Are you looking for the best low spread forex brokers in the UK 2026? Navigating the ever-changing world of online trading can be challenging for newbies, especially when it comes to finding reliable and secure platforms. Fortunately, with our expertise and years of experience, we have prepared a comprehensive list of the top low-spread forex brokers in the UK today. We also provide an overview of choosing the right broker and registering an account, so you are fully prepared to get started.

Essence

- Low spread forex brokers offer competitive spreads, reducing trading costs.

- The best low spread forex brokers in the UK adhere to the Financial Conduct Authority’s (FCA) regulations, ensuring a secure trading environment.

- It is crucial to test, compare, and analyse user testimonials on Google Play, the App Store, and Trustpilot before choosing a suitable low spread forex broker.

- Master the essential tips on currency trading before embarking on this venture.

- A low spread forex broker connects traders directly to liquidity providers using fixed, variable, and zero spread accounts.

- Creating an account with the best low spread forex broker is straightforward and takes minutes to complete.

- Choosing the right low spread forex broker is crucial for maximum experience.

List of the Best Low Spread Forex Brokers in the UK

- Capital.com – Beginner-Friendly Low-Spread Provider

- eToro – Top Option for Copy Trading

- Plus500 – Best* Low Spread Forex Broker For CFD Trades**

- Pepperstone – Best Low Spread Forex Broker For MetaTrader Users

- Spreadex – Best Low Spread Forex Broker With Spread Betting Options

- FxPro – Best Low Spread Forex Broker With a Micro Account

*Investment Trends 2022

**76% of CFD retail accounts lose money

Compare the Best Low Spread Forex Brokers

As mentioned earlier, we took it upon ourselves to conduct thorough market research and comparisons to come up with our list above of the best forex brokers with low spreads in the UK. In our comparison process, various elements were considered, which we have included in the table below for informed decisions.

| Low Spread Forex Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes (up to £85,000) |

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit Cards, Bank Transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes | Yes (up to $250,000) |

| Plus500 | FCA, CySEC, ASIC, MAS, FSA | 24/7 | Plus500 Webtrader | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, ASIC, DFSA | 24/7 | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai, Social Trading | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay | Yes | Yes (up to £85,000) |

| Spreadex | FCA | 24/5 | TradingView | Bank Wire Transfer, Credit cards | No | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB, FSCM | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes | Yes (up to €20,000) |

Brief Overview of Our Recommended Brokers’ Fees and Assets

Before engaging in forex trading in the UK, it is advisable to select a broker with features aligning with your trading requirements. We will guide you through the elements to consider in your selection later in this guide. But first, here is a table we prepared showing our recommended brokers’ fees and featured assets for informed decisions.

Fees

| Low Spread Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| eToro | From 2 pips | £50 | £5 withdrawal | £10 monthly |

| Plus500 | From 0.0 pips | £100 | Free | £10 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| FxPro | From 0.0 pips | $100 | Free | $15 once + $5 monthly |

Assets

| Low Spread Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Capital.com | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | No |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | No |

Our Opinion & Overview of the Best Low Spread Forex Brokers

After extensive research, thorough analysis of user testimonials, and rigorous testing, we have identified the best low spread forex brokers in the UK. These brokers have consistently demonstrated their commitment to providing traders with competitive pricing, transparent offerings, and outstanding customer service. Join us below as we provide detailed overviews of each of these top-tier forex brokers with low spreads. Discover why these brokers have earned their reputation and how they can enhance your forex trading experience.

1. Capital.com – Beginner-Friendly Low-Spread Provider

The first thing that struck us when testing Capital.com for forex was how competitive its spreads are, even for traders just starting out. On major pairs like EUR/USD, spreads begin from 0.0 pips, and trades are commission-free. Its low minimum deposit requirement of £20 is also a standout feature. For beginners, that means you can practise strategies and grow confidence without high trading costs eating into every move. You can also start with a demo account, which is completely risk-free and funded with virtual money.

What we also liked is that Capital.com offers free deposits and withdrawals, so you don’t need deep pockets to get going. The platform itself feels intuitive on both desktop and mobile. If you’re ready to expand your skills, you can connect to MT4 or TradingView for more advanced charting, social trading, and automated strategies.

Overall, Capital.com lists over 120 currency pairs and an additional 4,000 CFD and spread betting instruments. These include shares, commodities, cryptos, and indices. You can also trade on its 1X platform, which doesn’t come with leverage trading options. In terms of learning materials, there are plenty of resources, including the Investmate app, which newbies will utilise to boost their skill levels.

