OANDA Europe Limited is a company registered in England, number 7110087. It is authorised and regulated by the Financial Conduct Authority, No: 542574

- Brilliant trading platforms.

- Demo account available.

- Only Forex, spread betting and CFD products available.

- There is an inactivity charge which kicks in after 12 months.

Note: 76.6% of retail investor accounts lose money when trading CFDs with this provider.

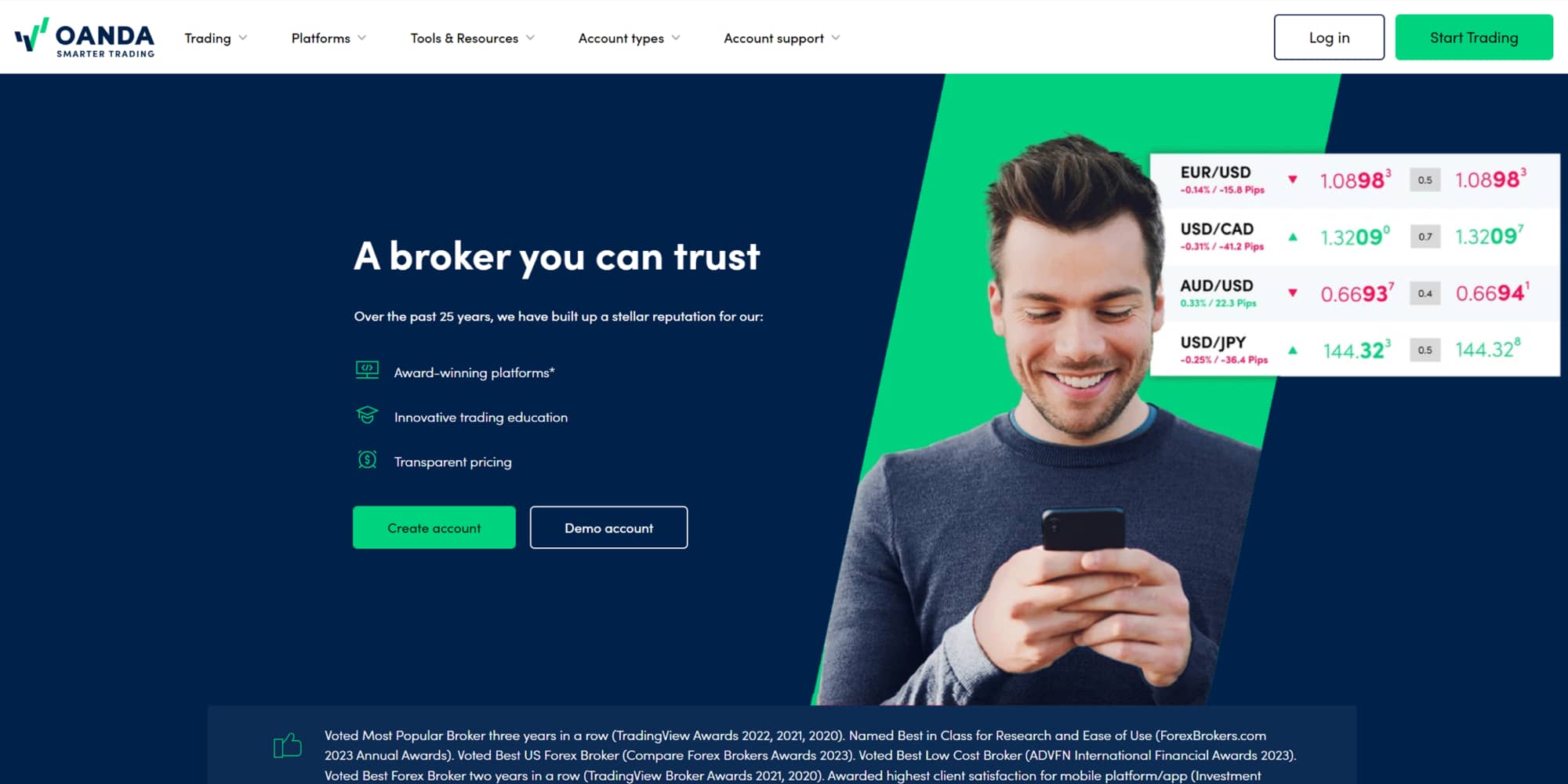

