Gone are the days of solitary investing, as social trading platforms have injected a breath of fresh air into the trading arena. With social trading empowering individuals in the UK, many are looking for the best platforms that support the activity.

For this reason, we decided to conduct extensive market research and present below the top five exceptional social trading platforms in the UK for 2026. These platforms showcase their unique features, superior security and robust social networking capabilities. We also guide you through some of the user testimonials to enhance your trading decisions.

List of the Best Social Trading Platforms 2026

- eToro* – Overall Best Social Trading Platform in the UK

- FXTM – Best Social Trading Platform With Low Minimum Deposit Requirement

- IG Markets – Best With Investment Options

- FP Markets – Best Social Trading Platform For Advanced UK Traders

- Spreadex – Beginner-Friendly

*Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Compare the Best Social Trading Platforms in the UK

Although we recommend the top social trading brokers in the UK to consider, we thought it is best to compare them for more understanding. Remember, our comparison is not only based on extensive tests but also analysis of user testimonials on Google Play, the App Store, and Trustpilot.

| Best Social Trading Platform | Licence | Support Service | Software | Payment | Demo Account | Money Insurance (Negative money protection) |

|---|---|---|---|---|---|---|

| eToro | ASIC, CySEC, FCA, FSAS | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Debit cards, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes | Yes (up to $250,000) |

| FXTM | CySEC, FSC | 24/5 | MetaTrader 4, MetaTrader 5, Mobile Trading | Credit/debit cards, e-Wallets, crypto, Bank Wire transfers | Yes | Yes (up to €20,000) |

| IG Markets | SEC, FCA, BaFin, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, BMA, CySEC | 24/5 | MT4, ProRealTime, L2 Dealer, TradingView | Credit/Debit cards, Apple Pay, Bank transfer | Yes | Yes (up to £85,000) |

| FP Markets | CySEC, ASIC, FCA, SEBI | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Yes | Yes (up to €20,000 to EU clients) |

| Spreadex | FCA, SEBI | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No | Available for some clients |

Brief Overview of Our Recommended Brokers’ Fees and Assets

Fees

Most traders prioritise brokers that are affordable to be able to easily budget and trade without overspending. For this reason, we decided to prepare a table below highlighting our top brokers’ trading and non-trading charges for informed calculations.

| Broker | Minimum Deposit | Commission/Spread | Transaction Fees | Inactivity fees |

|---|---|---|---|---|

| eToro | $50 | 2 pips | $5 withdrawal | $10 monthly |

| FXTM | $10 | No | $3 withdrawal | Yes |

| IG Markets | $0 | From 0.1 points | Free | £18 monthly |

| FP Markets | £100 | 0.0 pips | Zero | None |

| Spreadex | $0 | From 0.6 pips | Free | None |

Assets

We also understand that traders and investors prioritise social trading platforms based on the availability of assets. To help with your decisions, here are the featured assets we discovered in our top 5 recommendations.

| Broker | Stocks | Cryptos | Forex | Commodities | Indices | Options | ETFs |

|---|---|---|---|---|---|---|---|

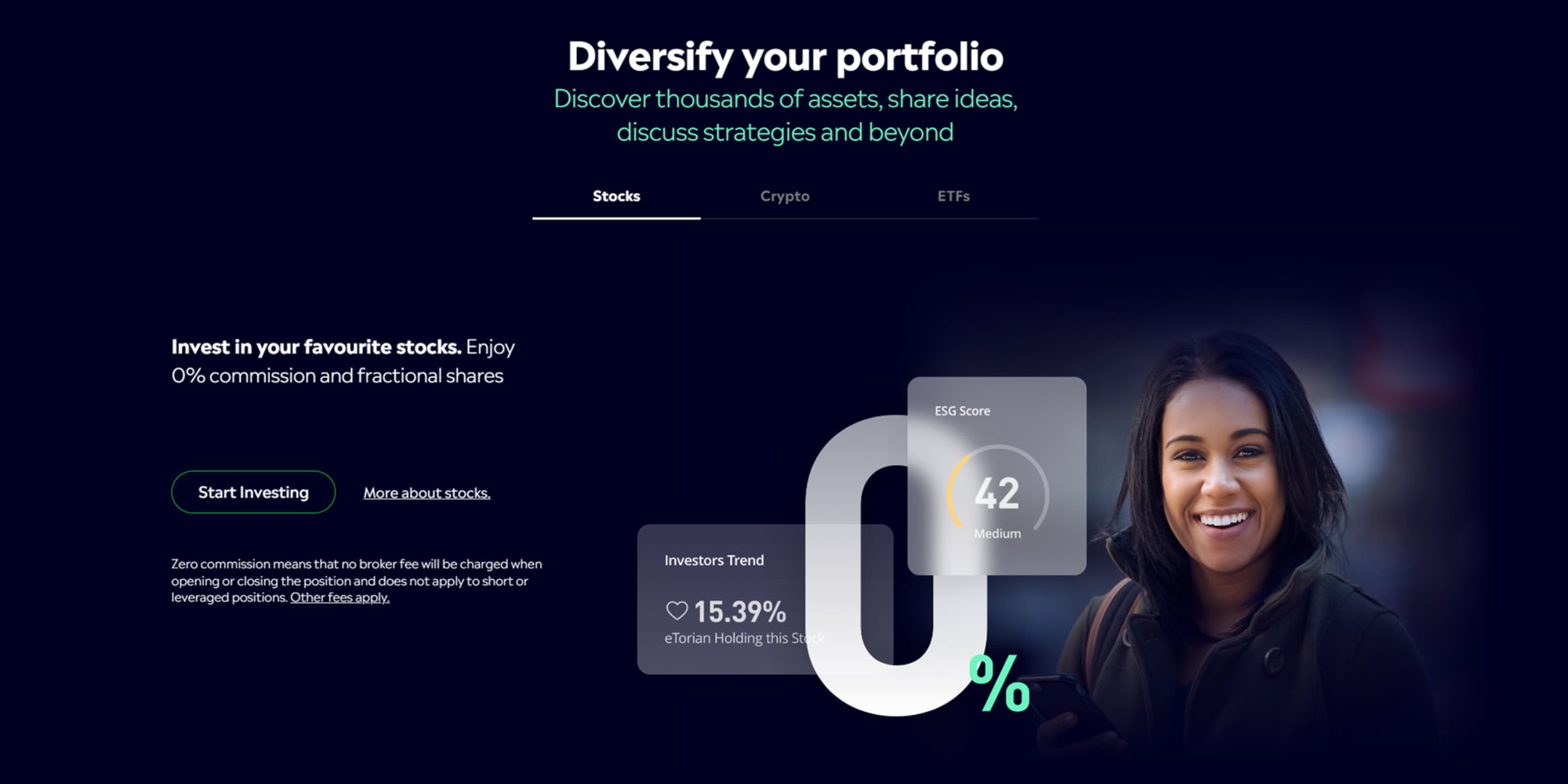

| eToro | Yes | Yes | Yes | Yes | Yes | No | Yes |

| FXTM | Yes | Yes | Yes | Yes | Yes | No | No |

| IG Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes | No | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Trading Platforms in the UK