- Low spreads from 0.0 pips with no commissions

- Low minimum deposit requirement for UK clients

- User-friendly platform with MT4 and TradingView support

- Excellent educational resources for beginners

- Range of risk-management tools

- No copy trading feature

- Advanced tools may feel overwhelming at first

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

2. eToro – Top Option for Copy Trading

We believe eToro is a smart pick for forex traders who prioritise low-friction access and social-copy trading. The broker allows you to trade over 68 currency pairs, with leverage up to 1:30 for retail clients and 1:400 for professional clients. While spreads on the major currency pairs start from 1 pip, they’re not the absolute lowest compared to most peers. However, we find the fees sufficient for strategic trading and swing approaches.

One of the features that makes eToro stand out is its CopyTrader tool, which lets you replicate the strategies of top-performing forex traders in real time. This feature gives less-experienced users access to more sophisticated strategies without having to build their own system. On top of that, you can use Smart Portfolios for multi-asset themes, including forex exposure.

Beyond forex, eToro offers an additional 7,000+ financial instruments, comprising shares, indices, commodities, crypto, ETFs, and more, for portfolio diversification. You can get started with as little as £50, which makes entry easy for UK clients. On top of that, eToro hosts a £100,000 virtually-funded demo account to test forex ideas risk-free. You also have an opportunity to earn up to 3.8% annual interest on cash balances, paid monthly.

- CopyTrader lets you mirror real traders’ forex strategies

- Access to 68+ forex pairs with decent leverage

- Has a highly rated copy trading platform

- Low minimum deposit requirement for UK clients

- Offers an opportunity to earn up to 3.8% interest on idle cash

- Spreads from around 1 pip aren’t the absolute lowest in the industry

- £5 withdrawal fee

- Copying requires £200 minimum allocation to a trader

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

3. Plus500 – Best Low Spread Forex Broker For CFD Trades

*Illustrative prices

Plus500 is a highly reputable* online broker in the UK that offers low spreads on forex CFD trades. While exploring it, we discovered that it lists over 60 currency pairs to choose from, thus making it easier for you to explore different global currencies and maximise your experience. Moreover, the broker offers leverage up to 300:1 for professional traders, if they meet specific criteria: sufficient trading activity in the last 12 months, a financial instrument portfolio of over €500,000, and relevant experience in the financial services sector — an attractive option for those looking to trade forex with small capital. All you have to do is deposit at least £100 to get started, which is a reasonable amount for both new and experienced traders.

In addition to forex trading, Plus500 provides access to over 2,000 CFD assets, including shares, commodities, indices, and more. There were no commission charges when we traded with it, but we incurred spreads starting from 0.0 pips. On top of that, Plus500 does not charge fees for transactions, which led us to conclude that it is a cost-effective option for budget-conscious traders. When it comes to support service, Plus500 is backed up by a dedicated team available 24/7 support service via email and live chat. For these reasons, we grant Plus500 a remarkable 4.9-star rating.

*Investments Trends 2022

- Low minimum deposit requirement

- Leverage limits up to 300:1 for professional traders

- Great 24/7 support service via email and live chat

- Commission-free forex trading

- Limited learning and research tools

- Inactivity fee of £10 per month if you fail to log into your account for over 3 months

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. Pepperstone – Best Low Spread Forex Broker For MetaTrader Users

Drawing from our comprehensive research and hands-on experience, we confidently endorse Pepperstone as the top choice for MetaTrader users seeking a low spread forex broker in the UK. With a minimum deposit requirement of £0 for UK traders, Pepperstone offers access to a wide array of over 60 currency pairs, featuring impressively low spreads starting from just 0.0 pips. The broker’s commitment to fast execution speeds makes it an ideal selection, particularly for those engaged in short-term trading strategies.

What sets Pepperstone apart is its expansive offering of over 1,200 CFD assets, including shares, indices, ETFs, and commodities, providing opportunities for portfolio diversification.

We also noted that the broker prioritises user convenience, offering a streamlined account opening procedure that enables traders to kickstart their trading journey swiftly. Its inclusion of forex spread betting is noteworthy, appealing to traders who prefer speculating on price movements. With a variety of forex trading platforms, including TradingView, MT4, MT5, and cTrader, rest assured of enjoying powerful tools for market analysis. We, therefore, give Pepperstone an impressive 4.9-star rating.

Read about the best spread betting brokers in the UK in our other guide.