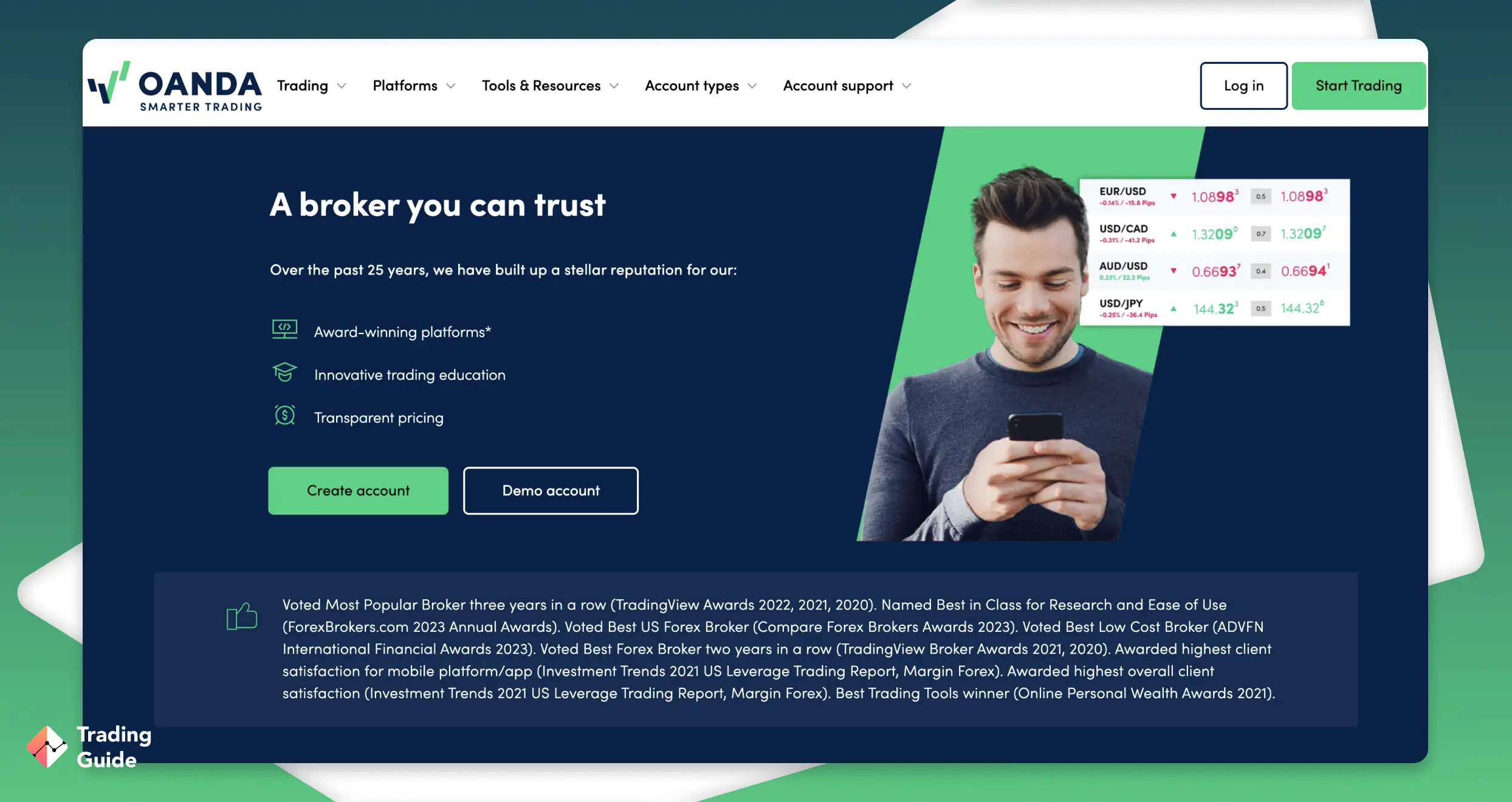

OANDA is one of the highly rated and most trusted forex and CFD brokers by users in the UK and other global regions. Established in 1996, the broker continues to offer exceptional trading services while adapting to advancing technology. We decided to thoroughly analyse this broker and write a comprehensive OANDA review so our readers can make informed decisions. So, join us, and let’s explore what this broker has to offer.

