Penny stocks are shares of public companies that trade for less than £5 per share. Their introduction into the financial landscape has attracted many traders and investors, especially those sceptical about spending a lot of money. However, like any other trading security, penny stock trading is risky, and you must have solid plans and strategies to manage the activity. The best broker for penny stock trading can help you manage these risks as you will be able to access quality trading tools. Plus, you will enjoy favourable trading conditions and additional features that will maximise your experience.

With numerous penny stock brokers in the UK financial landscape, we decided to conduct market research for the best options. Below is our list of recommendations based on factors, which we will share shortly. All you need to do is compare their features to find the best broker that aligns with your unique trading needs.

Essence

- The best penny stock brokers UK allow traders to invest in various small-cap stocks. These include AIM-stocks and equities listed on major exchanges, including the London Stock Exchange (LSE).

- The best brokers for penny stock trading provide competitive commission rates and fees, making them cost-effective for trading low-priced penny stocks.

- You should consider various elements, including security, platform performance, and more, when selecting a penny stock broker in the UK for maximum experience.

- Top brokers for penny stock trading have simple account opening procedures that take a few minutes to complete.

- Reputable penny stock brokers 2026 are regulated by top-tier authorities, including the FCA.

- Before risking real capital, it is advisable to practise trading penny stocks using brokers’ demo accounts. This will help you find out how to invest and test a broker’s performance.

- Traders should take precautionary measures and seek financial advice to avoid penny stock scams.

- The best brokers for penny stock trading must be approved by expert TradingGuide researchers and have excellent ratings from users.

List of the Best Penny Stock Brokers in the UK

- XTB – Best for Cost-Conscious Traders

- Spreadex – Top Option With Excellent Support Service

- Interactive Brokers – Overall Best

- Saxo – Best For Professional Traders

How We Choose Penny Stock Brokers

At TradingGuide, we pride ourselves on our research methodology when it comes to penny stock broker selection and recommendation. Our process begins with exhaustive research to identify a comprehensive list of potential brokers operating in the UK market.

Once we have compiled this list, we prioritise security and regulatory compliance, ensuring that any broker we recommend is regulated by the Financial Conduct Authority (FCA). Next, we sign up for demo trading accounts offered by these brokers. This hands-on approach allows us to thoroughly test their platforms, evaluate their performance, and compare other features they offer.

To maintain an unbiased perspective, we supplement our testing with analysing user testimonials from platforms like Google Play, the App Store, and Trustpilot. By incorporating real-world feedback from other investors, we ensure that our recommendations are not only based on our experiences but also reflect the broader sentiment within the investing community.

If you’re looking to invest in penny stocks, trust TradingGuide’s recommendations for penny stock brokers in the UK. They are backed by thorough research and up-to-date information.

Compare Best Brokers for Penny Stock Trading

In our relentless pursuit of delivering valuable insights for your penny stock trading journey, we’ve crafted this comparative table below. Our evaluation is a result of thorough research enriched by user feedback sourced from Google Play, the App Store, and Trustpilot. With these assessments, you can explore the distinctive features of each broker and make the best choice that aligns with your trading needs.

| Penny Stock Broker | Payment & Withdraw options | Licence | Stock Assets | Software | Demo Account |

|---|---|---|---|---|---|

| XTB | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal | FCA, FSC, CySEC | 1,900 | xStation 5, xStation Mobile | Yes |

| Spreadex | Credit/Debit Cards, Bank Transfer, Neteller, Apple/Google Pay | FCA | 3,000 | Spreadex’s Online Trading Platform, TradingView | No |

| Interactive Brokers | Bank Wire Transfers, ACH Transfers | FCM, CFTC, SEC, FINRA, MAS, ASIC, CBI, FCA, SFC (Hong Kong), IIROC/CIRO, NYSE (exchange member), NFA | 9,000 shares | IBKR Desktop, Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader, Client Portal, IBKR APIs, IMPACT | Yes |

| Saxo | Bank Transfers | FCA, MAS, FSMA, ASIC, FSA | 22,000+ | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO | Yes |

Brief Overview of Our Recommended Brokers’ Fees and Assets

When it comes to choosing the perfect penny stock broker in the UK 2026, having a clear understanding of the associated fees and the variety of assets at your disposal is essential. For this reason, we give you a glimpse of the fee structure and asset selection provided by our top penny stock brokers. Our goal is to empower you to make informed decisions that align with your trading objectives and financial preferences.

Fees

| Penny Stock Broker | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

| Spreadex | From 0.6 pips | £0 | Free | £10 monthly |

| Interactive Brokers | From $0.01 commission on US stocks | £0 | Free | None |

| Saxo | From £0.02 commission | £0 (for Classic account) | Free | £0 |

Assets

| Penny Stock Broker | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| XTB | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| Interactive Brokers | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Penny Stock Brokers

Below, we share our opinion on the best brokers for penny share trading based on our hands-on experience. We find satisfaction in ensuring you get accurate information that contributes to the best choices.

1. XTB – Best for Cost-Conscious Traders

Would you like to keep costs as low as possible? XTB is the best penny stock broker for you because, first, it has no minimum deposit requirement. That means you can register a new account today and start trading with any amount. Plus, high transaction fees won’t affect your capital and earnings since the platform supports free deposits and withdrawals.

Diversification is extremely easy on XTB. In addition to penny stocks, this broker offers thousands of other securities, from popular currency pairs to ETFs and indices. Here’s the kicker: XTB supports investing in real stocks and ETFs.

Lastly, commissions and spreads are super reasonable at XTB. For starters, this service provider offers you the opportunity to leverage 0% commission while investing in countless popular company stocks and shares.

- No minimum deposit requirement

- Favorable spreads and commissions

- Free deposits and withdrawals

- Offers investment products like stocks

- Amazing customer support

- £10 monthly inactivity fee

- Can overwhelm newbies

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

2. Spreadex – Top Option With Excellent Support Service

Spreadex is undeniably one of our top contenders in penny stock trading UK. Its platform stands out for its extensive selection of global penny stocks, all available at competitive fees. We also like Spreadex’s commitment to accessibility – it has no minimum deposit requirement and does not charge transaction fees. This makes it an excellent choice for both newbies and budget-conscious traders who want to invest in the stock market without breaking the bank.

Note that Spreadex has a user-friendly platform designed to cater to traders of all levels. During our research, we had the opportunity to test its support service, and we were impressed by the team’s responsiveness and the relevance of the solutions they provided. While the support team may not operate round the clock, it is accessible through various channels, including email, phone, and live chat. With a wide range of securities and the ability to cater to users’ needs, we give this broker a 4.3-star rating.

- No minimum deposit requirement

- Comprehensive selection of penny stocks for diverse investment opportunities

- Competitive pricing, thus enhancing affordability for traders

- Exceptional support services, providing guidance and insights for penny stock trading