- Low spreads from 0.0 pips for forex trading

- Additional 1,200+ CFD assets, including shares, indices, ETFs, and commodities, and more

- Advanced platforms, including MT4, MT5, and cTrader, with powerful tools and features

- Pepperstone has an Active Trader Program that offers additional benefits and perks for experienced traders.

- Only forex and CFD assets supported

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

5. Spreadex – Best Low Spread Forex Broker With Spread Betting Options

Based on our extensive research and experience reviewing Spreadex, we have found it to be an exceptional low spread forex broker in the UK. Spreadex boasts a legacy spanning over two decades and has continuously adapted to harness cutting-edge technology, offering traders a seamless blend of mobile convenience and spread betting flexibility. Our in-depth analysis of Spreadex revealed that traders benefit from a robust and intuitive platform, making it effortless to navigate the complex currency markets.

We were particularly impressed with Spreadex’s extensive offering of over 60 currency pairs and its unique feature of no minimum deposit requirement, making it an attractive choice for both novice and experienced forex enthusiasts. Spreadex’s commitment to competitive pricing, with spreads as low as 0.6 pips, has further solidified its status as a cost-effective option for traders seeking to maximise returns while minimising trading costs. Overall, we are pleased to give Spreadex a commendable 4.3-star rating.

- Free deposits and withdrawals

- Over 60 currency pairs are available for trading

- User-friendly forex broker suitable for traders of all levels

- Competitive spreads starting from 0.6 pips, helping to reduce trading costs.

