Tickmill is a global broker specialising on forex, precious metals, commodities, CFDs and indices.

- Great trading tools

- Three account types

- Safety of clients funds

- Multilingual support

- Educational materials need improvement

- Lack of platforms

Tickmill offers its services to institutions and individuals around the world. The company is regulated as a securities broker by the Seychelles Financial Services Authority. Besides its online trading services, Tickmill offers web conferencing and other educational materials. It also offers reward systems5 and partnership models to its clients.

Tickmill is a well-respected and reliable young broker who cares about the safety and comfort of its traders. This is why our team became interested in the company. We have studied, in detail, all the advantages and disadvantages of the broker. You can read the results of our work below.

Tickmill – Who Are They?

Since it was founded in 2014, the company has quickly gained many customers’ trust and has shown impressive growth. The company has over 150,000 satisfied clients, worldwide. This young company has boldly implemented its business model and constantly forms partnerships that gradually improve its clients’ trading conditions.

Tickmill is a broker that offers excellent trading opportunities using MT4. Unfortunately, the broker only adheres to this trading platform, but they develop it very well. Thus, Tickmill’s VPS hosting plays a big role for algorithmic traders, using MT4.

Moreover, the broker boasts of its outstanding research tools, which is their advantage. In addition, Tickmill offers Autochartist for automated technical analysis and the Myfxbook, which maintains a broker’s economic calendar.

