eToro is one of the world’s undisputed top-tier online brokers. With a focus on copy trading, CFDs, and even investment options, eToro offers trading services to everyone. Find out more about this global online broker in our complete eToro review.

- Buy and sell 20 cryptocurrencies 24/7

- Unique CryptoTrading feature

- Investment Options and Investment Portfolios

- Award-winning mobile platform

- High minimum account deposit for many

- Minimum amount to use copy trading is $500 per trade

- Hidden fees such as a $5 charge for withdrawals

eToro continues to stand tall among online brokers, renowned for its diverse offerings. Specialising in copy trading, CFDs, and an array of investment choices, it caters to a broad spectrum of traders. As a global platform, eToro’s appeal lies in accessibility, empowering users with seamless trading experiences.

As professional traders and researchers, we have prepared this comprehensive eToro review to shed light on its features. Our goal is to ensure you fully understand why it remains a preferred choice for both novice and seasoned traders worldwide.

Our Opinion About eToro

As a seasoned entity in the financial sector, our extensive testing and analysis of eToro reveals its standing as a premier broker. The platform offers an expansive range of CFD markets, providing traders diverse opportunities. Notably, eToro’s recent inclusion of real stocks and cryptocurrencies has significantly enhanced the trading experience, offering users more choices and flexibility.

eToro excels in its provision of educational resources, catering to both novice and experienced traders. Its comprehensive learning materials, including articles, tutorials, and webinars, serve as valuable assets for enhancing trading knowledge and skills. The broker also excels with its transparent fee structure with commission-free stock trading. However, users will encounter spreads, withdrawal fees, and currency conversion costs. These costs are competitive but should be taken into account when planning trades and withdrawals.

We also like eToro’s copy trading feature, which allows users to replicate the trades of experienced traders. This social trading element fosters interaction and knowledge exchange among traders, enabling newcomers to learn from seasoned professionals. Its intuitive trading platform, equipped with sophisticated analytical tools, empowers traders to make informed decisions. With a global user base spanning over 140 countries*, eToro has built a vibrant community of traders. This global presence fosters diversity in trading perspectives and opportunities.

After careful and thorough assessment, we wholeheartedly recommend eToro to our visitors seeking a reliable and comprehensive trading platform. However, acknowledging that each trader’s needs and preferences differ, we encourage potential users to explore our broker comparisons and top lists. This exploration will assist in determining whether eToro is the ideal fit for their specific trading requirements.

*eToro USA LCC does not offer CFDs, only real Crypto assets available

What We Like

- Access to 30+ Cryptocurrencies – Trade cryptocurrencies round the clock, offering flexibility and diverse investment options.

- Unique CryptoTrading Feature – eToro’s innovative CryptoTrading feature stands out, providing distinct advantages for crypto enthusiasts.

- Investment Options and Portfolios – Diverse investment options and portfolios cater to various investment preferences and strategies.

- Award-Winning Mobile Platform – The mobile platform’s accolades underline its user-friendly interface and functionality.

- Low Minimum Deposit – eToro maintains a low minimum deposit requirement, facilitating accessibility for traders.

What We Don’t

- High Minimum Amount for Copy Trading – Copy trading requires a minimum of £200 per trade, potentially limiting accessibility for traders on a tight budget.

- Hidden Fees – There are hidden fees, such as a £5 charge for withdrawals, which may affect overall profitability.

- Absence of MetaTrader Platforms – eToro’s platform does not support the MetaTrader platforms, which may be a drawback for users accustomed to those tools.

eToro In-Depth

eToro, founded in 2007 in Israel, revolutionised the financial industry through continual innovation. Initially focusing on FX and market research, eToro swiftly evolved, introducing the world’s first social trading service in 2010. The broker’s commitment to innovation led to an award-winning trading app, expanding its asset offerings to 3,000+ instruments. With a vast global user base of 30 million across 140+ countries, including the UK, US, EU, and Australia, eToro ensures inclusiveness and comprehensive financial services.

