In the bustling world of trading, where every decision can impact your financial voyage, choosing the right No Dealing Desk (NDD) broker is paramount. If you’ve ever felt lost amidst the myriad of options, fear not, for our guide is your compass. We not only unveil the best NDD brokers in the UK but also chart the course to help you select the one that aligns with your trading ambitions. What sets our recommendations apart? Each NDD broker we endorse boasts the FCA’s stamp of approval, solidifying your trust in their integrity and commitment to safeguarding your trading capital.

Essence

- NDD brokers offer traders direct access to interbank rates, which are the rates at which banks and financial institutions exchange currencies.

- While trading with NDD brokers can offer benefits like tight spreads and transparency, it’s essential for traders to understand that interbank rates can be volatile. This can be advantageous in some cases and challenging in others.

- NDD brokers operate without a dealing desk, meaning they do not take the opposing side of their clients’ trades.

- NDD brokers typically use market execution for orders, ensuring that trades are executed at the prevailing market price.

- Understanding the difference between NDD, ECN, DMA, and STP brokers will easily enable you to decide the best option.

- Traders must consider various elements when selecting an NDD broker in the UK for an exciting trading experience.

List of the Best NDD Brokers in the UK

- Plus500* – One of the Best** NDD Broker For Traders

- Spreadex – Leading Provider With Spread Betting Options

- FxPro – Best NDD Broker With Excellent Support Service

- Capital.com – Top Provider for Forex Trading

- Pepperstone – Overall Best NDD Broker in the UK

*76% of CFD retail accounts lose money

**Investment Trends 2020

Compare Best NDD Brokers in the UK

In our unwavering commitment to providing you with invaluable guidance on your penny stock trading venture, we present this comprehensive comparison of the finest NDD brokers. Our analysis is the culmination of extensive research, augmented by feedback from traders sourced from various reputable platforms, including Google Play, the App Store, and Trustpilot. This comparison equips you with the insights needed to navigate the world of NDD brokers effectively.

| Best NDD Brokers | Licence | Minimum Deposit | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|---|

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | £100 | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google Pay, Apple Pay | Yes |

| Spreadex | FCA, SEBI | £0 | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No |

| FxPro | FCA, FSCA, SCB | £100 | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill | Yes |

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | £20 | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | £0 | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple Pay, Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer | Yes |

Brief Overview of Our Recommended NDD Brokers’ Fees and Assets

Selecting the right No Dealing Desk broker is a decision that should be made with utmost care. To assist you in this endeavour, we provide below a comprehensive look at the fee structures and asset selections offered by our top recommended NDD brokers in the UK.

Fees

| NDD Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Plus500 | From 0.0 pips | £100 | Free | £10 monthly |

| Spreadex | From 0.6 pts | £0 | Free | None |

| FxPro | From 0.0 pips | £100 | Free | £15 once + £5 monthly |

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| Pepperstone | From 0 pips | £0 | Free | None |

Assets

| NDD Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | No |

| Capital.com | Yes | Yes | Yes | Yes | No |

| Pepperstone | Yes | Yes | Yes | Yes | No |

Our Opinion & Overview of the Best NDD Brokers in the UK

Our expert researchers have sifted through the data, user reviews, and our own rigorous testing to identify the NDD brokers that stand out in the UK market. These brokers have earned their place through a combination of transparency, competitive offerings, and a commitment to customer satisfaction. Join us below as we delve into the detailed overviews of each of these exceptional NDD brokers.

1. Plus500 – One of the Best** NDD Broker For Traders

*Illustrative prices

**Investment Trends 2020

Traders trying to enter the financial space using an NDD broker should consider Plus500. If you are a beginner, it would be better to start with their demo account and use Traders Academy to read market news and insights. As professional researchers and traders, we tested the broker and were impressed with its features. For instance, its interface is modern and user-friendly, which newbies will enjoy using. In addition, Plus500 has a low minimum deposit requirement, and all CFD trades are commission-free. Users will only incur low spreads from 0.0 pips, which is a cost-effective way for traders.

Regarding asset availability, we noticed that Plus500’s NDD platform lists more than 2,800 options for UK traders. These instruments include forex, shares, commodities, ETFs, and more, all of which you get to trade as CFDs. We also contacted the broker’s support service via phone, email, and live chat to gauge its reliability, and they did not disappoint in this category. We believe beginners have the best team for assistance and a comprehensive FAQ section for answers to commonly asked questions.