Finding the best social trading platforms in the UK to recommend to our readers was a lengthy and overwhelming process. With so many options available, we compared and tested them, focusing on elements such as security, platform, demo account, support service, and more.

Take a look below at our detailed opinion and overview of the best social trading platforms in the UK.

1. eToro – Overall Best Social Trading Platform in the UK

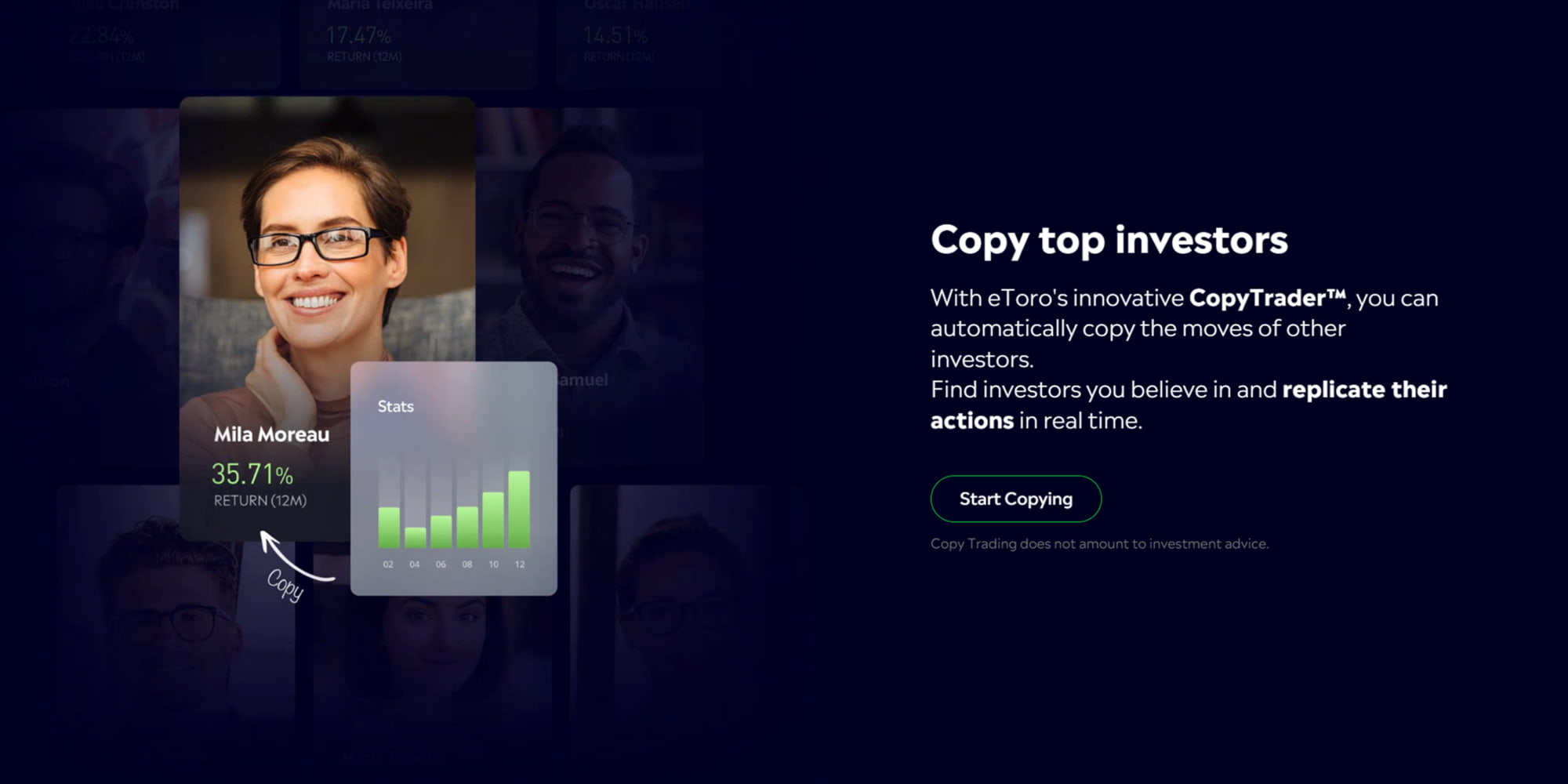

We explored eToro‘s social trading feature and must confess that it stands out among other platforms. The fact that eToro’s social trading platform enabled us to connect with millions of global users is a game changer. The platform creates a dynamic and collaborative environment where users can connect with a vast community of global traders. The seamless navigation is one of the primary reasons we recommend this platform to any user, particularly those who are new to trading.

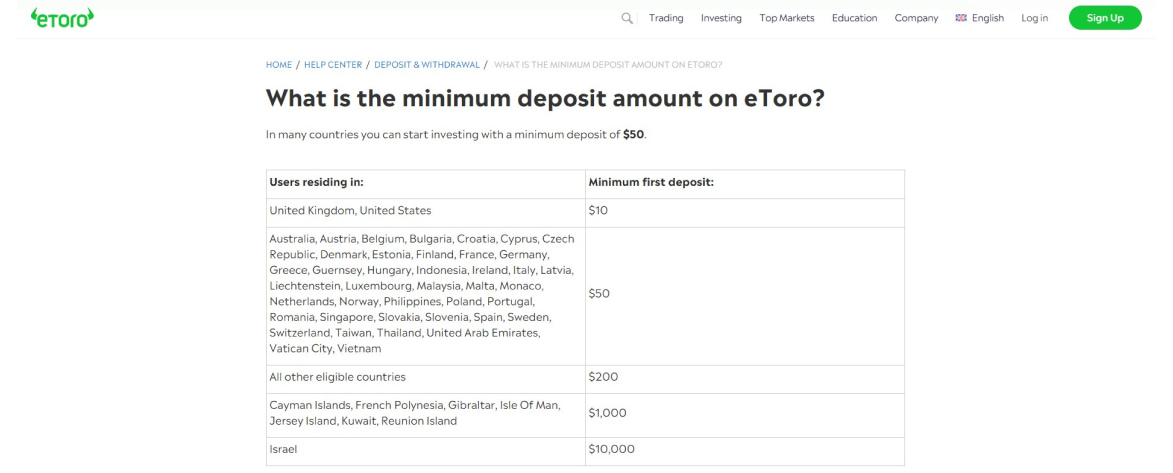

Unlike other UK platforms that feature social trading only, eToro takes social trading a step further by allowing users to automatically copy the trades of their chosen traders. We tried mirroring positions from other professional traders, and although we incorporated our strategies into the trades, we must admit that this feature is a must-try. Note that accessing the platform’s social trading requires a minimum deposit requirement of $50 only. However, copy trading requires that you reach a certain trading level as required by eToro, and you must deposit at least £200 to access and start copying professional traders.

- A user-friendly social trading platform with a modern design

- Extensive selection of learning resources on its eToro Academy platform

- Features a CopyTrader platform to complement its social trading feature

- Thousands of trading securities to choose from

- High trading fees compared to what other brokers charge

- Charges withdrawal fees

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

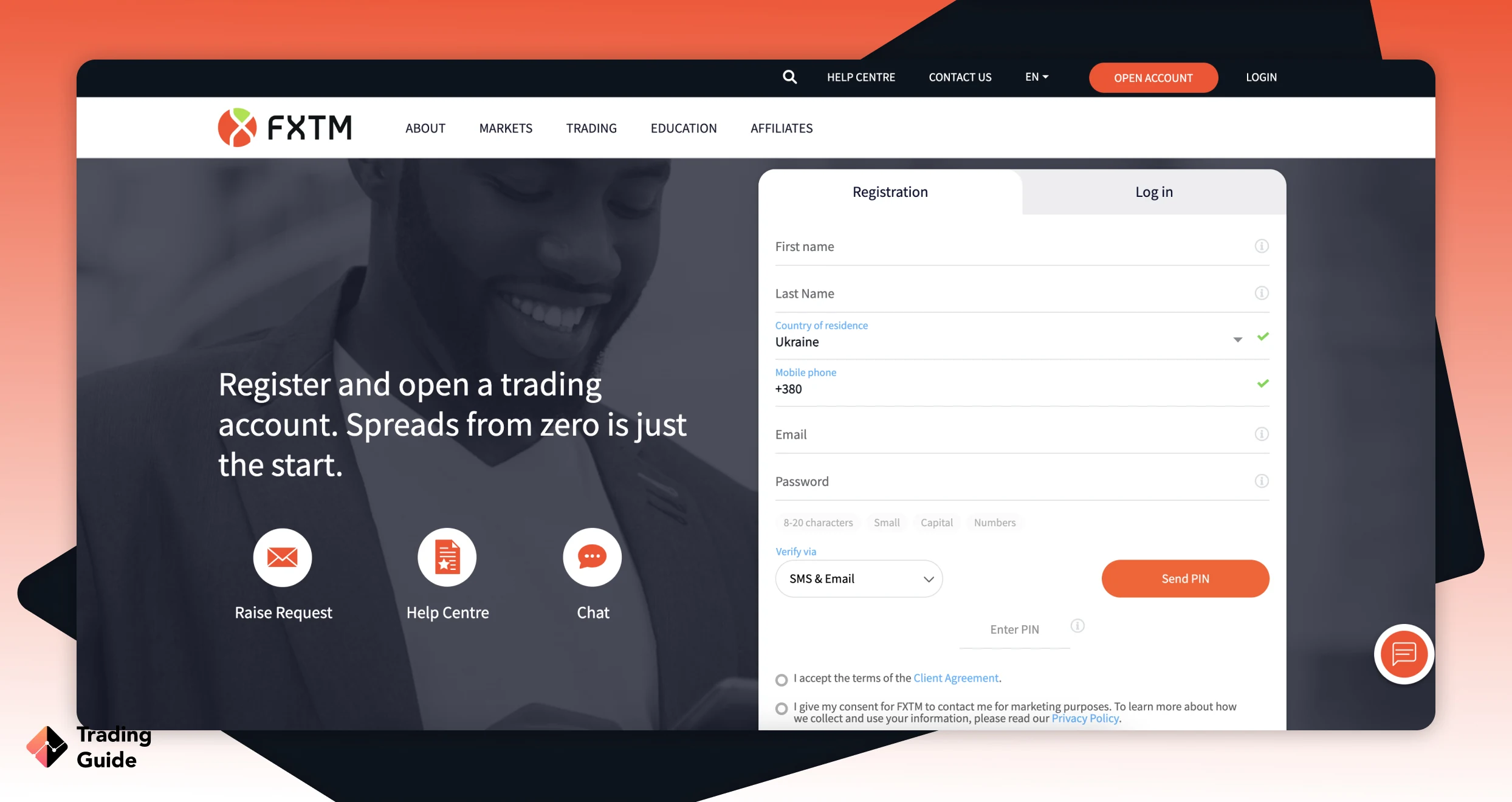

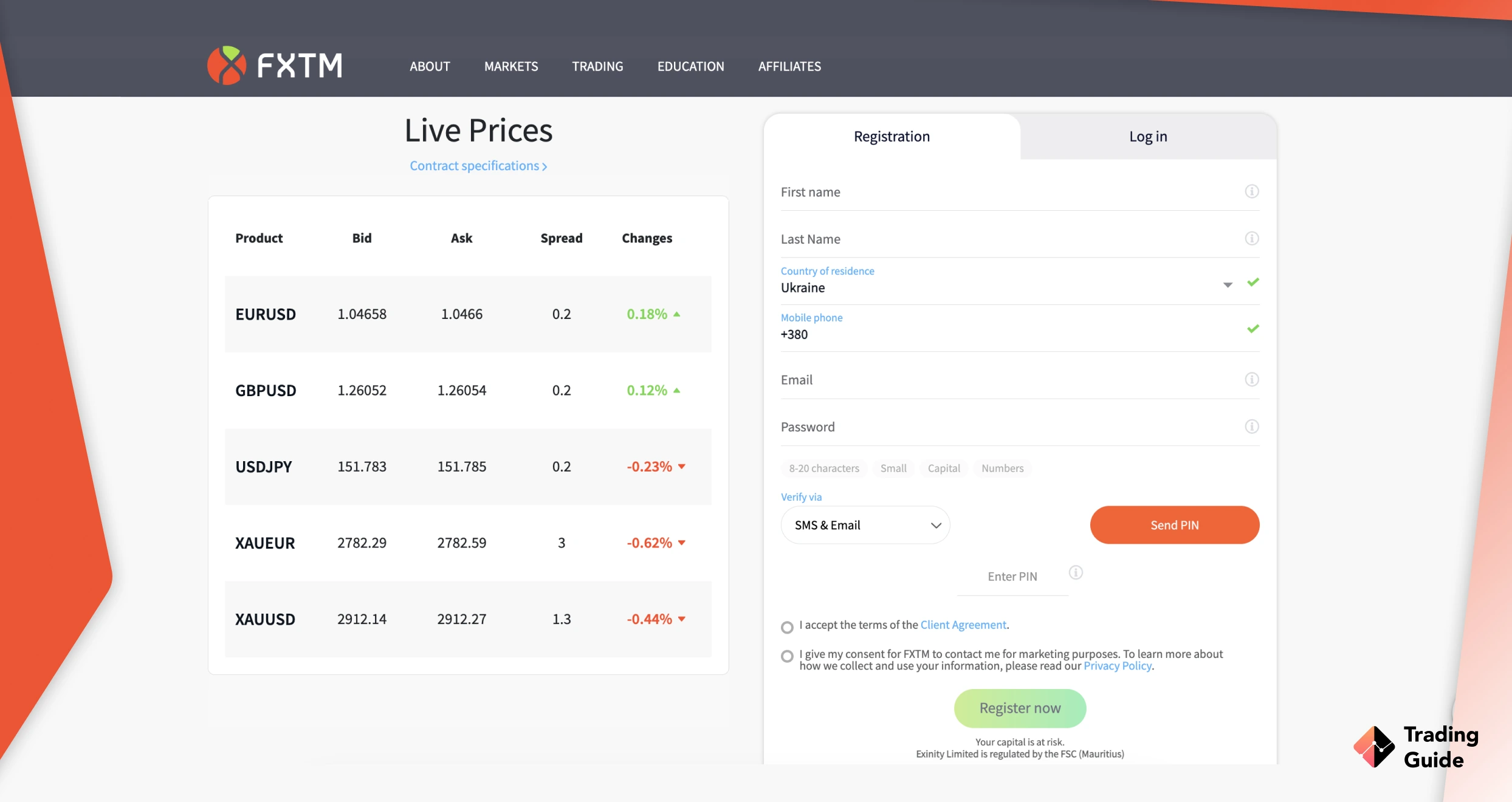

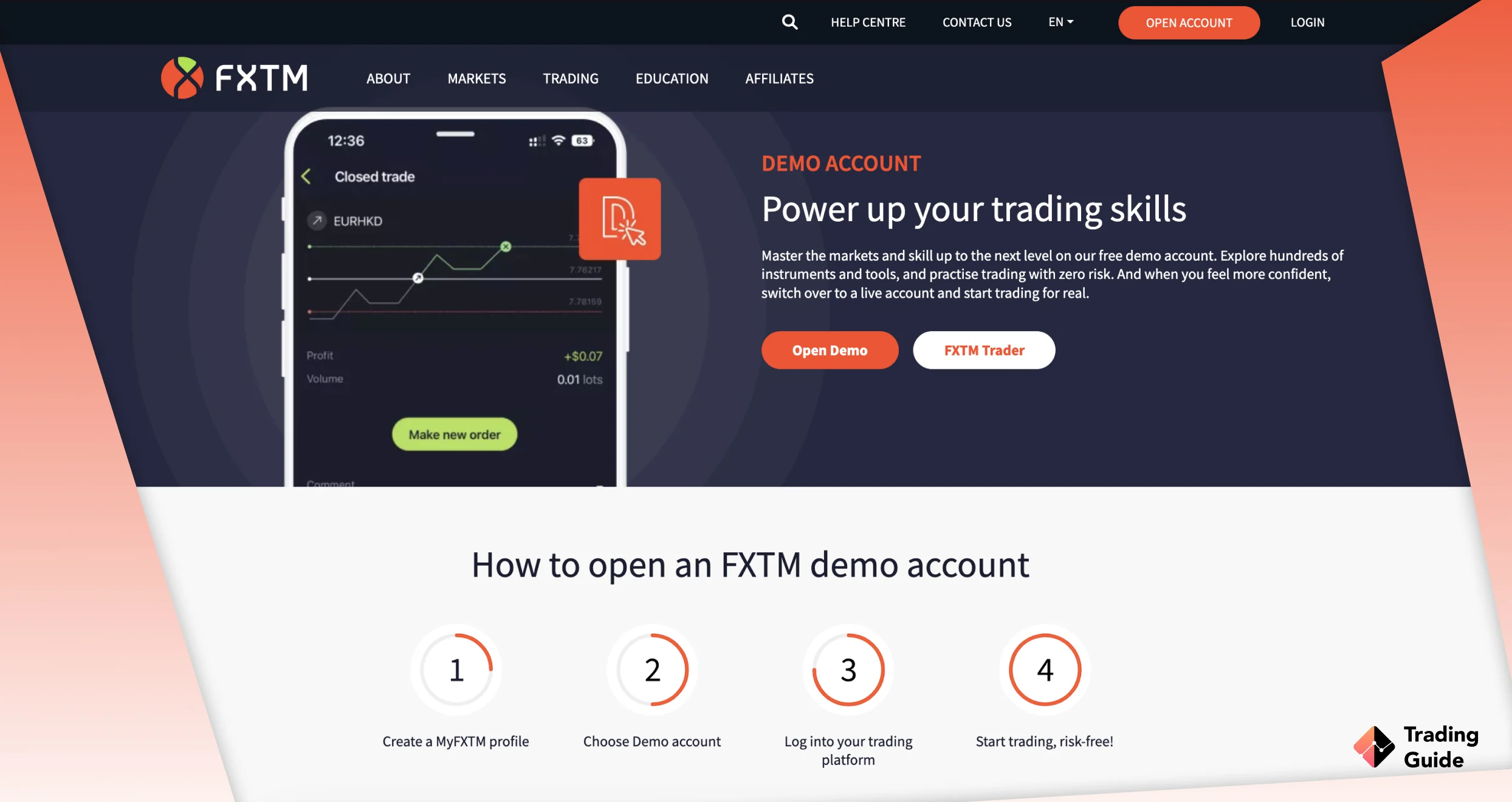

2. FXTM – Best Social Trading Platform With Low Minimum Deposit Requirement

FXTM is a reliable broker for UK traders, primarily because of its robust security measures and availability of excellent trading tools. While testing it, we like its FXTM Invest platform that connects global clients to socialise and follow professional ones. On this platform, you can also copy positions with increased potential and earn profits when the experts do. The best element about FXTM’s social trading platform is that it has a low minimum deposit requirement of £100, which is low compared to what most of its peers require.

FXTM also has a low minimum deposit requirement of £10 on its Web trading platform, with low spreads starting from 0.0 pips. In our opinion, we consider this broker perfect for low-budget traders. We also like this platform’s wide range of learning materials and availability of MT4 and MT5 platforms — an indication that it is ideal for any UK trader. That being said, we give FXTM a 4.8-star rating in this category.

- A wide range of securities to trade

- Low minimum deposit requirement for social trading

- Plenty of educational materials

- Very responsive customer support service

- Charges inactivity and withdrawal fees

- Customer support service is available on weekdays only

| Type | Fee |

| Minimum deposit | $200 |

| Overnight fee | $5 |

| Deposit fee | $0 |

| Withdrawal fee | $3 |

| Inactivity fee | Yes |

3. IG Markets – Best With Investment Options

IG Markets is one of the most reputable social trading platforms in the UK and other global regions. Having tested it, we were drawn to its advanced trading resources hosted on the MT4, L-2 Dealer, TradingView, and ProRealTime platforms. This guarantees an exciting experience, especially for those seeking advanced market analysis.

The broker has an IG Community platform, which connects global traders to engage in social trading. You can take advantage of it to learn trading tips that will maximise your potential. When it comes to investment options, IG Markets has an IG Invest app that allows you to buy over 13,000 stocks and ETFs. This investment service is commission-free when you buy US, UK, European, and Australian products.

IG Users get to choose a suitable account depending on their investment requirements. These include Share Dealing, SIPP, Flexible ISAs, and Smart Portfolios. Before committing real funds, feel free to explore IG Markets’ investment features via its demo account. And before you dive into live investing, note that this broker’s FX currency conversion fees recently increased from 0.5% to 0.7%.

67% of retail investor accounts lose money when trading spread bets and CFDs with this provider

- 15,000+ financial markets

- Traders can invest in commission-free stocks and ETFs

- Juicy interest of up to 4.5% AER for unused GBP balances

- No minimum deposit requirement

- Top-tier trading platforms like MT4 and TradingView

- An 18-monthly fee for dormant accounts

- Same-day bank transfers of less than £100 attract a £15 fee

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

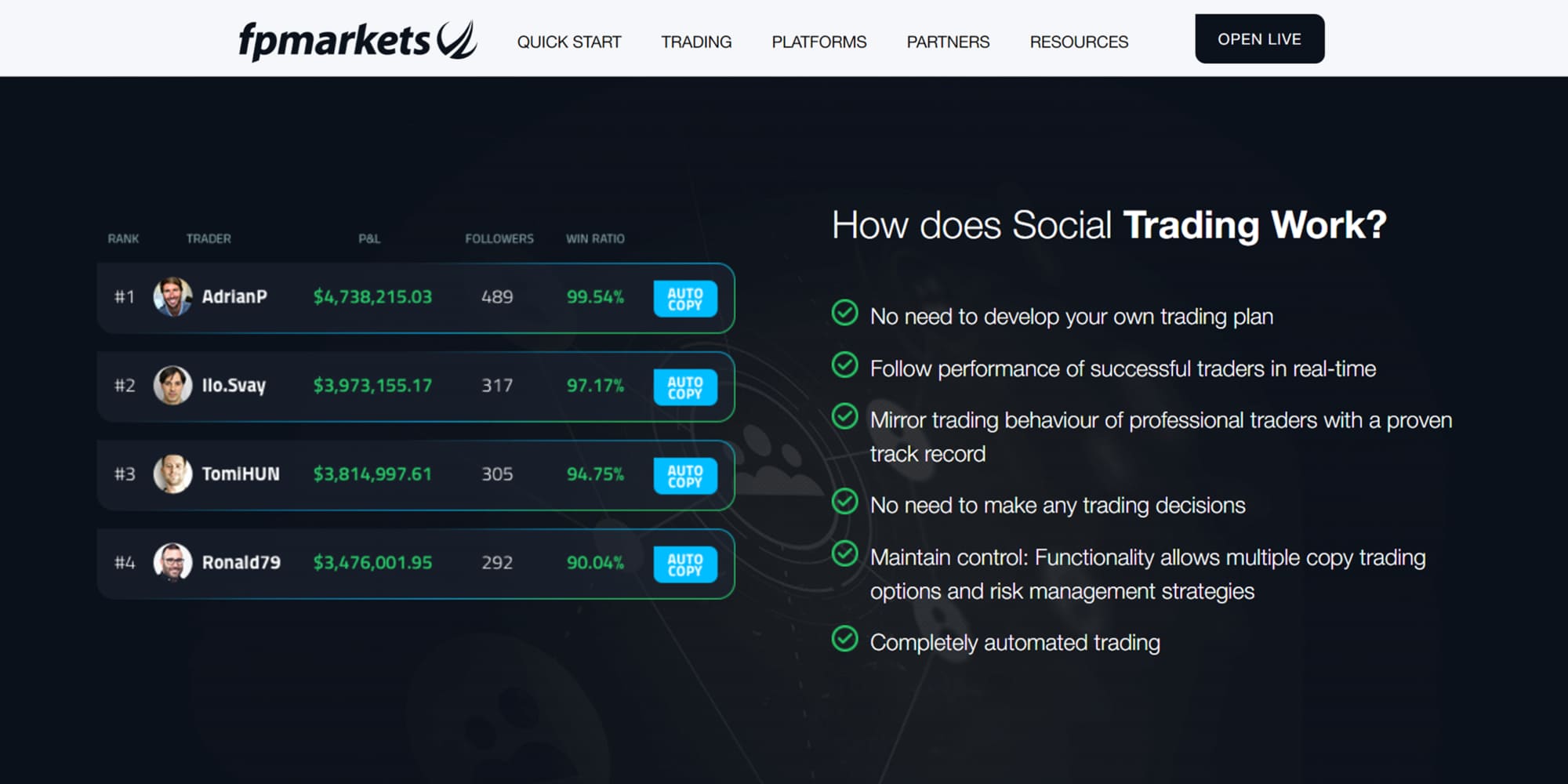

4. FP Markets – Best Social Trading Platform For Advanced UK Traders

We recommend FP Markets for advanced UK traders as it offers superior features and platforms. Note that social trading on FP Markets is accessible via the MT4 and MT5 platforms. While touring the social trading platform, we discovered an additional copy trading feature that comes with multiple modes. With no limit on the number of traders to socialise with, we had fun engaging other traders and sharing trading ideas with each other. You will definitely never get bored with FP Markets’ social trading platform.

To access this platform’s social trading feature, we were required to deposit a minimum amount of £100. We also noticed that FP Markets allows users to choose successful traders from a list of comprehensive rankings. Plus, it grants access to over 10,000 assets, expert advisors, and advanced resources. This is a clear indication that the social trading platform has a lot more to offer, and you should consider giving it a try.

- Low minimum deposit requirement

- Over 10,000 CFD assets to explore

- One of the best social trading platforms

- Low trading fees

- Beginners may find FP Markets’ social trading feature challenging to explore since it is provided on advanced platforms

- You can only trade CFD assets

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

5. Spreadex – Beginner-Friendly

If you are new to trading and would like to try social trading, Spreadex is a considerable choice. After exploring its features, I noticed that it is user-friendly and has a modern design to excite any new trader. Moreover, social trading is free even though you will access the feature via the TradingView platform. TradingView also hosts additional advanced resources that will guarantee seamless market analysis and skills development.

I discovered over 10,000 CFD and spread betting instruments at Spreadex, including shares, forex, commodities, indices, and more. The best part is that there is no minimum deposit requirement, and all transactions are free. Beginners are also guaranteed quality learning tools at its “Education Hub” platform. When it comes to support service, Spreadex has one of the most reliable teams. You can start trading at Spreadex with any amount you can afford, as the broker has no minimum deposit requirement.

- Lists thousands of CFD and spread betting instruments to explore

- No minimum deposit requirement

- Quality learning materials to boost beginners’ skills

- It offers social trading via the TradingView third-party platform

- No demo account

- There are no MetaTrader platforms, even though TradingView is an excellent substitute

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

What Do Other Traders Say?

When it comes to social trading platforms, the voice of experience holds immense value. Hearing what other traders have to say can provide valuable insights and help you make informed decisions. We took a tour of Google Play, the App Store, and Trustpilot and summarised below some of the top testimonials we encountered.

eToro

We sampled over 2000 user reviews regarding eToro’s social trading platform, and we must admit that the platform is loved by many. For instance, many users find the broker’s social trading platform to be user-friendly and intuitive. Its chat group is also easy to access, whether using a desktop or mobile device. We also discovered that the majority of users are impressed with the broker’s professionalism when it comes to handling arising issues.

Check below some of the ratings we gathered from these platforms:

-

“eToro’s social trading platform is a game-changer! I love how easy it is to connect with other traders and learn from their strategies. The interface is intuitive, and the chat groups are a great way to exchange ideas. I’ve had a fantastic experience so far!” – JohnDoe85 (5-star review)

-

“I’ve tried several trading platforms, but eToro’s social trading feature stands out. It’s incredibly user-friendly, and I’ve learned so much from experienced traders. The customer support team is also top-notch, addressing my concerns promptly. Highly recommended!” – TradingPro2023 (5-star review)

-

“eToro’s social trading platform has revolutionized the way I trade. The ability to copy trades from successful traders has been a game-changer for me. The platform is easy to navigate, and the community is supportive. I couldn’t be happier with my experience!” – Trader1234 (4-star review)

FP Markets

We were very impressed with how users rated FP Markets on Google Play, the App Store and Trustpilot. Many reviews regarding the broker’s social trading platform were positive, from its user-friendly and intuitive platform to the availability of social trading on advanced platforms like MT4 and MT5.

Some of the user comments regarding this platform’s social trading feature include:

-

“FP Markets’ social trading app is excellent. It’s easy to use, and I can connect with other traders effortlessly. The platform’s integration with MT4 and MT5 is a big plus. I’ve had a great experience so far!” – ForexPro456 (4-star review)

-

“I’ve been using FP Markets for social trading, and I’m highly impressed. The app is intuitive, and the availability of social trading on MT4 and MT5 sets it apart. The platform’s performance and features have exceeded my expectations.” – TradeSavage21 (4-star review)

-

“FP Markets’ social trading platform is exceptional. It’s user-friendly, and the availability of social trading on MT4 and MT5 is a huge advantage. The customer service is excellent, and I’ve had a positive experience overall. Highly recommended!” – TraderXpress2021 (5-star review)

The Ultimate Guide About Social Trading

Now that you are familiar with the best social trading platforms in the UK, we hope that you can now make the best choice and start enjoying the social trading feature. Before we let you go, it is important to understand everything about social trading from choosing the best social trading platform to starting the activity using your broker. Let’s take a tour in the below sections to ensure you are fully prepared.

How to Start Social Trading

Starting social trading is pretty easy when you have the best platform in your corner. However, ensure you start by learning what social trading is and how it works. Fortunately, many social trading platforms in the UK, including the ones we recommend, offer extensive learning resources you should take advantage of. You should also learn more about the markets you plan to trade so you can easily plan and strategize for increased potential. Most importantly, find the best platform suitable for your needs. We take you through how to select one in the section below.

How to Choose the Right Social Trading Platform

While our guide recommends some of the top social trading platforms in the UK above, we understand that you might consider conducting research for other options. Whether you are looking for a platform with a wide variety of traders to follow, or one with a user-friendly interface, taking the time to research and evaluate different platforms can help ensure that you find the best fit for your investment goals.

Below, we explore some of the key factors to consider when choosing a social trading platform in the UK. This is so you can save time and quickly kickstart your trading ventures.

Make sure the platform you select is licensed and regulated by the Financial Conduct Authority (FCA). This can help ensure that your funds are secure and that the platform operates in a transparent and trustworthy manner.

Consider the platform’s trading features, such as its user interface, charting tools, and technical indicators. Most importantly, ensure it features the assets you want to trade, whether forex, shares, cryptos, and more, for maximum experience.

Be aware of the charges associated with a social trading platform, including trading fees, transaction fees, inactivity costs, and more. Look for a platform that offers competitive fees that are transparent, easy to understand, and fit your budget.

Some social trading platforms offer demo accounts, which allow you to practice trading strategies and test the platform’s features without risking real money. Consider a platform offering a demo account if you’re new to social trading or want to try different strategies before committing using real funds.

Look for a platform that offers robust customer support, including phone, email, and live chat options. This can be especially important if you encounter technical issues or have questions about the platform’s features.

Finally, read user comments and reviews about a social trading platform to understand other traders’ experiences. Look for patterns in the feedback, such as consistent complaints about slow customer support or technical issues with the platform.

What is Social Trading, and How Does it Work?

Social trading is a dynamic and empowering approach that allows investors to connect and engage with fellow traders on a dedicated platform. It provides a wealth of information, enabling individuals to make informed trading decisions by following and interacting with other traders. By observing market trends and gauging sentiment through the actions of fellow traders, users can adjust their strategies accordingly.

Social trading also helps mitigate emotional biases and impulsive decisions by fostering a supportive and collaborative environment. It’s important to note that while some platforms offer free access, others may have fees for premium features like advanced tools or trade copying, which can enhance the trading experience.

Is Social Trading Beneficial?

Many investors believe that social trading can be highly beneficial for several reasons. Firstly, the activity allows novice traders to learn from experienced professionals by observing their strategies and investment decisions. This educational aspect helps beginners to gain valuable insights and develop their own trading skills.

Additionally, social trading platforms often provide a community-driven environment where traders can interact, share ideas, and discuss market trends. This collaborative approach fosters a sense of companionship and collective learning, thus helping you make informed decisions and choose traders whose strategies align with your investment goals.

Note that social trading can also increase your chances of profitable trades. By interacting with successful traders, individuals can save time needed for extensive research and analysis

5 Quick Steps To Start Social Trading with eToro

If you’re interested in social trading and want to create a social trading account, you will be glad to know that the process is relatively straightforward. Below, we will guide you through the five key steps in setting up a social trading account, using eToro as an example.

The first step to starting social trading is to sign up for an account on your chosen platform. For eToro, visit its website* and click the “Join Now” button. From there, you will be asked to provide your personal information, such as your name, email address, and phone number. You will also need to create a username and password for your account.

*{etoroCFDrisk}% of retail CFD accounts lose money.

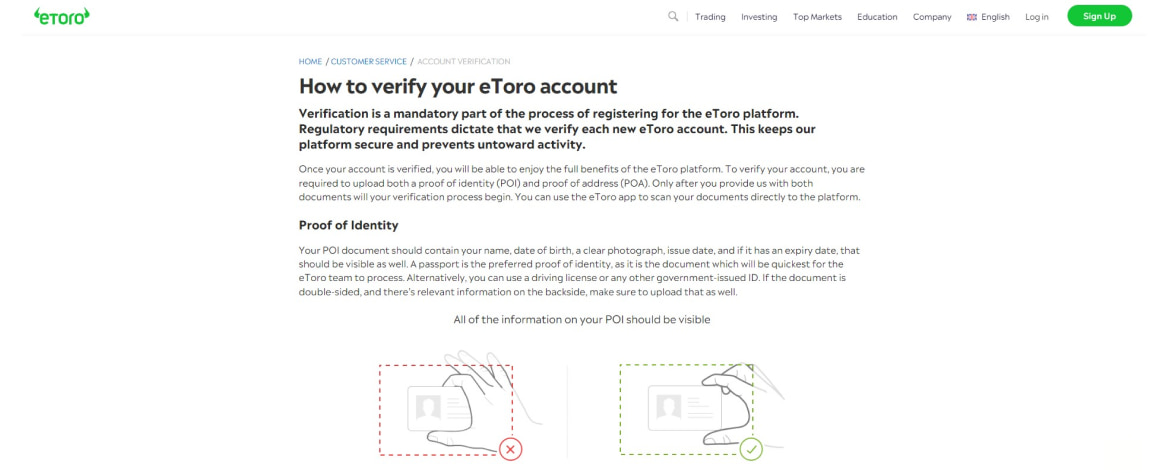

After signing up for an account, the next step is to verify your identity. This is a requirement for most social trading platforms in the UK to comply with anti-money laundering regulations. To verify your identity on eToro, the broker will request you to share a copy of your government-issued ID, such as your passport or driver’s license. You must also verify your location by sharing a copy of a recent utility bill or bank statement.

Once your identity has been verified, you can fund your social trading account. Most platforms accept a variety of payment methods, such as credit cards, bank transfers, and e-wallets. On eToro, you can fund your account with as little as $100.

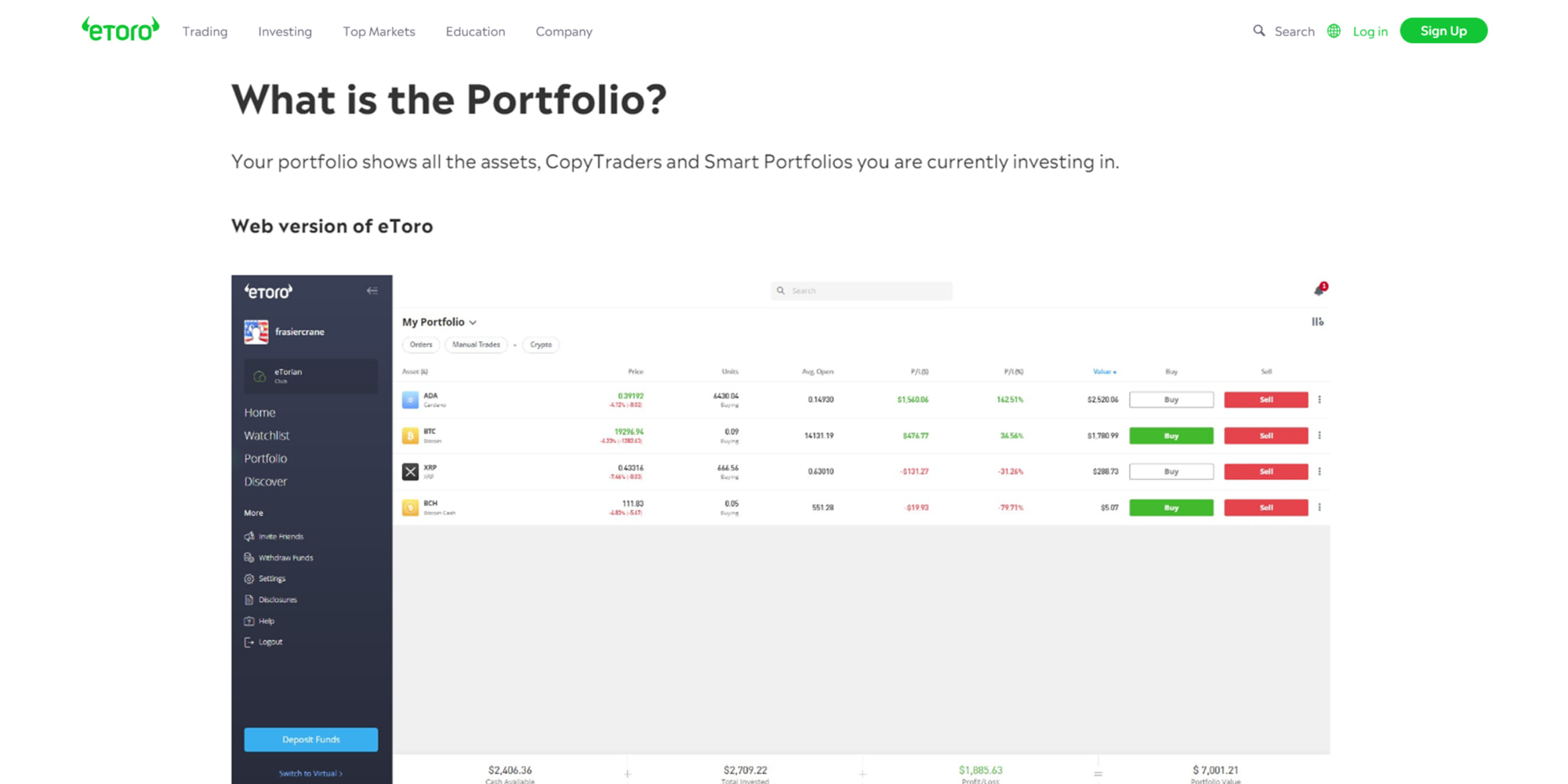

With your account funded, you can start exploring eToro’s social trading platform by joining its chat group and connecting with global traders for interaction. Note that the social trading feature on eToro is free, but you will deposit at least £200 if you want to explore its copy trading feature.

After opening a position, monitoring your portfolio regularly and adjusting your strategy as needed is important. Keep an eye on the performance of the trades and adjust your risk levels and portfolio allocation accordingly. Remember, social trading is not a sure-fire way to successful trades. Simply use the ideas you get from other traders to build a solid strategy for maximum potential.

Pros and Cons of Social Trading

While social trading can be a useful tool for gaining insights and improving your trading performance, it’s crucial to also understand where it falls short. Here are the pros and cons of social trading.

- Access to a wealth of information and trading ideas

- Opportunity to learn from experienced traders

- Can reduce emotional trading decisions

- Can provide a sense of community among traders

- Can be a useful tool for novice traders

- Potential for blindly following others without understanding their strategies

- May lead to over-reliance on other traders’ ideas and strategies

FAQs

Yes. Social trading is legal in the UK. However, social trading platforms and traders must adhere to regulations set by the Financial Conduct Authority (FCA) to ensure compliance with anti-money laundering laws and investor protection.

There are several reputable social trading platforms available, and the best one will depend on your specific needs and preferences. We list above some popular social trading platforms to choose from. All you have to do is compare them based on factors such as user reviews, platform security, ease of use, available trading tools, and the selection of traders to follow for a suitable choice.

Social trading platforms can be beneficial for novice traders who are new to the financial markets. The platforms provide an opportunity to learn from professionals and gain insights into successful trading strategies. Busy individuals who may not have the time to perform in-depth market research and analysis can also use social trading platforms to automatically replicate the trades of selected traders.

There are no restrictions on the assets to trade on social trading platforms. The specific selection of instruments will depend on the platform and the brokers they are partnered with. Some of the securities available to trade include stocks, currencies, commodities, indices, cryptocurrencies, and more.

Conclusion

Social trading platforms provide a unique opportunity for traders to learn from each other, share ideas, and potentially earn profits. Our list of the best social trading platforms in the UK above offers a variety of options to choose from, each with its own unique features and benefits. By considering factors such as licenses and security, trading platform, fees, customer support, and user comments, you can decide which platform is best for you. So, take advantage of the benefits of social trading and start exploring these platforms today.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

The engaging guide to social trading really caught my attention. It explained in a simple and clear way how to choose the best platforms, thoroughly researched by experts. The reviews from other traders boosted my confidence, especially the positive ones about eToro. Can't wait to start social trading!

This is an excellent guide for those who already have experience in trading but are new to social trading. I've been trading for two years, and the article provided me with everything I wanted to know about social trading. Now I understand how to choose the right platform, set up an account, and start interacting with fellow traders. The explanations about licensing, security, and the option of using a demo account were especially helpful. Thanks for the clear and straightforward recommendations!

Social trading is definitely a game changer, especially for beginners. I’ve tried eToro before, and the CopyTrader feature is solid, but the fees can add up