High leverage can maximise your profits in the currency market. However, it carries risks of losing a lot of money should a trade go against you. The good news is that many traders are earning good returns trading with leverage. This is especially if they trade with the best forex brokers regulated in their regions.

If you are a UK trader looking to apply this strategy in your activities, we are here to help. After conducting multiple broker tests and comparisons, we share below the top high leverage forex brokers that met our specifications. We will also take you through how to select the best for your needs and give a brief overview of getting started.

Essence

- The best forex broker with highest leverage should provide high-leverage ratios, amplifying trading positions and potential profits.

- Traders must select a high-leverage forex broker with FCA regulations to ensure a secure and compliant trading environment.

- Analyse user reviews and feedback to ensure you select a suitable high-leverage forex broker.

- While forex brokers with high leverage provide opportunities to earn huge profits, the losses can also be massive.

- Traders should employ effective risk management strategies to control potential losses.

- Understanding market volatility and adapting to price fluctuations becomes crucial when utilising high leverage, requiring prudent decision-making and a solid trading plan.

List of the Best High Leverage Forex Brokers in the UK

- IG – Leading Service Provider for MT4 Users

- eToro – Top Option For Social and Copy Trading

- FxPro – Best For Professional Traders

- Plus500* – Best With Excellent Support Service

- Pepperstone – Beginner-Friendly

- Spreadex – Top Option With Spread Betting Options

- XTB – Best for Long-Term Investors

*76% of CFD retail accounts lose money

Compare High Leverage Forex Brokers

Finding the best forex broker with high leverage in the UK can be a challenging and time-consuming task. However, it is crucial to choose the right broker, as it can have a significant impact on your trading success.

To simplify this process, we have conducted extensive research and testing to recommend below the best high-leverage brokers in the UK. Our research was based on a variety of factors, including trading platform features, account types, margin rates, customer support, and security measures.

We always want to ensure that our recommendations are unbiased. Therefore, we combined the findings from our tests with user testimonials from Google Play, the App Store, and Trustpilot. We believe that combining these two sources of information provides a comprehensive and accurate picture of the brokers’ performance and reputation.

| High-Leverage Forex Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes | Yes (up to £85,000 by FSCS) |

| eToro | FCA, ASIC, MAS, CySEC, MFSA, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/ debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes (up to $250,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FxPro Trading Platform, MT4, MT5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| Plus500 | FCA, CySEC, ASIC, MAS, FSA | 24/7 | Plus500 Webtrader | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | MetaTrader 4, MetaTrader 5, cTrader, TradingView | Credit cards, Bank transfer, PayPal | Yes | Yes (up to £85,000) |

| Spreadex | FCA, SEBI | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

| XTB | CIRO, FCA, CNMV, KNF | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, e-wallets, Bank transfers | Yes | Yes (up to £85,000) |

Brief Overview of Our Recommended Forex Brokers’ Fees and Assets

Trading with a higher leverage forex broker that you can afford and features your preferred securities is essential for an exciting experience. Since comparing such elements can be daunting to many, we simplify the procedures for you using the tables below. Use these details to compare and strategise for the best decisions.

Fees

| High Leverage Forex Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| IG Markets | From 0.1 points | £0 | Free | None |

| eToro | From 1 pip | £50 | Free | £10 monthly |

| FxPro | From 0.0 pips | £100 | Free | £15 once + £5 monthly |

| Plus500 | From 0.0 pips | £100 | Free | £10 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

Assets

| High Leverage Forex Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| IG Markets | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | No |

| FxPro | Yes | Yes | Yes | Yes | No |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes |

1. IG – Leading Service Provider for MT4 Users

IG is one of the UK’s top choices for forex trading, particularly for traders who rely on MetaTrader 4. The broker offers access to over 80 currency pairs, covering majors, minors, and exotics. This is in addition to 17,000+ CFD and spread betting assets for portfolio diversification, including commodities, ETFs, bonds, options, indices, shares, and more.

Trading with IG is highly transparent. Retail clients can leverage up to 1:30 on major forex pairs like EUR/USD, AUD/USD, and GBP/USD, while professional clients can access significantly higher leverage up to 1:200. Spreads are competitive, starting from just 0.6 pips on EUR/USD and 0.7 on USD/JPY. We find these forex fees among the lowest in the industry. On top of that, IG has no minimum deposit requirement, and all transactions are free.