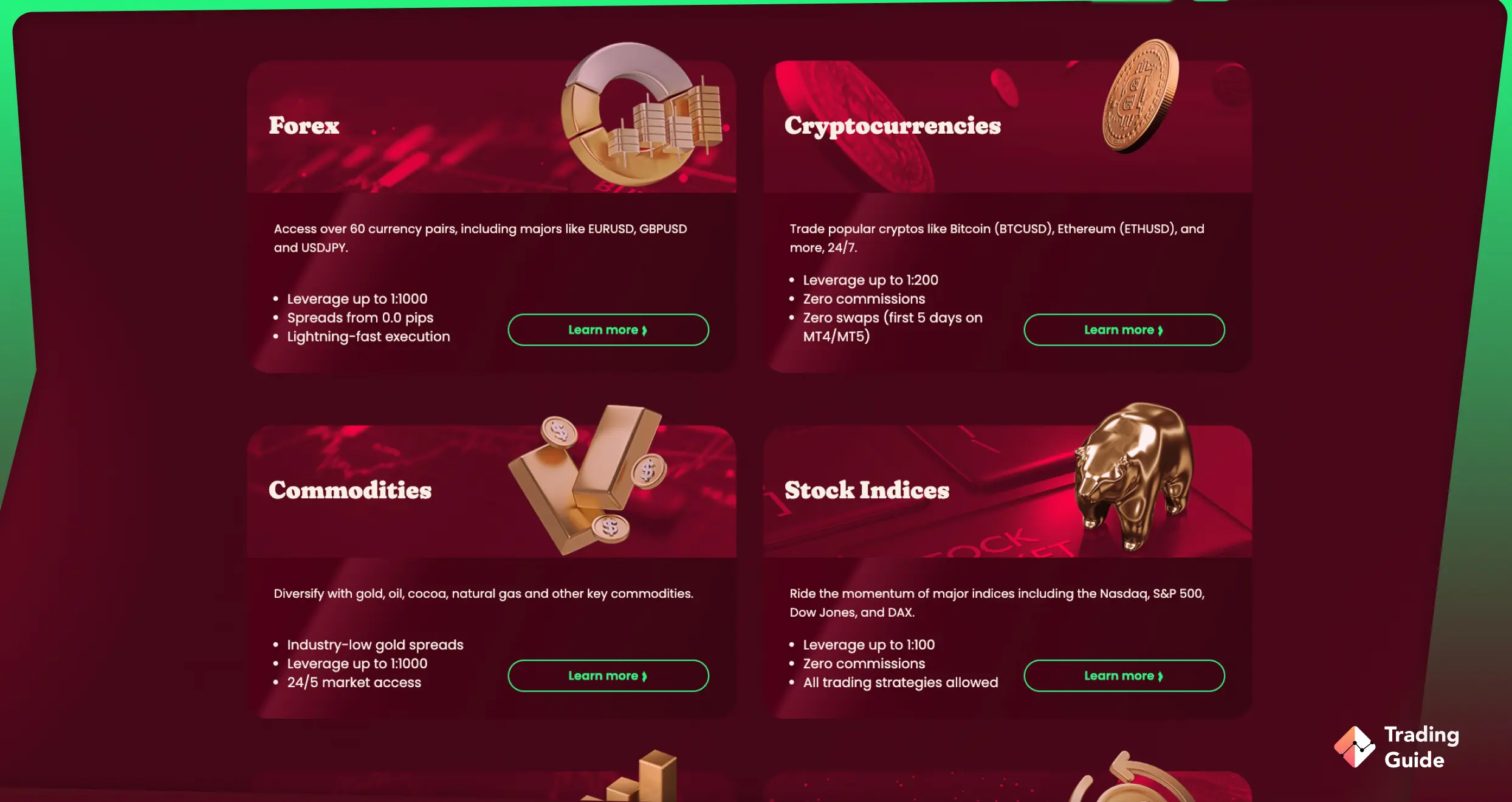

Tickmill also offers over 80 instruments, with spreads from 0.0 pips, and some of the lowest commissions on the trading market.

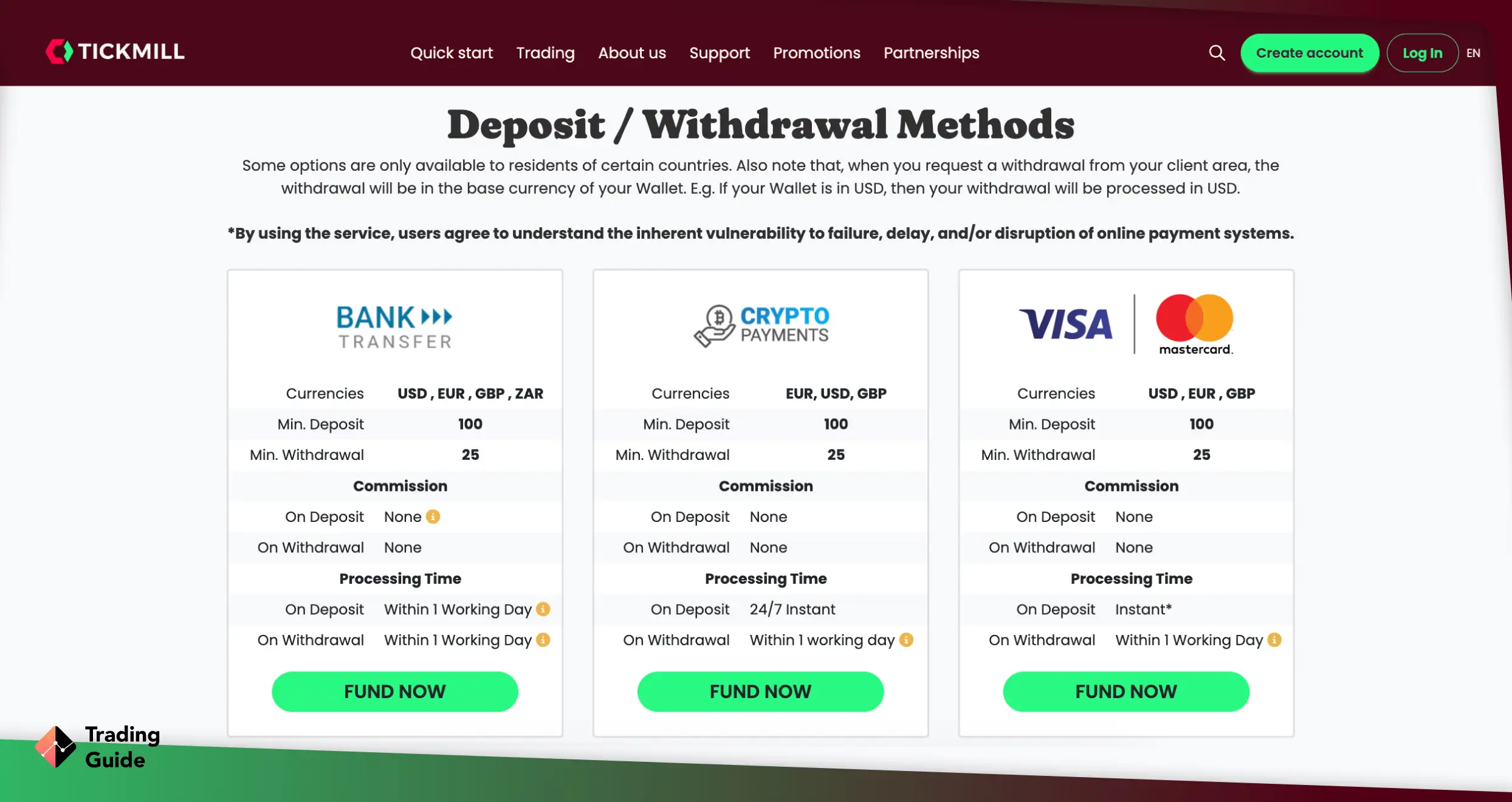

| Type | Fee |

|---|---|

| Minimum deposit | $100 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $0 |