Strategic collaborations and accolades further underline eToro’s dedication to pioneering advancements in trading technology while meeting the diverse needs of its worldwide clientele. See below a table format highlighting key points about eToro.

| Feature | Availability |

|---|---|

| Licences | FCA, SEC, ASIC, CySEC |

| Demo Account | Yes |

| Advanced Platforms | Single Proprietary |

| Trading Securities | Stocks, Cryptos, ETFs, Commodities, Currencies |

| Support Service | Email, Phone and Live Chat |

| Mobile App | Yes (Google Play and the App Store) |

| Stock investment cost | £0 |

Security

During our in-depth exploration, eToro displayed a steadfast dedication to security, acquiring licences from prominent global regulatory bodies across 140 countries. With oversight from CySEC, FCA, ASIC, and other reputable authorities, eToro ensures compliance with rigorous financial standards. Its proactive approach to regulatory adherence and wide-ranging approvals within the EU reflect a commitment to user protection. This extensive coverage and global compliance demonstrate eToro’s proactive measures in providing a secure trading environment. Based on our evaluation, we rate eToro’s security measures 4.8 out of 5.

Please note that many countries, especially in the European Union, have their own financial regulatory organs. Therefore, eToro is also approved by a number of EU states in addition to the CySEC license. For example, the Swedish Finansinspektionen (FI) has approved them as an online broker.

Platform and Account Types

Our exploration of eToro’s platform* unveiled a user-friendly interface, catering to traders across skill levels. Its web-based trading platform is well-designed, making it seamless for trading, investments, and copy trading. Transitioning to the mobile platform, we found that the award-winning app offers a comparable experience to the desktop version, enabling traders on-the-go access to essential tools.

Moreover, eToro encourages a community-driven approach through its social trading platform, facilitating interaction and knowledge exchange among users. While the platform primarily relies on its proprietary tools, it continuously updates and optimises its features. There is also a £100,000 virtually-funded demo account, which we recommend to any user seeking to familiarise themselves with the platform before committing real funds. Plus, we appreciate the diverse account options, such as investment portfolios, catering to varying trading preferences.

Considering the limitation in third-party platform integrations, we rate eToro’s platform and account types with a 4.0 out of 5. Despite these drawbacks, its user-friendly interface, robust copy trading, and community engagement make it a compelling option for traders.

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Fees

While it’s technically free to open an eToro account, and even though there is no commission on stock trading, there are certain fees that you will be expected to pay when you trade at eToro. Based on our experience, the broker has a low minimum deposit requirement of $50. This requirement is very low and a great benefit, although if depositing via bank transfer, the minimum requirement is £500.

We noticed that eToro charges £5 for every withdrawal, and its spreads are higher than those of many of its competitors. Deposits are also free if only you use one of the 14 supported currencies (including USD, GBP, and EUR). Other currency deposits attract foreign exchange rates, so ensure you confirm whether eToro supports the currency you use.

All things considered, and despite attempts to attract customers with low minimum deposit requirements, eToro is a rather expensive broker to trade with. We therefore rank its fees section with 4.0 stars.

| Types | Fee |

|---|---|

| Minimum Deposit | $50 |

| Conversion Fee | Depends on your payment method, currency, and eToro Club level |

| Overnight Fee | Vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | All withdrawal requests are subject to a $5 fee |

| Inactivity Fee | Monthly inactivity fee of $10 (charged after 12 months) |

Interest on Balance

eToro offers an attractive opportunity to make your idle funds work for you with highly competitive interest rates. Your uninvested cash can earn you a return, and eToro provides a range of annual interest rates based on the total balance you hold in your account. For instance, if you have a substantial balance of $250,000 or more, you can benefit from an impressive annual interest rate of 5.3%. For balances between $50,000 and $249,999, the rate is 5%, while those with $25,000 to $49,999 can earn 2.4%. Even if you have a more modest balance, you can still enjoy competitive rates with 2% for $10,000 to $24,999 and 1.5% for $5,000 to $9,999. The best part is that your interest is automatically added to your eToro balance every month, and there’s no long-term commitment. This means you can access your funds whenever needed, ensuring both liquidity and earnings.

Mobile Compatibility

In our evaluation of eToro’s mobile compatibility, we tested its performance on both Android and iOS devices. The app provided a seamless and intuitive trading experience with a user-friendly interface, enabling easy navigation and quick trade execution. Access to real-time market data, customisable watchlists, and interactive charts made it convenient to make informed decisions on the go. Overall, eToro’s mobile app delivers essential trading tools efficiently, earning a 5-star rating from us for its usability and functionality.

