Many investors are putting up their money in stock investments. This has brought the need for the best online stock brokers in the UK. If you have been learning how the stock market works, you probably know that investing with the best stockbroker will maximise your trading experience and increase your chances of success. But, how do you identify the best broker among hundreds of options out there?

As professionals with years of experience, we are not only going to recommend the best stock brokers in the UK. We will also state ways in which you can identify them and how to perform a UK stockbroker comparison. This is so that you can be well-equipped with enough information when going about your trading ventures.

Essence

- The best stock broker should offer a diverse range of trading instruments and access to different markets, enabling a broad spectrum of investment opportunities.

- Ensure your chosen stockbroker aligns with your trading preferences, offering trading tools, charts, and functionalities that match your trading style and goals for a satisfying trading experience.

- Prioritise platforms regulated by respected financial authorities to ensure compliance, security, and transparent trading operations.

- The best stock trading platforms should be integrated with mobile apps, allowing traders to execute trades, track portfolios, and access crucial market data conveniently from anywhere.

- Acknowledge the inherent risks in stock trading and undertake thorough research to comprehend the potential rewards and pitfalls before engaging in trading activities.

- Employ fundamental strategies suitable for novice investors to manage risk, such as dollar-cost averaging or diversification, as foundational approaches to stock trading.

List of the Best Stock Brokers

- eToro – Best for Beginners Stock Traders

- FxPro – Leading Provider for MT5 Users

- IG – Best for Long-Term Investors

- Plus500 – One of the Best* for CFD** Stock Trading

- Pepperstone – Top Option For Spread Betting

- Spreadex – Best With AIM Stocks

*Investment Trends 2022

**76% of CFD retail accounts lose money

How We Choose Stock Brokers

Choosing the right stock broker is a critical decision for any investor, and at TradingGuide, we understand the importance of thorough research to make informed recommendations. Our methodology for selecting the best stock brokers in the UK is comprehensive and rigorous.

During our research process, we dedicate countless hours to testing as many stock brokers as possible. This hands-on approach allows us to gain firsthand trading experience with each platform’s features and functionality. We make use of brokers’ demo accounts to further evaluate their performance in a risk-free environment.

But our assessment doesn’t stop there. We also sample user testimonials on reputable platforms such as Google Play, the App Store, and Trustpilot. By analysing real user experiences, we gain valuable insights into each broker’s strengths and weaknesses.

Despite the time-consuming nature of our research process, we believe it’s essential to leave no stone unturned. We aim to recommend only those brokers that meet our stringent criteria for reliability, performance, and customer satisfaction.

Furthermore, our team of researchers continuously monitors the UK stock market to provide you with the latest insights and analysis. So, trust TradingGuide to provide you with the best recommendations and investment guidance in the market.

Compare The Best Stock Brokers in the UK

You need the best stock broker in the UK to effectively trade or invest in various company stocks. Sadly, there are plenty of options to choose from, thus making it challenging for investors to identify the best for their needs. In this regard, our professional researchers took it upon themselves to conduct UK stock broker comparisons and tests so you can have the best options to choose from. The following are the factors that we based our UK brokers’ comparison on.

Note that our recommendations below are not only based on UK broker comparison and tests. To ensure we have unbiased recommendations, we combined our findings from the broker comparison UK process with user reviews on Google Play, Trustpilot, and the App Store. Here are the stock trading brokers based on these two processes.

| Stock Brokers | Licence | Minimum Deposit | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|---|

| eToro | FCA, MAS, CySEC, FSCA, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | £50 | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| FxPro | FCA, FSCA, SCB | £100 | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes |

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | £0 | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes |

| Plus500 | FCA, CySEC, ASIC, MAS, FSA | £100 | 24/7 | Plus500 Webtrader | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes |

| Pepperstone | CIRO, FCA, CFTC, CySEC, FSA, MAS, ASIC | £0 | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView, cTrader | Credit/debit cards, PayPal, Skrill, Neteller, POLI | Yes |

| Spreadex | FCA, SEBI | £0 | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No |

Brief Overview of Our Recommended Stock Brokers’ Fees and Assets

Navigating the world of stock trading necessitates the right broker aligning with your investment goals. Our tables below show the essential details on fees and assets across our recommended stock brokerage platforms in 2026. Compare and analyse these insights to make informed decisions tailored to your stock trading strategies and financial aspirations.