| Overnight fee | Yes |

| Type | Pro | Classic | VIP |

|---|---|---|---|

| Min. deposit | $100 | $100 | $0 |

| Min. balance | – | – | $50.000 |

| Spreads from | 0.0 pips | 1.6 pips | 0.0 pips |

| Min lots | 0.01 | 0.01 | 0.01 |

| Commissions | 2 per side per 100,000 traded | Zero commissions | 1 per side per 100,000 traded |

Compare Tickmill Features With Other Brokers

Compare brokers

Our Opinion About Tickmill

We consider Tickmill absolutely safe to trade with as they are regulated by the Seychelles Financial Services Authority (FSA), the Financial Conduct Authority (FCA), with FCA register number 717270, Financial Sector Conduct Authority (FSCA), and the Cyprus Investment Firm (CIF).

We have also noticed that the educational materials are excellent for such a young company. Tickmill offers its users training courses, e-books and weekly webinars in different languages. You can also find helpful educational videos on YouTube. However, the company still has room to develop, as we noticed that there is not enough special educational portals, which many other trading platforms offer.

Despite the fact that the company is still quite young, they have quickly grown within the market. Of course, they still have a lot to develop, but the quality of the services they do provide is already high.

FAQs

Tickmill offers three major account types: Pro Account, Classic Account, and VIP Account. The best account for you will depend on your expectations and experience level. That being said, the Classic and Pro accounts are designed with the needs of beginner and intermediate traders in mind. On the other hand, the VIP Account is best for advanced traders who often execute high-volume trades.