- No negative balance protection for professional traders

- Limited advanced research resources

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

6. FxPro – Best Low Spread Forex Broker With a Micro Account

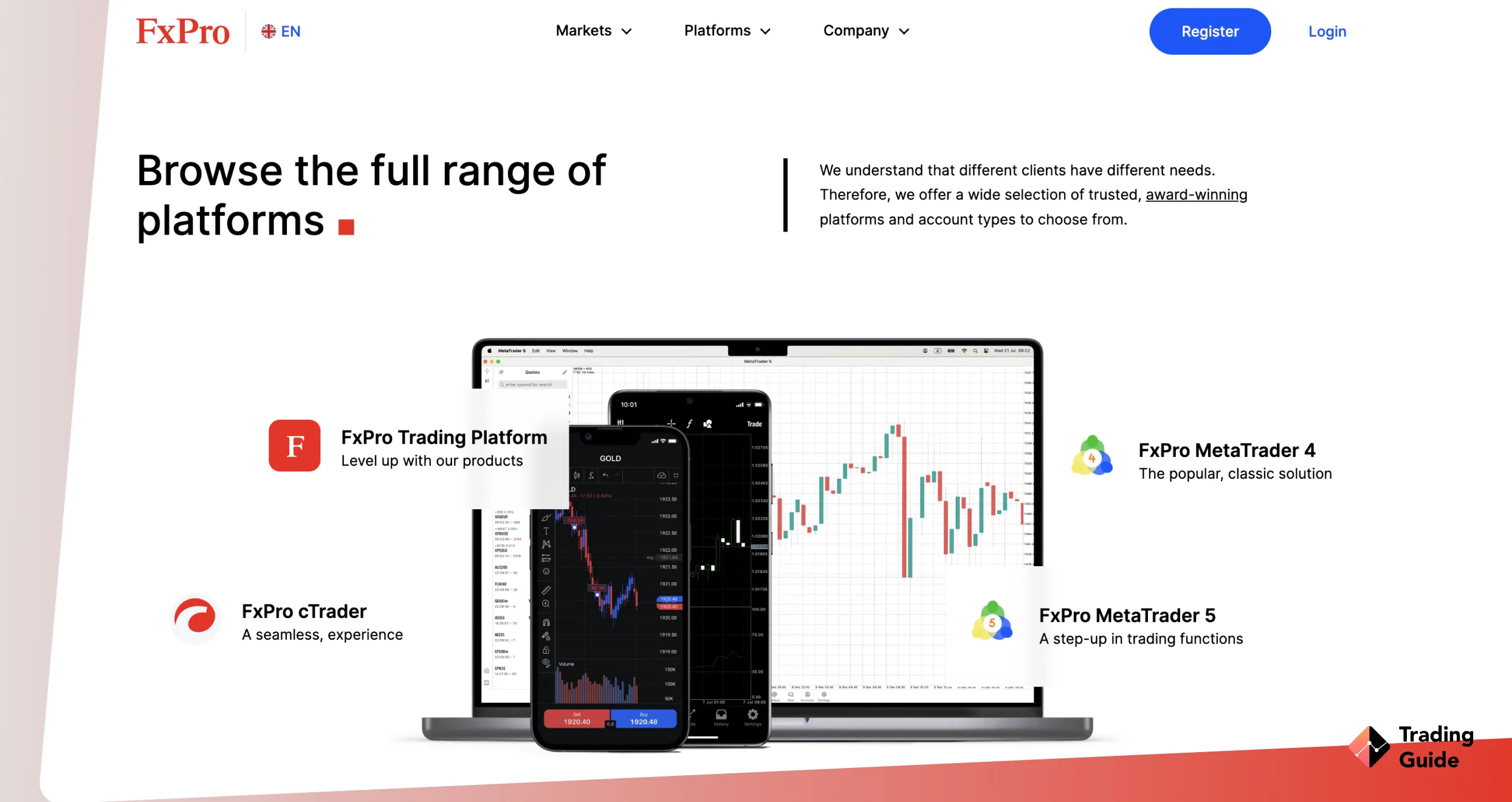

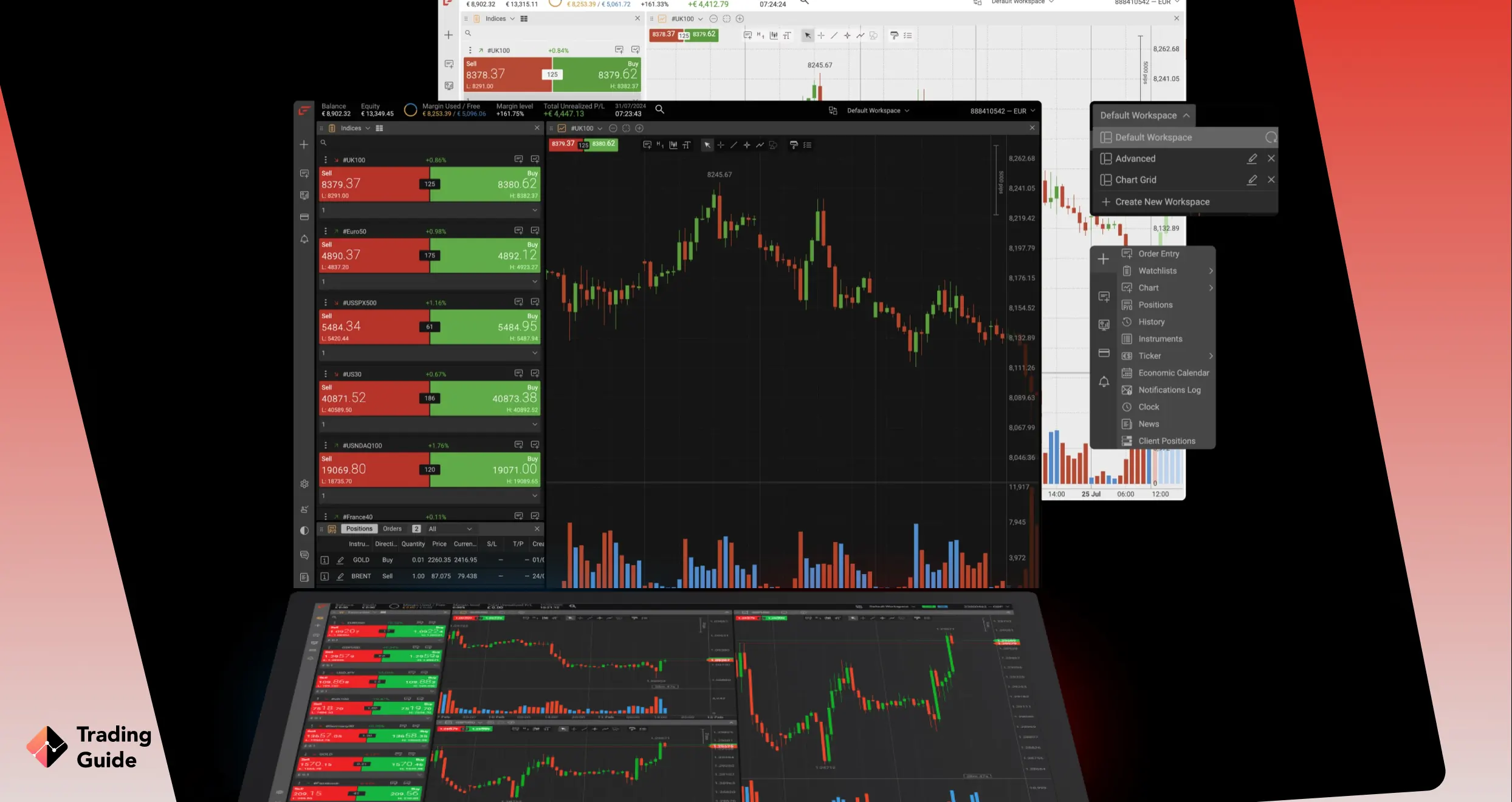

Our extensive research has led us to declare FxPro as the best low-spread forex broker with a micro account in the UK. From our analysis, the platform offers an impressive array of over 70 currency pairs, allowing traders to capitalise on diverse market opportunities. FxPro’s user-friendly and customisable platform, accessible through FxPro Web, cTrader, MT4, and MT5, ensures a seamless forex trading experience.

This broker has a £100 minimum deposit requirement, which provides affordability for a broad range of traders. However, a £1,000 deposit is suggested for those seeking optimal conditions. The inclusion of a micro account with trade sizes from 0.01 lots caters to traders of varying risk appetites. Users will also enjoy quality research materials, responsive support, and an extensive range of spread betting securities. You can test it via its demo account to confirm whether it meets your requirements.

- Trade sizes from 0.01 lots

- Over 70 currency pairs

- Low minimum deposit requirement

- Quality research and market analysis tools

- Limited learning materials compared to its peers

- No copy or social trading

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

What Do Other Traders Say?

Besides testing and comparing hundreds of low-spread forex brokers in the UK, we also analysed what other traders had to say regarding their experiences with the brokers. This is to ensure we leave no table unturned in our research and prove that our research process and findings are unbiased. Take a look below at some of the comments we sampled to help you make the best choice.

Pepperstone

Delving into user testimonials, we discovered that Pepperstone is a favourite among MetaTrader and CFD users, primarily due to its reputation for low spreads and rapid execution. Traders appreciate the streamlined account opening process and often highlight the platform’s reliability.

-

“Got fast and effective help in real time from Constantine, by means of the chat applet, through the application process for a live account. Issues fixed satisfactory and quickly.” – DEL REGNO David

-

“I’ve used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features.” – Jana from Gold Coast

-

“Easy to open. Easy to use. Easy to add money. Easy to withdraw money. Good customer service. Fast execution. Less spreads. Just learn how to trade and have fun.” – Pruthviraj Rathod.

Plus500