- Comprehensive learning tools on its “Trading Academy” section

- Low minimum deposit requirement

- 24/7 support service team via phone, email, and live chat

- A user-friendly and intuitive design NDD trading platform

- Limited asset offerings

- You must be an active trader to enjoy Plus500 services since its inactivity fee kicks in after only three months

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. Spreadex – Leading Provider With Spread Betting Options

One thing we like about Spreadex is its ability to execute trades seamlessly on desktop and mobile devices. During my testing, orders were filled quickly, cleanly, and without negative slippage. All this is thanks to Spreadex’s fair-price execution policy, which ensured we never received a worse fill than the price we clicked. Note that the broker has no minimum deposit requirement, and all transactions are free.

Additionally, Spreadex charges low fees, starting from 0.6 points on major currency pairs. The assets available for spread betting exceed 10,000, covering indices, shares, forex, commodities, bonds, interest rates, ETFs, and more. And besides spread betting, Spreadex supports CFD trading across its proprietary and TradingView platforms.

The platforms are highly customisable, with access to advanced charting tools, pattern recognition, pro trend lines, economic overlays, one-click dealing, force-open functionality, and real-time price alerts. For education and support, Spreadex provides a comprehensive learning hub, daily market insights, and a professional 24-hour support service that was consistently responsive during my tests.

