The UK is one of the best places to buy and sell company shares for a number of excellent reasons. First and foremost, this region has a strong regulatory framework set by one of the most respected authorities today – the Financial Conduct Authority. This organisation ensures UK traders and investors enjoy optimum protection and standards.

Plus, there are plenty of terrific share-dealing platforms in the UK. That isn’t idle speculation- I know they are outstanding because I’ve tested and used them for a long time. Since the list is long, I’ve decided to recommend 5 that are a cut above the rest. This should make it easier for you to find the best UK share-dealing platform for your trading and investment needs.

List of the Best UK Share Dealing Platforms

- Saxo – Best Overall Platform for Share Dealing in the UK

- eToro – Best for Social and Copy Trading

- Plus500*– Commission-Free Share Dealing Platform (via CFDs)

- Hargreaves Lansdown – Most Trusted Platform

- DEGIRO – Best Share Dealing Platform for Beginners

*76% of CFD retail accounts lose money with this provider

Platforms Reviews

I’ve been investing and trading shares for many years. Since I started out, I’ve used countless platforms; some served me well, while others were a total disappointment. I know trading with an unreliable provider is incredibly frustrating, so I dedicated my time and energy to this crucial task of helping you find the best online share dealing platform in the UK.

I have listed and reviewed five service providers that, in my opinion, are superior to the rest. I didn’t pull this list out of thin air – far from it. Before preparing this guide, I tested a multitude of brokers, ranked each one, and selected 5 that stood out. We’ll discuss the entire testing process in detail later.

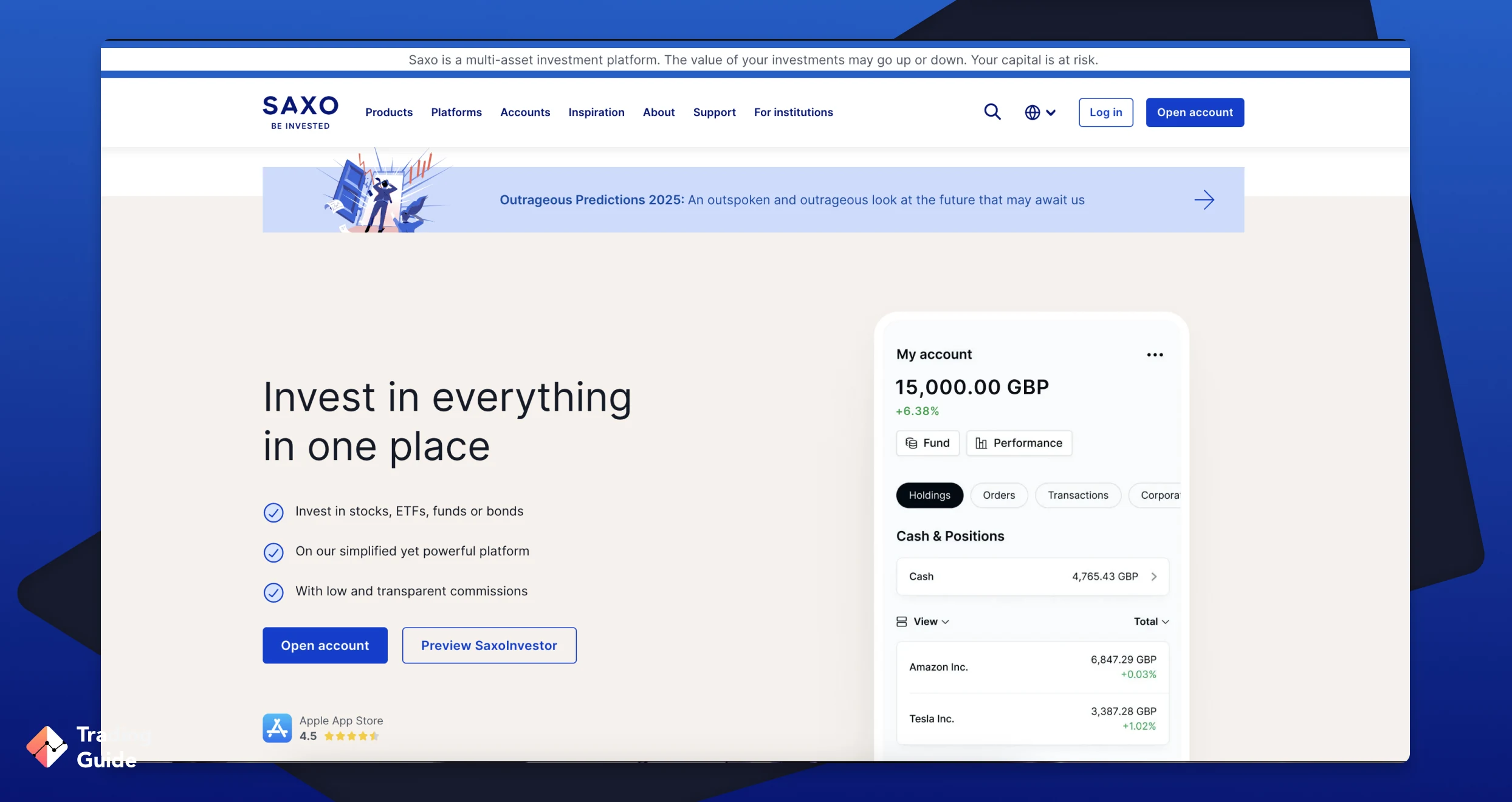

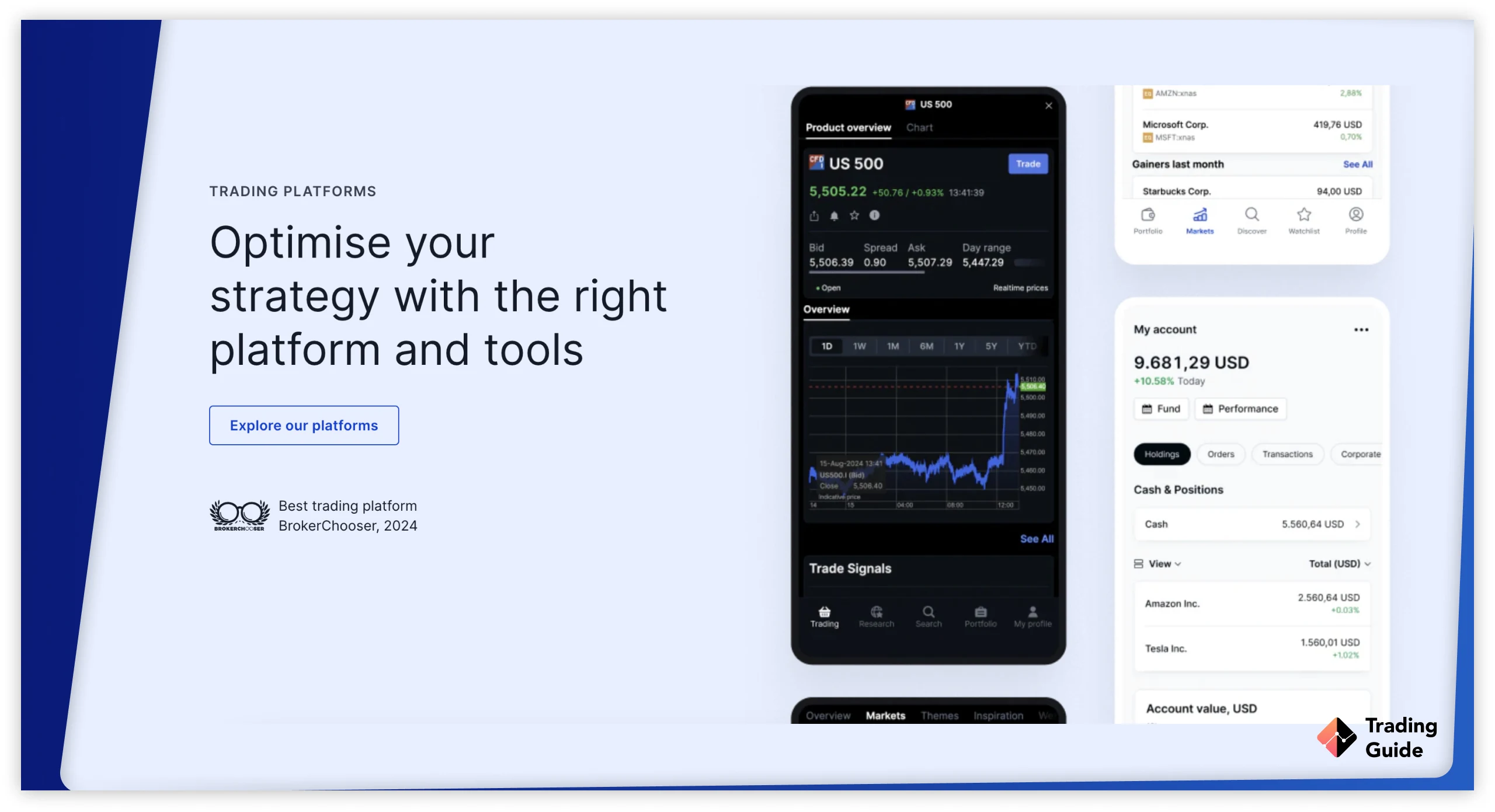

1. Saxo – Best Overall Platform for Share Dealing in the UK

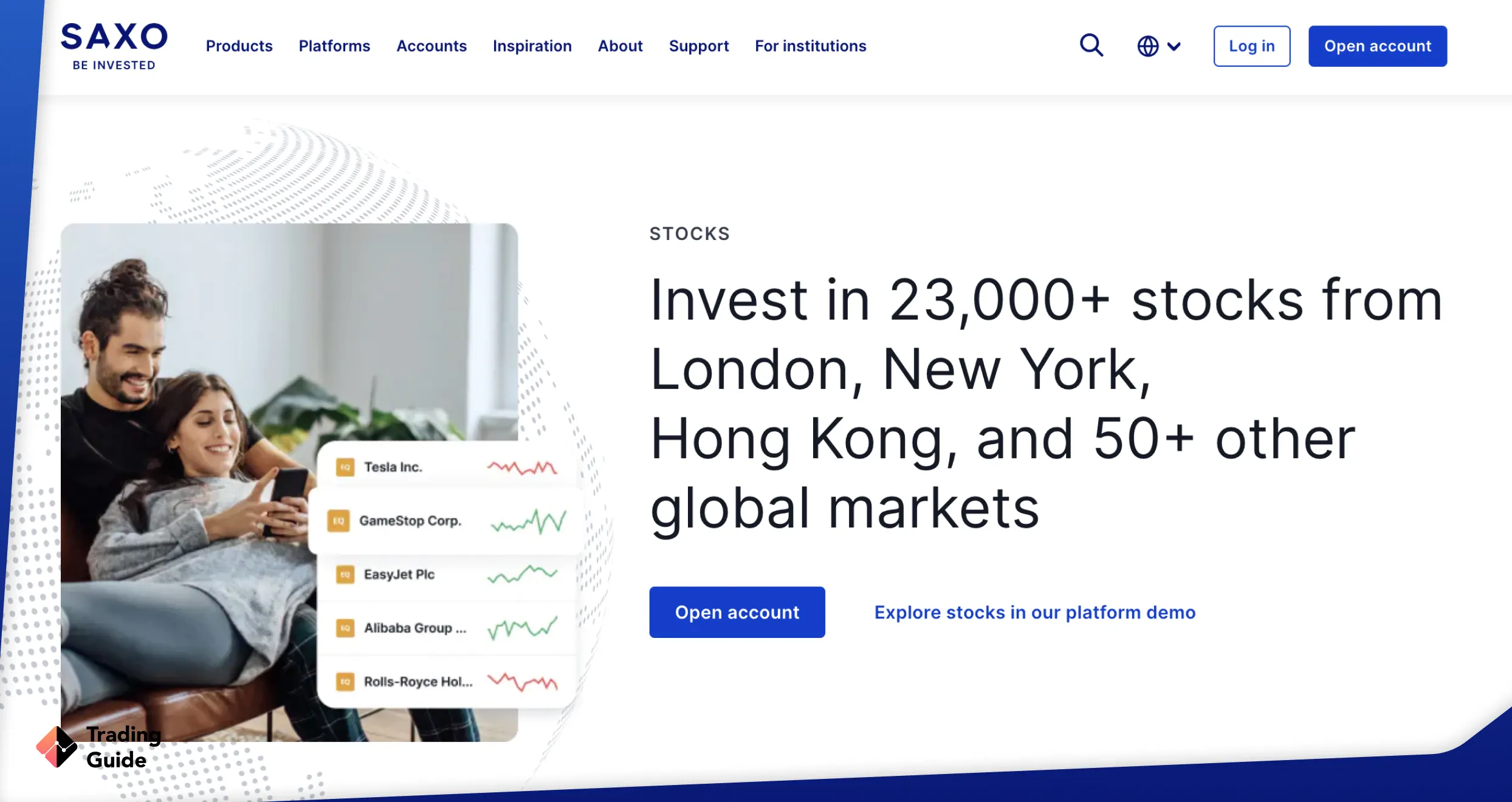

Saxo is the best overall for all the right reasons. The first thing that caught my eye was this platform’s MASSIVE asset collection. When I say massive, I mean it. Picture a platform with 23,000 stocks from diverse exchanges, from the UK and the US to Euronext. Sounds like the sweetest deal, right? Here’s even better news: this provider’s users can start their investment journey with as little as £1.

Besides stocks and shares, I found plenty of other assets on Saxo. The investment side has 7,400+ ETFs that you can buy from just £3, 5,200+ bonds with tight commissions from 0.05%, and 6,000+ low-cost funds. I also checked out what the broker offers to avid traders and discovered thousands of securities, from forex pairs and forex options to CFDs on stocks, commodities, and ETFs.

I was also impressed by Saxo’s suitability for traders of all levels. This broker has a beginner-friendly app perfect for anyone new to trading and investing. And to pros with advanced needs, Saxo offers SaxoTraderPro, a next-level platform loaded with a plethora of high-performance tools, from an advanced trade ticket to a robust charting package. With all that in mind, Saxo deserves a 5-star rating.

- Its users can invest in 23,000+ stocks

- Tens of thousands of bonds, CFDs, and other assets for diversification

- No minimum funding requirement

- Powerful platforms tailored for both novices and experts

- Zero inactivity fee for dormant accounts

- Individual, joint, and corporate accounts available

- High minimum initial funding for Platinum (£200K) and VIP (1 million)

- Limited learning resources for beginners

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

2. eToro – Best for Social and Copy Trading

Having delved deep into the world of share dealing platforms in the UK, eToro has emerged as a compelling choice, especially for those who value the dynamics of social and copy trading. My research has uncovered what makes eToro a standout platform. For starters, eToro simplifies share dealing by connecting you with a vast network of traders through its social trading platform. It goes a step further by introducing the intriguing concept of copy trading, which allows you to replicate the trading strategies of seasoned experts.

Another aspect that sets eToro apart is inclusivity. It’s designed for all, regardless of experience level. This service provider offers beginners a wealth of educational resources, from articles and guides to webinars and seminars. Experts, on the other hand, are supported with advanced tools, a wide range of assets, and powerful proprietary platforms.

Regarding assets, thousands are available on eToro, including 6,000+ stocks. You can get started with as little as £50 and enjoy commission-free share dealing. Plus, the broker lists additional securities you can diversify your portfolio with, such as crypto, currency pairs, and CFDs. These and more have encouraged me to award 4.8 stars to this wonderful service provider.

- Offers investment products, including 6,000+ stocks

- Supports social and copy trading

- Diverse resources for traders of all levels, including beginners

- Investors can also buy and sell crypto assets

- Pocket-friendly minimum deposit requirement

- CopyTrader has a £200 minimum amount requirement

- £10 monthly inactivity fee

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

| Features | Availability |

| Minimum Deposit Requirement | $50 |

| Supported Assets | Stocks, commodities, cryptocurrencies, ETFs, forex, indices, NFTs |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | E-wallets, Bank transfers, debit cards |

| Transaction Fees | $5 withdrawal fees apply |

3. Plus500 – Commission-Free Share Dealing Platform (via CFDs)

*Illustrative prices

My extensive research into share-dealing platforms eventually led me to Plus500, a CFD trading platform that stands out in several key areas. From my analysis, Plus500 lists over 2,200 shares from global markets, which you get to trade as CFDs only.

Additional securities, including forex, commodities, indices, and more, also exist for your CFD portfolio diversification purposes. The best element is that share CFD trading at Plus500 is commission-free, and professional traders get to enjoy a leverage limit of up to 1:20. In contrast, retail traders can increase their exposure and potential returns with up to 1:5 leverage. You can get started with as little as £100 for live trading, which makes the broker cost-effective.

I advise beginners to begin their share CFD trading ventures using Plus500’s virtually funded demo account. This is primarily because CFD share trading can be risky, and over 80% of retail traders lose their money. Therefore, consider boosting your confidence and trading skills before transitioning to live trading for increased profit potential. Based on my hands-on experience, Plus500 deserves 4.6 stars.

- Competitive minimum deposit requirement

- Supports margin/leveraged trading

- Share traders can diversify with FX pairs, index CFDs, etc.

- Free deposits and withdrawals

- Plenty of educational resources, including a free academy

- Only CFDs are available

- £10 monthly inactivity fee

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| Features | Availability |

| Minimum Deposit Requirement | £100 |

| Supported Assets | Forex, shares, commodities, ETFs, options, indices |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Visa, Mastercard, PayPal, bank transfer |

| Transaction Fees | £0 |

4. Hargreaves Lansdown – Most Trusted Share Dealing Platform

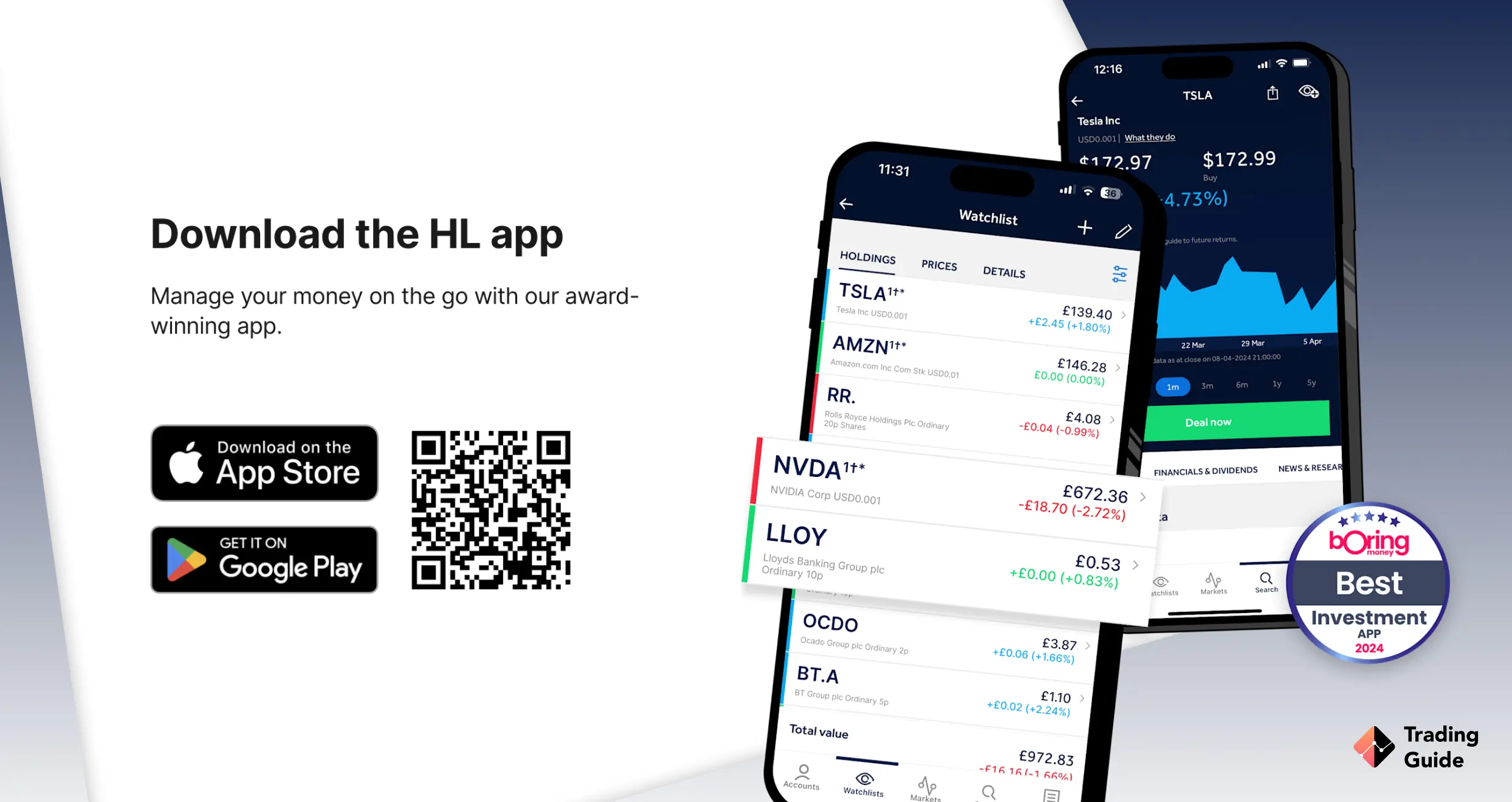

Hargreaves Lansdown stands as a beacon of trust and reliability in the world of share dealing. I researched the platform extensively and noticed that hundreds of thousands of share traders and investors trust it— a clear indication that it delivers on its promises. As we speak, the company boasts over 1.7 million clients, which is a commendable achievement.

I also enjoyed Hargreaves Lansdown’s flexibility and was able to effortlessly buy, sell, and hold shares without temporal constraints. This service provider offers two types of accounts to people interested in stocks and shares: stocks and shares ISAs and fund and share accounts. A stocks and shares ISA is your gateway to the universe of tax-free investing. But if you’re interested in an account that lets you trade shares whenever you like, the fund and share account is the better alternative.

I also noticed that Hargreaves Lansdown has a progressive cost structure – the more you deal, the lower your commissions. This makes it an attractive feature for frequent traders. Additionally, the platform hosts comprehensive educational and research tools, ensuring users’ share-dealing experience is convenient and informed. I give it a 4.7-star rating based on what I discovered.

- Trusted by millions of share dealers and investors

- Long track record and heavily monitored by the FCA

- Thousands of shares on more than 23 global markets

- No inactivity fees for dormant accounts

- Offers diverse accounts, including lifetime ISAs and junior SIPPs

- Limited tools and features for advanced traders and investors

- Scarce asset variety compared to its peers

- No demo accounts

| Type | Fee |

| Minimum Deposit | £1 |

| Deposit Fee | No |

| Withdrawal Fee | No |

| Inactivity Fee | No inactivity fees |

| Annual Fee | 0.45% |

| Features | Availability |

| Minimum Deposit Requirement | £1 |

| Supported Assets | Shares, ETFs, indices, bonds |

| Mobile App | Yes (Android or iOS) |

| Payment Methods | Credit cards, Bank Wire Transfer |

| Transaction Fees | £0 |

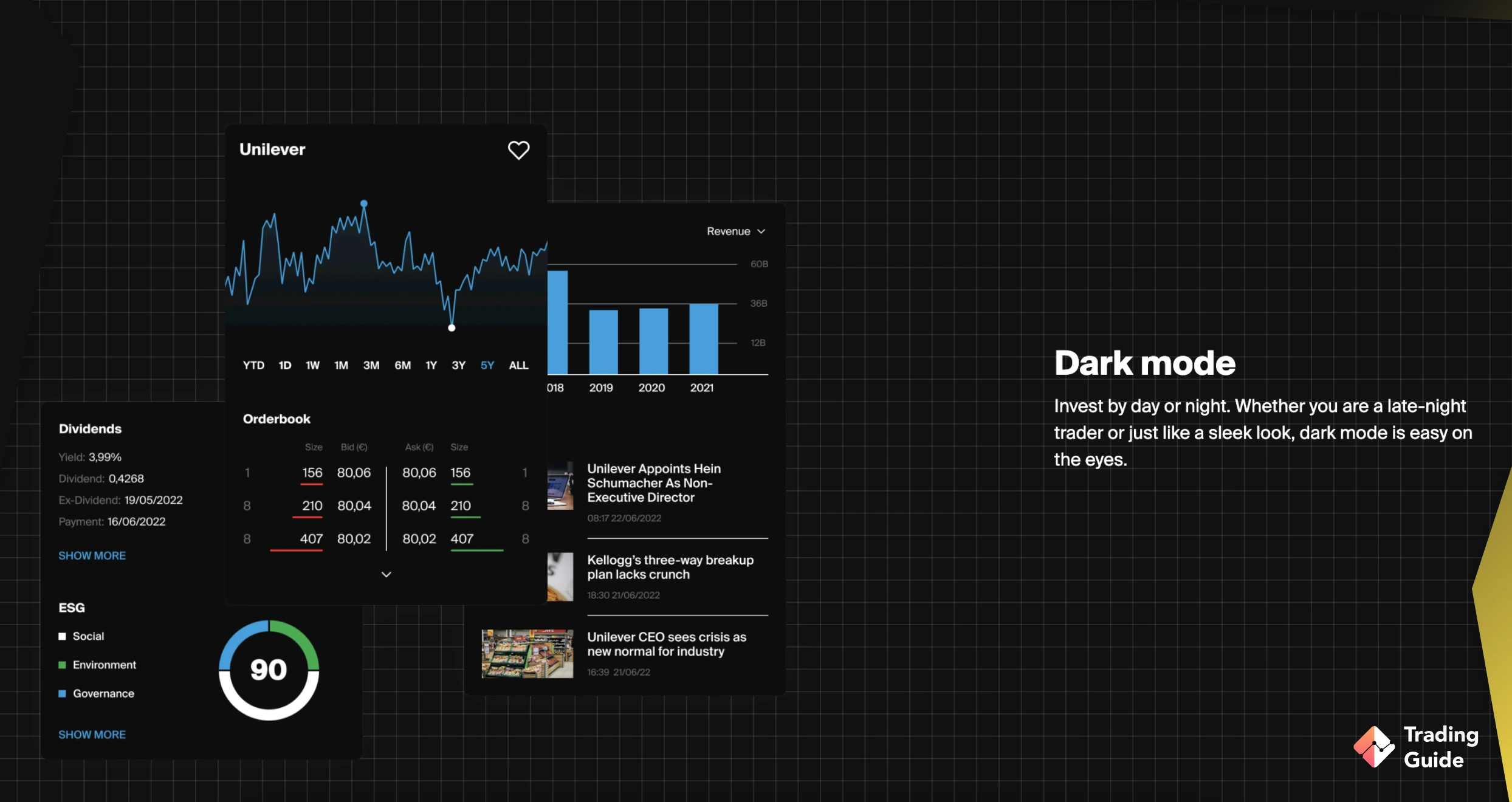

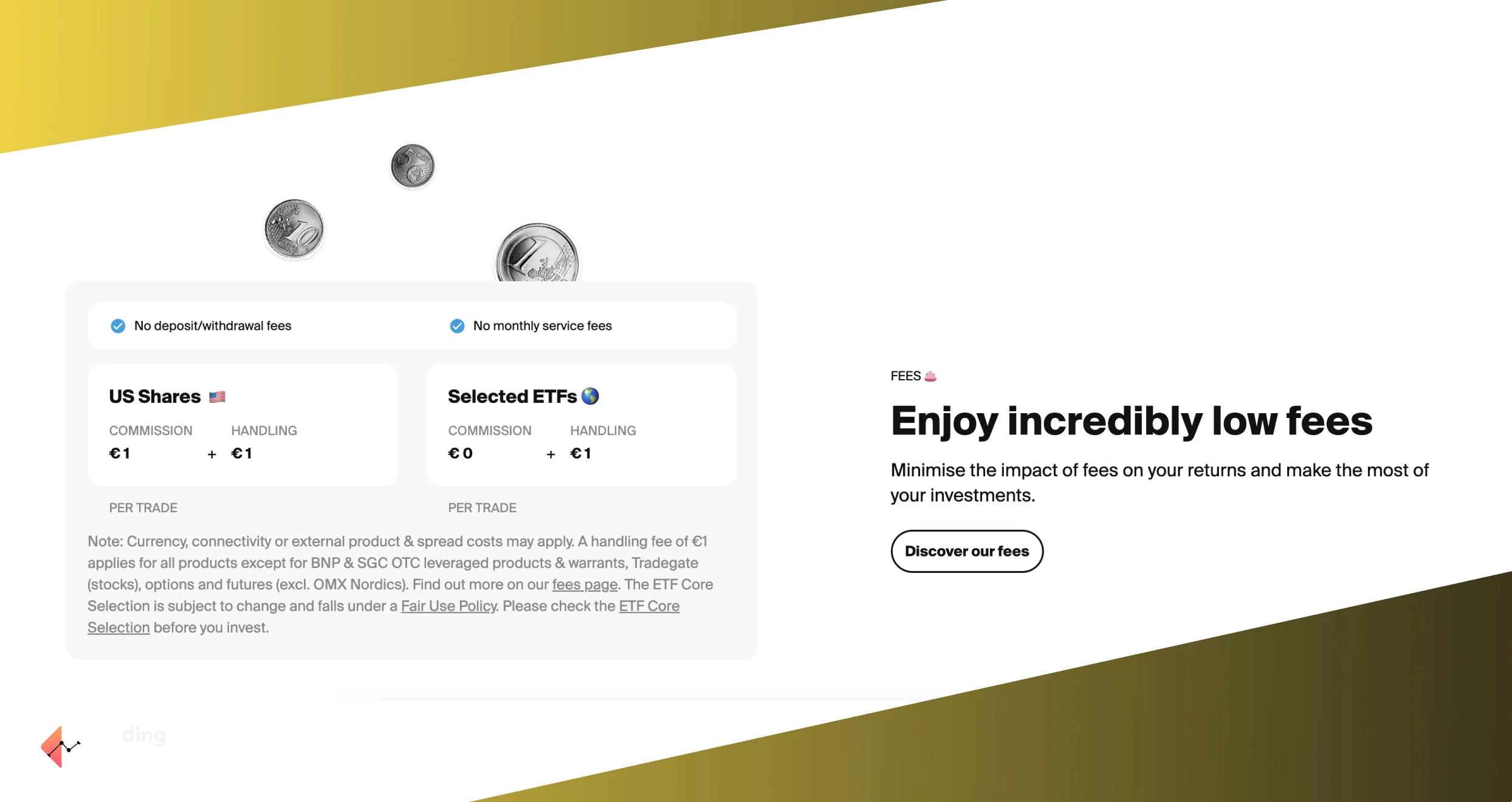

5. DEGIRO – Best Share Dealing Platform for Beginners

After using numerous sites, I have identified DEGIRO as the best share-dealing platform for beginners in the UK. The platform is beginner-friendly and cost-effective, making it perfect for those who are hesitant to risk substantial funds while they acquaint themselves with the intricacies of share dealing. DEGIRO is also remarkable for its transparency in presenting its offerings, assuring users of a clear and straightforward trading experience.

Note that DEGIRO facilitates access to both local and international share markets, allowing beginners to trade different products at any time. This inclusivity is invaluable for those looking to expand their portfolios and explore a wide range of investment options. DEGIRO doesn’t stop at providing a user-friendly platform. It also offers valuable research and educational materials, which can significantly enhance a beginner’s trading skills. This emphasis on education underscores DEGIRO’s commitment to supporting its users on their share-dealing journey.

As a beginner, you’ll have access to an impressive range of educational materials if you choose DEGIRO. The list includes an online academy with in-depth lessons and expertly crafted blog articles. In this regard, I give it a 4.3-star rating.

- Beginner-friendly share-dealing platform

- Seamless account opening procedure

- Reasonable range of educational materials

- Zero inactivity fee

- Diverse assets from stocks to ETFs and bonds

- No demo accounts

- CFD trading is not available

- Only bank transfers are allowed

| Types | Fee |

| Minimum deposit | €0 |

| Withdrawal fee | €0 |

| Inactivity fee | €0 |

| Deposit fee | €0 |

| Custody fee | €0 |

| Currency conversion | 0.25% |

| Features | Availability |

| Minimum Deposit Requirement | £0 |

| Supported Assets | Shares, ETFs, commodities, options, futures, bonds |

| Mobile App | Yes (Google Play, App Store) |

| Payment Methods | Bank wire transfer |

| Transaction Fees | £0 |

Compare Platforms Table

I’ve introduced you to what each of the best UK share-dealing platforms offers. My next mission is to help you compare the recommended service providers with an extensive comparison table. Find it below; it’ll help you weigh the differences and isolate the most fitting share-dealing platform based on crucial factors, from regulatory status to fees.

| Best UK Share Dealing Platform | Licence & Regulation | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Saxo | FCA, MAS, FSMA, ASIC, FSA | 24/5 | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO | Bank wire transfers | Yes | Yes |

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit cards, Bank transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes | Yes |

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google Pay, Apple Pay | Yes | Yes |

| Hargreaves Lansdown | FCA, FSCS | 24/5 | Web Platform, Mobile App | Credit/Debit Cards, Bank Transfers, E-wallet transfers | No | Yes |

| DEGIRO | BaFin, AFM, FCA | 24/5 | Web Platform, Mobile App | Bank Wire Transfer, Electronic Wallets, Trustly Withdraw money only via bank transfer | No | Yes |

Fees

| Best Share Dealing Platform | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Saxo | £0 | From 0.03% | Free | £0 |

| eToro | £50 | From 0% | Free | £10 monthly |

| Plus500 | £100 | From 0% | Free | £10 monthly |

| Hargreaves Lansdown | £0 | From £5.95 dealing fee | Free | £0 |

| DeGiro | £0 | From £1 | Free | £0 |

How to Choose a Share Dealing Platform

The right share-dealing platform is crucial to your success as an investor. Why? A fitting platform offers you everything you need to invest confidently and reap handsome returns. Without it, you are more likely to get frustrated, miss out on opportunities, and lose money. That is why I urge you to vet every service provider as extensively as possible before you even consider signing up. So, choosing the right broker in the UK is a critical step to kickstart your trading journey.

While vetting providers and searching for the best share-dealing platform in the UK, be mindful of the following:

Choose share dealing platforms licensed and regulated by recognised authorities, with the FCA as a top priority. I insist on that because multi-regulated sites follow strict standards for client fund protection, transparency, data safety, and more. Plus, they are members of top-tier compensation schemes like the FSCS, which protect you from losses that may arise if your chosen broker declares bankruptcy or insolvency. I also urge you to verify every broker’s licensing details through the regulators’ official online registers. This is crucial, as plenty of fraudulent, unlicensed companies use false and misleading claims to appear legitimate and lure investors.

After checking a broker’s licensing and regulatory status, assess its reputation through online reviews. That is the easiest way to get a clearer picture of how the service provider treats its clients. Never base your judgement on how fancy a share-dealing platform seems or its promises. Trustpilot, official app stores, and other independent sites have thousands of reviews, so I don’t expect this step to be challenging. Read multiple testimonials and look for recurring compliments or concerns. If you see the same complaint repeated several times, that’s a red flag, especially if it goes unaddressed for a long time.

Every pound you use to cover costs is money that should either be working for you in the market or bolstering your returns. Check every share-dealing platform’s fees before signing up to ensure you don’t part with too much. While evaluating charges, I strongly recommend paying close attention to several elements. First, check account maintenance, transaction, and inactivity fees. Then proceed to commissions and spreads because they determine how much you pay whenever you trade and invest. You should also factor in currency conversion, overnight, and holding charges.

Share dealing sites have different categories of assets. Some give you access to stocks and shares exclusively. Others also allow you to trade and invest in a wide variety of instruments, from crypto and forex to CFDs and ETFs. An average platform like Hargreaves Lansdown can serve you well if you are only interested in stocks and shares. But first, check if the available assets are share CFDs to avoid disappointment. But if you are an avid trader and investor, ensure you sign up on a site with a broader asset selection, like Saxo or eToro. We would recommend to read about the best UK commodity brokers in our other article.

Have you ever tried to talk to a brick wall? The same results you got are the same ones you’ll get if you sign up with a broker with poor customer support. You will receive little to no assistance whenever you face significant issues such as delayed deposits, difficulty with withdrawals, and technical glitches. Do what I always do: test every broker’s support service before registering. You don’t have to do anything complicated. Simply fabricate a question like “How long does verification take?” and ask it through all available channels. The best service providers will respond almost instantly and with clear answers.

Lastly, test each broker’s platforms and analyse available account options. Ensure the platforms at your disposal are easy to navigate and reliable. You can test their performance and suitability in demo mode if possible. Also, check the types of accounts offered by each service provider. The options you’ll see will vary from one brand to the next. For instance, on Hargreaves Lansdown, you’ll find options like stocks and shares ISA, while eToro has alternatives like retail and professional investment accounts.

FAQs

You can easily start trading shares by creating a share dealing account with a broker that is heavily monitored by top-tier authorities globally.

Yes. However, it won’t be as easy as using a share dealing broker. So if you want to buy shares, just find a broker, like the ones we recommend above.

Depending on a share dealing broker’s requirements, you can start share trading with as little as £100. This is because some share dealing platforms do not have minimum deposit requirements or trading commissions.

Shares involve having direct equity in a specific company you invest in, whereas stocks involve owning one or multiple share units in different companies.

Yes. Share trading is legal in the UK and has become among the most popular trading activities.

Yes. You are free to buy and sell the same stock repeatedly with a regulated broker like the ones we recommend above. Simply understand the restrictions that come with this form of trading.

Conclusion

Share dealing is 100% legal in the UK, so you can join in without reservations. But note that, while buying and selling shares, you may be required to pay some form of tax. For instance, the government might ask you to pay Capital Gains Tax whenever you sell shares that are not in an ISA or PEP and your returns exceed the £3,000 annual exemption threshold. Before you dive into share dealing, please research, read, and understand the associated tax obligations.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

eToro is really great in what they are doing! The easiest platform with clear info, educational materials and allows copying. 5+++

Is there any free share dealing platform in the UK?

Which trading platform is safe and good for an investor who would like to invest in split shares?

The guide pointed me in the right direction, suggesting eToro for social trading and Hargreaves Lansdown for a trustworthy experience – a recommendation that truly resonated. The clear breakdown of fees and user comments shared a genuine perspective. It's a concise and informative read, making it perfect advice for stepping into the world of stock trading.

I was curious if I could buy shares without a broker and came across this guide. It's full of useful information! I learned that while some platforms allow direct purchasing, it's easier and safer to use a trusted platform. The article provided a clear overview of different platform types, and I realized I made the right choice with eToro. Wish I had found this guide earlier when I was just starting to invest!

The comparison of fees and features is super helpful. I’m particularly interested in Plus500’s commission-free trading and eToro’s social trading.

Really helpful guide, thanks! I'm completely new to investing and have been putting it off for ages because I didn't know where to start. The Plus500 section mentions 80% of people lose money with CFDs which sounds terrifying! Would love to hear from anyone who started with these platforms - did you find them genuinely beginner-friendly or is there a steep learning curve?