Product Offerings

In our meticulous analysis of eToro’s asset offerings, we uncovered a diverse range tailored to suit various trading preferences. Here’s an in-depth look at the available assets on the platform:

- Stocks – Impressively, eToro boasts a collection of 6,000+ stocks, including prominent U.S. tech giants and smaller global companies. The allure of commission-free stock trading enhances accessibility for traders of all levels.

- Cryptocurrencies – As an early adopter, eToro provides access to over 30 coins and diverse cryptocurrency pairs. This robust selection caters comprehensively to the needs of cryptocurrency traders.

- Currency Pairs – eToro maintains its foundation as a forex broker, offering over 50 currency pairs, covering majors, minors, and select exotic options, providing ample choices for forex traders.

- Commodities – The platform lists 44 commodities, enriching its offerings and diversifying investment possibilities.

- Indices – Investors can access various indices, broadening their exposure to different markets.

- ETFs – With a portfolio of over 420 Exchange-Traded Funds (ETFs), eToro grants investors diverse options for investment.

- Additional Assets – In an innovative move, eToro extends its offerings to include NFTs, tapping into the growing interest in digital collectibles.

However, we couldn’t find options, bonds, or mutual funds within eToro’s offerings. Despite this, considering the platform’s overall asset diversity, we believe it adequately caters to users’ needs, thus warranting a commendable 4.1-star rating in this category.

Also, eToro has a crypto wallet, read about it in more detail in our eToro wallet review.

Education Tools

Upon exploring eToro’s educational resources, we found a diverse range of learning materials tailored for traders at all levels. Also known as the eToro Academy section, it offers informative articles, tutorials, webinars, and a demo account option, catering to beginners and seasoned traders alike. These resources cover essential topics, providing insights into trading strategies, market analysis, and risk management. Compared to its peers like Pepperstone and Plus500, we give eToro’s learning section a 5-star rating.

Payment Methods

Our testing revealed eToro’s diverse payment options, allowing funding in USD, GBP, EUR, and AUD without exchange fees. Debit cards, Neteller, Skrill, and Trustly facilitate seamless transactions. Bank transfers offer reliability but take longer. However, regional options like POLi (Australia) and iDEAL (EU) aren’t available in the UK. With multiple choices catering to most users, we give eToro’s payment methods a 4.5-star rating.

Customer Service

Assessing eToro’s customer service involved reaching out to its support team. While testing it, we found multiple contact options, including live chat, email, and phone support. The interface also featured an extensive FAQ section, offering immediate answers to common queries. Unfortunately, eToro’s phone support is not available 24/7. However, our interactions via email were efficient, with responses received within a commendable timeframe, typically within a few hours. The team demonstrated professionalism and a thorough understanding of the platform’s features. Considering the availability of multiple support channels and the team’s responsiveness, we rate eToro’s customer service highly, scoring it 4.7 out of 5 stars.