- A highly reputable UK broker with FCA regulation since 1999

- Dual CFD and spread betting offering across 10,000+ markets

- Competitive spreads from 0.6 points on major forex pairs

- No minimum deposit requirement and free transactions

- Quality learning and market analysis tools

- No physical purchases of the listed securities

- No demo account for new traders

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

3. FxPro – Best NDD Broker With Excellent Support Service

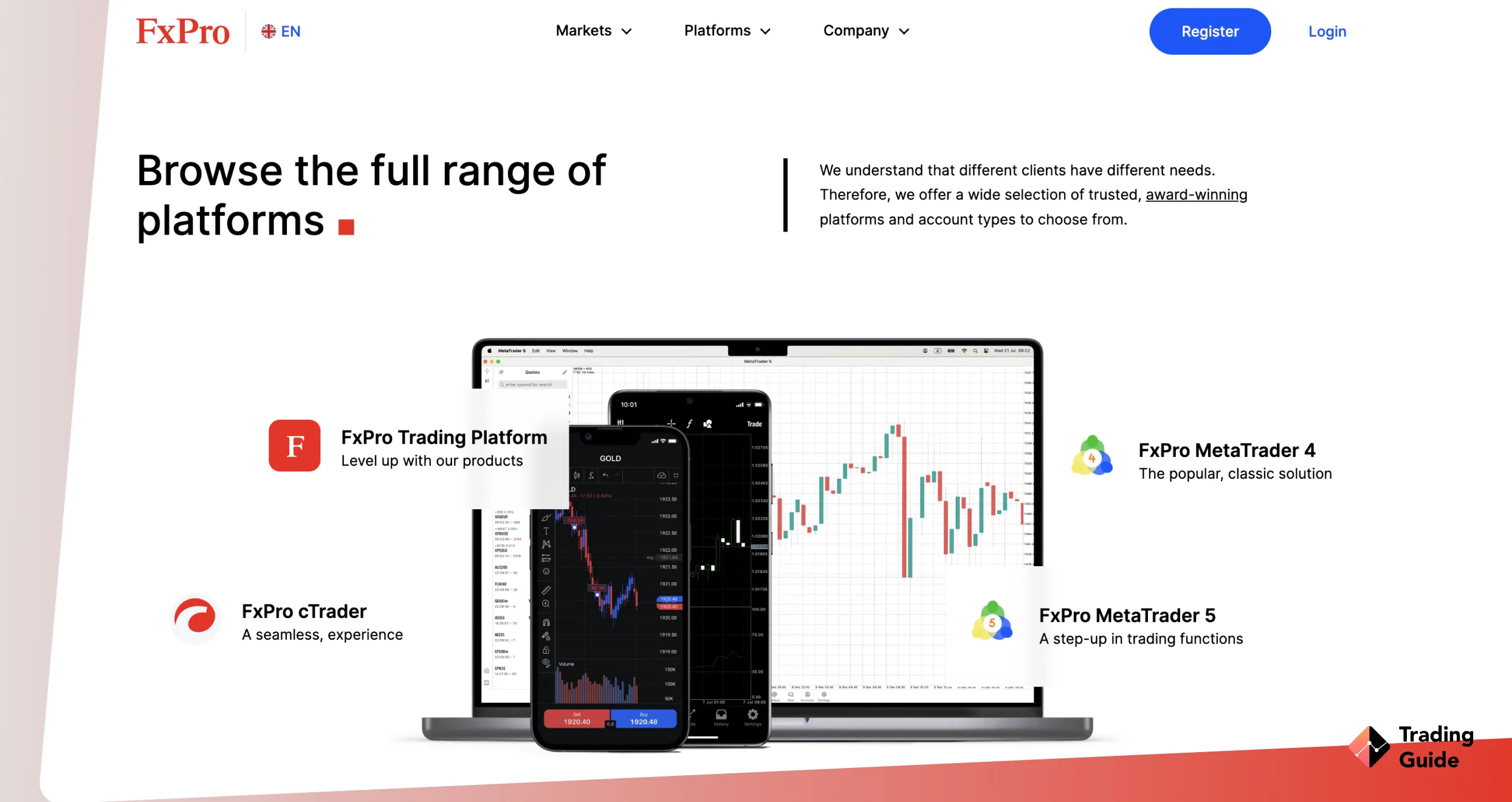

From our user-centric perspective, FxPro unquestionably earns its title as our top NDD broker with excellent support service. Our research revealed a support team that not only responds promptly but also delivers relevant and effective solutions via live chat, email, and phone, thus enhancing the overall trading experience. The broker’s NDD operation ensures your trades are executed without intervention, thus maximising your experience in this dynamic and highly volatile financial space.

FxPro hosts over 2,100 CFD assets, covering indices, shares, forex, and more. The availability of cTrader, MT4, and MT5 platforms caters to our diverse preferences, offering advanced tools for strategic trading. The £100 minimum deposit requirement makes the platform accessible, while commission-free trades and low spreads starting from 0.6 pips contribute to cost-effectiveness. FxPro’s commitment to quality research tools further solidifies its position as the go-to NDD broker, making us highly recommend it.

- The No Dealing Desk operation ensures fast trade execution speed

- Lists over 2,100 CFD assets, including indices, shares, and forex

- Multiple platforms, including cTrader, MT4, and MT5

- FxPro’s commitment to quality research tools empowers traders with valuable insights for informed decision-making

- No social or copy trading

- Certain features, such as high leverage or cryptocurrency trading, are restricted to professional traders