- No demo account

- Limited market analysis resources compared to its peers

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

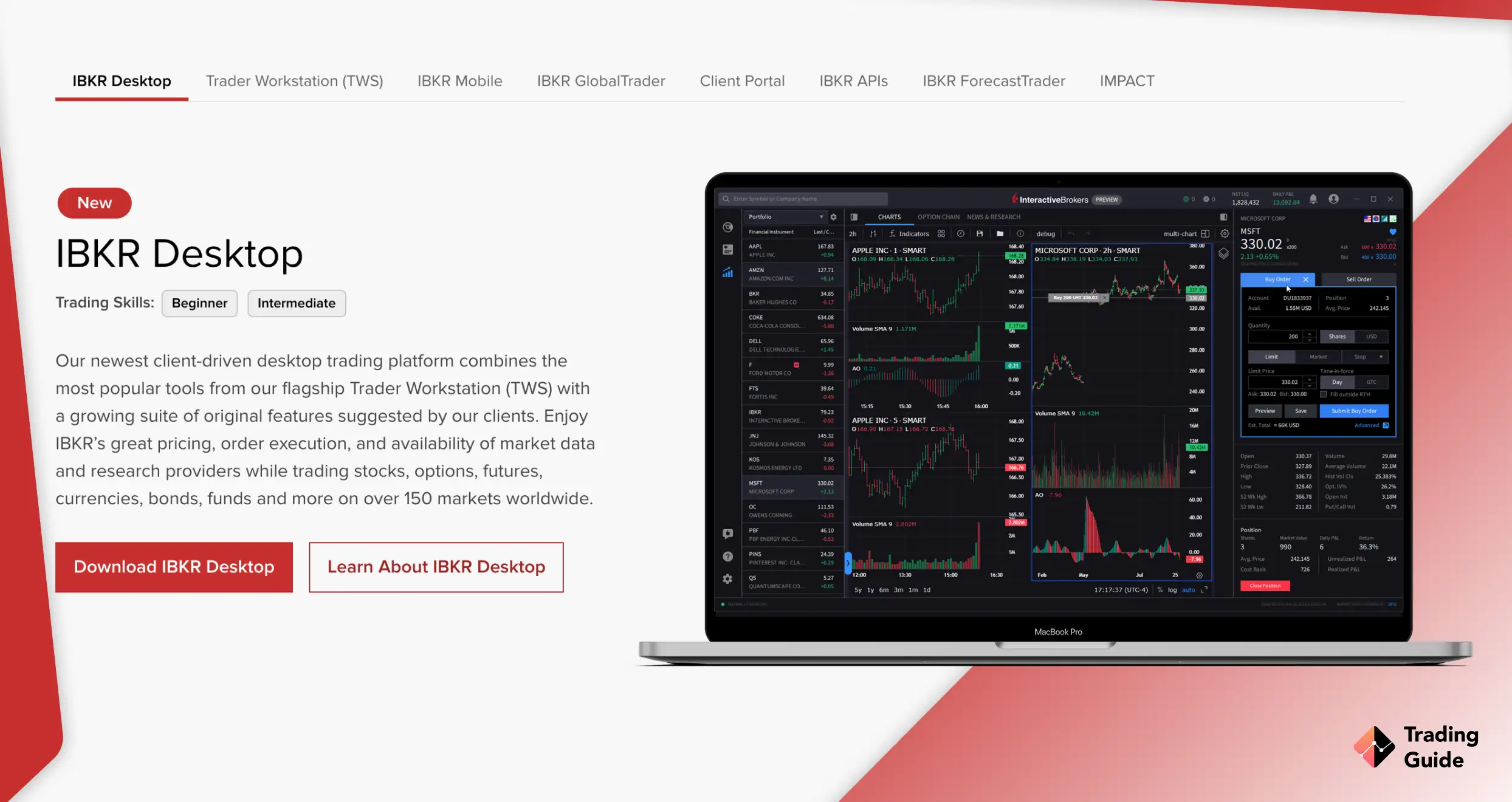

3. Interactive Brokers – Overall Best

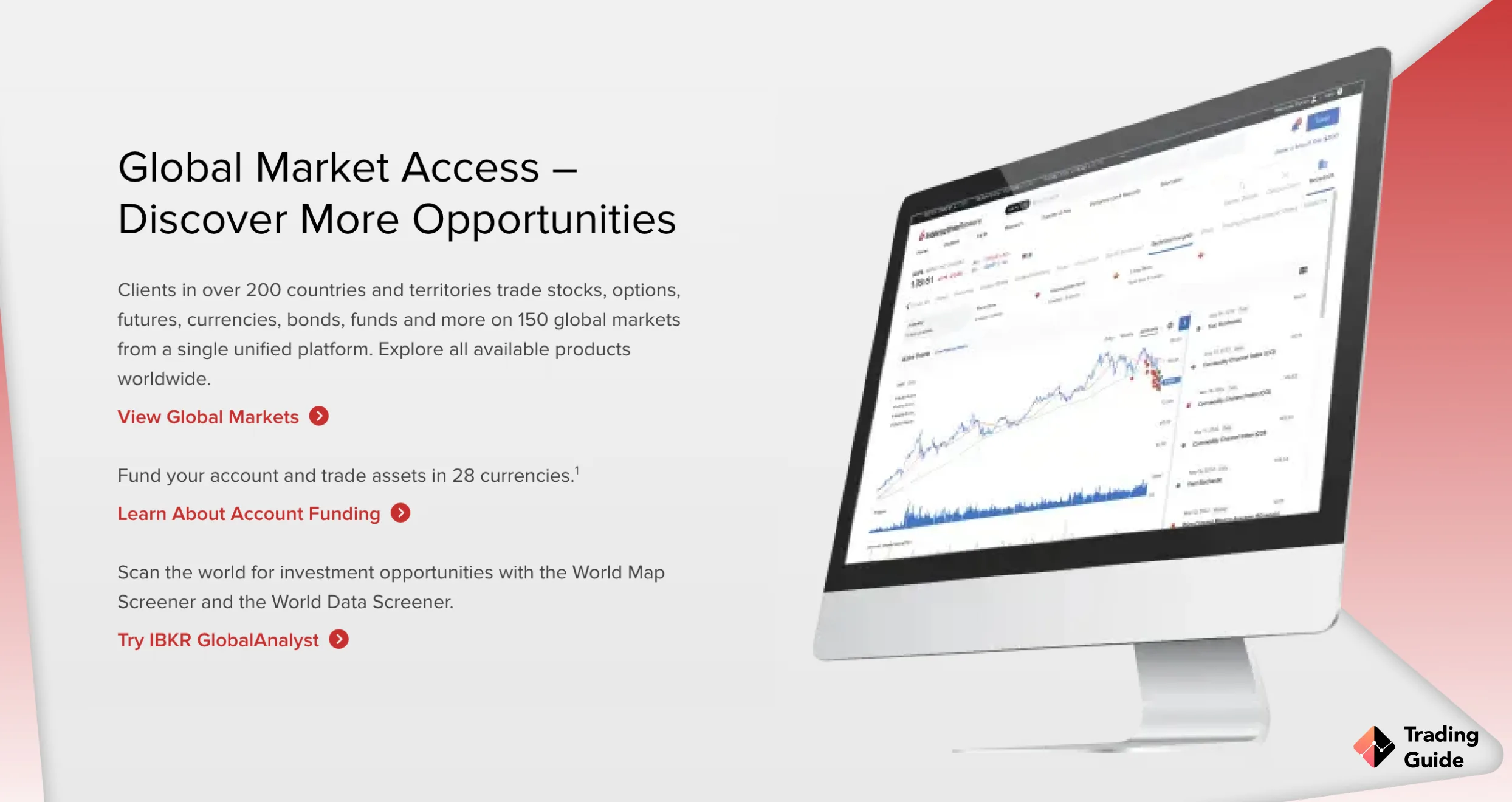

Interactive Brokers (IBKR) takes the crown as our ultimate choice for traders seeking a broker with unparalleled access to OTC stocks. With its commitment to safety and regulation, IBKR operates under the watchful eye of the Financial Conduct Authority (FCA) in the UK. This offers traders peace of mind in an increasingly complex financial landscape, thus maximising their experience. Moreover, IBKR’s open-door policy shines brightly, as there’s no minimum deposit requirement to kickstart your trading journey.