Fees

| Stock Brokers | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| eToro | 2 pips | £50 | £5 withdrawal | £10 monthly |

| FxPro | From 0.0 pips | £100 | Free | £15 one-off maintenance fee |

| IG Markets | From 0.1 points | £0 | Free | £18 monthly |

| Plus500 | From 0.0 pips | £100 | Free | £10 monthly |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

Assets

| Stock Brokers | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| eToro | Yes | Yes | Yes | Yes | No |

| FxPro | Yes | Yes | Yes | No | No |

| IG Markets | Yes | Yes | Yes | Yes | Yes |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

1. eToro – Best for Beginner Stock Traders

eToro stands out as a top trading platform for beginners due to its easy-to-use features. Besides having streamlined desktop and mobile trading platforms, We like that it is customisable, and newbies can use it long-term even after advancing their skills. When it comes to stock investing, we discovered over 4,500 stocks from 20+ exchanges to explore. These include popular companies like Tesla, Netflix, Microsoft, and more. And the best part is that fractional share investing is supported at eToro. This allows you to explore any shares with amounts you can afford.

eToro has a fast trade execution speed, and its learning materials are impressive. Another factor setting eToro above other stock brokers we tested is the copy and social trading features. It allows you to interact and socialise with other traders in a chatting group. With this advantage, it will be easier for you to learn and improve your trading skills quickly. The copy trading feature entails the CopyTrader and CopyPortfolios tools, allowing you to copy trades from the most experienced traders on the platform. With a low minimum deposit requirement of $100 and no deposit fees, eToro is worth exploring. However, ensure you test it first via its £100,000 virtually funded demo account before making a commitment.

- Advanced trading platform with an attractive user interface design

- Social trading features to copy and interact with experts

- Licensed and regulated by various top-tier authorities, such as the FCA and the ASIC