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

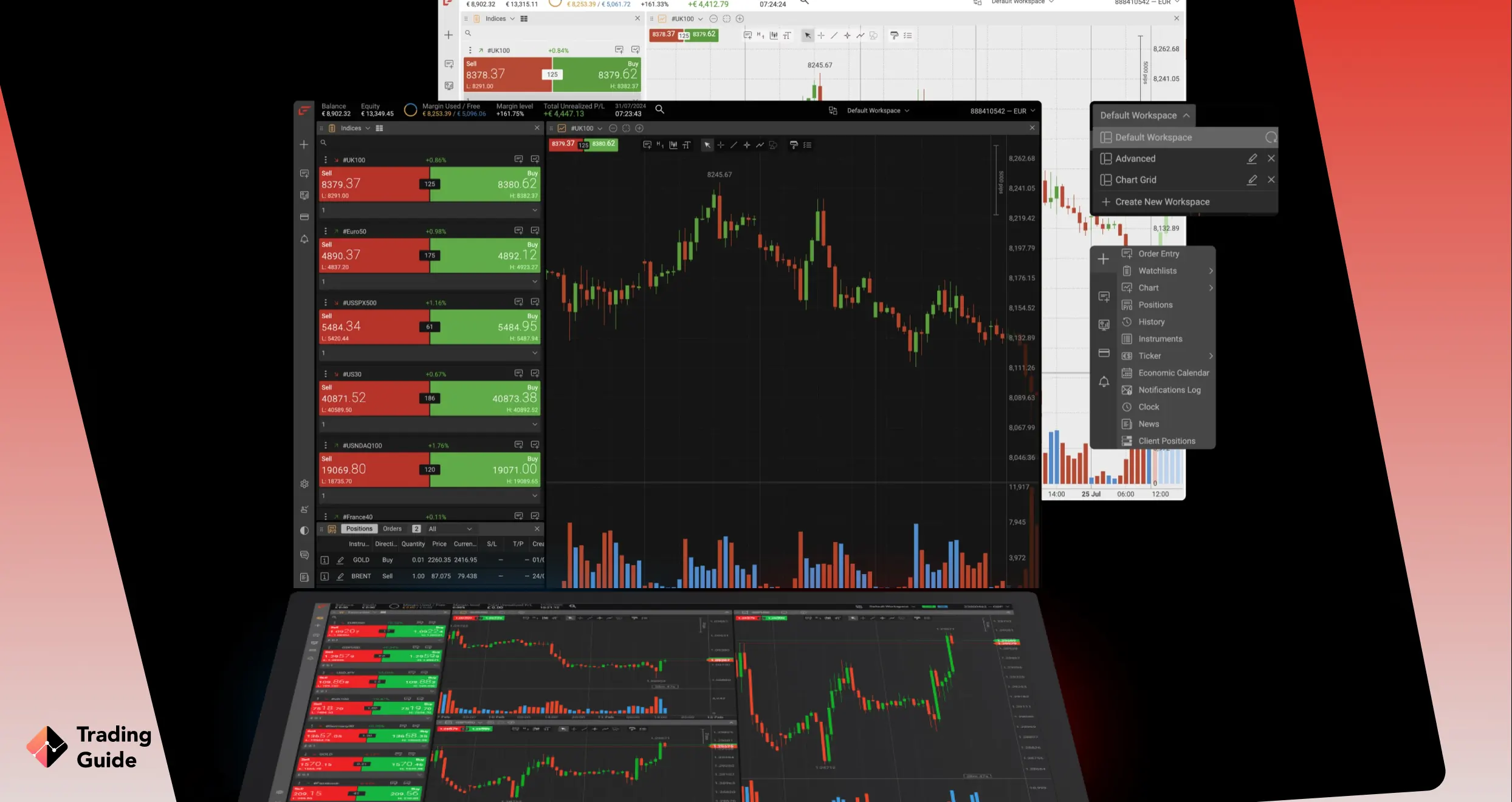

4. Capital.com – Top Provider for Forex Trading

From our experience, Capital.com is a strong choice for forex traders in the UK, offering a wide selection of 120+ currency pairs, including majors, minors, and exotics. While the broker uses a hybrid execution model, its fast trade execution, tight spreads, and transparent pricing make it feel close to a pure NDD experience.

Opening an account at Capital.com is straightforward, with a minimum deposit of just £20 and no commissions on trades. You only get to incur spreads, starting from 0.0 pips on major currency pairs. We also discovered an additional 5,000+ securities for portfolio diversification, including shares, indices, commodities, and more.

For risk-conscious traders, this broker’s 1X CFD account allows leverage-free indices and share trading. Moreover, its platforms are versatile. Traders can choose the web platform, mobile app, MetaTrader 4, or integrate with TradingView for advanced technical analysis. The broker provides 24/7 customer support and educational tools via the Investmate app, helping both beginners and experienced traders improve their strategies.

- Lists over 120 currency pairs and additional securities for portfolio diversification

- Commission-free trades with low spreads from 0.0 pips on major currency pairs

- Low minimum deposit requirement for UK clients

- Leverage-free trading via the 1X account

- 24/7 support and educational resources

- No buying and taking ownership of featured securities

- The 1X account covers forex and indices only

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

5. Pepperstone – Overall Best NDD Broker in the UK

We tested Pepperstone and consider it the overall best NDD broker in the UK due to its ability to accommodate all types of traders. We also believe the broker’s decade-long journey is marked by an impressive track record, offering traders unparalleled benefits. Lightning-fast execution, access to ECN and Direct Market Access platforms, and a vast selection of over 1,000 instruments underscore Pepperstone’s prominence.

Although Pepperstone has no minimum deposit requirement for UK traders, its spreads are low, making it accessible to traders of all levels. The diversity of NDD trading accounts, including TradingView, cTrader, MT4, and MT5, ensures a tailored trading experience. Moreover, Pepperstone extends its services to the UK’s spread betting enthusiasts, combining NDD execution with comprehensive options. We therefore give this broker a 4.5-star rating.

- Fast execution on trades.

- Market-leading spreads.

- No transaction costs.

- A user-friendly and customisable trading platform.

- Limited asset range.

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

What Do Other Traders Say?

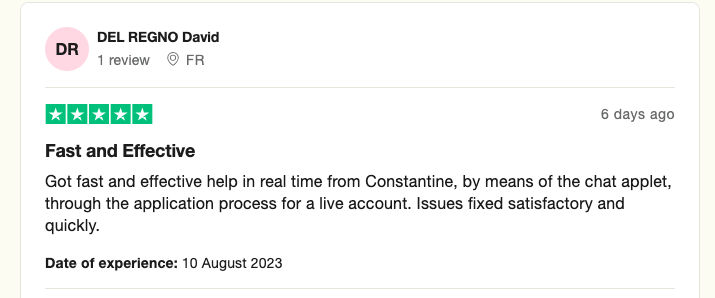

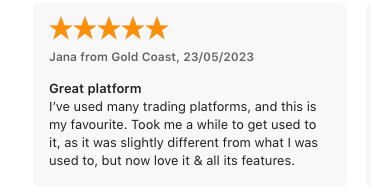

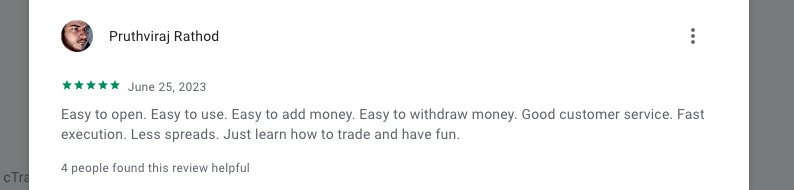

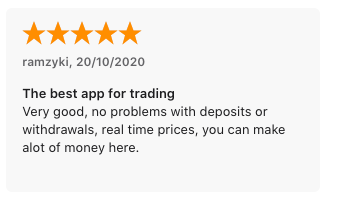

As mentioned earlier, we conducted thorough research on brokers in the UK to identify the top options with NDD features. Our research procedure involved not only multiple tests and comparisons. We also analysed user testimonials on Google Play, the App Store, and Trustpilot to ensure our recommendations are not biased. Here are some of the comments and ratings we encountered on these platforms.

Pepperstone

User testimonials for Pepperstone frequently highlighted its lightning-fast execution and transparency. Traders praised its user-friendly platform and customer support responsiveness. Many users also commended Pepperstone for providing a secure and reliable trading environment, earning it consistently high ratings.

-

“Got fast and effective help in real time from Constantine, by means of the chat applet, through the application process for a live account. Issues fixed satisfactory and quickly.” – DEL REGNO David

-

“I’ve used many trading platforms, and this is my favourite. Took me a while to get used to it, as it was slightly different from what I was used to, but now love it & all its features.” – Jana from Gold Coast

-

“Easy to open. Easy to use. Easy to add money. Easy to withdraw money. Good customer service. Fast execution. Less spreads. Just learn how to trade and have fun.” – Pruthviraj Rathod.

Plus500

Users of the Plus500 app have praised its ease of use and accessibility on both Android and iOS devices. It’s considered an excellent choice for traders looking for a straightforward and reliable platform. Plus500’s competitive minimum deposit requirement is also seen as a positive aspect.

-

“Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here.” – ramzyki

-

“I had a good experience with Plus500.

I recommend for those who want to achieve their goals come and invest with Plus500 and you will never be regret.” – Anonymous user

How to Start Trading Using an NDD Broker

Embarking on your trading journey with a No Dealing Desk (NDD) broker is a commendable decision that can offer transparency and fairness. However, before you dive into the world of NDD trading, it’s crucial to lay a solid foundation to maximise your chances of success. Here’s a step-by-step guide on how to start trading using an NDD broker.

- Education is Your Best Ally – Knowledge is power in the trading world. Therefore, invest time understanding the markets, developing trends, trading strategies, and risk management techniques. The more you know, the better equipped you’ll be to make informed decisions.

- Craft a Trading Plan – A well-thought-out trading plan is your roadmap to success. Define your trading goals, risk tolerance, and preferred trading style. Having a clear plan will help you stay focused and disciplined.

- Choose Your Broker Wisely – Your choice of an NDD broker is crucial. Look for a broker known for transparency, competitive pricing, and reliable execution. Investigate factors such as spreads, commissions, available instruments, trading platforms, and more. User reviews can offer valuable insights.

- Practice with a Demo Account – Before you commit real capital, use the broker’s demo account to hone your skills. It’s a risk-free way to get comfortable with the trading platform and test your strategies.

- Start Small and Manage Risks – When you transition to live trading, begin with modest positions to control the risk of losing money in case a trade works out against your expectations. Avoid overleveraging your account, as this can lead to significant losses. Also, consider using risk management controls such as stop-loss and take-profit orders.

- Maintain Emotional Discipline – Emotions can be your best friend or your worst enemy in trading. Stick to your trading plan and avoid making impulsive decisions driven by fear or greed.

- Review and Adapt – Find a trading journal to note your trading strategies to easily assess the overall performance. Analyse both winning and losing trades to identify areas for improvement. Adapt your strategy as needed, and never stop learning.

How to Choose the Right NDD Broker

When it comes to selecting the right No Dealing Desk (NDD) broker in the UK, there are several critical factors you should consider. Here’s a comprehensive guide to help you make an informed decision.

Start by ensuring that the NDD broker you are considering is fully licensed and regulated by a reputable financial authority in the UK, such as the Financial Conduct Authority (FCA). Regulatory compliance ensures the broker adheres to strict standards, safeguarding your investments. You must also confirm whether the broker employs robust security measures to protect your personal information and funds. Look for features like encryption, two-factor authentication (2FA), and segregated client accounts.

The speed and reliability of the trading platform are paramount. Look for a broker that offers a user-friendly, stable, and technologically advanced trading platform. Features like real-time charts, technical analysis tools, and mobile compatibility can greatly enhance your trading experience. Remember, a broker with fast trade execution speed allows you to quickly enter and exit a trade, ensuring you make the most out of arising potentially profitable opportunities.

Pay close attention to the fee structure of an NDD broker. While NDD brokers typically charge lower spreads than market maker brokers, be aware of any additional fees such as commissions, minimum deposit requirements, inactivity fees, and overnight financing charges. Compare these fees across different brokers to find the most cost-effective option for your trading style.

Ensure that the broker you select offers a wide range of assets that match your trading preferences. This includes forex pairs, commodities, stocks, indices, cryptocurrencies, and more. A diverse selection of assets allows you to diversify your portfolio and seize opportunities in various markets.

Quality customer service is essential, especially in the fast-paced world of trading. Check the broker’s responsiveness to customer inquiries, the availability of multiple support channels (email, live chat, phone), and the professionalism of its support staff. Reliable customer support can be a lifesaver in times of technical issues or account inquiries.

A demo account is an invaluable tool for new and experienced traders alike. It allows you to practice trading with virtual funds, test the broker’s platform, and develop your trading strategies risk-free. Look for a broker that offers a demo account with real market conditions.

Seek out user reviews and recommendations from traders who have experience with the NDD broker you’re interested in. Platforms like Google Play, Trustpilot, or the App Store and social media forums can provide valuable insights into the broker’s reputation, reliability, and overall customer satisfaction.