Our analysis of user comments shows that Plus500 is well-regarded for its range of assets, including forex and beyond. Zero commission trading and spreads starting from 0.0 pips are attractive features. Users also commend the broker’s 24/7 customer support, ensuring help is available when needed.

-

“After many years of trading on this platform I had the chance to learn and improve my trading skills. It’s the best app and easy to use. I’ve tried other platforms but this one it’s far better ?” – Ludovic Gyorfi

-

“Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here.” – ramzyki

-

“I had a good experience with Plus500.

I recommend for those who want to achieve their goals come and invest with Plus500 and you will never be regret.” – Anonymous user

Spreadex

After analysing user testimonials on Google Play, the App Store, and Trustpilot, we discovered that many users appreciate Spreadex for its user-friendly platform, competitive spreads, and a wide range of tradable instruments. Traders consistently highlight their satisfaction with the broker’s accessibility and all-in-one trading solutions.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

-

“A very useful financial spread betting app that should cover all your needs. It’s definitely the most useable of the broker apps that I’ve tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. They’ve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far” – JakeReadman

The Ultimate Guide to Low Spread Forex Trading

Selecting a low spread forex broker is just the beginning of your journey into the world of forex trading. To truly optimise your trading experience and navigate the dynamic forex market effectively, you also need a solid understanding of how to get started with low spread forex trading in the UK. In the sections below, we will provide you with an in-depth guide, ensuring that you are well-prepared to make informed decisions and succeed in the world of low spread forex trading.

How to Start Low Spread Forex Trading

Before you start trading forex using low spread brokers in the UK, you must understand various elements to easily manoeuvre the dynamic currency market. Below, we highlight some tips to help you along the way and maximise your chances of earning profits.

- Educate Yourself – The first step in low spread forex trading is to educate yourself about the forex market. Understand the basics of currency pairs, how the market operates, and the factors influencing currency exchange rates. There are plenty of educational resources available online, including courses, webinars, and trading books that can help you gain the knowledge you need. Also, keep up with the latest news and economic events that could impact the forex market.