Our Opinion About OANDA

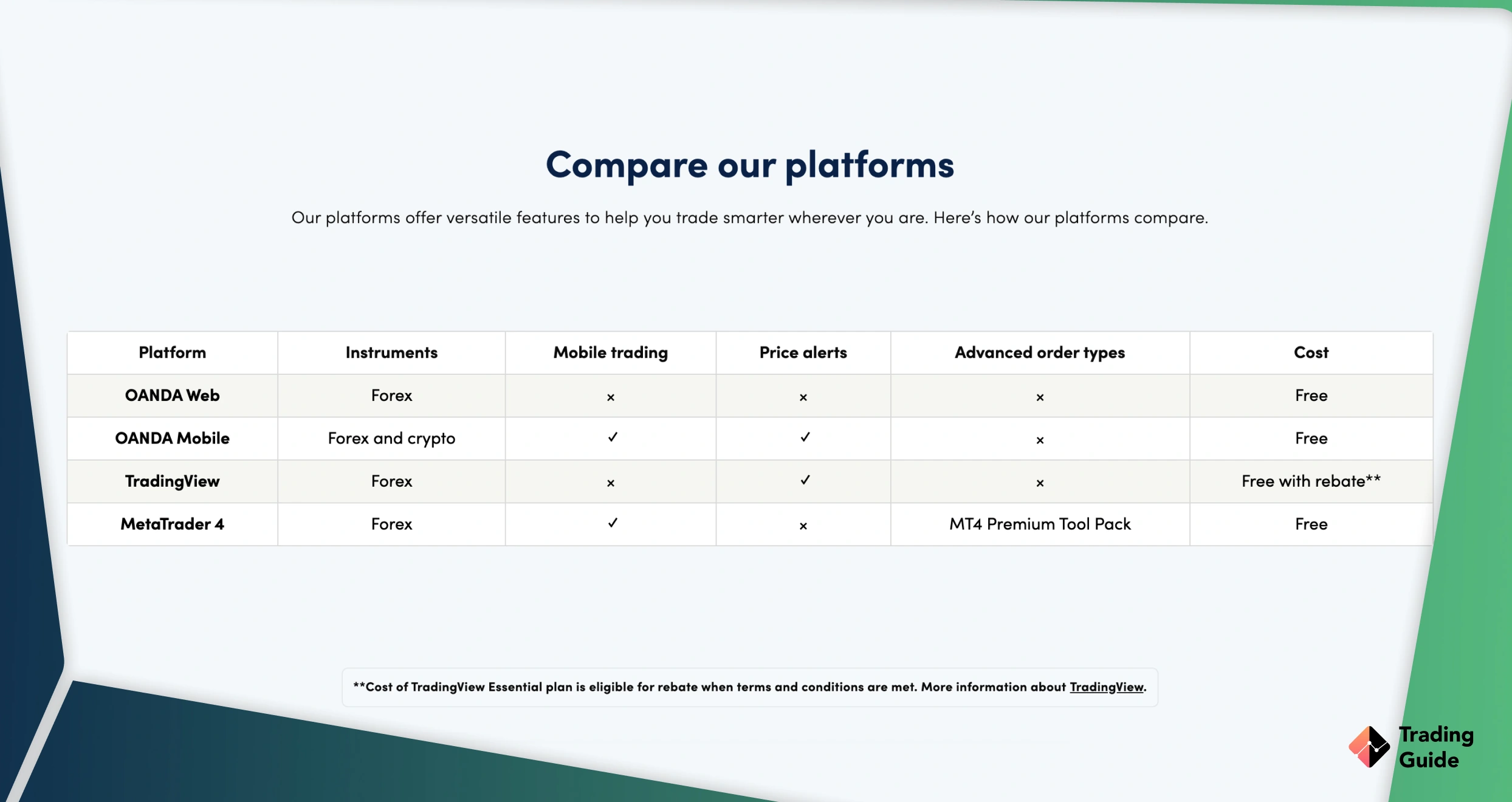

After a comprehensive evaluation of OANDA, we are pleased to highlight several key features that enhance the overall trading experience. One of the standout platforms offered by OANDA is MT5. Whether you are a beginner or a seasoned trader, the user-friendly nature of MT4 makes it accessible to all levels of traders, facilitating effective trading in forex and CFD markets.

Furthermore, OANDA’s support for the TradingView platform is noteworthy. TradingView is renowned for hosting a comprehensive set of tools essential for making well-informed trading decisions. From rapid trade execution to flexible alerts and high-quality charting and analysis tools, TradingView on OANDA ensures traders have access to top-tier resources to bolster their trading strategies.

When it comes to non-trading fees, OANDA stands out with its close-to-zero fee structure. The broker imposes no charges for depositing funds, withdrawing earnings, or even opening an account. This commitment to fee transparency is admirable. The sole non-trading fee that traders should be aware of is the inactivity fee, which comes into play when a trading account remains dormant for a year. This fee serves as a gentle reminder to keep accounts active, and its transparency aligns with OANDA’s customer-friendly approach.

To further enhance convenience, OANDA offers a diverse array of transaction options for funding and withdrawals. These options encompass debit and credit cards, e-wallets, bank transfers, and wire transfers. The variety ensures that traders can select the method that best suits their preferences and needs, streamlining the financial aspects of trading.

What We Like

- User-friendly platform – One of the first things that struck us about OANDA is its user-friendly trading platform. Whether you’re a seasoned trader or just starting, you’ll appreciate the intuitive design and ease of use.

- Robust research resources – OANDA stands out with its extensive research tools. With over 50 technical indicators, charting packages, and drawing tools, you have all the resources needed to make informed trading decisions at your fingertips.