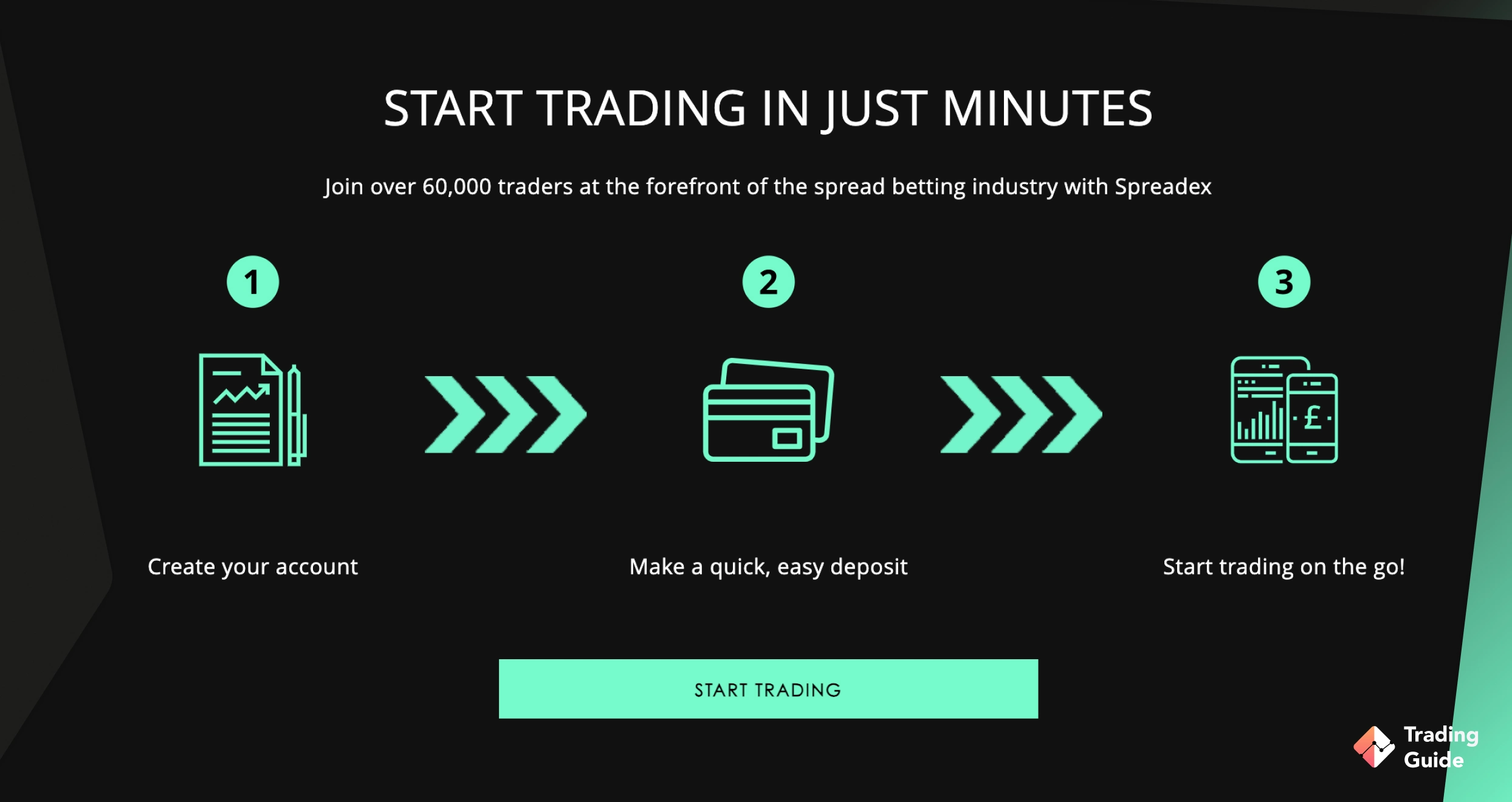

5 Quick Steps To Start Trading with NDD Broker

Trading with a No Dealing Desk (NDD) broker in the UK can provide you with direct market access and transparency, making it an attractive option for traders. If you’re ready to start trading with an NDD broker, here are five quick steps to help you get started.

Begin your journey by visiting the official website of an NDD broker you’ve chosen via the links we’ve shared on this page. Take your time to explore the broker’s website, paying close attention to essential information regarding their services, fees, and regulatory compliance. And if you are always on the move, consider installing its trading app on your mobile device for more convenience.

On the broker’s website, locate and click on the option to “Open an Account” or “Sign Up.” This action will initiate the account creation process. Be prepared to provide personal details, including your full name, date of birth, contact information, and residential address. Select the type of trading account that aligns with your trading goals and experience level, whether it’s a standard or professional account. You must also create a unique username and a strong password that you’ll use to access your trading account.

To adhere to FCA regulatory requirements and ensure the security of your account, you’ll need to verify your identity. Your broker will typically request specific documents, including a government-issued photo ID, passport or driver’s license and proof of your residential address, such as utility bill or bank statement. Scan or take clear photos of these documents and upload them securely through the broker’s verification portal. Keep in mind that the verification process may take some time, so exercise patience during this stage.

Once your account is verified, it’s time to fund it. Log in to your trading account using the username and password you established during registration. Find the “Deposit Funds” or “Fund Your Account” section within your account dashboard. Select your preferred funding method, which may include bank transfers, credit/debit cards, or electronic payment methods like e-wallets.

With your trading account funded, you’re ready to start trading. Choose an asset you want to trade, determine your trade size and set your entry and exit points. You can execute your trade using market orders or place pending orders to execute at specific price levels. Keep a close eye on your trade’s progress, and be prepared to manage it according to your strategy. This may involve setting stop-loss and take-profit orders to limit potential losses and secure profits.

What is an NDD broker?

An NDD (No Dealing Desk) broker is a financial intermediary that provides a forex trading platform with direct access to interbank financial market rates of exchange. Unlike traditional Dealing Desk brokers, NDD brokers do not act as counterparties to their clients’ trades, eliminating potential conflicts of interest. The brokers route their clients’ orders directly to multiple liquidity providers, including banks and financial institutions, allowing traders to benefit from competitive bid/ask spreads. While trading with NDD brokers offers transparency and impartiality, they may charge extra commissions or fees, making them relatively more expensive compared to trading with Dealing Desk brokers.

Difference Between NDD, ECN, DMA, and STP

No Dealing Desk (NDD) brokers have gained popularity for offering direct access to the interbank forex market. But within this realm, there are several distinct options available, including Electronic Communication Network (ECN), Direct Market Access (DMA), and Straight Through Processing (STP). Each of these platforms has its unique features and advantages that we are going to understand below.

- No Dealing Desk (NDD)

NDD brokers are at the forefront of the modern trading landscape. They operate without a traditional dealing desk, meaning that traders can interact directly with the interbank forex market. This setup eliminates conflicts of interest, as NDD brokers do not profit from clients’ losses.