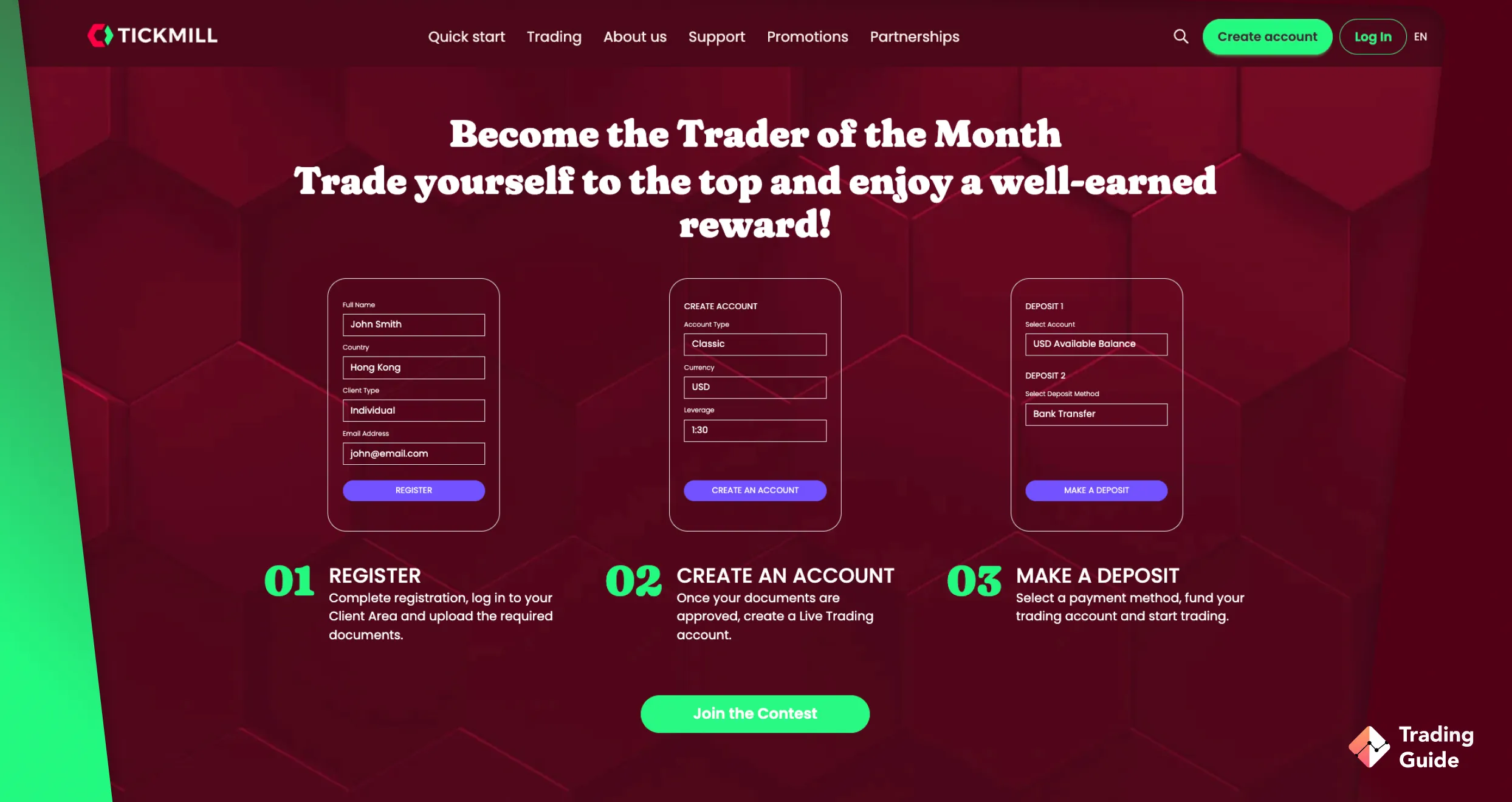

Absolutely. Tickmill is one of the best brokers we highly recommend to newbies. The broker is user-friendly and has a straightforward account registration procedure. In addition, it offers a demo account you can use to test various trading strategies in a completely risk-free environment. On top of that, Tickmill has over 80 instruments and some of the lowest commissions on the trading market.

Yes. Tickmill allows scalping on all its account types, enabling traders to execute multiple short-term trades. The broker also supports traders with excellent research tools for this trading strategy. If you are a beginner, Tickmill offers a risk-free demo account to practise scalping and invest if they find this strategy interesting. Tickmill also allows other short-term trading strategies, including day trading and swing trading.

Yes. Tickmill offers access to crypto CFDs – such as Bitcoin, Ethereum, Litecoin, Ripple, Cardano, and more. Crypto CFDs allow traders to speculate on the price movements of cryptocurrencies without taking ownership of the underlying asset.

Since it was founded in 2014, the company has quickly gained many customers’ trust and has shown impressive growth. The company has over 150,000 satisfied clients, worldwide. This young company has boldly implemented its business model and constantly forms partnerships that gradually improve its clients’ trading conditions.

I did make a demo account with Tickmill once along with a couple of other brokers. Ultimately, I settled for this broker because not only were the spreads low but it had other good features like tight spreads and low commission.

Firstly, I traded with XM as it offered decent trading conditions for me when I started my trading journey. Their spreads were good on their ultra-low account and commission was not charged on that account. Another broker that I tried was forex.com. It was quite a long-term experience for me trading with them as they offered me tighter spreads and good trading conditions. My friend was trading with Tickmill and referred this broker to me. They have a combination of lower spreads and lower commissions. Hence, they offer efficient trading conditions, but they have fewer methods to deposit.

Tickmill has low forex and non-trading fees. Account opening is fast, easy, and fully digital. You can use many options for deposit and withdrawal, and they're all free of charge. On the negative side, Tickmill has a limited product portfolio as it offers only forex and CFDs. Trading platforms, provided by MetaTrader, come with an outdated design and a poorly-structured news feed.

As a beginner, I recommend this broker, especially for scalpers. Tickmill broker is very low spread and commissions. In terms of withdrawals and deposit very fast, hopefully in the future tickmill continues to improve facilities so that it becomes the best broker. Thank you very much for the service!

Tickmill is a very good and reliable trading service. Spread can be ridiculous at times even for the pro account but that’s usually during quiet trading hours. Very easy to deposit and withdrawal of funds. Excellent customer service. I highly recommend.

Tickmill is a good and reliable trading service. Spread can be ridiculous at times even for the pro account but that’s usually during quiet trading hours. Very easy to deposit and withdrawal of funds. Excellent customer service. I like it so much!!

Tickmill is my favorite broker since 2020. It has low spreads, three account types and the best client service. Very user-friendly broker to use. Deposit and withdrawal are also fast.

Tickmill is one of the most trusted brokers I've traded with (my experience 4 years). Honest market execution does not require volatility. I wish all brokers follow tickmill steps. They have a good platform to trade and very polite customer support. Honored to make them my number one broker to recommend to you.

I do not think that this is a small broker. Everything is top notch and their quick and efficient customer service is quite useful. I would recommend this broker as I find it to be reliable and safe. It's a pleasure to work with you guys.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal