The search for the best forex brokers with micro account in the UK may seem overwhelming to most traders, especially with the many options dominating the financial market. The good news is that our team of expert researchers has conducted the necessary due diligence to ensure you have the best forex micro lot UK brokers at your disposal to choose from. Take a look below. We will also share the basic tips for getting started with such brokers, and many more.

Essence

- A micro account is a trading account specifically designed for beginner traders or those with limited capital. It allows traders to start with smaller investments than a standard account.

- Due to smaller trade sizes, micro accounts help mitigate risks, allowing traders to learn and practice without substantial financial exposure.

- Micro lot trading brokers usually offer leverage options, allowing traders to control more significant positions with a small amount of capital.

- Choose a micro account broker regulated by reputable authorities like the FCA for security and compliance.

- The best micro lot brokers should offer trading account upgrade options, allowing traders to transition to standard account as their skills and capital grow.

- Our recommended micro brokers offer transparent trading conditions, including spreads, commissions, and execution policies.

List of the Best Micro Account Brokers

- eToro – Beginner-Friendly Forex Micro Account Broker

- Pepperstone – Top Broker For MetaTrader Users

- Spreadex – Top Option For Spread Betting

- XTB – Best For Mobile Trading

- FxPro – Best for Automated Trading

How We Choose Micro Account Brokers

You probably must be wondering how we selected our top brokers with micro account in the UK. Although the process was lengthy and overwhelming, the result was rewarding as we got to recommend the best and inform our readers accordingly.

We begin by conducting comprehensive research to identify brokers specifically catering to traders with micro accounts. We prioritise those with robust security measures and are regulated by the Financial Conduct Authority (FCA).

Once we have a list of potential micro trading account brokers, we assess their trading platform features using demo accounts as they are risk-free and virtually funded. By testing and comparing as many micro accounts as possible, we are guaranteed the best options that cater to traders of all types.

We always believe in remaining unbiased while recommending brokers and trading platforms. That is why we also analyse user comments and ratings on Google Play, the App Store, and Trustpilot. By combining our findings with the test results, our readers are guaranteed micro account brokers that maximise their trading experience.

Compare Best Micro Account Brokers

Besides testing micro account brokers’ performance in the UK, we compare their features to ensure we categorise them accordingly for our readers. Some of the elements we consider include licences, support service availability, supported software and more. See below a table we have prepared highlighting some of our recommended brokers’ features for informed decisions.

| Micro Account Broker | Licence | Support Service | Software | Payment | Demo Account |

|---|---|---|---|---|---|

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit cards, Bank transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView, cTrader | Credit/debit cards, PayPal, Skrill, Neteller, POLI | Yes |

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank transfer, Neteller, Apple Pay & Google Pay | No |

| XTB | FCA, FSC, CySEC | 24/5 | xStation 5, xStation Mobile | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal | Yes |

| FxPro | FCA, FSCA, SCB | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes |

Brief Overview of Our Recommended Brokers’ Fees and Assets

As a trader, it is advisable to select the best forex brokers with micro account. This means they must have features aligning with your trading needs. Among these features are the applicable fees and assets to ensure you plan and budget accordingly. We understand that the comparison process can be lengthy. That is why we have prepared tables below highlighting our recommended brokers’ fees and assets for the best choices.

Fees

| Micro Account Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| eToro | 2 pips | $50 | $5 withdrawal | $10 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

| FxPro | From 0.0 pips | £100 | Free | £15 one-off maintenance fee |

Assets

| Micro Account Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| eToro | Yes | Yes | Yes | Yes | No |

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | No | Yes |

1. eToro – Beginner-Friendly Forex Micro Account Broker

From our tests and comparisons, we find eToro to be the top forex platform for newbies primarily due to its user-friendly and intuitive design platform. Still, it also has a low minimum deposit requirement of £50 for UK clients. This makes it easier for newbies to join the currency market without spending a lot of money. So far, we explored over 50 currencies, which we believe is enough to trade and diversify your forex trading portfolio. You can also trade and invest in stocks, ETFs, cryptos, commodities, and more at eToro.

Another element that made us list this best forex broker as beginner-friendly is its vast learning materials. These include articles, guides, recorded videos, webinars, and more. Plus, this broker’s demo account is tailored with beginner traders in mind. The account is fully loaded with £100,000 virtual funds to test this best broker and gauge your skill level before diving into live trading. Note that all deposits are free of charge when transacting, and you can use eToro’s micro account to access the social and copy trading features for maximum experience.

- Over 50 currencies to trade using eToro’s micro account

- Low minimum deposit requirement

- A simple and intuitive design platform

- Social and copy trading

- Withdrawal fees apply

- High forex trading spreads

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

2. Pepperstone – Top Broker For MetaTrader Users

Pepperstone stands out for micro lot traders who rely on MT4 and MT5, mainly because its pricing and execution conditions stay consistent even at the smallest position sizes. On the Razor account, commissions apply only when trading CFD Forex, and micro lots are rounded up or down on both MT4 and MT5. When you place a 0.01 lot trade on Razor, the commission typically rounds to £0.023 per 0.01 lot, with MT4 calculating both sides upfront. This level of clarity matters for micro traders who watch every pip of cost.

Forex trading at Pepperstone gives you access to over 90 currency pairs. You can trade them at low spreads starting from 0.0 points and low commissions on the Razor account. And besides forex, Pepperstone supports CFD trading and spread betting across 2,700+ assets, including shares, commodities, indices, ETFs, and more.

While MetaTrader remains the star attraction, this forex broker gives access to cTrader and TradingView platforms. You will benefit from quality advanced resources, including Expert Advisors, custom indicators, strategy backtesting, Smart Trader tools, social trading, and advanced charting. We also like that there are plenty of learning materials and a virtually funded demo account for beginners to get started.

- No minimum deposit requirement for UK clients

- Advanced features on the MetaTrader platforms, including automated trading, backtesting, and more

- Low trading fees

- Deep liquidity even for 0.01 lot trades

- Gives access to cTrader and TradingView platforms

- The Razor account charges commissions and spreads

- Lacks non-CFD assets

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

3. Spreadex – Top Option For Spread Betting

Spreadex has firmly established itself as the premier spread betting brokerage firm in the UK, and it stands out as our top choice for traders seeking a micro account option. With an impressive track record dating back to 1999, we believe this best forex broker offers a unique advantage of accessing the dynamic world of spread betting with a micro account. This makes it an ideal option for beginners and those looking to limit their risk exposure. From our hands-on experience, Spreadex has a user-friendly platform that caters to all levels of traders. It also offers over 60 forex pairs and an additional 10,000+ assets, including shares, commodities, indices, and more.

We noticed that Spreadex does not have a minimum deposit requirement, thus reducing the barrier to entry into the spread betting market. Its micro account, coupled with competitive spreads empowers traders to explore the intricacies of spread betting without committing substantial capital. The broker’s long-standing presence in the industry and dedication to ensuring client satisfaction solidifies its position as one of the best choices for spread bettors in the UK.

- Features social trading on its TradingView platform

- Over 60 currency pairs to trade

- Low spreads

- No minimum deposit requirement

- No Islamic or demo account

- No negative balance protection for professional traders

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

4. XTB – Best For Mobile Trading

We tested XTB and discovered that its micro lot trading feature is facilitated through a user-friendly and intuitive platform. XTB has no minimum deposit requirement, meaning users can start exploring the financial market with any amount they can afford. Additionally, the micro account option offers low spreads starting from 0.1 pips, making it an optimal choice for low-budget traders or newcomers. We explored over 50 currency pairs at XTB’s trading app. It also features an additional 6,000+ asset classes for efficient portfolio diversification.

Besides executing trades seamlessly on mobile devices, we noticed that the XTB trading platform employs robust security measures. This guarantees maximum safety for users’ personal details and funds. And although it doesn’t feature third-party platforms, the broker’s xStation 5 and xStation Mobile platforms offer unique resources for all types of users. On top of that, we like the fact that this CFD broker provides competitive interest rates on uninvested funds. It potentially allows traders to earn up to 5% GBP, 2.0% EUR or 2.0% USD annually. These rates offer an added avenue for potential passive income.

- A user-friendly trading app with high ratings from users

- No minimum deposit requirement

- Responsive and reliable support service

- Low spreads on the micro account

- Hosts only CFD and forex instruments

- Transaction charges apply to some e-wallet payments

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

5. FxPro – Best for Automated Trading

FxPro is one of the strongest UK brokers for traders who want a true micro account and the flexibility to automate almost any strategy. The broker allows trading from 0.01 lots across MT4, MT5, cTrader, TradingView and its own FxPro platform. This gives micro traders a full choice of advanced tools without needing a large deposit. You can get started with a minimum deposit of £100 and enjoy a retail leverage limit of up to 1:30 for forex.

We enjoyed automated trading at FxPro’s MT4 and MT5 platforms that support Expert Advisors. There is also the cTrader, which offers cBots written in C# and TradingView that gives access to Pine Script strategies. This makes the micro account attractive for traders testing robots or refining new systems. And the best part is that all platforms support fast execution, depth of market, one-click trading and custom indicators, with no dealing desk intervention.

Beyond over 70 currency pairs, FxPro lists 2,100+ CFD instruments including metals, indices, energy, futures, shares and ETFs. Traders can also access Trading Central insights, an economic calendar, technical materials, webinars and a full knowledge hub. On top of that, transactions are free, and its 24/5 dedicated support has proven reliable to many traders.

- Low minimum deposit requirement for UK clients

- Excellent automation support across MT4, MT5, cTrader and TradingView platforms

- Lists over 70 currency pairs and an additional 2,100+ securities for portfolio diversification

- Free deposits and withdrawals

- Quality learning and research tools

- Only CFD and spread betting assets are offered

- Charges an inactivity fee after only 6 months of the account’s dormancy

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

What Do Other Traders Say?

We do not rely solely on tests and comparisons when choosing the best micro account brokers to recommend. We also analyse user testimonials on Google Play, the App Store, and Trustpilot. This way, we get to fully understand the brokers’ strengths and weaknesses, thus making unbiased decisions. See below a few of the comments we sampled. We hope you will get a better insight into your research for the best broker.

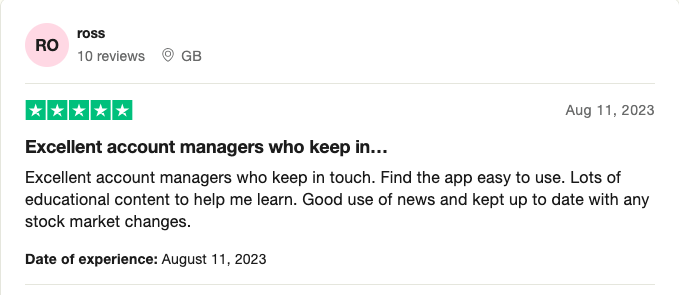

XTB

Traders appreciate XTB’s comprehensive trading tools and educational resources. The platform’s analytical tools and customer support are highlighted as advantageous.

-

“I have shares in other brokers, but I’m using this app to check prices and charts because it’s simply better. Flawless usability” – Kosciej

-

“Very good app. Customer service is welcoming. Lots of information for new traders available for free. Feel very valued and accepted as a beginner. Best app I have found after trying 10+ others.” – Thomas Ashley

-

“Excellent account managers who keep in touch. Find the app easy to use. Lots of educational content to help me learn. Good use of news and kept up to date with any stock market changes.” – Ross

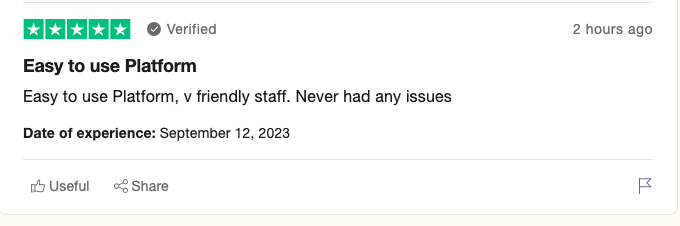

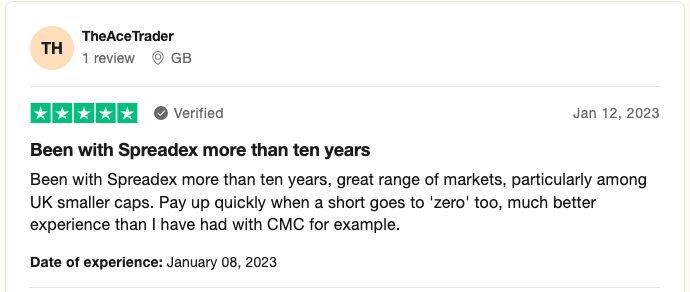

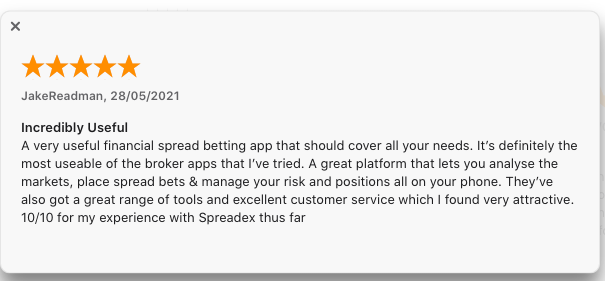

Spreadex

Spreadex stands out for its simplicity and accessibility in trading. Users commend the platform’s user-friendly interface and diverse range of markets available for trading.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

-

“A very useful financial spread betting app that should cover all your needs. It’s definitely the most useable of the broker apps that I’ve tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. They’ve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far” – JakeReadman

Micro Accounts vs Standard Account

Many traders are profiting from forex trading, and as a result, we’ve seen many join the currency trading venture. However, the activity carries the risk of losing money if you do not apply the best trading strategies accordingly.

Traders are torn about choosing between a Micro, Mini, or Standard trading account. A micro account is primarily suitable for newbies since it allows them to trade forex without investing a lot of money. This also means that the minimum deposit requirement for brokers with micro account is low.

The contract size to trade on this micro/small account is 1000 units of base currency. Most brokers with mini accounts also offer low spreads and a low minimum deposit requirement. There is also higher leverage.

In contrast, a standard currency trading account is for more advanced traders with a contract size of 100,000 units of base currency. You will also find this account type charging high trading fees with a high minimum deposit requirement (probably thousands of pounds).

Read full info about the DMA brokers in the UK and the best forex signal providers in our other guides.

How to Choose the Best Micro Account Trading Broker

Engaging in a real trading environment using a micro lot account broker is one way of improving your potential for success. Since trading using a micro account carries higher leverage, there are increased risks involved. Therefore, you should carefully choose the best forex broker by considering the following elements:

Reputable brokers with micro account that are highly regulated in the UK market should be what to go for. They guarantee your trading funds’ safety, unlike unscrupulous brokers that only intend to scam you off your trading capital. Therefore, ensure you confirm whether a broker is licensed and regulated by the FCA.

Before you open an account, find a micro account forex broker with a wide selection of assets to choose from, including forex pairs. The assets should be available in plenty so that you have the flexibility to diversify your portfolio across various global markets.

An easy-to-use trading platform that improves your trading experience is worth considering. Additionally, every trader understands the importance of keeping up with the latest financial market news. Therefore, choose a micro lot trading broker that offers various trading tools on its platform for market analysis.

Brokers that offer micro accounts have different trading and non-trading charges, so it is up to you to choose a forex broker that aligns with your trading capital. Fees like commission, spreads, minimum deposit requirement, overnight fee, transaction charges, among others, should be what contribute to your decision.

Most traders overlook this factor, but it is essential when choosing a micro lot account broker. There is always a time when you will require a broker’s assistance, and having reliable customer service will serve you best. Also, ensure the broker offers a wide range of communication channels, including phone, email, and live chat.

If you have zero experience with a micro lot trading broker, you probably would love to test it before making a final decision. Therefore, find a forex broker with a demo account to test drive it. Demo accounts work similarly to live trading accounts, but the only difference is that demo accounts are free.

What are Micro Accounts?

Micro accounts are a type of forex trading account offered by many online brokers, designed for novice traders and those with limited funds. These accounts have lower minimum deposit requirements, smaller contract sizes, and reduced trading costs compared to a standard account. This low barrier to entry and fees allows novice traders to get started with trading without risking a lot of money upfront.

The smallest contract you can trade with micro accounts is called a micro lot, which represents 1,000 units of the base currency. Overall, micro accounts are tailored for retail traders looking to explore the financial market at a low fee. You can find these forex accounts on credible brokers like the ones we recommend above for maximum experience. However, remember that over 76% of micro accounts lose money in trading. So, employ solid strategies and plan accordingly.

Explore in our other guide Low Spread Forex Brokers.

Pros & Cons of Micro Accounts

As mentioned earlier, micro accounts are forex trading accounts many online brokers offer. While they can be an excellent option for some traders, especially newbies, they have advantages and disadvantages. As a trader, understanding micro accounts’ pros and cons will help you determine if they are worth trading with.

Pros

- Low Barrier to Entry – Micro accounts have lower minimum deposit requirements, making it easier for novice traders to start trading.

- Smaller Contract Sizes – Micro accounts offer smaller contract sizes than standard account, making it easier for traders to manage risks and learn the ins and outs of trading.

- Reduced Trading Costs – A micro account broker offers tighter spreads than a standard account, thus reducing the cost of trading.

- Opportunity to Practice – Most micro accounts feature demo accounts that allow users to practice their skills and trading strategies without risking their hard-earned money.

- Access to Trading Tools – Many brokers featuring micro accounts offer a range of tools and educational resources for their forex trading account holders. This helps them to improve their trading skills and knowledge.

Cons

- Limited Profit Potential – The smaller contract sizes of micro accounts mean that traders will earn smaller profits and losses than standard accounts.

- Limited Trading Options – Some brokers may offer limited trading options for micro accounts, which can be a drawback for more experienced traders.

- Margin Requirements – While micro accounts have smaller contract sizes, traders still need to meet margin requirements, which can be challenging for those with limited funds.

You can learn in our other guide “How to Trade Option“.

FAQs

While both micro and cents accounts allow you to trade at lower risks, cent accounts trading balances are measured in cents rather than US dollar. In contrast, micro accounts balance and transactions are carried in US dollar.

Leverage in micro accounts can go as high as 30:1, depending on a broker. However, as a beginner, you do not want to trade on a large margin. So instead, use the micro account for improving your trading skills.

The contract size is what differentiates a micro account and a mini account. Whereas the micro account’s contract size is 1,000 units of base currency, the mini account’s contract size is 10,000 units of base currency.

Micro accounts are suitable for beginner traders willing to taste the world of forex trading without risking a lot of investment.

Micro accounts allow you to trade with smaller amounts, meaning that the profits that you will likely incur are low. In addition, the spreads in micro accounts are usually higher than those in a standard account.

Yes, they are because of the smaller trading sizes. Beginners can start their trading venture using micro accounts before moving on to a more advanced platform.

Conclusion

Beginner traders in the UK forex industry, especially those on a low budget, should take advantage of micro account brokers. Choose from our above recommendations based on your trading requirements. With them, not only will you improve your skills at a low cost, but you will also increase your chances of earning profits. Also, note the Micro vs Cent account difference. Understanding distinction can help you make informed decisions when selecting the most suitable trading account type.

Remember, having the best micro lot account broker in the UK is not a sure-fire way to success. You still need to be selective about the assets you trade in micro lots accounts and ensure you are fully familiar with its operations and risks. Furthermore, conduct a thorough market analysis for the best forex trading strategy and always stick to your trading plan. Losses are inevitable in any trade, so be open to learning from your mistakes to quickly become independent.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I want to start to trade with AvaTrade but I'm worried about the inactivity fee

try city index. I started with demo account few mont ago

It was very helpful for me to learn about the differences between micro and standard accounts in trading. Here are a few key points that I highlighted: Initial investments, Contract size, Trading conditions, Standard accounts. I now understand which account type might be the best choice.Very useful information. Thank you. ??

This article proved to be highly informative and beneficial for me as an experienced trader. Despite my expertise, I found valuable insights about reliable brokers and the advantages of utilizing micro accounts. The clarification of differences between micro and cent accounts was a refreshing aspect, providing an understanding of how to leverage these accounts to one's advantage. I can now easily identify the best micro account that suits my requirements, boosting confidence in successful trading.

I really like the idea of starting small with low-risk exposure, as it allows people like me to practice and learn without diving in too deep financially.

What strikes me most is how they've structured the broker comparisons - the fee breakdowns are incredibly detailed and save hours of digging through terms and conditions. However, I'm skeptical about some of these "no minimum deposit" claims since most brokers still require practical minimums to execute meaningful trades, especially when you factor in spread costs and potential slippage.