- Electronic Communication Network (ECN)

ECN trading platforms take transparency and efficiency to the next level. They function as computerised systems that automatically match buy and sell orders from various traders, creating a seamless and decentralised marketplace. ECN is the go-to choice for those who prefer to trade without intermediaries. It allows traders from different corners of the world to interact directly, enhancing market depth and liquidity.

- Direct Market Access (DMA)

DMA platforms provide traders with direct access to electronic facilities. These platforms are automated and connect traders’ orders with prices offered by market makers and liquidity providers. DMA essentially places you at the heart of the financial market exchange, offering a more direct and precise trading experience. DMA is favoured by those who want granular control over their orders and execution, as it allows traders to interact with the market at a deeper level, accessing order books and liquidity pools directly.

- Straight Through Processing (STP)

STP is another approach within the NDD framework. Under STP, brokerages send traders’ orders directly to liquidity providers. These liquidity providers are carefully chosen by the broker to ensure that the market conditions align with the trader’s interests. STP is synonymous with speed. Orders are executed swiftly without re-quotes or delays, making it an attractive option for traders who thrive in fast-paced environments. Additionally, STP brokers often offer higher liquidity since they source prices from a variety of market participants. This results in tighter spreads and favourable quotes for traders.

Overall, the choice between ECN, DMA, and STP within the NDD framework depends on your trading preferences and objectives. ECN excels in fostering a global trading community, while DMA provides precise control over order execution. STP, on the other hand, is all about speed and tight spreads.

Pros and Cons to Trade Using an NDD Broker

NDD brokers have gained popularity for their transparent and direct approach to trading. However, like any trading platform, they come with their own set of advantages and disadvantages. In the table below, we’ll explore the pros and cons of trading using an NDD broker to help you make an informed decision.

| Pros | Cons |

|---|---|

| NDD brokers offer a high level of transparency by providing direct access to the interbank forex market. | While NDD brokers offer transparency, they may charge commissions or wider spreads compared to DD brokers. |

| Unlike Dealing Desk (DD) brokers, NDD brokers do not take the opposing side of their clients’ trades. This means they have no incentive to see traders lose money. | Slippage can occur when market prices change rapidly, causing orders to be executed at a different price than expected. NDD brokers are not immune to slippage, and traders should be aware of this risk. |

| They offer tighter spreads and competitive pricing since they aggregate prices from various liquidity providers. | For novice traders, the direct access to the interbank market through NDD brokers can be overwhelming. |

| NDD brokers typically provide fast order execution without re-quotes or delays. | |

| The brokers offer access to a variety of trading platforms, including ECN, DMA, and STP. |

FAQs

No. Unfortunately, Forex.com is not an NDD broker. However, you can still benefit from its forex trading offerings and low trading charges for every trade.

Yes. IC Markets uses the ECN style in trade execution and has become one of the best NDD brokers with tight spreads.

The best thing about trading with NDD brokers is that you get to trade directly with interbank rates. You are also guaranteed that your broker has no conflict of interest with your trades.

No Dealing Desk (NDD) means a trading platform that forex brokers provide for traders to have unfiltered access to interbank rates of exchange. There are many NDD brokers in the UK, and if you are looking for a suitable one, kindly refer to our recommendations above.

It is whereby a broker holds on to currency trades without passing them down to liquidity providers. Also known as market makers, such brokers create markets for trading.

Conclusion

In the UK, No Dealing Desk (NDD) brokers hold a distinct allure for traders. These brokers operate without conflicts of interest, assuring that your trades are executed fairly. Moreover, the advantage of competitive bid/ask spreads, directly sourced from liquidity providers, adds to their appeal. So, if you’re contemplating NDD brokerages for your trading endeavours, our recommended choices above offer a solid foundation. All you have to do is take your pick and venture into the world of financial markets, knowing that your interests are aligned with your broker’s commitment to a transparent and equitable trading environment

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Pepperstone has great pricing and trading conditions, and I often receive positive slippage on limit orders 🙂 Never had issues with withdrawals, and their customer service is absolutely great!

This article about NDD brokers gave me a clear understanding of the advantages of trading. I learned that NDD brokers provide transparency and direct market access. User reviews confirmed that choosing Pepperstone is justified - fast execution and responsive support. I'm impressed with AvaTrade's extensive educational materials and their reliability. These reviews helped me make a well-informed choice of a broker for successful trading. Thank you for the clear and useful information!

I’ve had some experience with NDD brokers, and from what I’ve tried, Pepperstone stands out for its fast execution and low spreads.