- Exceptional mobile trading – OANDA’s mobile trading app is a gem. It not only offers fast trade execution but also an intuitive interface that makes it a breeze to manage your investments from anywhere.

- Cost-effective trading – OANDA boasts low trading fees, with spreads starting at just 0.8 pips on major currency pairs. This is a major plus for traders looking to maximise their profits while minimising costs.

- Fee transparency – OANDA does not levy fees for deposits, withdrawals, or trading activities, except for the spread. This transparency is a welcome relief for budget-conscious traders.

What We Don’t

- Inactivity Fee – OANDA charges a $10 monthly inactivity fee if your trading account remains dormant for over 12 months. This fee might concern traders who don’t trade frequently.

- Limited trading options – You can only trade forex, spread betting and CFD products. There is no buying and taking full ownership of the featured assets.

OANDA In-Depth

OANDA is one of the brokers with no minimum deposit requirement, allowing users to get started with any amount they can afford. We also consider it flexible, meaning that any user, whether new or experienced, will have an exciting adventure with it. OANDA broker is also highly regulated and encrypted, guaranteeing users’ data safety.

That being said, here is a table we’ve prepared briefly explaining OANDA’s features for better understanding.

| Feature | Availability |

|---|---|

| Minimum deposit requirement | £0 |

| Licences | FCA, CySEC, FSA, CIRO, ASIC, CFTC |

| Demo Account | Available |

| Advanced Platforms | MT5, TradingView |

| Trading Securities | Forex, indices, commodities, bonds |

| Support Service | Phone, email, live chat |

| Mobile App | Yes (Google Play, the App Store) |

| Stock investment cost | £0 |

Security

Security is paramount in the world of online trading, and OANDA demonstrates a strong commitment to safeguarding its users’ assets and data. During our assessment of the platform, we observed that OANDA employs industry-standard encryption protocols to secure the transmission of data between users’ devices and its servers. This encryption ensures that sensitive information, such as personal details and financial data, remains confidential and protected from unauthorised access.

Furthermore, OANDA’s dedication to security is underscored by its regulatory compliance. The broker is regulated by reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the United States. These regulatory bodies impose stringent standards and oversight to ensure the safety and integrity of the trading platform. Compliance with such regulations not only safeguards the platform from potential impostors but also helps prevent money laundering activities.

In light of these security measures and regulatory adherence, we confidently rate OANDA as a broker that prioritises the protection of its clients, earning it a 4.6-star rating in our assessment.

Platform and Account Types

In our exploration of OANDA’s platform and account offerings, we found a diverse selection of account types to accommodate a range of trading needs. OANDA provides standard and professional accounts, ensuring flexibility for traders of various experience levels. Additionally, OANDA offers a valuable demo account for practice for those looking to refine their skills or test strategies risk-free.

OANDA web trading platform stands out for its user-friendly interface, making it accessible to traders across all experience levels. Its modern design not only ensures a seamless user experience but also provides real-time market data, customisable watchlists, and user-friendly charts. Moreover, OANDA supports both the MT5 and TradingView platforms, renowned for their advanced trading tools and analysis capabilities. These platform options empower traders with the tools needed to make well-informed investment decisions. We, therefore, give OANDA a 4.8-star rating in this category.

Fees

Regarding fees, OANDA is a competitive choice in the brokerage landscape. The absence of a minimum deposit requirement means you can start trading with the amount that suits you. Deposits into your OANDA account are free, providing flexibility for your financial transactions. However, it’s important to note that while withdrawals using credit/debit cards and e-wallets are free, transacting via bank wire transfer comes with a fee of £20.

OANDA also maintains a transparent approach to inactivity fees, which stand at £10 monthly should your trading account remain dormant for over 12 months. Additionally, overnight charges are calculated based on the current interest rates and the amount of margin used, ensuring a fair reflection of the market conditions. For margin trading, OANDA applies reasonable rates starting from 5%. Overall, the broker’s fee structure is competitive, giving it a 3.8-star rating.

| Type | Fee |

|---|---|

| Deposit | £0 |

| Withdrawal | £20 for a bank wire transfer |

| Inactivity | £10 monthly |

| Overnight Charges | Based on the current interest rates and the amount of margin that is used |

| Margin Rate | 5% |

Mobile Compatibility

Our evaluation of OANDA’s mobile app left us thoroughly impressed with its seamless functionality and adaptability to the needs of modern traders who rely on their smartphones for trading activities. The app is meticulously designed to cater to traders on the go, ensuring you can effectively manage your investments from the palm of your hand.

One of the standout features of the OANDA mobile app is its lightning-fast execution speed. The app also offers a clean and intuitive interface that simplifies the trading process. Navigating various features is a breeze, allowing you to swiftly access real-time market data, customise watchlists to track your preferred assets, and utilise interactive charts for in-depth analysis. With many users recommending the app and our own experience affirming its excellence, we confidently assign this feature a 4.1-star rating.

Product Offerings

OANDA provides diverse trading products catering to a wide range of investment preferences. Note that the broker only features forex, CFD, and spread betting instruments, meaning users cannot buy and take ownership of the underlying assets. Here are the CFD instruments you will trade at OANDA.

- Indices: OANDA offers a range of indices as CFDs, allowing traders to speculate on the performance of global stock indices like the S&P 500, FTSE 100, and more. This provides exposure to broader market movements.

- Commodities: Traders can access various commodities such as oil, natural gas, and precious metals like gold and silver through OANDA’s CFD offerings.

- Bonds: OANDA also facilitates bond trading as CFDs, providing exposure to fixed-income securities. Bond CFDs offer diversification and potential income generation.

- Cryptocurrencies: OANDA users have the opportunity to explore crypto tokens at OANDA, including popular options like Bitcoin and Ethereum. Unfortunately, cryptocurrency offerings at this broker’s website are limited compared to what its peers offer.

While OANDA covers a variety of assets, it’s important to remember it does not offer the trading of stocks on foreign exchanges, mutual funds, or royalty trusts for UK users. Nevertheless, its extensive range of CFD products, particularly in forex, indices, commodities, and cryptocurrencies, provides traders with a comprehensive toolkit for diversification and strategic trading. We find OANDA’s product offerings well-rounded, earning this section a 3.8-star rating.