- Commission-free stock investing

- Over 4,500 shares to explore

- No third-party platforms like the MT4/5

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

2. FxPro – Leading Provider for MT5 Users

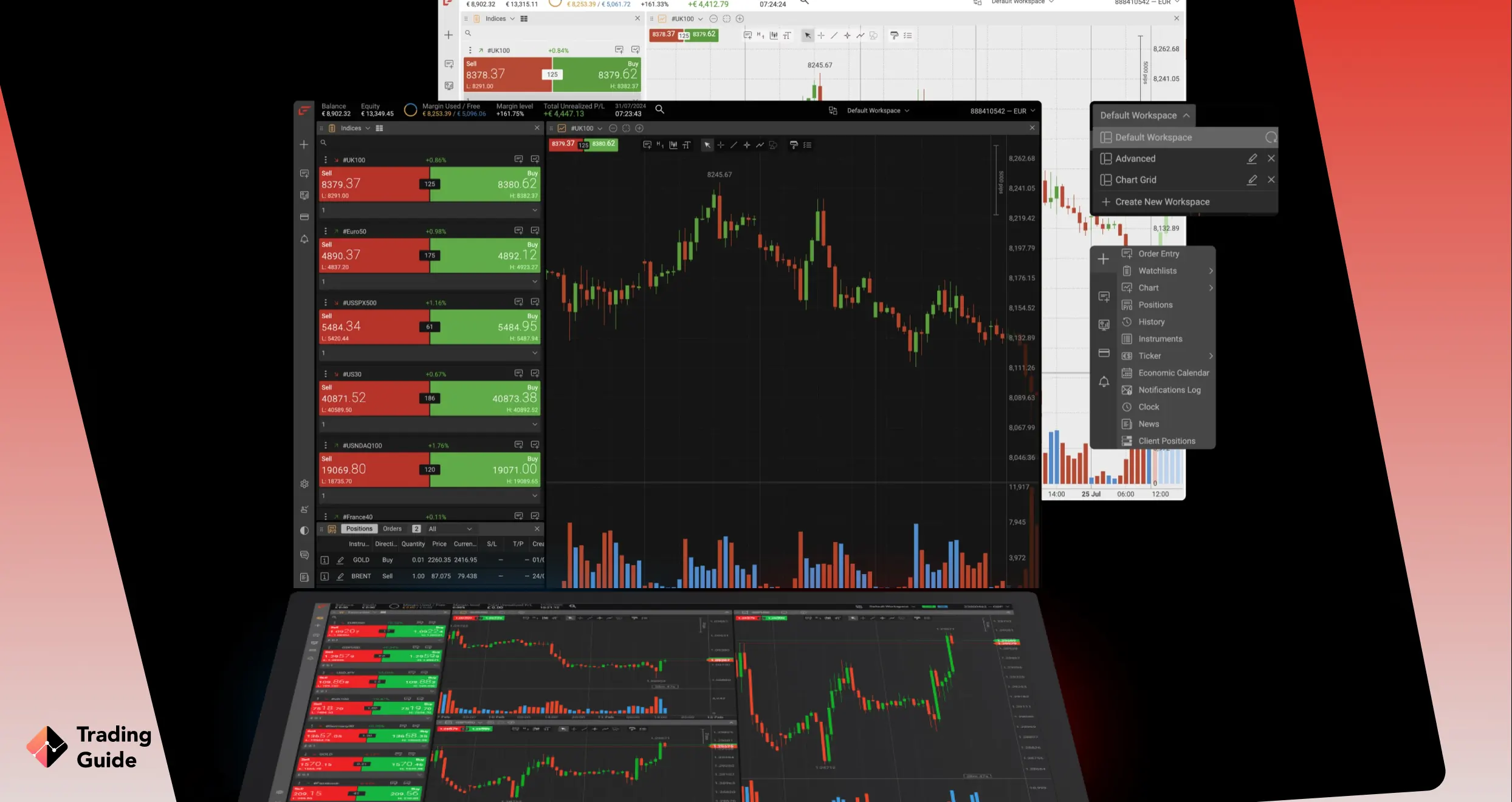

Our experience with FxPro was exceptional. No wonder it has earned a strong reputation among UK traders who prefer the precision and versatility of MT5. The platform combines advanced charting, multi-asset access, and algorithmic trading tools. For this reason, we believe it is an excellent choice for those who want to manage both short-term trades and longer-term stock positions.

With over 1,800 share CFDs from leading global exchanges, plus access to forex, indices, ETFs, metals, energies, and crypto, FxPro allows users to diversify easily across markets. Moreover, MT5 users can take advantage of Depth of Market, 6 pending order types, and 21 timeframes for detailed technical analysis. The integration of Trading Central tools adds a layer of professional insight, helping traders refine their entry and exit strategies.

Beyond trading tools, FxPro provides fast trade execution, no dealing desk intervention, and VPS hosting for uninterrupted automated trading. On top of that, users can trade on other supported platforms, including MT4, cTrader, and its proprietary FxPro WebTrader. You can get started with as little as £100, which comes with free transactions.

- Lists 1,800+ global share CFDs plus multiple asset classes

- Advanced MT5 features with Trading Central integration

- Fast, reliable trade execution

- Supports automated and EA trading

- Low minimum deposit requirement for UK clients

- No built-in social trading

- No buying and taking ownership of the available shares

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

3. IG – Best for Long-Term Investors

For anyone in the UK looking to invest for the long haul, IG stands out as a compelling option. It offers extensive access to global markets, including more than 15,000 shares and ETFs, allowing investors to build diversified portfolios across various regions and sectors. Using share dealing, you can set up a Stocks and Shares ISA or a SIPP account for retirement-focused investing, which helps keep returns tax-efficient.

Additionally, IG has Smart Portfolios that allow clients to invest in its fully managed low-cost portfolios. The platform is friendly and doesn’t require a minimum deposit to get started. We also like its commission-free trading on shares and ETFs held in the UK’s GBP GIA, ISA or SIPP. This, together with free transactions, makes it easier to grow a portfolio without worrying about trading costs.

In addition to shares and ETFs, IG lists over 15,000 CFD and spread betting securities for portfolio diversification. Another impressive feature is its strong infrastructure behind its services. We discovered reliable web and mobile platforms, connections to established tools like MT4, ProRealTime, and L2 Dealer, and opportunities for higher returns through its 4% interest rate on cash balances.

67% of retail investor accounts lose money when trading CFDs with this provider.

- Access to 15,000+ global shares and ETFs for diversified portfolios

- Stocks and Shares ISA and SIPP support for tax-efficient long-term savings

- No minimum deposit requirement for UK clients

- Commission-free share/ETF trading in GBP accounts

- Multiple trading accounts to choose from

- Interest earned on idle cash balances

- There’s currently no access to MT5 and cTrader platforms for UK clients

- High CFD trading fees compared to some of its peers

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

4. Plus500 – One of the Best for CFD Stock Trading

*Illustrative prices

After testing and comparing hundreds of stock brokers, we find Plus500 to be one of the top choices for CFD stock trading. You can explore stock CFD on its trading platform at a low cost, making it a go-to broker for investors with a low budget. Although it spreads, you will notice that the fee is also low compared to most UK stock brokers. Other costs we incurred at Plus500 include overnight funding, currency conversion fees, and guaranteed stop-order charges. When it comes to creating an account, you only need to deposit at least £100 to get started. Overall, non-trading and trading costs at Plus500 are low, and we also recommend it to low-budget sock traders.

While there are no third-party platforms at Plus500, we like the broker’s proprietary platform, which is supported on all devices. The platforms do not limit your trading activities, as there are unique resources for all types of stock traders. As experts, we like its “Professional Trading” platform with advanced resources and higher leverage limits. Newbies also have the demo account at their disposal, which we advise you to take advantage of and test the broker before considering creating a live trading account. Besides CFD stocks, Plus500 is home to additional CFD assets like forex, commodities, ETFs, and more.

- Zero commission on stock trades

- Wide range of more than 2,000 trading instruments

- Easy-to-use and customisable trading platform

- Supported on all devices

- Limited educational tools

- Charges inactivity fees only after three months

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. Spreadex – Best With AIM Stocks

Spreadex stands as the best online stock broker for AIM (Alternative Investment Market) stocks in the UK. From our experience, the broker is one of the most user-friendly and has a modern design. It is also customisable, making it a suitable option for stock investors looking for a broker for a long-term commitment. With a history dating back to 1999, Spreadex has garnered a reputation for providing seamless access to some of the top AIM-listed stocks, enabling traders to diversify their portfolios and explore emerging companies. We invested in a range of AIM stocks with a market capitalisation of £5m+.

Besides stocks, we noticed that this online broker lists additional securities. These include forex, commodities, ETFs, and more, which we believe you can utilise for your portfolio diversification. While stocks are available to share trade as CFDs and spread betting only, we like the fact that the broker charges low fees. Plus, Spreadex’s minimum deposit requirement is £0 and users get to transact free of charge. There is also a dedicated, reliable, and responsive support service at your disposal in case of any challenges.

- No minimum deposit requirement

- The broker offers an opportunity to explore small-cap stocks, including those in the AIM category with a market cap of £5m+

- Free transactions and no inactivity fee

- Thousands of shares to trade as CFDs and spread betting

- No buying and taking ownership of listed stocks

- No demo account

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

6. Pepperstone – Top Option For Spread Betting

Pepperstone is one of the most appealing choices for UK traders who want to spread bet on shares with tight pricing and a clean, reliable trading setup. If you focus on company movements or earnings-driven opportunities, Pepperstone gives you access to 1,100+ global shares, including 24-hour US share markets, so you can react to news as it breaks.

Alongside shares, traders can also spread bet across forex, indices, commodities and ETFs. Spreads are competitive, with gold from 0.07 points and major FX pairs from 0.6 points. All fees are built into the spread, which keeps the cost structure simple and transparent. Pepperstone backs this up with a 99.59% fill rate, no dealing desk intervention, and fast execution.

Besides spread betting, Pepperstone supports CFD trading across 2,700+ securities. There is no minimum deposit requirement, and all transactions are free. We also like that Pepperstone gives access to multiple trading platforms. Whether you prefer MT4 or MT5 for indicators and EAs, cTrader for depth-of-market analysis, or TradingView for chart-driven setups, all platforms integrate smoothly.

- Supports spread betting across shares and other securities

- No minimum deposit requirement for UK clients

- Commission-free spread betting with low spreads

- Broad platform range including MT4, MT5, cTrader and TradingView

- A user-friendly and modern design trading platform

- No physical purchases on listed securities

- No cryptocurrency trading for retail clients

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

What Do Other Traders Say?

Gaining insights from real traders is crucial when considering the right stockbroker. For this reason, we visited Google Play, the App Store and Trustpilot, and present below unfiltered user feedback for our recommended stock brokers in the UK. Feel free to compare these comments to identify a suitable broker for your needs.

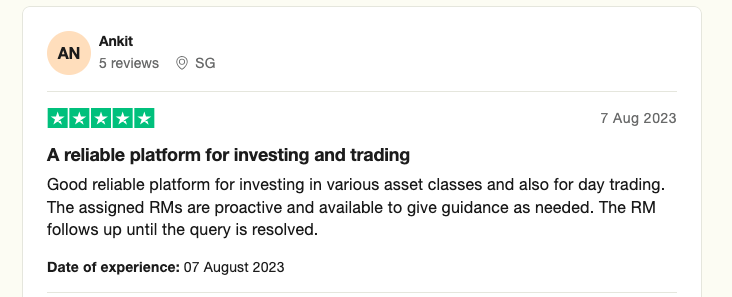

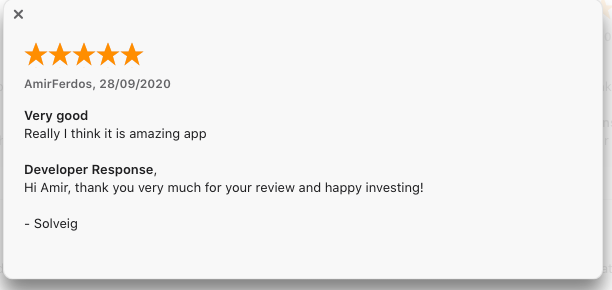

eToro

Users praise eToro for its user-friendly platform and unique social trading feature. The ability to copy successful traders and the diverse range of stocks available for trading received positive feedback.

-

“Good reliable platform for investing in various asset classes and also for day trading. The assigned RMs are proactive and available to give guidance as needed. The RM follows up until the query is resolved.” – Ankit

-

“Really I think it is amazing app” – AmirFerdos

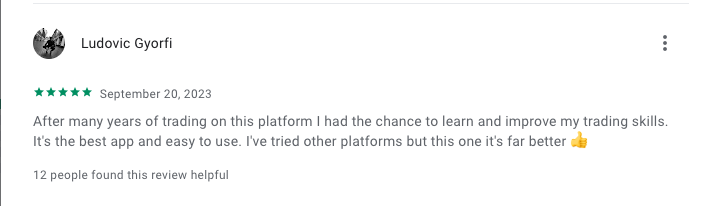

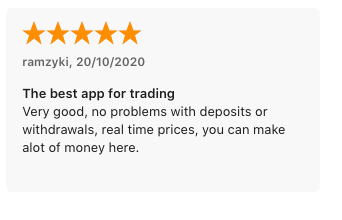

Plus500

Users commend Plus500 for its intuitive platform and availability of a wide range of stocks for trading. However, there are occasional remarks about customer service and educational resources.

-

“After many years of trading on this platform I had the chance to learn and improve my trading skills. It’s the best app and easy to use. I’ve tried other platforms but this one it’s far better ?” – Ludovic Gyorfi

-

“Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here.” – ramzyki

-

“What made me happy and relieved in my trading life with plus500 is the withdrawals they so quick it literally never took me more than 6 minutes it was approved. Well guys hope south Africa uses your great platform ??” – Sifiso Lucky Biyela

Spreadex

Spreadex stands out for its simplicity and ease of use in stock trading. Users mention the platform’s accessibility, yet some suggest improvements in expanding its stock offerings.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

-

“A very useful financial spread betting app that should cover all your needs. It’s definitely the most useable of the broker apps that I’ve tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. They’ve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far” – JakeReadman

How To Choose the Right StockBroker in the UK

There are many stock brokers in the UK, most of which are well reputable. Some of the brokers are well known for their wide variety of features—others for their offerings, and so on. We can’t say that one broker is better than the other because each of them is unique in its own way. So, it’s up to you to choose a broker that is compatible with your trading requirements.

Do not agonise about how to go about this because we’ve got you covered. Below, we have stated the significant factors you need to look out for when choosing the right stock broker.

The best stock broker must be safe to invest in. Ensure that they are licensed and regulated by the UK’s financial regulatory body, the Financial Conduct Authority (FCA). In case they are regulated by other top-tier jurisdictions, the better since it proves their credibility even more.

No investor wants to deal with complex trading platforms that will lag your trading activities. For this reason, the right broker for you should have an easy-to-use trading platform that has an intuitive design and is customisable. It should suit investors of all types by hosting quality trading tools and executing stock trades seamlessly on desktop and mobile devices.

This is one factor you should never turn a blind eye to. Check the charges of the stock broker you choose. Whereas some of them have high trading and non-trading charges, others do not. The charges may also come as fixed or variable, so make sure you are aware of the charges before making a commitment. Simply put, choose an online stock broker you can afford.

A good UK stock broker must have a plethora of trading instruments to choose from. This mostly applies to novice investors, where you have to try various offerings and see which one works best for you. You do not want to find a stock broker with limited financial instruments and get bored after a few trades.

Some stock brokers in the UK are still using the traditional payment methods of debit/credit card and bank transfers. Therefore, if you are not comfortable with the traditional payment methods, consider a broker with more advanced methods like Neteller or Skrill.

When looking for a stock broker, you always want to try it out and see if it aligns with your trading requirements. All brokers we recommend here have demo accounts, and this is a factor that you also need to consider. The reason we recommend such brokers is because many UK investors are afraid of running the risk of investing in a broker and realise that they aren’t suitable for them.

It’s not a good feeling to invest in a UK stock broker with poor customer support service. Who will attend to your inquiries when they arise? Therefore, when choosing a stock broker, try reaching out to its customer support and see how responsive they are. Are they available 24 hours a day? What communication channels are available? Choose according to what you prefer.

Read about the top crypto brokers UK in our other article.

Getting Started with an Online Stockbroker

At this point, we have equipped you with all the basic information you need to know about UK stock brokers, how to find the best one, as well as our handpicked list of the best UK stock brokers right now.

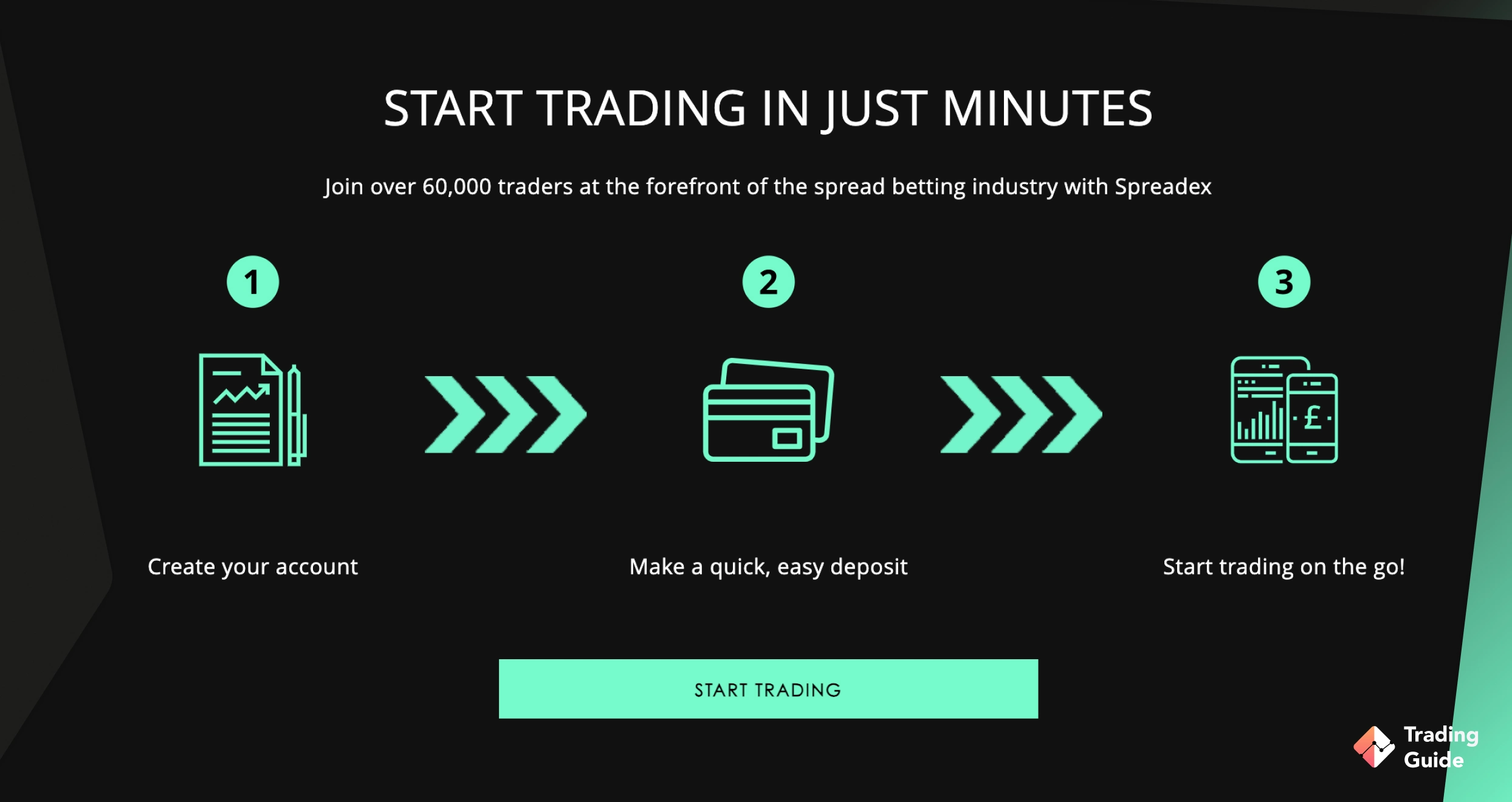

However, before you can start day trading and investing in stocks, you need to register a brokerage account. This is not a complicated process, but it has to be done correctly or your account will not be verified, and you will not be able to trade with the said broker. Follow these five steps to get started with your new UK stockbroker.

As discussed extensively in this guide, it is an art to find the best stock broker for your specific needs. That’s why we provide both recommendations of all the top brokers as well as instructions on how to find a stockbroker in the UK on your own.

Once you’re happy with the broker of your choice, you need to visit the broker to open your stock brokerage account. We suggest that you follow our links to the broker to ensure that you get directed directly to the registration process.

Using a process similar to that of social media platforms, banks, and other online services, your stock broker will now ask you to provide basic personal information. This information will serve as the foundation for your trading account and will have to be verified, so please ensure that it’s correct and accurate. They include your name, email, phone number, source of income, and more.

Details that you will be asked to share include full name, address, date of birth, and email address. However, brokers will also ask about your income and test your understanding of basic financial markets and leveraged trading. This is to protect you from unnecessary losses.

Once you’ve completed step 2 (above), you will gain access to a limited trading account that you can use to orient the broker and check out the markets and services. At this point, you will also be able to start using your demo account (if the broker provides one).

However, to gain full access to your account, you have to complete two more steps. The first is a verification process where you provide a copy of your ID (passport, driver’s licence, etc.) and a utility bill that’s no older than 3 months. This is needed to verify your identity and location, which will determine the trading laws that apply to you.

As soon as the broker has verified you (this can take between a couple and 48 hours), you only have to make an initial deposit to get started. All stock brokers in the UK set their own limits, so pick one that you feel comfortable with.

Today, minimum deposit levels range from £0 to well over £300, depending on the broker, your account type, and what you’re planning on trading.

And that is it. As you can see, it is quite easy to register an account with an online stockbroker in the UK. Unfortunately, due to brokers’ processing times, the process can feel time-consuming. Just remember to provide accurate information and have all the needed documents ready to make the process as smooth as possible.

What Do Stock Brokers Do?

Stock brokers are professionals who facilitate the buying and selling of stocks, bonds, and other securities on behalf of their clients via stock exchanges or over the counter. They provide a range of services to investors, including market research, financial planning, and investment advice at a fee. Brokers work with clients to help them develop a trading strategy tailored to their specific needs and goals. They may also offer educational resources and tools to help clients learn more about investing and how to make informed decisions.

Online stock trading UK brokers play a critical role in the financial markets by ensuring that transactions are executed efficiently and at a fair price. They act as intermediaries between buyers and sellers, facilitating transactions and ensuring that both parties receive a reasonable price for the securities being bought and sold. This is particularly important for large institutional investors, who rely on the best investment companies in the UK to help them navigate complex financial markets and execute large trades.

Where to Buy Stocks in the UK?

Buying stocks in the UK is easier than ever before, especially when using an online trading UK broker licensed and regulated by the FCA. Online stock brokers allow you to buy and sell stocks through a user-friendly trading platform. They also charge lower fees and commissions and offer access to various research and analysis tools. We list in our mini-reviews above some popular UK trading stock brokers. All you have to do is compare their features to select the best trading broker that fits your needs.

It’s also possible to buy stocks directly from a company, though this method is not common and is more complicated. Also known as a direct stock purchase plan (DSPP) or a dividend reinvestment plan (DRIP), it is mainly offered by large companies as a way to allow investors to purchase stock directly from them. Investors in the UK can also use traditional brokers to buy stocks. These are intermediaries between stock buyers and sellers that have been around before the advancement of technology. They mainly operate in physical locations.

FAQs

First, you need a UK stock broker that is licensed and regulated by the Financial Conduct Authority (FCA). Then, open a live trading account and make a deposit. The stock broker will then give you access to various stock markets to invest in.

To start trading, you need to analyze whether you think the value of a stock will increase or decrease within a certain period, and open a position that mirrors that prediction.

With that being said, asking yourself “how do I trade stocks” is a sign that you probably don’t know enough to actually start trading. Instead, you should spend the time needed to learn the basics of trading.

It is possible to invest in stocks without a broker and that applies to both publicly traded and private companies. Although, it can be challenging to contact a company on your own trying to buy stocks from them. Therefore, the only more straightforward way is through a reputable and reliable stock broker that will give you access to multiple stock markets.

Also, to speculate on stocks using CFDs or spread betting, you must use a broker. Since you never own the assets that you speculate on, the broker will provide you with everything you need to trade.

With the help of a reputable stock broker, beginners can easily buy stocks in the UK. Just make sure that before you begin to invest in stock trading, you have surveyed the market and know how many stocks you want to buy and from which company.

Please keep in mind that stock trading is complicated and associated with risk. That’s why we encourage you to practice as much as you possibly can before you start. For example, use a demo account to practice and make use of your broker’s educational material to master the necessary skills.

Yes. Trading stocks is a risky business that can be profitable if you apply the right strategies. Although, as much as the value of a share can increase, it can also drop tremendously, making you lose your investment capital.

There is no way to eradicate all risks in stock trading, but by mastering as many skills as possible, you can lower the risk.

Please note that up to 80% of retail traders lose money in the long run!

Trading online is the act of buying and selling financial securities, including stocks, currencies, commodities, cryptocurrencies and more, through online trading UK brokerage firms. With online brokers, investors can place trades in real-time, monitor their investments, and access various research and analysis tools to help inform their investment decisions.ᅠ

A broker is a general term that refers to an individual or firm that acts as an intermediary between buyers and sellers in financial transactions. On the other hand, a stock broker is a type of broker that allows investors to put their money on or trade individual company stocks. We list in our mini-reviews above examples of the best stock brokers in the UK.

The three different types of stock brokers are full-service brokers, discount brokers, and online brokers. Full-service brokers provide a range of services, including investment advice, financial planning, and asset management, but tend to have higher fees and commissions. Discount brokers offer lower fees and commissions but typically provide fewer services. Online brokers are similar to discount brokers but operate entirely online, offering a user-friendly broker trading platform and lower fees than traditional brokers.

Conclusion

By now, you must have a grasp of the best stock brokers in the UK and their offerings. Remember, the best stockbroker is the one that fits your trading requirements. Ultimately, they must also be regulated by tier-one financial authorities and their trading activities executed seamlessly. And to maximise your chances of success, conduct a thorough market analysis for the best stock selection. Also, apply risk management controls like stop-loss and take-profit orders. For beginners in the UK, invest a capital you are comfortable losing since the share market can be unpredictable, making losses inevitable.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Can I use another trading platform as a beginner? I’ve heard many positive feedbacks about Plus500, is it suitable for newbies?

Plus500 is an excellent trading platform for beginners. The most important factor for beginners is that the broker suits your budget and that you feel comfortable using it.

Please see our broker recommendations for beginners if you need more pointers and recommendations.

Which is the best UK stock broker for beginners?

I started with eToro, they have good support

I recommend

IG Markets!

Every stock trading platform is unique. TD Ameritrade - best overall, best for beginners. it's accessible for all types of customers. This platform is meant for self-directed trading (though they may offer educational tools and materials). It bears noting that trading profits are never guaranteed; for every potential reward there is an equal amount of risk.

An individual tends to look at investment opportunities when they have a certain amount of money that is going unutilized. It is always good to seek investment opportunities when after all the expenses; the individual is able to save a hefty amount of money in their savings accounts. Stocks market is more like a gambling zone where the ups and downs in the stock market tend to either give big profits or small returns altogether.

I have been attracted by the idea of trading and making money on my phone through stock trading. Some of the things I have seen are making me interested in trading. Some of them include:

Freedom of location and time: I like the idea of being able to trade from anywhere in the world if I am in a place with an internet connection. It means that I can continue with my day-to-day activities and still trade without pressure or fear of missing out on opportunities. The stock market also allows traders to trade at convenient times of the day. It is not like the regular 9 to 5 where one has to follow boring routines every day.

There is no need for a degree: before making money from the stock market, there is no need to get a degree. I don't have to go through a 4years learning process like the regular college pattern to make money off the stock market.

No profit limit: there is also no limit to the amount of profit made from the stock market. There are many stocks in the world, and brokers also give people the chance to use leverage. Leveraging allows one to trade with an amount he doesn't have to gain more money. I believe that stock trading is a quick way to gain money.

In stock market investing, practice beats theory. You should be familiar with your trading tools before you start investing in the stock market for your own account. Practice allows you to get used to the market you want to trade. In addition, there are plenty of demo accounts available with real-time lessons at your disposal. Do not hesitate to test them.

Wanna dive into trading? This guide spills the beans on picking the best broker in the UK – crucial for successful investments. It dishes out advice on what to focus on: safety, platform, fees. A straightforward guide to kickstart your journey. Honestly, useful stuff, especially for newbies. Give it a read and you won't regret it!

I was looking for information on how to choose the right broker. The article not only listed key selection factors like safety and fees but also provided a step-by-step guide to opening an account. Now I'm confident that I can start trading stocks with a reliable broker without any issues. Thanks for the useful information!

Solid overview, but always remember—no broker is perfect, and hidden fees can sneak up on you.

Picking the right broker is key. I’ve tried plenty in the UK, and the best ones keep it simple — fair fees, solid platforms, and no nasty surprises.