How to Sign Up For an Account at eToro

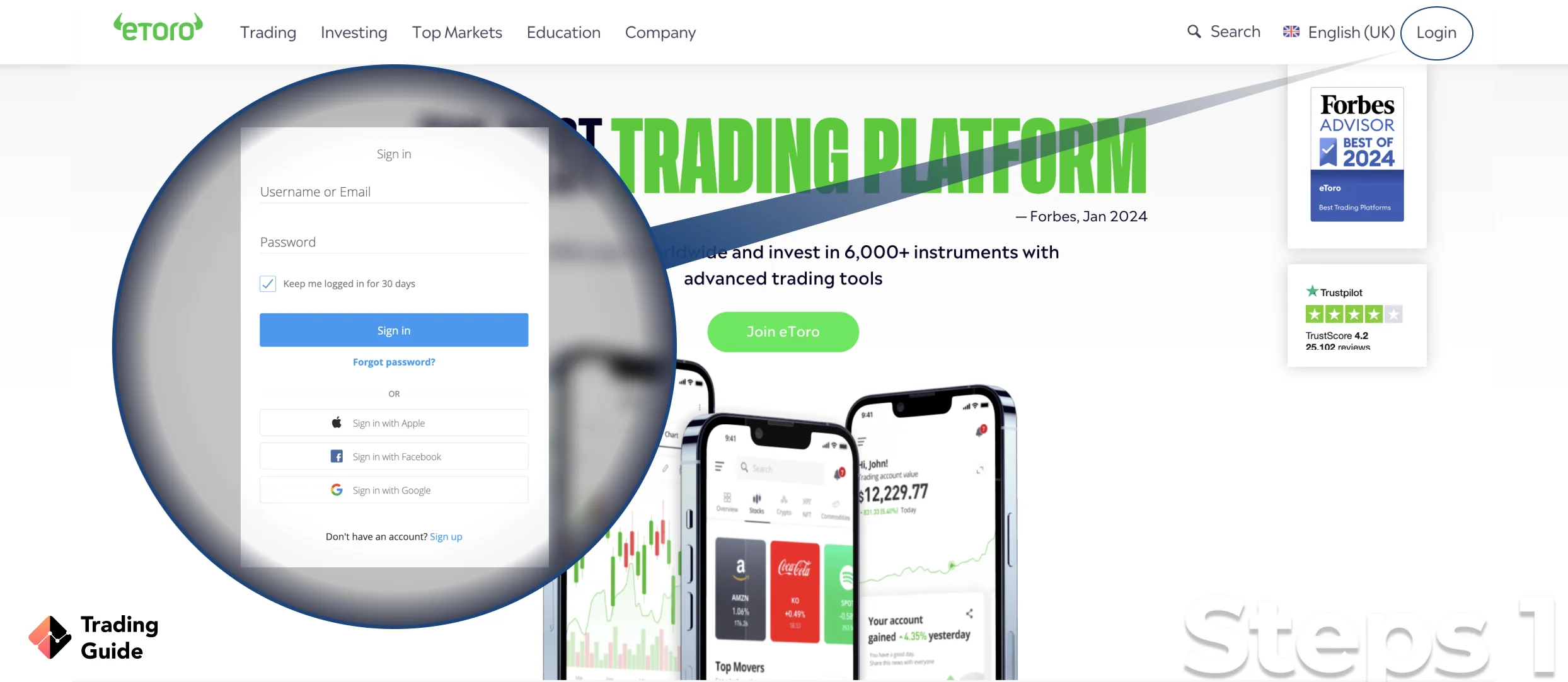

Signing up for an eToro account is a straightforward process that involves five easy steps, enabling you to begin your trading journey efficiently. Regardless of whether you’re interested in a regular trading account with copy trading features or considering the professional or corporate version, the following procedures will guide you through the setup process:

Navigate to the official eToro website by clicking any of the links we’ve shared on this page. Then, ensure you understand the broker’s T&Cs to avoid future inconveniences. And if you are always on the move, install eToro’s app on your mobile device for seamless activity management.

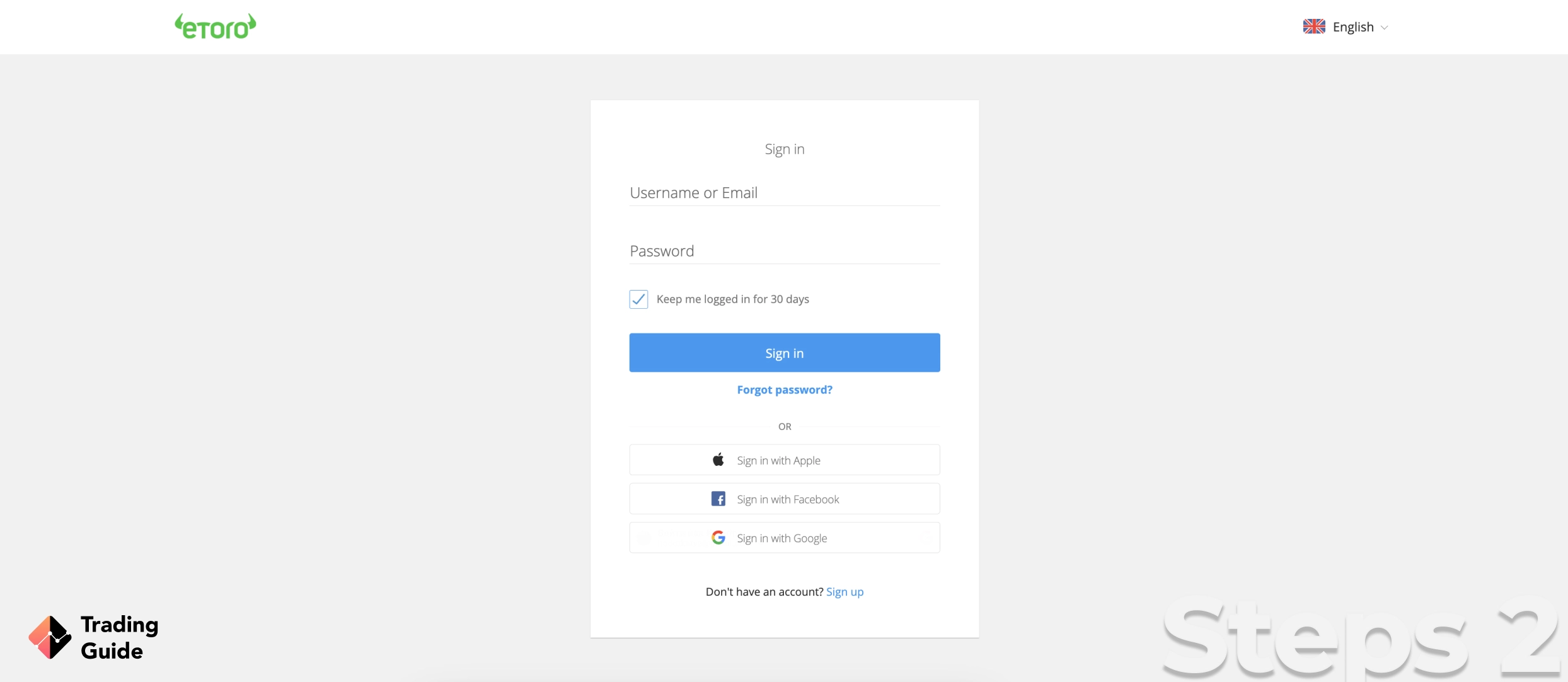

On the page, Click on the “Join eToro” button and fill in the required details such as your name, email address, and chosen password. Alternatively, you can sign up using your Google or Facebook account for added convenience.