Education Tools

Exploring OANDA’s educational resources, we found a valuable repository of materials that cater to traders across different experience levels. The platform offers a range of learning resources designed to empower users with the knowledge needed to make informed trading decisions.

These resources encompass a variety of formats, including articles, guides, webinars, and events, making them accessible to both beginners and experienced traders. The content covers various investment topics, from fundamental concepts to advanced investment strategies and in-depth market analysis. Compared to its peers, OANDA’s learning tools earn a 4.1-star rating, reflecting their effectiveness in empowering traders to make more informed trading decisions.

Customer Service

Our investigation into OANDA’s support service revealed a service that operates efficiently to assist traders. OANDA offers support through multiple channels, including email, phone, and live chat. While it’s important to note that their support operates five days a week, it provides users with access to assistance in various ways. Plus, the service has a quick response time, making it reliable. With increased efficiency and availability of a FAQ section for quick answers, OANDA broker garners a favourable 4.5-star rating in our assessment for this category.

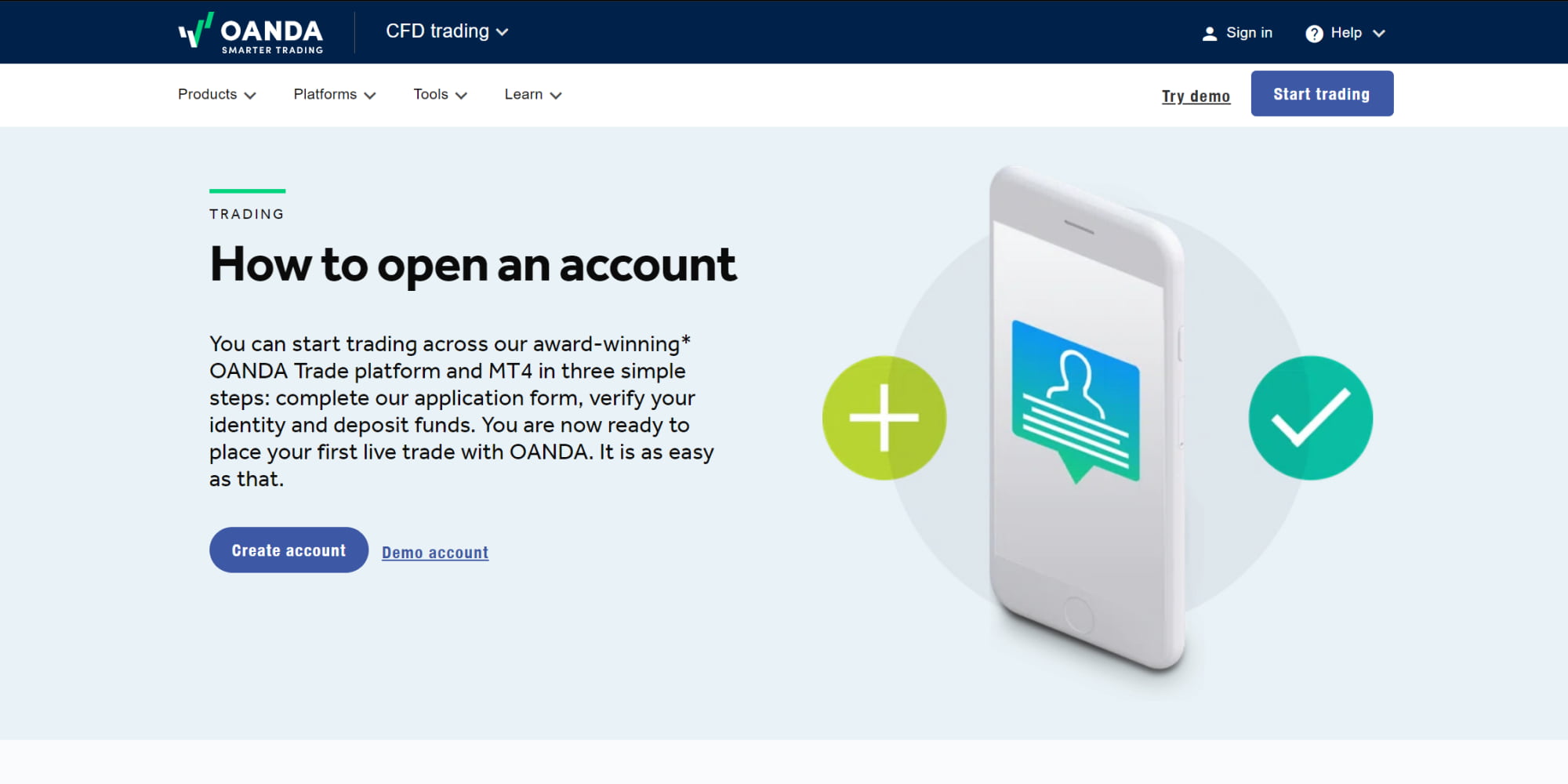

How to Sign Up For an Account at OANDA

We created a trading account with OANDA, and we’re pleased to report that the journey was marked by simplicity and efficiency. Much like our experience with most brokers, OANDA’s account registration process is straightforward, requiring only basic information. In fact, we give it a 4.7-star rating for its user-friendliness and ability to activate our accounts on time.

For those contemplating trading opportunities with OANDA, we’ve compiled a comprehensive guide below on how to initiate the account creation process.

Start by visiting the official OANDA website. You can do this by clicking on any of the links we’ve shared for quick access. While on the site, ensure you are familiar with the asset you plan to trade and the broker’s terms and conditions for an exciting experience. You should also download and install OANDA’s app on your mobile device to trade on the go.

On the OANDA homepage, look for the “Sign Up” button and click on it to initiate the account setup process. You must complete this procedure using your personal details, including your name, email, date of birth, jurisdiction area, and more. Also, create a secure password to protect your account.

In this section, you must provide proof of identity and location. This may include sharing copies of your ID number, passport or driver’s licence and a utility bill or bank statement, respectively. OANDA may also ask you some basic questions about your employment status.

Once your account is set up and verified, you’ll need to link your bank account to your OANDA account to deposit funds. OANDA does not have a minimum deposit requirement, so you can deposit any amount you are comfortable with. It’s worth noting that OANDA typically offers free deposits, and you can also transact using e-wallets and credit/debit cards.

Once you have made a deposit, OANDA will redirect you to where it lists its assets for trading. Feel free to choose the asset you prefer and set up your strategy before opening a position. You must also apply risk management controls, as losses are inevitable in any trade.

Alternative to OANDA

While we hold OANDA in high regard as a top-notch broker, we recognise that every trader’s needs and preferences vary. Our commitment is to guide each of our readers in discovering a brokerage platform that aligns perfectly with their unique trading requirements. To facilitate this, we’ve thoughtfully curated a list of reputable alternatives to OANDA, each deserving your consideration. Browse the table below to explore some of our top-rated options in online trading.

| Broker | Minimum Deposit | Demo Account | Mobile App | Commission/Spread |

|---|---|---|---|---|

| Pepperstone | £500 | Yes | Yes | Yes |

| FP Markets | £100 | Yes | Yes | Yes |

| Plus500* 80% of retail investor accounts lose money when trading CFDs with this provider. | £100 | Yes | Yes | Spread only |

| CMC Markets | £0 | Yes | Yes | Yes |

Is OANDA Good For You?

Determining if OANDA suits your trading needs hinges on several vital factors, and we’re here with concise insights to aid your decision-making. For forex traders, OANDA excels with its robust offering of 68 forex pairs, catering to both novices and experienced traders alike. The broker also features quality learning tools, a user-friendly interface, and the benefit of a risk-free demo account to hone beginner traders’ skills. If you are an advanced trader searching for third-party platforms, you can rely on OANDA’s MT5 and TradingView platforms, featuring advanced market analysis tools.

Overall, OANDA is a credible and reliable forex and CFD broker worth considering. However, assess your unique trading goals and preferences to determine if they align with your needs. Take advantage of its demo account to explore available offerings and gauge your skill level before taking the plunge.

FAQs

Absolutely. OANDA is one of the most highly ranked forex, spread betting and CFD brokers globally. Besides offering amazing trading tools for its users, the broker is highly encrypted and overseen by tier-one authorities, including the FCA.

Yes. Based on our analysis, OANDA is an excellent choice for newbies in the financial space. Note that the broker has a user-friendly and intuitive design platform and lists plenty of learning resources to ensure you quickly improve your skill level. OANDA also offers newbies a virtually funded demo account to test their skills and explore various trading instruments free of charge.

No. There is no monthly fee when trading on OANDA. However, should there be no activity in your trading account for over 12 months, expect a monthly inactivity charge of £10.

Yes. OANDA has proven to be a legitimate broker by offering superior trading services under the supervision of various financial authorities, including the FCA. For instance, the broker ensures its trading platform remains safe by verifying the identities of all traders. Your funds are also segregated in a separate account, meaning only you can access them.

OANDA sets leverage limits for retail CFD traders according to ESMA regulations for EU and UK traders. Its maximum leverage limit for retail clients is 50:1 on forex products. However, professional clients can explore leverage of up to 200:1.

Yes. OANDA has a native mobile app you can access on Google Play and the App Store. Like the web version, the OANDA trading app is user-friendly and executes trades seamlessly for maximum experience.

No. Although signing up for a trading account at OANDA is free, traders will incur commissions or spreads for its trading services. Note that deposits and withdrawals are free at OANDA, and there is no minimum deposit requirement.

Oanda app is laggy

I didn’t find anything negative. The trading process is quite smooth and I didn’t have problems with app here. So, I can label this brokerage service as reliable and trustworthy.

Currently, I am using Oanda, though their website might not be aptly designed as it seems to be complicated and leverage is also not as high as the tough competitors but it is a trader friendly broker allowing all strategies along with tight spreads and less commission in addition to highly satisfactory withdrawals.

I am using pure ECN accounts of Oanda as well as Fxview. They both are established names in the industry and are regulated. And as it is you must be aware that with ECN accounts the funds of the traders are maintained in segregated accounts. Now if you are looking for a micro broker that offers ECN accounts, I would again suggest using these 2 brokers. There are no minimum balance requirements and their commissions and spreads are low. Fxview as an added advantage also offers negative balance protection. I have used other brokers also in the past but found the offerings of these 2 better than others.

I’m satisfied with manual trading here. I would like to use customized technical indicators here. I heard that some brokers forbid the use of custom indicators. Can I use custom indicators on your Metatrader4?

I like this platform, and never had any problems. The app is stable. I stopped trading from my computer and used the mobile app more often. It is really amazing. It's nice that there is a good selection of different types of charts. I like the simplicity and ease of use. I am currently investing a little bit at a time and this app is perfect for me. I prefer to use it on the MT4 platform.

Great trading platform, more convenient that what I’ve seen except FXCM that is no longer available in the US. Love the ability to hide the rates or the account activity window on the left. Also love the free floating readjustable movable charts. Also love the ability of visually setting the order and stop loss and take profit right on the chart. Very pleased with the design, love the platform's colors. I would love to see an ability to create custom colors on the charts and drawings instead of just fixed preset colors. Keep up good work.

I needed a second timeframe and finally, I found it in this application. And in general, the app is done perfectly. Convenient, clear interface. Nothing lags, nothing slows down. Simple and fast registration. Thank you!

I've been trading with Oanda for 2 years and I haven't encountered any serious problems. Their customer service is very good. I fully expect to keep trading with them as my account gets bigger and bigger.

Their service is pretty good. I have been using it for 2 years and I am very satisfied with it.

Oanda is a good broker for me. It has a good trading platform which is easy to use. At first I used a demo account, but now - it is real. I am not sad that I started trading with Oanda.

OANDA has great spreads. You get a small fee for a withdrawal but you can get it back if you email them. Dependable broker, easy to work with, stable. The platforms that they have are great and user-friendly.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?