Forex trading apps are now essential for UK traders. The right app enables you to manage trades efficiently, track live markets, and access tools that enhance your decision-making. But not every app is worth your time or money.

To help you choose wisely, I’ve reviewed the most reliable forex trading apps in the UK. Each app was tested for speed, usability, fees, and reliability. In this guide, you’ll find clear recommendations, what makes each app stand out, and tips to trade with more confidence.

Essence

- Forex (foreign exchange) trading involves buying and selling currencies to profit from fluctuations in exchange rates.

- The forex market is the largest and most liquid in the world, with opportunities available around the clock.

- When choosing an app, always prioritise an FCA-regulated broker to ensure your funds are safe and your trading is fair.

- Demo accounts are a safe way to practise strategies before risking real money.

- User reviews on Google Play, the App Store, or Trustpilot reveal the reliability of each app in real trading.

- Market volatility creates many profit opportunities, but it also increases risk.

List of the Best Forex Trading Apps in the UK

- Capital.com – Leading Provider With Excellent Support Service

- FxPro – Best With Multiple Platforms

- IG – Leading Provider for MT4 Enthusiasts

- eToro – Beginner-Friendly

- FP Markets – One of the Cheapest

- Spreadex – Best With Spread Betting Options

- Plus500 – Biggest For CFD* Trading

- Pepperstone – Best For Social Trading

*76% of CFD retail accounts lose money with this provider

How We Choose Forex Trading Apps

As seasoned traders with decades of experience in finance, our approach to recommending forex trading apps is meticulous and thorough. We invest hundreds of hours in exhaustive research, leaving no stone unturned.

Our process begins by carefully selecting a wide range of forex apps in the UK, ensuring they are hosted by brokers regulated by the Financial Conduct Authority (FCA). We then download these apps onto our mobile devices and create trading accounts on their platforms. To assess their performance, we extensively utilise demo accounts to analyse their features before narrowing down our top choices.

Besides conducting multiple tests and comparisons, we incorporate user opinions in the process. By visiting platforms like Google Play, the App Store, and Trustpilot, we remain unbiased and match every trader with a suitable app.

Compare The Best Forex Trading Apps

Every app on this list earned its place for a reason. I’ve already explained how each one was tested, but now it’s time to see how they stack up side by side.

My comparison table below shows the key features that set these apps apart. Feel free to take a look so you can quickly spot what matches your trading goals.

| Forex Trading App | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes | Yes (up to £85,000 by FSCS) |

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit Cards, Bank Transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes | Yes (up to $250,000) |

| FP Markets | ASIC, CySEC, FSCA, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trading App, MT5 Mobile Trader | Credit/Debit Cards, International/Domestic Bank Transfer, Neteller, Skrill, Fasapay, PayTrust88, Ngan Luong, PayPal, Bank of China Online Pay | Yes | Yes (up to €20,000) |

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank Transfer, Neteller, Apple/Google Pay | No | Yes (up to £85,000) |

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google/Apple Pay | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, MAS, ASIC, FSCA, DFSA, CySEC, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfers, Neteller, Skrill, PayPal | Yes | Yes (up to £85,000) |

Brief Overview of Our Recommended Forex Trading Apps’ Fees and Assets

Many UK forex traders prioritise apps they can afford and list their preferred instruments. If you find the comparison process lengthy, utilise my table below to select what aligns with your requirements.

Fees

| Forex Trading App | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| FxPro | From 0.0 pips | £100 | Free | £15 once + £5 monthly |

| IG Markets | From 0.1 points | £0 | Free | £18 monthly |

| eToro | 2 pips | £50 | £5 withdrawal | £10 monthly |

| FP Markets | From 0.0 pips | £100 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| Plus500 | From 0.0 pips | £100 | Free | £10 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | None |

Assets

| Best Forex Trading App | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Capital.com | Yes | Yes | Yes | Yes | No |

| FxPro | Yes | Yes | Yes | Yes | No |

| IG Markets | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | No |

| FP Markets | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Forex Trading Apps in the UK

Now that you know our research methodology, keep reading to understand what my top forex trading apps have to offer. I share my opinion based on my hands-on experience. My goal is to ensure you gain a clear understanding of each app’s features, advantages, and potential drawbacks.

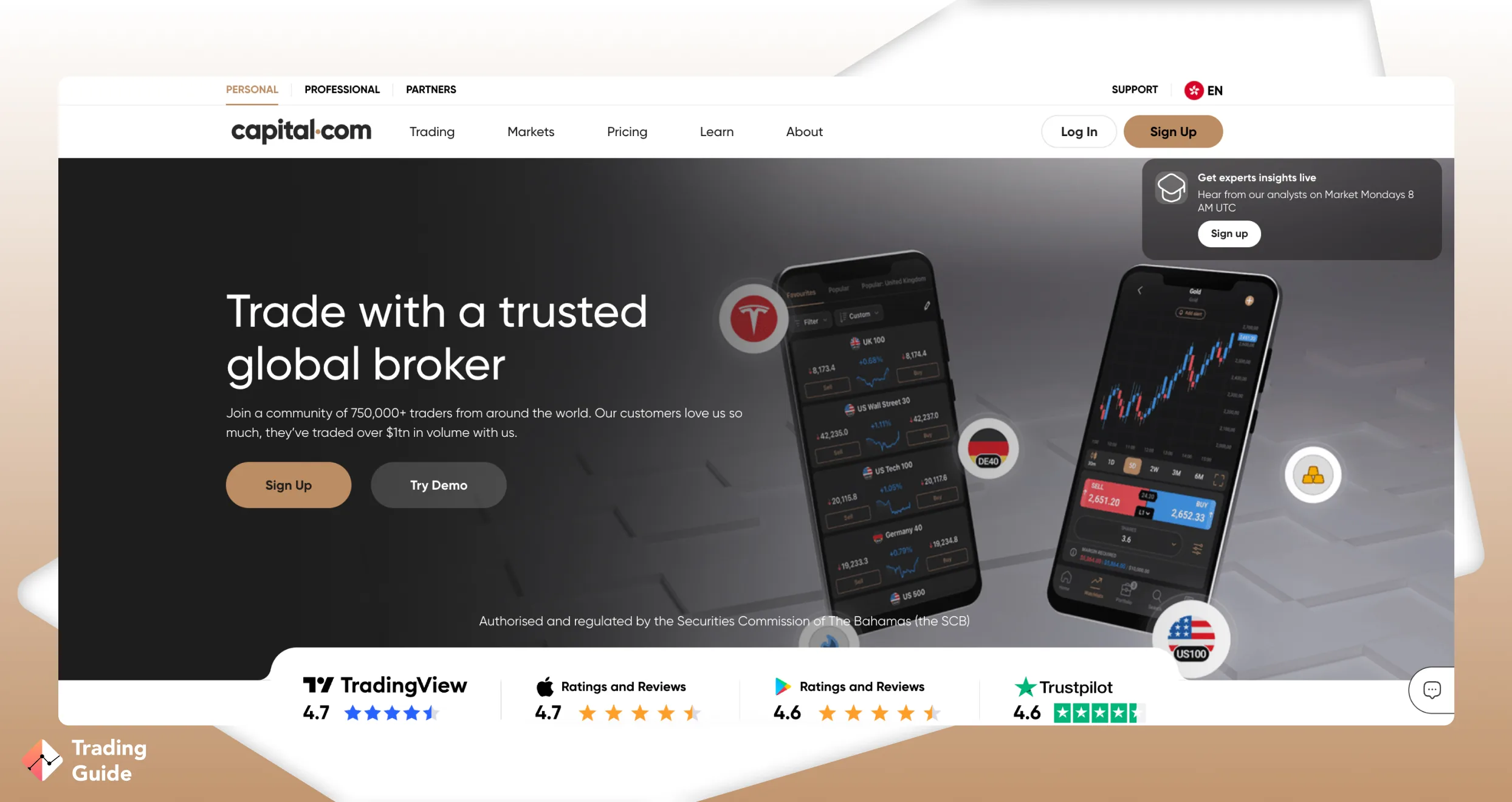

1. Capital.com – Leading Provider With Excellent Support Service

For UK traders looking for a forex trading app with a reliable support service, Capital.com is your go-to option. The app is intuitive and responsive, making it easy to monitor live forex prices, manage positions, and execute trades on the go. During my testing, spreads on major pairs like EUR/USD were low, starting from 0.0 pips. Plus, all trades were commission-free, which is ideal for both beginners and more active traders.

I was really impressed with this broker’s customer support service. Its team is available 24/7 via phone, email, or live chat, and they get to answer all questions professionally and promptly. The comprehensive FAQ section is also handy for troubleshooting without having to wait for a response.

The app integrates seamlessly with MT4 and TradingView for traders who want advanced charting, automated strategies, social trading, or more in-depth technical analysis. You can trade over 120 currency pairs and an additional 4,000 assets as CFDs or spread betting. All these are available with a minimum deposit of only £20.

- Tight spreads from 0.0 pips with commission-free trades

- Excellent 24/7 customer support via phone, email, and live chat

- Integrates with MT4 and TradingView for advanced trading

- £20 minimum deposit and free deposits/withdrawals

- No crypto payment methods

- No copy trading option

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

2. FxPro – Best With Multiple Platforms

My experience with the FxPro forex trading app has reinforced its position as one of the top choices in the currency market. The app features a user-friendly interface and smooth navigation across multiple platforms, including FxPro MT4, MT5, and cTrader. The advantage of having various platforms within one app is that you can easily switch to a more advanced option without needing to download additional apps. I traded over 70 currency pairs with low spreads starting from 0.6 pips on major pairs.

Besides forex, FxPro offers a range of CFD assets, including shares, indices, futures, metals, and energy. I like that the forex app allows its clients to use leverage, up to 1:30 for retail traders and 1:500 for professionals. The availability of quality learning and research materials further enhances the app’s appeal, providing valuable insights for informed decision-making. Overall, FxPro’s No Dealing Desk intervention ensures transparent and fair trade executions.

- Low minimum deposit requirement

- Advanced trading platforms, including FxPro proprietary, MT4, MT5, and cTrader

- High leverage limit for professional traders

- Reliable and responsive support service

- Limited asset offerings compared to its peers

- You can only trade the available assets as CFDs

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

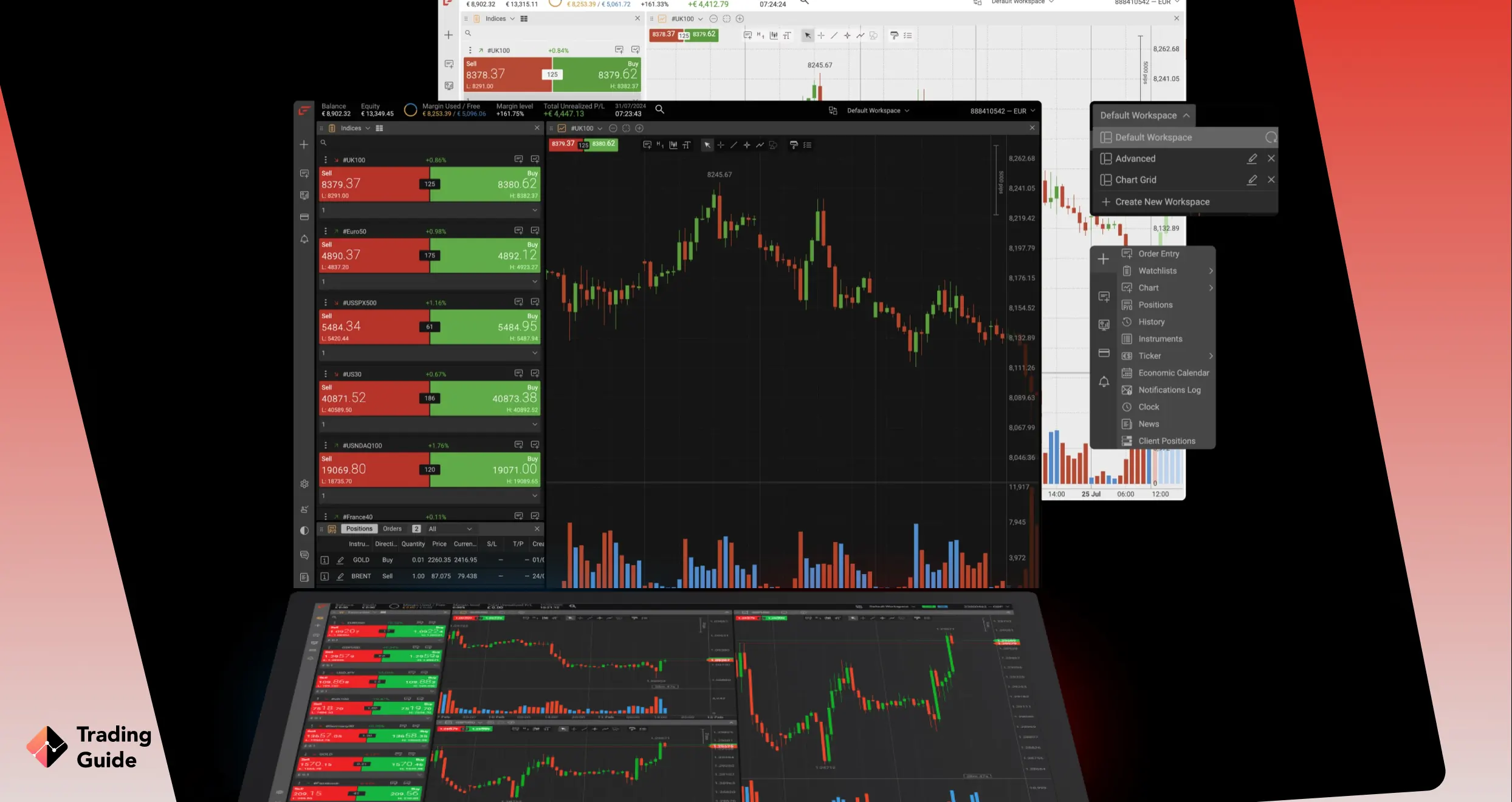

3. IG – Leading Provider for MT4 Enthusiasts

If you prefer trading forex on MT4, IG is one of the most reliable apps available to UK traders. It gives you direct access to MT4 with full support for automated trading, custom indicators, expert advisors, and advanced charting. I also like that IG connects MT4 to a deep liquidity pool, producing fast execution and consistently competitive spreads across major, minor, and exotic currency pairs.

When it comes to forex pricing, IG keeps things transparent. Retail traders can access leverage up to 1:30 on major pairs like EURUSD and GBPUSD. Spreads are competitive too, from 0.6 points on major currency pairs. When it comes to currencies, IG supports more than 80. These come with an additional 17,000+ CFD and spread betting instruments for portfolio diversification.

You are not limited to MT4 either. IG also gives access to other third-party platforms, including TradingView, ProRealTime, and L2 Dealer, for DMA-style trading. There’s no minimum deposit requirement for UK clients, and all funding transactions are free. Long-term investors can also switch to share dealing or ETF investing without needing to change brokers.

67% of retail investor accounts lose money when trading CFDs with this provider.

- Full MT4 support with automated trading and expert advisors

- 80+ forex pairs plus 17,000+ additional CFD and spread betting markets

- Competitive spreads with EUR/USD from 0.6 points

- Supports long-term investing through its web-based share dealing account and an IG Invest app

- No minimum deposit for UK clients and free transactions

- Currently no access to MT5 or cTrader

- Only selected assets are available for physical purchasing

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

4. eToro – Beginner-Friendly

Every novice investor in the UK, let alone worldwide, wishes to find a forex broker with an easy-to-use trading platform that is fully customisable. I believe eToro’s forex trading app meets this criteria, considering its great user interface design and reliable support service. Based on our experience and comparing it to its peers, I primarily recommend it to newbies.

I like that the eToro app features innovative social and copy trading. These allow users to engage with other forex investors through chat groups and replicate trades from experienced traders. Although the copy feature is not a sure-fire way to earn profits, it helps you quickly learn and improve your forex trading strategies. I explored over 6,000 instruments using this app, including shares, ETFs, cryptos, commodities, and more. Feel free to test its features using its demo account loaded with £100,000 virtual funds to determine if it meets your trading needs.

- Advanced social and copy trading feature

- Low minimum account deposit requirement of £50 for UK clients

- Multi-regulated forex broker by tier-one authorities

- Free £100,000 demo account

- High spreads

- Withdrawal fees apply

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

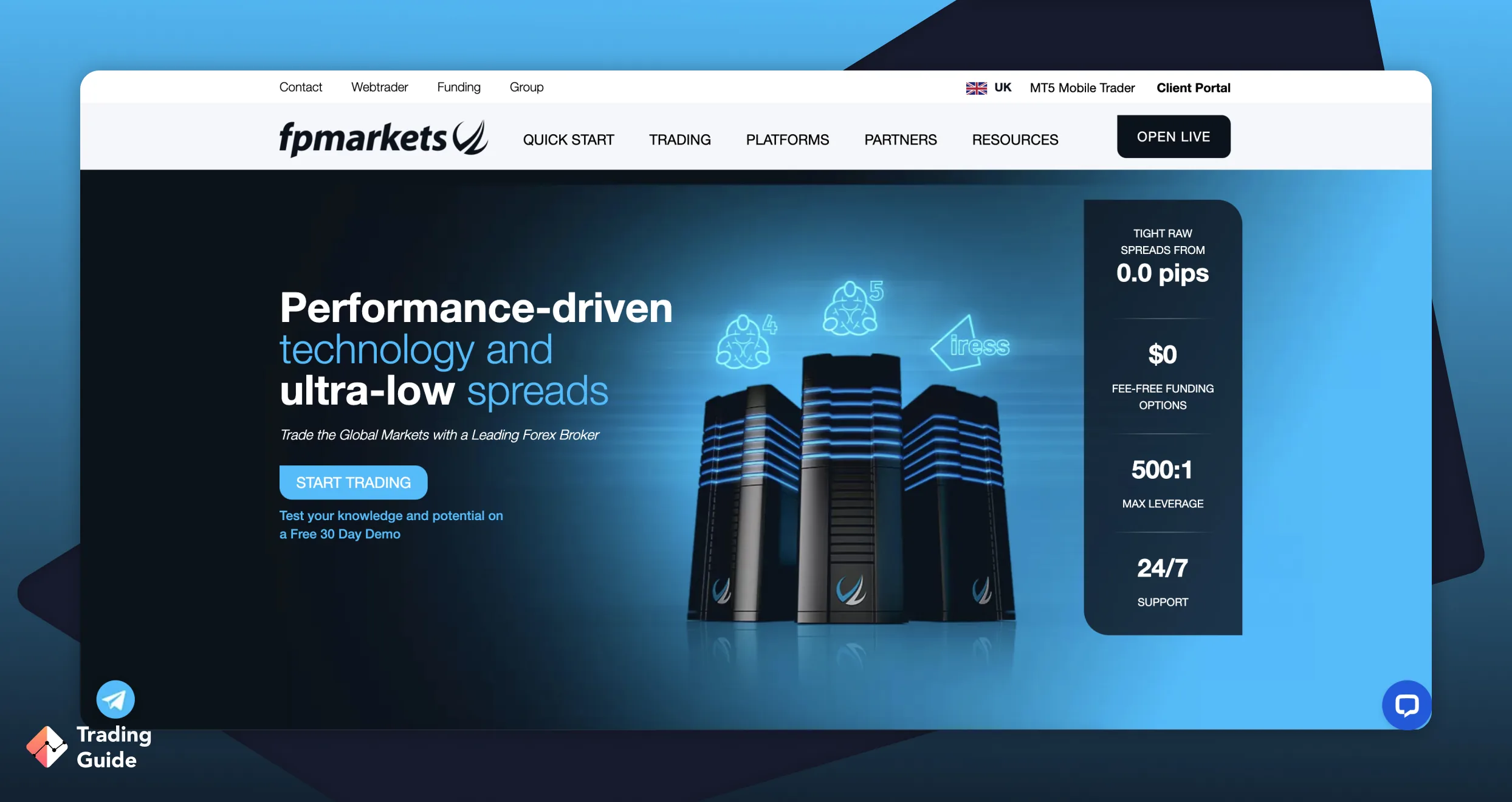

5. FP Markets – One of the Cheapest

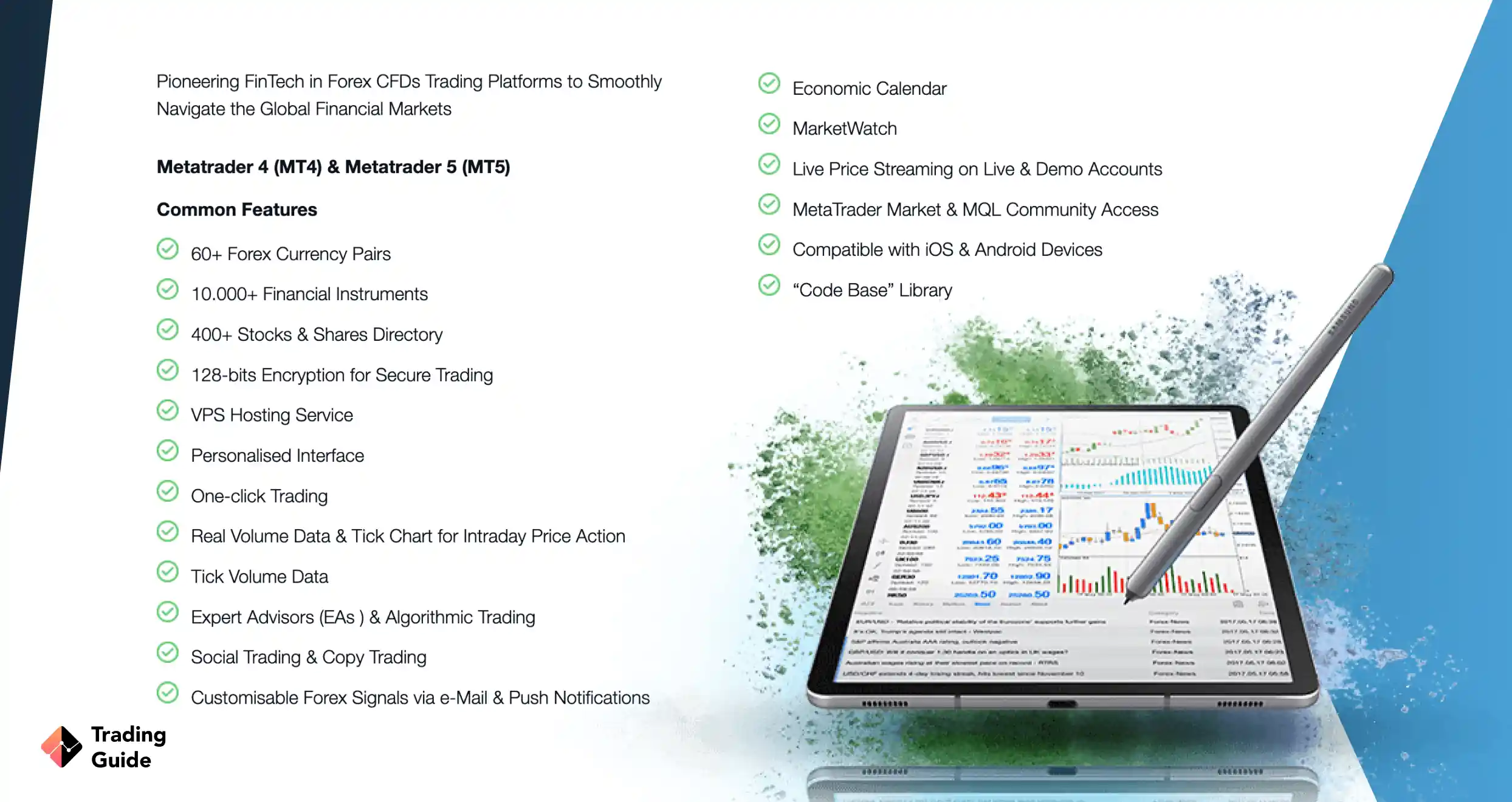

FP Markets is an Australia-based company with a strong presence in the United Kingdom. It serves millions of forex traders looking for a reliable and cost-effective trading solution. While testing it, I explored over 70 currency pairs on a user-friendly and customisable interface. You can download FP Markets’ native app from Google Play or the App Store to trade on the go.

I find this app to be one of the cheapest due to its low deposit requirement of £100. You will incur low charges, with spreads starting from 0.0 pips on major forex pairs. In addition, FP Markets has no transactions or inactivity charges, giving you all the flexibility you need to explore the forex market without incurring unnecessary costs. You will enjoy forex trading on FP Markets’ advanced MT4 trading platform. Other platforms this broker offers include MT5, WebTrader and Iress (DMA).

- Highly rated social and copy trading platforms for maximum experience

- Low forex trading charges starting from 0.0 pips

- Additional CFD asset classes, including shares, commodities, cryptocurrencies, etc., for portfolio diversification

- Compatible with Android and iOS mobile devices

- Features expert advisors and quality research resources

- No safe two-step login procedure for mobile devices

- Forex price plan is unavailable

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

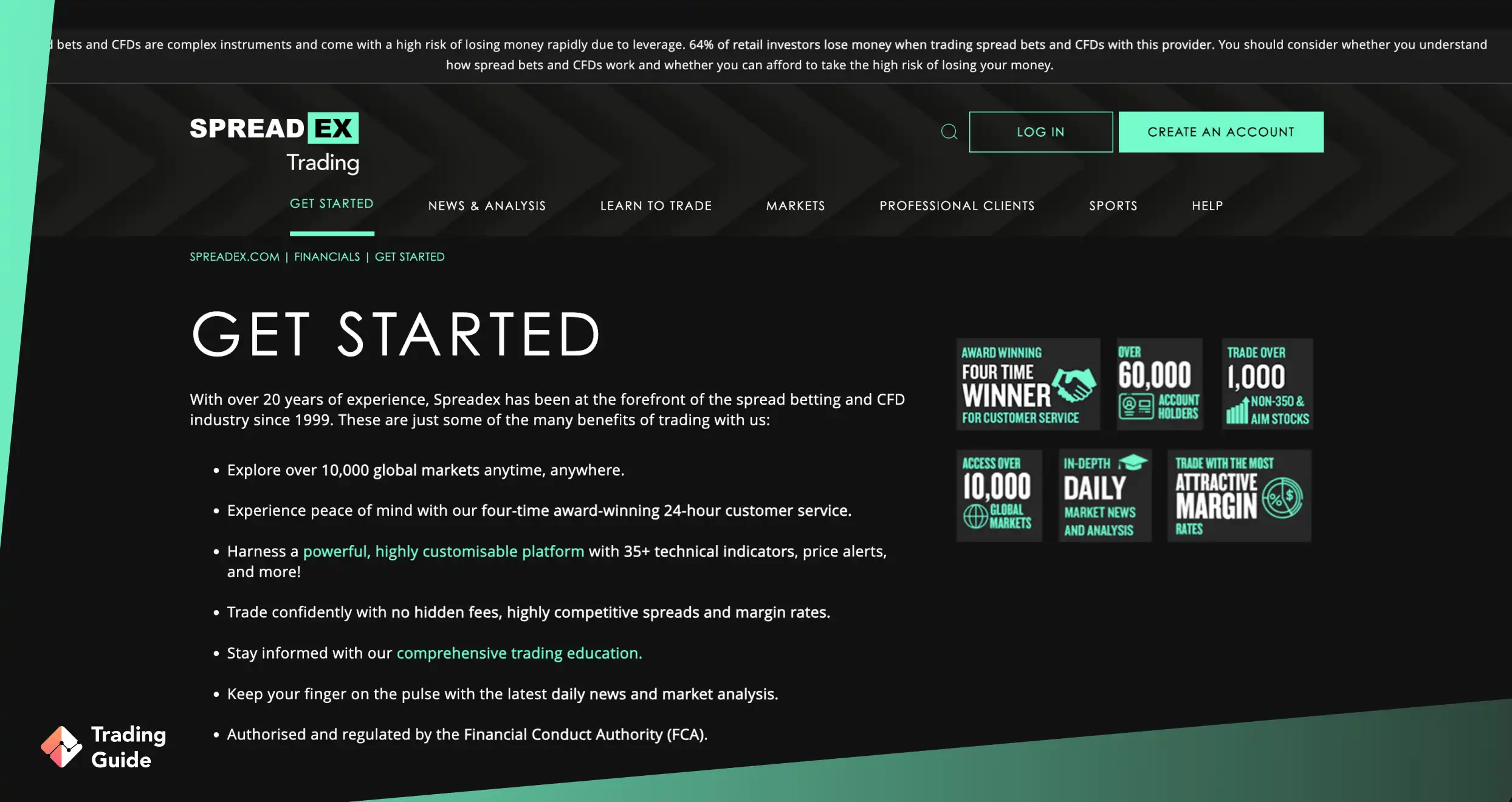

6. Spreadex – Best With Spread Betting Options

Spreadex stands out as one of the best forex trading platforms with spread betting options in the UK market today. Established in 1999, this trading app combines the convenience of mobile trading with the flexibility of spread betting, offering traders a powerful and intuitive trading platform to navigate the forex markets. Offering over 60 currency pairs and no deposit requirement, Spreadex is a go-to choice for any forex trader looking for an all-in-one trading solution.

What sets Spreadex apart is its innovative and user-friendly mobile app, tailored for both beginner and experienced traders. Besides currencies, the app lists an additional 10,000+ tradable instruments for portfolio diversification. Spreadex’s commitment to competitive pricing, with spreads as low as 0.6 pips, makes it a cost-effective option for forex traders looking to maximise their returns while minimising trading costs.

- Free deposits and withdrawals

- Over 60 currency pairs are available for trading

- User-friendly mobile app suitable for traders of all levels

- Competitive spreads starting as low as 0.6 pips, helping to reduce trading costs

- No negative balance protection for professional traders

- Limited advanced research resources

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

7. Plus500 – Biggest For CFD Trading

CFD traders looking for a reliable app should consider Plus500. Besides the 65+ currency pairs it lists, I discovered an additional 2800+ CFD assets, including shares, commodities, ETFs, and more. The app is regulated by world-class financial authorities, including the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), ensuring security for your investments. Plus, it is among the most highly rated on Google Play and Apple’s App Store. Many users praise it for its efficiency and powerful advanced features that enhance the trading experience.

I noticed that this app offers commission-free trades with tight spreads from 0.0 pips on major currency pairs. Its margin trading limit goes up to 1:30 for retail traders and 1:300 for professional clients. You can evaluate its offerings using its demo account to determine if it meets your forex trading requirements. Plus500 also provides reliable 24/7 customer service with prompt assistance on any trading issues.

- 0% commission on CFDs forex trading

- Highly rated trading app on Google Play and App Store

- Regulated by tier-one financial authorities

- Low minimum account deposit requirement

- Limited educational and research tools

- Charges inactivity fees which kick in after three months of inactivity

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

8. Pepperstone – Best For Social Trading

Pepperstone is one of the UK brokers that allow traders to explore major, minor, crosses, and exotic currency pairs. I discovered over 90 currency pairs alongside 2,400+ CFD and spread betting instruments. These include shares, indices, commodities, ETFs, and more, which you can use to diversify your portfolio. The best part is that the broker has a user-friendly and customisable trading platform compatible with desktop and mobile devices.

I also like that Pepperstone has no deposit requirements and no transaction fees. Moreover, it hosts trading tools suitable for all types of traders on its world-renowned third-party platforms. These include cTrader, TradingView, MT4, and MT5. These platforms also feature social trading, whereby users get to mingle with their peers to learn more trading tips. With social trading, you can also follow the most professional forex traders and mirror their potentially profitable positions.

- No minimum deposit requirement

- Low forex trading fees with spreads from 0.0 pips

- Multiple trading platforms to choose from

- Quality learning and market analysis tools

- Limited asset offerings compared to its peers

- Its featured assets are available to trade as CFDs and spread betting only

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

Investments involve risks and are not suitable for all investors. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

How do Forex Trading Apps Work?

Forex trading apps provide convenient platforms for traders to engage in the foreign exchange market directly using their smartphones or tablets. These apps streamline the trading process by offering real-time market data, analytical tools, and the ability to execute trades with just a few taps.

At their core, forex trading apps function by connecting users to the global currency markets through secure and user-friendly interfaces. They allow traders to monitor currency pairs, track market trends, and execute trades instantly, regardless of location.

Most forex trading apps offer a range of features, including customisable watchlists, price alerts, and technical analysis tools to help traders make informed decisions. Additionally, the apps provide access to educational resources and market news to help users stay informed about the latest developments anywhere, anytime.

Behind the scenes, these apps rely on sophisticated algorithms and high-speed connections to ensure rapid execution of trades and accurate pricing information. Some apps also offer advanced order types and risk management tools to help traders mitigate potential losses.

How To Choose the Right Forex Trading App

Choosing the best forex trading app in the UK can play a crucial role in your success as a trader. With numerous options available, it is crucial to evaluate several key factors to ensure you make the right choice for your trading needs. Here are some essential considerations to help you find the best forex trading app UK.

Regulatory compliance is paramount in the forex market to safeguard traders’ interests. A reputable regulatory body like the Financial Conduct Authority (FCA) ensures that brokers adhere to strict standards regarding capital adequacy, client fund segregation, and fair trading practices. Choosing a regulated app guarantees that your funds are secure and that you’re trading on a transparent and trustworthy platform.

A trading platform serves as your gateway to the forex market, so choosing one that meets your needs is essential. Look for features like intuitive navigation, customisable layouts, advanced charting tools, and seamless order execution. It’s also important that the trading platform functions well on mobile devices for those who want to manage their trades while on the move.

Trading fees can significantly impact your profitability, especially if you trade frequently. Assess the fee structure, including spreads, commissions, overnight financing charges, transaction costs, and other charges. Choose a broker with a fee structure that suits your trading style and budget to help you manage expenses effectively and enhance your overall trading experience.

Reliable customer support is invaluable, especially when you encounter issues or face technical difficulties. Choose a forex trading app that provides multiple support channels, such as live chat, email, and phone support. Ensure the support team is responsive and knowledgeable, ready to offer solutions to any problems you might face.

Accessibility to diverse payment methods simplifies the funding and withdrawal process when trading forex in the UK. Ensure the app you select supports popular payment options like bank transfers, credit/debit cards, and e-wallets, with swift transaction processing and minimal fees. Additionally, verify the security measures in place to protect your financial information and transactions.

Choosing a forex trading app with a diverse range of trading assets helps with portfolio diversification. Look for an app that offers not just forex, but also stocks, indices, ETFs, commodities, cryptocurrencies, and more. This variety allows you to take advantage of different market opportunities and better manage your risk.

Demo accounts offer a risk-free environment for practising trading strategies and familiarising yourself with a platform’s features. Therefore, the best app for forex trading should provide access to demo accounts with virtual funds, real-time market data, and full functionality. Utilise this feature to hone your skills, test different strategies, and gain confidence before transitioning to live trading.

User reviews and recommendations provide valuable insights into an app’s performance, reliability, and overall user experience. To gain a comprehensive view of an app’s reputation, research feedback from well-regarded platforms such as Google Play, the App Store, and Trustpilot. These reviews can reveal key information about the app’s stability, execution speed, customer service quality, and transparency in pricing and policies. Pay close attention to recurring themes in user feedback to identify any common issues or strengths.

Read about the best automated trading platforms in the UK and How to start trading options in the UK in our other articles.

What are the Risks of Using a Forex Trading App?

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

While forex trading apps guarantee convenience, they expose traders to market volatility. The forex market is notoriously unpredictable, with prices fluctuating rapidly due to various factors such as economic indicators, geopolitical events, and central bank decisions. Traders using mobile apps should be prepared for sudden price movements that can result in significant gains or losses, especially when trading on margin.

Moreover, the lack of regulation in some forex trading apps poses a substantial risk to traders. Unregulated apps may engage in unethical practices such as price manipulation, stop hunting, or even refusing to process withdrawals. Traders must conduct thorough research and choose apps regulated by reputable authorities to ensure their funds are protected and trading conditions are fair.

Additionally, cybersecurity threats loom large in the digital age. Trading via mobile apps exposes traders to the risk of hacking, phishing, and malware attacks. Unauthorised access to trading accounts can lead to theft of funds or identity theft. To mitigate these risks, traders should use strong passwords, enable two-factor authentication, and avoid accessing trading accounts on public Wi-Fi networks.

Lastly, traders should be mindful of the psychological aspects of trading. The convenience of trading on a mobile app can lead to overtrading, where traders execute too many trades impulsively. It’s essential for traders to maintain discipline, stick to their trading plan, and avoid making decisions based on emotions or short-term market fluctuations.

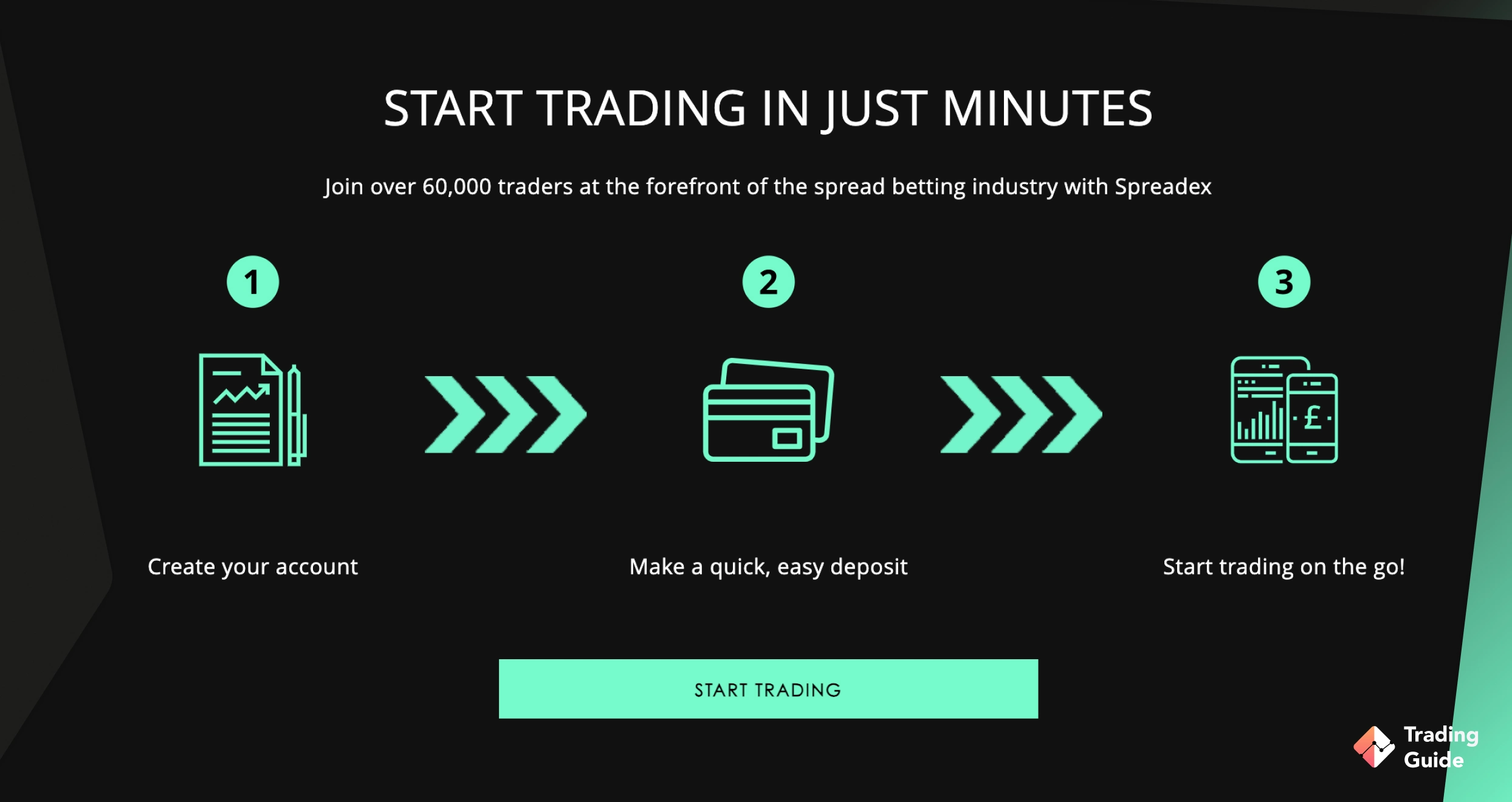

How To Register a Forex Trading App Account

Using a forex trading app UK is straightforward once you know the steps involved. If you are a beginner, follow these steps to register your account and start your trading journey.

Start by comparing and testing various apps in the UK to find the one that best suits your needs. You can refer to our recommendations above, as they have undergone multiple tests and comparisons. Before registering, familiarise yourself with the app’s terms and conditions. Most importantly, install the app on your mobile device to easily manage your forex trades anytime.

After installing the app, It is time to create a trading account. For ease, we advise you to use its web version on your desktop device. On the registration page, enter your personal details, such as your name, email address, phone number, and date of birth. You should also create a username and a strong password to secure your account.

Many forex trading apps in the UK require account verification to comply with the FCA regulatory requirements and enhance security. Verification typically involves providing additional documentation to confirm your identity and address. Commonly accepted documents include a government-issued photo ID (such as a passport or driver’s licence) and a recent utility bill or bank statement. Follow the app’s instructions to upload clear and legible copies of these documents. The verification process may take a few days to complete, so be patient and check your email or app notifications for updates on your verification status.

Once your account is verified, you will need to fund it to start trading. Navigate to the deposit section within the app, where you will find various payment methods available to fund your account. Common deposit methods include bank transfers, credit/debit cards, and electronic payment systems like PayPal or Skrill. Choose your preferred payment method and enter the deposit amount per the app’s minimum deposit requirement. Follow the prompts to complete the transaction securely.

With funds in your account, you are ready to trade forex. Explore the app’s features, including real-time market data, customisable charts, and technical analysis tools, to identify trading opportunities. Choose your preferred currency pair, and execute trades directly from your mobile device with just a few taps.

Since the forex market is unpredictable, monitor your positions closely and use risk management tools such as stop-loss and take-profit orders to mitigate potential losses. Stay informed about market developments and economic events that may impact currency prices, and adjust your trading strategy accordingly.

Best Forex Trading Indicators

Forex trading indicators are tools traders use to analyse market data and identify potential trading opportunities. These indicators are based on mathematical calculations applied to price, volume, or other market variables. They help traders make informed decisions by providing insights into market trends, momentum, volatility, and potential entry or exit points. Here are some of the most widely used forex trading indicators.

- Moving Average (MA) – As a smoothing mechanism, moving averages offer a clear view of price trends over a specified period. They’re akin to a steady hand guiding traders through market fluctuations, often signalling potential trend changes with crossover patterns.

- Bollinger Bands – Think of Bollinger Bands as dynamic boundaries enclosing price action. These bands expand and contract based on market volatility, helping traders identify overbought or oversold conditions and anticipate potential price breakouts.

- Parabolic SAR – Parabolic SAR is like a beacon at night, providing traders with potential stop-loss levels that dynamically adjust based on market conditions. It trails price action, flipping from above to below the price to signal potential trend reversals.

- Stochastic Oscillators – These tools pinpoint potential trend reversals or continuations by comparing an asset’s closing price to its price range over a specified period. Traders utilise stochastic signals to gauge market momentum and identify entry or exit points.

- Moving Average Convergence/Divergence (MACD) – MACD is a versatile momentum indicator that tracks the relationship between two moving averages. Its signal line crossovers serve as valuable insights into shifts in market momentum and potential trend reversals.

- Fibonacci Retracements – Drawing on the mystical Fibonacci sequence, these retracement levels unveil potential support and resistance zones based on key Fibonacci ratios. Traders use them to pinpoint entry and exit points, harnessing the power of natural market retracements.

- Relative Strength Index (RSI) – RSI assesses the strength of recent price movements to determine overbought or oversold conditions. It offers traders valuable insights into potential reversal points and market sentiment shifts.

- Pivot Point – Pivot points serve as pivotal landmarks in the trading landscape, offering traders reference points for potential support and resistance levels. They are calculated based on the previous day’s high, low, and closing prices, guiding traders in mapping out potential price movements.