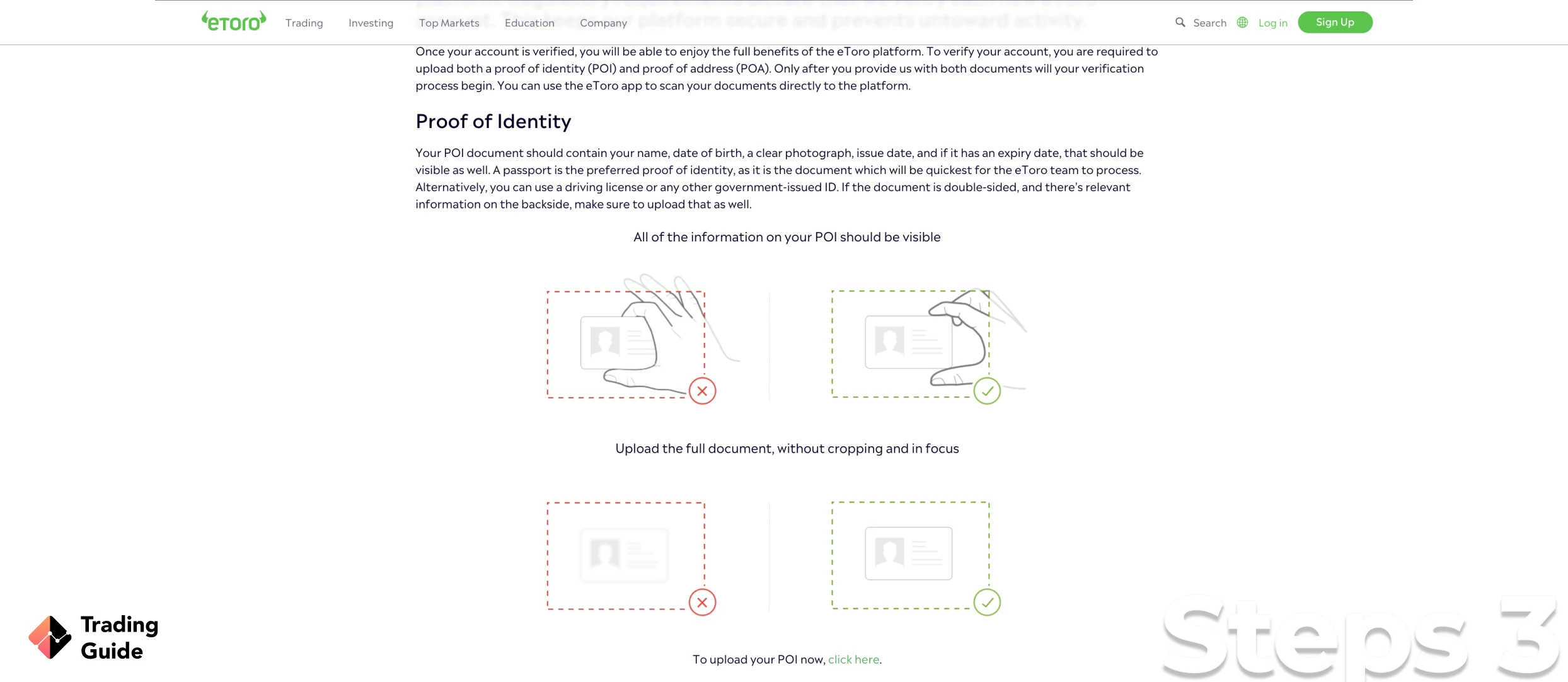

Completing the registration prompts the platform to request identity verification for compliance purposes. Prepare a valid government-issued ID (such as a passport or driver’s licence) and proof of address (like a utility bill or bank statement) to facilitate this verification process.

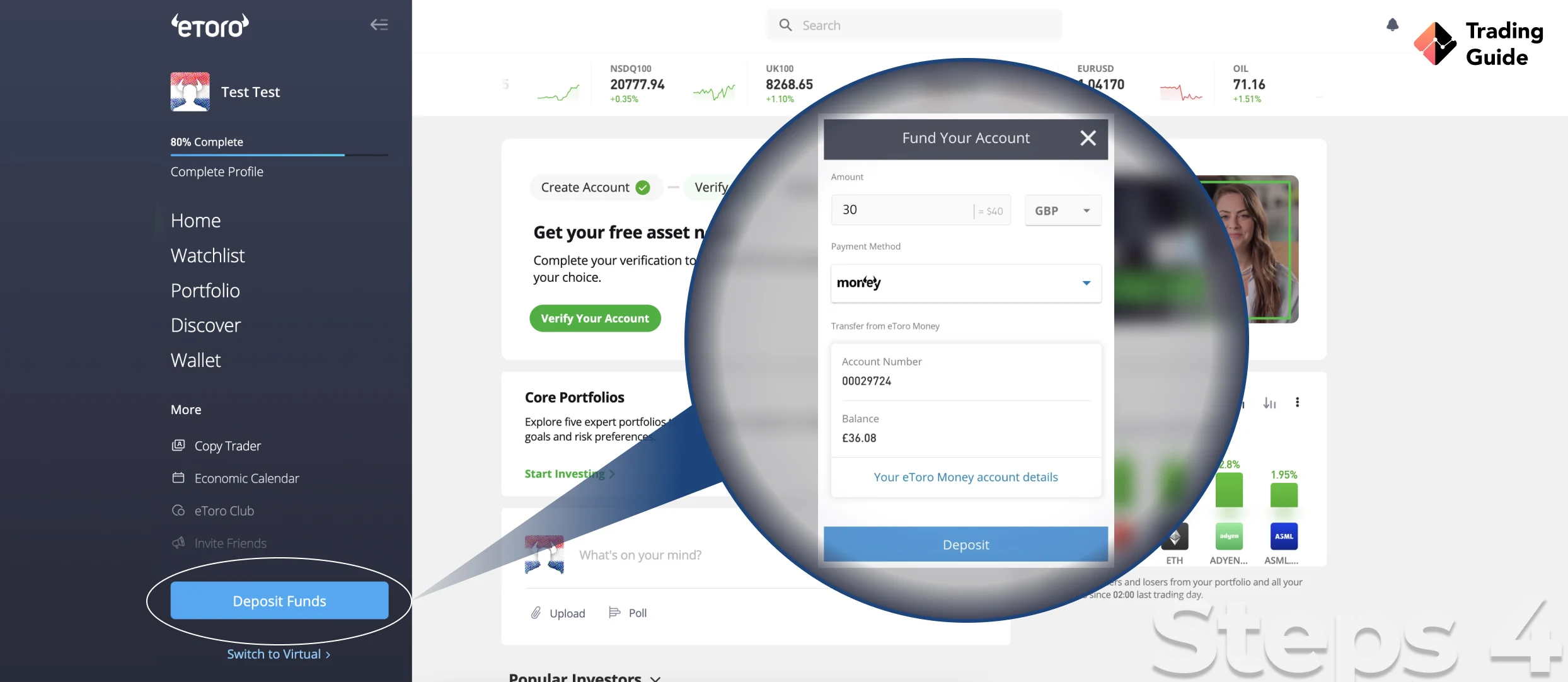

After your account is verified, you will receive an email notification, after which you should proceed to make your initial deposit. Note that eToro has a minimum deposit requirement of $50 for UK traders and investors. It also supports multiple payment options, including debit cards, e-wallet, and bank transfers.

Once your deposit reflects in your eToro account, you’re ready to start trading. Navigate the platform to explore the various assets available for trading, utilise the copy trading feature if desired, and begin your investment journey. There is also a demo account funded with £100,000 virtual money for testing the broker and gauging your skill level.

From our experience, eToro’s account set up process is easy, and we give it a 4.9-star rating in this category.

Alternative to eToro

While eToro stands out as a reputable broker, different traders have distinct preferences. To assist in finding a suitable alternative, we’ve compiled a list of highly rated brokers that could meet your trading needs.

| Broker | Minimum Deposit | Demo Account | Mobile App | Commission/Spread |

|---|---|---|---|---|

| Pepperstone | £500 | Yes | Yes | Yes |

| FP Markets | £100 | Yes | Yes | Yes |

| XTB | £0 | Yes | Yes | Yes |

Is eToro Good For You?

Determining if eToro aligns with your trading needs involves considering various factors to assess its suitability for your preferences and requirements. From our assessment, eToro stands out for its innovative social trading platform, offering copy trading features that allow users to mimic the strategies of experienced investors. If you value learning from others’ approaches or seek engagement within a community-based trading environment, eToro’s social features could be appealing.

Another notable aspect is eToro’s diverse range of investment options, encompassing stocks, cryptocurrencies, CFDs, and more. This variety caters to traders exploring multiple markets, providing ample choices for investment diversification. The platform’s user-friendly interface is designed for accessibility, ensuring easy navigation and straightforward functionality. Whether you’re a novice or an experienced trader, eToro’s intuitive design can facilitate your trading activities.

Most importantly, eToro’s global regulatory compliance and multiple licences instil trust and security, adhering to stringent international standards. However, it’s essential to consider potential drawbacks before making a final decision. For instance, eToro imposes a relatively high minimum amount (£200 per trade) for copy trading, potentially limiting accessibility for traders with smaller budgets. Hidden fees, such as withdrawal charges, can also impact overall profitability and require careful consideration.

How eToro Makes Money From You and for You

eToro operates on a commission and spread-based model, meaning you will incur spreads or commissions for trading different securities on the platform. These trading fees you pay to the broker are its profit, so ensure you understand such costs and budget accordingly for an exciting experience.

eToro also generates income through overnight and withdrawal fees. Overnight fees apply when a trade is left open overnight and vary depending on the asset being traded. Withdrawal fees (£5 per request) are charged when you withdraw funds from your eToro account, whether via debit cards, bank transfers, or e-wallets.

In addition to making money from commissions, spreads and withdrawal fees, eToro offers professional traders an opportunity to earn extra income via its CopyTrader feature. As a trader looking forward to copying trades, you will not incur extra fees except for the standard commissions and spreads. However, for professional traders, eToro pays you a fixed payment per copier and additional bonuses for advancing rank. This means the more copiers you have, the more money you will make.