- Select a Reputable Broker – Choosing the right low spread forex broker is crucial. Look for brokers regulated by the Financial Conduct Authority (FCA) in the UK to ensure a high level of safety and security for your funds. Compare different brokers to find the one that offers competitive spreads, a user-friendly trading platform, and excellent customer support.

- Practice with a Demo Account – Before risking your real capital, open a demo trading account with your chosen broker. This will allow you to practice trading with virtual money, honing your skills and strategies without the risk of losing your hard-earned cash.

- Develop a Trading Plan – A well-defined trading plan is essential for success in low spread forex trading. Determine your risk tolerance, set clear entry and exit points, and establish a risk management strategy. Your plan should also include how much capital you’re willing to invest and your overall trading goals.

- Start Small – When you’re ready to trade with real money, start small. It’s better to begin with a modest investment and gradually increase your position size as you gain experience and confidence. This approach helps manage risk and protects your capital.

- Use Risk Management Tools – Employ risk management tools offered by your broker, such as stop-loss orders and take-profit orders. These tools can help you limit potential losses and lock in profits.

- Keep Records – If you are a beginner in the currency market, it is advisable to keep a trading journal to record your trades, strategies, and outcomes. This will help you analyse your performance, identify strengths and weaknesses, and make improvements over time.

How To Choose the Right Low Spread Forex Broker

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

Selecting the right low spread forex broker in the UK is a pivotal decision for traders. In a market saturated with options, the task of finding the broker that aligns with your needs can be a daunting one. To simplify this process, we’ve compiled the key points you should consider when choosing the ideal low-spread forex broker in the UK.

Your top priority should be security. Look for a forex broker regulated by the Financial Conduct Authority (FCA) to ensure your trades are conducted under the best possible conditions and your funds remain protected. The FCA oversees and regulates financial markets in the UK, including forex brokers, ensuring strict adherence to financial and ethical standards. This not only safeguards your data and funds but also simplifies the legal recourse in case of contract breaches.

The availability of currency pairs is another critical factor. A reputable forex broker should offer a broad spectrum of currency pairs, encompassing major, minor, and exotic pairs. The greater the variety of currency pairs offered, the more trading opportunities become available. Additionally, a good broker should extend its asset offerings to include stocks, commodities, cryptocurrencies, and more for portfolio diversification.

The trading platform is the primary tool for forex trading. It’s imperative to select a broker with a reliable and user-friendly platform that facilitates fast trade execution and provides quality learning and research tools. Ideally, choose a broker offering multiple trading platforms, including desktop, mobile, and web-based options, to ensure constant access to your account.

Forex brokers impose various fees and commissions, including spreads, overnight fees, and transaction charges. It’s crucial to opt for a broker that offers transparent pricing with no hidden fees that might catch you off guard. Traders should also seek brokers with low transaction costs, as excessive fees can erode profits.

The quality of customer service is another essential consideration. A reliable forex broker should offer efficient customer support, whether it operates 24/7 or five days a week. Equally important is that customer support should be accessible through multiple communication channels, such as phone, email, and live chat, and provide timely and helpful responses to inquiries.

Analyzing user reviews and recommendations is crucial when evaluating a low-spread forex broker in the UK. Seek out user reviews on reputable platforms like Trustpilot, Google Play, and the App Store. These reviews can provide valuable insights into the broker’s performance, reliability, and the quality of their customer service.

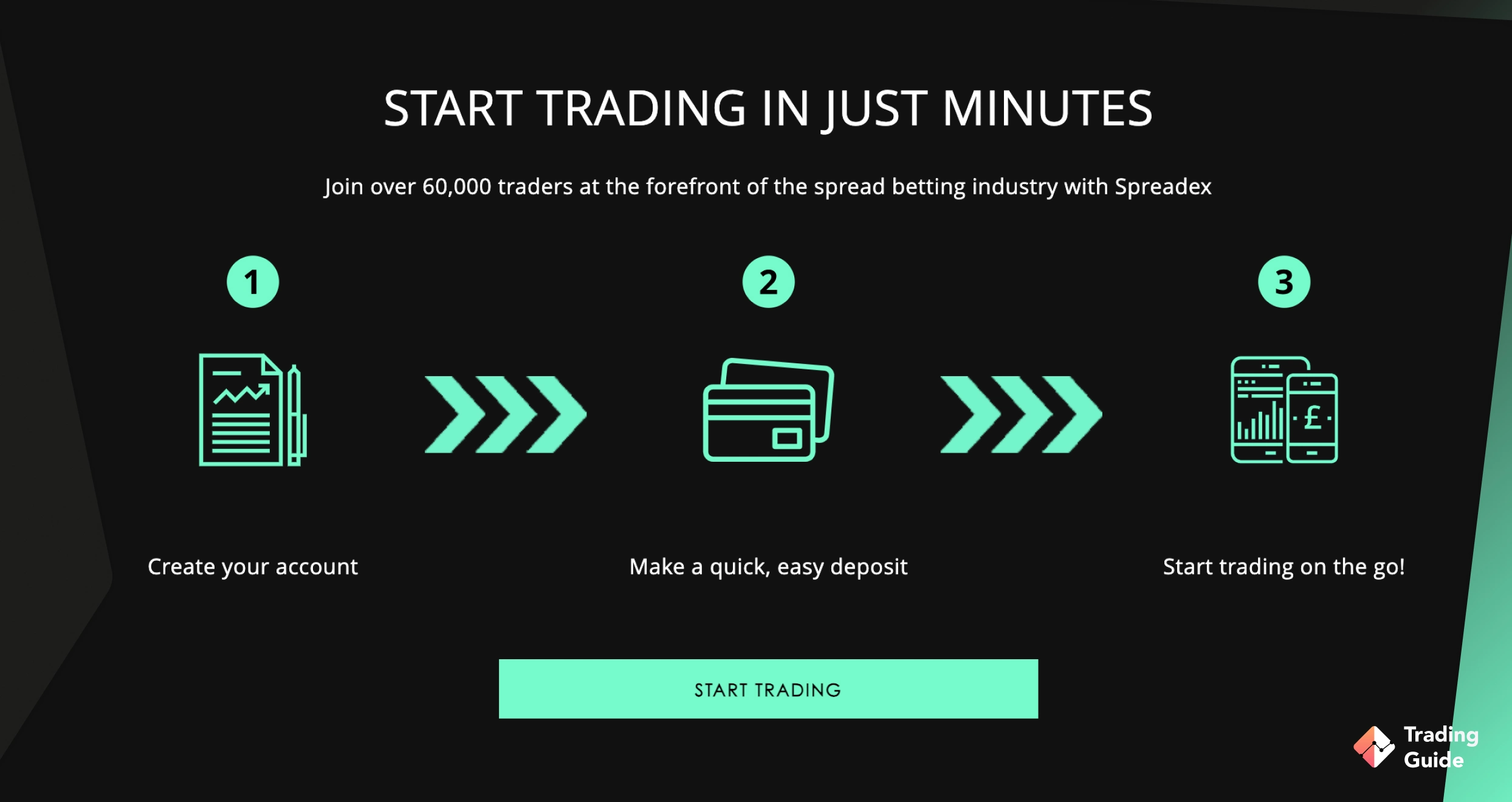

5 Quick Steps To Start Trade Forex With a Low-Spread Account

If you’re looking to initiate forex trading with a low-spread account in the UK, there are five fundamental steps you should follow to get started. Here, we provide a comprehensive guide on how to register for a low-spread forex account in the UK.

Commence your journey by visiting the website of a reputable broker that offers low-spread forex accounts in the UK. You can effortlessly do this by selecting a broker from our list of recommended options above and promptly accessing their website through the provided link. It’s essential to thoroughly understand the broker’s terms and conditions and, if applicable, install their trading application before proceeding with the registration process.

Upon arriving at the broker’s website, look for the “Sign Up” or “Register” button. Click on it and meticulously follow the provided instructions to create your trading account. You will be prompted to furnish personal information, including your name, email address, phone number, date of birth, and other necessary details.

Following the successful creation of your account, the next imperative step is to verify it. This process aligns with regulatory requirements established by the Financial Conduct Authority (FCA) to ensure a broker’s compliance with anti-money laundering regulations. To verify your identity, you will be requested to submit a copy of your ID, passport, or driver’s license. Additionally, the broker may require you to supply a recent utility bill or bank statement as evidence of your address.

Once your account has been verified, you can proceed to deposit funds in accordance with the broker’s specified minimum deposit requirement. It’s worth noting that most brokers offer various payment options, including bank transfers, credit cards, and e-wallets. Therefore, select the payment method that suits you best and diligently follow the provided instructions to complete the deposit.

With funds securely in your account, you are now prepared to embark on your forex trading journey with the benefit of low spreads. Ensure that the selected broker provides you with a user-friendly trading platform for seamless buying and selling of currency pairs. To mitigate risks, consider testing the broker using its risk-free demo account before engaging in real-money trading.