IG’s MT4 integration allows for advanced charting, algorithmic trading, and automated strategies, making it suitable for both experienced traders and those looking to refine their approach. And if you are looking for additional third-party platforms with high-quality resources, the broker provides access to ProRealTime, L2 Dealer, and TradingView. Simply identify what aligns with your requirements.

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider

- Access to 80+ currency pairs and 17,000+ CFD/spread betting assets

- Competitive spreads, from 0.6 pips on EUR/USD

- MT4 platform supports automated strategies and advanced charting

- Has investment securities across ISA, GIA, and SIPP accounts

- Flexible trading via web, mobile, and third-party platforms

- Leverage limits are restricted for retail clients

- MT5 platform not available for UK forex traders

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | None |

| Advanced graphs (ProRealTime) | £30 per months |

2. eToro – Top Option For Social and Copy Trading

From our experience testing eToro, it is one of the more approachable platforms for anyone who wants to trade forex with the support of social and copy-trading tools. Retail traders in the UK get access to more than 68 currency pairs, and you can trade them long or short with up to 1:30 leverage. If you qualify as a professional client, the limits rise to 1:400, which completely changes how much flexibility you have when scaling positions.

Spreads on the major pairs generally start from around 1 pip. It is not the tightest you will find, but we found the pricing steady enough for short-term trades and news-driven entries. Besides forex, you can explore an additional 7,000+ securities, including shares, indices, commodities, ETFs, cryptocurrencies, and more.

Social and copy trading is supported through the CopyTrader platform. Users easily observe other traders, analyse their risk profiles, and copy their active positions instantly. Smart Portfolios add another layer for anyone who wants diversified themes without building everything from scratch. You can get started with as little as £50, enjoy free deposits and an opportunity to earn 3.8% annual interest on unused cash balances.

- Excellent social and copy-trading via CopyTrader

- Up to 1:30 leverage limit for retail clients and 1:400 for professionals

- Lists over 68 currency pairs and additional securities for portfolio diversification

- Has a £50 minimum deposit requirement for UK clients

- Easy-to-use app and strong community insights

- Forex trading fees are higher compared to most of its peers

- £5 withdrawal fee

- £200 minimum to copy a single trader position can limit micro-allocations

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

3. FxPro – Best High Leverage Forex Broker For Professional Traders in the UK

In our extensive experience with high-leverage forex brokers in the UK, FxPro has undoubtedly proven itself to be the go-to choice for professional traders. With over 70 currency pairs and additional asset classes, FxPro caters to diverse trading strategies. Its user-friendly platform, available on MT4, MT5, cTrader, and FxPro Web, showcases an intuitive design, ensuring a seamless trading experience. We were also impressed by the broker’s remarkable order execution speed, which is crucial for capturing market opportunities.

FxPro offers commission-free forex trades, boasting competitive spreads starting from 0.6 pips on major currency pairs. The leverage limit goes up to 1:30 for retail clients and an impressive 1:500 for professional clients. However, to enjoy high leverage for professional traders, you must be categorised as a professional by fulfilling specific criteria. From our analysis, FxPro has a minimum deposit requirement of £100 and free transactions, which we believe is reasonable for any user looking to dive into the currency market.

- Lists over 70 currency pairs to trade

- Low forex trading fees

- Quality learning and research materials

- Responsive and reliable support service

- While the support team is impressive, it is only available five days a week

- No buying and taking full ownership of the featured assets

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

4. Plus500 – Best With Excellent Support Service

*Illustrative prices

Our interaction with the Plus500 support team left a lasting impression. Their prompt and effective responses comprehensively addressed our inquiries and concerns. The team further solidified its commitment by following up via email, ensuring our satisfaction and fostering engagement in trading activities.

Additionally, Plus500 boasts a user-friendly platform adorned with customisable features. Trading enthusiasts can access over 60 forex CFD pairs leveraging up to 1:30. This is along with an array of other CFD assets like shares, and commodities, ensuring diversified portfolios. For seasoned traders, there’s a specialised platform with leverage limits that go up to 1:300. We therefore give this broker a 4.5-star rating.