- Ichimoku Cloud – The Ichimoku Cloud offers a holistic view of market trends, support and resistance levels, and potential entry and exit points. Traders navigate its layers to understand market conditions and make informed trading decisions.

Pros and Cons of Trading Forex with a Trading App

Forex trading apps guarantee convenience and accessibility, but they come with their own set of advantages and limitations. Here’s a breakdown of the pros and cons:

Pros

- Offer access to the currency market anytime, anywhere.

- You can execute trades instantly, taking advantage of market opportunities as they arise.

- The apps make forex trading accessible to a broader range of traders.

- They feature intuitive interfaces that are easy to navigate.

- They often come with built-in alert features that notify traders of significant market events or price movements.

Cons

- Trading apps may offer fewer features than desktop trading platforms. This limits the depth of analysis and trading options available to traders.

- The smaller screen sizes of mobile devices can make it challenging to analyse charts and perform detailed technical analyses.

- Mobile devices are more susceptible to security risks, such as hacking or malware attacks.

FAQs

Yes. Forex trading is legal in the UK, and many traders are making profits from the activity. However, you need a solid plan and strategy to succeed. For instance, it is best to trade with forex brokers licensed and regulated by the Financial Conduct Authority (FCA). This is the only legal way to trade in the UK, and using unregulated and unlicensed brokers makes you vulnerable to getting scammed. In addition, ensure you fully understand how forex trading works, and you can use the available research and analysis tools to create the best strategy. Most importantly, you must also be at least 18 years old to start investing in forex.

Yes. Forex in the UK is considered a business venture, and for this reason, any profits you make trading forex, except those you earn from spread betting, must be taxed. The reason spread betting is not taxed in the UK is that it is classified in the gambling category. That being said, before you start trading forex, confirm your tax requirements to avoid unnecessary conflicts with the federal government. This also applies when trading other securities, including stocks, commodities, cryptocurrencies, etc.

Many forex brokers in the UK, including our recommended ones, have a minimum deposit requirement of as little as £100. While you have a chance of earning profits trading forex with £100, we advise you to familiarise yourself with how forex trading works before you deposit your real funds. The easiest way to do so is through their risk-free demo accounts.

To start trading with £100, ensure you find a forex broker that aligns with your trading budget. Consider the minimum deposit requirement and other charges, including commissions, spreads, deposit and withdrawals fees, etc.

First, you need to be at least 18 years old and learn how the currency market works, including all the risks. Then, choose the best forex broker that complements your trading requirements, whether regarding charges, security, asset offerings, and more. In addition, use brokers’ demo accounts to practice what you already learned and test the broker’s reliability. Once you clear all the doubts, sign up for a real account where you will be required to trade with real funds.

We advise you to start investing with small cash and increase the amount as you become more strategic. Remember, trading is risky, and while you can earn good profits, you are also likely to lose your investment funds.

It’s a no-brainer that trading forex as spread betting is not taxable because spread betting is classed as gambling. However, all the forex trading profits you make during the tax year must be charged as capital gains tax. Keep in mind that the tax rates vary based on your taxable income. Therefore, ensure you confirm if you are a basic or higher rate taxpayer before paying your income gains taxes.

Although it is possible to trade forex without a broker, the process is not as easy as you think it might be. First, you will need to find the best licensed and regulated forex broker that will allow you to access various tradable markets. Luckily, this page recommends top brokers for not only forex trading but for other assets, including CFDs, stocks, commodities, cryptocurrencies, etc. All you need to do is choose one based on your trading requirements. If you are a beginner, start forex trading using demo accounts, as you do not want to start investing your money without fully understanding the market and your capabilities.

Read about the NinjaTrader brokers in the UK and Penny stock brokers in our other articles.

Conclusion

As technology advances, the demand for forex trading apps in the UK is on the rise. Fortunately, TradingGuide provides top recommendations for the best apps available in the market. These apps have been rigorously tested to ensure they meet safety standards and suit your investment needs.

For beginners, choosing the right app can set the stage for a rewarding trading experience. Utilise the demo accounts offered by our recommended apps to practice and build confidence before transitioning to live trading. To manage risks effectively, use stop-loss and take-profit orders, and keep track of your trade performance to make informed decisions in this dynamic market.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Does eToro really free? Can I open an account for free?

eToro is not free but it doesn’t cost anything to register an account. In order to get full access to your account you have to fulfil the minimum deposit requirement. You will also be paying spread (as a trading fee) as well as a few non-trading fees.

With that being said, eToro is completely commission-free.

Which Forex broker is the best for depositing a large amount of money?

eToro

I trading with this broker more than 3 years, it is safe and the best for depositing a large amount of money

You need to choose your online broker carefully. Getting the best forex broker for your investment strategy is half the road to making money on the stock market. Take the time to check whether the forex broker FCA regulated, look at the types of stock exchange accounts offered, the commissions and spreads, the support available and the training offered. Remember, you are not going to make money on the stock market with a forex scam broker. You are going to waste your money more than anything else.

Stumbled upon this cool article about forex trading. It covers trade apps, registration steps, and even dives into indicators. It's straight-up useful, no fluff. Highlights the risks, so you don't mess up. If you're into trading or just starting, it's a solid read. Check it out, mate!

Impressive guide on selecting the best UK forex trading app! Detailed analysis of licenses, platform, fees, and customer support is invaluable. Emphasis on securing investment capital through regulated brokers is crucial. The step-by-step registration process is user-friendly. Warnings about risks and scams are vital. Overall, a cool sidekick for UK forex, blending research and user reviews. Gonna check out those recommended apps, play around with demos.

This article revealed an important question for me: is it possible to trade Forex without a broker. It clearly explained that while this is technically possible, having a licensed broker will make the process much easier. The article recommends the best brokers suitable not only for Forex but also for trading various assets. Recommending the use of demo accounts for beginners adds a practical side to the learning curve. A very informative and useful article for me, as I am interested in Forex trading.

Great list! As a fellow UK trader, I've tried a few of these apps and they're all solid options. I'm particularly interested in the Admiral Markets app, as I've heard great things about their charting capabilities. Thanks for sharing!

Seems like a lot of options, but I’m still cautious. While the low fees and demo accounts are nice, I’d want to see more details on the risks, especially with CFDs and leverage.

This is a fantastic roundup of Forex trading apps! I appreciate the detailed analysis of each app's features and user experience. It really helped me narrow down my options. Excited to start trading with the ones you recommended!

New to forex trading and found this guide super helpful! eToro looks perfect with easy social trading and a big demo account to practice risk-free. Definitely giving it a try!