Another way eToro makes money is via inactivity fees traders pay for leaving their accounts inactive for over 12 months. There is also a currency conversion fee when you transact using currencies besides the GBP for UK traders. Lastly, traders get to pay interest to brokers for funds used in margin trading.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recom-mendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQs

Yes, eToro is a trustworthy broker. With licenses from several regulating bodies, including the Financial Conduct Authority (FCA), you can rest assured that eToro will keep you, your personal information, and funds protected.

Moreover, eToro has millions of customers from all over the world that all swear by the broker.

While eToro can be used for long-term investing, especially in shares and cryptocurrencies, it is mainly an online trading broker. Thuse, eToro is best for short term strategies such as day trading and swing trading.

eToro has different minimum deposit requirements depending on where you live and what type of account you’re going to use. For UK traders, the minimum deposit is $50 but we advise you to read the broker’s terms before you sign up and make a first deposit to ensure that you’re aware of all the requirements.

As a UK trader you’re obligated to pay taxes on all profits you make from online trading and long-term investments. Please contact your local tax office for more detailed information about your tax obligations.

Transaction times greatly depend on the payment method that you’re using.

The fact that eToro is licensed and regulated by the FCA means that the broker has to keep customer funds separate from the rest of the company. Hence, if the company goes bust, trader funds are still available and will be withdrawn to each trader.

There is a £10,000 per day deposit level when using eToro. This is quite high and since the level resets every day, few brokers will find this limiting.

eToro got on the cryptocurrency train early and is still one of the leading online brokers for cryptocurrency trading and investments. And yes, of course, you can buy Bitcoin with eToro.

Depositing times depend completely on the payment method that you’re using. Generally, online payment solutions are completed instantly while bank transfers can take up to a few days.

Is eToro good for Forex?

Well, all brokers are more or less the same- work off MT 5 manipulate the prices/ have algorithms to track you- who you are when you log in your trading style- construe the prices against you - slow down the price feeds. The minimum trade size in eToro is a mini-lot. Unless you are going to invest thousands of dollars, your risk on the market is not ideal with every position you open.

Anyway, the only experience will tell you.

I have no experience with them, but I've seen reviews, bad reviews. If you want a safe broker, research, and keep researching. Good luck!

eToro is fully dependent on you as an investor. With eToro you can either trade on your own, or copy someone or invest in their funds. When you are a beginner it is advisable to copy someone. Happy trading!

the eToro demo account has proved its success for me. I plan to try their live account in the near future

So far I haven't heard about any eToro scams and I hope I never do

Most of the people that I know and saw directly trading forget to use the protection order settings while trading forex on platforms like eToro at the beginning. How do I know that - because when you copy-trade someone on both platforms eToro copy-trading Covesting module you can follow the trader’s activity closely. Many newbies forget to use a tight stop loss or enter in positions out of greed.

Big or small investors I will recommend eToro any given day for trading because it's very affordable and has transparent pricing which is rare to be found a thing with brokers. Being a small investor, I love using eToro, it really helped me in my investment decisions by charging very little.

I have been trading at etoro since 2016. In my opinion, it is a perfect broker. There are really no commissions. Except for a fixed $5 for withdrawal. Technical support is one of the best. Very easy to make transactions with crypto, you can physically quickly transfer it to etoro wallet.

I never had any problems with eToro for me everything works fine. Personal account manager was very helpful and friendly.

Great app and platform, I love their customer service. Easy to set up an account and start trading stocks, ETFs, and crypto. Easy to transfer funds out of the account when needed. I would highly recommend this platform to anyone. Very happy client.

I have been investing with eToro for over 2 years and am very happy with the user-friendly easy to navigate platform. They offer a variety of stocks, cryptos, commodities, etc. They provide a lot of useful information. I would recommend.

I really enjoy the eToro platform because it is very user-friendly, and you can access most markets and financial instruments. Their experts are always open to discuss with you their insights. Their customer service is reliable and polite.

I am really happy with this broker. Easy to register and deposit, and has enough with assets to trade!

Customer support is responsive. Etoro stands out as the top choice due to its diverse range of trading instruments and commitment to fund security. I had no trouble conducting cryptocurrency transactions on the platform, highlighting its excellence. Etoro is the best platform in the market, especially in the context of social trading, which plays a crucial role in building investor trust. Highly recommended!

This was a helpful breakdown of eToro.Thanks!

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal