Trading mutual funds in the UK has become a popular activity and can be lucrative if you use the right tools. One of the tools to maximise your potential in the mutual funds market is trading with the best broker. If you have been trading, you probably know that identifying the best brokers for mutual funds in the UK can be gruelling. However, if you are new and want to try out your luck in trading, we have a list below of the top mutual funds brokers in the UK.

List of the Best Brokers for Mutual Funds in the UK

- Interactive Brokers – Overall Best Broker for Mutual Funds in the UK

- Charles Schwab – Best Broker for Mutual Funds for Beginners in the UK

- Hargreaves Lansdown – The Safest Broker for Mutual Funds in the UK

- Saxo – Best Mutual Funds Broker For Professional Traders

- Fidelity – Best Mutual Funds Broker With Excellent Asset Selection

Compare Best Brokers for Mutual Funds in the UK

TradingGuide experts reviewed, evaluated, and rated multiple brokers for mutual funds in the UK based on numerous tests and other traders’ opinions. Our approach started with creating demo accounts on the brokers to test various elements, including credibility, platform offerings and performance, charges, and more.

We also contacted the providers directly to get accurate information that will help you make sound and informed decisions for your trading needs. Additionally, we rated the brokers based on other traders’ opinions and recommendations on Google Play, App Store, and Trustpilot. You can see below a sample table of our ratings based on the research.

| Best Mutual Fund Broker | Licence | Support Service | Software | Payment | Demo Account | Money Insurance (Negative money protection) |

|---|---|---|---|---|---|---|

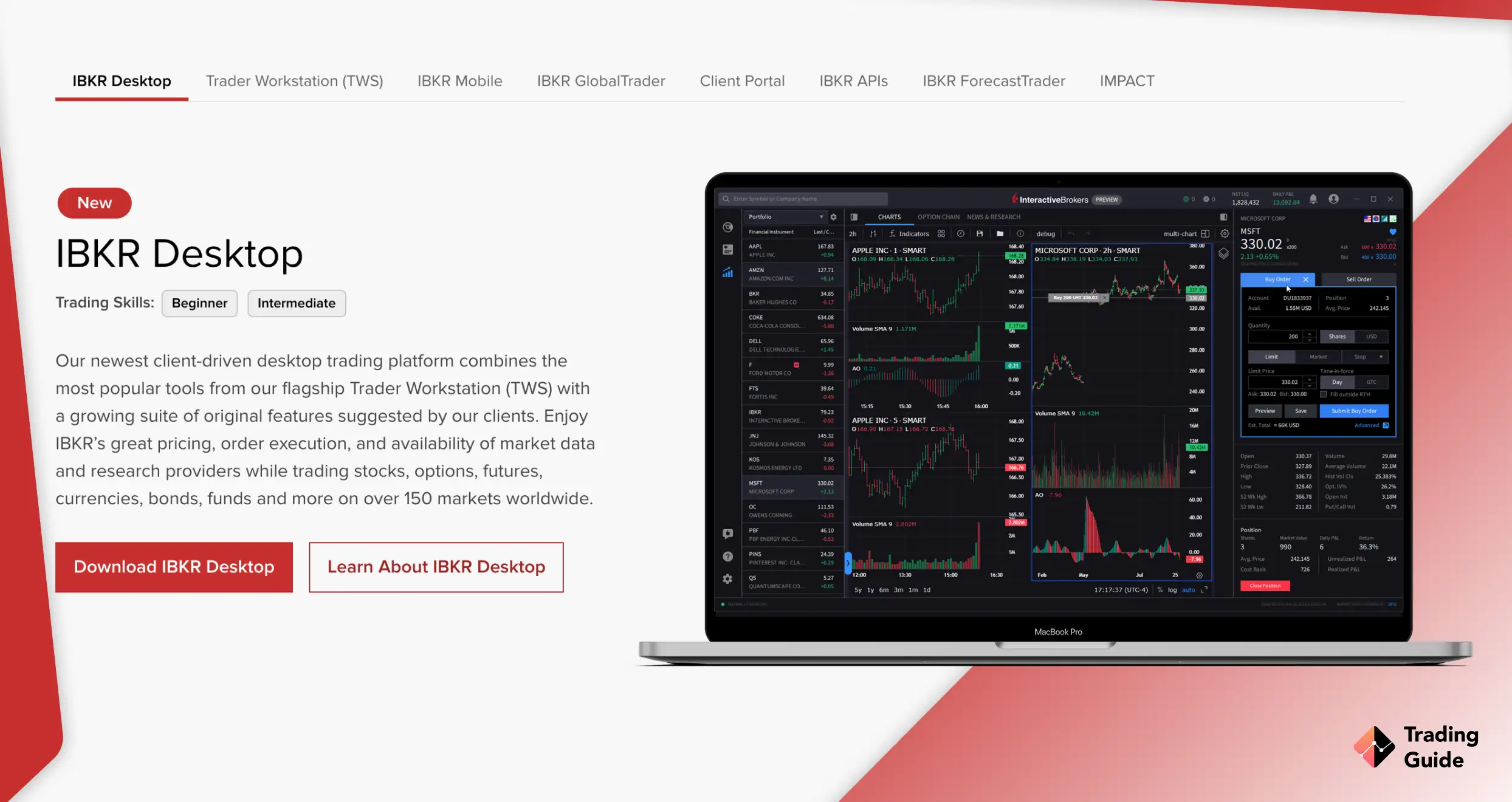

| Interactive Brokers | FCM, CFTC, SEC, FINRA, MAS, ASIC, CBI, FCA, SFC, IIROC/CIRO, NYSE (exchange member), NFA | 24/5 | IBKR Desktop, Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader, Client Portal, IBKR APIs, IMPACT | Bank or wire transfers | Yes | Yes, up to £85,000, according to the FSCS |

| Charles Schwab | SIPC | 24/7 | Thinkorswim desktop, thinkorswim mobile, thinkorswim web platform | ACH transfers, wire transfers, and check deposits | Yes | Yes, up to £85,000 |

| Hargreaves Lansdown | FCA, FSCS | 24/7 | Web Platform, Mobile App | Credit/Debit Cards, Bank Transfers, E-wallet transfers | No | Yes, up to £85,000 |

| Saxo | FCA, MAS, FSMA, ASIC, FSA | 24/5 | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO | Bank Wire Transfer | Yes | Yes, up to £100.000 |

| Fidelity | FCA, SEC, FINRA, FSCS, SIPC, NFA | 24/7 | Mobile App, Web Platform | Bank Transfer, PayPal, Venmo, Apple Pay, Wire Transfers | Yes | Yes, up to $500,000, which includes $250,000 for cash |

1. Interactive Brokers – Overall Best Broker for Mutual Funds in the UK

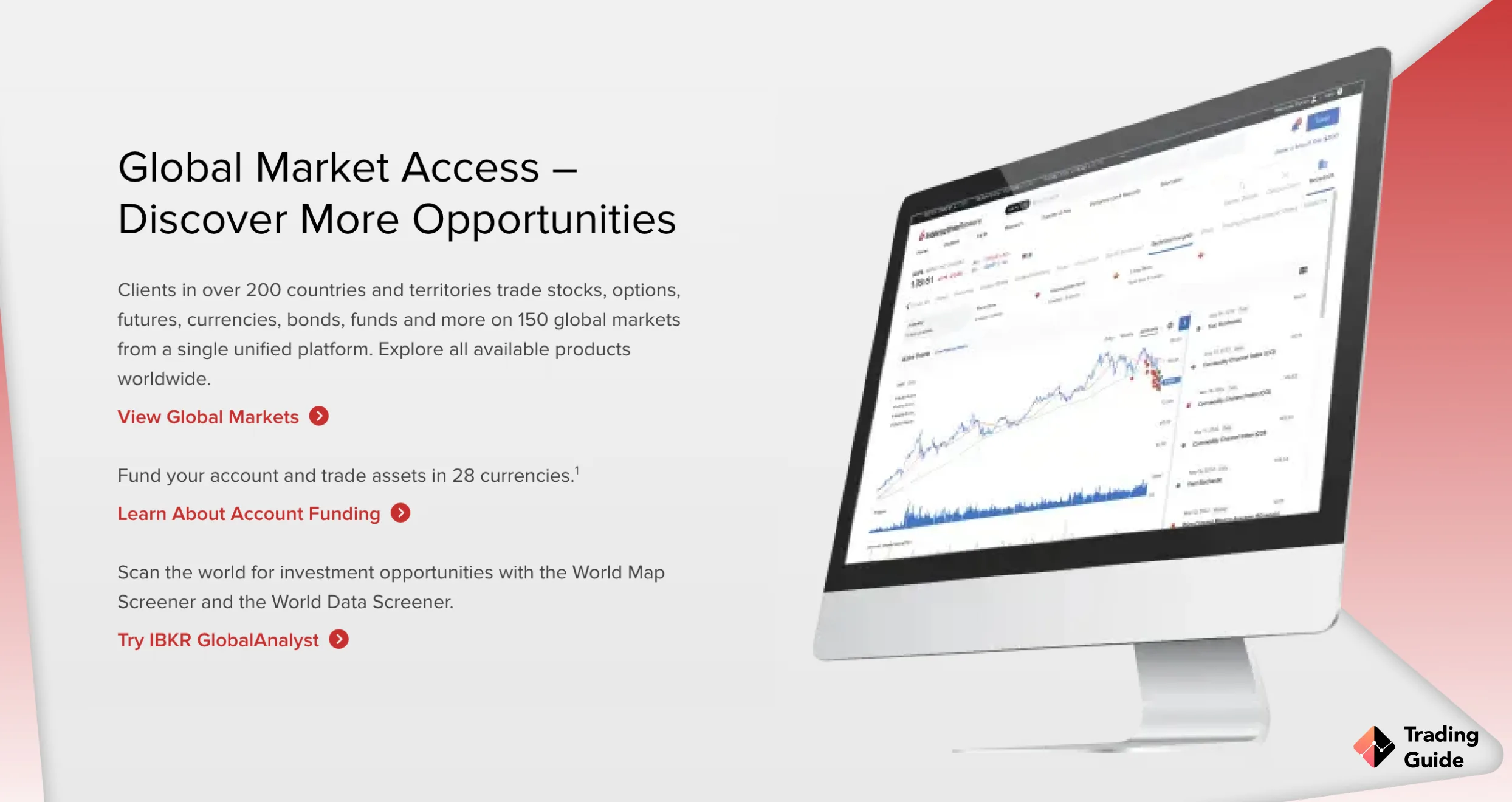

According to our research, Interactive Brokers (IBKR) is overall the best broker for mutual funds in the UK. This comprehensive brokerage firm hosts over 40,000 funds, most of which are traded at low commissions and no custody fees. With these funds, your portfolio will be spread out, thus maximising your profit potential.

IBKR also has an efficient search tool that is free for usage to help you find suitable funds for your investment. There are no account or deposit fees, and all transactions are free of charge. Additionally, the broker offers a risk-free demo account. We highly recommend that you make use of it for testing the broker and practising mutual funds trading before starting to trade live markets.

Although some newbies may find this broker’s tools challenging to use, it is wise that you start mutual funds investment on its beginner-friendly platform. Also, limit yourself to basic tools and make full use of the learning resources to improve your trading skills fast.

- No account minimum deposit requirement

- Efficient for both beginners and professionals

- Plethora of research resources and learning content

- Platform can be challenging to navigate for newbies due to plenty of trading tools

- Only five days a week support service

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

2. Charles Schwab – Best Broker for Mutual Funds for Beginners in the UK

Charles Schwab is beginner-friendly because it has designed a simple platform that is easily customisable. With thousands of mutual funds assets offered from leading fund companies, it is easier for newbies to choose the most suitable assets.

Charles Schwab is also a low-cost broker, which for beginners venturing in mutual funds is a plus and safe way to start investing. Moreover, there is no minimum deposit required after creating a mutual fund investment account. Newbies will also benefit from its excellent learning resources, including articles, guides, videos, and demo accounts.

Beginners for mutual funds investment in the UK also require enough support as they transition to becoming more independent. Therefore, with Charles Schwab, you are free to contact its dedicated customer service that operates round the clock on a daily basis in case of any mutual funds trading challenges.

- 24/7 professional customer support

- User-friendly platform with clear fee reports and price alerts

- No account deposit limit

- Investing in some mutual funds is costly

- Its many trading tools can be challenging for newbies to navigate

| Type | Fee |

| Minimum Deposit | $0 |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | No |

| Annual Fee | No |

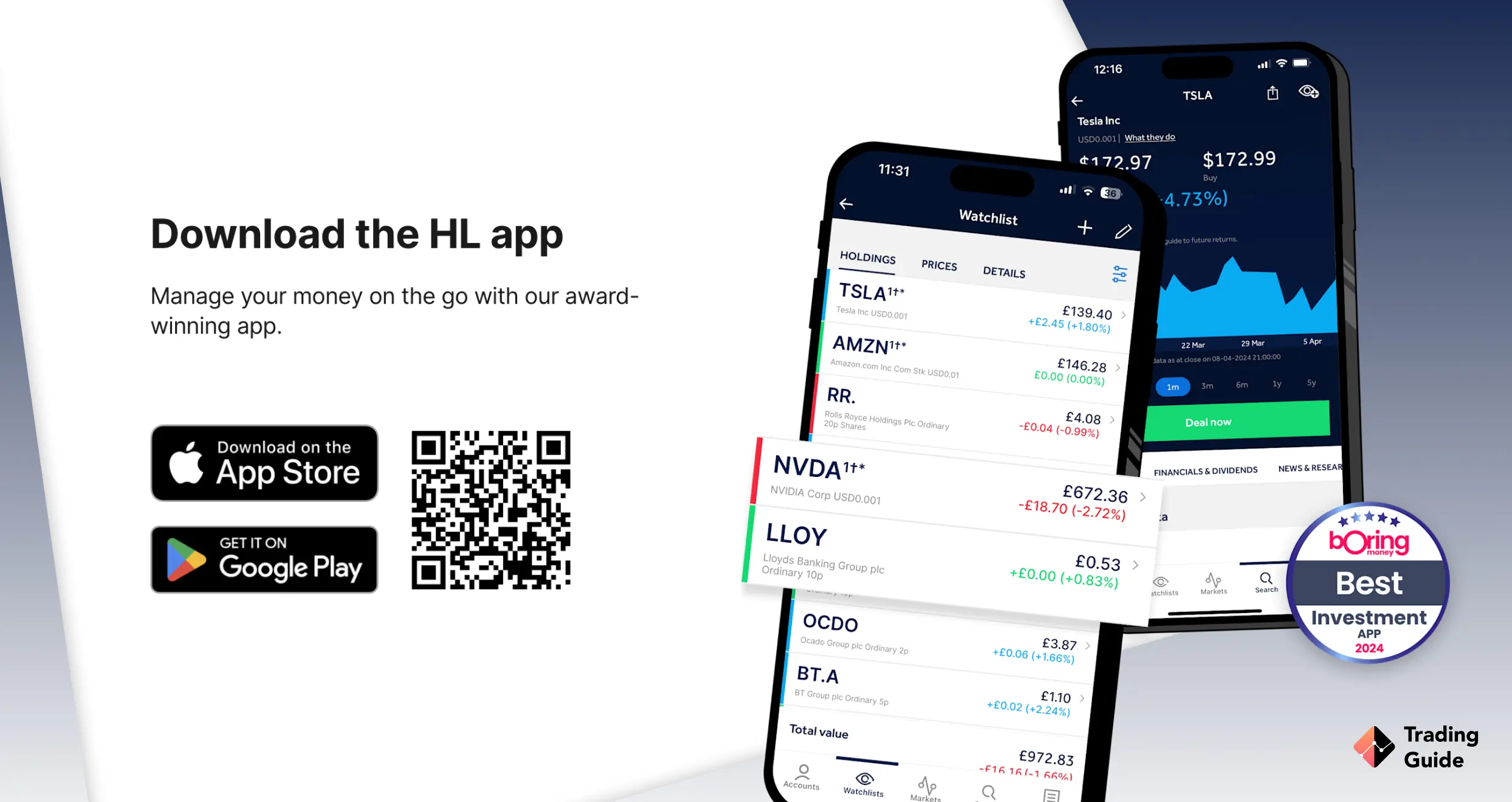

3. Hargreaves Lansdown – The Safest Broker for Mutual Funds in the UK

Hargreaves Lansdown is a UK-based broker for mutual funds and has the Financial Conduct Authority (FCA) overseeing its trading activities. It also has a long track record that goes back to the 1980s, making it the safest in the mutual funds trading category in the UK. Additionally, Hargreaves Lansdown is listed in the London’s Stock Exchange, proving its credibility even further since it releases its financial statements regularly with transparency.

Another reason why you should trust Hargreaves Lansdown is that it features negative balance protection for UK mutual funds investors. This means that if a trade does not favour your strategy, you will not lose more than your investment account balance regardless of market volatility.

Thousands of mutual funds are offered by this broker. Although mutual funds trading costs are relatively high, it supports UK traders with quality learning materials. Platforms on web and mobile devices are also easy to use and are customizable to suit all types of investors.

- Located and regulated by the FCA

- Thousands of mutual funds provided

- Free transactions when making deposits and withdrawals

- High fees for mutual funds investment

- Accepts only GBP currency

| Type | Fee |

| Minimum Deposit | £1 |

| Deposit Fee | No |

| Withdrawal Fee | No |

| Inactivity Fee | No inactivity fees |

| Annual Fee | 0.45% |

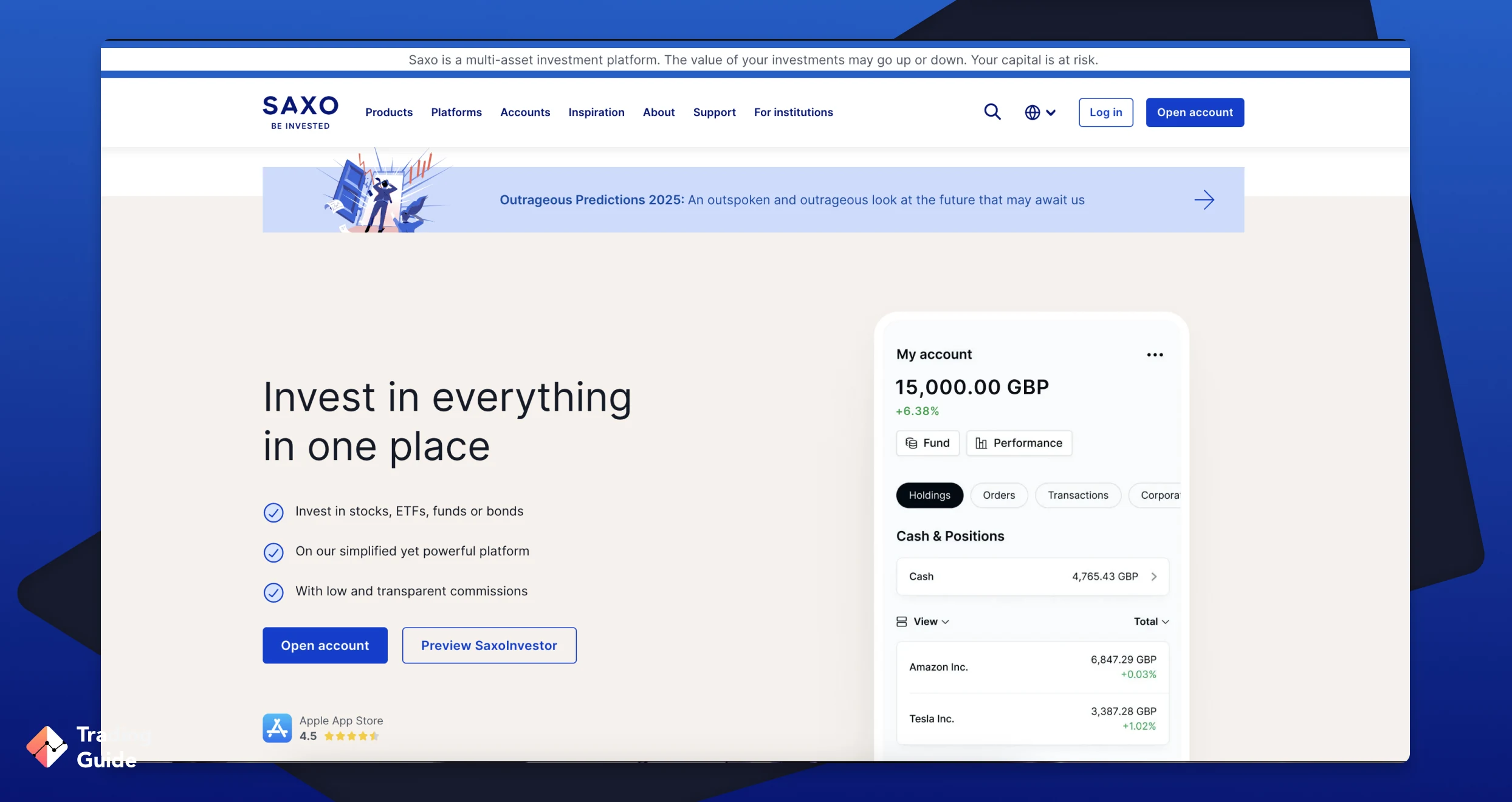

4. Saxo – Best Mutual Funds Broker For Professional Traders

While exploring Saxo, we were impressed with its user-friendly and intuitive design interface. The broker’s SaxoTraderPro is primarily tailored for professional traders since it features high-performance tools with in-depth market analysis options. Saxos’ mutual funds platform lists over 23,000 options from the world’s top money managers to explore.

Trading mutual funds at Saxo is commission-free, and you have an opportunity to let its professionals manage your portfolio. Besides mutual funds, we traded additional securities, including stocks, ETFs, bonds, futures, and more. All these services and more are available at a zero minimum deposit with free transactions. From our analysis, we give Saxo a 4.5-star rating.

- Numerous research and market analysis resources for professional traders

- A wide range of mutual funds to trade

- Intuitive design platform with a clear user interface

- Lists additional asset classes for portfolio diversification

- Does not support the MetaTrader platforms

| Type | Fee |

| Minimum deposit | $0 (for Classic account) |

| Inactivity fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Manual order fee | €50 per order |

| Stocks | from $1 on US stocks |

| Futures | $1 per lot |

| Listed options | $0.75 per lot |

| ETFs | from $1 |

| Bonds | from 0.05% on govt. bonds |

| Mutual funds | $0 |

5. Fidelity – Best Mutual Funds Broker With Excellent Asset Selection

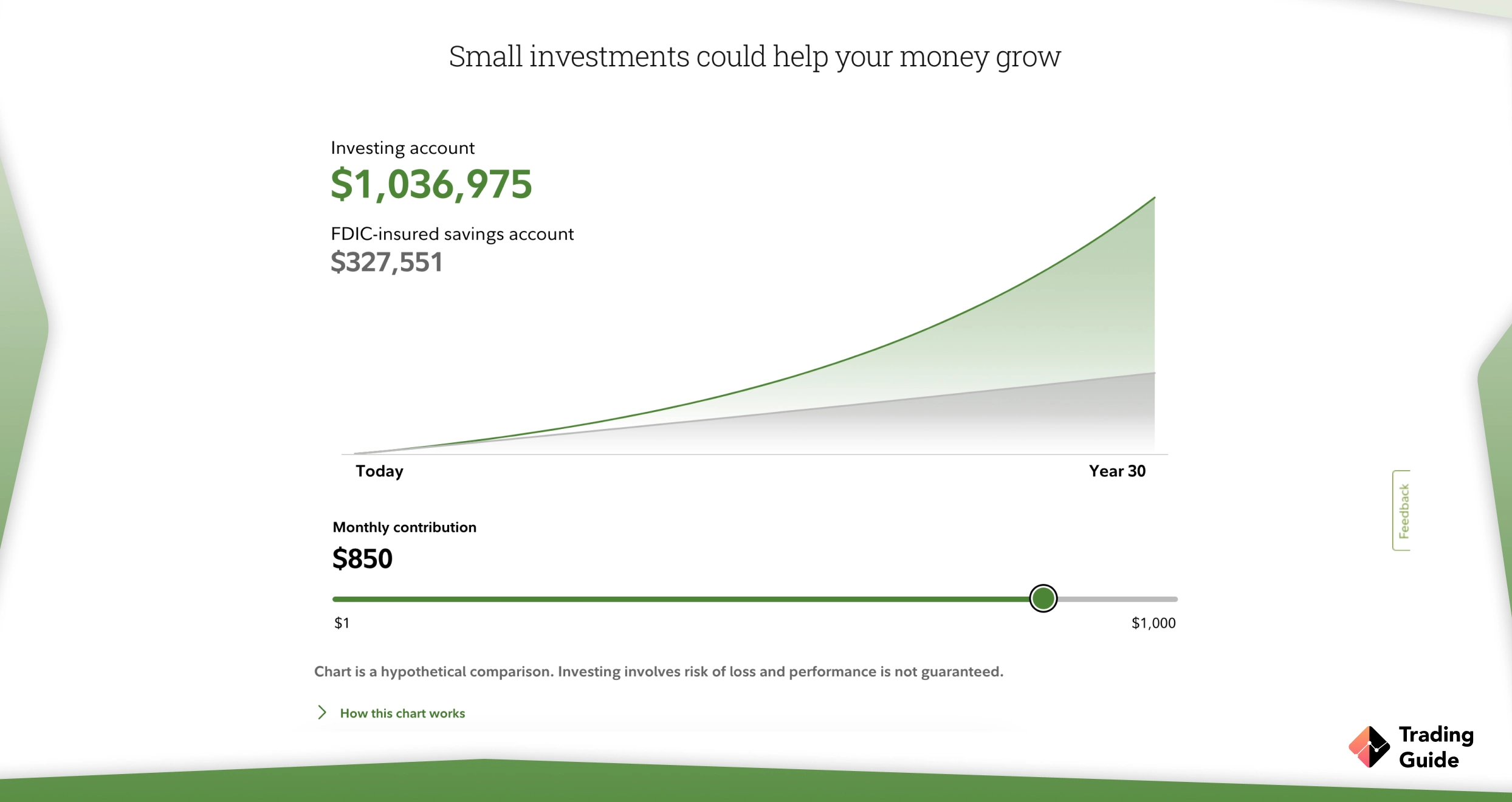

After meticulous research into mutual fund brokers in the UK, our findings unequivocally position Fidelity as the Best Mutual Funds Broker with Excellent Asset Selection. Fidelity’s stellar reputation is underlined by its expansive range of mutual funds (250+), providing investors with a diverse selection to align with their financial goals. Besides mutual funds, the broker also hosts cryptos, ETFs, options, bonds, and more. The user-friendly interface ensures easy navigation through this extensive selection.

Another thing we like about Fidelity is that it doesn’t have a minimum deposit requirement, making it easier for any trader to get started. Although mutual funds trading charges can be high for low-budget individuals, Fidelity hosts some of the best research and educational resources. We also recommend the broker’s actively managed funds option that allows expert portfolio managers to help you select the best investments with the potential to outperform. Based on our experience, we give Fidelity a 4.1-star rating.

- No minimum deposit requirement

- 250+ mutual funds to explore

- Quality research materials

- Additional excellent selection of portfolio diversification assets

- High mutual fund fees

- Its desktop platform can be challenging for newbies to navigate

| Type | Fee |

| Minimum deposit | $0 |

| Overnight fee | $20 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $0 |

| Stock trading | $0 |

| Options | $0 |

| ETFs | $0 |

| Bonds and CDs | $0 |

How to Choose the Best Broker for Mutual Funds in the UK

Investing in mutual funds in the UK has proven lucrative though there are risks involved to succeed. Most of these risks include managing your activities effectively, and one way to do so is by trading with a suitable mutual funds broker.

There are a gazillion mutual funds brokers out there, but there is still a dilemma on how to choose the best ones. Luckily, we know the way around this, which simply requires you to check the below elements before choosing.

Online brokerage firms for mutual funds trading in the UK are plenty, and you must consider your safety when choosing one. What we mean is that you should always opt for licensed and regulated brokers if you want to avoid falling victim to scammers waiting to get away with your money once you create an account with them. Simply put, the Financial Conduct Authority (FCA) regulates the UK market. Therefore, only brokers approved by the authority are worth risking your funds and legal to trade with.

Any trading and non-trading charges you pay should be budgeted for since they end up eating into your returns. While you may be trying to avoid losses, they are inevitable, and you should be prepared when they occur. That is why we recommend that you trade with the funds you are willing to lose.

The investment options you want in your mutual funds portfolio must be provided by the broker you choose to trade with. However, it is best to select a mutual funds broker with additional offerings to allow you to explore more options in the long run.

When investing in mutual funds in the UK, stay clear of platforms with slow order execution speed. Instead, try and find one that is fast and host the most suitable trading accounts, research resources, learning content, and more. This helps bring out the best in your abilities, hence speeding up your skill development.

If a mutual funds platform in the UK hosts a demo account, we encourage you to start your trading there and create the live account when confident and ready to spend real money.

Making deposits and withdrawals require convenient methods that will streamline your activities. Therefore, while most traders in the UK ignore this element, you shouldn’t, as it helps avoid incurring money transfer or currency exchange charges. Transacting with the best methods also saves time, which is a significant element when trading or investing in volatile markets.

Imagine signing up for a trading account with a mutual funds broker in the UK, make a deposit, start trading and voila, you begin experiencing trading challenges. You try contacting the broker’s support service, but its response rate is prolonged, or they are not operating on that specific day.

As a result, your activities are at risk of being inconvenienced, which may bring about losses if you are not keen. So, ensure you check how efficient and reliable a mutual funds broker’s customer service is before you commit.

Mutual Funds vs. Index funds

At this point, some of you might be confused about the difference between index funds (indices) and mutual funds, so we thought we’d clear the air.

Now, as you probably expect these two types of investments share many similarities and have the same characteristics. At the same time, there are important differences between the two.

To start, mutual funds and index funds can be based on stocks, bonds, and other securities. Also, you can normally trade mutual funds and index funds with the same broker, preferably a CFD or DMA broker. One of the most well-known index funds in the world is the S&P 500 which tracks 500 of the biggest companies in the United States.

In terms of differences, there are quite a few. Firstly, index funds are always based on a specific list of securities, such as the S&P 500 while mutual funds are individual and ever-changing since they’re created by brokers and investment managers.

Moreover, index funds are considered passive management securities while mutual funds are active management securities. In other words, index funds tend to be better suited for long-term investments and profits, while mutual funds provide benefits when trading since you often have to make daily decisions.

In addition, mutual funds are generally more expensive than index funds requiring a bigger budget and profit margins. This is another reason why leveraged products such as CFDs are great for this type of instrument.

FAQs

Yes. Although you can purchase mutual funds directly from a fund company, using an approved broker will give you access to more opportunities. Therefore, choose a mutual funds broker in the UK from our list above, create a trading account, and reap the benefits.

Since brokers act as intermediaries in mutual fund trading, they charge a commission fee based on the value of your investment. The amount charged will be their profit.

Yes. Like other trading assets, mutual funds will either bring about profits or losses. However, you can minimise the risk of losing by trading with a suitable mutual funds broker.

Yes. Online brokerage firms are safe for investments. However, it is best to confirm their credibility before you purchase mutual funds with them. In the UK, you should ensure that the FCA regulates your mutual funds broker.

No. You will pay taxes for profits you make selling mutual funds in the UK except for dividends on the UK companies.

Yes. Mutual funds can make you rich only if you put more effort into understanding the markets and creating the best strategy. You also need a good broker like the ones recommended above to boost your chances of earning profits.

Conclusion

The best thing about investing in mutual funds is that it can take away the need for extensive research by putting your investments on autopilot. However, you still need the best broker for mutual funds with excellent features to maximise your potential. From our list above, there is a suitable broker for you. Therefore, consider reviewing their features and test them before settling for a suitable one.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

I want to start investing with mutual funds. I hope it without demanding a huge amount of investment...

trading is not easy, although some people will tell you it is! that's simply not true. you will need to study hard and have patience. that's the key.

Always demo for a while and dont go live until you are consistent in the demo. Make sure you choose a good broker, one where you are in full control of your money

The article on the best brokers for mutual funds is quite informative. I learned the key points of choosing a broker and the difference between mutual and index funds. A list of recommended brokers with a focus on security, fees and assets helped me navigate this market. An interesting comparison between passive and active portfolio management. Useful article for beginners and experienced traders.

My brother recommended I might like this web site. He was once entirely right. This publication truly made my day. You can't believe simply how much time I had spent for this info! Thanks!

Thank you for your feedback.

It really helped me understand the different brokers for mutual funds