- £100 minimum deposit requirement

- A user-friendly and intuitive design platform

- Commission-free trades with low spreads starting from 0.0 pips

- Free deposits and withdrawals

- Excellent collection of learning resources

- Imposes a £10 monthly inactivity fee after only three months

- You can only trade forex and CFD assets

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. Pepperstone – Best High Leverage Forex Broker for Newbies

While we find Pepperstone an excellent broker for all, we primarily recommend it to newbies entering the currency market. Through multiple tests, we discovered that it is user-friendly and has a fast trade execution speed. Moreover, Pepperstone has no minimum deposit requirement, which allows any newbie sceptical of risking a lot of money to explore the financial landscape. We also like that users highly rate its app, and beginner traders will have no challenge managing their activities on the go.

When it comes to leverage limits, Pepperstone offers up to 500:1 for professional clients and 30:1 for retailers. The high leverage limit is available on its Pepperstone Pro account, for which you must be eligible. And the best part is that this broker features social and copy trading. As a beginner, the feature allows you to interact with other global traders and copy potentially profitable positions from the experts.

Overall, we discovered over 100 currency pairs to trade with low spreads from 0.0 pips. There are also advanced platforms with unique resources to help you in skills and strategy development. These include cTrader, MT4, MT5, and TradingView.

Furthermore, it’s wise to delve into a detailed Pepperstone review to establish whether the platform matches your trading criteria.

- No minimum deposit requirement for UK clients

- Amazing learning materials for skills development

- A user-friendly and modern design platform

- Leverage limits go up to 500:1

- Limited asset offerings compared to its peers

- You can only trade the additional securities as CFDs and spread betting

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

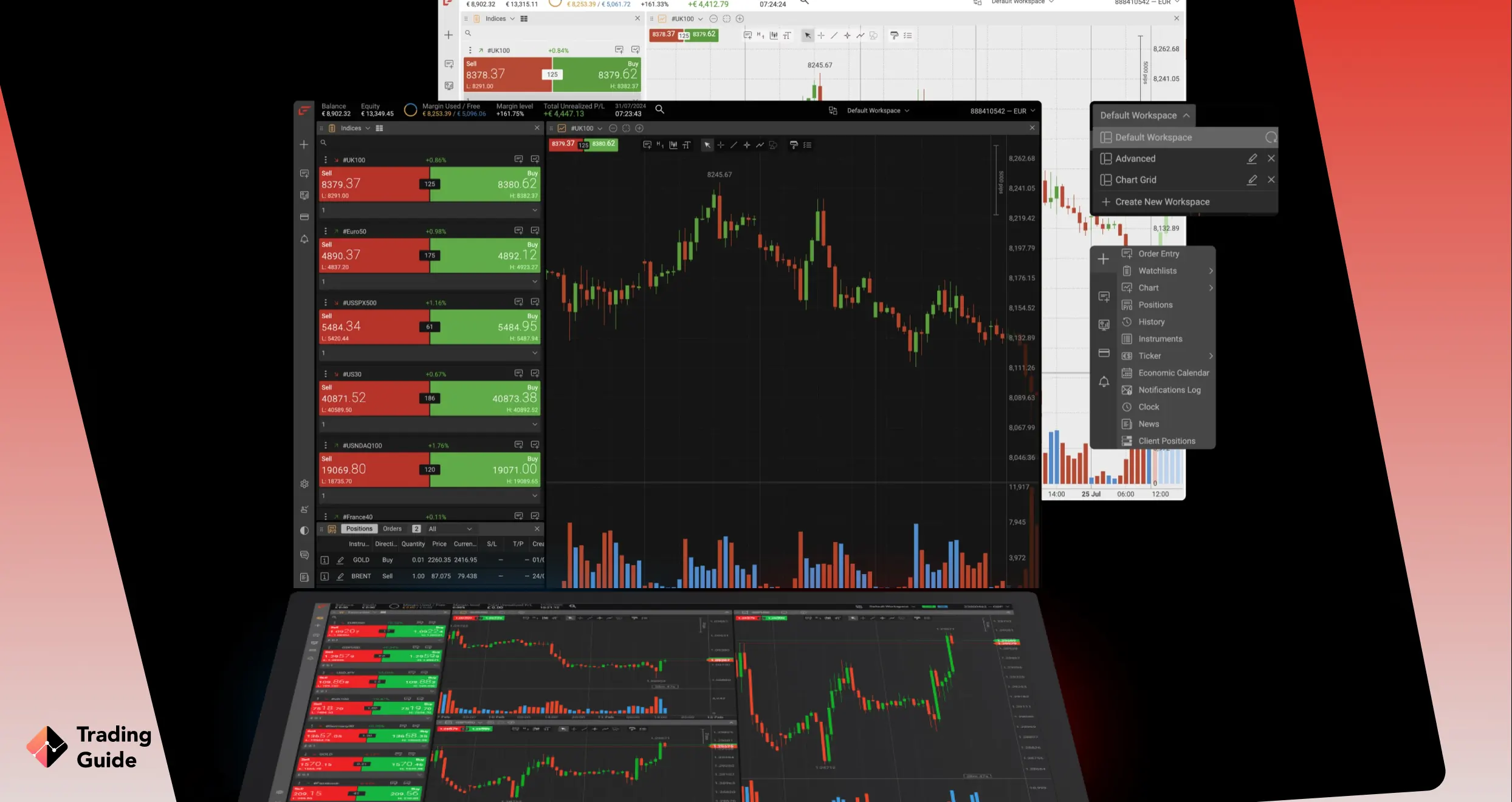

6. Spreadex – Top Option With Spread Betting Options

Trading forex with Spreadex gave us an opportunity to explore over 60 currency pairs while incurring low spreads starting from 0.6 pips. The broker doesn’t have a minimum deposit requirement, and all transactions are free. We believe this allows users to budget accordingly and get started with any amount they can afford. Leverage limits remain per ESMA ruling, meaning retail forex traders get to enjoy up to 30:1 in the FCA jurisdiction.

We like that Spreadex’s spread betting platform is designed to cater to traders of all skill levels. Its TradingView platform is equipped with advanced charting tools and robust analysis resources, which will enable traders to make well-informed decisions. On top of that, you get to enjoy social trading features and adequate learning resources for skills development.

- Over 60 forex pairs to trade

- Reliable and responsive support service via multiple channels

- Low forex trading spreads starting from 0.6 pips

- User-friendly trading platform suitable for traders of all levels.

- No demo account

- No negative balance protection for professional traders

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

7. XTB – Best for Long-Term Investors

Even though XTB is popular among UK traders seeking competitive forex conditions, we’ve found it especially strong for long-term investing. The broker offers 60+ CFD currency pairs, all with tight spreads from 0.8 pips, low swaps, and precise position sizing with microlots from 0.01. During our tests, order execution on both xStation Web and Mobile was fast and stable, even during volatile sessions. You can open long and short leveraged positions, and while ESMA caps retail leverage at 30:1, XTB’s overall trading environment still feels refined and efficient.

Where XTB sets itself apart for me is the depth of its investment range. You can search through more than 10,900 instruments, including over 6,600 global stocks and 1,800 ETFs, along with indices and commodities. The commission-free stock allowance of up to £100,000 per month is a significant advantage for buy-and-hold investors.

XTB’s Stocks and Shares ISA also makes it appealing for long-term wealth building, letting you invest tax-free while earning interest on uninvested cash. With no minimum deposit, FCA regulation, reliable customer support, and constantly updated market research, XTB remains one of the brokers we rely on most for both leveraged CFD trading and steady long-term investing.

- No minimum deposit requirement for UK clients

- Lists over 60 currency pairs to trade using leverage

- ISA account with interest on uninvested funds

- Commission-free stock investing up to £100k per month

- Low forex spreads from 0.8 pips on major currency pairs

- No third-party platforms like MT4 or MT5

- No algorithmic trading support

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

What Do Other Traders Say?

Exploring unfiltered user feedback is pivotal in selecting the ideal high leverage forex broker. Below, we present insights gathered from real traders for the leading high leverage forex brokers in the UK. These diverse experiences offer valuable perspectives, aiding in your decision-making process.

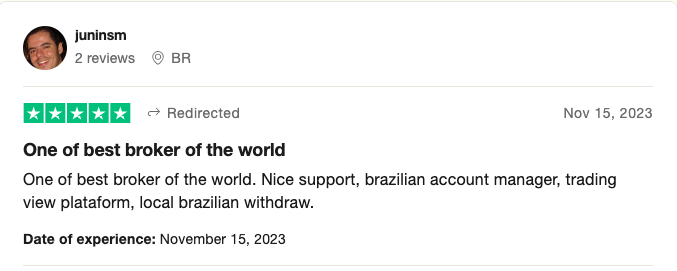

Pepperstone

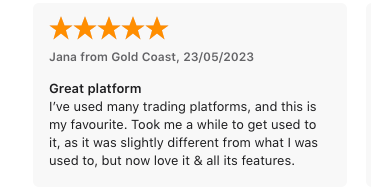

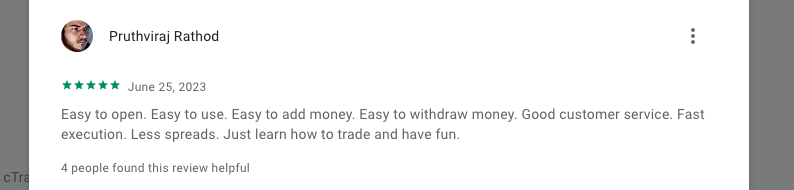

Pepperstone receives acclaim for its efficient, high-leverage trading infrastructure and variety of available platforms. Users value the low-latency execution and diverse leverage options.

-

“One of best broker of the world. Nice support, brazilian account manager, trading view plataform, local brazilian withdraw.” – Juninsm

-

“I’ve used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features.” – Jana from Gold Coast

-

“Easy to open. Easy to use. Easy to add money. Easy to withdraw money. Good customer service. Fast execution. Less spreads. Just learn how to trade and have fun.” – Pruthviraj Rathod.

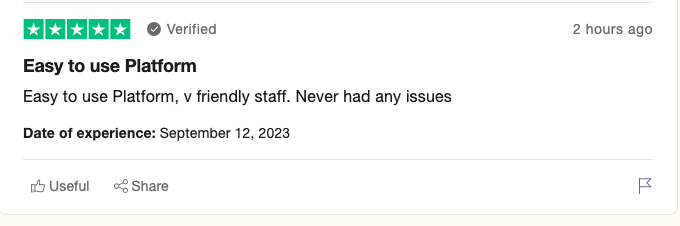

Spreadex

Spreadex stands out for its simplicity and accessibility in high-leverage forex trading. Users appreciate the straightforward interface and diverse leverage options available.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

-

“A very useful financial spread betting app that should cover all your needs. It’s definitely the most useable of the broker apps that I’ve tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. They’ve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far” – JakeReadman

What is Forex Trading?

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

Forex trading, also referred to as currency trading or foreign exchange, is the buying and selling of global currencies with the aim of earning a profit. Forex is the largest financial market globally, with an average daily turnover of over $7 trillion.

Forex trading involves trading currency pairs, such as the EUR/USD, USD/JPY, and GBP/USD, with the value of one currency being measured against the value of another. Traders typically buy a currency pair if they believe its value will soar in the long run and sell it if they think its value will fall.

The currency market is open 24 hours a day, five days a week, with trading occurring in major financial centres worldwide, including London, New York, Tokyo, and Sydney. This makes it a highly liquid and accessible market for traders of all experience levels.

What is Leverage?

Leverage in forex trading is whereby traders use borrowed funds from their brokers to increase the potential of high returns on investment. Simply put, leverage allows traders to control larger positions in the currency market with a smaller amount of capital. In the UK, the highest leverage offered to retail traders is regulated by the Financial Conduct Authority (FCA) and is typically limited to 30:1 for major currency pairs. To ensure compliance with these regulations and to have access to responsible and regulated trading conditions, traders often seek the services of FCA-regulated brokers.

While leverage can bring about increased profits, it can also leave you with massive losses. Therefore, traders should always use it cautiously and only apply it in trades they are confident in profiting from. Plus, have a good understanding of how leverage works and how to effectively manage risks that come with using it. This includes setting stop-loss orders to limit potential losses and avoiding over-leveraging positions. You must also ensure you are trading with the best leverage trading platforms offering transparent and fair trading conditions, including competitive spreads, low fees, and reliable execution.

How Leverage Works

As mentioned earlier, leverage trading allows traders and investors to maximise their exposure to the financial markets. Leverage works by enabling a trader to put up only a fraction of the total value of the trade as collateral. This is known as the margin. Your broker will then provide the remaining funds necessary to execute the trade.

For instance, let’s say you wish to purchase company XYZ shares worth £10,000. Unfortunately, you only have £2000 as your initial capital. In this case, your broker will allow you to trade on margin per ESMA regulations. In UK stock investment, retail traders can enjoy leverage limits of up to 5:1 (20% margin). This means you can manage the £10,000 position with an initial capital of £2000 while your broker lends you £8000.

Note that while leverage can bring about massive profits, losses are inevitable. Therefore, we advise you to apply leverage if you are confident in your strategy. You do not want to risk more than your initial capital. Plus, apply risk management controls such as stop-loss and take-profit orders to mitigate massive losses. This is if a trade works against you.

Brokers always issue margin calls in events where the market moves against traders, or they exceed margin requirements. In a margin call, you will be required to deposit more funds to maintain an open position. Should you fail to respond per the brokers’ requests, your broker may liquidate the position to cover losses.

High Leverage Vs Low Leverage

In trading, you will encounter high and low leverage limits. Since leverage or margin trading is like a double-edged sword, you must understand the difference between the two. It is also crucial to be familiar with the risks involved in applying high leverage vs low leverage for informed decisions.

You can open larger positions with high leverage and potentially earn higher returns. This is unlike low leverage, whereby you open smaller positions relative to your account size. The best element about low leverage compared to high is that you reduce the risk of significant losses in case a trade works against you.

Additionally, low leverage has favourable margin requirements compared to higher leverage. Traders opting for low leverage have more flexibility in managing their margin requirements. They can afford to maintain larger margin amounts. As a result, it reduces the likelihood of margin calls and allows for a more relaxed trading experience.

In contrast, high leverage allows traders to maintain smaller margin amounts to control larger positions. This means the margin requirements are closer to the trader’s entry price, leaving less room for market fluctuations before a margin call is triggered.

Overall, high leverage is suitable for professional or experienced traders. This is because such traders have a deep understanding of the market and are open to taking bigger risks based on their skills. In contrast, low leverage is suitable for beginners. You will reduce the risks of incurring massive losses.

Always start by learning the markets and developing solid strategies before applying leverage. Plus, start with small capital and keep increasing as you become more familiar with online trading/investing.

FCA Leverage Limits

The Financial Conduct Authority (FCA) oversees online brokers’ activities in the UK. Among the responsibilities is ensuring the leverage limits set by ESMA for retail traders are adhered to by the broker. This is to protect traders from excessive risks that might leave them with massive losses. Note that leverage limits dictate the maximum amounts brokers can offer retail traders. The limits vary depending on the asset you trade, whether forex, shares, commodities, cryptocurrencies, and more. See below the leverage limits the FCA imposes across various asset classes.

- Major currency pairs – Up to 30:1

- Major indices – Up to 20:1

- Commodities except gold – Up to 10:1

- Individual equities – Up to 5:1

- Cryptocurrencies – Up to 2:1

The above leverage limits apply to traders in the UK and EU countries. They directly affect individuals trading CFD assets. Brokers who fail to adhere to these limits are prone to penalties, fines, or even licence revocation within the UK region.

Pros and Cons of High Leverage Forex Trading

One of the key advantages of high leverage forex trading is the use of increased leverage, which allows traders to control larger positions in the market with a smaller amount of capital. However, the activity carries significant risks and is not suitable for all investors.

Below, we shed light on the pros and cons of high leverage forex trading to ensure you understand what you will be signing up for when trading with such brokers in the UK.

Pros

- High profit potential – High forex trading leverage allows traders to magnify their potential profits by controlling larger positions with a smaller capital.

- Boosts capital efficiency – Leverage increases your initial investment capital, making it easier for you to control larger trading positions.

- Combats low volatility – It’s a no-brainer that the currency market carries low volatility than other financial markets. With high leverage forex trading, you have an opportunity to amplify the effects of movements that fail to occur on your trading results.

Cons

- Increased risk of losses – While high leverage forex trading can magnify losses, it can also leave you with massive losses and debts if you are not careful.

- Constant liability – When participating in high-leverage forex trading, note that you will always be in debt that must be paid off to continue trading.

- Margin calls – When trading with high leverage, traders may be subject to margin calls if their trading account balance falls under the required margin level. This can result in the forced closure of positions, leading to significant losses.

How To Choose the Right High Leverage Broker in the UK

Choosing the right high-leverage forex broker in the UK is an important decision for any trader, whether you are a beginner or experienced. The broker you choose can have a significant impact on your trading success, and there are several factors to consider when making your decision. Here are some key points to note when selecting a high-leverage forex broker in the UK.

The security of your funds should be of top priority when choosing a forex broker. Look for brokers that are regulated by reputable authorities, such as the Financial Conduct Authority (FCA) in the UK. This ensures that the broker operates under strict rules and regulations to protect your funds. Moreover, you can easily take legal action against such brokers in case of an agreement breach.

Look for a broker offering a wide range of currency pairs, as well as other financial instruments such as commodities, stocks, and indices. This will provide you with more trading opportunities and allow you to diversify your portfolio.