What is a Lowest Spread Forex Broker?

A lowest spread forex broker is a financial intermediary that offers traders an opportunity to engage in forex trading with minimal cost differentials between the buying and selling prices of currency pairs. In essence, the “spread” refers to the price difference between what a trader can buy a currency pair for (the ask price) and what they can sell it for (the bid price). A low spread broker strives to keep this price difference as small as possible, thereby reducing the trading costs incurred by traders. This feature is highly sought after in the forex market, as it can significantly enhance a trader’s profitability and efficiency, making it a key criterion for traders when choosing their preferred broker.

How Does a Low Spread Forex Broker Work?

A low spread forex broker operates by connecting traders to liquidity providers, such as major banks and institutions, to offer competitive spreads. This is achieved through a competitive bidding process where the broker secures the best price for traders. Fast trade execution and transparent pricing ensure minimal cost differentials, empowering traders with cost-effective trading in the dynamic forex market.

To fully enjoy the services that come with low spread forex brokers in the UK, you must sign up for a trading account. For beginners, consider starting with a broker’s demo account, especially if it has a high minimum deposit requirement. Then, choose the best account for your skill level, considering the options below.

Zero Spread Accounts

Zero spread accounts are a type of forex trading account where the spread is set at zero, and traders pay a commission on trades. This eliminates the spread cost, providing transparency and potentially cost-effective trading. Zero spread accounts are popular among brokers looking to minimise traders’ costs and give them transparent pricing.

Fixed Spread Accounts

Fixed spread accounts offer traders consistent spreads for specific currency pairs, unaffected by market conditions. This predictability is advantageous for those seeking stability in pricing, especially for longer-term strategies. However, fixed spreads are typically wider than variable spreads, potentially resulting in higher trading costs over time. This means you should weigh predictability against costs when choosing a fixed spread account.

Learn how to trade CFDs in our other guide.

FAQs

There is no definitive answer to this question, as the best low spread forex broker in the UK may vary depending on individual needs and preferences. The good news is that we recommend above the best low-spread forex brokers in the UK based on multiple tests and comparisons. All you have to do is select the one with features meeting your trading requirements.

The most trusted low-spread forex brokers in the UK are licensed and regulated by the Financial Conduct Authority (FCA). They also have an excellent reputation from most users on platforms like Google Play, the App Store, and Trustpilot. We list above examples of FCA-regulated brokers that guarantee your funds’ safety and maximum trading experience.

Yes. Although it is unlikely to find a broker with 0 spreads, most of them charge commissions instead, as this is one of the ways they make money. However, some brokers, like the ones we recommend above, offer very low spreads, particularly for major currency pairs such as EUR/USD or GBP/USD.

A low-spread broker can provide several benefits for traders, including reduced trading costs and the potential for higher profits. Lower spreads mean that traders can enter and exit trades at a lower cost, which can be particularly beneficial for high-frequency traders or scalpers.

Conclusion

The importance of having a credible and reliable low spread forex broker cannot be emphasised enough. As a trader trying to explore the currency market, our above recommendations are your best platforms to get started. All you have to do is compare their features for informed selection.

Remember, always take advantage of a broker’s demo account to avoid risking real money without understanding its operations. Most importantly, be patient, especially if you start by incurring losses. With the best low spread forex broker plus our guidelines for getting started above, it will be easier for you to manoeuvre the currency market and maximise your chances of earning profits.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I found this article about low-spread forex brokers extremely enlightening! The authentic user testimonials and the comprehensive guide were instrumental in making informed choices. It serves as a valuable guide, particularly for those navigating the trading realm, especially in crypto. The breakdown of pros and cons, along with user recommendations, establishes it as a trustworthy resource. I highly recommend it to fellow traders for a smooth beginning.

After reading the article, I reconsidered my views on forex brokers with low spreads, and despite using OANDA, I am now contemplating a switch to Plus500. The clear steps for registration and starting trading provided in this article are appealing. The explanation of how it works enhances understanding in choosing the best conditions for successful trading. The recommendations on selecting an account type with zero or fixed spreads are insightful. I will definitely give it a try.

I’ve had a good experience with eToro for forex trading. It's not listed above, but it's a solid choice, especially for beginners. The platform is user-friendly, offers social trading features, and provides a wide range of assets, including forex. Plus, it has no minimum deposit for UK traders, which is great for those just starting out.

I’ve used Pepperstone in the past, and I agree that their low spreads and fast execution are great for short-term trading. Have you found any broker that stands out for you when it comes to customer service?