We like how Interactive Brokers shines in its penny-pinching approach to trading. Commission fees for penny stocks often dip below the £1 mark, and impressively, it offers free deposits and withdrawals. Gone are the days of worrying about inactivity fees, as IBKR sets no such traps. We also enjoyed fast order execution speed, which is essential for penny stock traders, particularly those who thrive in the fast-paced world of active and frequent trading. With IBKR, your penny stock ambitions are empowered like never before, making us rate it with 5 stars.

- No account minimum requirement.

- Less than £1 per share on penny stock trading.

- Excellent research resources.

- Multiple platforms, each with unique resources for all types of traders.

- A challenging desktop platform for beginner penny stock traders to navigate.

- Support service response rate can be improved.

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

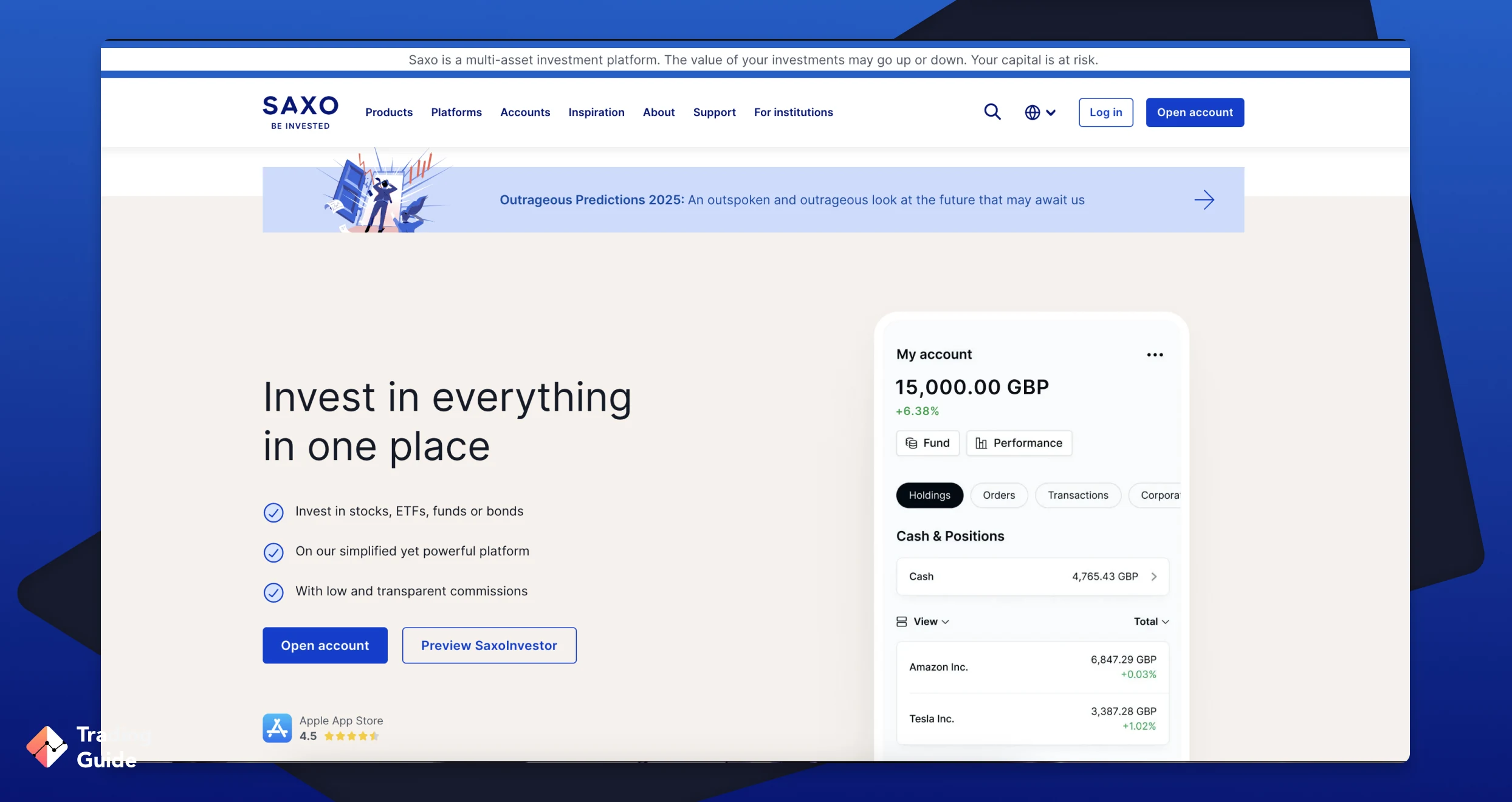

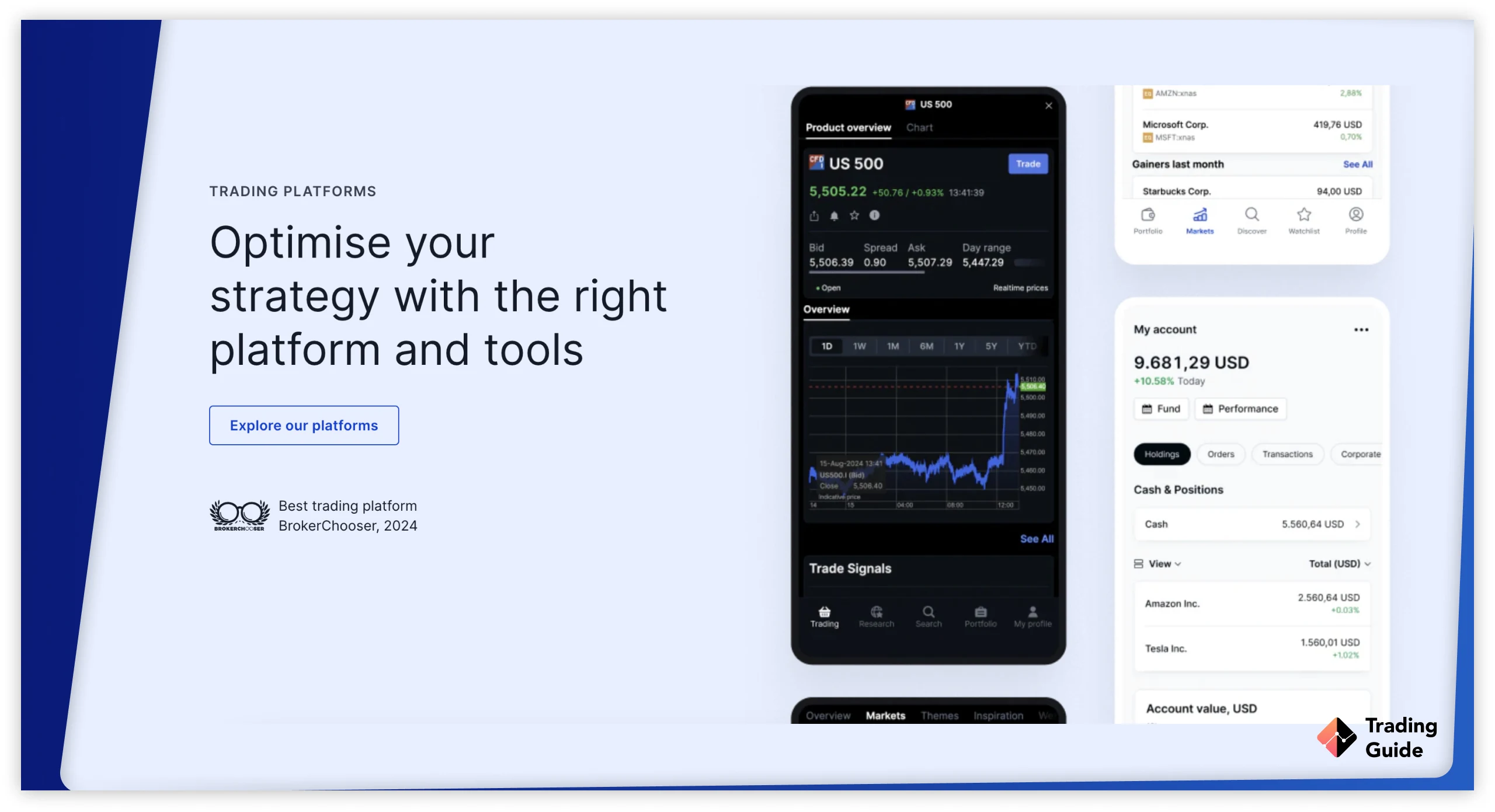

4. Saxo – Best For Professional Traders

During our evaluation of this broker, we discovered that Saxo offers an extensive array of options on a remarkably user-friendly platform. We like the fact that the broker is dedicated to providing top-notch third-party research resources and access to expert portfolio management services. Moreover, Saxo offers access to a huge number of penny stocks, available for purchase with a minimal commission of just £0.01 per share. This low trading cost empowers professional traders to diversify their portfolios effectively, mitigating the risks associated with investing in one asset.

