to diversify their portfolios.

Cons

- Complexity: This trading method can be more complex than traditional trading, and you may require specialised knowledge and experience to use it effectively.

- Lack of personalized service: DMA eliminates the need for intermediaries and the personalised service that brokers and market makers provide. Traders may not have access to research, market analysis, or trading advice.

- Market volatility: DMA trading exposes traders to market volatility, which can be unpredictable and lead to significant losses. Traders must be aware of the risks and have a solid risk management plan for increased potential.

FAQs

The easiest way to explain the difference between STP and DMA trading is that STP brokers typically charge a commission, while DMA brokers are commission-free (but with other fees, such as spread).

However, the services offered by the two types of brokers are almost the same, offering you the option to trade directly off an exchange’s order books.

Signing up with a DMA broker is as easy as it gets.

You start by finding a suitable DMA broker among our recommendations. Then, all you have to do is visit the broker, add your personal information (name, address, phone, etc.), and register your account.

To get full access to your account, you will, according to ESMA rules, you will have to verify your identity. There is a number of ways to do this, but it normally involves you providing your broker with a copy of your ID.

Because it’s easy, convenient, and really exciting. It’s also a practical way to use a cheap but efficient online broker to access the real exchanges and their assets.

As with all forms of trading, there are potential profits to be made from DMA trading. Just keep in mind that there is always risk involved and you may end up losing everything you invest and, in some cases, even more than that.

Because you’re trading directly with an exchange without having to go through complicated processes with your broker.

When using one of our recommended online brokers, you can use their DMA platforms to access the exchanges directly, thus saving a lot of time.

DMA or Direct Market Access in cryptocurrency refers to a trading technology that allows traders to access cryptocurrency markets directly without intermediaries such as brokers or market makers. DMA provides traders with direct access to the order book of cryptocurrency exchanges, enabling them to place orders and execute trades quickly and efficiently.

No. While DMA can be helpful in exploring the financial market, it isn’t as good as other existing technical analysis indicators. Remember, DMA is a trading technology that allows traders to access financial markets directly.

DMA pricing refers to the pricing structure used by brokers or trading platforms offering the Direct Market Access feature. DMA pricing typically involves a per-trade commission, which is often lower than what traditional brokers or market makers charge. DMA pricing may also include other fees, such as exchange or data fees, which vary depending on the exchange and trading platform.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

How is the current performance of CMC Markets and Interactive Brokers?

For almost a year that I have been trading in the market, I actually do experience hard times and of course a good time. I have 2 tips for you and the first one is to look for trading strategies on the market which is pretty successful even in the bearish market.. There is a lot of trading stats and analysis all over the net which could provide you with something good when it comes to decision making. The second one is to always look for something where you can earn or save. There are actually a lot of ways or tips that you can see all over the internet but these two are the most important thing for me when it comes to trading

Saxo Markets has been my go-to for crypto trading in the UK, and it's been a great experience. The platform is easy to figure out, even if you're new to crypto. Buying and selling different cryptocurrencies is a breeze, and they offer a lot of choices. It's a straightforward platform, and whenever I had questions, their support team was there to help me out. If you're looking for a reliable option for crypto trading, Saxo Markets is a solid choice.

Great overview of DMA brokers in the UK! I wanted to understand what DMA trading is and how to choose the right broker. The article detailed all the aspects of DMA, including its pros and cons, and provided a step-by-step guide to account registration. Now I feel more confident about trading with direct market access. Highly recommended for the informative content!

I do think the piece could mention a bit more about how to handle the risks of DMA trading. For beginners, it's important to focus on risk management tools like stop-loss orders and start small with demo accounts.