High leverage can increase your potential profits, but it can also increase your risks. Look for a broker that offers a suitable leverage ratio that aligns with your trading strategy and risk appetite. Our recommended forex brokers above have high leverage limits that could potentially maximise your returns.

The trading platform is another primary element to never overlook. Make sure the broker you select offers a reliable and user-friendly trading platform that suits your trading style. The platform should also host a variety of trading tools, such as technical analysis tools, economic calendars, and market news, to help you make informed trading decisions. If you are a beginner, consider the selection of learning resources and a demo account.

A broker with responsive and reliable customer support service can be valuable, especially if you need help with your account or have questions about your trades. Therefore, test a broker’s responsiveness before making a final decision. Whether it operates 24/7 or only five days a week, ensure its availability fits your trading schedule.

It is also crucial to compare reviews and recommendations from other traders on Google Play, the App Store, and Trustpilot. Only settle for brokers with positive reviews and a solid reputation in the industry.

Learn about the UK options trading in our other article.

Getting Started with High Leverage Broker

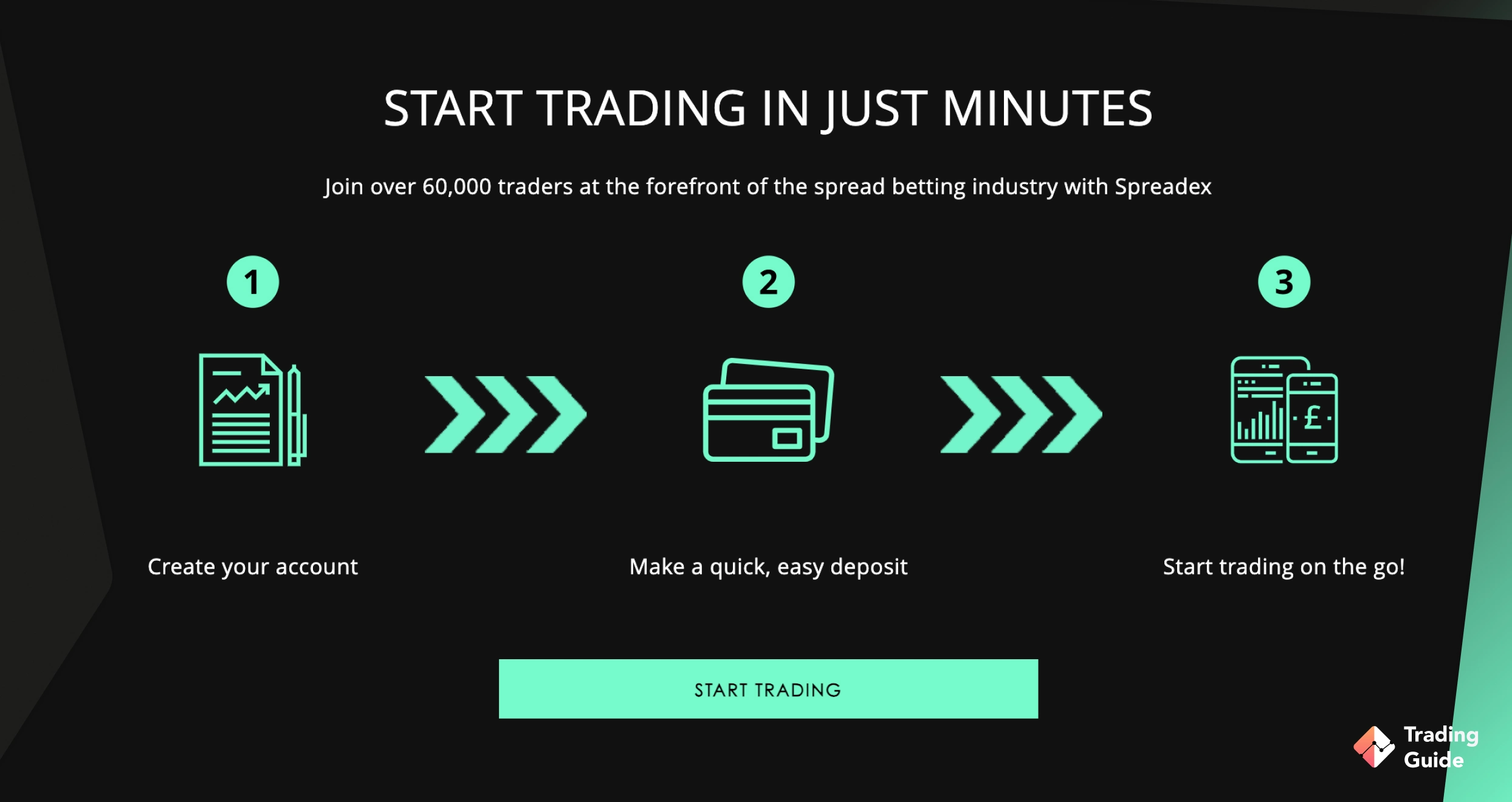

Getting started trading with a high-leverage forex broker in the UK can be overwhelming, but it doesn’t have to be. With a few simple steps, you can start trading and potentially grow your investment in no time. Below, we take you through the process of getting started with a high-leverage forex broker in the UK so you can be fully prepared to dive into the forex market and enjoy your experience.

Once you are familiar with the forex market and have selected the best high-leverage forex broker, visit its website to sign up for a trading account. Before you begin the registration process, understand the broker’s terms and conditions. You can also download its app on your mobile device to effectively manage your position on the go.

Once you have selected a broker, create an account using your personal details, such as your full name, email address, phone number, and country of residence. Remember to always provide accurate information since FCA-regulated brokers verify users’ identities and locations.

In this procedure, the broker will require you to provide some documents like an ID card, driver’s license, or passport for identity verification. You should also share a copy of your recent bank statement or utility bill to prove your address. Once your account is verified, an email notification will be sent.

The next step is to deposit funds into your trading account per the broker’s requirements. Brokers in the UK typically accept various payment methods, including credit/debit cards, bank transfers, and e-wallets (Neteller or Skrill). So, choose a convenient payment method to transact with.

Once a broker confirms your deposit, you can start trading by selecting the currency pairs you want to trade and setting up your trading strategy. Remember to start with a small amount and practice using a demo account before trading with real money.

Note: High leverage is a powerful tool that can multiply your gains, but it is also risky as it can magnify your losses. In this regard, ensure you are confident in your trading strategy before applying leverage in your forex trades. Also, have sufficient funds to cover your margin requirement.

Find out about the cheapest brokers UK in our other guide.

FAQs

For beginners, it is generally recommended to start with a lower leverage ratio, such as 10:1 or 20:1, to minimize the risk of large losses. You can gradually increase the leverage ratio as you gain more experience and become more comfortable with the risks associated with leverage.

The maximum forex leverage that retail clients can use is 30:1 for major currency pairs and 20:1 for non-major currency pairs. Professional clients may be able to access higher leverage ratios, but they must meet certain criteria and pass an assessment test. You should confirm a broker’s leverage limit before making a commitment.

High-leverage brokers make money by charging a spread or a commission on each trade. They may also earn revenue by taking the opposite side of their clients’ trades or by earning interest on clients’ funds held in their trading accounts.

Yes. High-leverage forex trading can be a good idea for experienced traders who are able to manage their risk effectively and have a solid trading strategy. However, it is generally not recommended for beginners or traders who are uncomfortable with the risks associated with leverage. High leverage can bring about huge profits and losses, so it is essential to use it responsibly and with caution.

Conclusion

Trading with high-leverage forex brokers in the UK can be a great way to potentially increase* your investment returns. With our recommended brokers and the step-by-step procedures outlined above, you can take advantage of the benefits of high leverage while minimizing the potential downside. Whether you are a newbie or a professional trader, the key is to remain disciplined and always stay informed about market developments and changes in trading conditions.

*Your capital is at risk

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

This high-leverage forex guide is awesome! It explained everything so well, guiding me to make smart choices in the UK market. The way it talks about risks, the pros and cons, and the step-by-step starting guide is super helpful. It's like having a friend who really knows forex, making it easy for anyone new to trading. Big thumbs up!

This guide expanded my knowledge in the forex field. Although I've traded on the market before, the article introduced me to new platforms, particularly IG Markets and City Index. The risk management methods and overview of high leverage were very insightful and helpful. Now I have more tools for successful trading. Thanks for the valuable advice!

I would recommend Pepperstone for beginners. For more experienced traders, XTB is a great choice

The mathematical reality is that high leverage turns trading into a negative-sum game where transaction costs and the inevitable losing streaks will eventually wipe out most participants, regardless of how "user-friendly" the platform is.