Beyond penny stocks, Saxo opens the door to over 23,500 additional global stocks, including well-known giants like Adidas and Netflix. You can indulge in penny stock trading via the desktop platform or the SaxoTraderGO app, compatible with Android and iOS devices. Saxo’s minimum deposit requirement is £0 for its Classic account, meaning it allows you to start investing with as little as £1 in the UK. To ensure it aligns with your trading goals and budget, consider exploring Saxo through its demo account. We, therefore, give this penny stocks and ETFs broker a 4.1-star rating.

- Plenty of research resources

- Numerous penny stocks to invest in or trade as CFDs

- A user-friendly and customisable trading platform

- Low commission

- Does not support the MetaTrader platforms

| Type | Fee |

| Minimum deposit | $0 (for Classic account) |

| Inactivity fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Manual order fee | €50 per order |

| Stocks | from $1 on US stocks |

| Futures | $1 per lot |

| Listed options | $0.75 per lot |

| ETFs | from $1 |

| Bonds | from 0.05% on govt. bonds |

| Mutual funds | $0 |

Read about online stock brokers in the UK and NinjaTrader brokers in 2026 in our other guides.

What Do Other Traders Say?

While we didn’t directly ask traders for their opinions, we thoroughly analysed the ratings and testimonials they provided on Google Play, the App Store and Trustpilot. This approach enables us to share the collective sentiment and experiences of the trading community regarding penny stock brokers in the UK. By examining the honest ratings and reviews we’ve shared below, you can gain valuable insights to guide your decisions.

XTB

XTB has garnered praise on Google Play, Trustpilot, and the App Store for its user-friendly interface and comprehensive range of trading tools. Traders find it accessible for beginners while offering advanced features for professionals. Here are some comments we gathered from users.

-

“I have shares in other brokers, but I’m using this app to check prices and charts because it’s simply better. Flawless usability” – Kosciej

-

“Very good app. Customer service is welcoming. Lots of information for new traders available for free. Feel very valued and accepted as a beginner. Best app I have found after trying 10+ others.” – Thomas Ashley

-

“Excellent account managers who keep in touch. Find the app easy to use. Lots of educational content to help me learn. Good use of news and kept up to date with any stock market changes.” – Ross

Spreadex

Traders appreciate Spreadex’s flexibility with no minimum deposit requirement and its responsive customer support. Some, however, consider the trading fee relatively high.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

-

“A very useful financial spread betting app that should cover all your needs. It’s definitely the most useable of the broker apps that I’ve tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. They’ve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far” – JakeReadman

Interactive Brokers

Users value Interactive Brokers for its access to numerous penny stocks and rapid order execution. Some find its platform complex, but its support service is praised for being responsive with relevant solutions.

-

“Very good app, I’m using it on regilar basis. There is no such slow login issues for me, login lasts few seconds. Also the login is remembered when using biometric for some days/weeks, so you would need to enter passwords again, which is good security level.” – Vasil Popov

-

“IBKR’s iPhone app is far better for trading and for checking portfolio, browsing options prices, and looking at the market with watch lists, than Robinhood’s or Fidelity’s. They’re what I use for watchlists and to peruse options prices, even if I’ll end up trading on other brokers’ phone apps. It’s miles better. As for the broker, IBKR Pro has easily paid for itself and migrating to it has been objectively profitable for me. This is because of its better access to markets and trading hours allowing me to place certain trades. I’ve also been happy enough with trade execution and commissions costs.” – User4658991

-

“Best broker in the business – I’ve been with them 20 years. Lowest margins, best product range and fast execution.” – John

Saxo

The majority of this broker’s users appreciate Saxo for its extensive stock selection, despite the relatively high minimum deposit requirement. Portfolio management services are also noted as beneficial.

-

“The person was very patient and good at slowly explaining things step by step and also strived to introduce the useful functions of the trading platform.” – Frank Sakda Sreesangkom

-

“Took a bit to get used to, but now I can really appreciate the slick UI and great performance. Wide range of products and their support replied in a timely manner the few times I had questions. Also never had any problems with outages which is a huge relieve” – Christoph Müller

-

“This app is fast and efficient. It has good information about all the assets you can trade and nice articles about each type of asset.” – Anders Sch

The Ultimate Guide About Trade on Penny Stocks

Trading penny stocks goes beyond broker selection. It’s about comprehending the nuances of this unique market. Our mission is to equip you with an in-depth understanding, ensuring you’re well-prepared to make informed choices. To fulfil this mission, we’ve meticulously crafted the sections below, each offering insights into the intricacies of penny stock trading. This knowledge will empower you to excel in this dynamic arena.

How to Start Penny Stock Trading

Venturing into penny stock trading can be exciting and potentially profitable. However, like any investment, it requires careful planning and strategy. This is where we come in to guide you through the essential tips and tricks to effectively manage your activities.

Before diving into penny stock trading, take the time to educate yourself about the market. Understand what penny stocks are, their characteristics, and how they differ from larger stocks. Numerous online resources, books, and courses can provide valuable insights.

Selecting the right penny stock broker is crucial. Look for one that offers a wide range of penny stocks, competitive fees, and a user-friendly trading platform. Based on our extensive research, we’ve identified some of the best brokers for penny stock trading in the UK, which you can explore in our above sections.

Develop a clear and well-defined trading plan. Determine your financial goals, risk tolerance, and the amount of capital you’re willing to invest in a particular penny stock. Your plan should outline your entry and exit strategies for each trade.

It’s advisable to start with a small investment or capital, especially if you are new to penny stock trading. Penny stocks are often highly volatile, and losses can occur. Beginning with a modest amount allows you to gain experience without exposing yourself to high risk.

Don’t put all your eggs in one basket. Expand your capital across multiple instruments as a way to diversify your portfolio. You can invest in multiple stocks or add other market instruments like forex, commodities, cryptos, and more.

Thoroughly research the penny stocks you intend to invest in. Analyse company financials, news, and industry trends. Avoid making impulsive decisions; instead, base them on well-informed research.

Many penny stock brokers UK, including the ones we recommend, offer demo accounts. These are risk-free environments where you can practise trading penny stocks with virtual money. It’s an excellent way to hone your skills and strategies before risking real capital.

Penny stock trading is influenced by news and market sentiment. Stay updated with relevant developing news and events that could impact the value of your investments.

Implement sound risk management strategies, such as setting stop-loss orders. You do not want to lose money due to unavoidable reasons. Risk management controls ensure your positions are closed at a certain level.

How to Choose the Right Penny Stock Broker

Penny stocks are volatile assets, and trading them carries a high risk. To navigate this market successfully, it’s important to start by choosing the right penny stock broker. Here are the top features that will help you decide which penny stock platform suits your needs.

It’s imperative to ensure that any penny stock broker you consider is licensed and regulated by top-tier authorities, such as the Financial Conduct Authority (FCA). Regulatory oversight guarantees the safety of your trading funds and ensures you operate in a secure environment.

Given the rapidly fluctuating penny stock prices, a fast-execution trading platform is crucial. Look for brokers that offer a platform optimised for quick trade execution. Additionally, the platform should provide access to essential trading tools, including research materials and educational resources.

While penny stocks are affordable, it’s essential to have a clear budget in mind. Different brokers have varying trading and non-trading fees. Scrutinise details such as minimum deposit requirements, transaction costs, inactivity fees, and any potential hidden charges. Understanding these fees ensures you can plan your trading strategy effectively. Also, settle for brokers that offer multiple payment methods, like debit/credit cards, e-wallets, and bank transfers. This will ensure you have access to convenient transaction methods.

A reputable penny stock broker should offer a diverse range of penny stocks, enabling you to trade across various markets. Having access to a wide selection of assets allows you to experiment with different penny stocks and refine your trading strategies.

Effective customer support is vital when trading penny stocks. Choose a broker with responsive and dedicated customer service. This support system should provide prompt solutions to any issues you may encounter while trading. Keep in mind that some brokers offer 24/5 support, while others provide round-the-clock assistance, so select one that aligns with your trading schedule.

Whether you’re a novice or an experienced trader, it’s wise to test a broker before committing real funds. Most brokers offer free demo accounts, which allow you to explore their platform and services without risking your capital. Utilise this opportunity to assess the broker’s platform speed, available assets, and overall suitability for your trading needs.

Pay attention to recommendations and reviews from other users who have experienced the broker’s services. Their insights on platforms such as Google Play, the App Store, and Trustpilot can offer valuable perspectives on the broker’s reliability and customer satisfaction.

How Do Penny Stocks Work?

A penny stock, in financial markets, is a share of a small company that typically trades at a low price, often below £5 per share. These stocks are considered high-risk investments compared to regular shares due to their volatility and susceptibility to rapid price fluctuations. Penny stocks are usually issued by small companies and are bought and sold by individual investors in smaller quantities.

Penny stocks work similarly to other stocks but differ in key ways. They are primarily traded on less-regulated over-the-counter (OTC) markets. This means that they are exempt from the stringent reporting requirements and regulations that govern equities listed on major stock exchanges like the NYSE, the London Stock Exchange, or the NASDAQ. The lack of regulation can make penny stocks highly speculative and risky, as investors may have limited information access about a company’s financial health and growth potential.

Overall, we believe that penny stocks’ low share price and small quantities in which they are often sold make them prone to significant price swings. This attracts both risk-tolerant traders seeking short-term gains and those willing to navigate the challenges and uncertainties of this unique segment of the stock market.

5 Quick Steps To Trade Penny Stocks UK

As mentioned earlier, trading penny stocks can be a high-risk, high-reward endeavour with proper planning and strategy. However, do you know how to trade penny stocks using a broker in the UK? Below are the steps to follow when investing in penny stocks.

The first step is to select a reputable penny stock broker. Based on our extensive research, we’ve identified some of the top options in the UK, and have listed them above for you to choose. Opt for a broker that aligns with your trading goals and offers the necessary tools and resources for successful penny stock trading.

Once you’ve chosen your preferred broker, visit its website by clicking any of the links we’ve shared on this page and initiate the account creation process. This typically involves providing your personal information, including name, date of birth, email, etc., and agreeing to the broker’s terms and conditions.

After creating your trading account, the broker may require you to verify your details. This is a standard security measure to ensure your identity and protect your funds. For instance, a broker may require you to share a copy of your original ID card, driver’s licence, or passport for identity verification. You may also have to share another copy of a recent utility bill or bank statement as proof of residence.

To start trading stocks, you’ll need to fund your account. Most brokers, including our recommended ones, offer various deposit methods, including bank transfers, credit cards, and e-wallets. Choose the option that suits you best and make your initial deposit.

With your trading account funded, you’re ready to trade or buy penny stocks. Use the broker’s trading platform to explore available penny stocks, analyse market trends, and execute your trades. Remember to implement your trading strategy, manage risk, and stay informed about market developments, whether you buy penny shares or trade them as CFDs. Note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Therefore, before trading penny stocks via this derivatives method, consider whether you understand the risks and whether you can afford to take the high risk of losing your money.

Find out more about the best ETF brokers in the UK in another article.

The Risk of Trading Penny Stocks

Trading penny stocks can be an alluring prospect due to the potential for high returns in a relatively short period. However, it’s crucial to understand and acknowledge the inherent risks associated with penny stock trading. We have witnessed many retail investor accounts lose money when trading penny stocks.

One of the primary risks stems from the volatility of these stocks. Penny stocks are typically shares representing small, less-established companies. This means that they are more susceptible to significant price fluctuations. This volatility can lead to rapid and substantial losses if not managed effectively.

Another key risk factor is the lack of regulation and oversight in the penny stock market. Penny stocks in the UK are often traded on less regulated OTC markets, exempting them from the rigorous reporting requirements and regulations imposed on stocks listed on major exchanges. As a result, investors may find it difficult to access critical information about the financial health, operations, and prospects of these penny stock companies. This information gap can make it challenging to make informed investment decisions and increase the potential for fraudulent activities and pump-and-dump schemes.

Avoiding Penny Stock Scams

Penny stocks come with a high risk of falling victim to scams and fraudulent schemes. To safeguard your investments and navigate the penny stock market successfully, it’s crucial to be vigilant and follow these tips.

- Beware of unlicensed and unregulated penny stock brokers who also guarantee returns on high-risk investments. Remember, when you trade penny stocks, it is all about risking funds, and regulated brokers guarantee maximum safety.

- Be careful about penny stock brokers taking advantage of the latest trends to convince you to invest in a specific penny stock. For instance, don’t be convinced to trade or buy penny stocks during certain periods like high inflation. Instead, conduct your research on a penny stock to ensure you are making the right move.

- Be cautious of any penny stock being aggressively promoted through spam emails or social media, as these could be signs of a scam. Remember, if an investment opportunity seems too good to be true, it probably is.

- Refrain from completely trusting a broker, whether they convince you to quickly invest in penny shares or not. Remember, some brokers will take time to win your trust before scamming you.

- Do not rely on stock exchange listings, as this doesn’t guarantee you are investing with a legitimate penny stock broker. Remember, most penny stocks to buy are not listed on major exchanges.

FAQs

Yes. Since penny stocks are traded with amounts less than £5, you can diversify your portfolio across different companies and make money should a trade favour you. But, most importantly, you need the best penny stock broker in the UK, and we have listed the best in our mini-reviews above.

Yes. Amazon was once a penny stock back in the 1990s when it was being introduced in the market. Its stocks were traded at less than £2 per share.

The best way for beginners to buy penny stocks is to identify the best penny stock broker then sign up for a demo account. Using this account, you can practice penny stock trading until you feel ready to venture into the real markets.

Yes. Day trading penny stocks is possible since the assets are cheap and highly volatile. For this reason, you can open positions multiple times within a day and make profits.

Yes. Based on our penny stocks investment analysis, we believe that the assets can offer the potential for high returns. Although they are highly speculative and carry significant risks, you must be strategic and dedicated to your activities for maximum potential.

Yes. Although penny stocks are generally considered high-risk investments due to their low price and susceptibility to fraudulent activities, they are safe investments. This is because many investors are earning good profits from them. However, you must conduct thorough research and exercise caution to minimise the risk of losing your investment capital.

Conclusion

We hope that our extensive research on the best brokers for penny stocks in the UK has provided valuable guidance for those venturing into the world of penny stock trading. While the allure of substantial profits in a short time is tempting, it’s crucial to approach this market with a clear strategy. You can buy and take ownership of penny stocks or trade them as CFDs or spread betting. However, before you explore the assets as derivatives, consider whether you understand how spread bets and CFDs work.

Additionally, carefully assess your financial goals, risk tolerance, and trading preferences. It is also crucial to stay informed about market developments and expand your portfolio to mitigate the high risk of losing a lot of money. By following these guidelines, you can explore the potential of penny stocks while safeguarding your financial interests.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Do penny stocks really make money?

When it comes to tracking stock prices, it's important to keep a cool head. Don't get excited and don't let your emotions take you over. This way you will make wise investment choices and you will be able to start well on the stock market. Following this stock market advice means that you are reducing your margin for failure.

The article gave me a clear understanding of choosing a broker and shared the opinions of other traders. Information about XTB, AvaTrade, SpreadEx, Interactive Brokers and Saxo Markets was very useful. Feedback from traders added objectivity, and I especially appreciated their experience and advice. The How to Start Trading Penny Stocks and Risks of Trading Penny Stocks sections provided important steps and made you aware of the risks. As someone interested in crypto, I found the article useful notes for diversifying your investment portfolio.

This guide provides valuable information for investors, skillfully emphasizing the significance of selecting the right broker. It imparts the knowledge necessary to navigate a volatile stock market. The curated list of top brokers proved highly beneficial to me!

I'm interested in penny stocks and would like to know more about the best penny stock brokers in the UK. Can you recommend any?

Hi, Latestmodapks! Thank you for your comment. You can go into our article about the best penny stock brokers in the UK and find suitable for you.

Interesting read! I'm currently looking for a reliable penny stock broker in the UK, and this post has provided me with some valuable insights. I appreciate the breakdown of each broker's fees, commission structures, and reliability. Will definitely consider these options for my next trade. Thanks for sharing!

Great post! As a UK-based trader, I'm always on the lookout for reliable penny stock brokers. I've tried a few of the ones listed here and can confirm that they offer competitive pricing and good service?

It's useful for beginners like me, especially the section on fees and assets. I’ll probably start by looking into XTB since it’s budget-friendly with no minimum deposit.

Love how this breaks down both fees and asset coverage across brokers — super helpful